Arrow Electronics (ARW)

Arrow Electronics keeps us up at night. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Arrow Electronics Will Underperform

Founded as a single retail store, Arrow Electronics (NYSE:ARW) provides electronic components and enterprise computing solutions to businesses globally.

- Sales tumbled by 3.5% annually over the last two years, showing market trends are working against its favor during this cycle

- Earnings per share decreased by more than its revenue over the last two years, showing each sale was less profitable

- Competitive supply chain dynamics and steep production costs are reflected in its low gross margin of 12.2%

Arrow Electronics lacks the business quality we seek. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Arrow Electronics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Arrow Electronics

Arrow Electronics’s stock price of $140.55 implies a valuation ratio of 11.7x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Arrow Electronics (ARW) Research Report: Q4 CY2025 Update

Global electronics components and solutions distributor Arrow Electronics (NYSE:ARW) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 20.1% year on year to $8.75 billion. On top of that, next quarter’s revenue guidance ($8.25 billion at the midpoint) was surprisingly good and 9.3% above what analysts were expecting. Its non-GAAP profit of $4.39 per share was 23.1% above analysts’ consensus estimates.

Arrow Electronics (ARW) Q4 CY2025 Highlights:

- Revenue: $8.75 billion vs analyst estimates of $8.21 billion (20.1% year-on-year growth, 6.6% beat)

- Adjusted EPS: $4.39 vs analyst estimates of $3.57 (23.1% beat)

- Revenue Guidance for Q1 CY2026 is $8.25 billion at the midpoint, above analyst estimates of $7.55 billion

- Adjusted EPS guidance for Q1 CY2026 is $2.80 at the midpoint, above analyst estimates of $2.34

- Operating Margin: 3.4%, in line with the same quarter last year

- Free Cash Flow Margin: 2%, down from 4.2% in the same quarter last year

- Market Capitalization: $7.11 billion

Company Overview

Founded as a single retail store, Arrow Electronics (NYSE:ARW) provides electronic components and enterprise computing solutions to businesses globally.

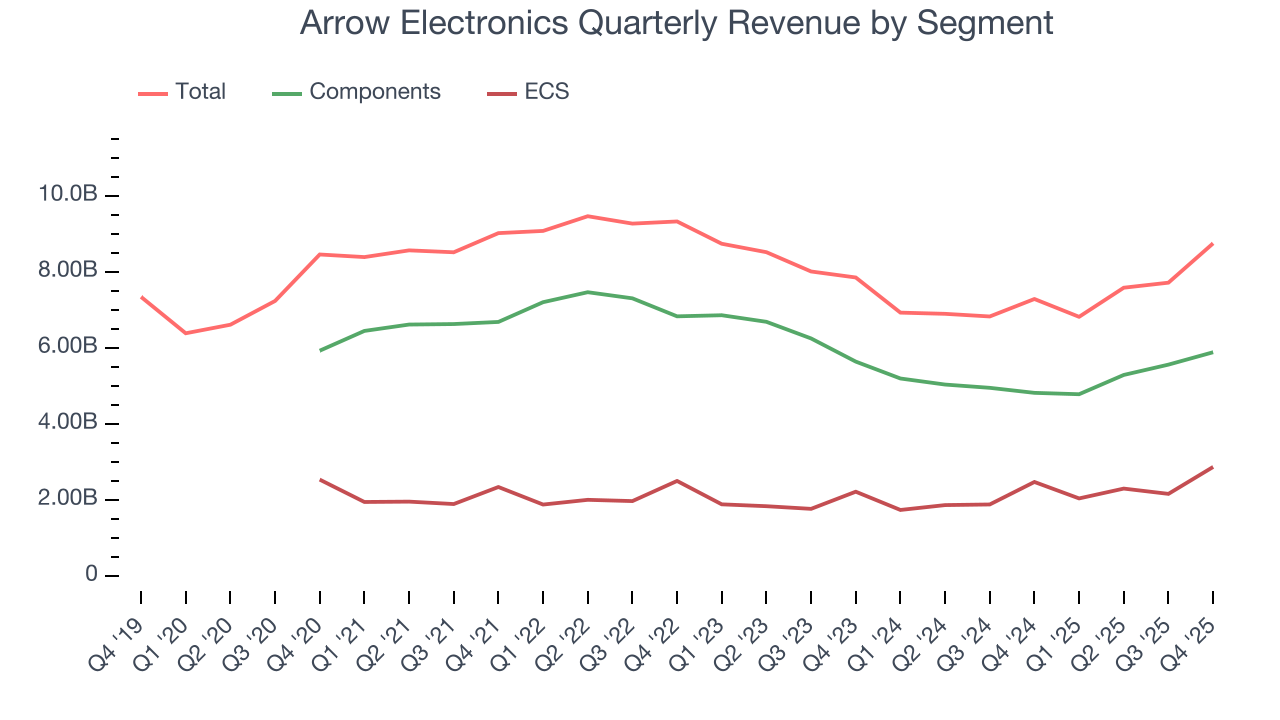

Established in the mid-20th century and based in Colorado, the company operates through two main business segments: Global Components and Global Enterprise Computing Solutions (ECS).

The Global Components segment, which represents the larger portion of Arrow's business, focuses on the distribution of electronic components and related services. This division caters to original equipment manufacturers, contract manufacturers, and other commercial customers across various industries. The product range spans from semiconductors to passive components, offering customers access to a vast array of electronic parts from numerous suppliers.

Complementing the components business, Arrow's Global ECS segment provides enterprise computing solutions primarily to resellers and managed service providers. This division offers products and services, encompassing areas such as data storage, cybersecurity, software applications, and networking. A feature of the ECS business is ArrowSphere, the company's cloud marketplace and management platform. This tool aims to simplify the process for partners to deliver and manage complex cloud-based solutions, addressing the growing demand for flexible, scalable IT infrastructure.

4. Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors in the technology products and services industry include Insight Enterprises (NASDAQ:NSIT), PC Connection (NASDAQ:CNXN), and CDW Corporation (NASDAQ:CDW).

5. Revenue Growth

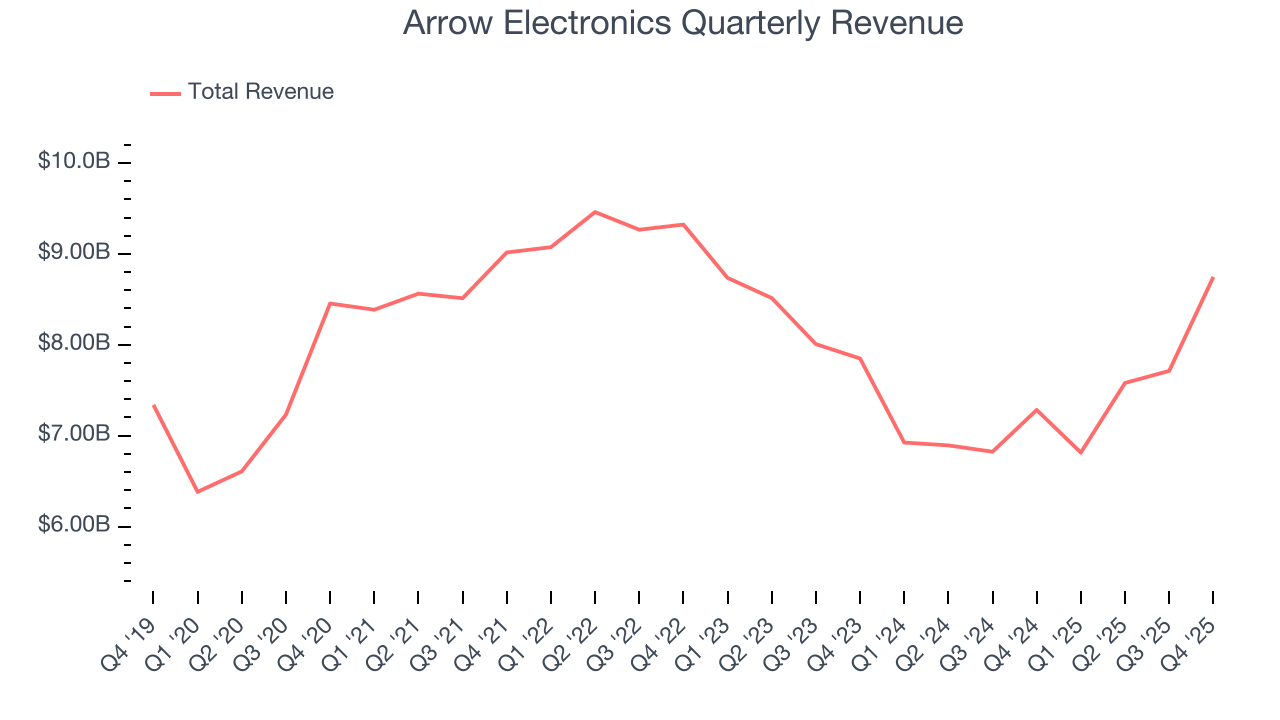

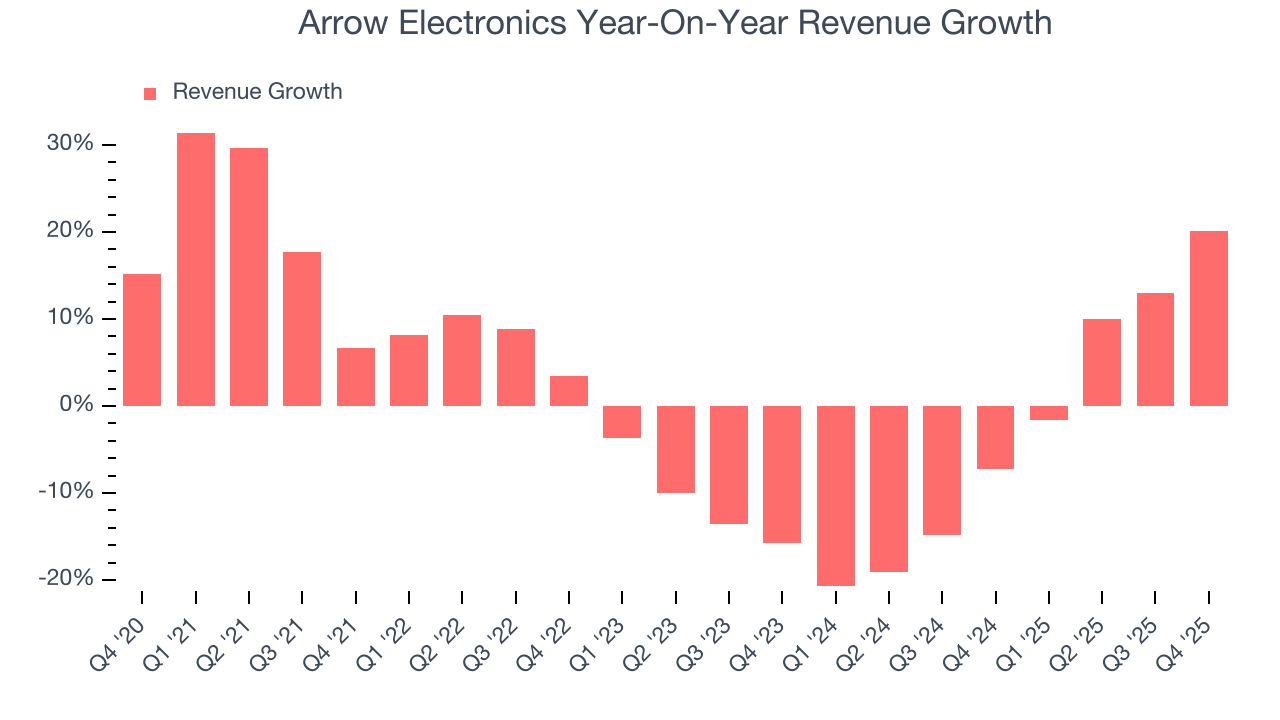

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Arrow Electronics grew its sales at a weak 1.5% compounded annual growth rate. This fell short of our benchmarks and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Arrow Electronics’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.5% annually.

Arrow Electronics also breaks out the revenue for its most important segments, Components and ECS, which are 67.3% and 32.7% of revenue. Over the last two years, Arrow Electronics’s Components revenue (electronic component sales) averaged 6.6% year-on-year declines. On the other hand, its ECS revenue (computing solutions and services) averaged 10.4% growth.

This quarter, Arrow Electronics reported robust year-on-year revenue growth of 20.1%, and its $8.75 billion of revenue topped Wall Street estimates by 6.6%. Company management is currently guiding for a 21.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

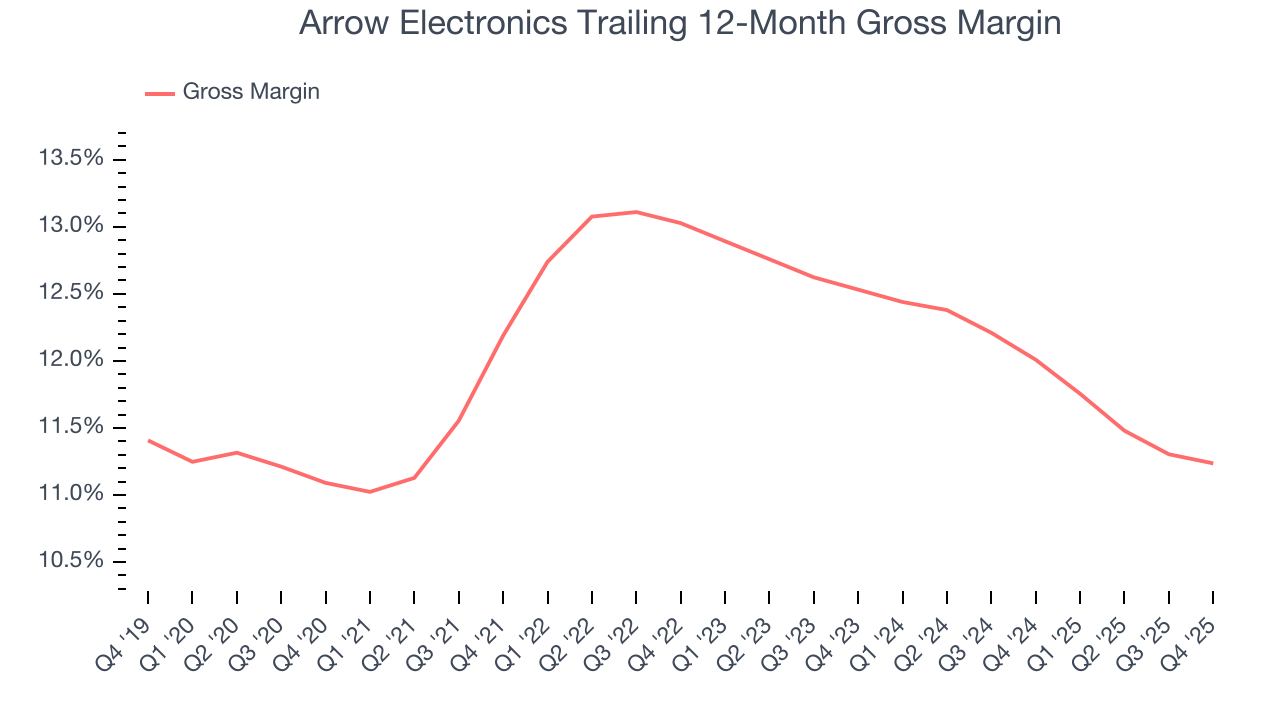

Arrow Electronics has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 12.2% gross margin over the last five years. Said differently, Arrow Electronics had to pay a chunky $87.76 to its suppliers for every $100 in revenue.

Arrow Electronics’s gross profit margin came in at 11.5% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

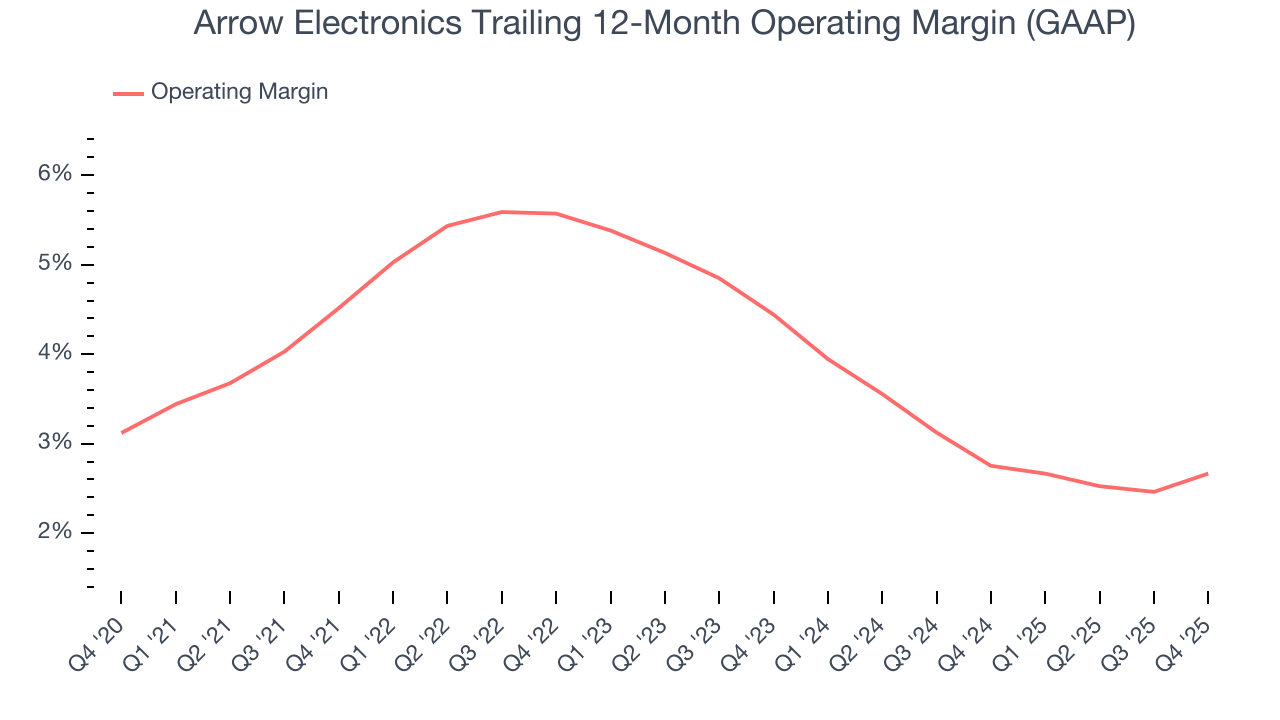

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Arrow Electronics was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.1% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Arrow Electronics’s operating margin decreased by 1.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Arrow Electronics’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Arrow Electronics generated an operating margin profit margin of 3.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

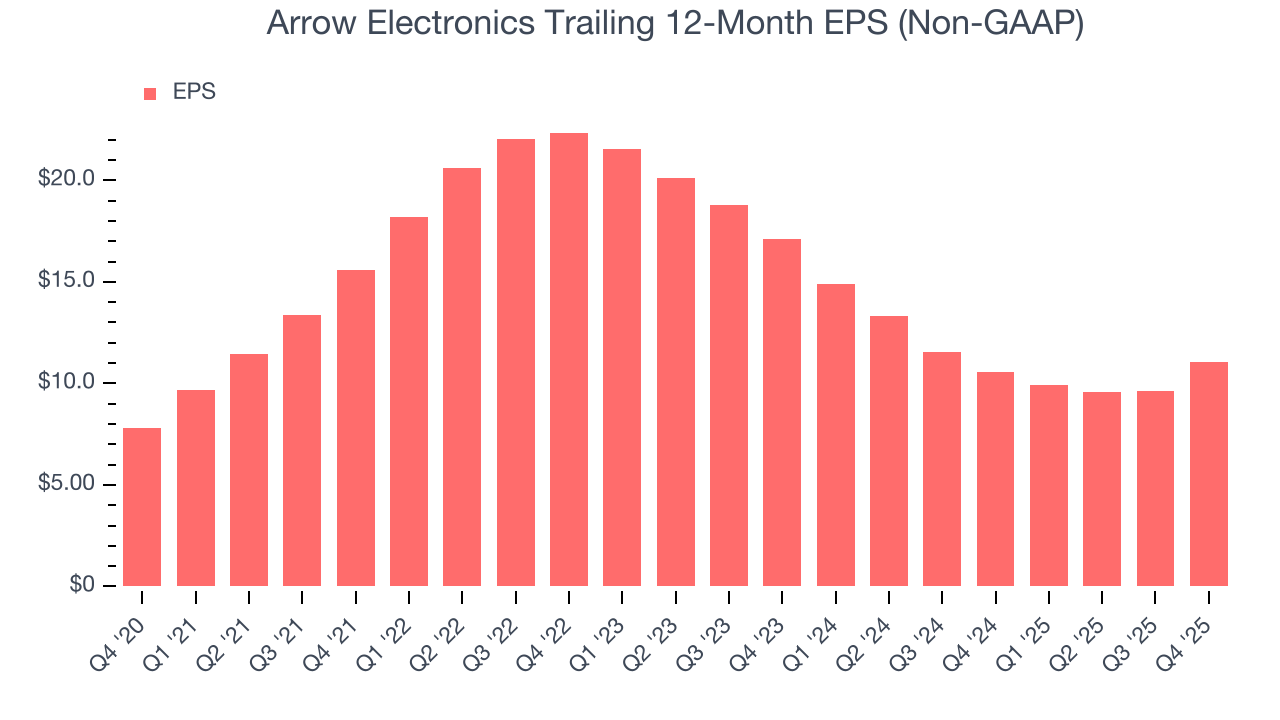

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

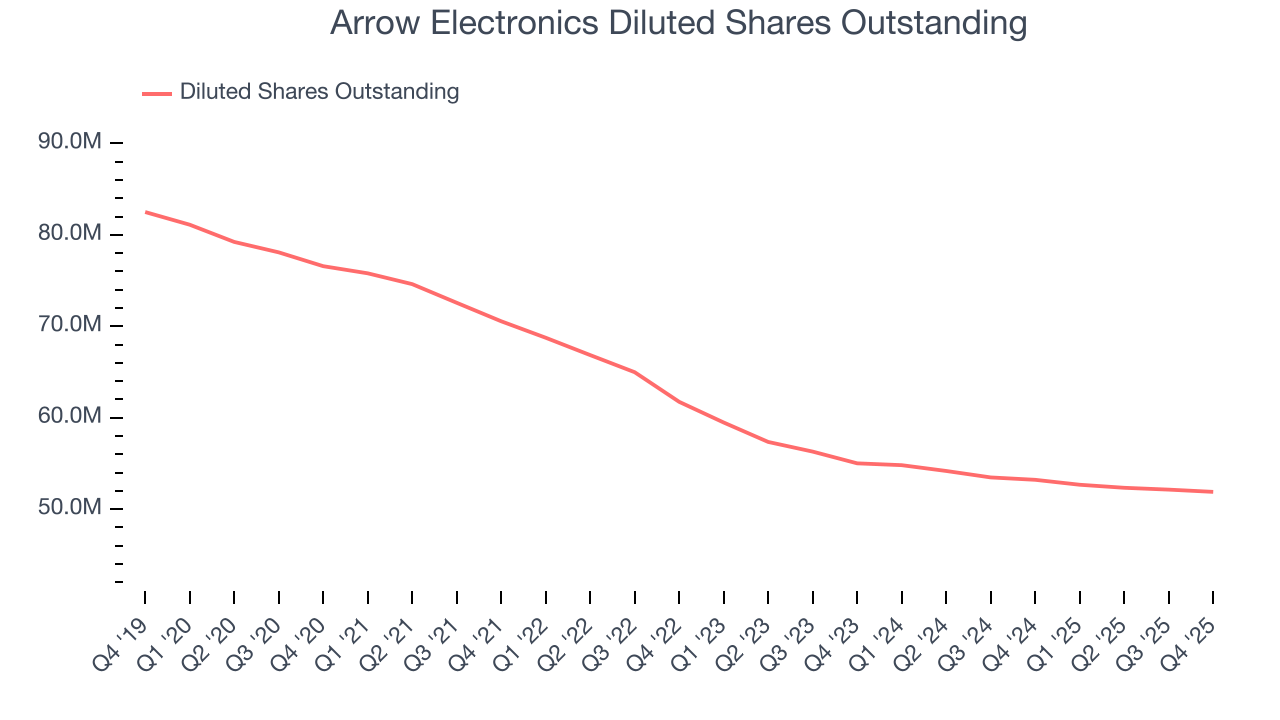

Arrow Electronics’s EPS grew at an unimpressive 7.1% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

Diving into the nuances of Arrow Electronics’s earnings can give us a better understanding of its performance. A five-year view shows that Arrow Electronics has repurchased its stock, shrinking its share count by 32.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Arrow Electronics, its two-year annual EPS declines of 19.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Arrow Electronics reported adjusted EPS of $4.39, up from $2.97 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Arrow Electronics’s full-year EPS of $11.03 to grow 6.7%.

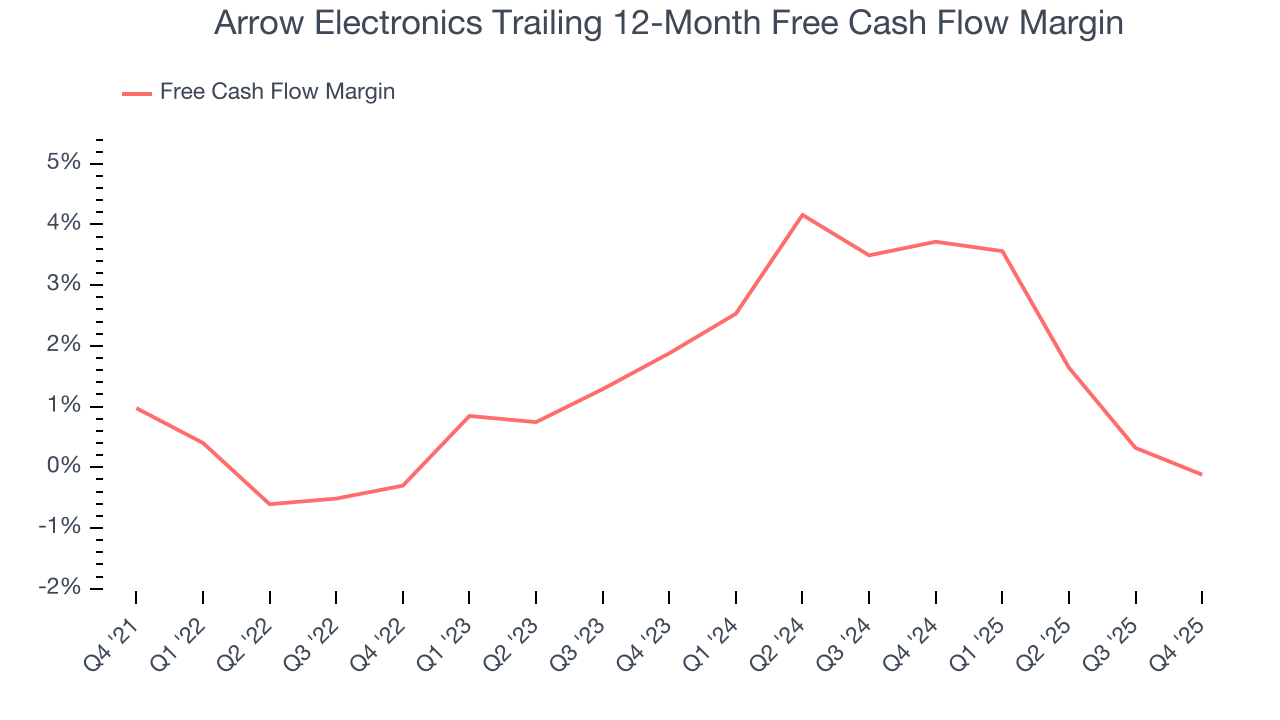

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Arrow Electronics has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.1%, lousy for an industrials business.

Taking a step back, we can see that Arrow Electronics’s margin dropped by 1.1 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s in the middle of an investment cycle.

Arrow Electronics’s free cash flow clocked in at $172.6 million in Q4, equivalent to a 2% margin. The company’s cash profitability regressed as it was 2.2 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

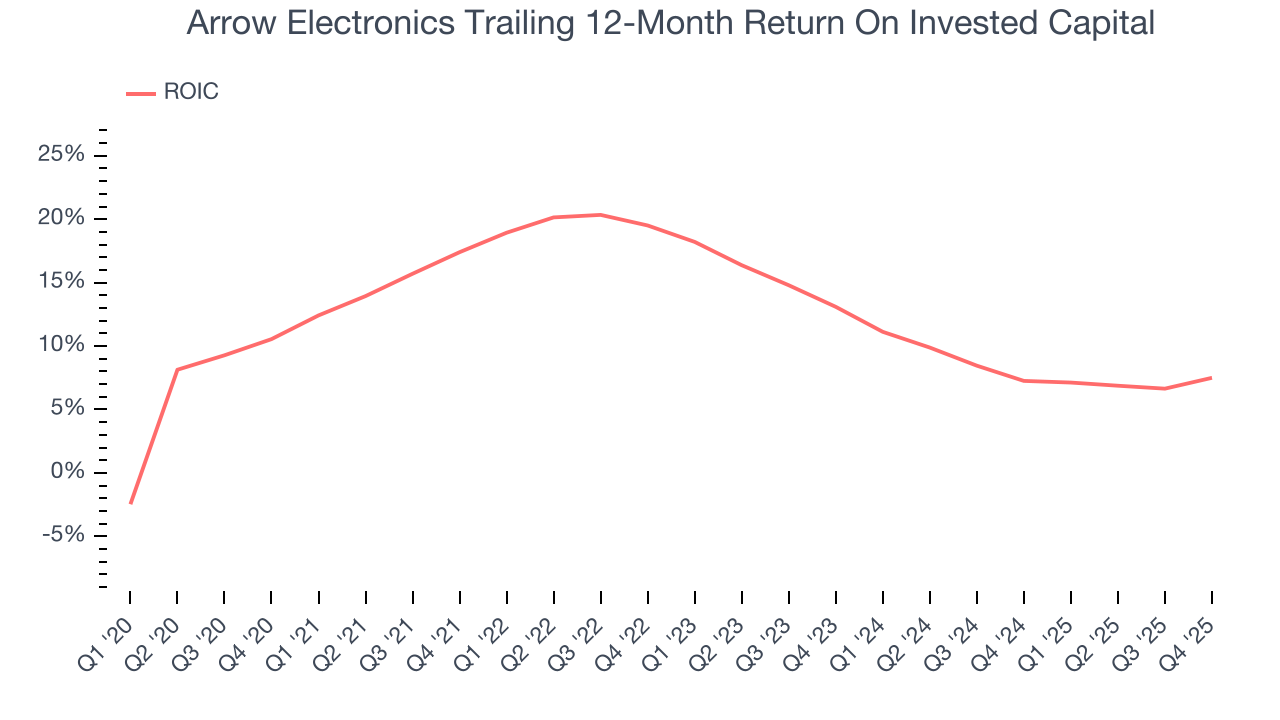

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Arrow Electronics hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Arrow Electronics’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

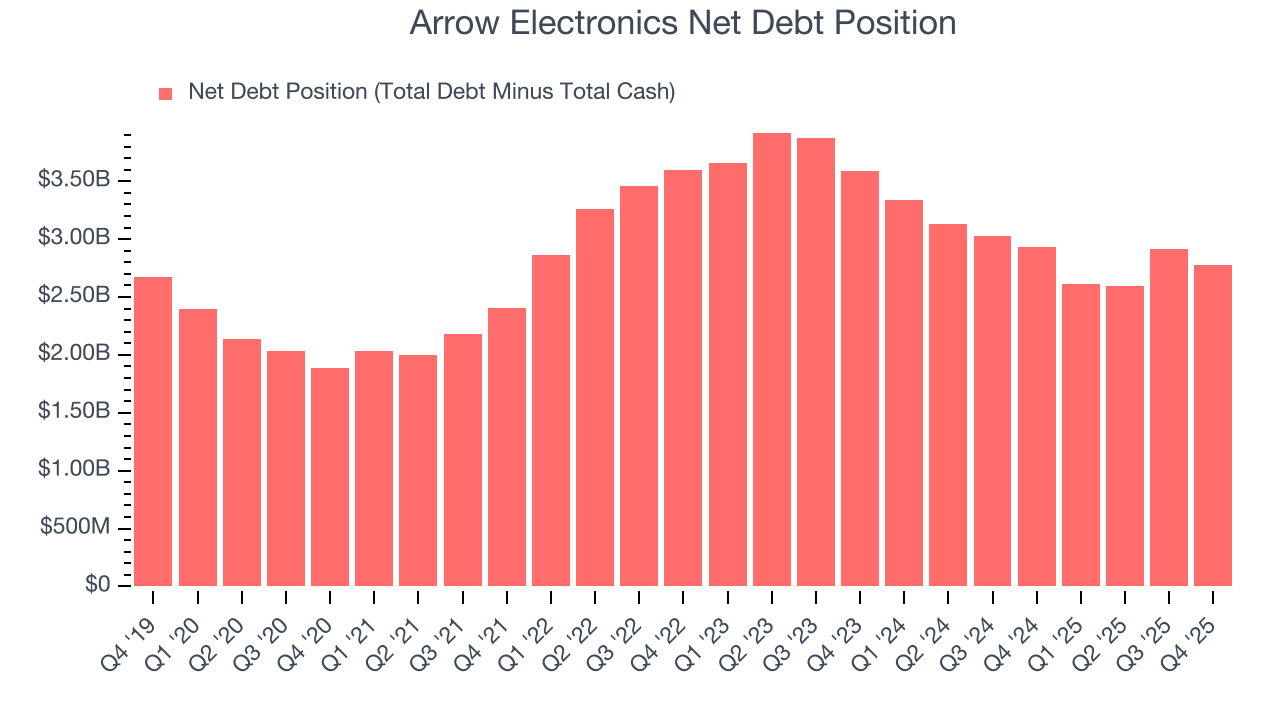

11. Balance Sheet Assessment

Arrow Electronics reported $306.5 million of cash and $3.09 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.04 billion of EBITDA over the last 12 months, we view Arrow Electronics’s 2.7× net-debt-to-EBITDA ratio as safe. We also see its $149.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Arrow Electronics’s Q4 Results

We were impressed by Arrow Electronics’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 2.1% to $144.04 immediately following the results.

13. Is Now The Time To Buy Arrow Electronics?

Updated: February 5, 2026 at 10:55 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Arrow Electronics, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies making their customers lives easier, but in the case of Arrow Electronics, we’ll be cheering from the sidelines. For starters, its revenue growth was weak over the last five years. And while its solid ROIC suggests it has grown profitably in the past, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its low gross margins indicate some combination of competitive pressures and high production costs.

Arrow Electronics’s P/E ratio based on the next 12 months is 11.7x. This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $113 on the company (compared to the current share price of $140.55).