Arlo Technologies (ARLO)

Arlo Technologies catches our eye. Its rising free cash flow margin gives it more chips to play with.― StockStory Analyst Team

1. News

2. Summary

Why Arlo Technologies Is Interesting

Originally spun off from networking equipment maker Netgear in 2018, Arlo Technologies (NYSE:ARLO) provides cloud-based smart security devices and subscription services that help consumers and businesses monitor and protect their homes, properties, and loved ones.

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 23.2% outpaced its revenue gains

- Solid 8.2% annual revenue growth over the last five years indicates its offering’s solve complex business issues

- On a dimmer note, its suboptimal cost structure is highlighted by its history of operating margin losses

Arlo Technologies almost passes our quality test. If you’ve been itching to buy the stock, the valuation looks fair.

Why Is Now The Time To Buy Arlo Technologies?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Arlo Technologies?

Arlo Technologies is trading at $13.85 per share, or 15.3x forward P/E. Arlo Technologies’s multiple is lower than that of many business services companies. Even so, we think it is justified for the top-line growth you get.

It could be a good time to invest if you see something the market doesn’t.

3. Arlo Technologies (ARLO) Research Report: Q4 CY2025 Update

Smart security company Arlo (NYSE:ARLO) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 16.2% year on year to $141.3 million. On top of that, next quarter’s revenue guidance ($140 million at the midpoint) was surprisingly good and 5.9% above what analysts were expecting. Its non-GAAP profit of $0.22 per share was 34% above analysts’ consensus estimates.

Arlo Technologies (ARLO) Q4 CY2025 Highlights:

- Revenue: $141.3 million vs analyst estimates of $135.6 million (16.2% year-on-year growth, 4.2% beat)

- Adjusted EPS: $0.22 vs analyst estimates of $0.16 (34% beat)

- Adjusted EBITDA: $23.26 million vs analyst estimates of $17.1 million (16.5% margin, 36% beat)

- Revenue Guidance for Q1 CY2026 is $140 million at the midpoint, above analyst estimates of $132.1 million

- Adjusted EPS guidance for Q1 CY2026 is $0.20 at the midpoint, above analyst estimates of $0.17

- Operating Margin: 3.3%, up from -4.6% in the same quarter last year

- Free Cash Flow Margin: 12.7%, up from 4.6% in the same quarter last year

- Market Capitalization: $1.26 billion

Company Overview

Originally spun off from networking equipment maker Netgear in 2018, Arlo Technologies (NYSE:ARLO) provides cloud-based smart security devices and subscription services that help consumers and businesses monitor and protect their homes, properties, and loved ones.

Arlo's ecosystem centers around wireless security cameras, video doorbells, floodlight cameras, and home security systems that connect to the company's cloud platform. These devices use artificial intelligence and computer vision to detect people, packages, vehicles, and animals, providing users with real-time alerts and video recordings accessible through the Arlo mobile app.

The company operates on a hardware-plus-subscription model. While customers can purchase Arlo's devices outright, the company increasingly focuses on its recurring revenue services. Arlo Secure offers cloud video storage, advanced object detection, and emergency response capabilities. Arlo Total Security provides professional monitoring services with the company's security hardware. Arlo Safe extends protection beyond the home with personal safety features including crash detection and one-touch emergency response.

A typical Arlo customer might install wireless cameras around their property to monitor for package deliveries or potential intruders. When motion is detected, the system sends smartphone notifications with video clips, allowing users to see and communicate with visitors through two-way audio. For businesses, Arlo's solutions can monitor remote locations like construction sites or retail spaces.

Arlo generates revenue through device sales via retailers like Amazon, Best Buy, and Walmart, as well as through monthly subscription fees. The company has a significant partnership with European security provider Verisure, which serves as Arlo's exclusive distributor in Europe and accounts for a substantial portion of its revenue.

Arlo's cloud platform processes millions of events daily, using AI to filter notifications and reduce false alarms. The company's technology works with major smart home ecosystems like Amazon Alexa, Google Assistant, and Apple HomeKit, allowing for voice control and integration with other connected devices.

4. Specialized Technology

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

Arlo Technologies competes with other smart security providers including Ring (owned by Amazon), Google Nest, SimpliSafe, ADT (NYSE:ADT), and Wyze, as well as traditional security companies and telecommunications providers that offer security services.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $529.3 million in revenue over the past 12 months, Arlo Technologies is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, Arlo Technologies’s 8.2% annualized revenue growth over the last five years was solid. This is an encouraging starting point for our analysis because it shows Arlo Technologies’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Arlo Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 3.8% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Arlo Technologies reported year-on-year revenue growth of 16.2%, and its $141.3 million of revenue exceeded Wall Street’s estimates by 4.2%. Company management is currently guiding for a 17.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will spur better top-line performance.

6. Operating Margin

Although Arlo Technologies was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 6.5% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Arlo Technologies’s operating margin rose by 12.9 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

In Q4, Arlo Technologies generated an operating margin profit margin of 3.3%, up 7.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

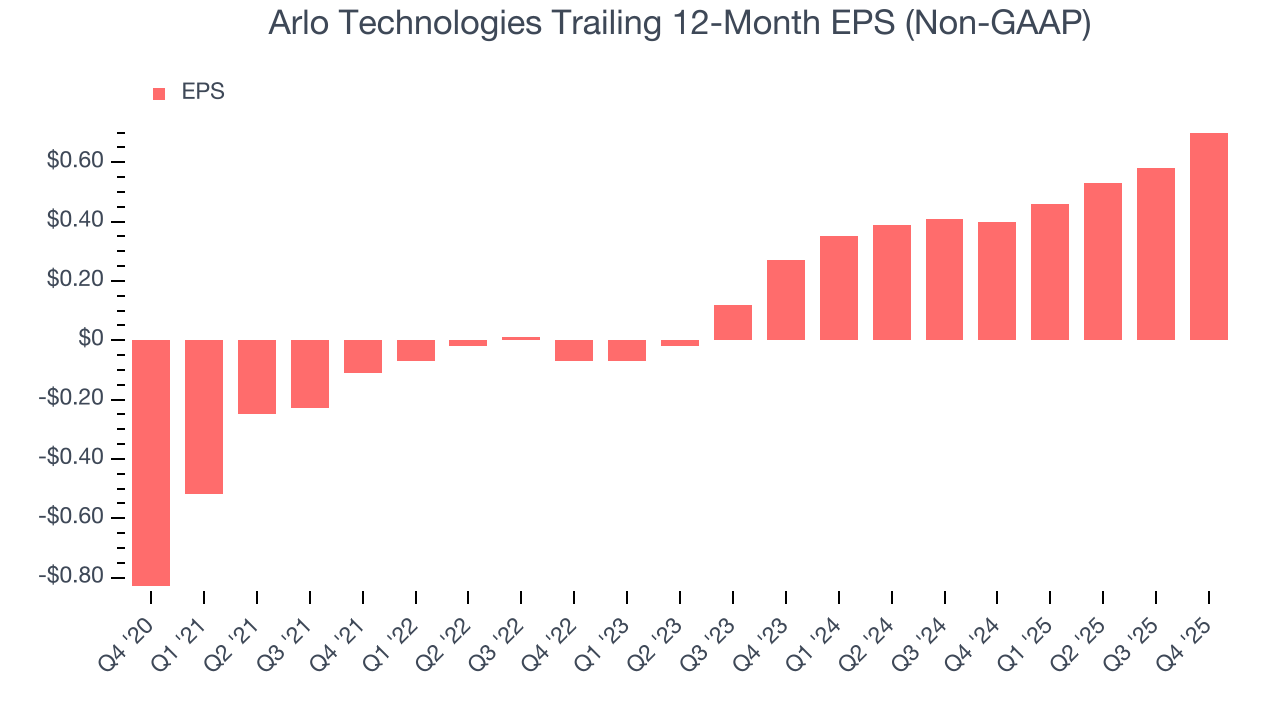

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Arlo Technologies’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Arlo Technologies’s EPS grew at an astounding 61% compounded annual growth rate over the last two years, higher than its 3.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Arlo Technologies’s earnings quality to better understand the drivers of its performance. Arlo Technologies’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Arlo Technologies reported adjusted EPS of $0.22, up from $0.10 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Arlo Technologies’s full-year EPS of $0.70 to grow 11.5%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Arlo Technologies has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, subpar for a business services business.

Taking a step back, an encouraging sign is that Arlo Technologies’s margin expanded by 18.5 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Arlo Technologies’s free cash flow clocked in at $17.94 million in Q4, equivalent to a 12.7% margin. This result was good as its margin was 8.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

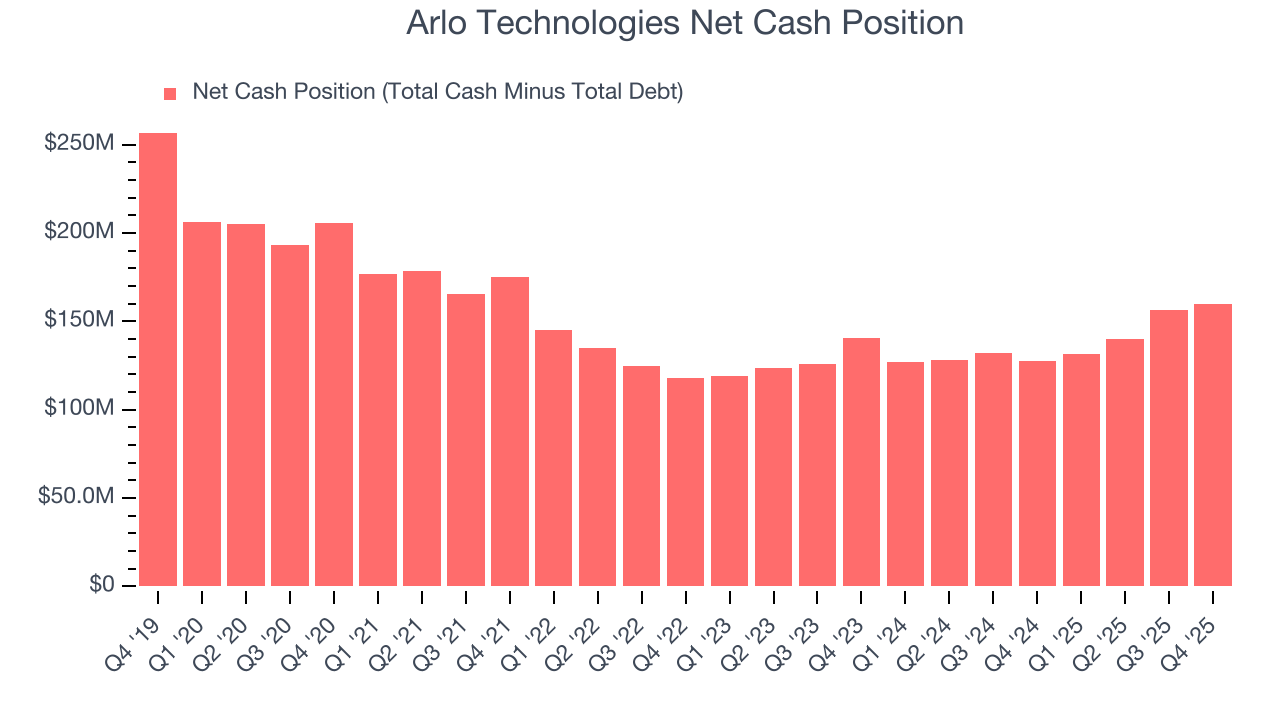

9. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Arlo Technologies is a profitable, well-capitalized company with $166.4 million of cash and $6.74 million of debt on its balance sheet. This $159.7 million net cash position is 12.6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from Arlo Technologies’s Q4 Results

It was good to see Arlo Technologies beat analysts’ EPS expectations this quarter. We were also excited its EPS guidance for next quarter outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 10.9% to $13.70 immediately following the results.

11. Is Now The Time To Buy Arlo Technologies?

Updated: February 26, 2026 at 11:13 PM EST

When considering an investment in Arlo Technologies, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Arlo Technologies is a fine business. To kick things off, its revenue growth was solid over the last five years. And while its operating margins reveal poor profitability compared to other business services companies, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

Arlo Technologies’s P/E ratio based on the next 12 months is 15.3x. When scanning the business services space, Arlo Technologies trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $23.20 on the company (compared to the current share price of $13.85), implying they see 67.5% upside in buying Arlo Technologies in the short term.