Ameresco (AMRC)

Ameresco doesn’t impress us. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why Ameresco Is Not Exciting

Having played a role in upgrading the energy solutions of Alcatraz Island, Ameresco (NYSE:AMRC) provides energy and renewable energy solutions for various sectors.

- Negative free cash flow raises questions about the return timeline for its investments

- Competitive supply chain dynamics and steep production costs are reflected in its low gross margin of 16.5%

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

Ameresco falls below our quality standards. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Ameresco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Ameresco

Ameresco’s stock price of $32.51 implies a valuation ratio of 33.9x forward P/E. Not only does Ameresco trade at a premium to companies in the industrials space, but this multiple is also high for its fundamentals.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Ameresco (AMRC) Research Report: Q3 CY2025 Update

Energy and renewable energy projects company Ameresco (NYSE:AMRC) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 5% year on year to $526 million. On the other hand, the company’s full-year revenue guidance of $1.9 billion at the midpoint came in 0.5% below analysts’ estimates. Its non-GAAP profit of $0.35 per share was 15.4% above analysts’ consensus estimates.

Ameresco (AMRC) Q3 CY2025 Highlights:

- Revenue: $526 million vs analyst estimates of $520.5 million (5% year-on-year growth, 1% beat)

- Adjusted EPS: $0.35 vs analyst estimates of $0.30 (15.4% beat)

- Adjusted EBITDA: $70.4 million vs analyst estimates of $65.72 million (13.4% margin, 7.1% beat)

- The company reconfirmed its revenue guidance for the full year of $1.9 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $0.80 at the midpoint

- EBITDA guidance for the full year is $235 million at the midpoint, below analyst estimates of $236.7 million

- Operating Margin: 8.1%, up from 7% in the same quarter last year

- Free Cash Flow was $17.71 million, up from -$90.31 million in the same quarter last year

- Market Capitalization: $2.08 billion

Company Overview

Having played a role in upgrading the energy solutions of Alcatraz Island, Ameresco (NYSE:AMRC) provides energy and renewable energy solutions for various sectors.

The company's products and services reduce energy costs and greenhouse gas emissions for its clients, which include federal, state, and local governments, healthcare and educational institutions, and commercial and industrial entities. One notable example showing its expertise in renewable energy solutions for existing infrastructure was the design and installation of solar panels on Alcatraz Island.

In addition to installing solar panels, Ameresco offers wind power and geothermal systems. With its technology and expertise, it also gets hired to refurbish and upgrade existing power systems to make them more modern, renewable, and efficient. The company rounds out its products and services by providing insulation improvements, lighting retrofits, and heating, ventilation, and air conditioning systems. These solutions are all designed to reduce energy costs.

The design and installation of its products in large-scale infrastructure projects make up the vast majority of its revenue, which is earned through contracts. After completing a project, Ameresco will provide ongoing operations and maintenance services under multi-year contracts that act as a steady source of recurring revenue.

4. Energy Products and Services

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Ameresco’s top competitors include Johnson Controls (NYSE:JCI), and private companies Schneider Electric and ENGIE Services.

5. Revenue Growth

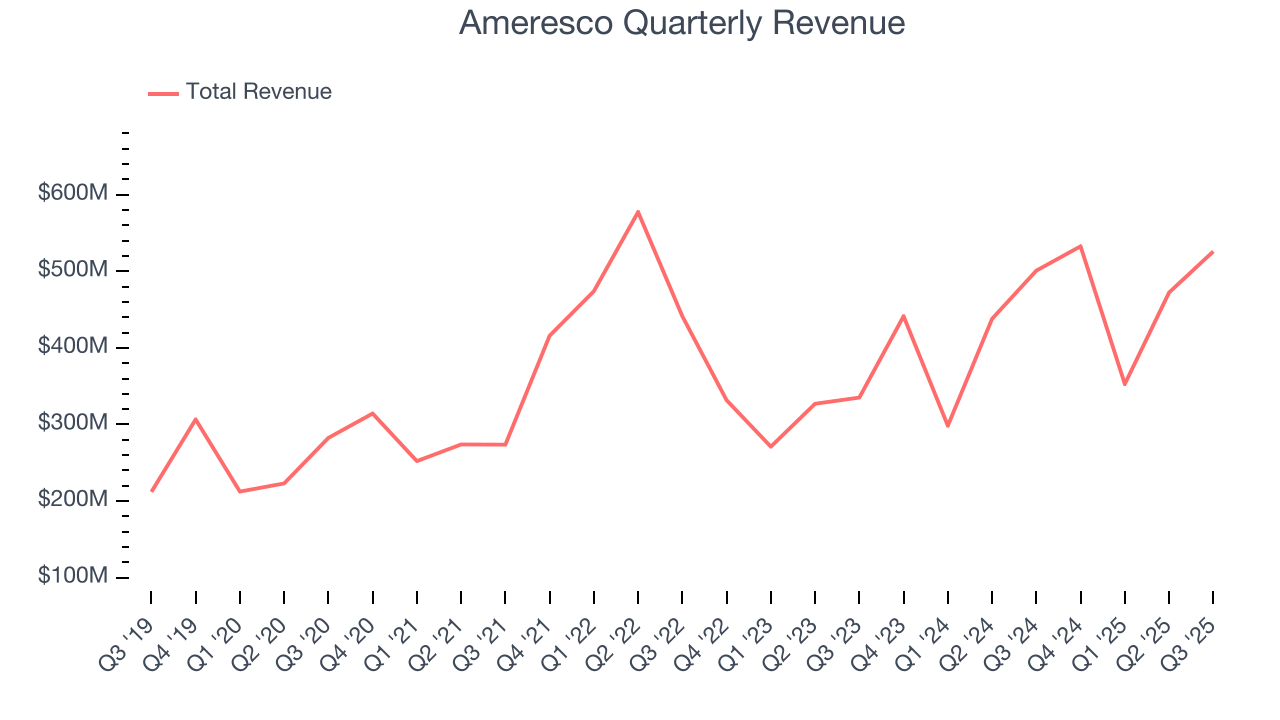

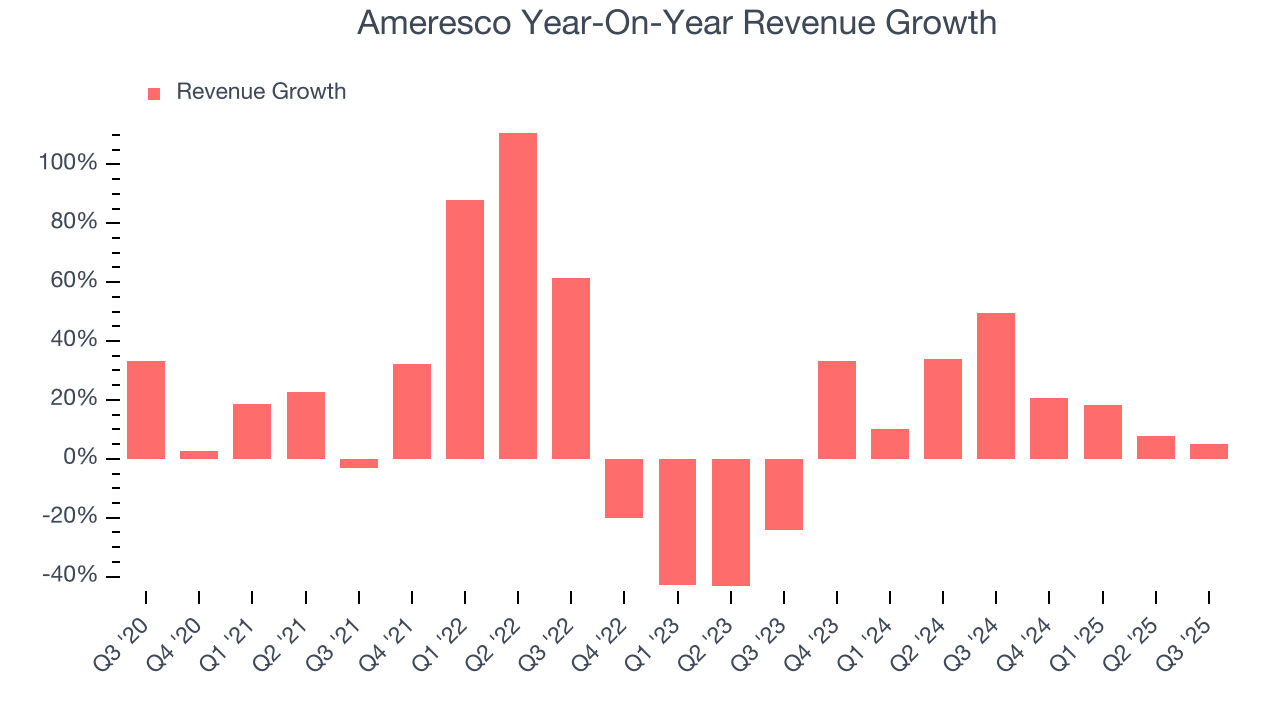

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Ameresco grew its sales at an excellent 13% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Ameresco’s annualized revenue growth of 22% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Ameresco reported year-on-year revenue growth of 5%, and its $526 million of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 7.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and suggests the market is baking in some success for its newer products and services.

6. Gross Margin & Pricing Power

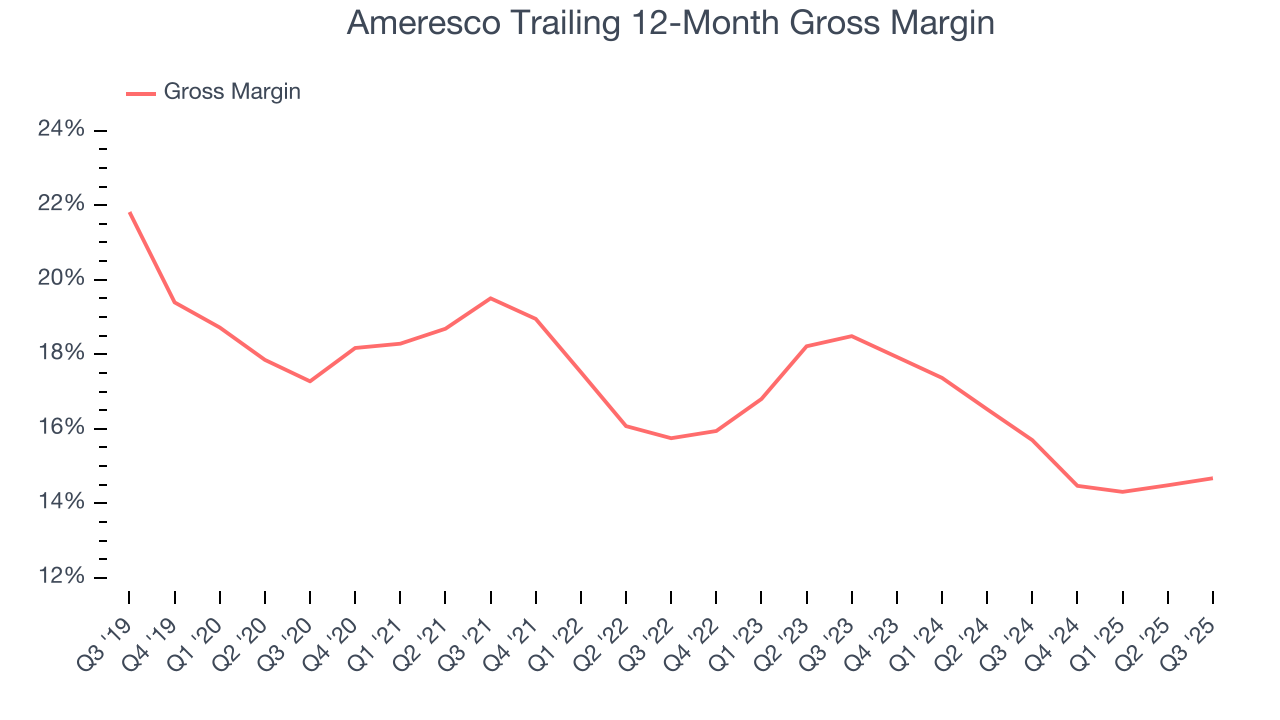

Ameresco has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 16.5% gross margin over the last five years. Said differently, Ameresco had to pay a chunky $83.55 to its suppliers for every $100 in revenue.

Ameresco’s gross profit margin came in at 16% this quarter, in line with the same quarter last year. Zooming out, Ameresco’s full-year margin has been trending down over the past 12 months, decreasing by 1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

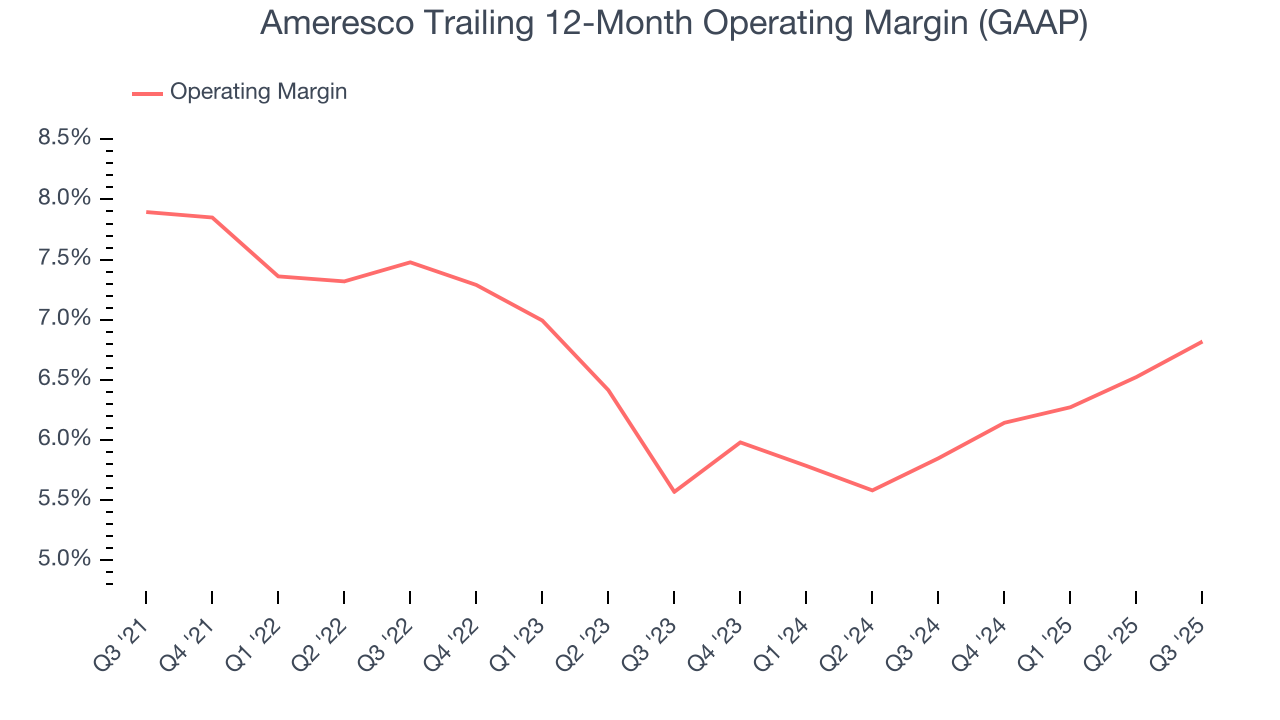

Ameresco was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Ameresco’s operating margin decreased by 1.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Ameresco’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Ameresco generated an operating margin profit margin of 8.1%, up 1 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

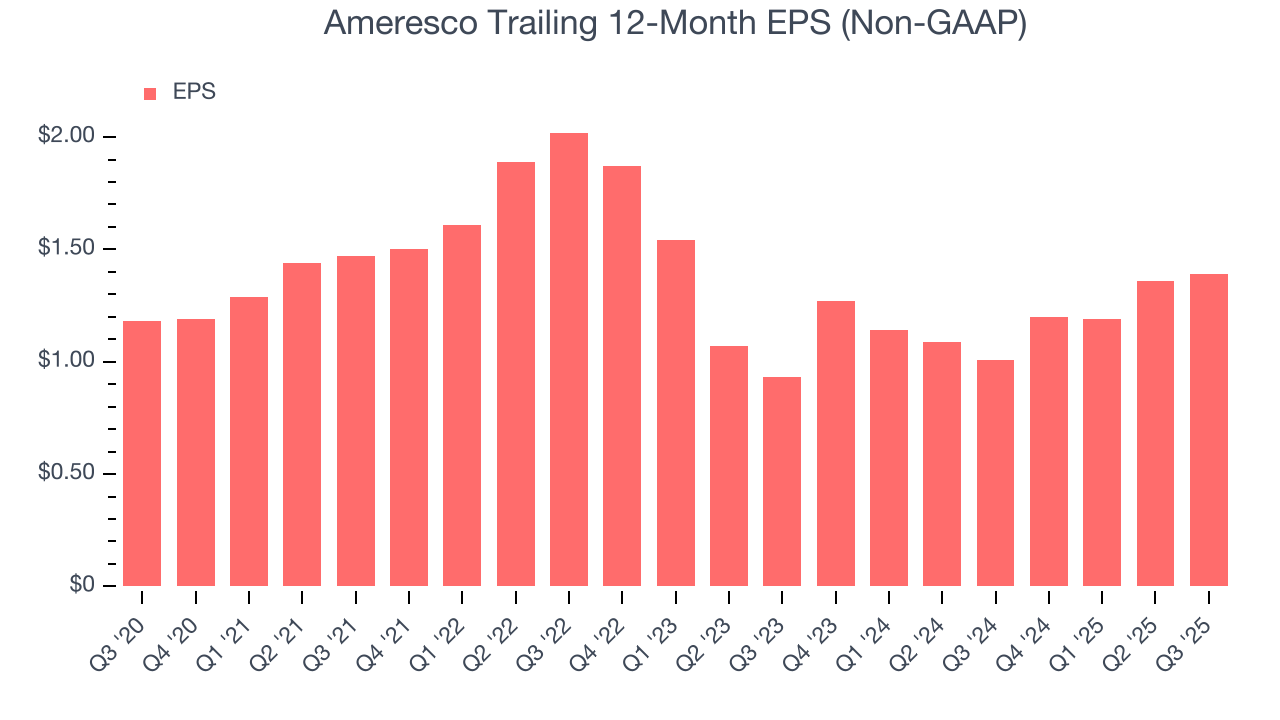

Ameresco’s EPS grew at a weak 3.3% compounded annual growth rate over the last five years, lower than its 13% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

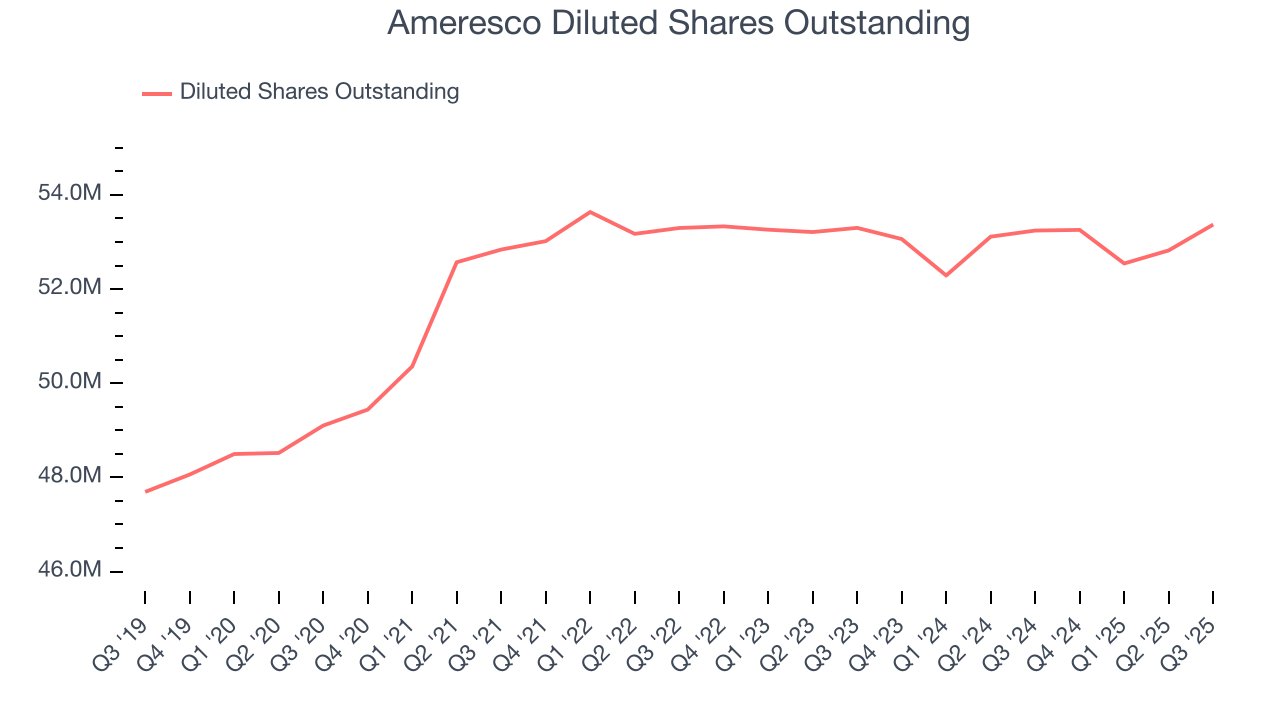

Diving into the nuances of Ameresco’s earnings can give us a better understanding of its performance. As we mentioned earlier, Ameresco’s operating margin expanded this quarter but declined by 1.1 percentage points over the last five years. Its share count also grew by 8.7%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Ameresco, its two-year annual EPS growth of 22.3% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, Ameresco reported adjusted EPS of $0.35, up from $0.32 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Ameresco’s full-year EPS of $1.39 to shrink by 28.6%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

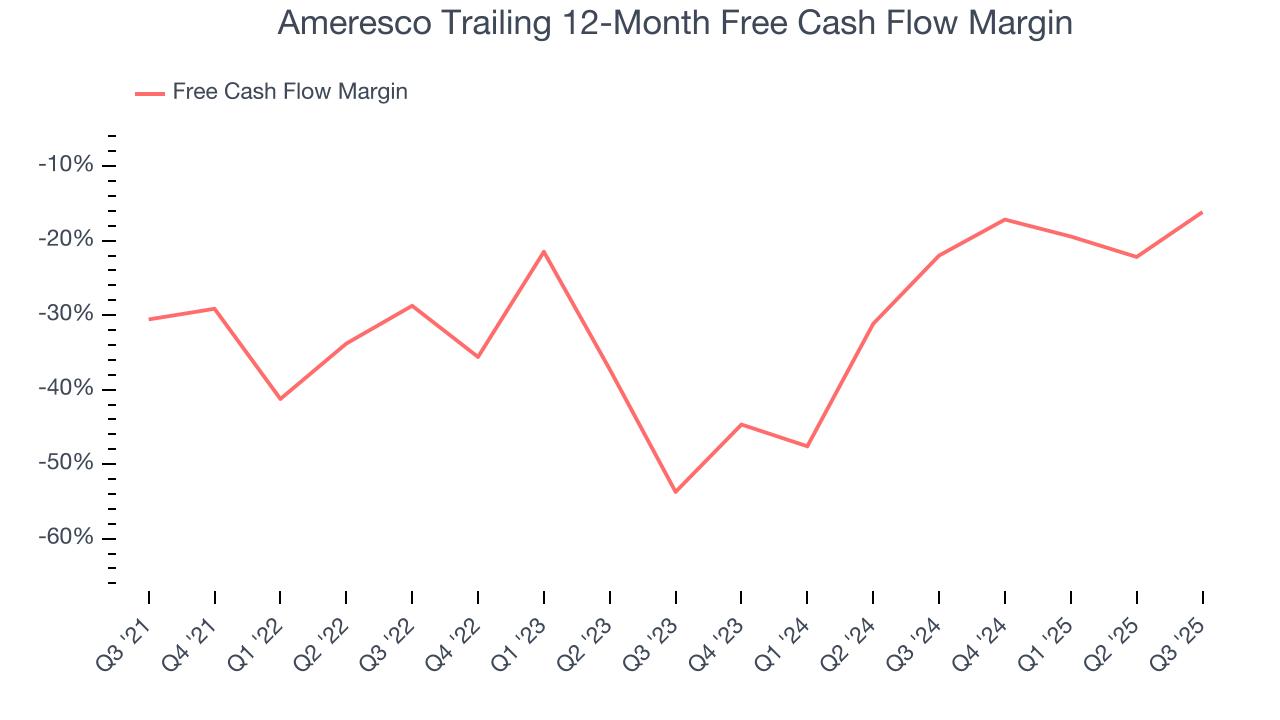

While Ameresco posted positive free cash flow this quarter, the broader story hasn’t been so clean. Ameresco’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 28.6%, meaning it lit $28.56 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Ameresco’s margin expanded by 14.4 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

Ameresco’s free cash flow clocked in at $17.71 million in Q3, equivalent to a 3.4% margin. Its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Ameresco historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Ameresco’s ROIC decreased by 2.5 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

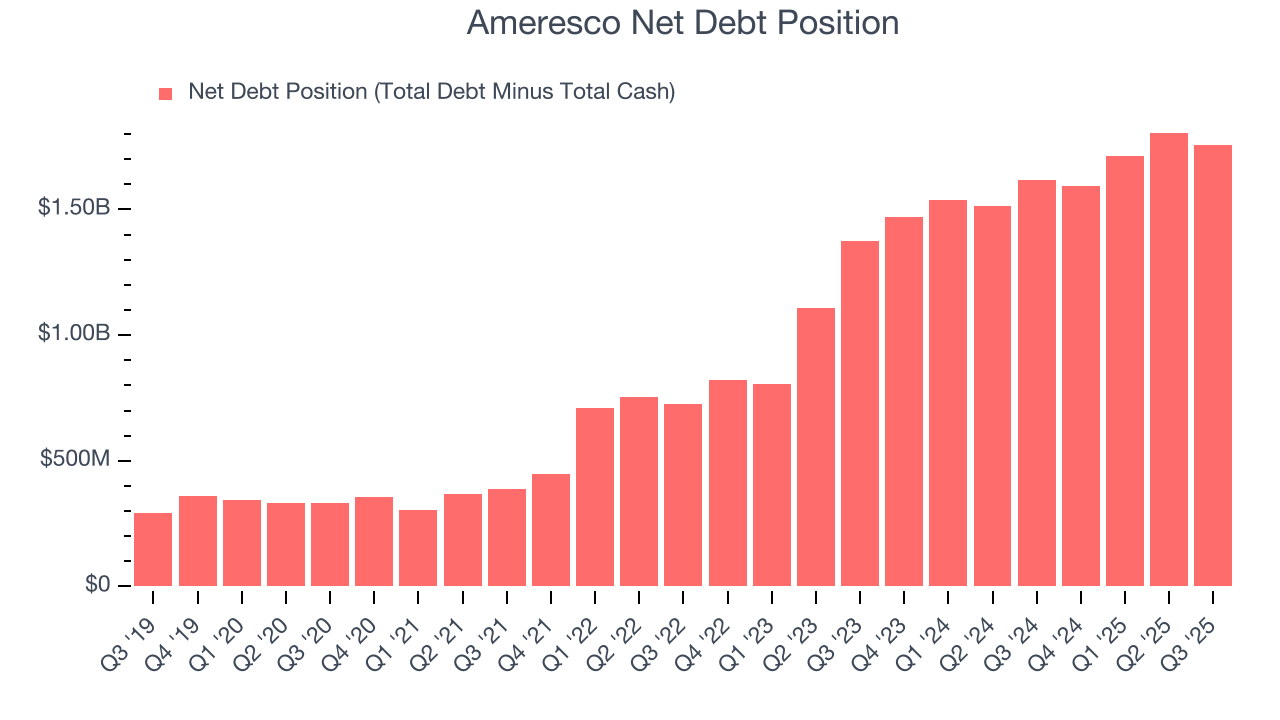

Ameresco burned through $304.2 million of cash over the last year, and its $1.95 billion of debt exceeds the $193.1 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Ameresco’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Ameresco until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from Ameresco’s Q3 Results

We enjoyed seeing Ameresco beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance slightly missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. The outlook is weighing on shares, and the stock traded down 3.3% to $38.70 immediately after reporting.

13. Is Now The Time To Buy Ameresco?

Updated: January 24, 2026 at 10:33 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Ameresco, you should also grasp the company’s longer-term business quality and valuation.

Ameresco is a pretty decent company if you ignore its balance sheet. To kick things off, its revenue growth was impressive over the last five years. And while Ameresco’s projected EPS for the next year is lacking, its rising cash profitability gives it more optionality.

Ameresco’s P/E ratio based on the next 12 months is 33.9x. All that said, we aren’t investing at the moment because its balance sheet makes us balk. If you’re interested in buying the stock, wait until its debt falls or its profits increase.

Wall Street analysts have a consensus one-year price target of $43.50 on the company (compared to the current share price of $32.51).