Assurant (AIZ)

We’re wary of Assurant. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Assurant Will Underperform

With roots dating back to 1892 when it was founded by a Civil War veteran, Assurant (NYSE:AIZ) provides specialized insurance products and services that protect major consumer purchases like mobile devices, vehicles, homes, and appliances.

- Outsized scale creates growth headwinds as its 4.8% annualized net premiums earned increases over the last five years underperformed other financial institutions

- The company has faced growth challenges as its 6% annual revenue increases over the last five years fell short of other insurance companies

- On the bright side, its incremental sales over the last five years have been more profitable as its earnings per share increased by 18.1% annually, topping its revenue gains

Assurant’s quality is not up to our standards. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Assurant

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Assurant

At $235.15 per share, Assurant trades at 1.8x forward P/B. This multiple is quite expensive for the quality you get.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Assurant (AIZ) Research Report: Q4 CY2025 Update

Insurance services company Assurant (NYSE:AIZ) announced better-than-expected revenue in Q4 CY2025, with sales up 7.9% year on year to $3.35 billion. Its non-GAAP profit of $5.61 per share was 1.9% above analysts’ consensus estimates.

Assurant (AIZ) Q4 CY2025 Highlights:

- Net Premiums Earned: $2.71 billion vs analyst estimates of $2.68 billion (5.8% year-on-year growth, 0.8% beat)

- Revenue: $3.35 billion vs analyst estimates of $3.30 billion (7.9% year-on-year growth, 1.4% beat)

- Pre-tax Profit: $283.5 million (8.5% margin)

- Adjusted EPS: $5.61 vs analyst estimates of $5.50 (1.9% beat)

- Market Capitalization: $11.79 billion

Company Overview

With roots dating back to 1892 when it was founded by a Civil War veteran, Assurant (NYSE:AIZ) provides specialized insurance products and services that protect major consumer purchases like mobile devices, vehicles, homes, and appliances.

Assurant operates through two main segments: Global Lifestyle and Global Housing. The Global Lifestyle segment offers mobile device protection plans, extended service contracts for electronics and appliances, and vehicle service contracts. When a customer's phone breaks or their refrigerator malfunctions after the manufacturer's warranty expires, Assurant covers repair or replacement costs. The company also provides vehicle service contracts that pay for repairs when mechanical breakdowns occur.

The Global Housing segment focuses on insurance products for homeowners, including lender-placed insurance, which protects mortgage lenders when borrowers fail to maintain required coverage on their properties. For example, if a homeowner's insurance lapses, Assurant's tracking system identifies this gap and, after notification attempts, places coverage to protect the lender's interest in the property. This segment also offers renters insurance, flood insurance, and tenant bonds as alternatives to security deposits.

Assurant distributes its products primarily through partnerships with leading companies across various industries. Mobile carriers sell device protection when customers purchase new phones, auto dealers offer vehicle service contracts during car sales, mortgage servicers implement lender-placed insurance programs, and property managers provide renters insurance options to tenants. The company earns revenue through premiums, fees for administrative services, and commissions.

Assurant's business model relies on sophisticated tracking systems, digital platforms, and an extensive repair and logistics network, including nearly 500 Cell Phone Repair locations offering same-day service. The company maintains a global footprint with operations concentrated in North America but extending to Latin America, Europe, and the Asia-Pacific region.

4. Property & Casualty Insurance

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

Assurant's competitors include insurance providers like The Allstate Corporation (NYSE:ALL), Progressive Corporation (NYSE:PGR), and Travelers Companies (NYSE:TRV) in the property and casualty space. In the mobile device protection market, it competes with SquareTrade (owned by Allstate) and AppleCare, while in the vehicle service contract business, it faces competition from Ally Financial (NYSE:ALLY) and CarShield.

5. Revenue Growth

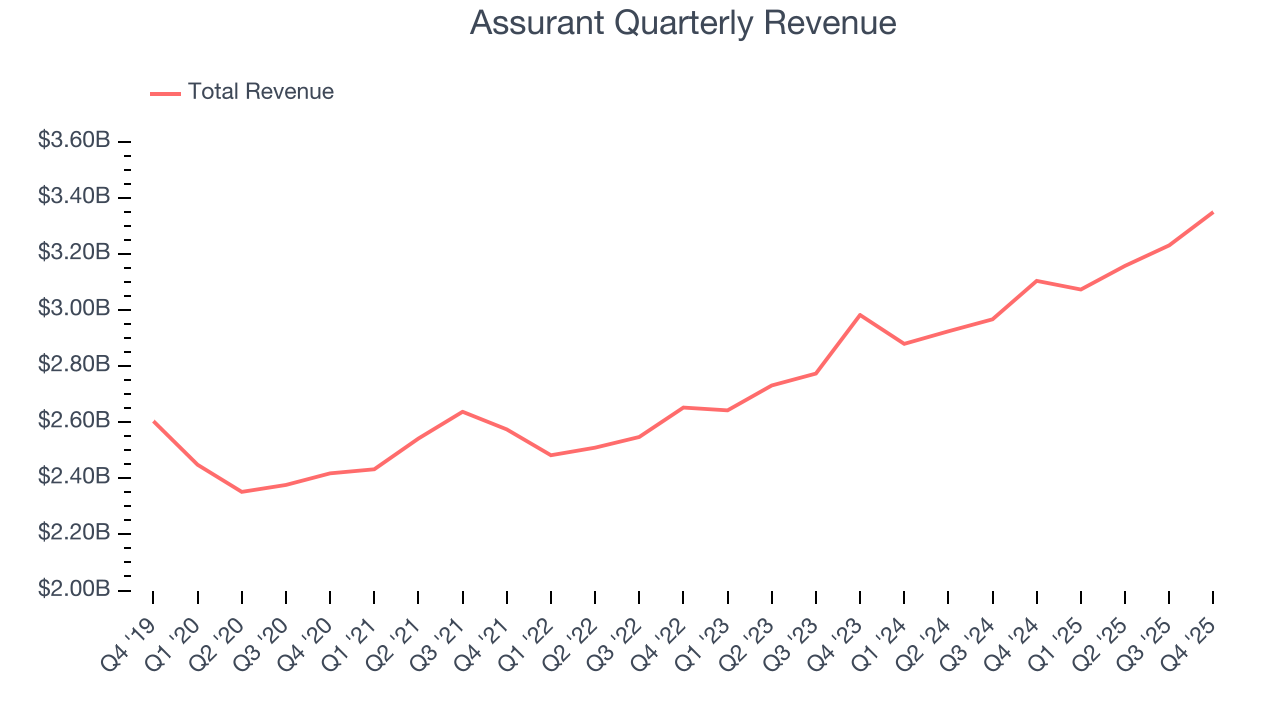

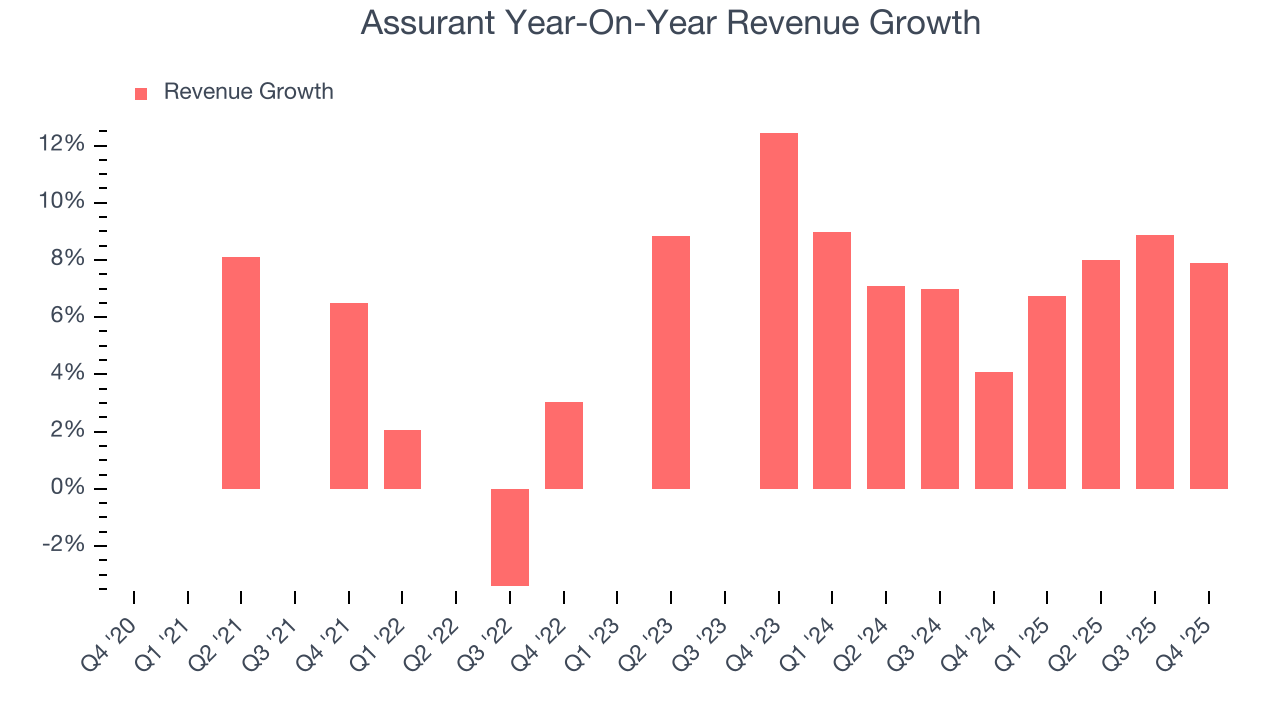

Insurers earn revenue three ways. The core insurance business itself, often called underwriting and represented in the income statement as premiums earned, is one way. Investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities is the second way. Fees from various sources such as policy administration, annuities, or other value-added services is the third. Regrettably, Assurant’s revenue grew at a tepid 6% compounded annual growth rate over the last five years. This fell short of our benchmark for the insurance sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Assurant’s annualized revenue growth of 7.3% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Assurant reported year-on-year revenue growth of 7.9%, and its $3.35 billion of revenue exceeded Wall Street’s estimates by 1.4%.

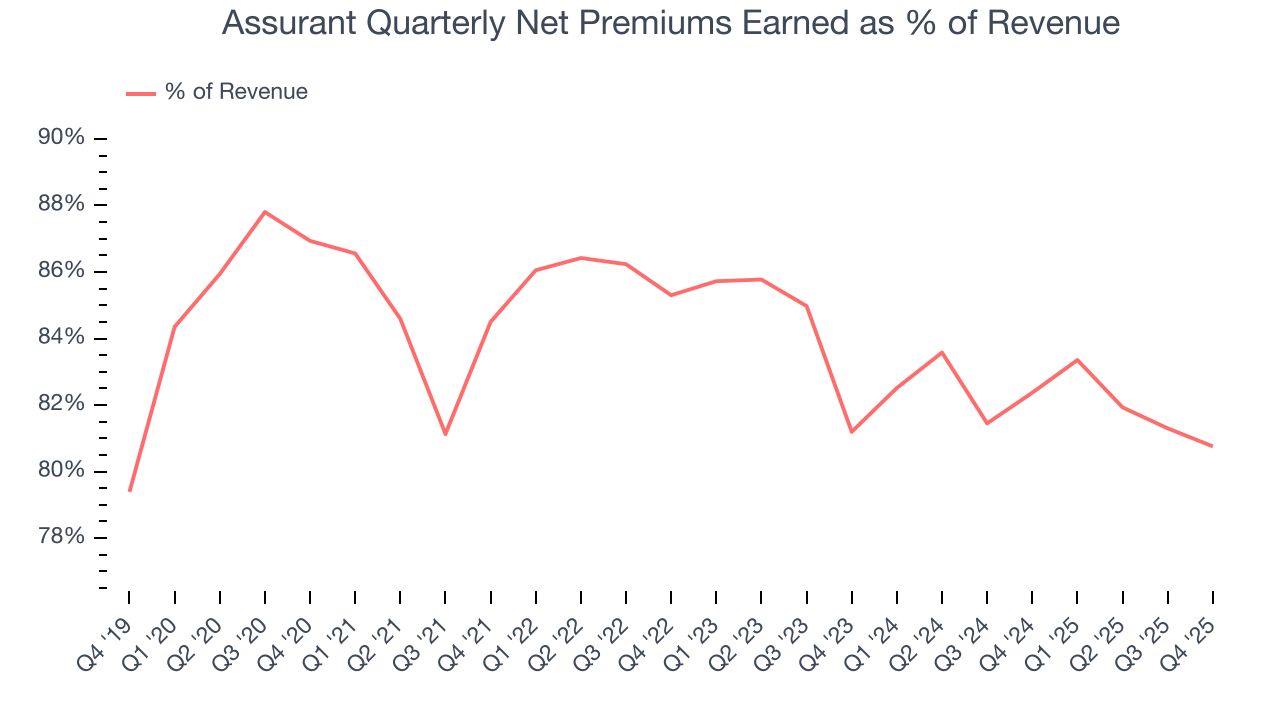

Net premiums earned made up 83.6% of the company’s total revenue during the last five years, meaning Assurant barely relies on non-insurance activities to drive its overall growth.

Our experience and research show the market cares primarily about an insurer’s net premiums earned growth as investment and fee income are considered more susceptible to market volatility and economic cycles.

6. Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are:

- Gross premiums - what’s ceded to reinsurers as a risk mitigation and transfer strategy

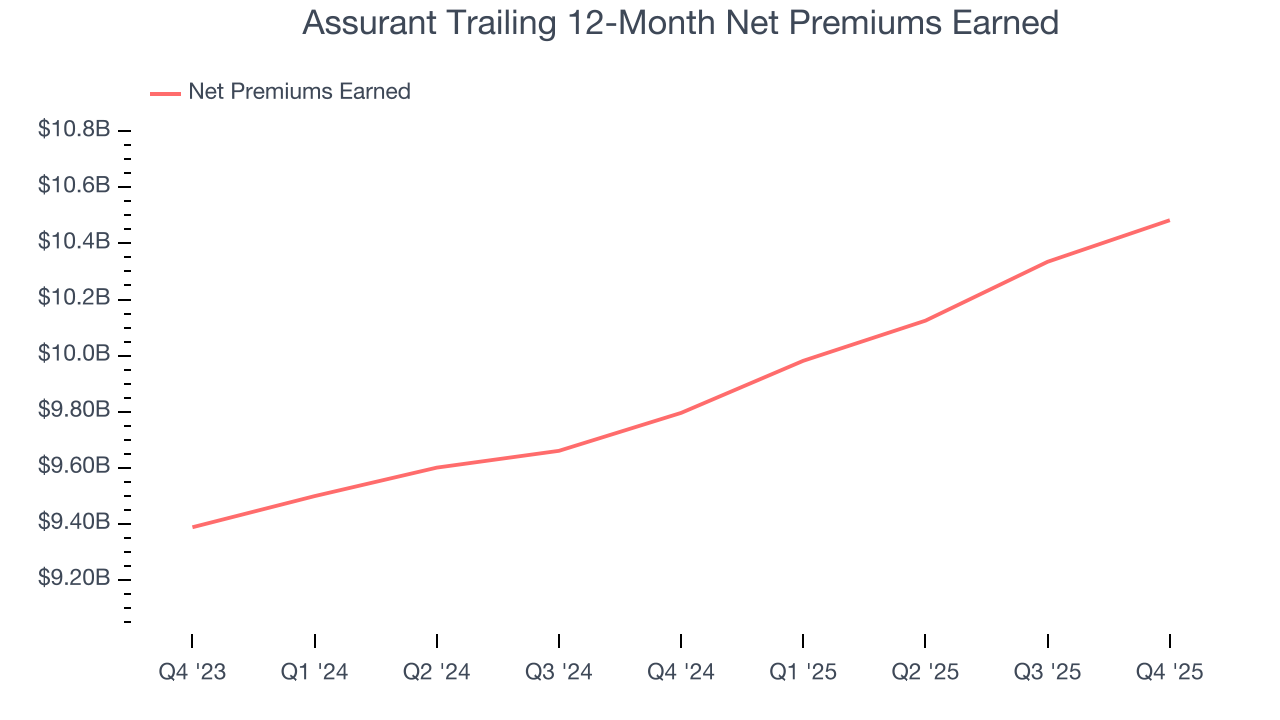

Assurant’s net premiums earned has grown at a 4.8% annualized rate over the last five years, worse than the broader insurance industry and slower than its total revenue.

When analyzing Assurant’s net premiums earned over the last two years, we can paint a similar picture as it recorded an annual growth rate of 5.7%. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. While these additional streams certainly contribute to the bottom line, their impact can vary. Some firms have shown greater success and long-term consistency in investing their float compared to peers. However, sharp fluctuations in the fixed income and equity markets can significantly affect short-term performance.

Assurant produced $2.71 billion of net premiums earned in Q4, up 5.8% year on year and in line with Wall Street Consensus estimates.

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because insurers are balance sheet businesses, where assets and liabilities define the core economics. This means that interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company’s control - should not.

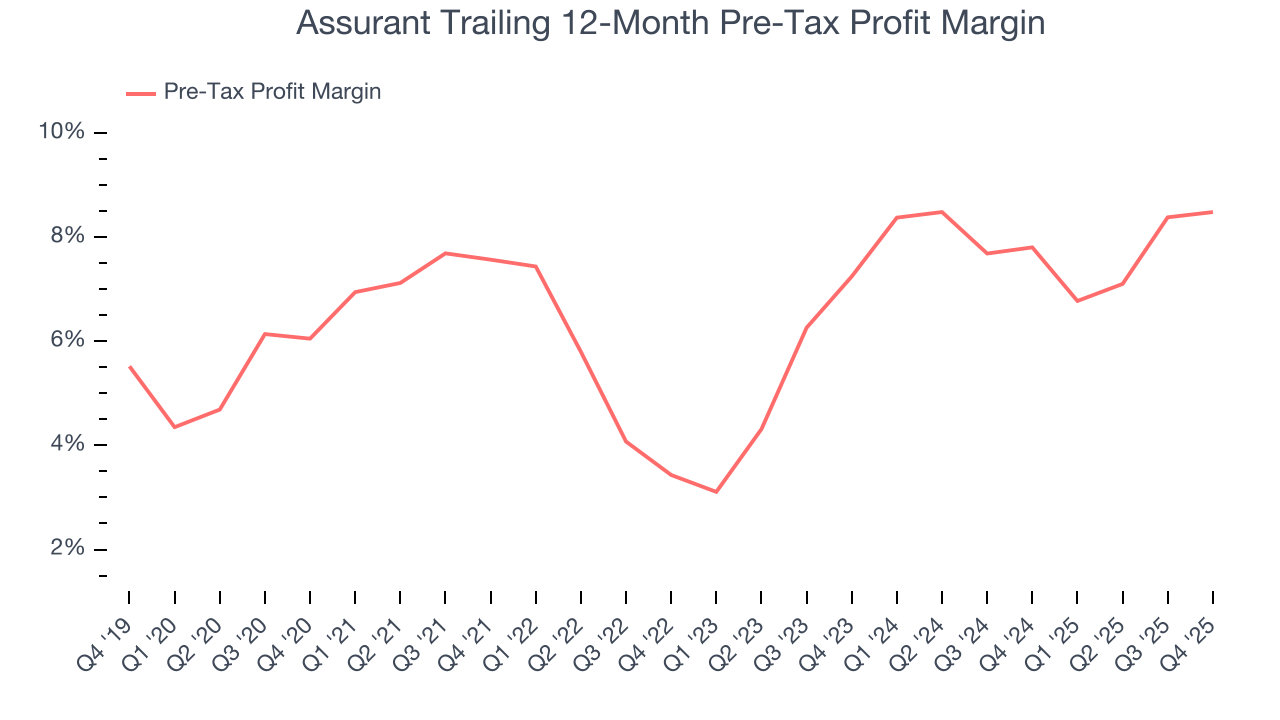

Over the last five years, Assurant’s pre-tax profit margin has fallen by 2.4 percentage points, going from 7.6% to 8.5%. It has also expanded by 1.2 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

Assurant’s pre-tax profit margin came in at 8.5% this quarter. This result was in line with the same quarter last year.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

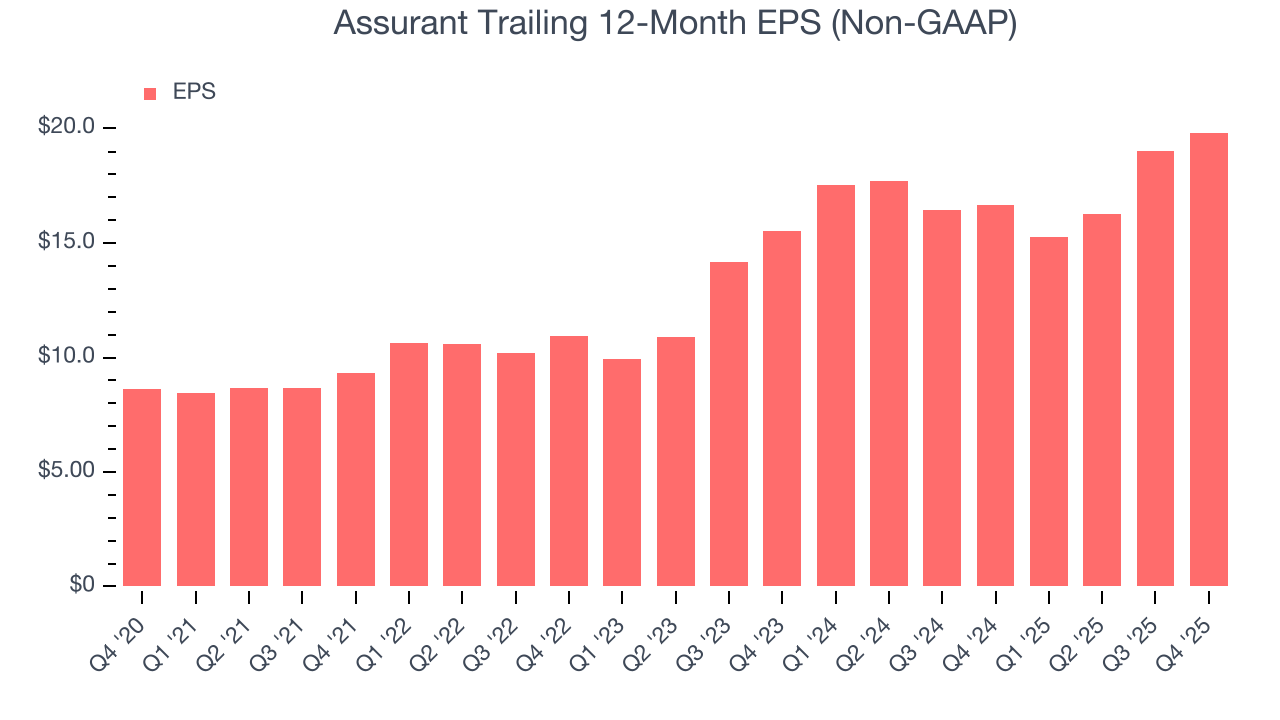

Assurant’s EPS grew at a remarkable 18.1% compounded annual growth rate over the last five years, higher than its 6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

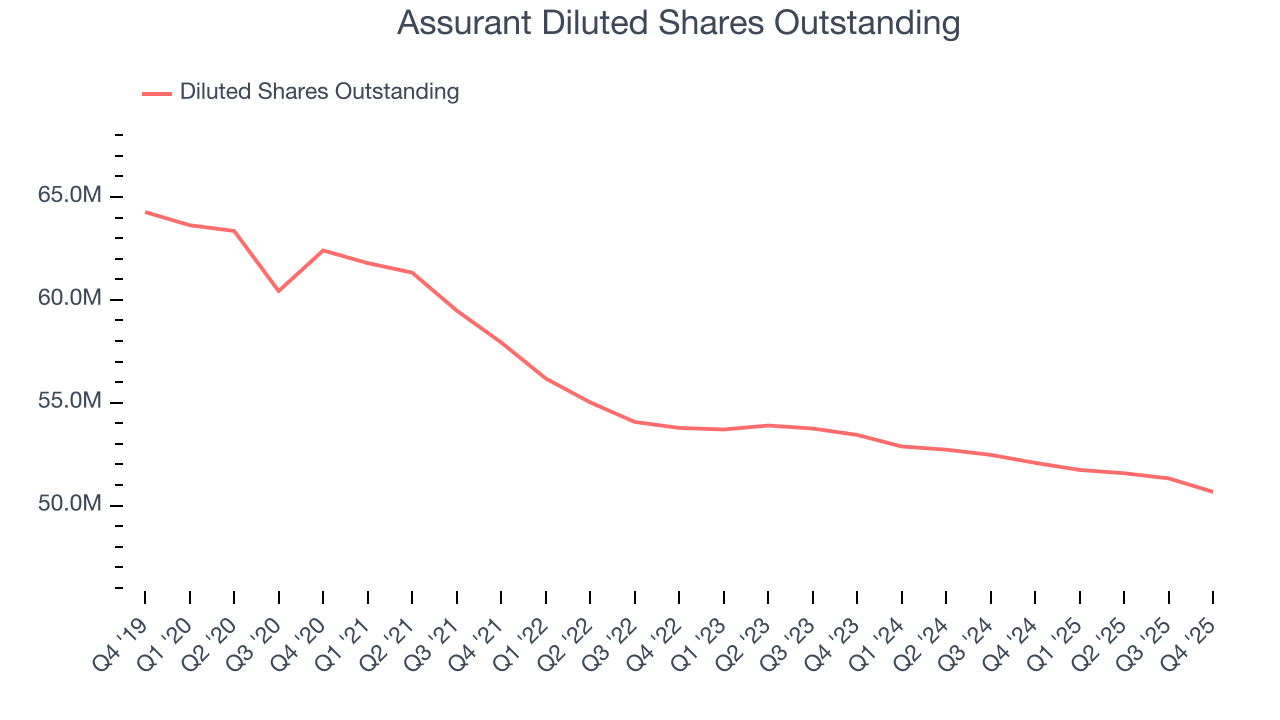

We can take a deeper look into Assurant’s earnings to better understand the drivers of its performance. As we mentioned earlier, Assurant’s pre-tax profit margin was flat this quarter but expanded by 2.4 percentage points over the last five years. On top of that, its share count shrank by 18.8%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Assurant, its two-year annual EPS growth of 13.1% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Assurant reported adjusted EPS of $5.61, up from $4.79 in the same quarter last year. This print beat analysts’ estimates by 1.9%. Over the next 12 months, Wall Street expects Assurant’s full-year EPS of $19.83 to grow 5.5%.

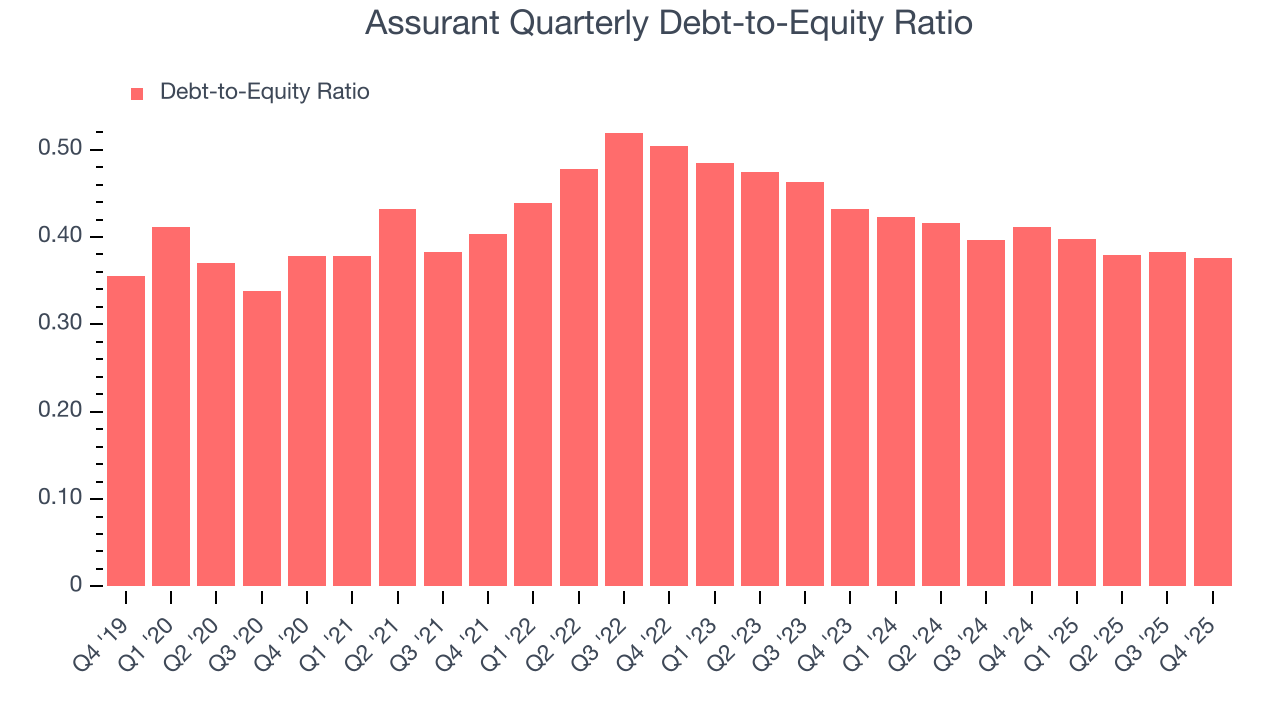

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Assurant currently has $2.21 billion of debt and $5.87 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.4×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

10. Return on Equity

Return on equity (ROE) is a crucial yardstick for insurance companies, measuring their ability to generate returns on the capital provided by shareholders. Insurers that consistently deliver superior ROE tend to create more value for their investors over time through strategic capital allocation and shareholder-friendly policies.

Over the last five years, Assurant has averaged an ROE of 12.1%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

11. Key Takeaways from Assurant’s Q4 Results

It was good to see Assurant narrowly top analysts’ revenue expectations this quarter. We were also happy its net premiums earned narrowly outperformed Wall Street’s estimates. On the other hand, its EPS slightly beat. Zooming out, we think this was a mixed quarter. The stock remained flat at $235.15 immediately following the results.

12. Is Now The Time To Buy Assurant?

Updated: February 10, 2026 at 11:44 PM EST

Before making an investment decision, investors should account for Assurant’s business fundamentals and valuation in addition to what happened in the latest quarter.

Assurant’s business quality ultimately falls short of our standards. To kick things off, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. And while its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking. On top of that, its net premiums earned growth was uninspiring over the last five years.

Assurant’s P/B ratio based on the next 12 months is 1.8x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $259.33 on the company (compared to the current share price of $235.15).