Bread Financial (BFH)

Bread Financial faces an uphill battle. Its revenue and earnings have underwhelmed, suggesting weak business fundamentals.― StockStory Analyst Team

1. News

2. Summary

Why We Think Bread Financial Will Underperform

Formerly known as Alliance Data Systems until its 2022 rebranding, Bread Financial (NYSE:BFH) provides credit cards, installment loans, and savings products to consumers while powering branded payment solutions for retailers and merchants.

- Sales tumbled by 6.1% annually over the last two years, showing market trends are working against its favor during this cycle

- Falling earnings per share over the last two years has some investors worried as stock prices ultimately follow EPS over the long term

- On the plus side, its ROE punches in at 22.7%, illustrating management’s expertise in identifying profitable investments

Bread Financial’s quality doesn’t meet our expectations. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Bread Financial

Why There Are Better Opportunities Than Bread Financial

Bread Financial is trading at $70.49 per share, or 7.7x forward P/E. Bread Financial’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Bread Financial (BFH) Research Report: Q4 CY2025 Update

Financial services company Bread Financial (NYSE:BFH) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 5.3% year on year to $975 million. Its non-GAAP profit of $2.07 per share was significantly above analysts’ consensus estimates.

Bread Financial (BFH) Q4 CY2025 Highlights:

- Net Interest Income: $1.05 billion vs analyst estimates of $1.02 billion

- Net Interest Margin: 18.9% vs analyst estimates of 18.4% (46.7 basis point beat)

- Revenue: $975 million vs analyst estimates of $954.4 million (5.3% year-on-year growth, 2.2% beat)

- Efficiency Ratio: 57% vs analyst estimates of 53.5% (355 basis point miss)

- Adjusted EPS: $2.07 vs analyst estimates of $0.48 (significant beat)

- Market Capitalization: $3.11 billion

Company Overview

Formerly known as Alliance Data Systems until its 2022 rebranding, Bread Financial (NYSE:BFH) provides credit cards, installment loans, and savings products to consumers while powering branded payment solutions for retailers and merchants.

Bread Financial operates through two main business segments: its traditional credit card business and its newer digital payment solutions. The company's core business involves partnering with approximately 100 brands to offer private label and co-brand credit cards. These partnerships span diverse retail sectors including travel, entertainment, health, beauty, jewelry, and specialty apparel, with clients such as Victoria's Secret, Ulta Beauty, and Saks Fifth Avenue.

For retailers, Bread Financial manages the entire credit lifecycle—from application processing and underwriting to customer service and collections. These branded credit programs help merchants increase sales and customer loyalty while providing valuable consumer data and analytics. The typical partnership agreements run 5-10 years, creating stable, long-term revenue streams.

Beyond traditional credit cards, the company has expanded into digital payment solutions through its Bread Pay platform, which offers installment loans and split-pay options. The installment loans allow consumers to finance purchases with fixed monthly payments over 3-48 months, while the split-pay option divides purchases into four interest-free payments over six weeks. These products appeal particularly to younger consumers who prefer alternatives to traditional credit.

Bread Financial also operates a direct-to-consumer business with its own branded credit cards on the American Express network and Bread Savings, which offers high-yield savings accounts and certificates of deposit. The company generates revenue primarily through interest and fees on its loan products, as well as from merchant discount fees that compensate for promotional financing offers.

4. Credit Card

Credit card companies facilitate electronic payments and extend revolving credit to consumers. Growth comes from increasing digital payment adoption, cross-border transaction growth, and value-added services for cardholders and merchants. Challenges include regulatory scrutiny of fees and practices, competition from alternative payment methods, and potential credit losses during economic downturns.

Bread Financial competes with traditional credit card issuers like Synchrony Financial (NYSE:SYF) and Capital One (NYSE:COF), as well as with buy-now-pay-later providers such as Affirm (NASDAQ:AFRM), Klarna, and Block's Afterpay (NYSE:SQ). In the digital banking space, it faces competition from online banks like Ally Financial (NYSE:ALLY) and numerous fintech startups.

5. Revenue Growth

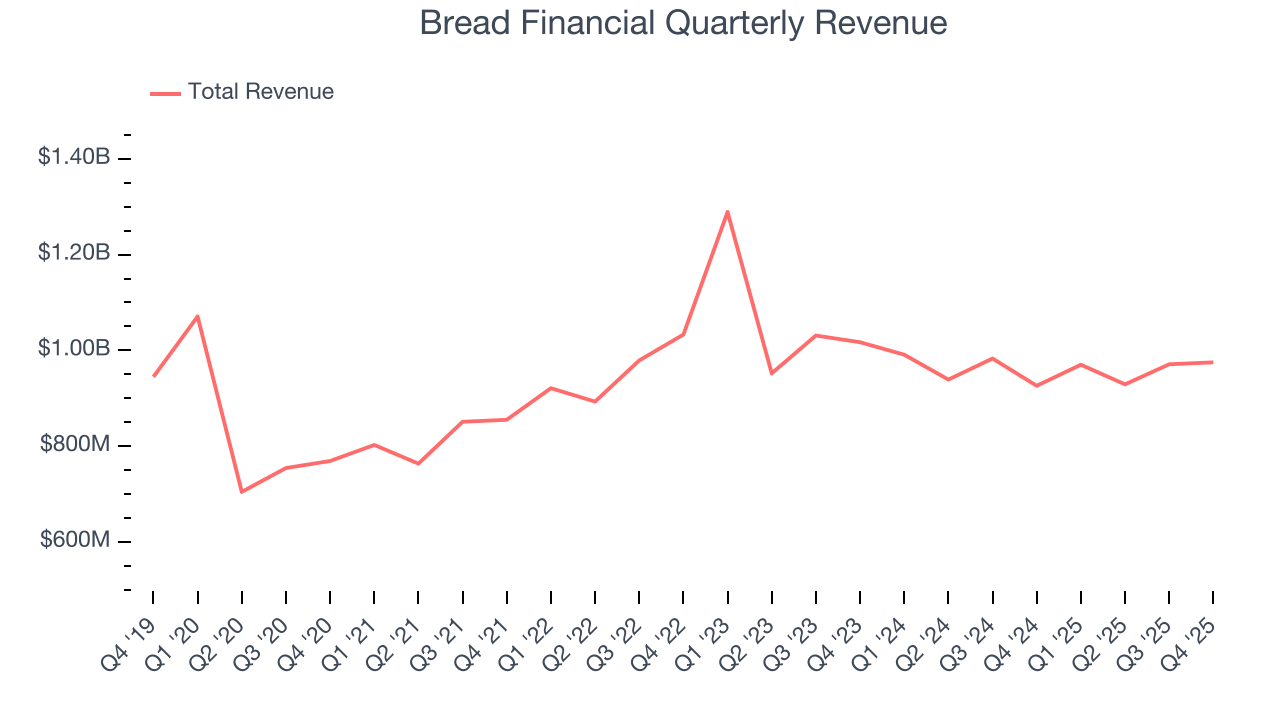

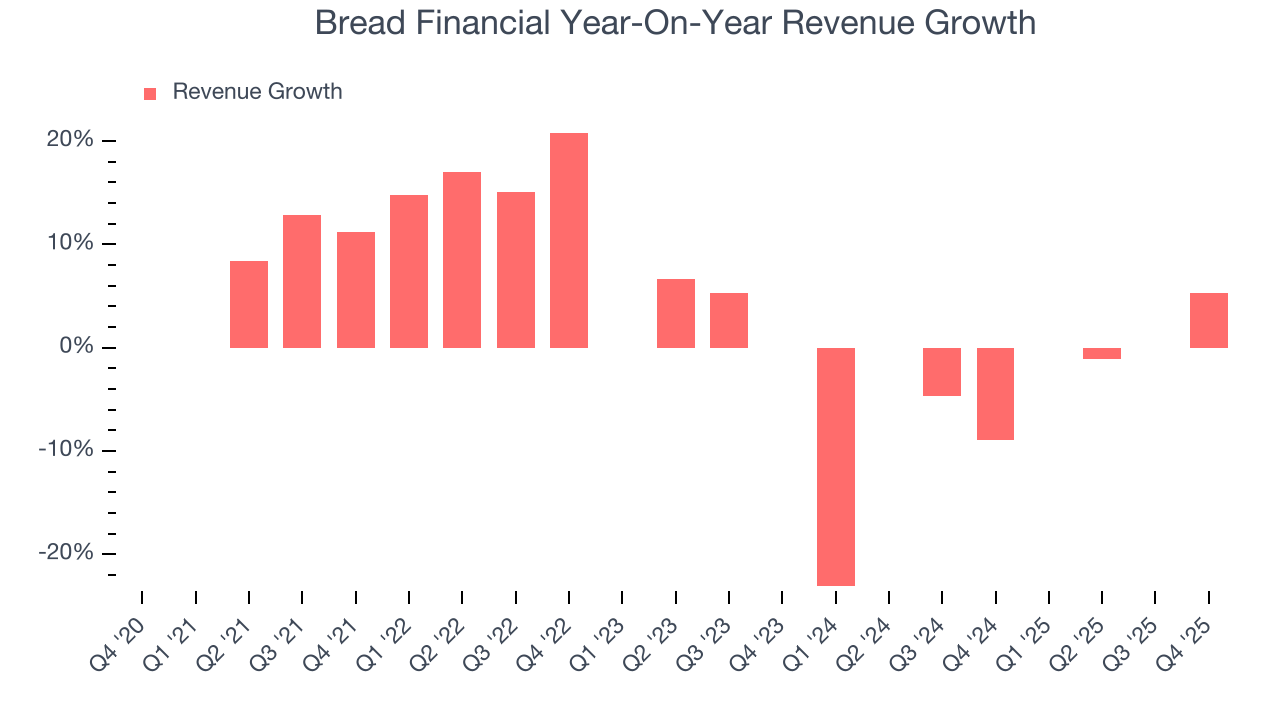

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Bread Financial grew its revenue at a sluggish 3.1% compounded annual growth rate. This was below our standard for the financials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Bread Financial’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.3% annually.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Bread Financial reported year-on-year revenue growth of 5.3%, and its $975 million of revenue exceeded Wall Street’s estimates by 2.2%.

6. Net Interest Margin

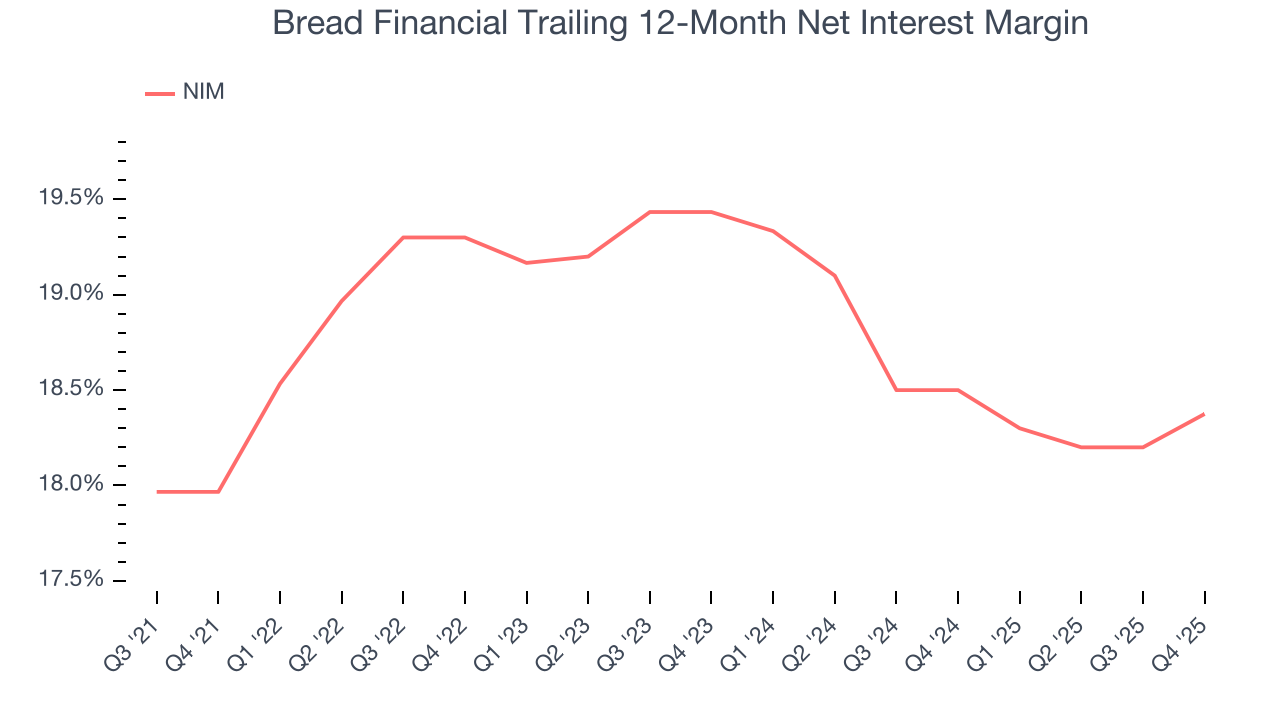

Net interest margin (NIM) serves as a critical gauge of a financial institution's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Bread Financial’s net interest margin has increased by 40.8 basis points (100 basis points = 1 percentage point) over the last four years but decreased by 105.8 basis points on a two-year basis. Although the longer-term change is reassuring, the two-year result was worse than the financials industry. The firm’s NIM for the trailing 12 months was 18.4%.

7. Efficiency Ratio

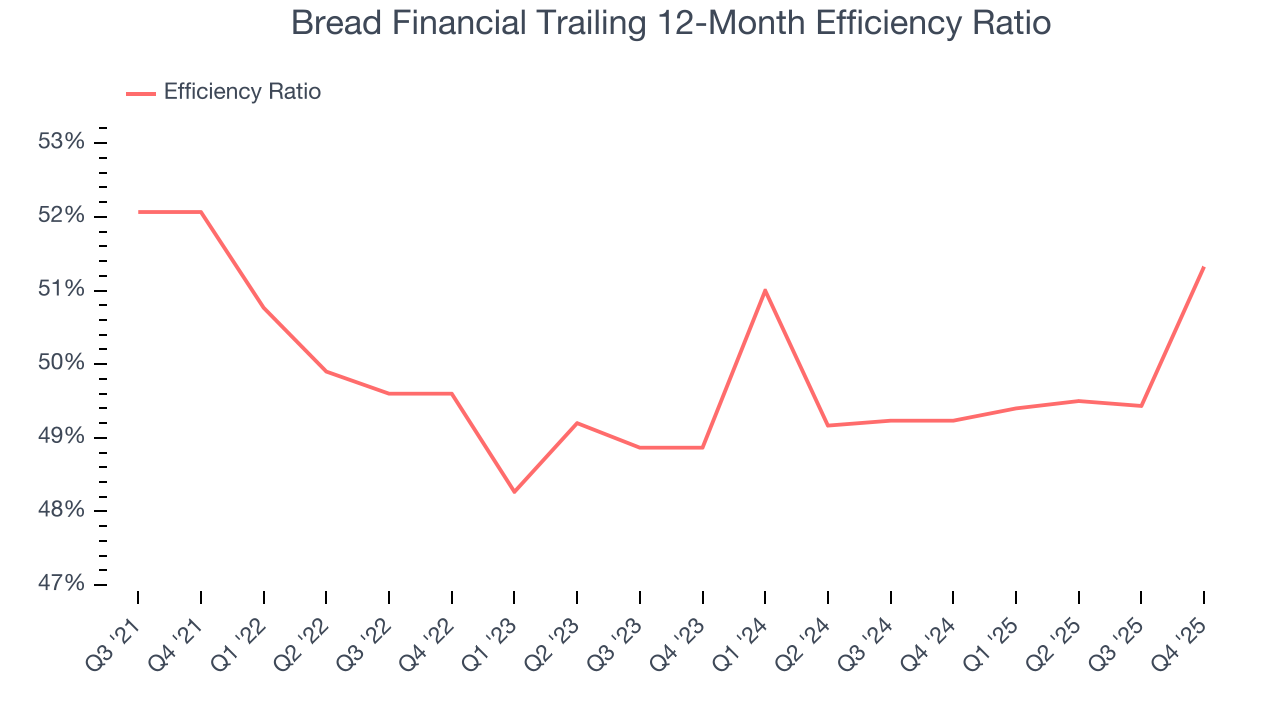

Topline growth carries importance, but the overall profitability behind this expansion determines true value creation. For Credit Card companies, the efficiency ratio captures this relationship by measuring non-interest expenses, including salaries, facilities, technology, and marketing, against total revenue.

Markets understand that a lender’s expense base depends on its revenue mix and what mostly drives share price performance is the change in this ratio, rather than its absolute value. It’s somewhat counterintuitive, but a lower efficiency ratio is better.

Over the last four years, Bread Financial’s efficiency ratio couldn’t build momentum, hanging around 51.3%. It has also worsened by 2.5 percentage points on a two-year basis, showing its expenses have recently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

Bread Financial’s efficiency ratio came in at 57% this quarter, falling short of analysts’ expectations by 355 basis points (100 basis points = 1 percentage point).

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

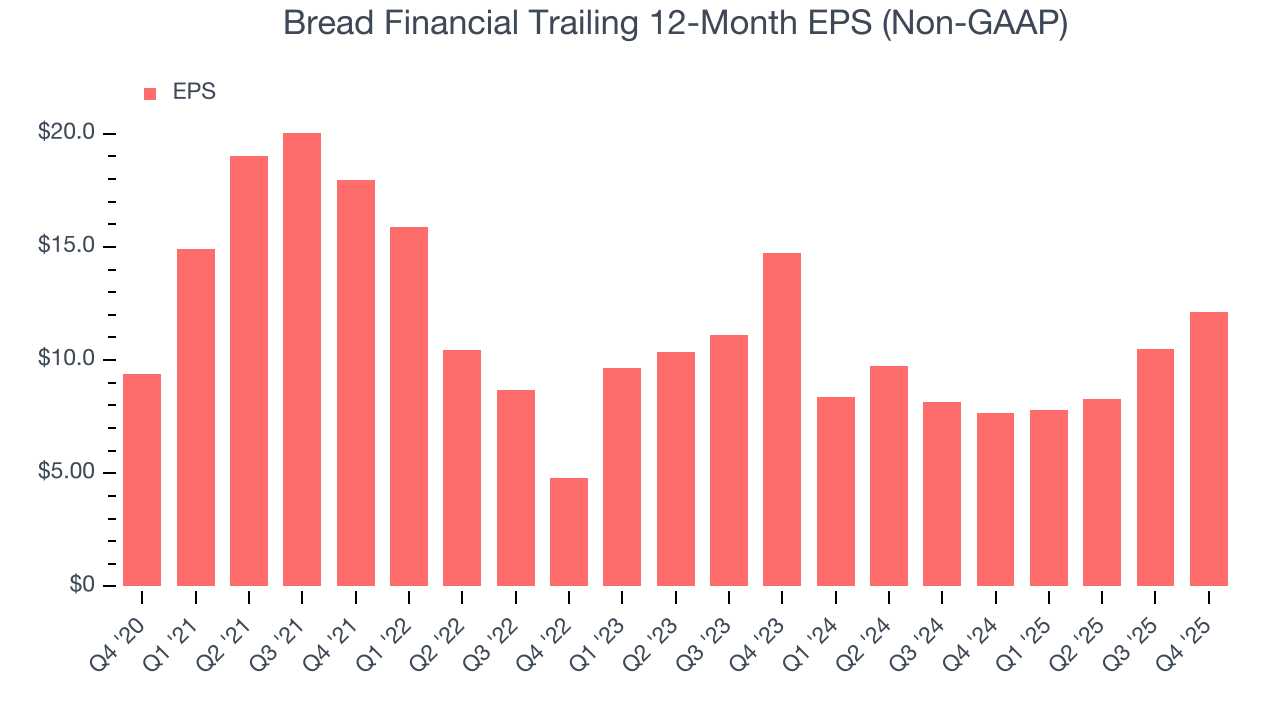

Bread Financial’s EPS grew at an unimpressive 5.3% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its efficiency ratio didn’t improve.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Bread Financial, its two-year annual EPS declines of 9.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Bread Financial reported adjusted EPS of $2.07, up from $0.41 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Bread Financial’s full-year EPS of $12.13 to shrink by 20.5%.

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Bread Financial has averaged an ROE of 22.7%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Bread Financial.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Bread Financial has no debt, so leverage is not an issue here.

11. Key Takeaways from Bread Financial’s Q4 Results

It was good to see Bread Financial beat analysts’ EPS expectations this quarter. We were also excited its net interest margin outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 3.4% to $70.49 immediately after reporting.

12. Is Now The Time To Buy Bread Financial?

Updated: January 29, 2026 at 9:27 AM EST

Are you wondering whether to buy Bread Financial or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies supporting the economy, but in the case of Bread Financial, we’ll be cheering from the sidelines. For starters, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. And while its stellar ROE suggests it has been a well-run company historically, the downside is its unimpressive EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders. On top of that, its efficiency ratio didn’t move over the last four years.

Bread Financial’s P/E ratio based on the next 12 months is 7.1x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $80.07 on the company (compared to the current share price of $70.49).