Affiliated Managers Group (AMG)

Affiliated Managers Group doesn’t impress us. Its lack of sales growth shows demand is soft, a concerning sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Affiliated Managers Group Is Not Exciting

Using a partnership approach that preserves entrepreneurial culture at its portfolio companies, Affiliated Managers Group (NYSE:AMG) is an investment firm that acquires stakes in boutique asset management companies while allowing them to maintain operational independence.

- Sales were flat over the last five years, indicating it’s failed to expand this cycle

- A silver lining is that its ROE punches in at 21.7%, illustrating management’s expertise in identifying profitable investments

Affiliated Managers Group is in the penalty box. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Affiliated Managers Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Affiliated Managers Group

Affiliated Managers Group is trading at $284.49 per share, or 8.8x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Affiliated Managers Group (AMG) Research Report: Q4 CY2025 Update

Asset management company Affiliated Managers Group (NYSE:AMG) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 6.2% year on year to $556.6 million. Its non-GAAP profit of $9.48 per share was 7.3% above analysts’ consensus estimates.

Affiliated Managers Group (AMG) Q4 CY2025 Highlights:

- Assets Under Management: $813.3 billion (14.9% year-on-year growth)

- Revenue: $556.6 million vs analyst estimates of $566.3 million (6.2% year-on-year growth, 1.7% miss)

- Pre-tax Profit: $525.7 million (94.4% margin)

- Adjusted EPS: $9.48 vs analyst estimates of $8.84 (7.3% beat)

- Market Capitalization: $8.67 billion

Company Overview

Using a partnership approach that preserves entrepreneurial culture at its portfolio companies, Affiliated Managers Group (NYSE:AMG) is an investment firm that acquires stakes in boutique asset management companies while allowing them to maintain operational independence.

AMG's business model centers on acquiring equity interests in independent investment management firms, typically ranging from 50% to 75%, rather than outright ownership. This approach allows the boutique firms to retain their unique investment cultures and decision-making autonomy while gaining access to AMG's global distribution capabilities and operational support. The company refers to these investment firms as "Affiliates," which span various investment strategies including equities, fixed income, alternatives, and multi-asset approaches.

The Affiliates serve diverse client bases including institutional investors like pension funds, endowments, and foundations, as well as retail investors through various investment vehicles. For example, a university endowment might allocate capital to an AMG Affiliate specializing in emerging market equities, while a pension fund might invest with another Affiliate focused on private equity or hedge fund strategies.

AMG generates revenue primarily through its share of the management fees and performance fees earned by its Affiliates. These fees are typically calculated as a percentage of assets under management (AUM) and, in some cases, include performance-based components. The company's global distribution platform helps Affiliates expand their client reach across North America, Europe, Asia, and other regions.

The company also provides succession planning solutions for boutique investment firms, addressing a critical industry challenge as founding partners approach retirement. This aspect of AMG's business allows it to preserve the intellectual capital and investment expertise of established firms while facilitating ownership transitions.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

Affiliated Managers Group competes with other asset management holding companies such as BlackRock (NYSE:BLK), T. Rowe Price Group (NASDAQ:TROW), Franklin Resources (NYSE:BEN), and Invesco (NYSE:IVZ), as well as alternative asset managers like Blackstone (NYSE:BX) and KKR (NYSE:KKR).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Affiliated Managers Group struggled to consistently increase demand as its $2.07 billion of revenue for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Just like its five-year trend, Affiliated Managers Group’s revenue over the last two years was flat, suggesting it is in a slump.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Affiliated Managers Group’s revenue grew by 6.2% year on year to $556.6 million, missing Wall Street’s estimates.

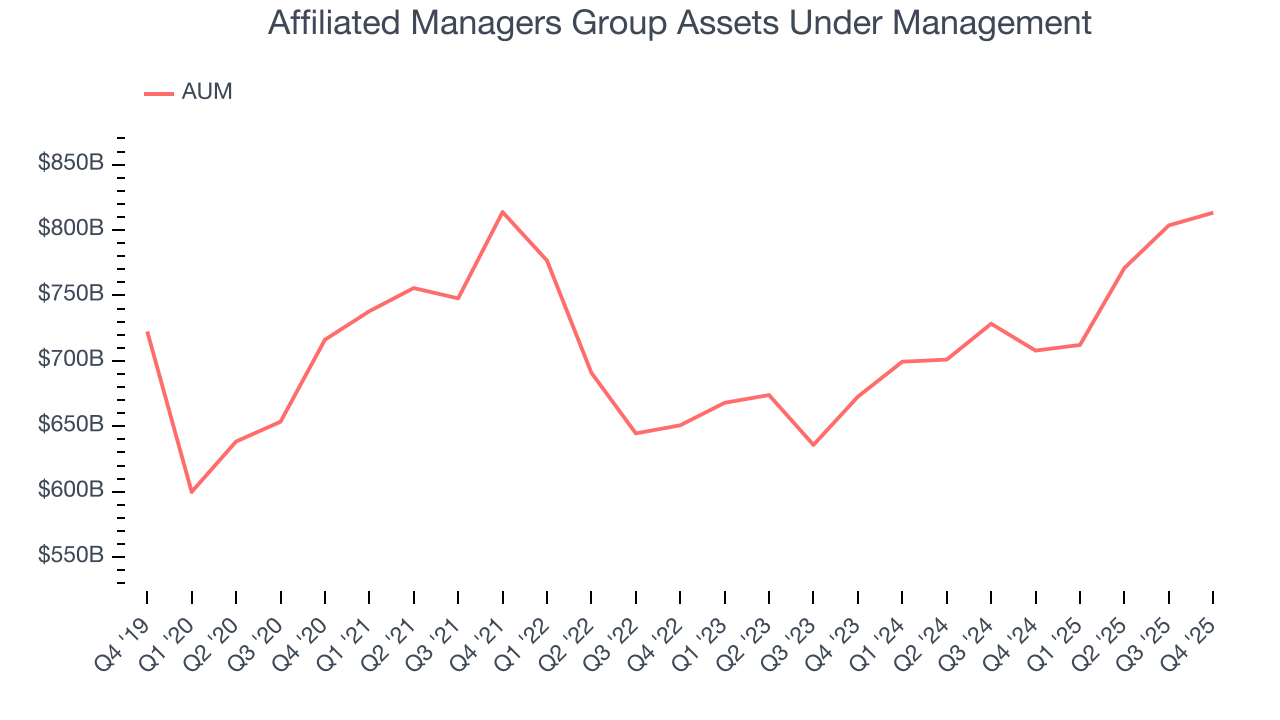

6. Assets Under Management (AUM)

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

Affiliated Managers Group’s AUM has grown at an annual rate of 3.5% over the last five years, worse than the broader financials industry but faster than its total revenue. When analyzing Affiliated Managers Group’s AUM over the last two years, we can see that growth accelerated to 8.2% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. That said, assets aren't the be-all and end-all due to their unpredictable and cyclical nature.

In Q4, Affiliated Managers Group’s AUM was $813.3 billion. This print was 14.9% higher than the same quarter last year.

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last five years, Affiliated Managers Group’s pre-tax profit margin has fallen by 32.1 percentage points, going from 47.3% to 57.2%. It has also expanded by 4.2 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q4, Affiliated Managers Group’s pre-tax profit margin was 94.4%. This result was 42.2 percentage points better than the same quarter last year.

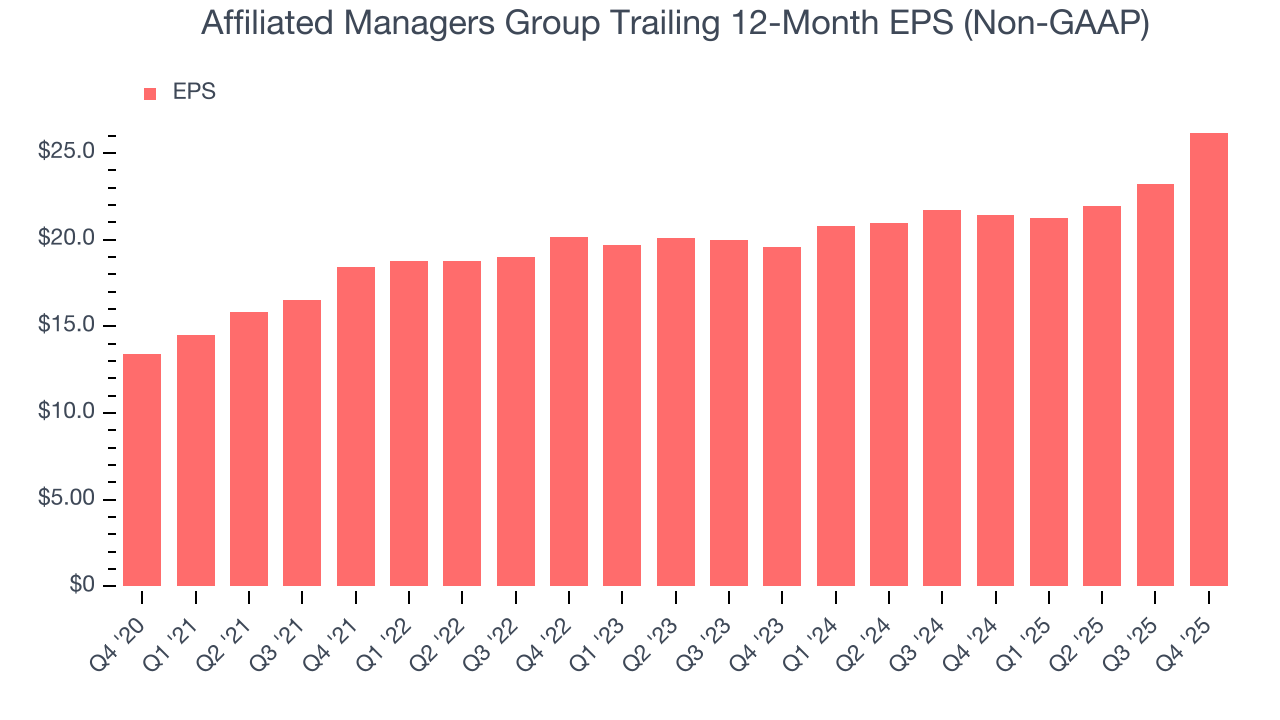

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Affiliated Managers Group’s EPS grew at a solid 14.3% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Affiliated Managers Group, its two-year annual EPS growth of 15.6% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Affiliated Managers Group reported adjusted EPS of $9.48, up from $6.53 in the same quarter last year. This print beat analysts’ estimates by 7.3%. Over the next 12 months, Wall Street expects Affiliated Managers Group’s full-year EPS of $26.17 to grow 15.9%.

9. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Affiliated Managers Group has averaged an ROE of 21.1%, excellent for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Affiliated Managers Group.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Affiliated Managers Group currently has $2.69 billion of debt and $3.24 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.8×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Affiliated Managers Group’s Q4 Results

It was good to see Affiliated Managers Group beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Zooming out, we think this was a mixed quarter. The stock traded up 2.4% to $315.34 immediately following the results.

12. Is Now The Time To Buy Affiliated Managers Group?

Updated: March 6, 2026 at 11:59 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Affiliated Managers Group doesn’t top our investment wishlist, but we understand that it’s not a bad business. Although its revenue growth was weak over the last five years, its growth over the next 12 months is expected to be higher. And while Affiliated Managers Group’s AUM growth was weak over the last five years, its expanding pre-tax profit margin shows the business has become more efficient.

Affiliated Managers Group’s P/E ratio based on the next 12 months is 8.8x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $392.29 on the company (compared to the current share price of $284.49).