Affiliated Managers Group (AMG)

We’re skeptical of Affiliated Managers Group. Its lack of sales growth shows demand is soft, a concerning sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think Affiliated Managers Group Will Underperform

Using a partnership approach that preserves entrepreneurial culture at its portfolio companies, Affiliated Managers Group (NYSE:AMG) is an investment firm that acquires stakes in boutique asset management companies while allowing them to maintain operational independence.

- Sales were flat over the last five years, indicating it’s failed to expand this cycle

- A positive is that its ROE punches in at 21%, illustrating management’s expertise in identifying profitable investments

Affiliated Managers Group’s quality doesn’t meet our hurdle. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Affiliated Managers Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Affiliated Managers Group

At $319.80 per share, Affiliated Managers Group trades at 11.2x forward P/E. Affiliated Managers Group’s valuation may seem like a bargain, especially when stacked up against other financials companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Affiliated Managers Group (AMG) Research Report: Q3 CY2025 Update

Asset management company Affiliated Managers Group (NYSE:AMG) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 2.2% year on year to $528 million. Its non-GAAP profit of $6.10 per share was 3.7% above analysts’ consensus estimates.

Affiliated Managers Group (AMG) Q3 CY2025 Highlights:

Company Overview

Using a partnership approach that preserves entrepreneurial culture at its portfolio companies, Affiliated Managers Group (NYSE:AMG) is an investment firm that acquires stakes in boutique asset management companies while allowing them to maintain operational independence.

AMG's business model centers on acquiring equity interests in independent investment management firms, typically ranging from 50% to 75%, rather than outright ownership. This approach allows the boutique firms to retain their unique investment cultures and decision-making autonomy while gaining access to AMG's global distribution capabilities and operational support. The company refers to these investment firms as "Affiliates," which span various investment strategies including equities, fixed income, alternatives, and multi-asset approaches.

The Affiliates serve diverse client bases including institutional investors like pension funds, endowments, and foundations, as well as retail investors through various investment vehicles. For example, a university endowment might allocate capital to an AMG Affiliate specializing in emerging market equities, while a pension fund might invest with another Affiliate focused on private equity or hedge fund strategies.

AMG generates revenue primarily through its share of the management fees and performance fees earned by its Affiliates. These fees are typically calculated as a percentage of assets under management (AUM) and, in some cases, include performance-based components. The company's global distribution platform helps Affiliates expand their client reach across North America, Europe, Asia, and other regions.

The company also provides succession planning solutions for boutique investment firms, addressing a critical industry challenge as founding partners approach retirement. This aspect of AMG's business allows it to preserve the intellectual capital and investment expertise of established firms while facilitating ownership transitions.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

Affiliated Managers Group competes with other asset management holding companies such as BlackRock (NYSE:BLK), T. Rowe Price Group (NASDAQ:TROW), Franklin Resources (NYSE:BEN), and Invesco (NYSE:IVZ), as well as alternative asset managers like Blackstone (NYSE:BX) and KKR (NYSE:KKR).

5. Revenue Growth

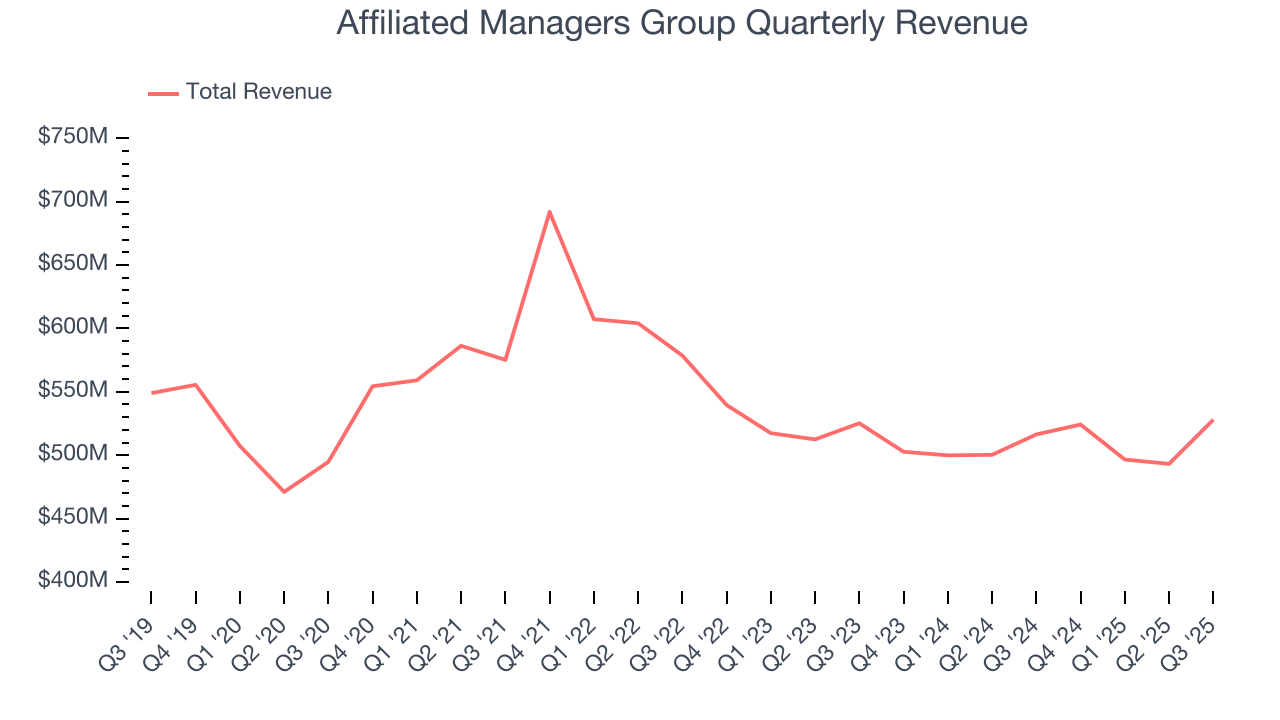

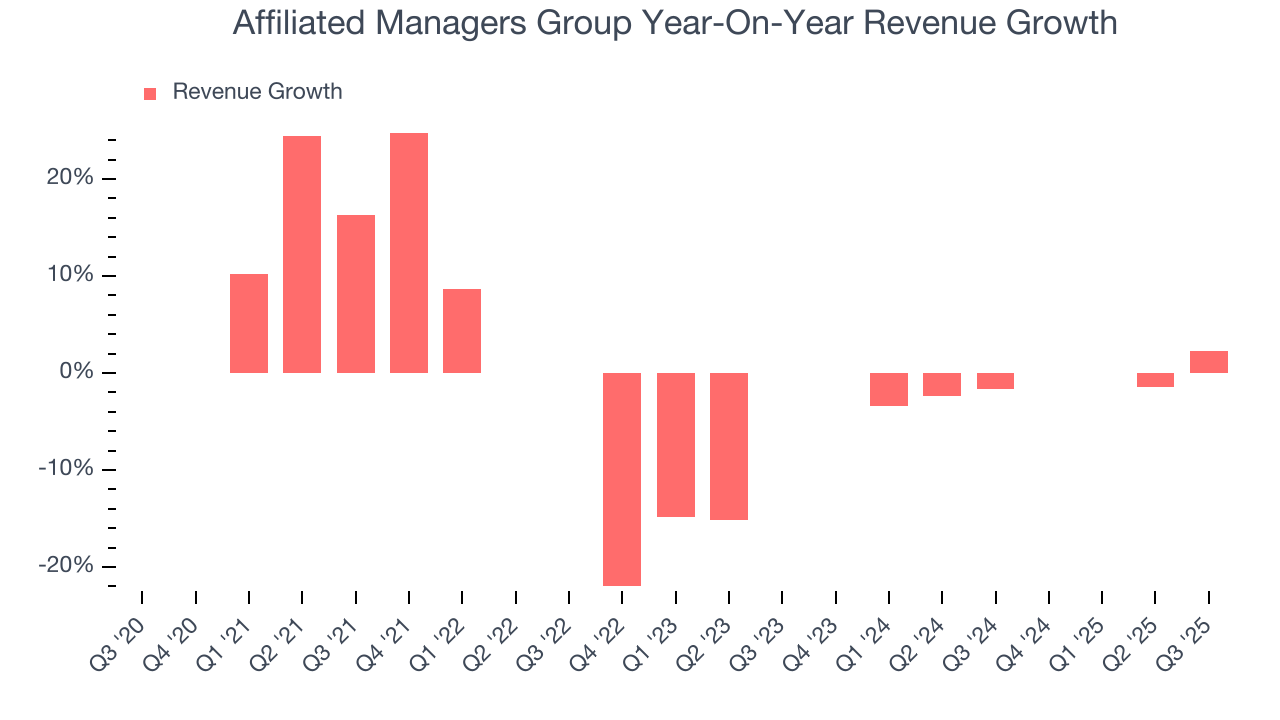

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Affiliated Managers Group struggled to consistently increase demand as its $2.04 billion of revenue for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of lacking business quality.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Affiliated Managers Group’s recent performance shows its demand remained suppressed as its revenue has declined by 1.3% annually over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Affiliated Managers Group’s revenue grew by 2.2% year on year to $528 million, falling short of Wall Street’s estimates.

6. Assets Under Management (AUM)

Assets Under Management (AUM) is the cornerstone of a financial firm's investment division, representing all client capital under its stewardship. Management fees on this AUM create reliable, recurring revenue that maintains stability even when investment performance struggles, though prolonged poor returns can eventually affect asset retention and growth.

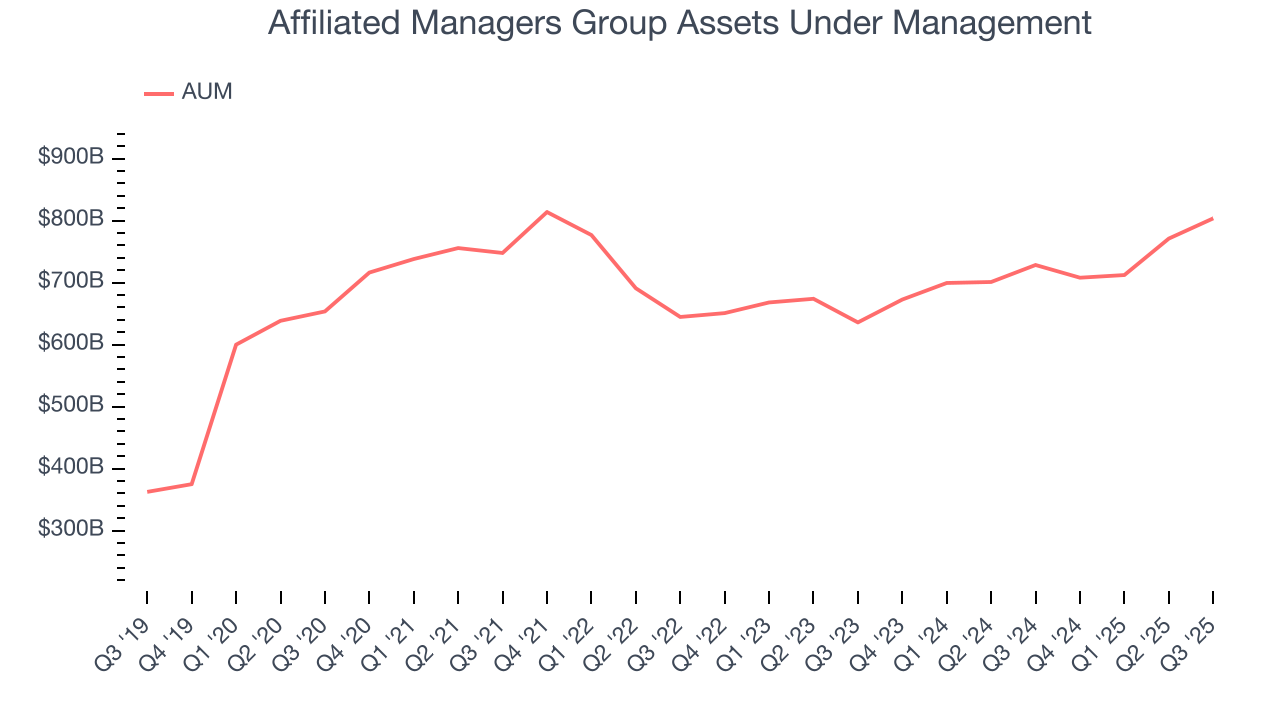

Affiliated Managers Group’s AUM has grown at an annual rate of 5.7% over the last five years, worse than the broader financials industry but faster than its total revenue. When analyzing Affiliated Managers Group’s AUM over the last two years, we can see that growth accelerated to 6.7% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. That said, assets aren't the be-all and end-all due to their unpredictable and cyclical nature.

In Q3, Affiliated Managers Group’s AUM was $803.6 billion, beating analysts’ expectations by 2.1%. This print was 10.3% higher than the same quarter last year.

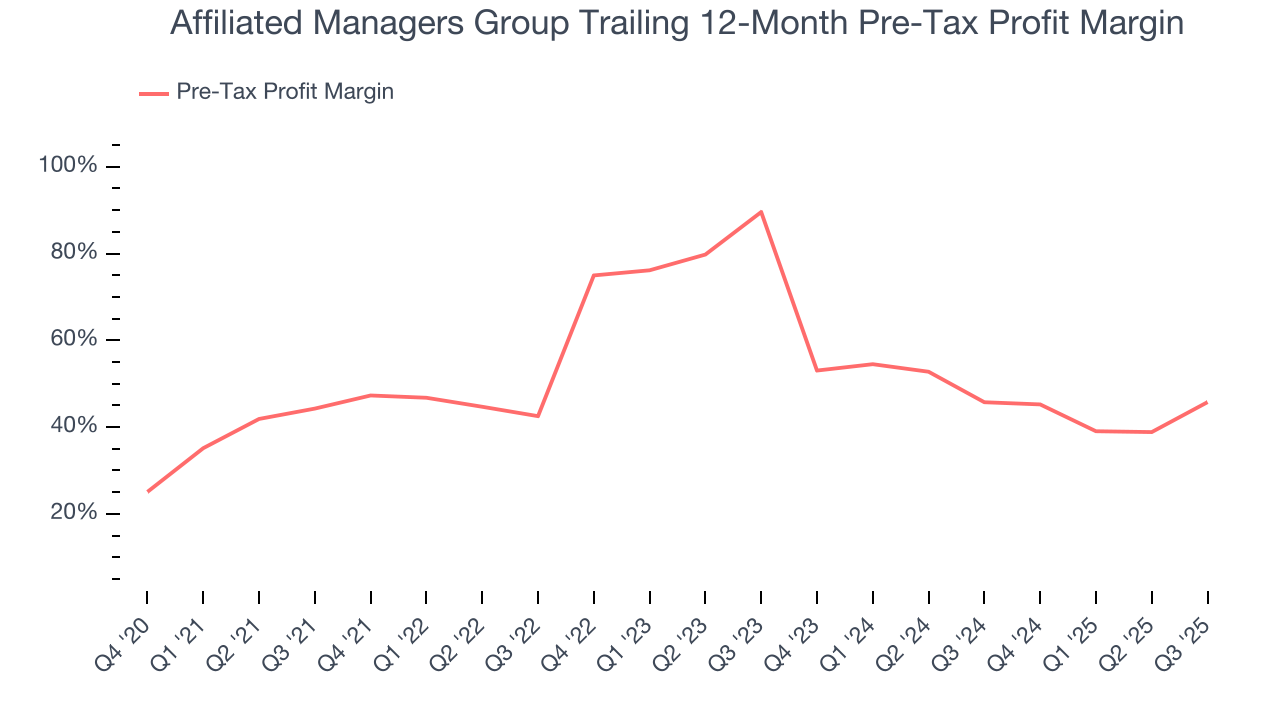

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last four years, Affiliated Managers Group’s pre-tax profit margin has fallen by 1.5 percentage points, going from 44.3% to 45.8%. However, the company gave back some of its expense savings as its pre-tax profit margin declined by 43.8 percentage points on a two-year basis.

Affiliated Managers Group’s pre-tax profit margin came in at 68.7% this quarter. This result was 26.6 percentage points better than the same quarter last year.

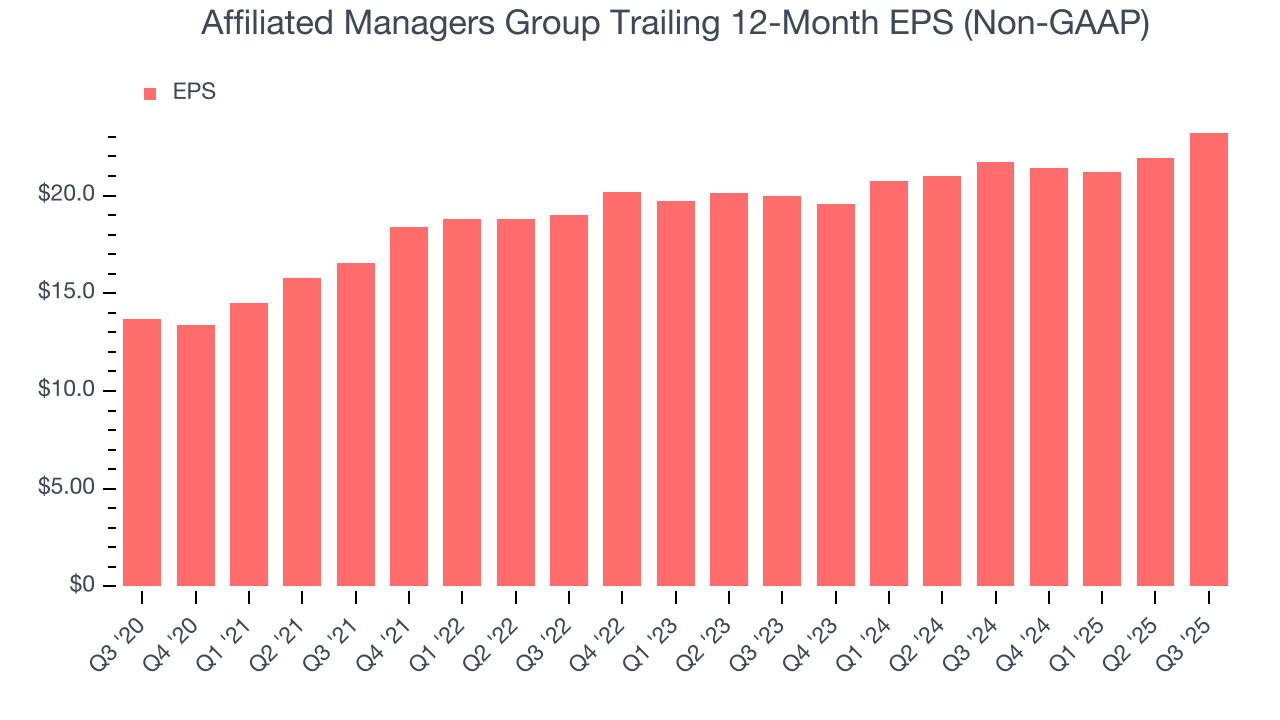

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Affiliated Managers Group’s EPS grew at a decent 11.1% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Affiliated Managers Group, its two-year annual EPS growth of 7.8% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Affiliated Managers Group reported adjusted EPS of $6.10, up from $4.82 in the same quarter last year. This print beat analysts’ estimates by 3.7%. Over the next 12 months, Wall Street expects Affiliated Managers Group’s full-year EPS of $23.22 to grow 17.8%.

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Affiliated Managers Group has averaged an ROE of 20.8%, excellent for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Affiliated Managers Group.

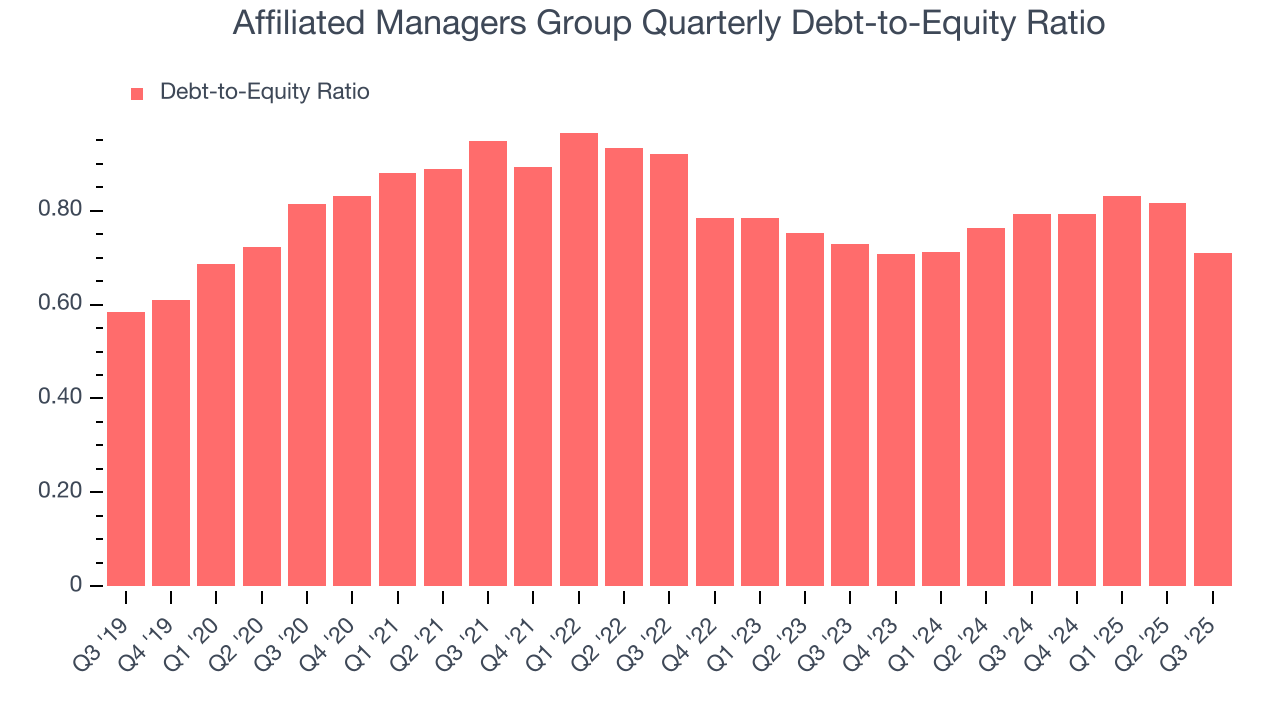

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Affiliated Managers Group currently has $2.37 billion of debt and $3.34 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.8×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Affiliated Managers Group’s Q3 Results

We enjoyed seeing Affiliated Managers Group beat analysts’ AUM expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, this quarter was mixed. The stock traded up 1.7% to $242.10 immediately following the results.

12. Is Now The Time To Buy Affiliated Managers Group?

Updated: January 24, 2026 at 11:08 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Affiliated Managers Group, you should also grasp the company’s longer-term business quality and valuation.

Affiliated Managers Group isn’t a terrible business, but it doesn’t pass our quality test. First off, its revenue growth was weak over the last five years. And while Affiliated Managers Group’s expanding pre-tax profit margin shows the business has become more efficient, its AUM growth was weak over the last five years.

Affiliated Managers Group’s P/E ratio based on the next 12 months is 11.2x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $364.14 on the company (compared to the current share price of $319.80).