Applied Industrial (AIT)

Applied Industrial doesn’t excite us. Its decelerating growth shows demand is falling and its weak gross margin indicates it has bad unit economics.― StockStory Analyst Team

1. News

2. Summary

Why Applied Industrial Is Not Exciting

Formerly called The Ohio Ball Bearing Company, Applied Industrial (NYSE:AIT) distributes industrial products–everything from power tools to industrial valves–and services to a wide variety of industries.

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

- Estimated sales growth of 5.1% for the next 12 months is soft and implies weaker demand

- The good news is that its incremental sales significantly boosted profitability as its annual earnings per share growth of 84% over the last five years outstripped its revenue performance

Applied Industrial is in the penalty box. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Applied Industrial

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Applied Industrial

Applied Industrial’s stock price of $281.21 implies a valuation ratio of 26x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Applied Industrial (AIT) Research Report: Q3 CY2025 Update

Industrial products distributor Applied Industrial (NYSE:AIT) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 9.2% year on year to $1.2 billion. Its GAAP profit of $2.63 per share was 6% above analysts’ consensus estimates.

Applied Industrial (AIT) Q3 CY2025 Highlights:

- Revenue: $1.2 billion vs analyst estimates of $1.19 billion (9.2% year-on-year growth, 1.1% beat)

- EPS (GAAP): $2.63 vs analyst estimates of $2.48 (6% beat)

- Adjusted EBITDA: $146.3 million vs analyst estimates of $142.7 million (12.2% margin, 2.5% beat)

- EPS (GAAP) guidance for the full year is $10.48 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 10.8%, in line with the same quarter last year

- Free Cash Flow Margin: 9.3%, down from 11.1% in the same quarter last year

- Organic Revenue rose 3% year on year vs analyst estimates of 2.1% growth (87.2 basis point beat)

- Market Capitalization: $9.82 billion

Company Overview

Formerly called The Ohio Ball Bearing Company, Applied Industrial (NYSE:AIT) distributes industrial products–everything from power tools to industrial valves–and services to a wide variety of industries.

Applied Industrial was founded in 1923. By 1997, the product portfolio was much more vast than the original bearings it was known for, and the company changed its name to Applied Industrial Technologies to more accurately reflect its business.

Today, AIT offers products including bearings, power transmission products, fluid handling equipment, hydraulic pumps, and a wide variety of other industrial supplies. The company also offers repair and storeroom services to keep customers’ equipment in top condition and to help customers manage their supply of products. For example, AIT may support a manufacturing plant by regularly supplying conveyor belts for assembly lines before they wear out to ensure the plant's operations are never down. AIT may also store and manage equipment for the plant to reduce costs and working capital needs.

The primary revenue sources for Applied Industrial come from the sale of industrial products and related services, such as technical support and inventory management. The company's business model focuses on direct sales through its network of service centers and online platforms, providing accessibility and convenience for its customers.

4. Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors in the industrial products and services industry include W.W. Grainger (NYSE:GWW), Fastenal (NASDAQ:FAST), and MSC Industrial Direct (NYSE:MSM).

5. Revenue Growth

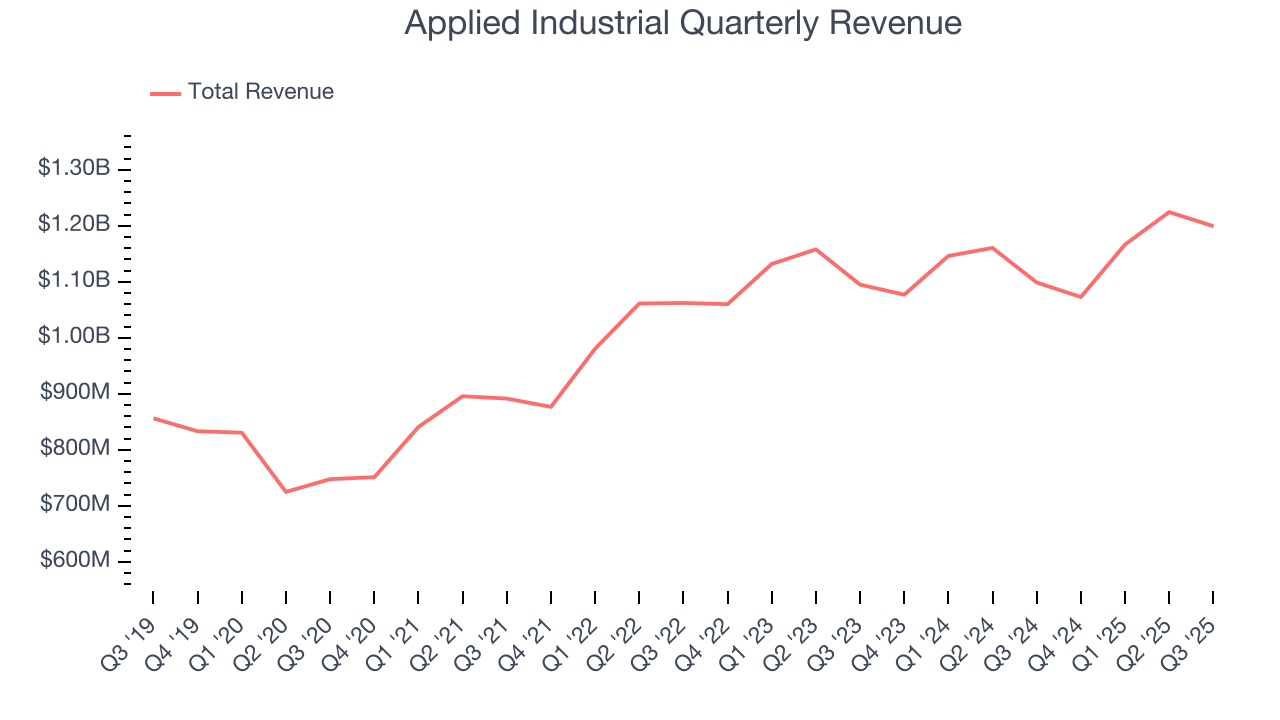

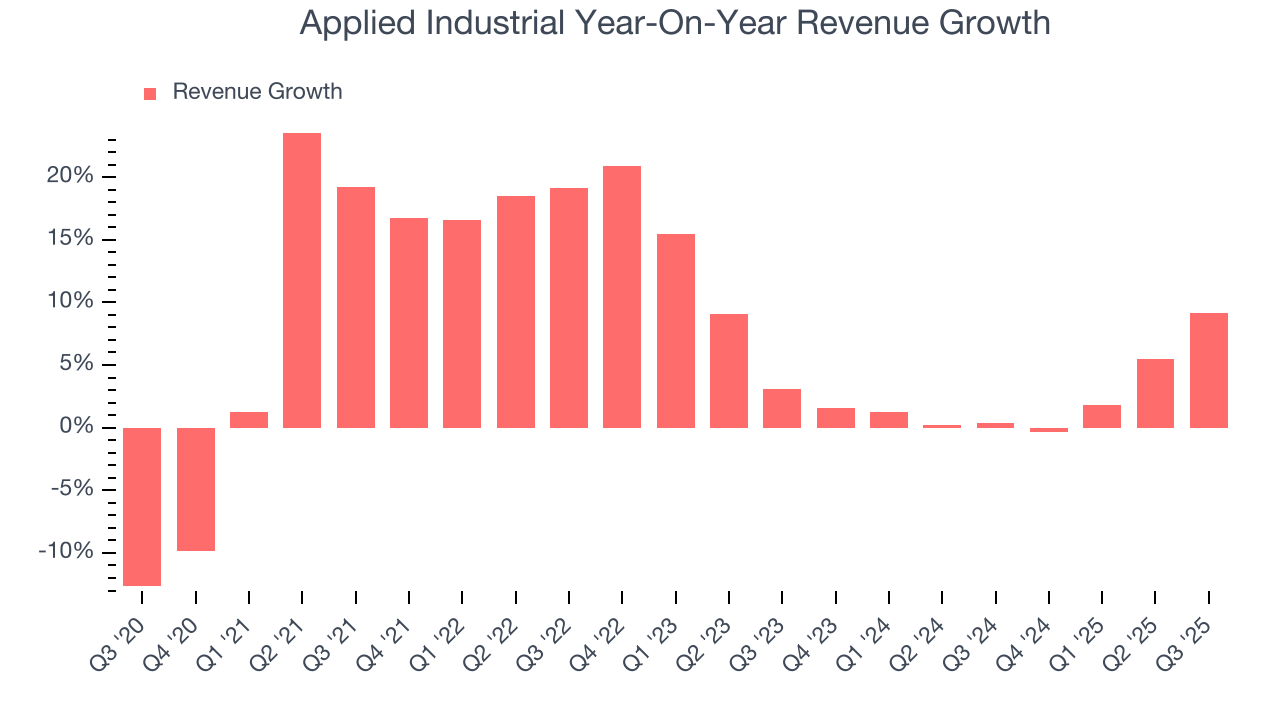

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Applied Industrial grew its sales at a decent 8.3% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Applied Industrial’s recent performance shows its demand has slowed as its annualized revenue growth of 2.4% over the last two years was below its five-year trend.

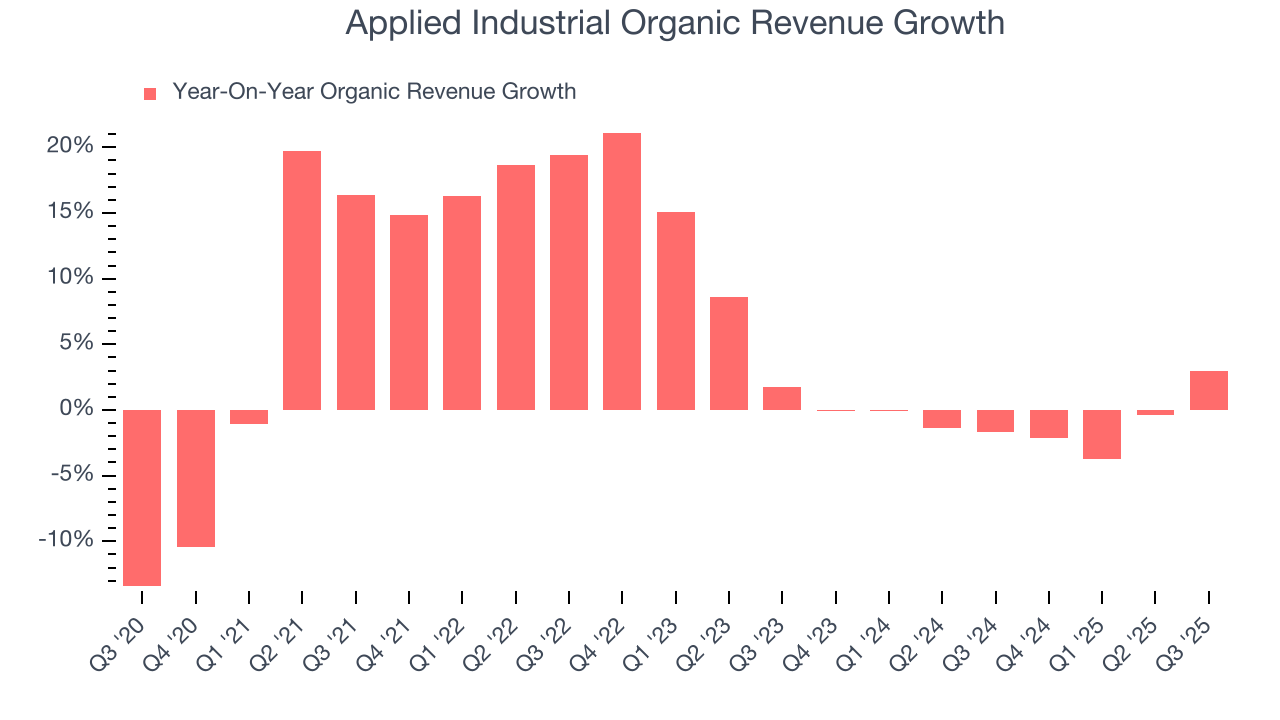

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Applied Industrial’s organic revenue was flat. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Applied Industrial reported year-on-year revenue growth of 9.2%, and its $1.2 billion of revenue exceeded Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

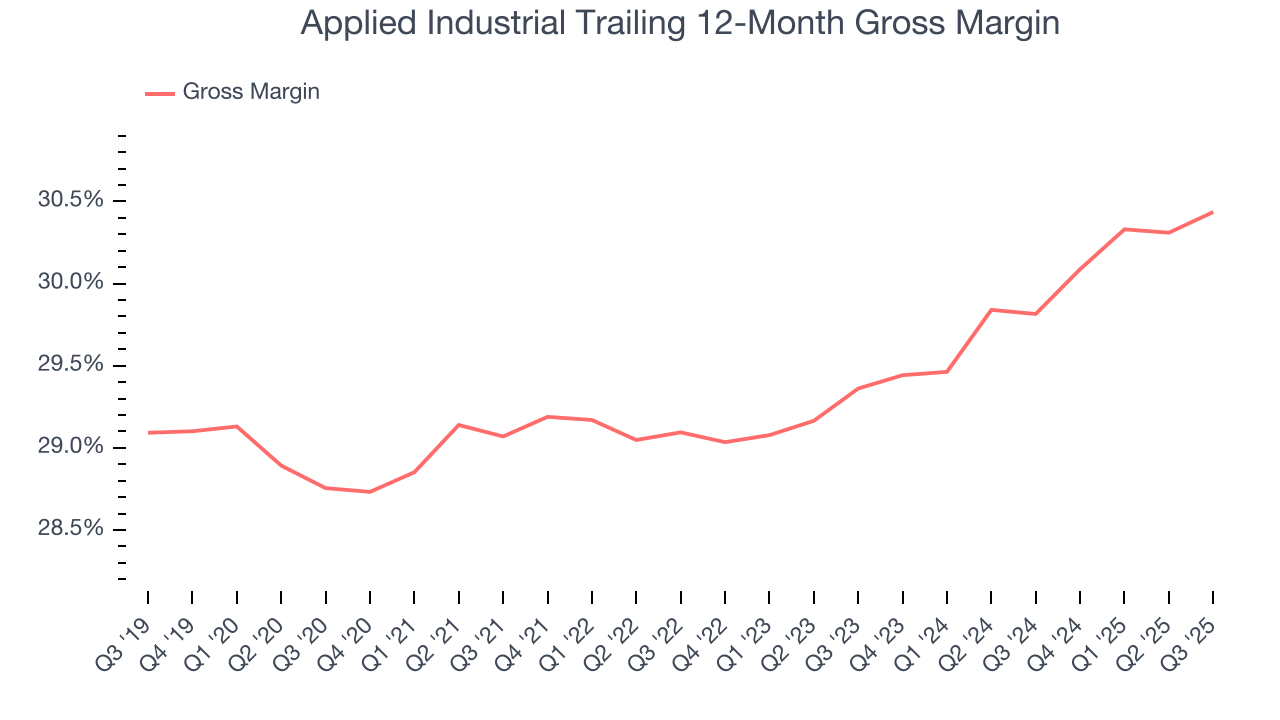

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Applied Industrial’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 29.6% gross margin over the last five years. That means Applied Industrial paid its suppliers a lot of money ($70.40 for every $100 in revenue) to run its business.

Applied Industrial’s gross profit margin came in at 30.1% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

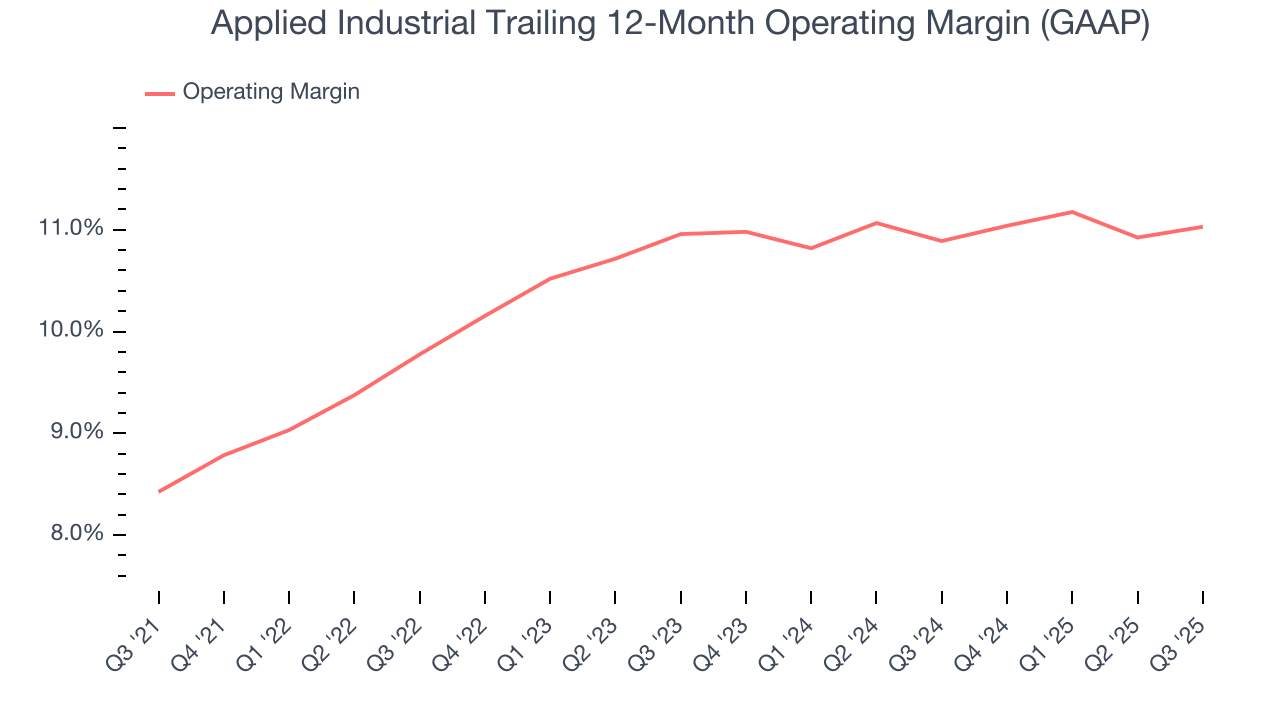

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Applied Industrial has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Applied Industrial’s operating margin rose by 2.6 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Applied Industrial generated an operating margin profit margin of 10.8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

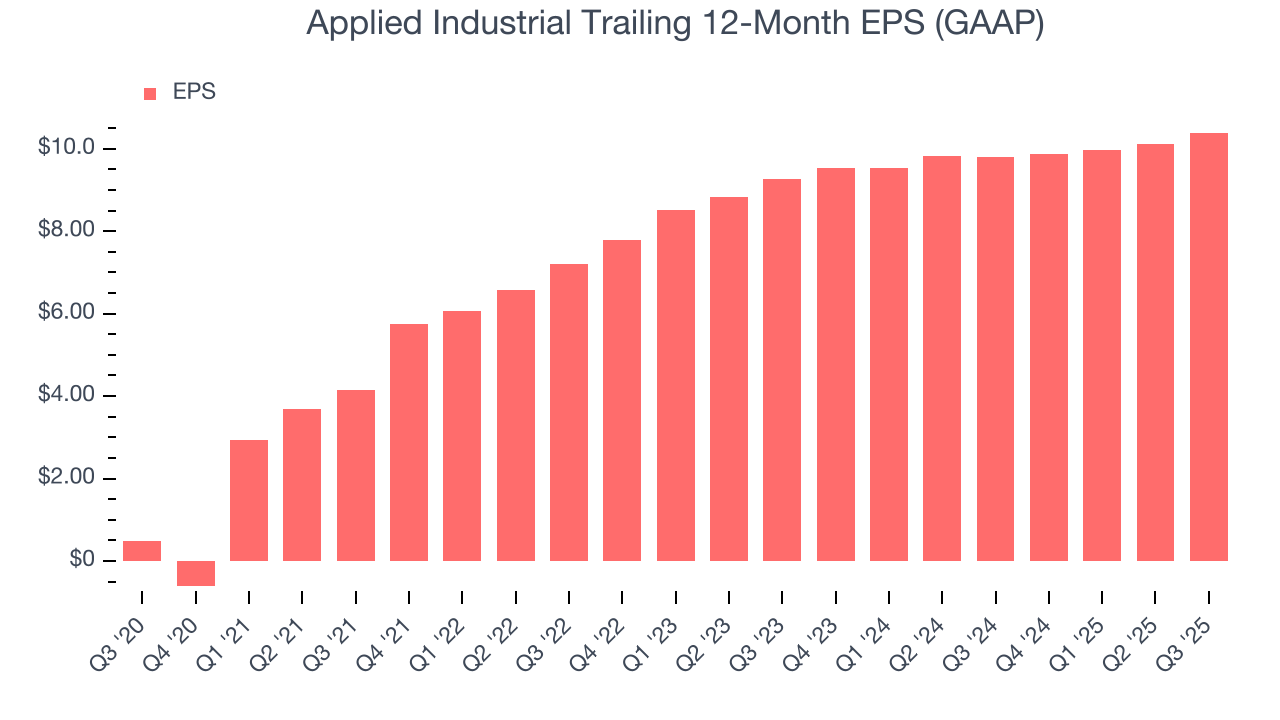

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Applied Industrial’s EPS grew at an astounding 84% compounded annual growth rate over the last five years, higher than its 8.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

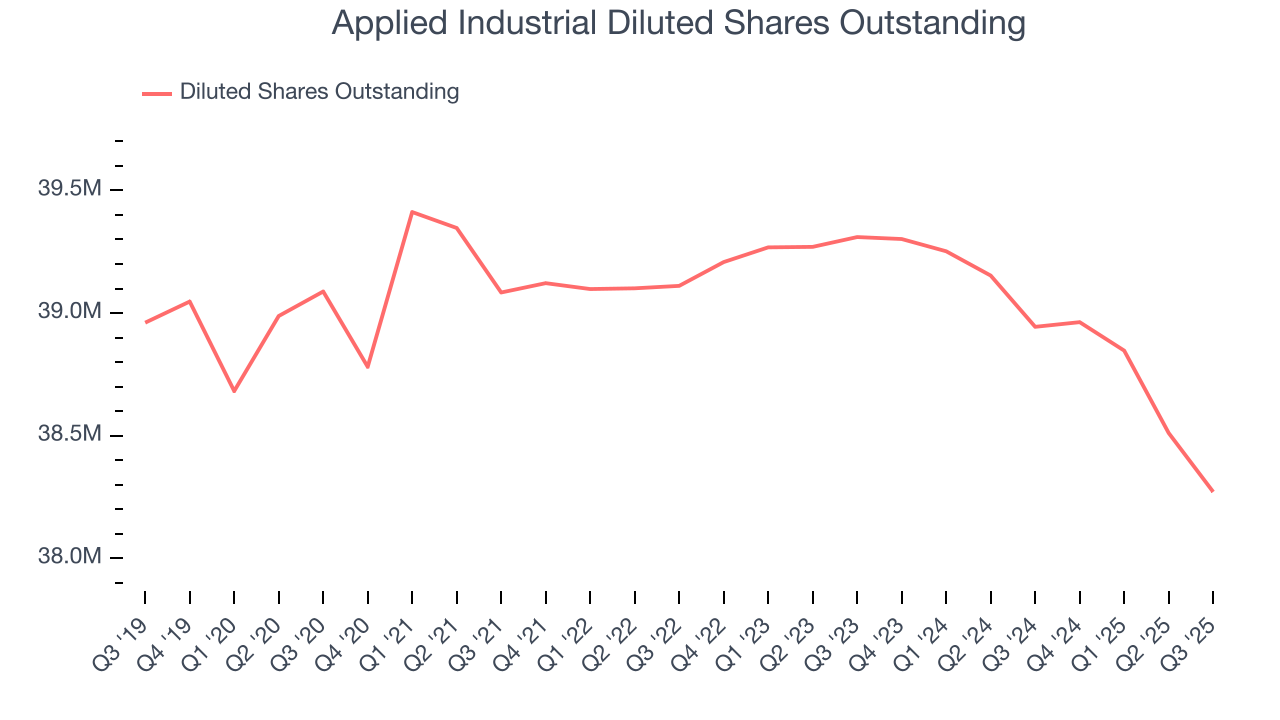

We can take a deeper look into Applied Industrial’s earnings to better understand the drivers of its performance. As we mentioned earlier, Applied Industrial’s operating margin was flat this quarter but expanded by 2.6 percentage points over the last five years. On top of that, its share count shrank by 2.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Applied Industrial, its two-year annual EPS growth of 5.9% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Applied Industrial reported EPS of $2.63, up from $2.36 in the same quarter last year. This print beat analysts’ estimates by 6%. Over the next 12 months, Wall Street expects Applied Industrial’s full-year EPS of $10.39 to grow 3.8%.

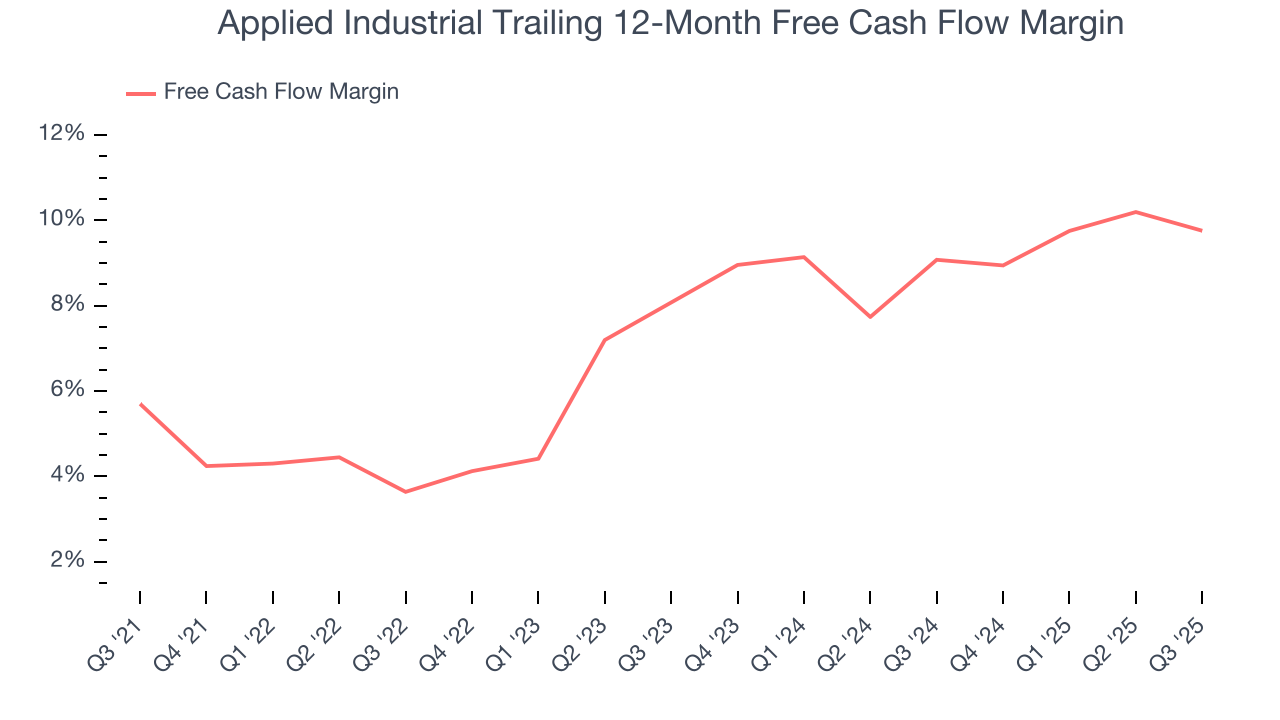

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Applied Industrial has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.4% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Applied Industrial’s margin expanded by 4.1 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Applied Industrial’s free cash flow clocked in at $112 million in Q3, equivalent to a 9.3% margin. The company’s cash profitability regressed as it was 1.8 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

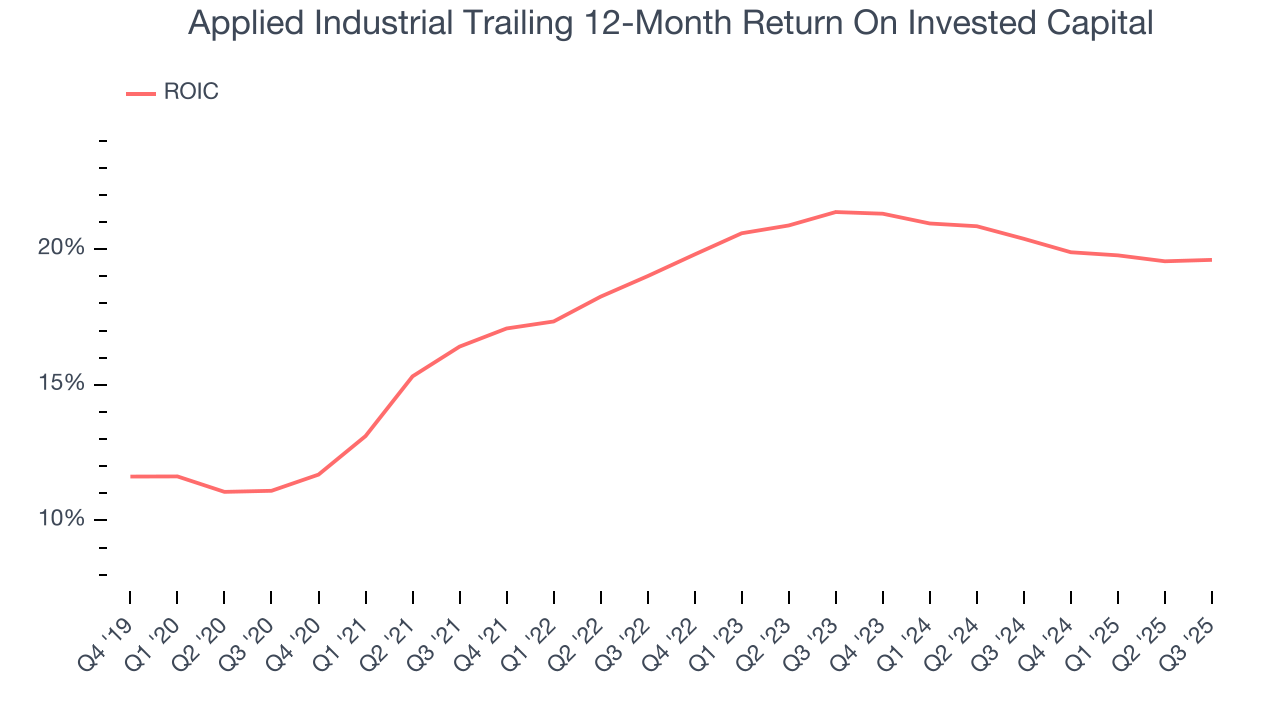

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Applied Industrial hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 19.4%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Applied Industrial’s ROIC increased by 2.3 percentage points annually over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

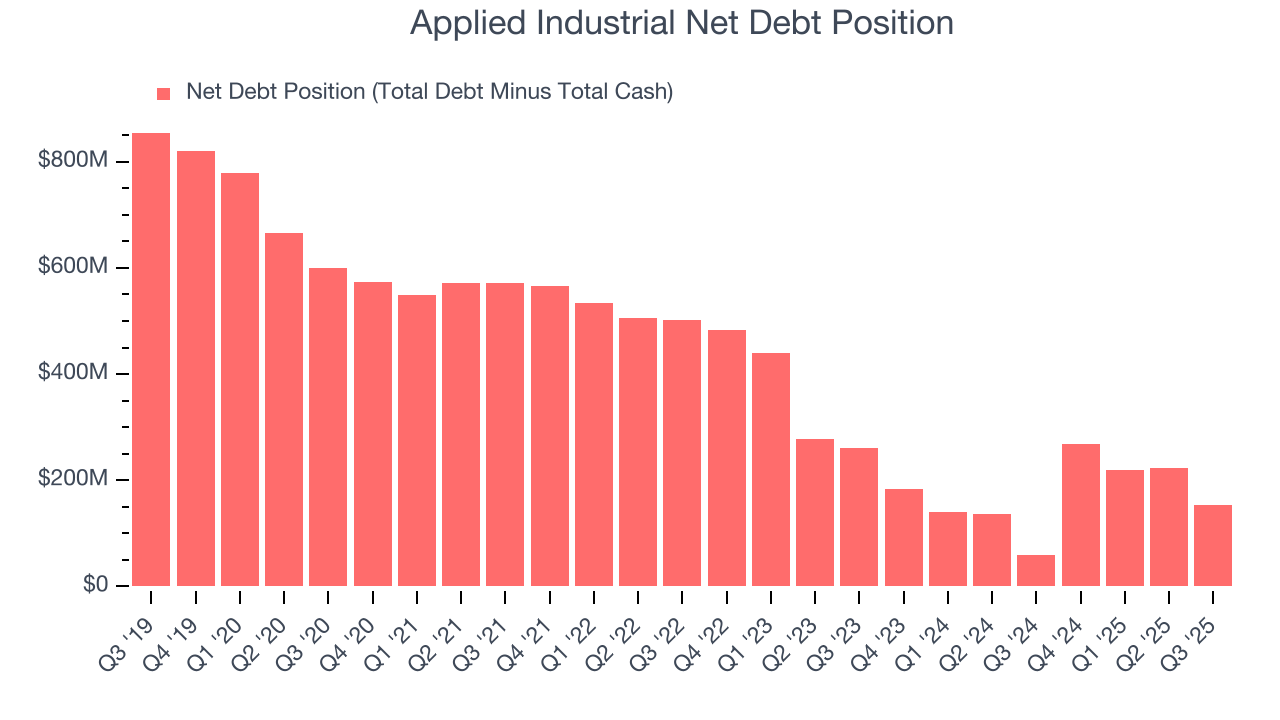

11. Balance Sheet Assessment

Applied Industrial reported $418.7 million of cash and $572.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $579.3 million of EBITDA over the last 12 months, we view Applied Industrial’s 0.3× net-debt-to-EBITDA ratio as safe. We also see its $246,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Applied Industrial’s Q3 Results

It was encouraging to see Applied Industrial beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed. Overall, this print had some key positives. The stock traded up 3% to $267.90 immediately following the results.

13. Is Now The Time To Buy Applied Industrial?

Updated: January 20, 2026 at 10:03 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Applied Industrial.

Applied Industrial’s business quality ultimately falls short of our standards. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its flat organic revenue disappointed. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking.

Applied Industrial’s P/E ratio based on the next 12 months is 26x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $304.17 on the company (compared to the current share price of $277.59).