Brunswick (BC)

We wouldn’t recommend Brunswick. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Brunswick Will Underperform

Formerly known as Brunswick-Balke-Collender Company, Brunswick (NYSE: BC) is a designer and manufacturer of recreational marine products, including boats, engines, and marine parts.

- Sales trends were unexciting over the last five years as its 4.8% annual growth was below the typical consumer discretionary company

- Earnings per share fell by 8.5% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

- Poor expense management has led to an operating margin that is below the industry average

Brunswick doesn’t measure up to our expectations. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Brunswick

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Brunswick

Brunswick is trading at $84.15 per share, or 21.2x forward P/E. Not only is Brunswick’s multiple richer than most consumer discretionary peers, but it’s also expensive for its revenue characteristics.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Brunswick (BC) Research Report: Q4 CY2025 Update

Boat and marine manufacturer Brunswick (NYSE:BC) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 15.5% year on year to $1.33 billion. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $1.3 billion was less impressive, coming in 0.8% below expectations. Its non-GAAP profit of $0.58 per share was 2% above analysts’ consensus estimates.

Brunswick (BC) Q4 CY2025 Highlights:

- Revenue: $1.33 billion vs analyst estimates of $1.21 billion (15.5% year-on-year growth, 10.3% beat)

- Adjusted EPS: $0.58 vs analyst estimates of $0.57 (2% beat)

- Revenue Guidance for Q1 CY2026 is $1.3 billion at the midpoint, below analyst estimates of $1.31 billion

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.10 at the midpoint, missing analyst estimates by 2.2%

- Operating Margin: 3.1%, up from -4.8% in the same quarter last year

- Free Cash Flow Margin: 6.6%, down from 23.9% in the same quarter last year

- Market Capitalization: $5.47 billion

Company Overview

Formerly known as Brunswick-Balke-Collender Company, Brunswick (NYSE: BC) is a designer and manufacturer of recreational marine products, including boats, engines, and marine parts.

Brunswick was founded in the 19th century, initially carving a niche in products like billiards before pivoting to the marine industry. It was created out of a vision to deliver high-quality products that enhance leisure time. Brunswick shifted to the marine industry to take advantage of the expanding leisure market and the appeal of boating.

The company presents a diverse array of marine vehicles and high-performance outboard engines, serving both leisure boaters and professionals. The selection spans from modest-sized vessels suitable for family leisure to advanced marine craft engineered for demanding oceanic excursions.

Brunswick’s primary revenue streams come from boat and engine sales, complemented by a strong aftermarket presence for parts and accessories. It also has a comprehensive dealer network that helps sell its products

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the recreational marine industry include Malibu Boats (NASDAQ:MBUU), Marine Products (NYSE:MPX), and MasterCraft Boat (NASDAQ:MCFT).

5. Revenue Growth

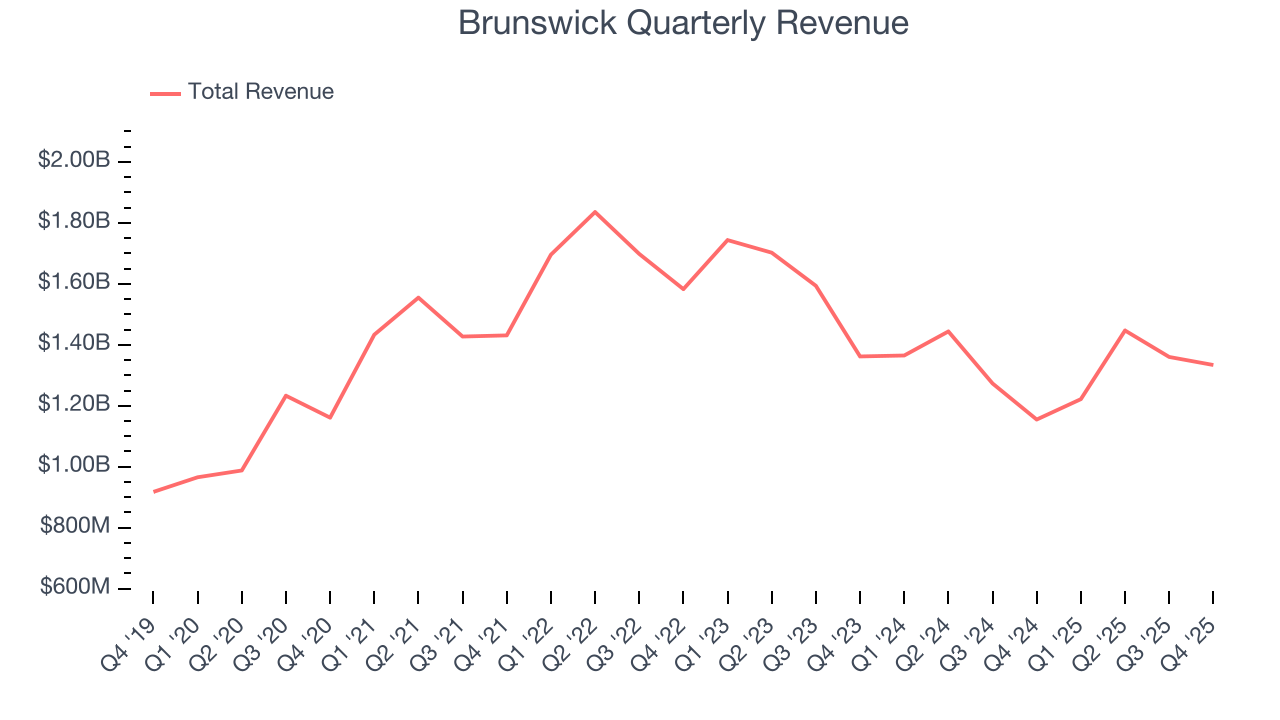

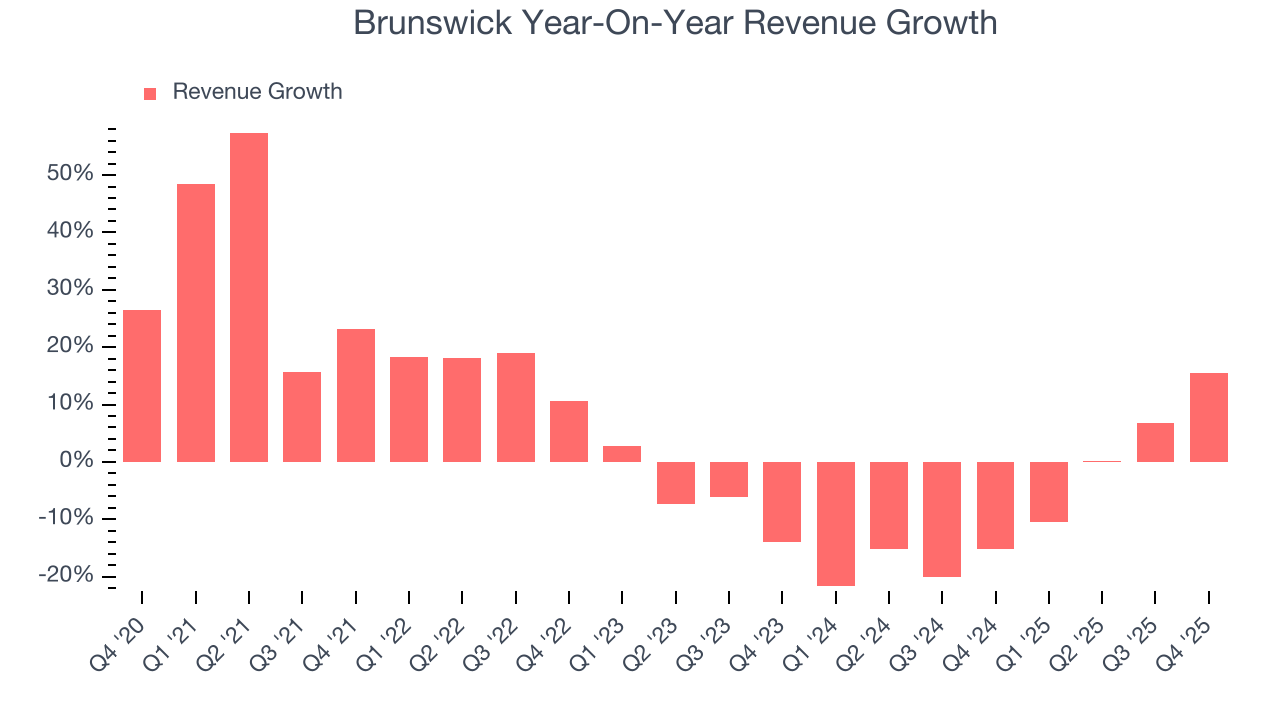

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Brunswick grew its sales at a weak 4.3% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Brunswick’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 8.5% annually.

This quarter, Brunswick reported year-on-year revenue growth of 15.5%, and its $1.33 billion of revenue exceeded Wall Street’s estimates by 10.3%. Company management is currently guiding for a 6.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Operating Margin

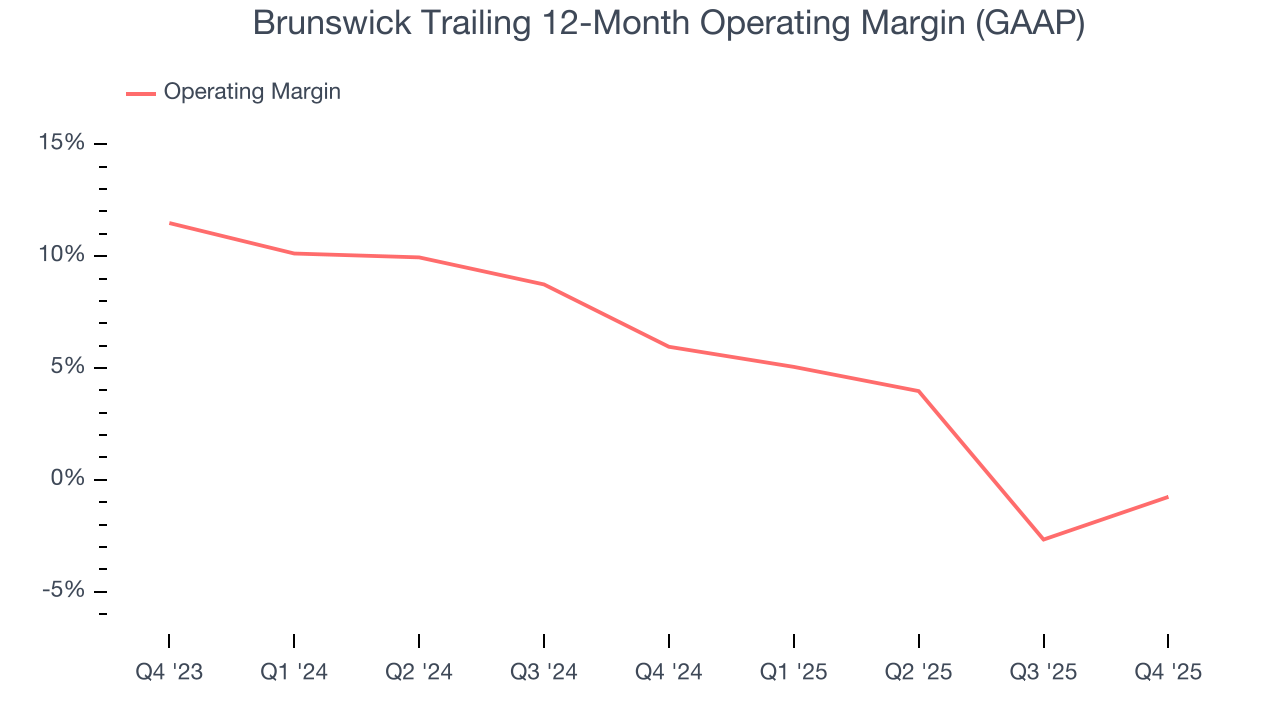

Brunswick’s operating margin has shrunk over the last 12 months and averaged 2.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q4, Brunswick generated an operating margin profit margin of 3.1%, up 8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

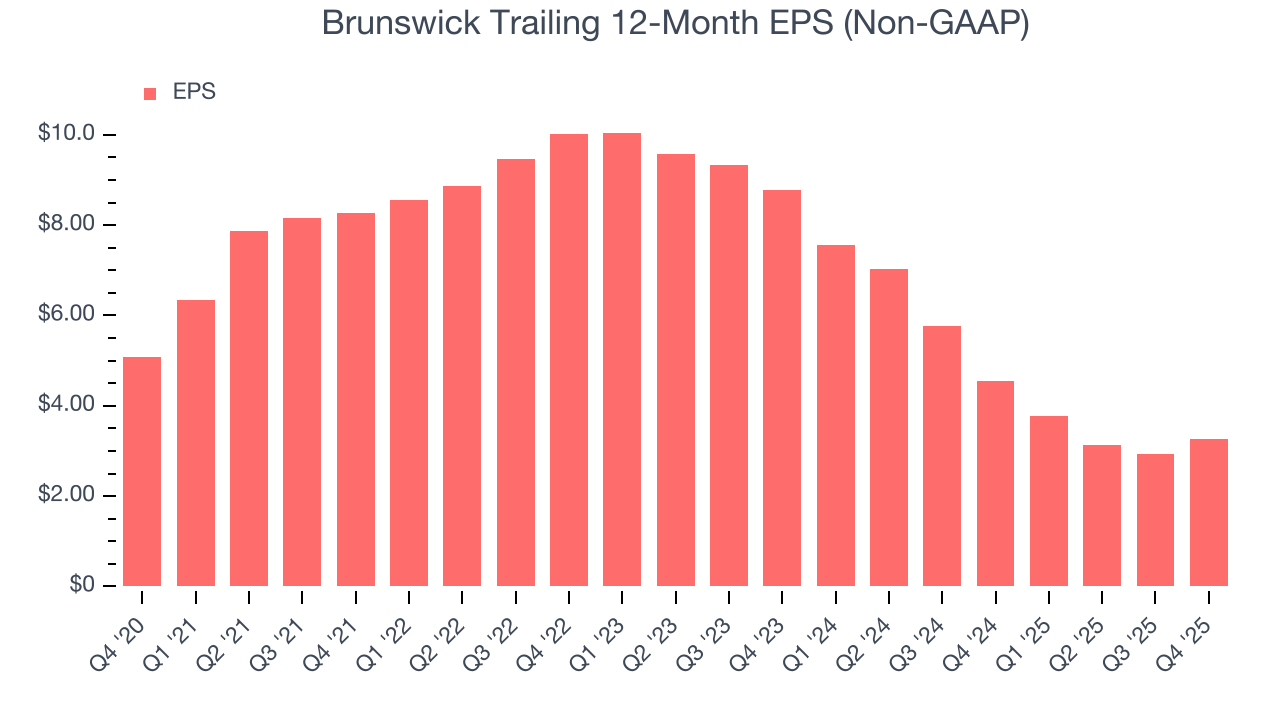

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Brunswick, its EPS declined by 8.4% annually over the last five years while its revenue grew by 4.3%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, Brunswick reported adjusted EPS of $0.58, up from $0.24 in the same quarter last year. This print beat analysts’ estimates by 2%. Over the next 12 months, Wall Street expects Brunswick’s full-year EPS of $3.27 to grow 29.7%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

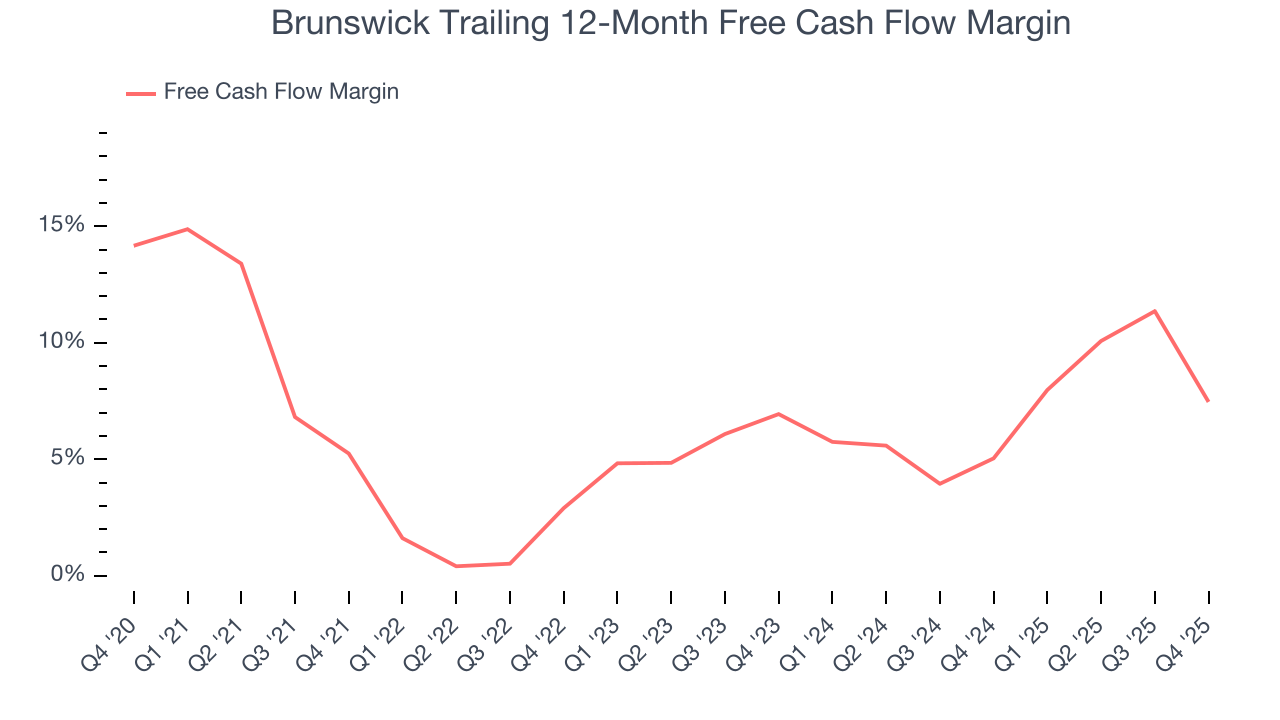

Brunswick has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.3%, lousy for a consumer discretionary business.

Brunswick’s free cash flow clocked in at $87.6 million in Q4, equivalent to a 6.6% margin. The company’s cash profitability regressed as it was 17.3 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting Brunswick’s free cash flow margin of 7.5% for the last 12 months to remain the same.

9. Return on Invested Capital (ROIC)

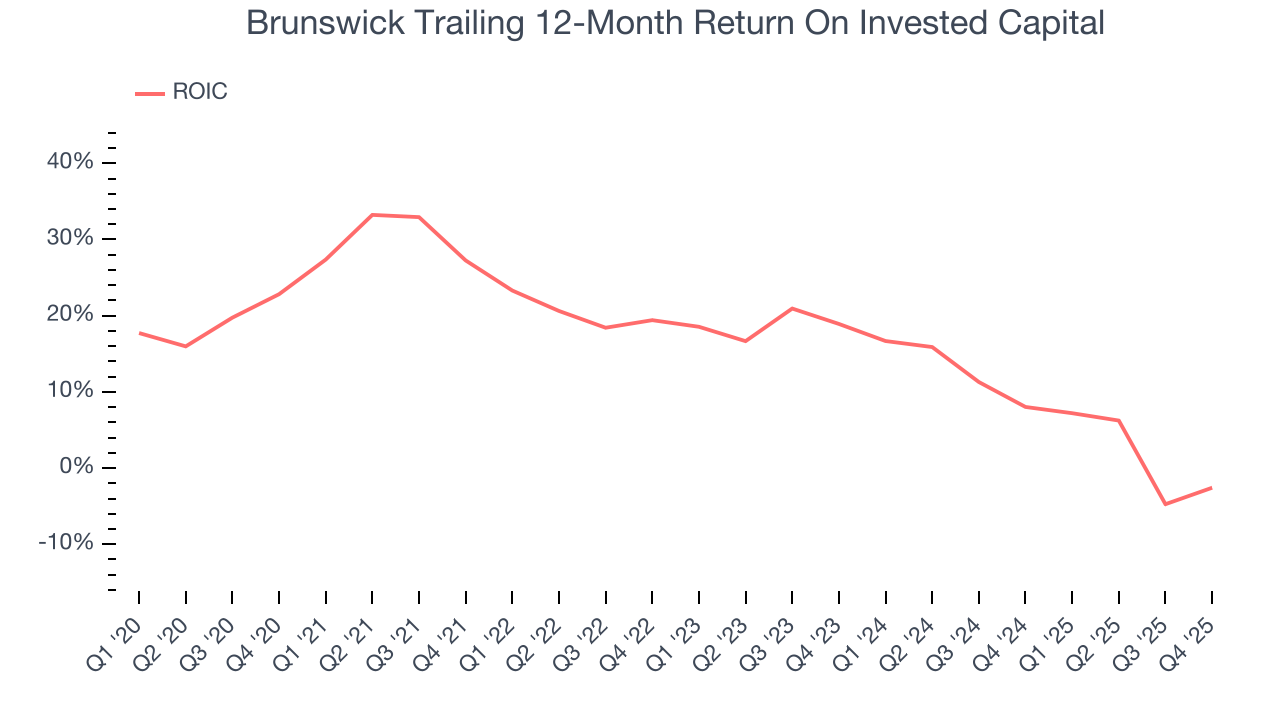

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Brunswick historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 14.2%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Brunswick’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Key Takeaways from Brunswick’s Q4 Results

We were impressed by how significantly Brunswick blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this print was mixed. The stock remained flat at $84.17 immediately after reporting.

11. Is Now The Time To Buy Brunswick?

Updated: January 29, 2026 at 7:00 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Brunswick, you should also grasp the company’s longer-term business quality and valuation.

Brunswick doesn’t pass our quality test. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Brunswick’s Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

Brunswick’s P/E ratio based on the next 12 months is 19.9x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $82.24 on the company (compared to the current share price of $84.17), implying they don’t see much short-term potential in Brunswick.