Alight (ALIT)

Alight is in for a bumpy ride. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Alight Will Underperform

Born from a corporate spinoff in 2017 to focus on employee experience technology, Alight (NYSE:ALIT) provides human capital management solutions that help companies administer employee benefits, payroll, and workforce management systems.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 3.7% annually over the last five years

- Earnings per share have contracted by 16.1% annually over the last two years, a headwind for returns as stock prices often echo long-term EPS performance

- Forecasted revenue decline of 7.2% for the upcoming 12 months implies demand will fall even further

Alight’s quality is inadequate. There are more appealing investments to be made.

Why There Are Better Opportunities Than Alight

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Alight

Alight is trading at $0.89 per share, or 2.9x forward P/E. This sure is a cheap multiple, but you get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Alight (ALIT) Research Report: Q4 CY2025 Update

Human capital management provider Alight (NYSE:ALIT) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 4% year on year to $653 million. Its non-GAAP profit of $0.18 per share was 23% below analysts’ consensus estimates.

Alight (ALIT) Q4 CY2025 Highlights:

- Revenue: $653 million vs analyst estimates of $654.9 million (4% year-on-year decline, in line)

- Adjusted EPS: $0.18 vs analyst expectations of $0.23 (23% miss)

- Adjusted EBITDA: $178 million vs analyst estimates of $220.2 million (27.3% margin, 19.2% miss)

- Operating Margin: -115%, down from 6.5% in the same quarter last year

- Free Cash Flow Margin: 15.2%, up from 13.5% in the same quarter last year

- Market Capitalization: $684.8 million

Company Overview

Born from a corporate spinoff in 2017 to focus on employee experience technology, Alight (NYSE:ALIT) provides human capital management solutions that help companies administer employee benefits, payroll, and workforce management systems.

Alight's business revolves around its Alight Worklife platform, which serves as a digital hub where employees can manage their health insurance, retirement plans, paid time off, and other benefits. The platform combines cloud technology with data analytics and artificial intelligence to create personalized experiences for users while giving employers insights into workforce trends and needs.

For large enterprises with complex benefits structures, Alight handles the day-to-day administration of health and retirement programs, ensuring compliance with regulations and processing transactions like retirement contributions or healthcare claims. When an employee needs to take medical leave or has questions about their 401(k), they might interact with Alight's systems or customer service representatives without realizing it.

Through its Professional Services segment, Alight also helps organizations implement and optimize major HR software platforms like Workday, SAP SuccessFactors, and Oracle. For example, when a multinational corporation decides to consolidate its disparate HR systems onto a single cloud platform, Alight's consultants might manage the entire transition, from initial planning through deployment and staff training.

The company generates revenue through multi-year contracts with employers, typically charging based on the number of employees served and the complexity of services provided. Alight's business model benefits from high switching costs, as changing HR and benefits administrators requires significant time and resources from clients.

Alight maintains an extensive partner network, integrating with over 350 external platforms and service providers. This ecosystem allows the company to offer additional capabilities like specialized wellbeing programs through its Alight Marketplace, creating a comprehensive solution for workforce management needs.

4. Professional Staffing & HR Solutions

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

Alight competes with large HR consulting firms like Mercer and Willis Towers Watson (NASDAQ: WTW), benefits administration specialists such as Fidelity and Empower, payroll providers including ADP (NASDAQ: ADP), and HR technology companies like Workday (NASDAQ: WDAY) and Accenture (NYSE: ACN).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $2.26 billion in revenue over the past 12 months, Alight is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Alight struggled to generate demand over the last five years. Its sales dropped by 3.7% annually, a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Alight’s annualized revenue declines of 2.8% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

This quarter, Alight reported a rather uninspiring 4% year-on-year revenue decline to $653 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

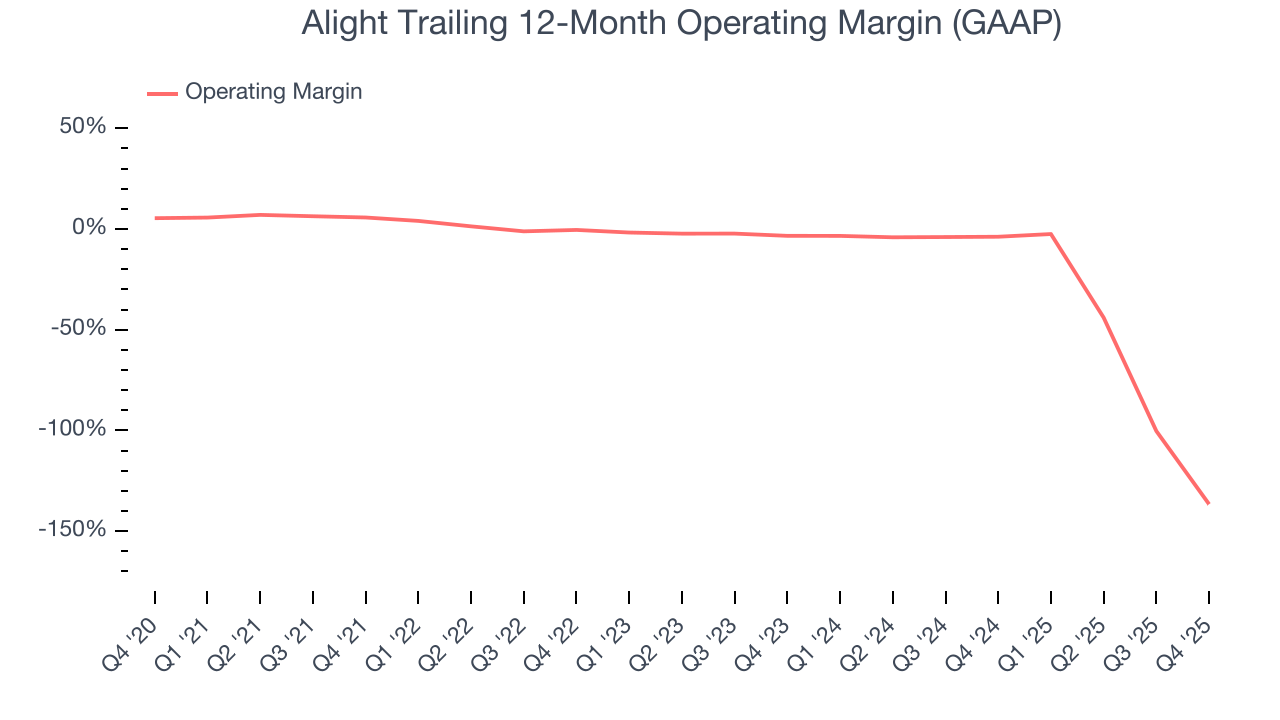

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Alight’s high expenses have contributed to an average operating margin of negative 23.8% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Alight’s operating margin decreased significantly over the last five years. Alight’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Alight generated a negative 115% operating margin. The company's consistent lack of profits raise a flag.

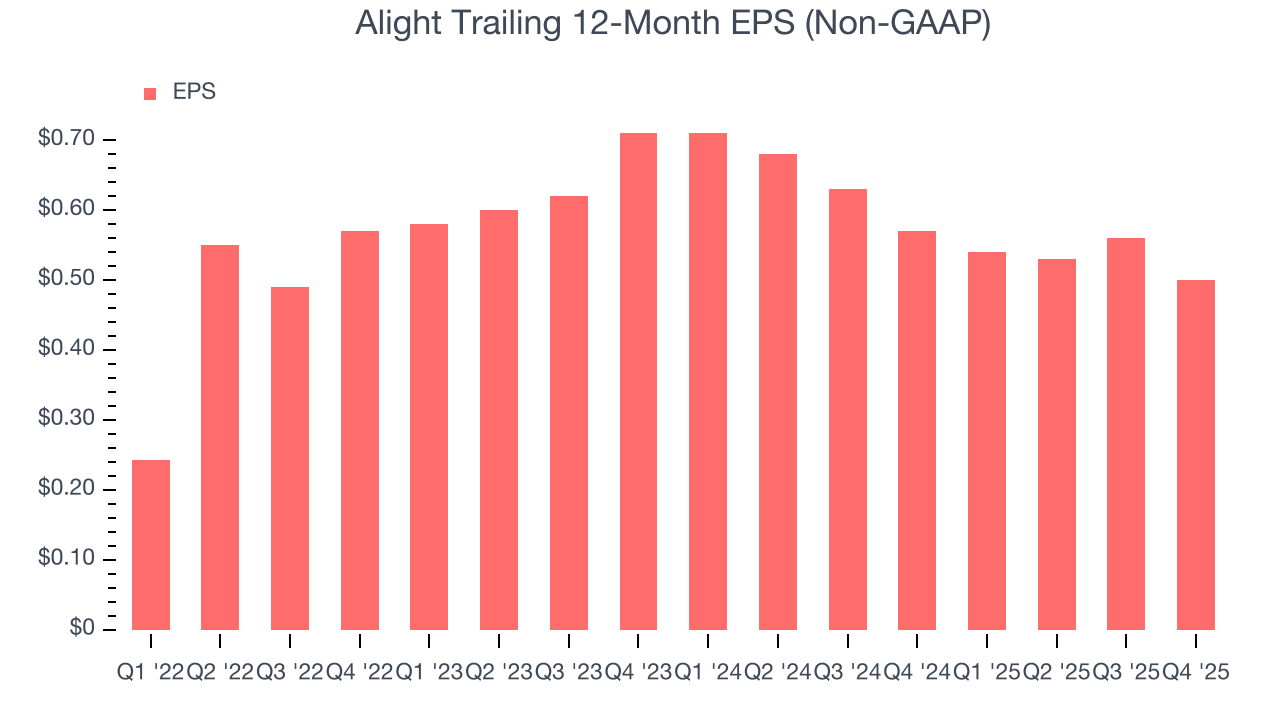

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Alight’s full-year EPS grew at an astounding 34.4% compounded annual growth rate over the last four years, better than the broader business services sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Alight, its EPS declined by more than its revenue over the last two years, dropping 16.1%. This tells us the company struggled to adjust to shrinking demand.

We can take a deeper look into Alight’s earnings to better understand the drivers of its performance. Alight’s operating margin has declined over the last two yearswhile its share count has grown 5.1%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Alight reported adjusted EPS of $0.18, down from $0.24 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Alight’s full-year EPS of $0.50 to grow 17.7%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Alight has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.8% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that Alight’s margin expanded by 11 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Alight’s free cash flow clocked in at $99 million in Q4, equivalent to a 15.2% margin. This result was good as its margin was 1.6 percentage points higher than in the same quarter last year, building on its favorable historical trend.

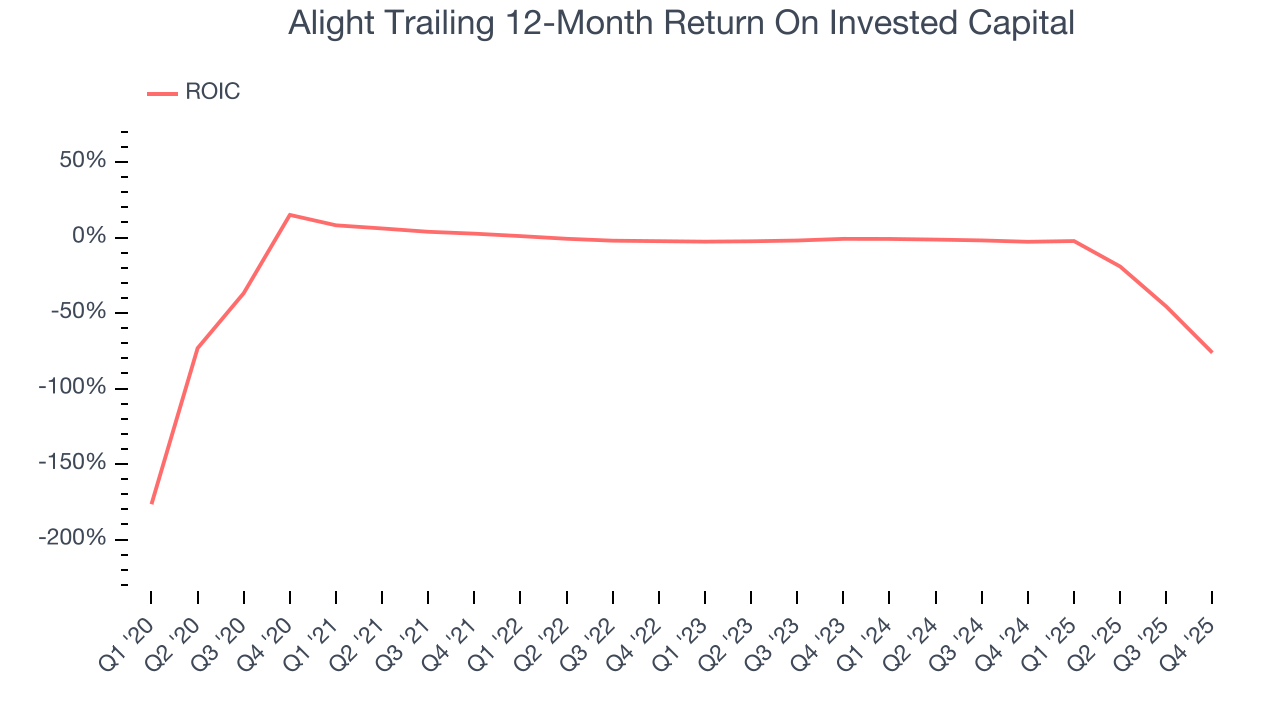

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Alight’s five-year average ROIC was negative 16%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Alight’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

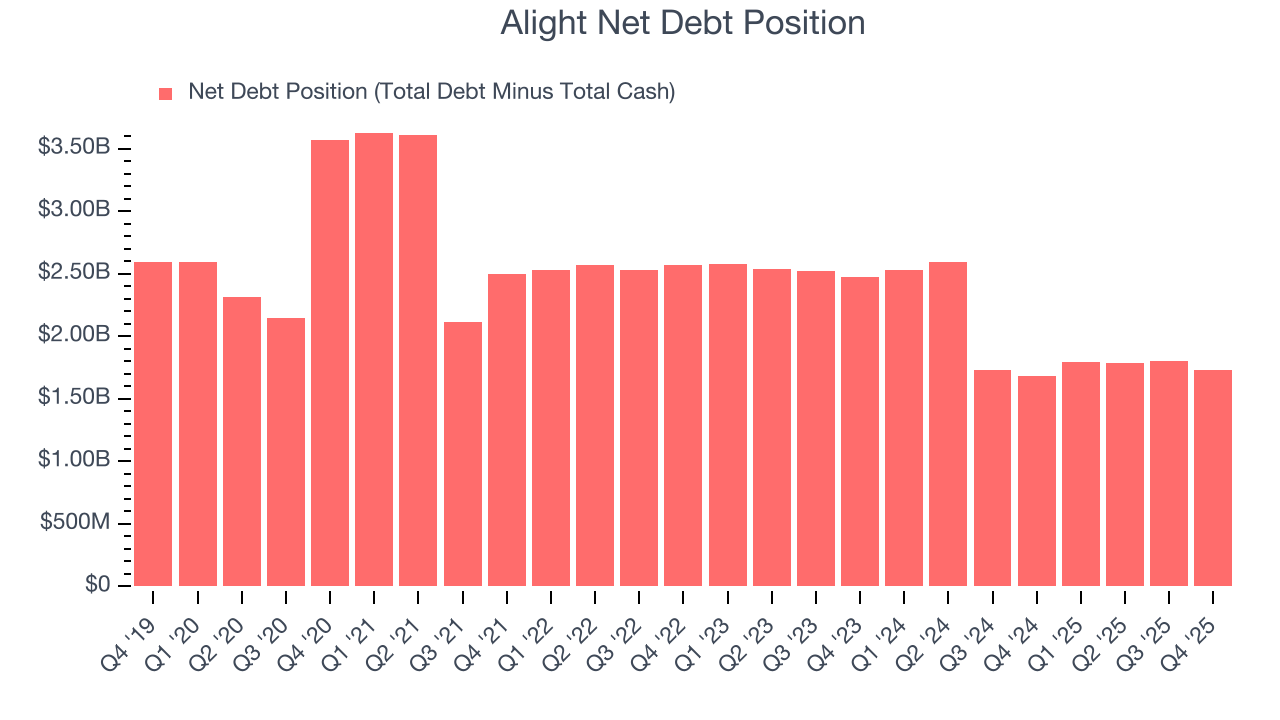

10. Balance Sheet Assessment

Alight reported $273 million of cash and $2.01 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $561 million of EBITDA over the last 12 months, we view Alight’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $44 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Alight’s Q4 Results

We struggled to find many positives in these results. Its EPS missed and its revenue was in line with Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $1.31 immediately after reporting.

12. Is Now The Time To Buy Alight?

Updated: March 3, 2026 at 11:54 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Alight.

Alight doesn’t pass our quality test. For starters, its revenue has declined over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its rising cash profitability gives it more optionality, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Alight’s P/E ratio based on the next 12 months is 2.9x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $2.70 on the company (compared to the current share price of $0.89).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.