Allstate (ALL)

We aren’t fans of Allstate. Its sales and EPS are expected to be weak over the next year, which doesn’t bode well for its share price.― StockStory Analyst Team

1. News

2. Summary

Why Allstate Is Not Exciting

Born from a Sears, Roebuck & Co. initiative during the Great Depression with its famous "You're in good hands" slogan, Allstate (NYSE:ALL) is one of America's largest personal property and casualty insurers, offering protection for autos, homes, and personal property.

- Scale is a double-edged sword because it limits the firm’s capital growth potential compared to its smaller competitors, as reflected in its below-average annual book value per share increases of 3.2% for the last five years

- Estimated sales growth of 1.4% for the next 12 months implies demand will slow from its two-year trend

- A consolation is that its notable projected book value per share growth of 19.1% for the next 12 months hints at strong capital generation

Allstate is in the doghouse. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Allstate

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Allstate

Allstate is trading at $203.02 per share, or 1.9x forward P/B. This valuation is fair for the quality you get, but we’re on the sidelines for now.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Allstate (ALL) Research Report: Q4 CY2025 Update

Insurance giant Allstate (NYSE:ALL) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 3.8% year on year to $17.35 billion. Its non-GAAP profit of $14.31 per share was 45.1% above analysts’ consensus estimates.

Allstate (ALL) Q4 CY2025 Highlights:

- Net Premiums Earned: $15.51 billion vs analyst estimates of $14.85 billion (2.9% year-on-year growth, 4.4% beat)

- Revenue: $17.35 billion vs analyst estimates of $16.69 billion (3.8% year-on-year growth, 3.9% beat)

- Pre-tax Profit: $4.92 billion (28.3% margin)

- Adjusted EPS: $14.31 vs analyst estimates of $9.86 (45.1% beat)

- Market Capitalization: $52.8 billion

Company Overview

Born from a Sears, Roebuck & Co. initiative during the Great Depression with its famous "You're in good hands" slogan, Allstate (NYSE:ALL) is one of America's largest personal property and casualty insurers, offering protection for autos, homes, and personal property.

Allstate operates through a network of thousands of exclusive agents, independent agents, contact centers, and online platforms to deliver its insurance products. The company's portfolio extends beyond traditional auto and home insurance to include specialty coverage for motorcycles, boats, and recreational vehicles, as well as umbrella policies that provide additional liability protection.

The insurer has embraced technology to enhance its offerings, developing telematics programs like Drivewise, which monitors driving behavior through mobile apps or in-vehicle devices to encourage safer driving and provide more personalized pricing. Similarly, its Milewise program offers usage-based insurance where customers pay based on miles driven.

Beyond its core insurance business, Allstate has diversified into protection services through several subsidiaries. Allstate Protection Plans safeguards consumer electronics and appliances purchased from major retailers. Allstate Identity Protection helps customers secure their personal information against fraud. The company also provides roadside assistance services and dealer services for vehicle service contracts.

A typical Allstate customer might be a homeowner who bundles multiple policies for savings, uses the mobile app to file claims after storm damage, and receives personalized pricing based on their driving habits tracked through telematics. Allstate generates revenue primarily through insurance premiums, with additional income from investment returns on its substantial portfolio.

4. Property & Casualty Insurance

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

Allstate's main competitors in the property and casualty insurance market include State Farm, Progressive (NYSE:PGR), Berkshire Hathaway's GEICO (NYSE:BRK.A, NYSE:BRK.B), Liberty Mutual, and Travelers (NYSE:TRV).

5. Revenue Growth

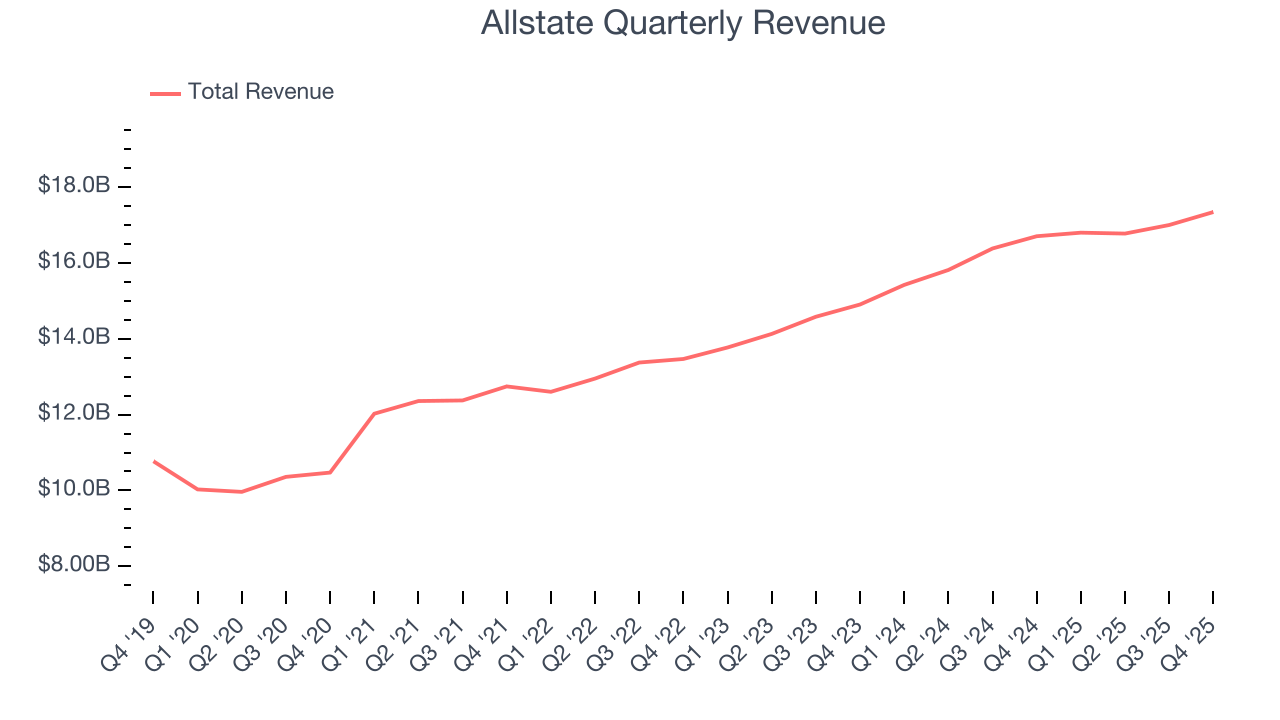

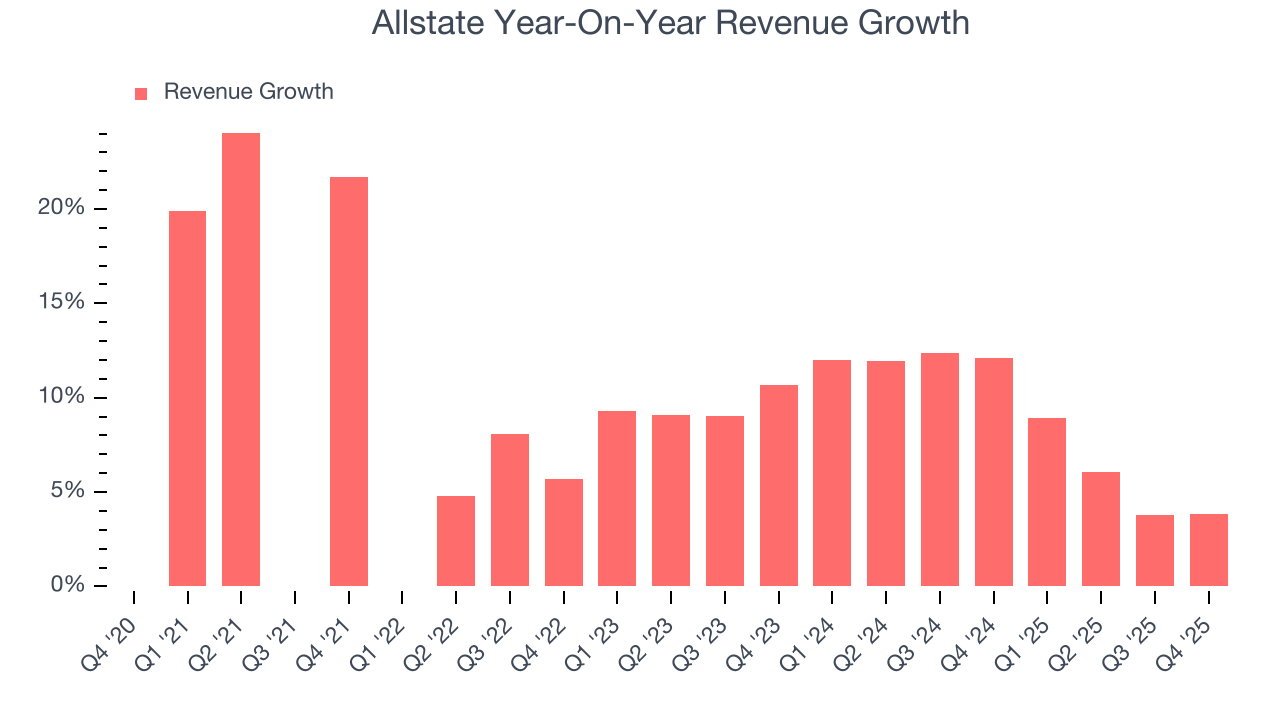

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Over the last five years, Allstate grew its revenue at an impressive 10.7% compounded annual growth rate. Its growth beat the average insurance company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Allstate’s annualized revenue growth of 8.8% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Allstate reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 3.9%.

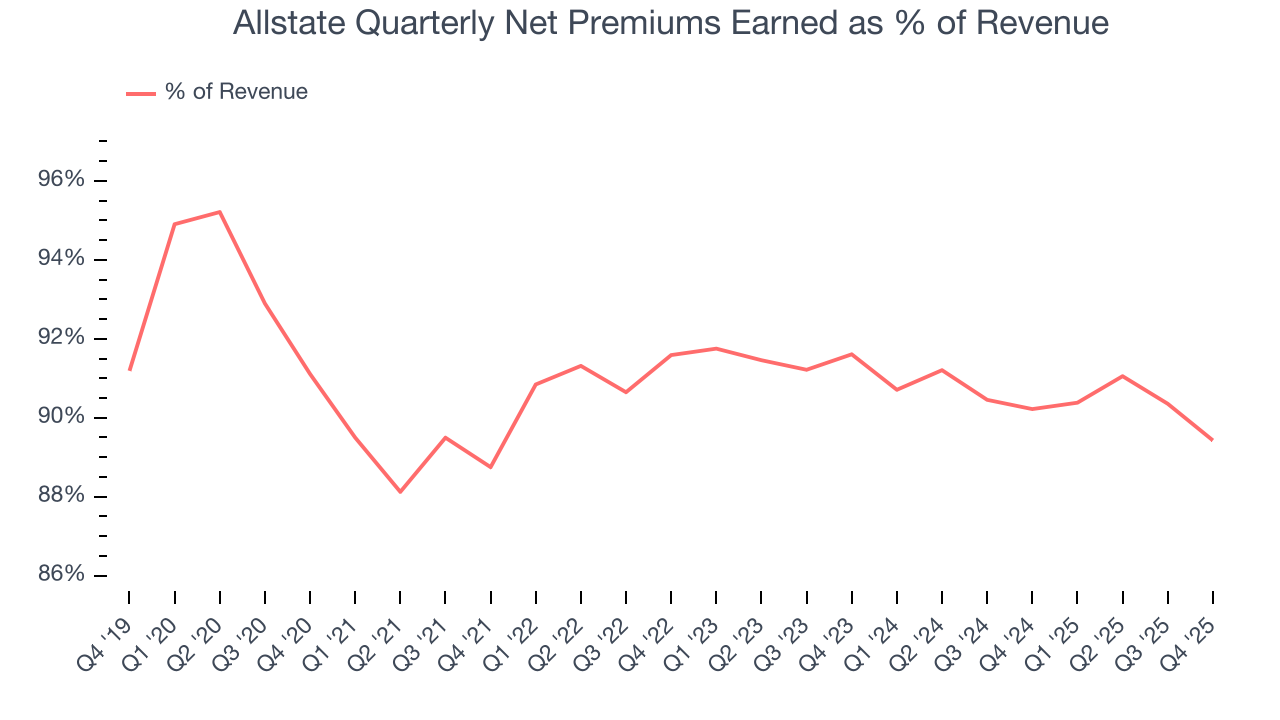

Net premiums earned made up 90.5% of the company’s total revenue during the last five years, meaning Allstate lives and dies by its underwriting activities because non-insurance operations barely move the needle.

Net premiums earned commands greater market attention due to its reliability and consistency, whereas investment and fee income are often seen as more volatile revenue streams that fluctuate with market conditions.

6. Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are:

- Gross premiums - what’s ceded to reinsurers as a risk mitigation and transfer strategy

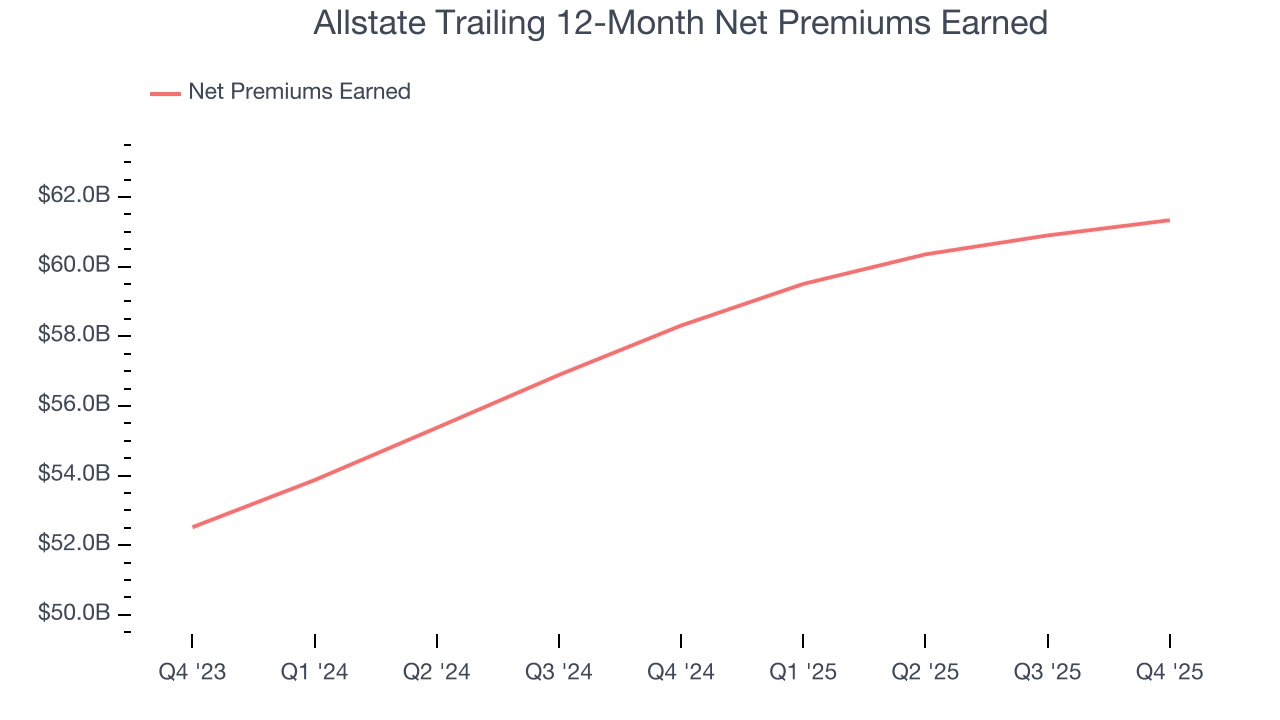

Allstate’s net premiums earned has grown at a 10% annualized rate over the last five years, a step above the broader insurance industry and in line with its total revenue.

When analyzing Allstate’s net premiums earned over the last two years, we can see that growth decelerated to 8.1% annually. This performance was similar to its total revenue.

Allstate’s net premiums earned came in at $15.51 billion this quarter, up 2.9% year on year and topping Wall Street Consensus estimates by 4.4%.

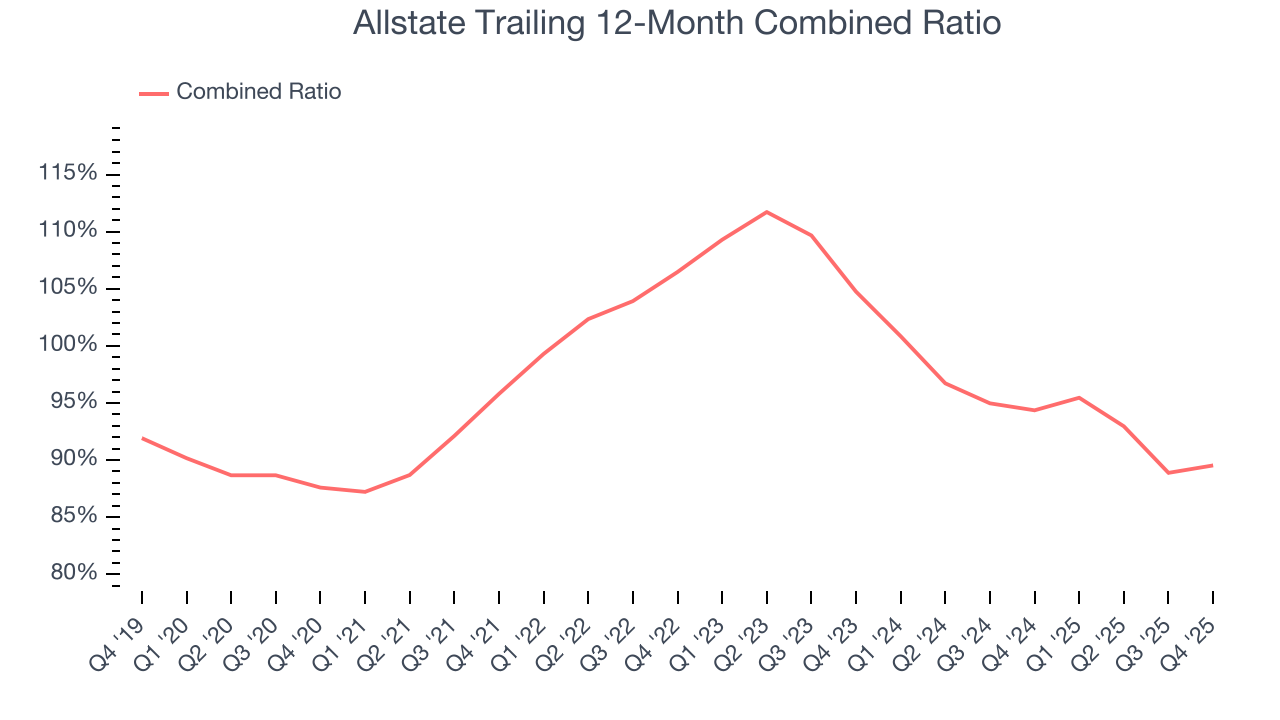

7. Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

Combined ratio = (costs of underwriting + what an insurer pays out in claims) / net premiums earned. If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations.

Given the calculation, a lower expense ratio is better. Over the last five years, Allstate’s combined ratio has increased by 1.9 percentage points, going from 95.8% to 89.5%. Luckily, it seems the company has recently taken steps to address its expense base as its combined ratio improved by 15.2 percentage points on a two-year basis.

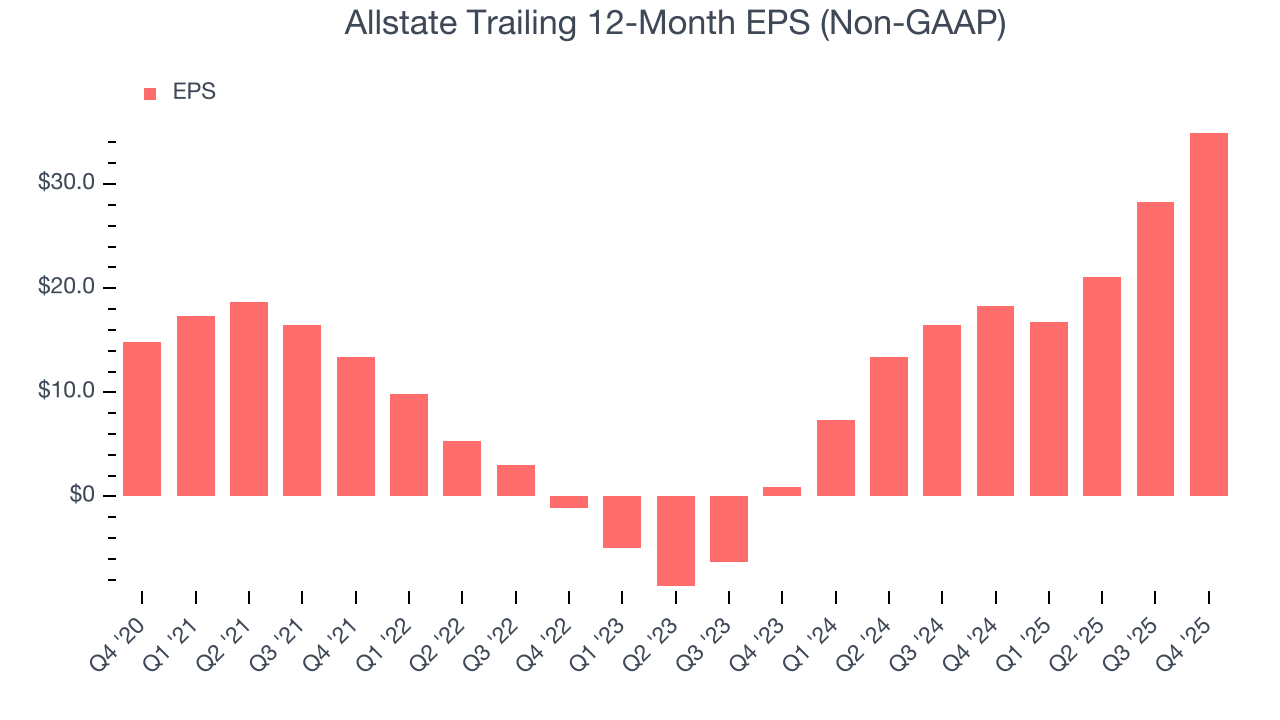

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

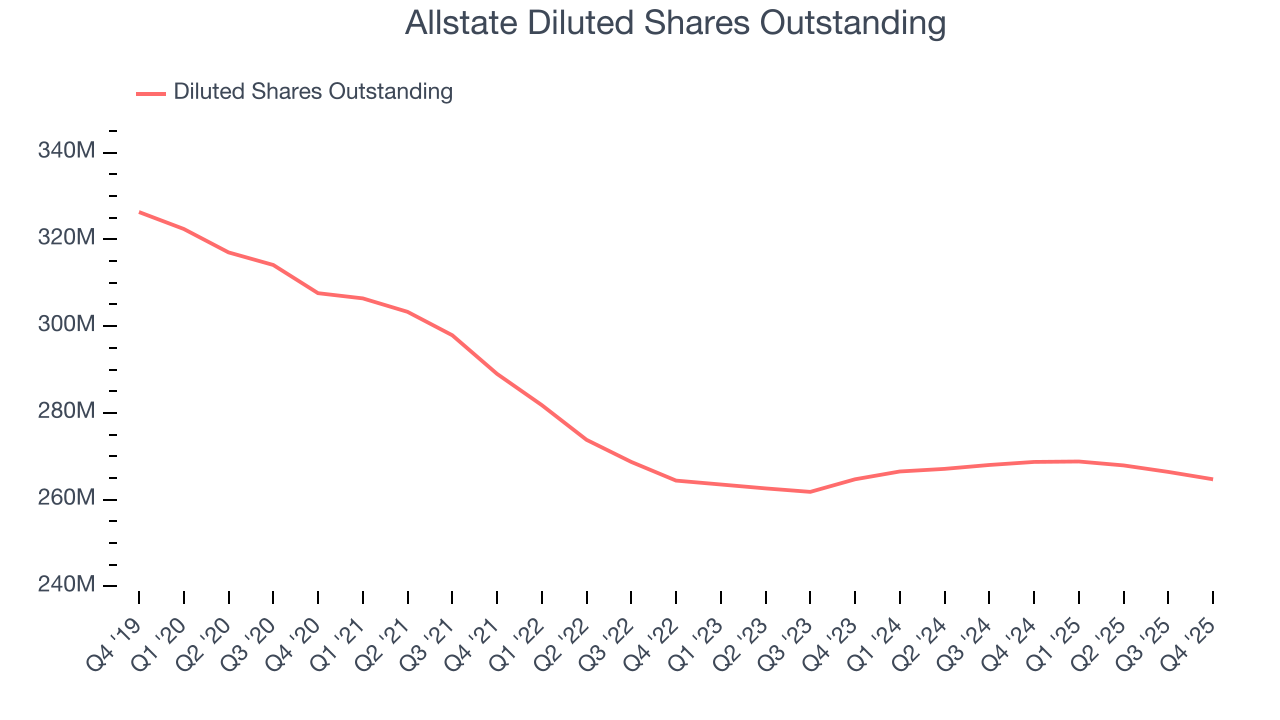

Allstate’s EPS grew at a remarkable 18.7% compounded annual growth rate over the last five years, higher than its 10.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Allstate’s earnings can give us a better understanding of its performance. A five-year view shows that Allstate has repurchased its stock, shrinking its share count by 13.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Allstate, its two-year annual EPS growth of 520% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Allstate reported adjusted EPS of $14.31, up from $7.67 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Allstate’s full-year EPS of $34.95 to shrink by 30.8%.

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Allstate has no debt, so leverage is not an issue here.

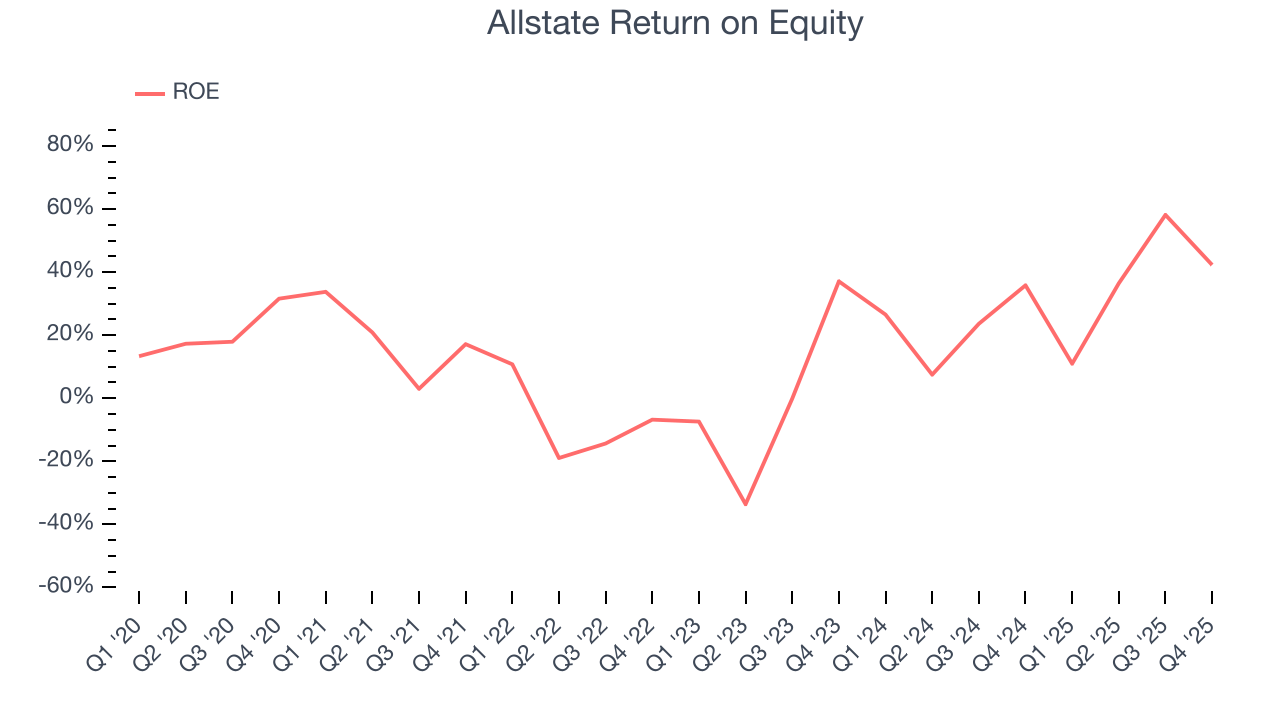

10. Return on Equity

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Allstate has averaged an ROE of 14.1%, healthy for a company operating in a sector where the average shakes out around 12.5% and those putting up 20%+ are greatly admired. This is a bright spot for Allstate.

11. Key Takeaways from Allstate’s Q4 Results

It was good to see Allstate beat analysts’ EPS expectations this quarter. We were also excited its net premiums earned outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 1.9% to $211.12 immediately following the results.

12. Is Now The Time To Buy Allstate?

Updated: February 4, 2026 at 5:28 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Allstate.

Allstate has a few positive attributes, but it doesn’t top our wishlist. To kick things off, its revenue growth was impressive over the last five years. And while Allstate’s projected EPS for the next year is lacking, its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders.

Allstate’s P/B ratio based on the next 12 months is 1.7x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $236.76 on the company (compared to the current share price of $211.12).