Atkore (ATKR)

We wouldn’t buy Atkore. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Atkore Will Underperform

Protecting the things that power our world, Atkore (NYSE:ATKR) designs and manufactures electrical safety products.

- Annual sales declines of 10% for the past two years show its products and services struggled to connect with the market during this cycle

- Performance over the past two years shows each sale was less profitable as its earnings per share dropped by 44.4% annually, worse than its revenue

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

Atkore’s quality doesn’t meet our bar. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Atkore

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Atkore

Atkore is trading at $70.08 per share, or 13.4x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Atkore (ATKR) Research Report: Q4 CY2025 Update

Electrical safety company Atkore (NYSE:ATKR) reported revenue ahead of Wall Streets expectations in Q4 CY2025, but sales were flat year on year at $655.5 million. Its non-GAAP profit of $0.83 per share was 31.8% above analysts’ consensus estimates.

Atkore (ATKR) Q4 CY2025 Highlights:

- Revenue: $655.5 million vs analyst estimates of $649.9 million (flat year on year, 0.9% beat)

- Adjusted EPS: $0.83 vs analyst estimates of $0.63 (31.8% beat)

- Adjusted EBITDA: $69.15 million vs analyst estimates of $59.07 million (10.5% margin, 17.1% beat)

- Management reiterated its full-year Adjusted EPS guidance of $5.30 at the midpoint

- EBITDA guidance for the full year is $350 million at the midpoint, above analyst estimates of $346.1 million

- Operating Margin: 3.1%, down from 10.3% in the same quarter last year

- Free Cash Flow was -$67.26 million, down from $33.08 million in the same quarter last year

- Market Capitalization: $2.36 billion

Company Overview

Protecting the things that power our world, Atkore (NYSE:ATKR) designs and manufactures electrical safety products.

Examples of its electrical safety products include conduit systems, which are large cases that protect electrical wires and cables from moisture, chemicals, and other types of damage from electrical shocks and fires. These systems act as housing for complex electrical wirings and are needed to meet safety and regulation requirements. They also keep large amounts of thick electrical wires organized and uncluttered.

Atkore sells these conduit systems to electrical contractors and installers, industrial facilities, commercial and residential buildings, or any other organization that needs to house and maintain a large number of electric cables, like utilities companies and governments.

It derives the majority of its revenue from the sale of these electrical safety systems, with associated products like pipe fittings, connectors, and structure supports to defend against earthquakes. It sells its products through direct sales to contractors and installers as well as other methods including distribution networks, online sales, and industry trade shows.

4. Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Competitors of Atkore include Hubbell (NYSE:HUBB), Pentair (NYSE:PNR), and Legrand (EPA:LR).

5. Revenue Growth

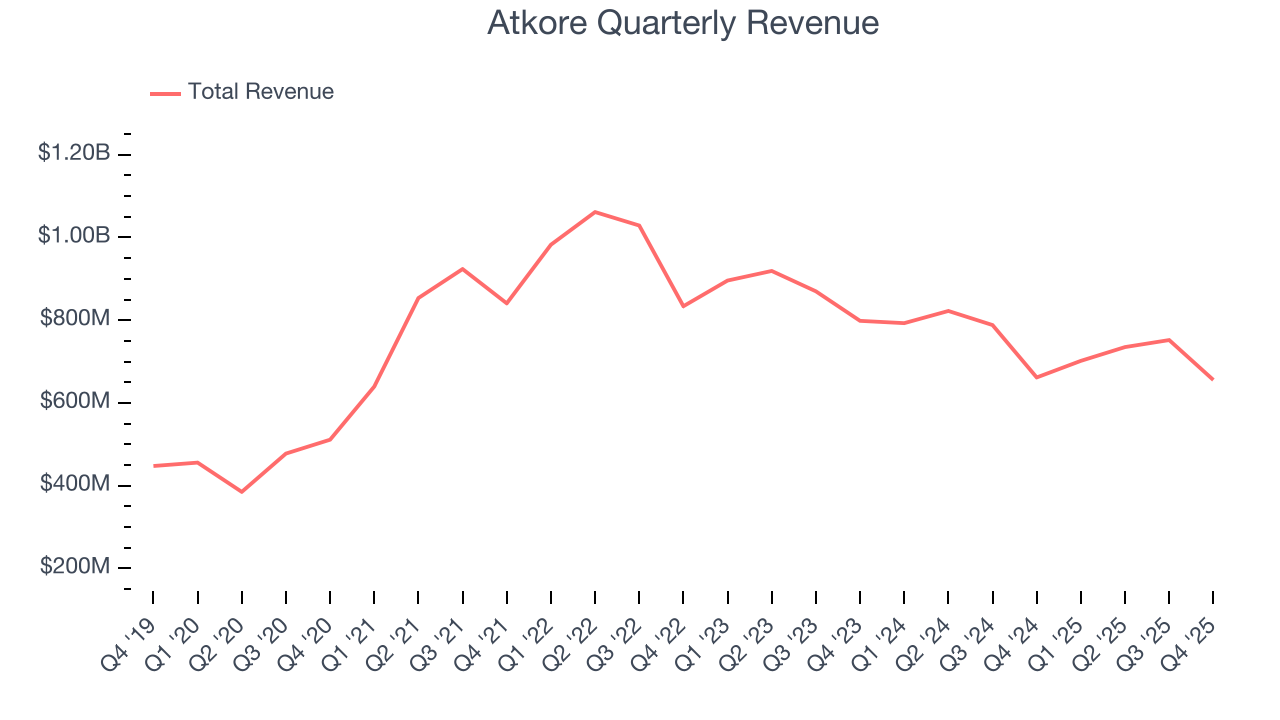

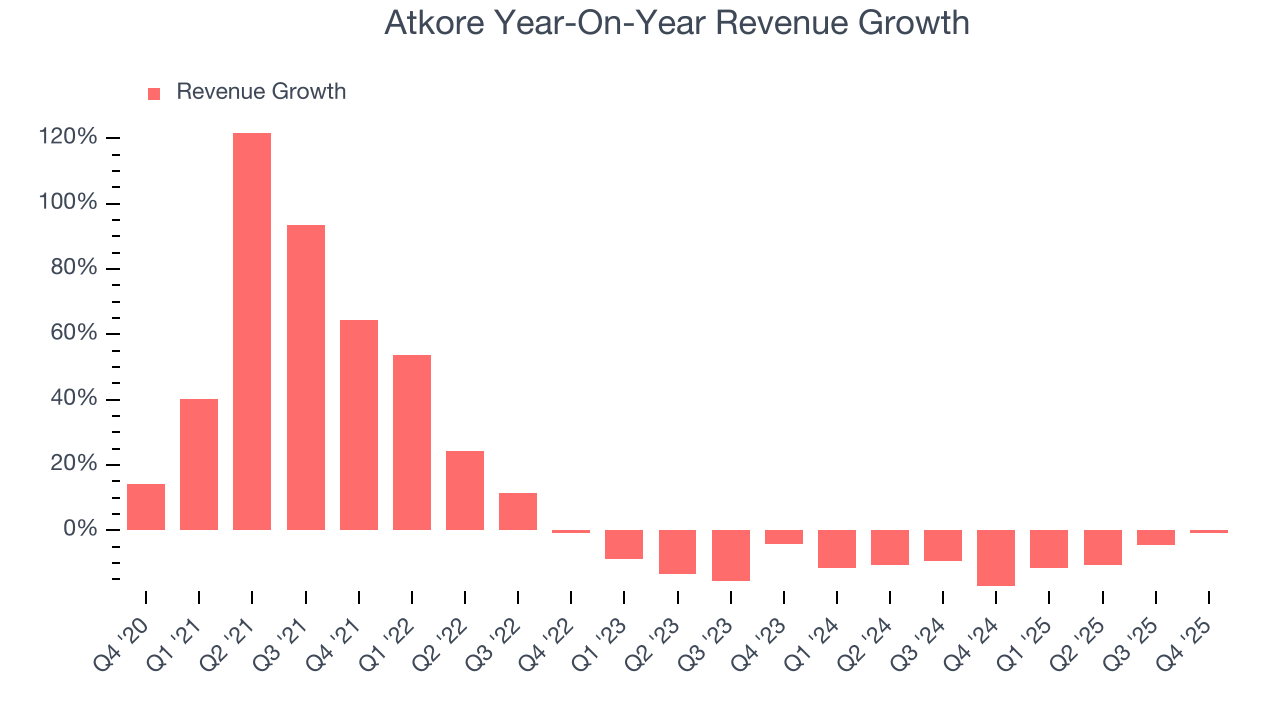

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Atkore’s 9.2% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Atkore’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.6% over the last two years.

This quarter, Atkore’s $655.5 million of revenue was flat year on year but beat Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

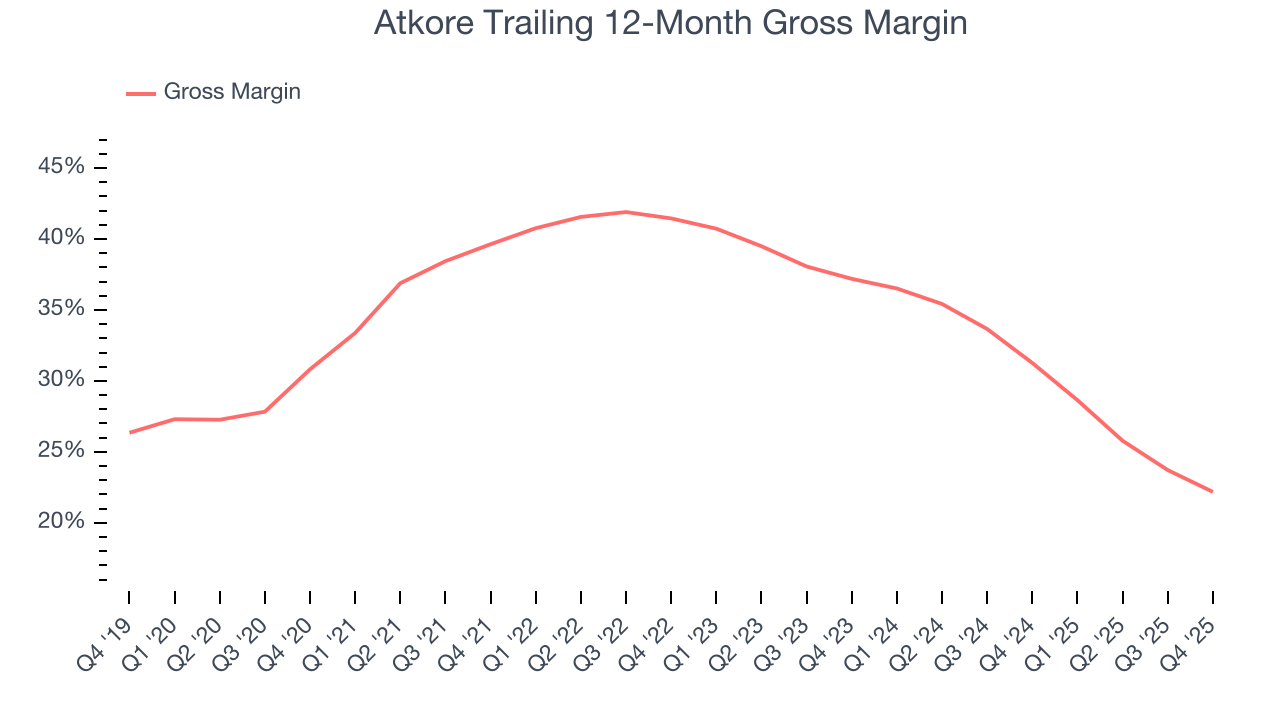

Atkore’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 35% gross margin over the last five years. That means for every $100 in revenue, roughly $35.00 was left to spend on selling, marketing, R&D, and general administrative overhead.

Atkore’s gross profit margin came in at 19.2% this quarter, down 6.6 percentage points year on year. Atkore’s full-year margin has also been trending down over the past 12 months, decreasing by 9.1 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

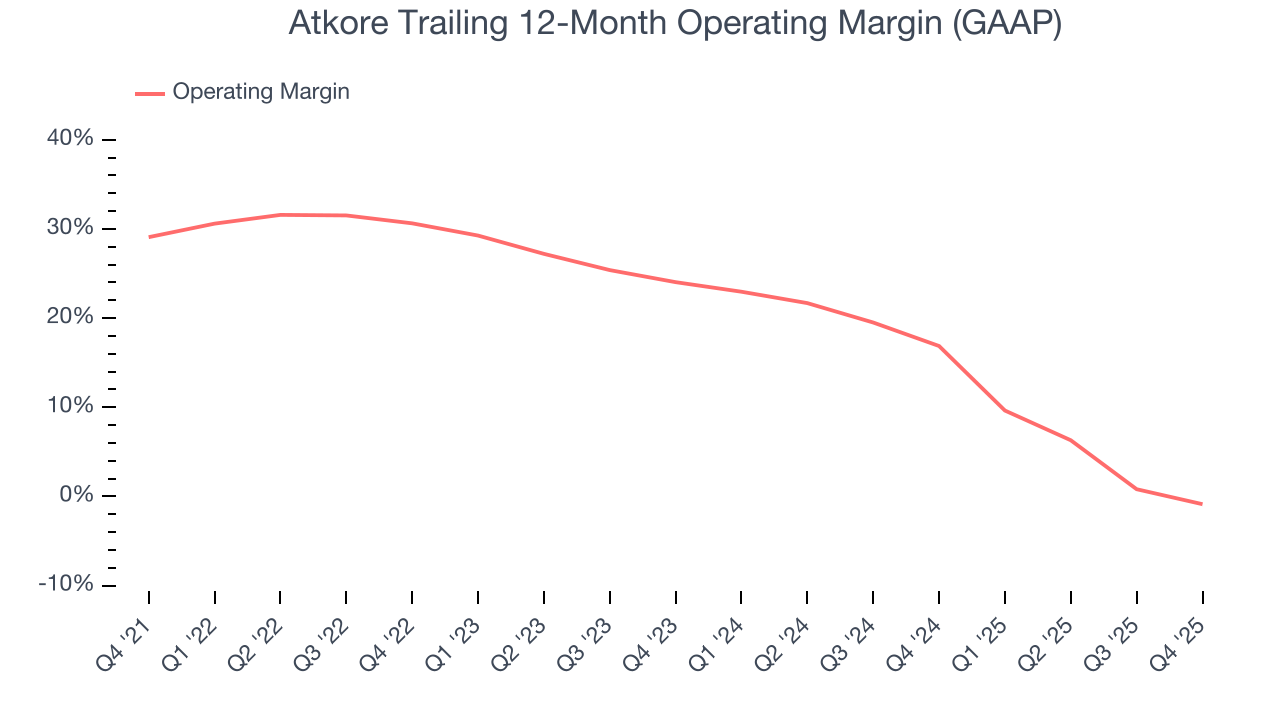

Atkore has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 21%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Atkore’s operating margin decreased by 30 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Atkore generated an operating margin profit margin of 3.1%, down 7.2 percentage points year on year. Since Atkore’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

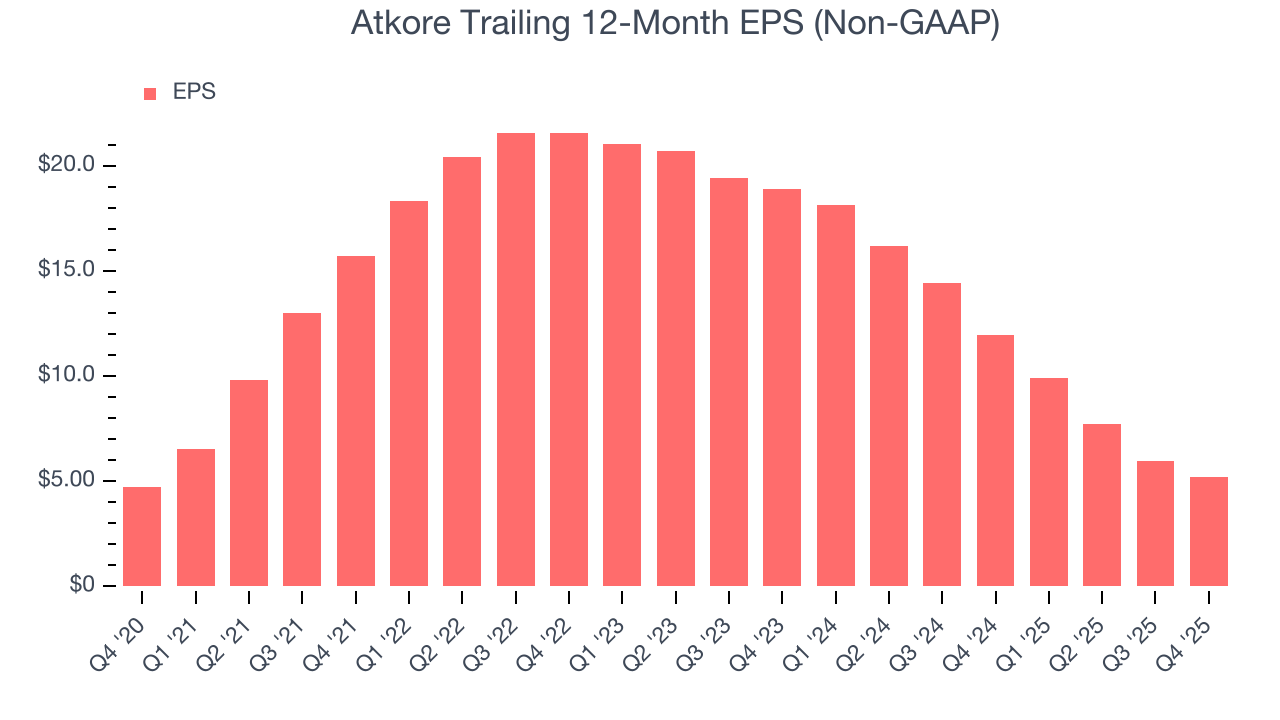

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Atkore’s EPS grew at a weak 1.9% compounded annual growth rate over the last five years, lower than its 9.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Atkore’s earnings can give us a better understanding of its performance. As we mentioned earlier, Atkore’s operating margin declined by 30 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Atkore, its two-year annual EPS declines of 47.6% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Atkore reported adjusted EPS of $0.83, down from $1.63 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Atkore’s full-year EPS of $5.19 to grow 5.6%.

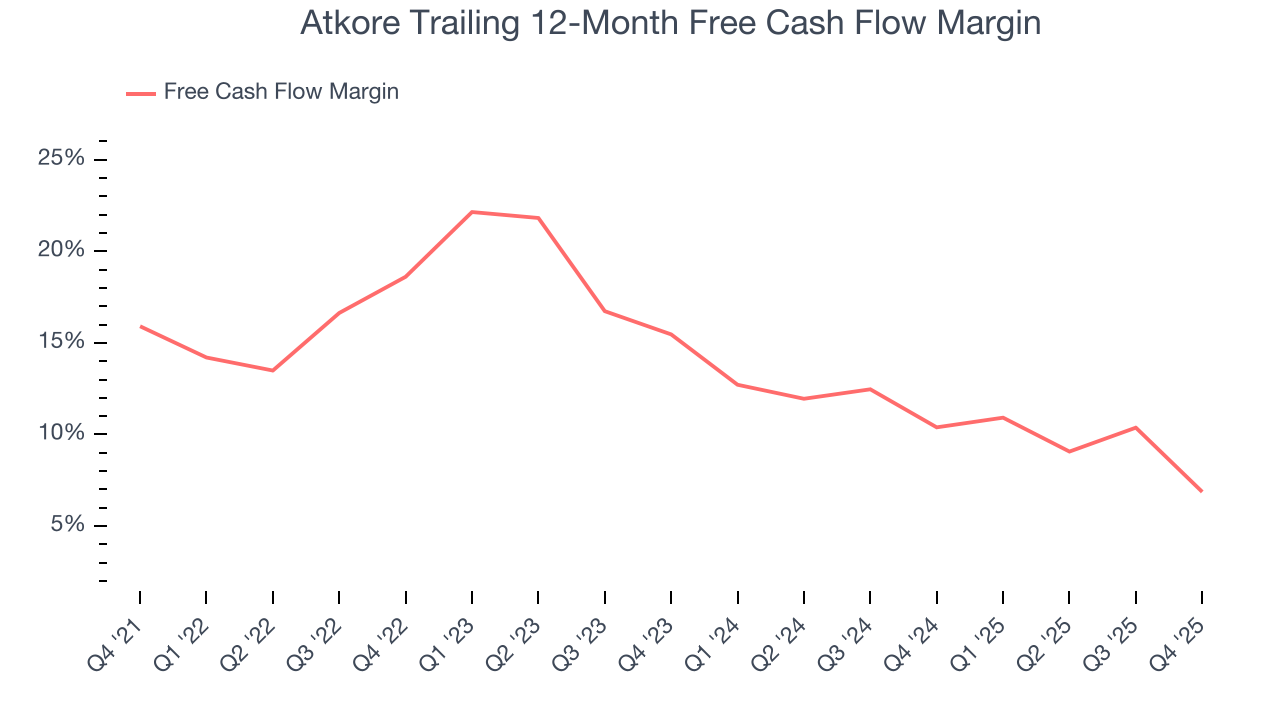

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Atkore has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 13.9% over the last five years.

Taking a step back, we can see that Atkore’s margin dropped by 9 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Atkore burned through $67.26 million of cash in Q4, equivalent to a negative 10.3% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

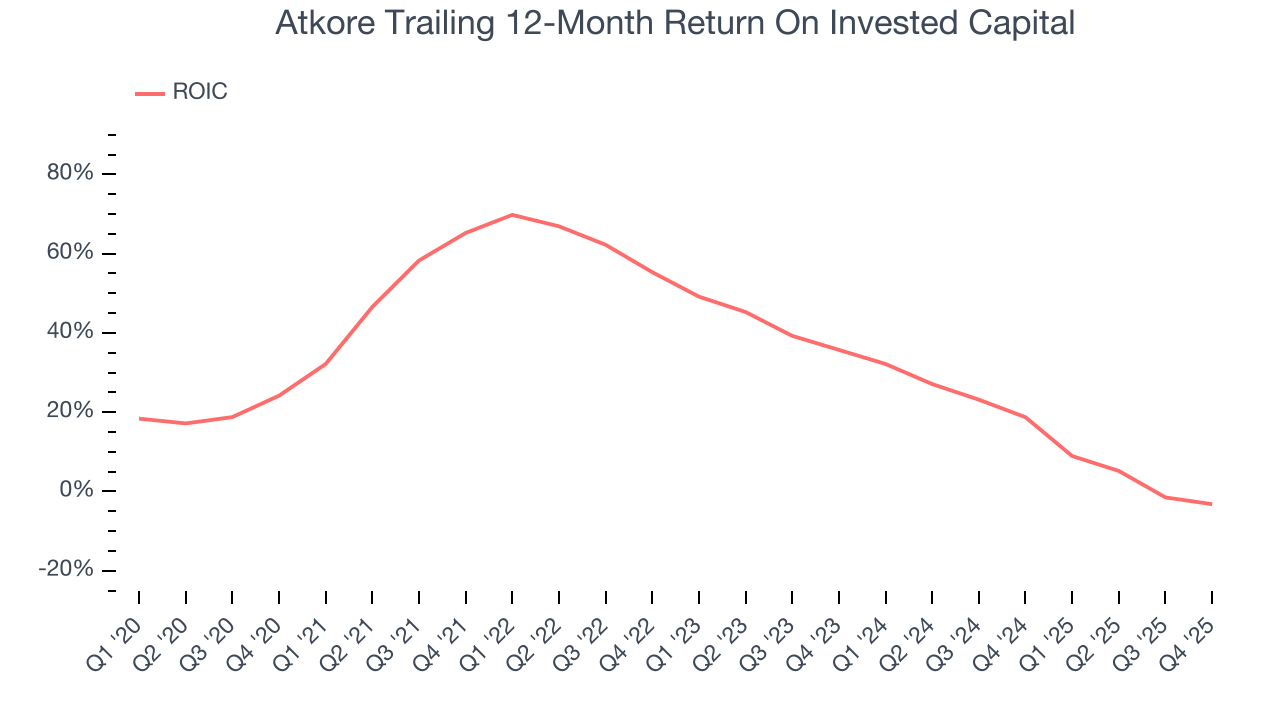

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Atkore hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 34.4%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Atkore’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

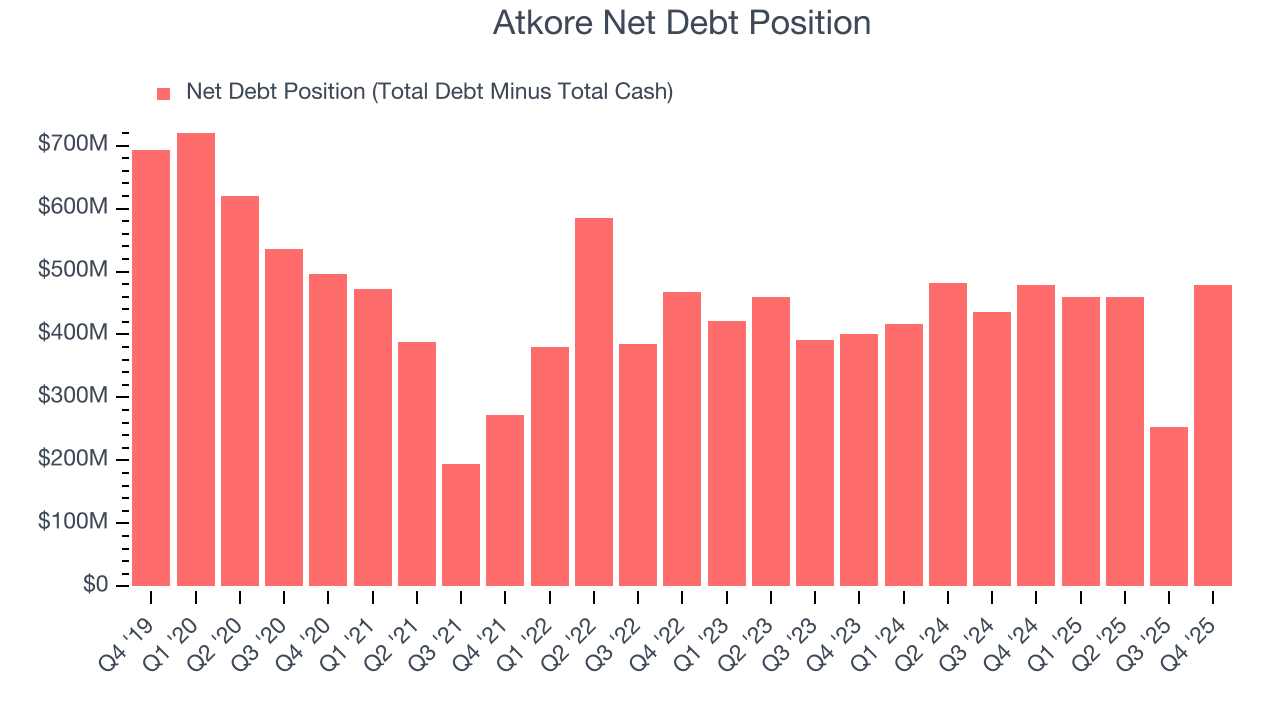

11. Balance Sheet Assessment

Atkore reported $443.8 million of cash and $922.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $356.4 million of EBITDA over the last 12 months, we view Atkore’s 1.3× net-debt-to-EBITDA ratio as safe. We also see its $18.16 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Atkore’s Q4 Results

It was good to see Atkore beat analysts’ EBITDA and EPS expectations convincingly this quarter. We were also excited its full-year EPS guidance was raised. Zooming out, we think this quarter featured some important positives. The stock remained flat at $70.10 immediately following the results.

13. Is Now The Time To Buy Atkore?

Updated: February 3, 2026 at 6:28 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Atkore, you should also grasp the company’s longer-term business quality and valuation.

Atkore falls short of our quality standards. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s impressive operating margins show it has a highly efficient business model, the downside is its declining operating margin shows the business has become less efficient.

Atkore’s P/E ratio based on the next 12 months is 12.8x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $65.80 on the company (compared to the current share price of $70.10).