Franklin Resources (BEN)

Franklin Resources is in for a bumpy ride. Its low returns on capital raise concerns about its ability to deliver profits, a must for quality companies.― StockStory Analyst Team

1. News

2. Summary

Why We Think Franklin Resources Will Underperform

Operating under the widely recognized Franklin Templeton brand since 1947, Franklin Resources (NYSE:BEN) is a global investment management organization that offers financial services and solutions to individuals, institutions, and wealth advisors worldwide.

- Incremental sales over the last five years were much less profitable as its earnings per share fell by 2.5% annually while its revenue grew

- Underwhelming 8.3% return on equity reflects management’s difficulties in finding profitable growth opportunities

- A bright spot is that its annual revenue growth of 12.3% over the last five years beat the sector average and underscores the unique value of its offerings

Franklin Resources’s quality isn’t great. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Franklin Resources

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Franklin Resources

Franklin Resources is trading at $26.77 per share, or 10.1x forward P/E. Franklin Resources’s multiple may seem like a great deal among financials peers, but we think there are valid reasons why it’s this cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Franklin Resources (BEN) Research Report: Q4 CY2025 Update

Global investment management firm Franklin Resources (NYSE:BEN) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 38.3% year on year to $2.33 billion. Its non-GAAP profit of $0.70 per share was 27.5% above analysts’ consensus estimates.

Franklin Resources (BEN) Q4 CY2025 Highlights:

- Assets Under Management: $1.68 trillion vs analyst estimates of $699.1 billion (172% year-on-year growth, 141% beat)

- Revenue: $2.33 billion vs analyst estimates of $2.09 billion (38.3% year-on-year growth, 11.5% beat)

- Pre-tax Profit: $451.8 million (19.4% margin)

- Adjusted EPS: $0.70 vs analyst estimates of $0.55 (27.5% beat)

- Market Capitalization: $13.49 billion

Company Overview

Operating under the widely recognized Franklin Templeton brand since 1947, Franklin Resources (NYSE:BEN) is a global investment management organization that offers financial services and solutions to individuals, institutions, and wealth advisors worldwide.

Franklin Resources manages hundreds of billions in assets through a diverse range of investment products including mutual funds, ETFs, institutional accounts, and separately managed portfolios. The company's investment strategies span across asset classes—from equities and fixed income to alternatives and multi-asset solutions—allowing clients to build diversified portfolios tailored to their financial goals.

The firm serves a broad client base that includes individual investors saving for retirement, large pension funds managing employee benefits, financial advisors constructing client portfolios, and institutional investors like endowments and foundations. A financial advisor might use Franklin Templeton's fixed income funds to provide income stability for a retiree's portfolio, while simultaneously recommending their emerging market equity funds for younger clients seeking long-term growth.

Franklin Resources generates revenue primarily through management fees calculated as a percentage of assets under management, with additional income from sales charges on certain fund offerings and advisory services. The company has expanded its capabilities through strategic acquisitions, including Legg Mason in 2020, which significantly broadened its investment offerings and global reach.

The firm operates with a global footprint, maintaining offices in over 30 countries while offering investment expertise across developed and emerging markets. Franklin Resources has adapted to industry changes by expanding its alternative investment capabilities, enhancing its ESG (Environmental, Social, and Governance) offerings, and developing technology platforms to improve client experiences and operational efficiency.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

Franklin Resources competes with other major asset managers including BlackRock (NYSE:BLK), T. Rowe Price (NASDAQ:TROW), Invesco (NYSE:IVZ), and State Street Global Advisors (NYSE:STT), as well as with diversified financial services firms like Fidelity Investments and Vanguard Group.

5. Revenue Growth

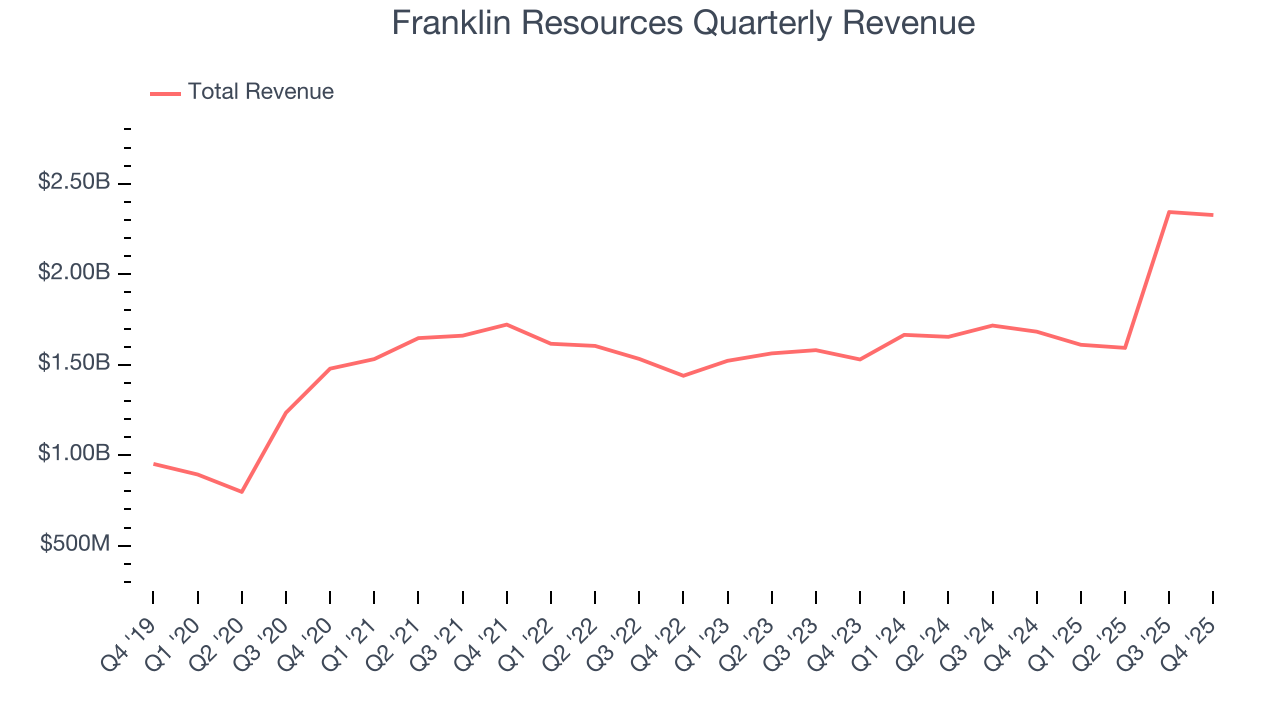

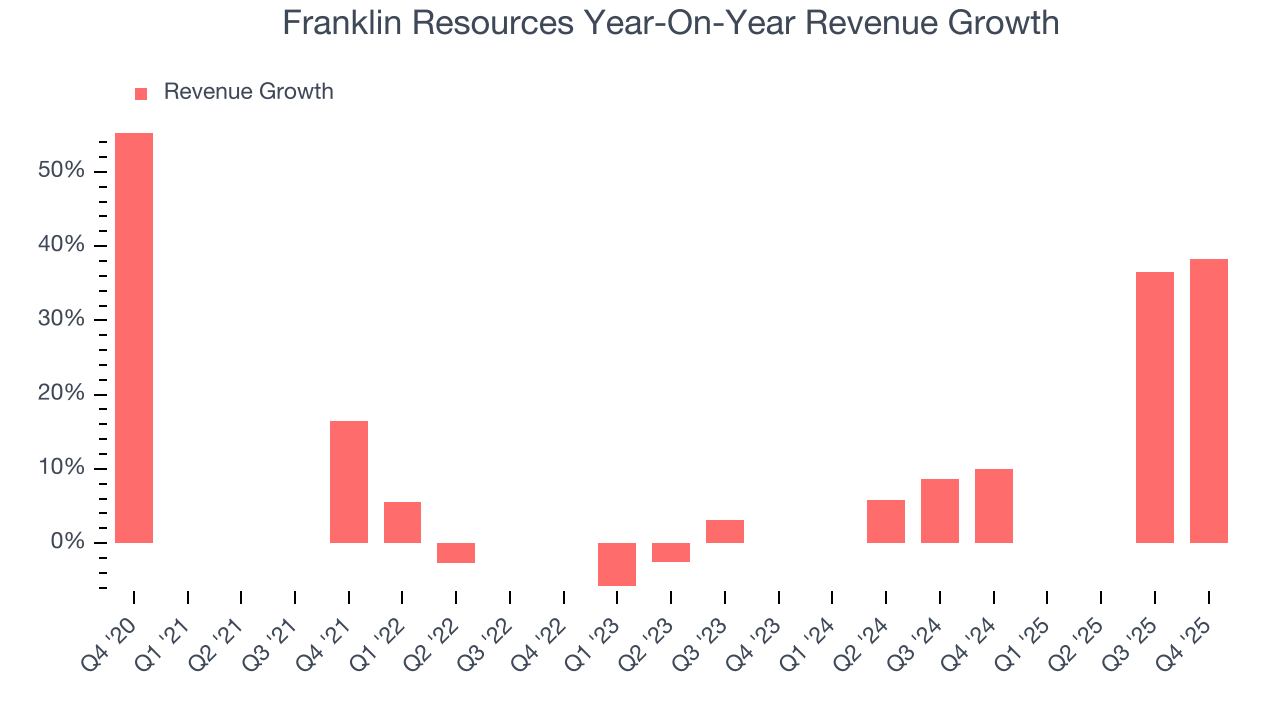

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Franklin Resources’s revenue grew at a solid 12.3% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Franklin Resources’s annualized revenue growth of 12.7% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Franklin Resources reported wonderful year-on-year revenue growth of 38.3%, and its $2.33 billion of revenue exceeded Wall Street’s estimates by 11.5%.

6. Assets Under Management (AUM)

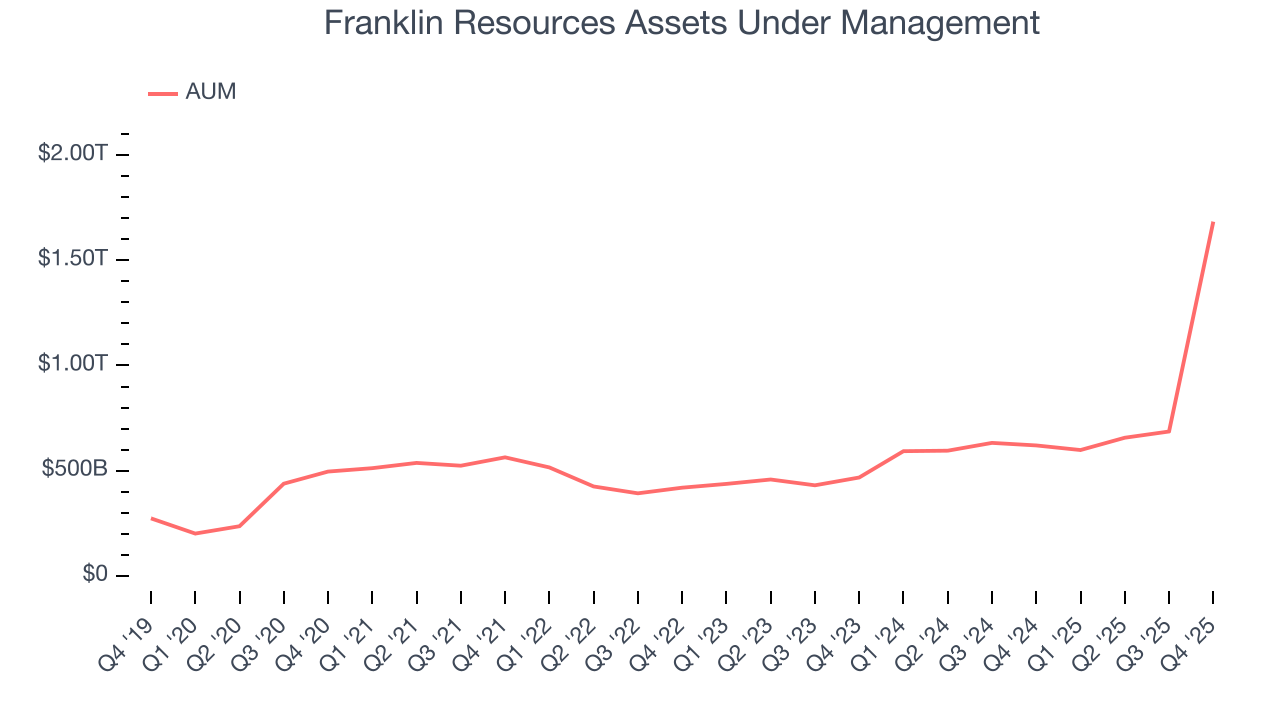

Assets Under Management (AUM) is the cornerstone of a financial firm's investment division, representing all client capital under its stewardship. Management fees on this AUM create reliable, recurring revenue that maintains stability even when investment performance struggles, though prolonged poor returns can eventually affect asset retention and growth.

Franklin Resources’s AUM has grown at an annual rate of 21.5% over the last five years, better than the broader financials industry and faster than its total revenue. When analyzing Franklin Resources’s AUM over the last two years, we can see that growth accelerated to 42.2% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. Just remember that while assets are relevant to watch, we don't place too much emphasis on them because they ebb and flow with the market.

Franklin Resources’s AUM punched in at $1.68 trillion this quarter, beating analysts’ expectations by 141%. This print was 172% higher than the same quarter last year.

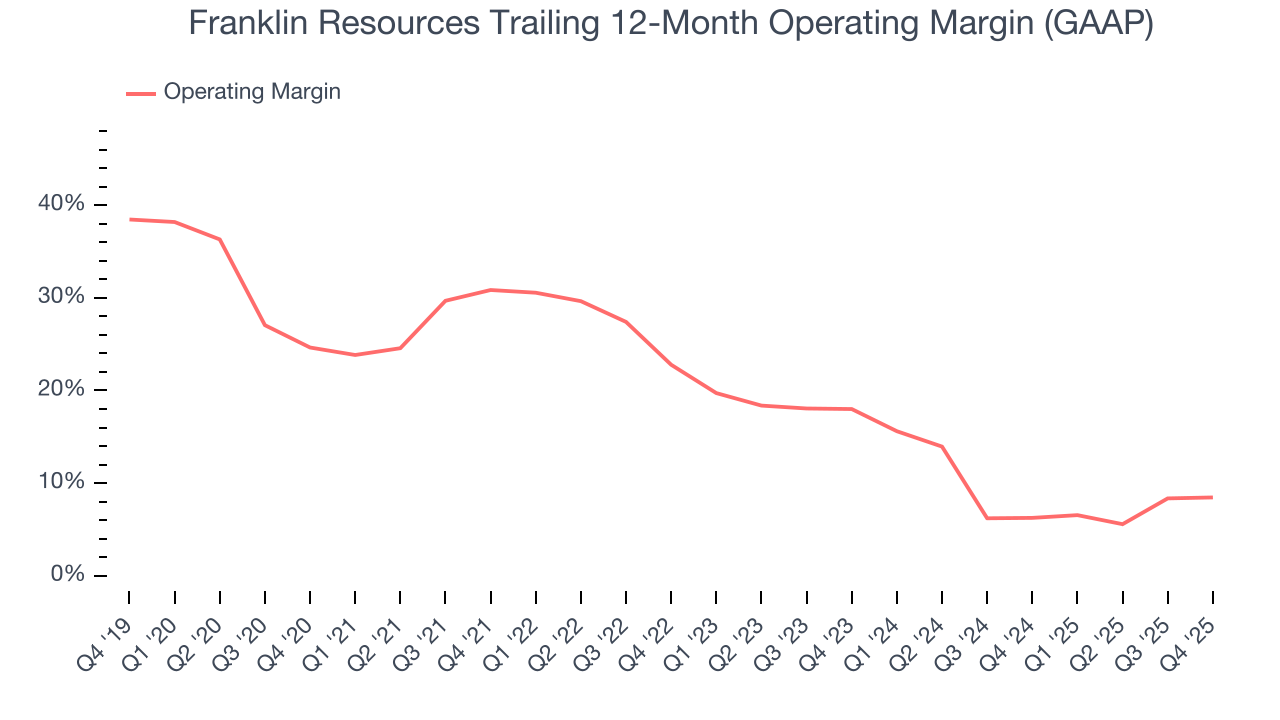

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Over the last five years, Franklin Resources’s operating margin has risen by 22.4 percentage points, going from 30.8% to 8.5%. Luckily, it seems the company has recently taken steps to address its expense base as its operating margin expanded by 2.2 percentage points on a two-year basis.

Franklin Resources’s operating margin came in at 12.1% this quarter. This result was in line with the same quarter last year.

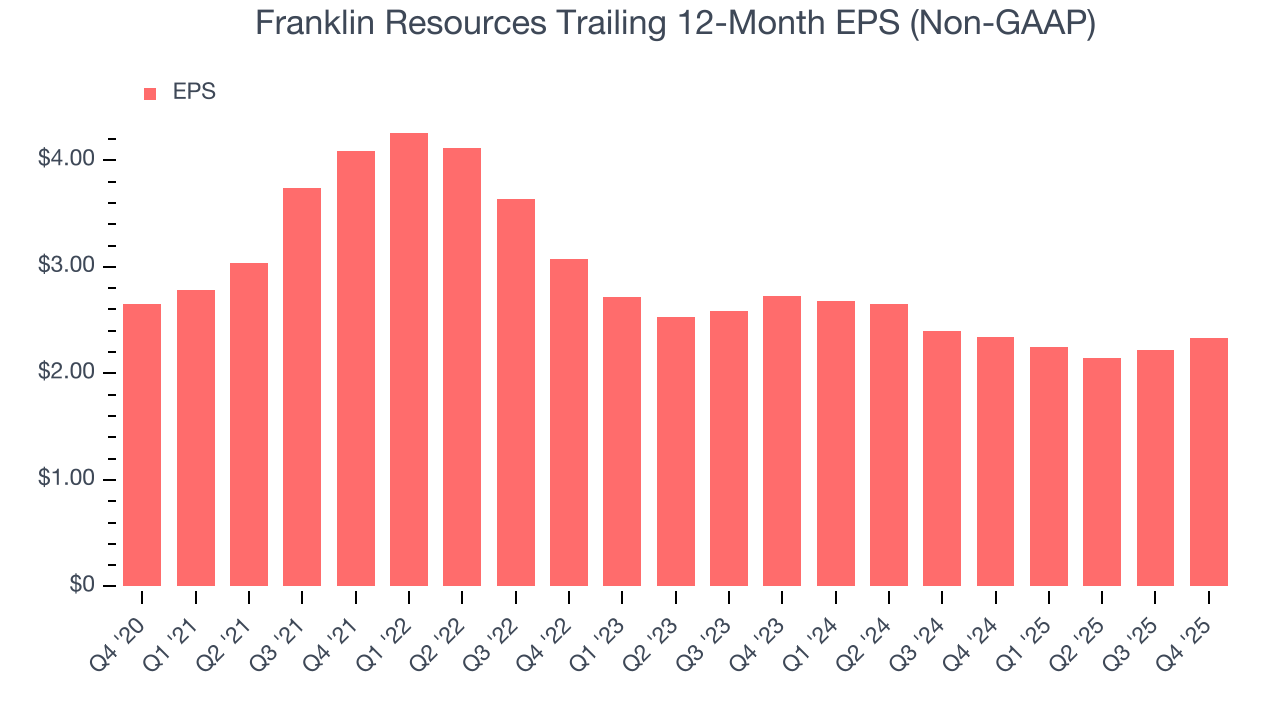

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Franklin Resources, its EPS declined by 2.5% annually over the last five years while its revenue grew by 12.3%. This tells us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Franklin Resources, its two-year annual EPS declines of 7.6% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Franklin Resources reported adjusted EPS of $0.70, up from $0.59 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Franklin Resources’s full-year EPS of $2.33 to grow 13%.

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Franklin Resources has averaged an ROE of 8.5%, uninspiring for a company operating in a sector where the average shakes out around 10%.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Franklin Resources has no debt, so leverage is not an issue here.

11. Key Takeaways from Franklin Resources’s Q4 Results

It was good to see Franklin Resources beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 1.6% to $26.31 immediately following the results.

12. Is Now The Time To Buy Franklin Resources?

Updated: January 30, 2026 at 11:37 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Franklin Resources.

Franklin Resources doesn’t pass our quality test. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its declining pre-tax profit margin shows the business has become less efficient. And while the company’s AUM growth was impressive over the last five years, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets.

Franklin Resources’s P/E ratio based on the next 12 months is 10.1x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $25.73 on the company (compared to the current share price of $26.77), implying they don’t see much short-term potential in Franklin Resources.