AAR (AIR)

AAR is interesting. Its rapid revenue growth gives it operating leverage, making it more profitable as it expands.― StockStory Analyst Team

1. News

2. Summary

Why AAR Is Interesting

The first third-party MRO approved by the FAA for Safety Management System Requirements, AAR (NYSE:AIR) is a provider of aircraft maintenance services

- Revenue outlook for the upcoming 12 months is outstanding and shows it’s on track to gain market share

- Earnings growth has trumped its peers over the last five years as its EPS has compounded at 25.6% annually

- On a dimmer note, its low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

AAR has some noteworthy aspects. If you like the story, the price looks reasonable.

Why Is Now The Time To Buy AAR?

High Quality

Investable

Underperform

Why Is Now The Time To Buy AAR?

At $110.53 per share, AAR trades at 23.4x forward P/E. AAR’s multiple is lower than that of many industrials companies. Even so, we think it is justified for the top-line growth you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. AAR (AIR) Research Report: Q4 CY2025 Update

Aviation and defense services provider AAR CORP (NYSE:AIR) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 15.9% year on year to $795.3 million. On top of that, next quarter’s revenue guidance ($820.6 million at the midpoint) was surprisingly good and 3.9% above what analysts were expecting. Its non-GAAP profit of $1.18 per share was 14.2% above analysts’ consensus estimates.

AAR (AIR) Q4 CY2025 Highlights:

- Revenue: $795.3 million vs analyst estimates of $761.6 million (15.9% year-on-year growth, 4.4% beat)

- Adjusted EPS: $1.18 vs analyst estimates of $1.03 (14.2% beat)

- Adjusted EBITDA: $96.5 million vs analyst estimates of $90.97 million (12.1% margin, 6.1% beat)

- Revenue Guidance for Q1 CY2026 is $820.6 million at the midpoint, above analyst estimates of $790 million

- Operating Margin: 8.4%, up from -0.3% in the same quarter last year

- Free Cash Flow Margin: 0.8%, down from 2% in the same quarter last year

- Market Capitalization: $3.48 billion

Company Overview

The first third-party MRO approved by the FAA for Safety Management System Requirements, AAR (NYSE:AIR) is a provider of aircraft maintenance services

Founded in 1951 and headquartered in Wood Dale, Illinois, AAR has established itself in the aviation aftermarket and defense sectors.The company operates through two primary business segments: Aviation Services and Expeditionary Services.

The Aviation Services segment, which accounts for the majority of AAR's sales, provides aftermarket support and services for commercial aviation and government and defense markets. This segment's offerings include inventory management and distribution services, maintenance, repair, and overhaul (MRO) services, and engineering services. AAR's Aviation Services segment sells and leases a variety of new, overhauled, and repaired engine and airframe parts and components to commercial aviation and government/defense customers.

AAR's Expeditionary Services segment primarily focuses on products and services supporting the movement of equipment and personnel by the U.S. and foreign governments and non-governmental organizations. This segment designs, manufactures, and repairs transportation pallets, containers, and shelters used in military and humanitarian tactical deployment activities.

The company has numerous facilities across North America, Europe, and Asia. AAR's customer base includes domestic and foreign passenger airlines, cargo airlines, regional and commuter airlines, business and general aviation operators, original equipment manufacturers (OEMs), aircraft leasing companies, aftermarket aviation support companies, the U.S. Department of Defense and its contractors, the U.S. Department of State, and foreign military organizations or governments.

The company recently acquired Trax USA Corp., a leading provider of aircraft MRO and fleet management software, enhancing its portfolio with higher-margin aviation aftermarket software offerings. This acquisition aligns with AAR's strategy to provide opportunities for cross-selling products and services.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

AAR’s competitors include General Dynamics (NSYE:GD) and Kratos Defense and Security (NASDAQ:KTOS)

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, AAR grew its sales at an impressive 10.8% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AAR’s annualized revenue growth of 17% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Parts Supply, Repair & Engineering, and Integrated Solutions, which are 44.5%, 30.7%, and 22.1% of revenue. Over the last two years, AAR’s revenues in all three segments increased. Its Parts Supply revenue (engine and airframe parts) averaged year-on-year growth of 15.9% while its Repair & Engineering (maintenance, repair, and overhaul services) and Integrated Solutions (fleet management) revenues averaged 29.8% and 9.5%.

This quarter, AAR reported year-on-year revenue growth of 15.9%, and its $795.3 million of revenue exceeded Wall Street’s estimates by 4.4%. Company management is currently guiding for a 21% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.2% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and indicates the market sees success for its products and services.

6. Operating Margin

AAR was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.6% was weak for an industrials business.

On the plus side, AAR’s operating margin rose by 3.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, AAR generated an operating margin profit margin of 8.4%, up 8.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

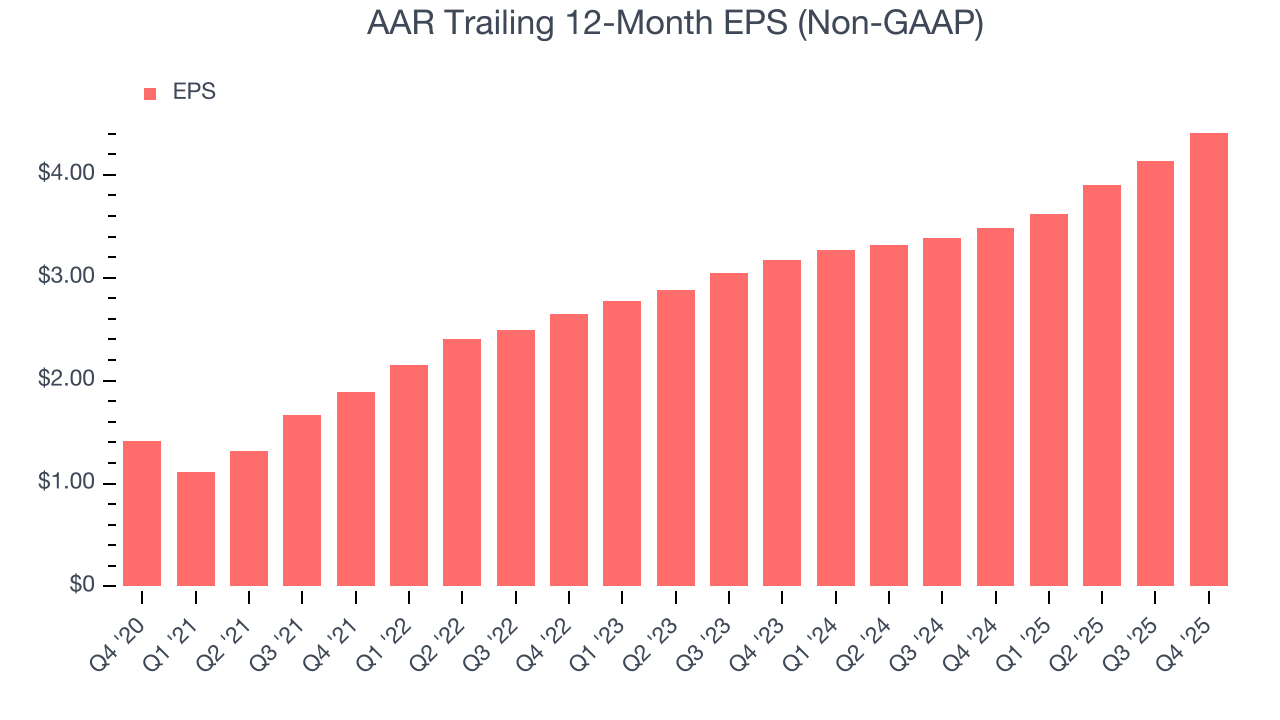

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AAR’s EPS grew at an astounding 25.6% compounded annual growth rate over the last five years, higher than its 10.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into AAR’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, AAR’s operating margin expanded by 3.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For AAR, its two-year annual EPS growth of 17.9% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, AAR reported adjusted EPS of $1.18, up from $0.90 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects AAR’s full-year EPS of $4.41 to grow 9.9%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

AAR broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that AAR’s margin dropped by 3.9 percentage points during that time. If the trend continues, it could signal it’s in the middle of an investment cycle.

AAR broke even from a free cash flow perspective in Q4. The company’s cash profitability regressed as it was 1.2 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although AAR has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.5%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, AAR’s ROIC decreased by 2 percentage points annually over the last few years. If its returns keep falling, it could suggest its profitable growth opportunities are drying up. We’ll keep a close eye.

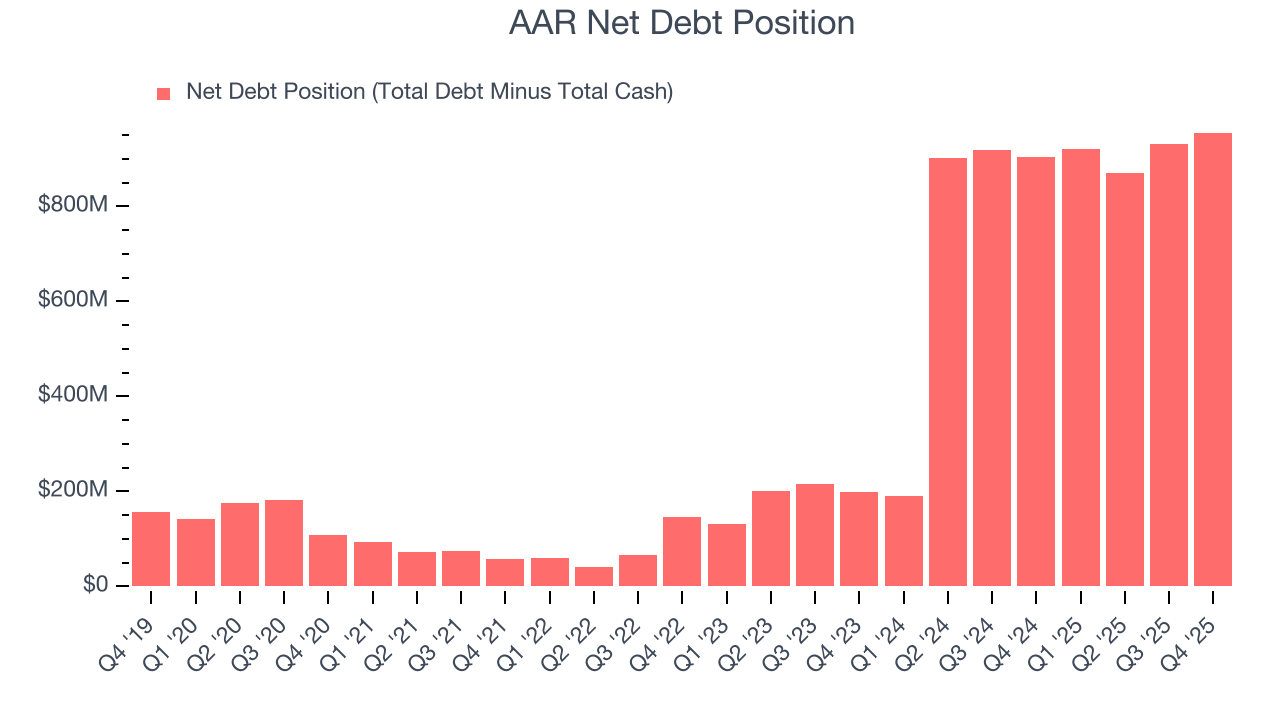

10. Balance Sheet Assessment

AAR reported $96.2 million of cash and $1.05 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $355.3 million of EBITDA over the last 12 months, we view AAR’s 2.7× net-debt-to-EBITDA ratio as safe. We also see its $73.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from AAR’s Q4 Results

We were impressed by how significantly AAR blew past analysts’ revenue expectations this quarter. We were also glad its Parts Supply revenue topped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 1.7% to $91.99 immediately following the results.

12. Is Now The Time To Buy AAR?

Updated: March 5, 2026 at 10:49 PM EST

Before deciding whether to buy AAR or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

AAR is a fine business. First off, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. And while its low free cash flow margins give it little breathing room, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, its projected EPS for the next year implies the company will continue generating shareholder value.

AAR’s P/E ratio based on the next 12 months is 23.4x. Looking at the industrials space right now, AAR trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $114.50 on the company (compared to the current share price of $110.53), implying they see 3.6% upside in buying AAR in the short term.