A. O. Smith (AOS)

We aren’t fans of A. O. Smith. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think A. O. Smith Will Underperform

Credited with the invention of the glass-lined water heater, A.O. Smith (NYSE:AOS) manufactures water heating and treatment products for various industries.

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 2.9%

- A silver lining is that its disciplined cost controls and effective management have materialized in a strong operating margin, and its profits increased over the last five years as it scaled

A. O. Smith’s quality is not up to our standards. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than A. O. Smith

High Quality

Investable

Underperform

Why There Are Better Opportunities Than A. O. Smith

At $67.20 per share, A. O. Smith trades at 16.9x forward P/E. A. O. Smith’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. A. O. Smith (AOS) Research Report: Q3 CY2025 Update

Water heating and treatment solutions company A.O. Smith (NYSE:AOS) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.4% year on year to $942.5 million. On the other hand, the company’s full-year revenue guidance of $3.83 billion at the midpoint came in 1.7% below analysts’ estimates. Its GAAP profit of $0.94 per share was 3.3% above analysts’ consensus estimates.

A. O. Smith (AOS) Q3 CY2025 Highlights:

- Revenue: $942.5 million vs analyst estimates of $947.1 million (4.4% year-on-year growth, in line)

- EPS (GAAP): $0.94 vs analyst estimates of $0.91 (3.3% beat)

- Adjusted EBITDA: $197.2 million vs analyst estimates of $193.4 million (20.9% margin, 2% beat)

- The company dropped its revenue guidance for the full year to $3.83 billion at the midpoint from $3.89 billion, a 1.7% decrease

- EPS (GAAP) guidance for the full year is $3.78 at the midpoint, missing analyst estimates by 1.6%

- Operating Margin: 18.6%, in line with the same quarter last year

- Free Cash Flow Margin: 25.5%, up from 18.1% in the same quarter last year

- Market Capitalization: $9.61 billion

Company Overview

Credited with the invention of the glass-lined water heater, A.O. Smith (NYSE:AOS) manufactures water heating and treatment products for various industries.

The company addresses global water challenges by providing water heating and treatment solutions. Its products ensure access to clean and hot water for homes, businesses, and industries, which promotes the health, hygiene, and comfort levels of its customers.

The company’s products can be separated into two primary categories: water heating products and water treatment products. Its water heating products include gas and electric water heaters for residential uses and heavy-duty water heaters for commercial uses. Its water treatment products include water softeners, which are designed to reduce the “hardness” of the water (“water hardness” is a measure of the amount of dissolved calcium and magnesium in the water), and water filtration and purification products, which are designed to improve drinking water quality.

The company generates revenue through the sale of its products. A notable portion of its revenue is generated via sales in China, Europe and India, so it has international revenue generation, but North America makes up the majority of its revenue. The company relies on demand from the residential and commercial construction market for water heating and treatment solutions, so it has a simple business model.

4. HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Competitors with the same product offers and market as A.O. Smith include Watts Water Technologies (NYSE:WTS), and privately-held companies Rheem Manufacturing and Vaillant.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, A. O. Smith’s sales grew at a mediocre 6.4% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. A. O. Smith’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, A. O. Smith grew its revenue by 4.4% year on year, and its $942.5 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

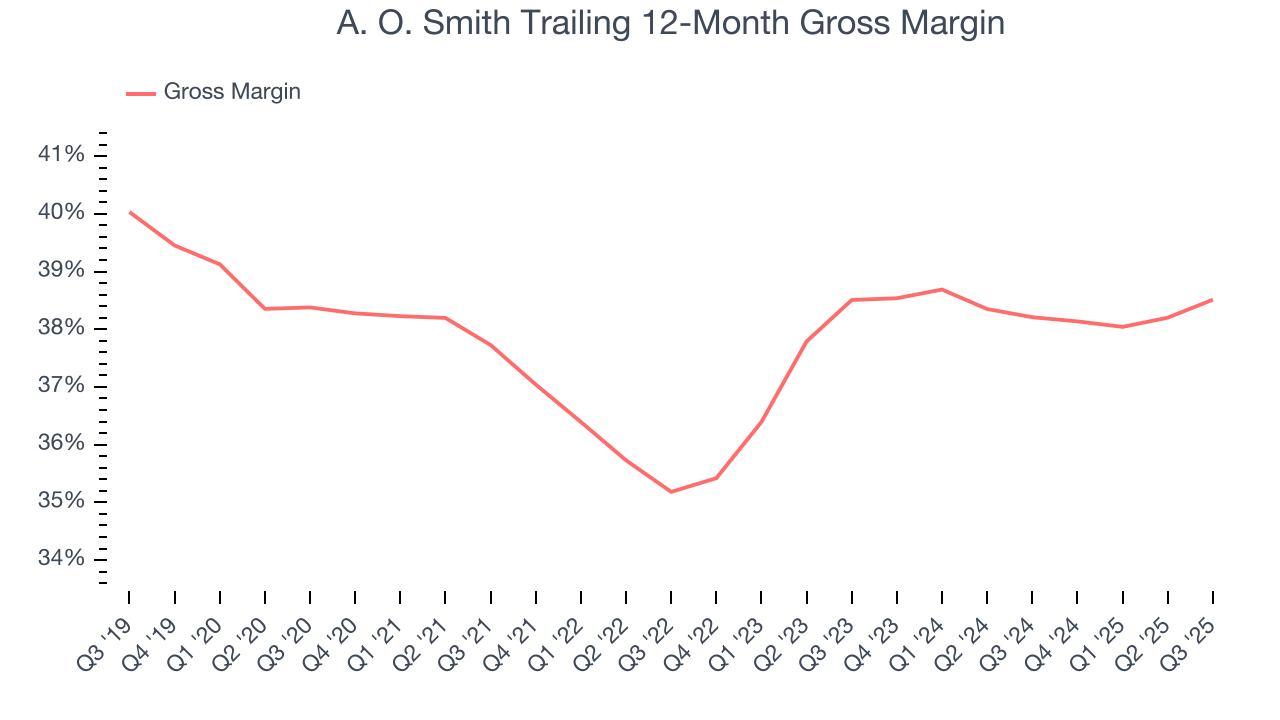

A. O. Smith’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 37.6% gross margin over the last five years. Said differently, roughly $37.63 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

In Q3, A. O. Smith produced a 38.7% gross profit margin, up 1.3 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

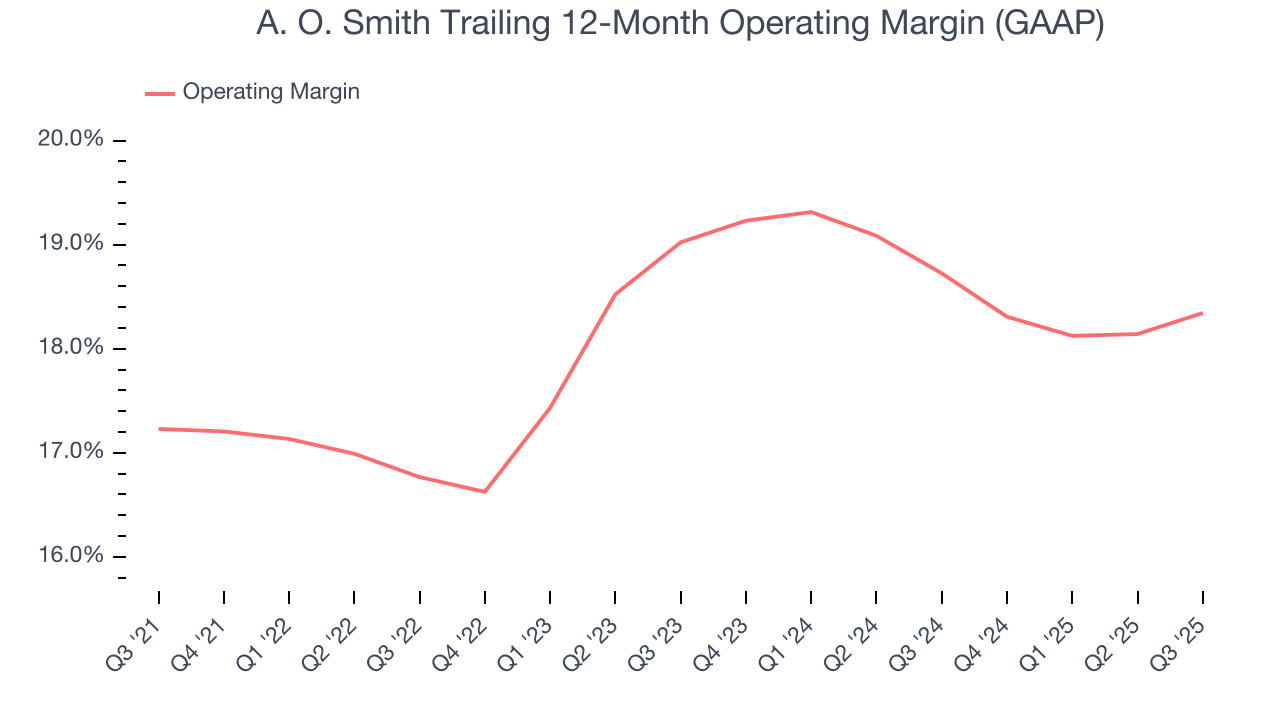

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

A. O. Smith has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, A. O. Smith’s operating margin rose by 1.1 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, A. O. Smith generated an operating margin profit margin of 18.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

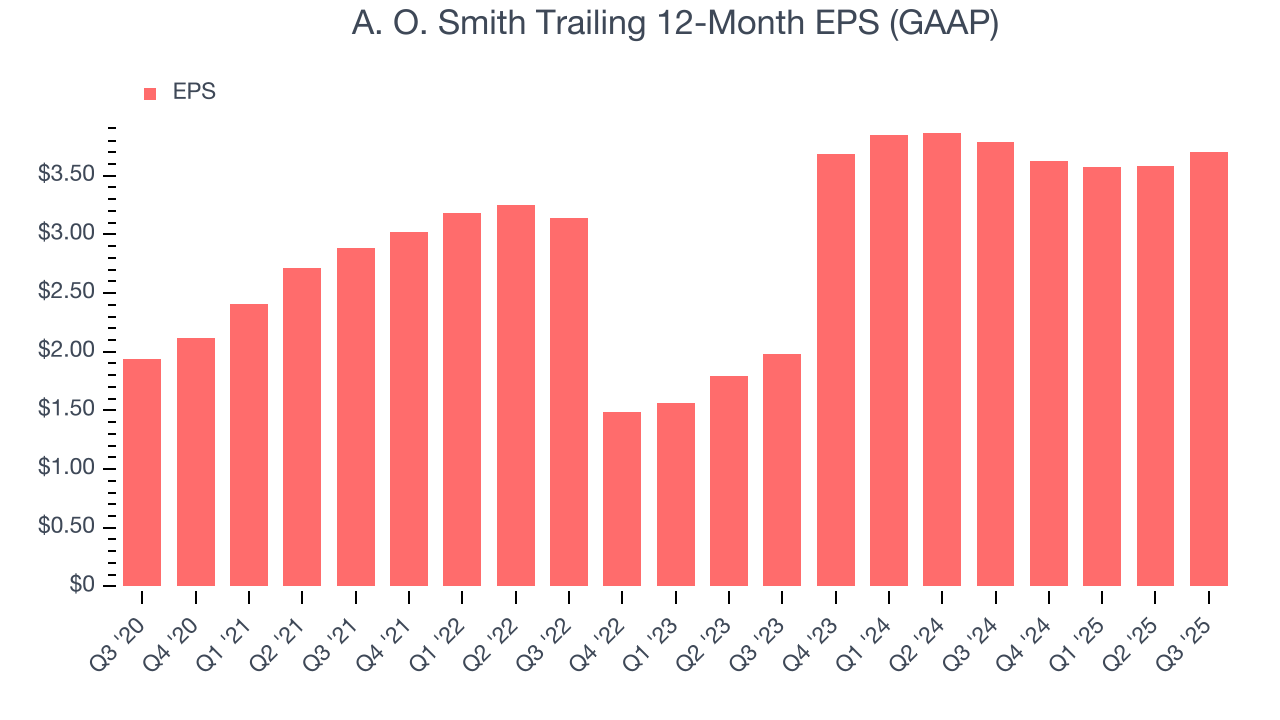

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

A. O. Smith’s EPS grew at a remarkable 13.8% compounded annual growth rate over the last five years, higher than its 6.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

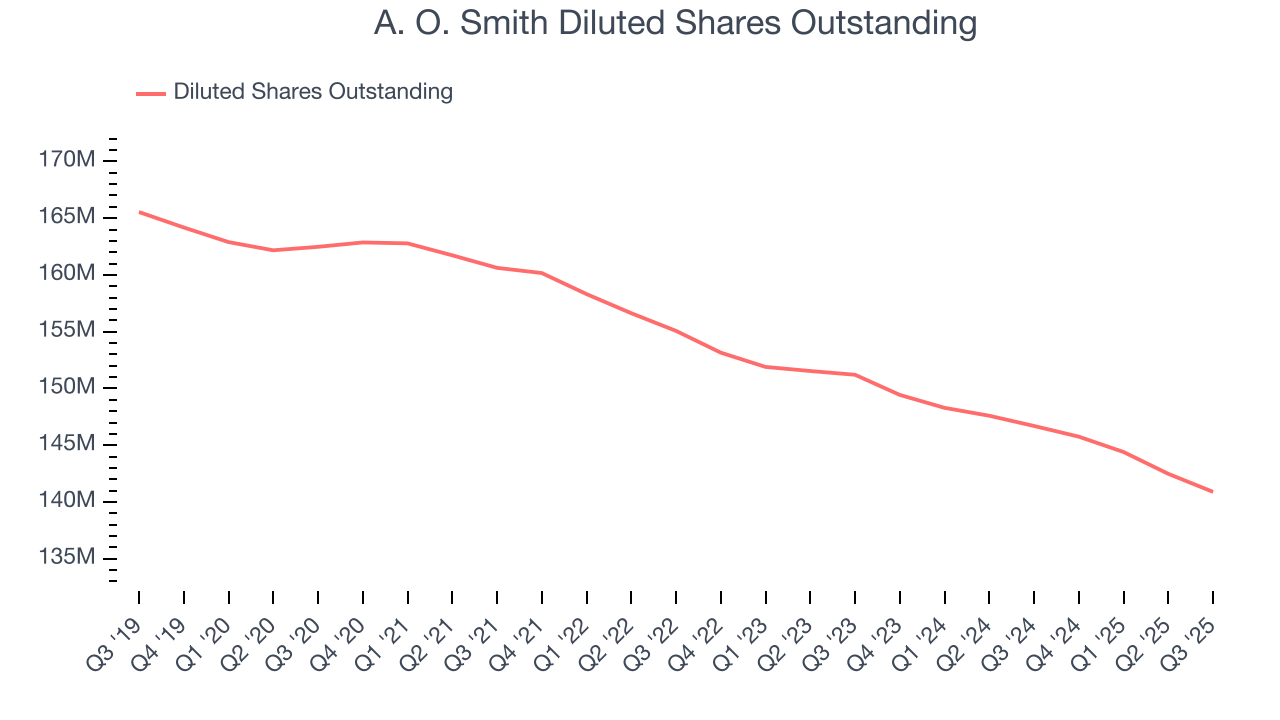

We can take a deeper look into A. O. Smith’s earnings to better understand the drivers of its performance. As we mentioned earlier, A. O. Smith’s operating margin was flat this quarter but expanded by 1.1 percentage points over the last five years. On top of that, its share count shrank by 13.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For A. O. Smith, its two-year annual EPS growth of 36.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, A. O. Smith reported EPS of $0.94, up from $0.82 in the same quarter last year. This print beat analysts’ estimates by 3.3%. Over the next 12 months, Wall Street expects A. O. Smith’s full-year EPS of $3.71 to grow 11.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

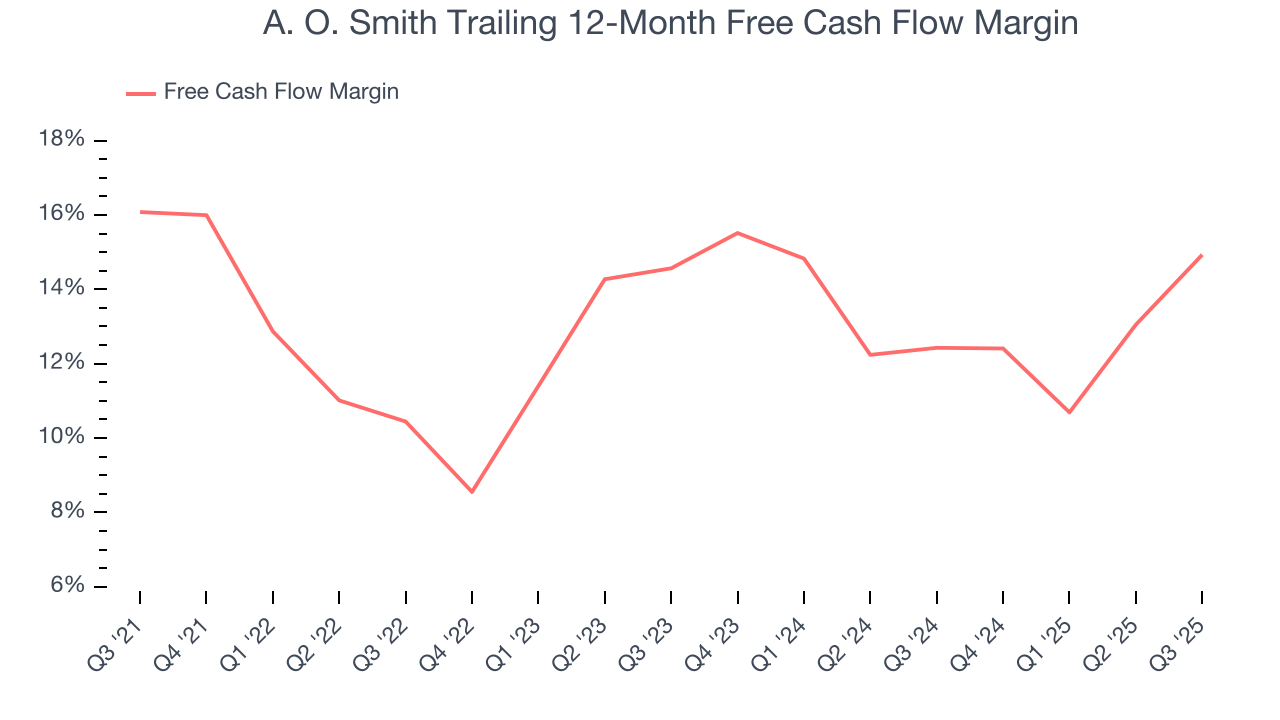

A. O. Smith has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 13.6% over the last five years.

Taking a step back, we can see that A. O. Smith’s margin dropped by 1.1 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

A. O. Smith’s free cash flow clocked in at $240.6 million in Q3, equivalent to a 25.5% margin. This result was good as its margin was 7.4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

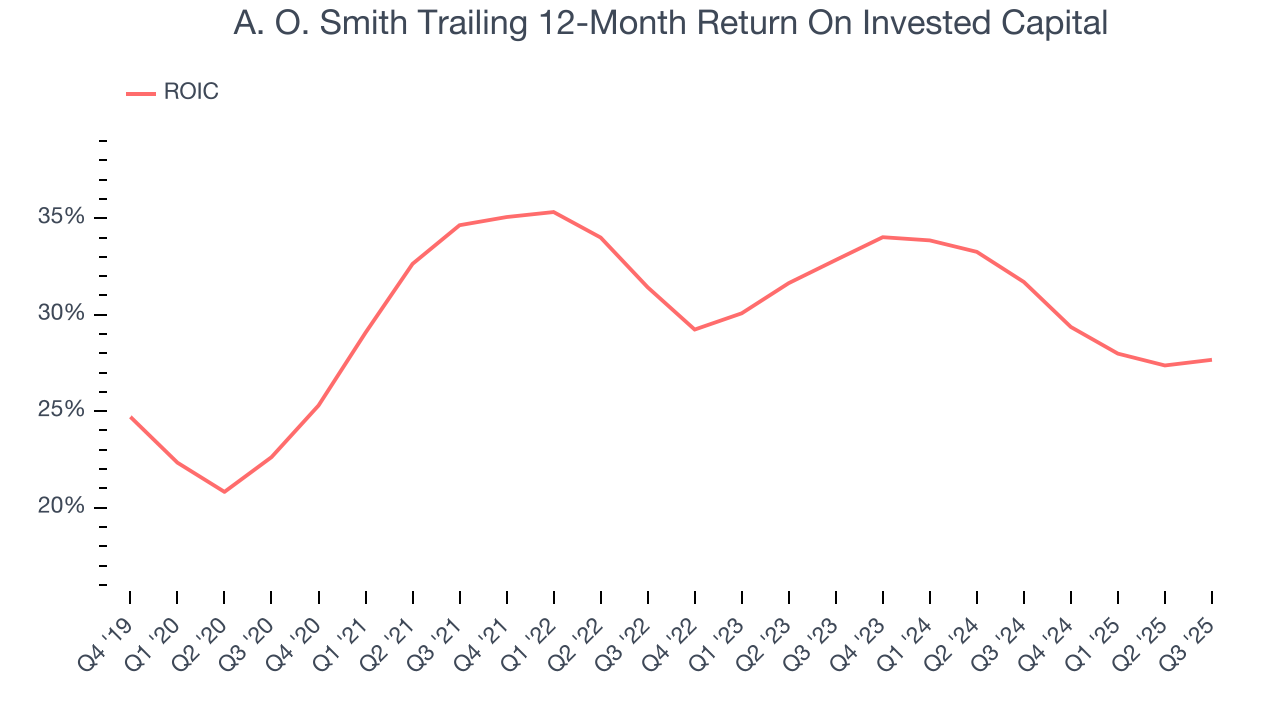

Although A. O. Smith hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 31.7%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, A. O. Smith’s ROIC averaged 3.4 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

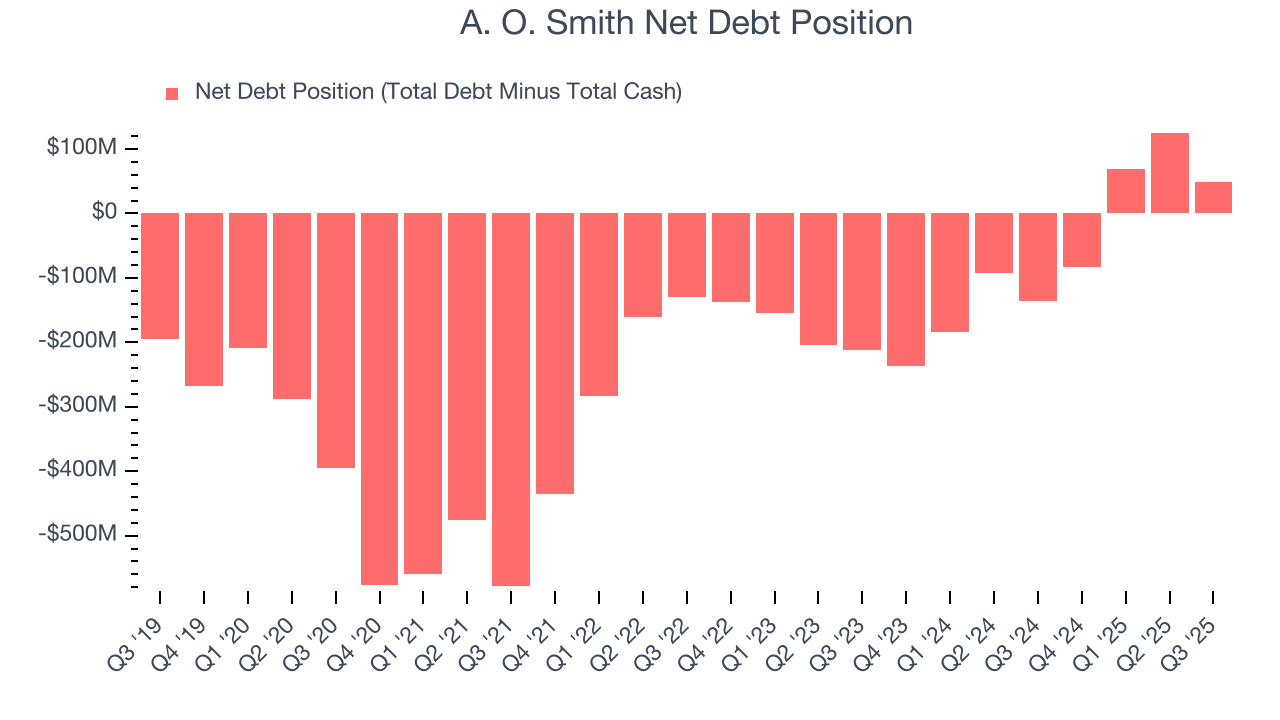

A. O. Smith reported $172.8 million of cash and $221.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $802.4 million of EBITDA over the last 12 months, we view A. O. Smith’s 0.1× net-debt-to-EBITDA ratio as safe. We also see its $6.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from A. O. Smith’s Q3 Results

It was encouraging to see A. O. Smith beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $67.99 immediately after reporting.

13. Is Now The Time To Buy A. O. Smith?

Updated: December 4, 2025 at 10:19 PM EST

Before deciding whether to buy A. O. Smith or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

A. O. Smith isn’t a terrible business, but it isn’t one of our picks. To begin with, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its impressive operating margins show it has a highly efficient business model, the downside is its flat organic revenue disappointed. On top of that, its diminishing returns show management's prior bets haven't worked out.

A. O. Smith’s P/E ratio based on the next 12 months is 16.9x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $78.50 on the company (compared to the current share price of $67.20).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.