Bausch + Lomb (BLCO)

We’re cautious of Bausch + Lomb. Its underwhelming returns on capital show it struggled to generate meaningful profits for shareholders.― StockStory Analyst Team

1. News

2. Summary

Why We Think Bausch + Lomb Will Underperform

With a nearly 170-year history dedicated to vision care and eye health innovation, Bausch + Lomb (NYSE:BLCO) develops and manufactures a comprehensive range of eye health products including contact lenses, pharmaceuticals, surgical devices, and consumer eye care solutions.

- Low returns on capital reflect management’s struggle to allocate funds effectively

- Investment activity picked up over the last five years, pressuring its weak free cash flow profitability

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

Bausch + Lomb doesn’t satisfy our quality benchmarks. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Bausch + Lomb

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Bausch + Lomb

Bausch + Lomb is trading at $17.75 per share, or 20.5x forward P/E. This multiple is high given its weaker fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Bausch + Lomb (BLCO) Research Report: Q4 CY2025 Update

Eyecare company Bausch + Lomb (NYSE:BLCO) announced better-than-expected revenue in Q4 CY2025, with sales up 9.8% year on year to $1.41 billion. The company’s full-year revenue guidance of $5.43 billion at the midpoint came in 0.8% above analysts’ estimates. Its non-GAAP profit of $0.32 per share was 10.3% below analysts’ consensus estimates.

Bausch + Lomb (BLCO) Q4 CY2025 Highlights:

- Revenue: $1.41 billion vs analyst estimates of $1.38 billion (9.8% year-on-year growth, 1.5% beat)

- Adjusted EPS: $0.32 vs analyst expectations of $0.36 (10.3% miss)

- Adjusted EBITDA: $330 million vs analyst estimates of $320.7 million (23.5% margin, 2.9% beat)

- EBITDA guidance for the upcoming financial year 2026 is $1.03 million at the midpoint, below analyst estimates of $1.00 billion

- Operating Margin: 8%, up from 6.8% in the same quarter last year

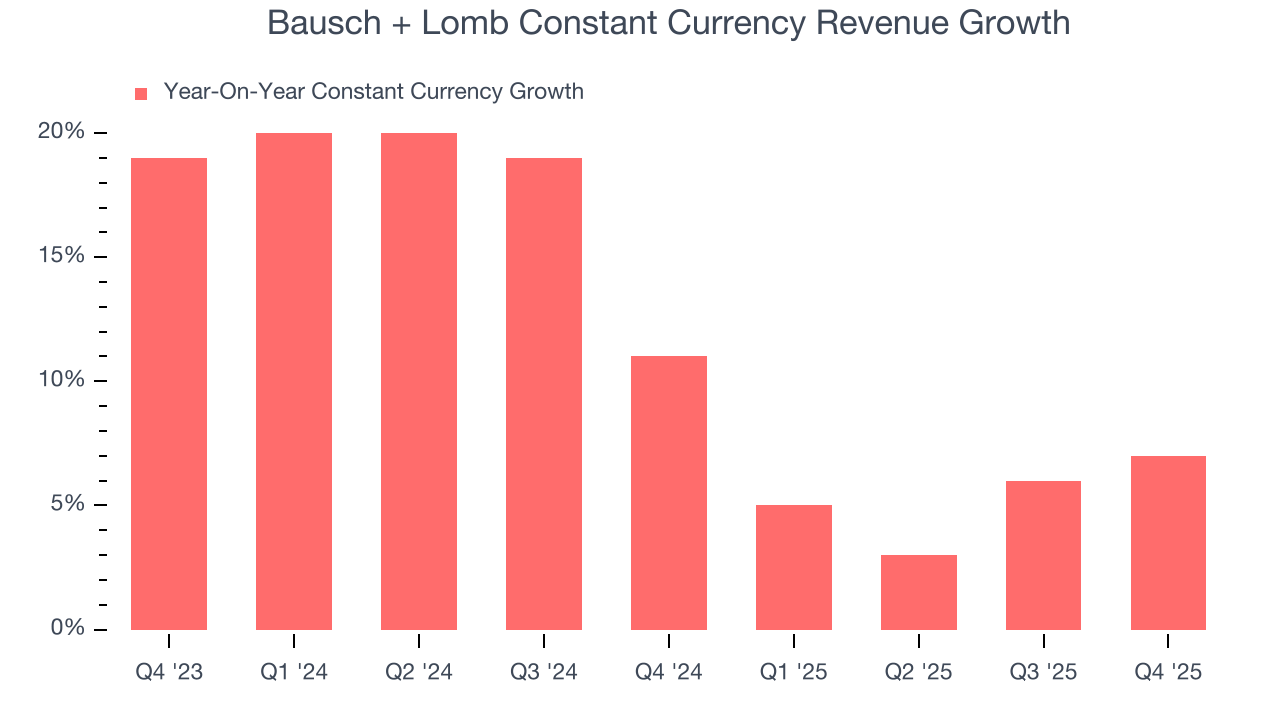

- Constant Currency Revenue rose 7% year on year (11% in the same quarter last year)

- Market Capitalization: $6.28 billion

Company Overview

With a nearly 170-year history dedicated to vision care and eye health innovation, Bausch + Lomb (NYSE:BLCO) develops and manufactures a comprehensive range of eye health products including contact lenses, pharmaceuticals, surgical devices, and consumer eye care solutions.

Bausch + Lomb operates through three distinct business segments: Vision Care, Ophthalmic Pharmaceuticals, and Surgical. The Vision Care segment includes both consumer eye care products and contact lenses. Consumer products range from vitamin supplements like PreserVision AREDS 2 for age-related macular degeneration to lens care solutions such as Biotrue and Renu, as well as over-the-counter eye drops like LUMIFY for redness relief. The contact lens portfolio features daily disposables like Bausch + Lomb INFUSE and monthly options like Bausch + Lomb ULTRA with specialized designs for conditions such as astigmatism and presbyopia.

The Ophthalmic Pharmaceuticals segment provides prescription medications for various eye conditions. XIPERE treats macular edema associated with uveitis, while Vyzulta reduces intraocular pressure in glaucoma patients. Other key products include Lotemax for post-operative inflammation and Besivance for bacterial conjunctivitis.

In the Surgical segment, Bausch + Lomb offers equipment, implantables, and consumables for eye surgeries. The Stellaris Elite system provides a platform for both cataract and vitreoretinal procedures. The VICTUS femtosecond laser assists in cataract and corneal refractive surgeries. The company also manufactures intraocular lenses (IOLs) that replace the eye's natural lens during cataract surgery, including brands like enVista and Crystalens.

Bausch + Lomb generates revenue through direct sales to eye care professionals, hospitals, and surgical centers, as well as through retail channels and distributors. The company maintains a global presence with products marketed in approximately 100 countries, supported by a network of sales representatives and distribution partners. Its business model combines selling high-volume consumer products through retail channels while also providing specialized medical devices and pharmaceuticals to healthcare providers.

The company invests in research and development to expand its product portfolio and address unmet needs in eye health. Bausch + Lomb holds hundreds of patents covering its technologies, though it operates in a competitive landscape where continuous innovation is essential to maintain market position.

4. Medical Devices & Supplies - Specialty

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies, although specialty devices are more niche. The capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Bausch + Lomb competes with several major eye health companies including Johnson & Johnson Vision (NYSE:JNJ), Alcon (NYSE:ALC), and Cooper Companies (NYSE:COO) in the contact lens and surgical markets. In pharmaceuticals, it faces competition from Novartis (NYSE:NVS), Regeneron (NASDAQ:REGN), and AbbVie's Allergan (NYSE:ABBV). The consumer eye care segment competes with Prestige Consumer Healthcare (NASDAQ:PBH) and private label brands.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $5.10 billion in revenue over the past 12 months, Bausch + Lomb has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

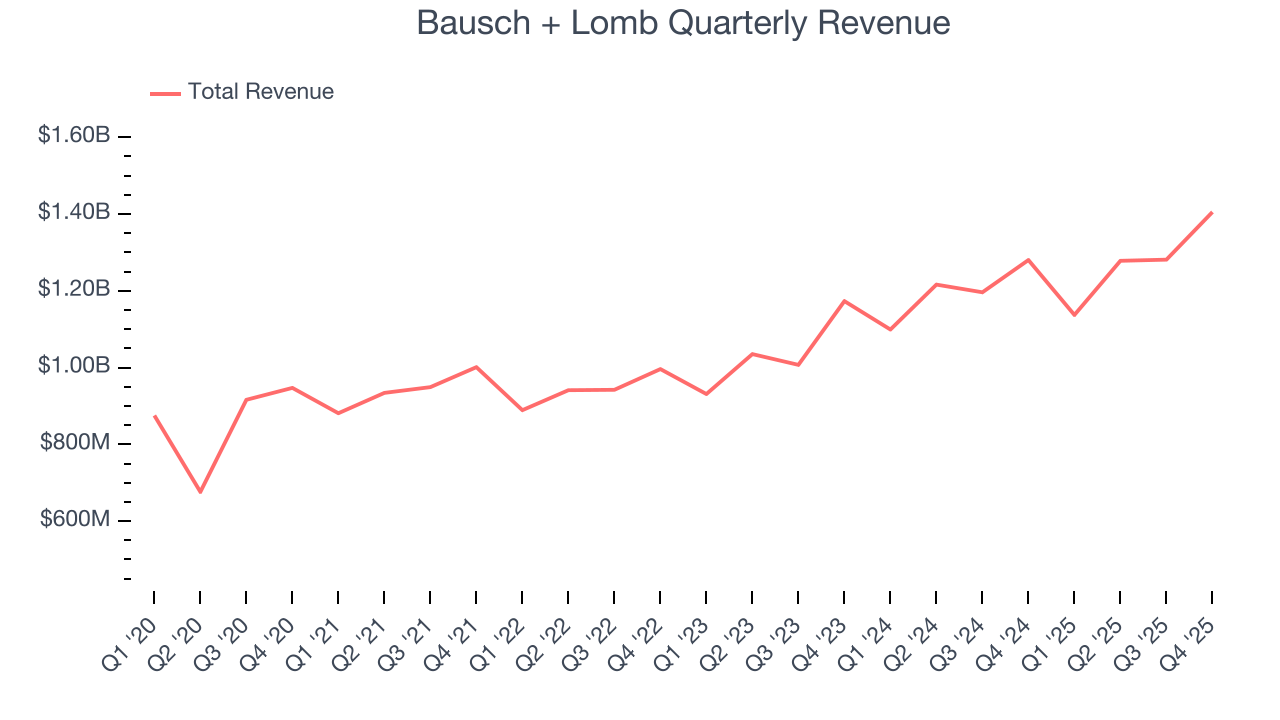

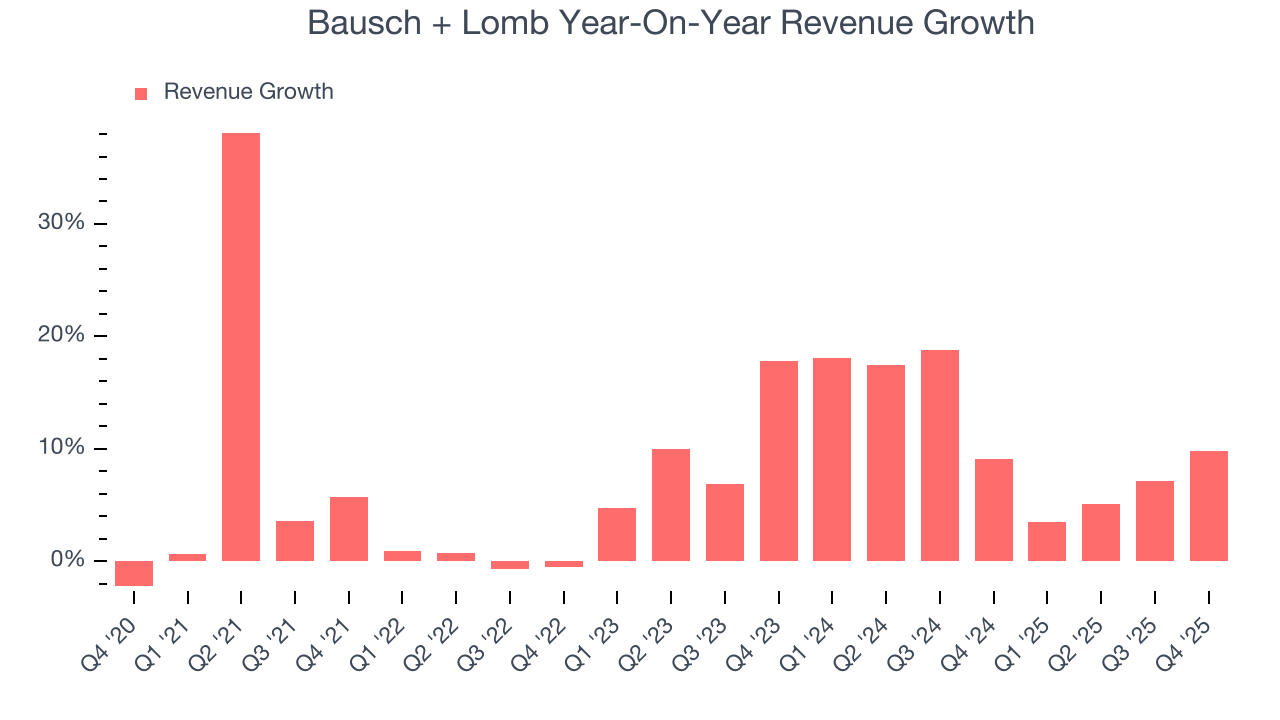

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Bausch + Lomb grew its sales at a decent 8.4% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Bausch + Lomb’s annualized revenue growth of 10.9% over the last two years is above its five-year trend, suggesting some bright spots.

Bausch + Lomb also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 11.4% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Bausch + Lomb has properly hedged its foreign currency exposure.

This quarter, Bausch + Lomb reported year-on-year revenue growth of 9.8%, and its $1.41 billion of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and suggests the market is baking in some success for its newer products and services.

7. Operating Margin

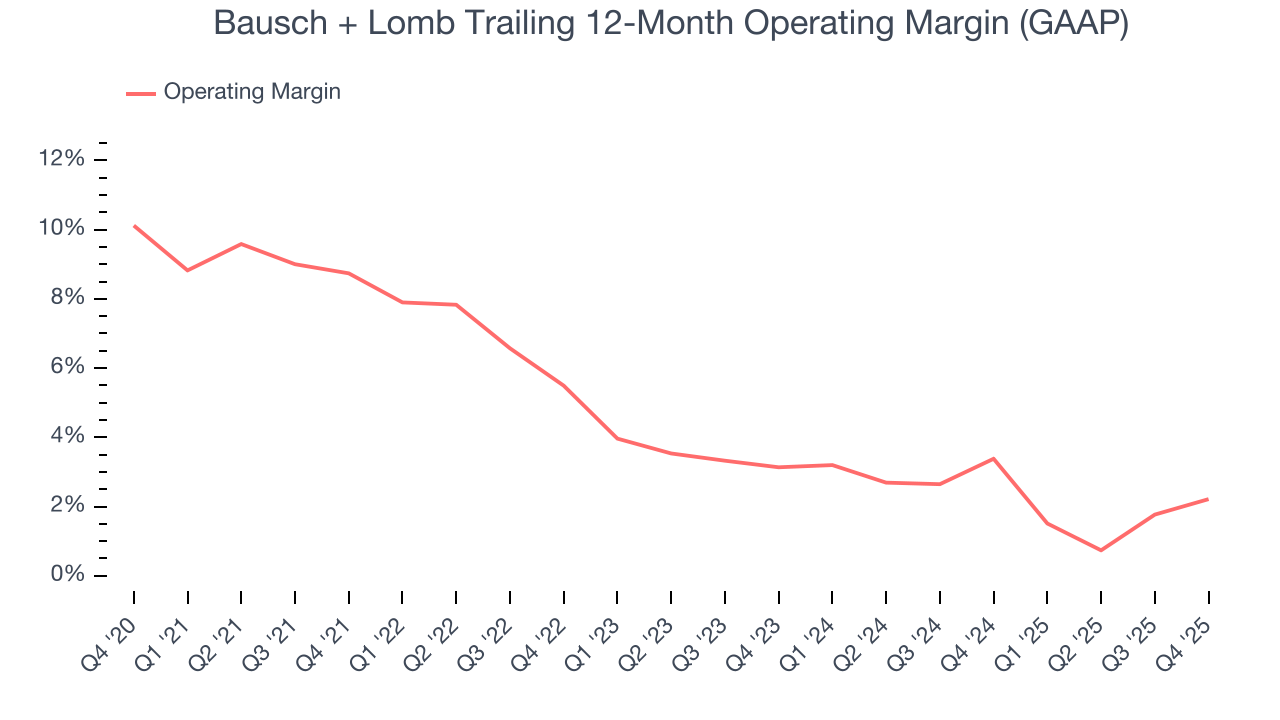

Bausch + Lomb was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.4% was weak for a healthcare business.

Looking at the trend in its profitability, Bausch + Lomb’s operating margin decreased by 6.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Bausch + Lomb’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Bausch + Lomb generated an operating margin profit margin of 8%, up 1.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

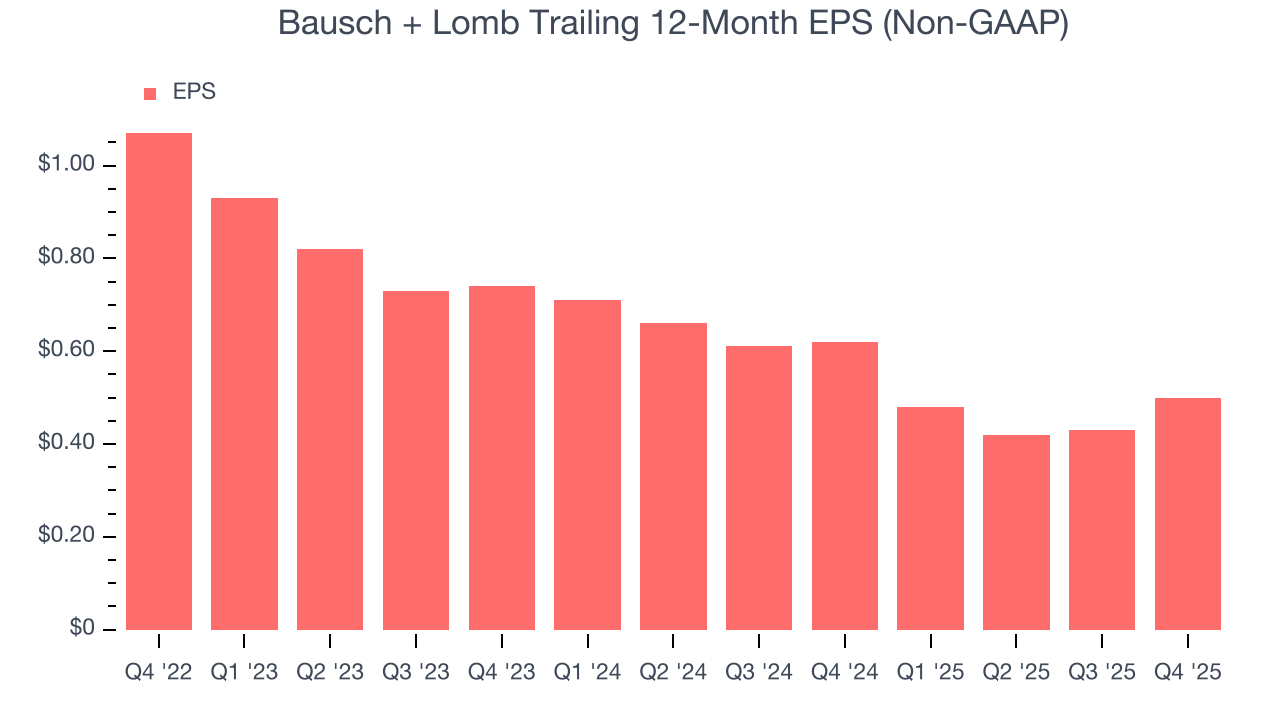

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Bausch + Lomb’s full-year EPS dropped significantly over the last three years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Bausch + Lomb’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, Bausch + Lomb reported adjusted EPS of $0.32, up from $0.25 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Bausch + Lomb’s full-year EPS of $0.50 to grow 58.2%.

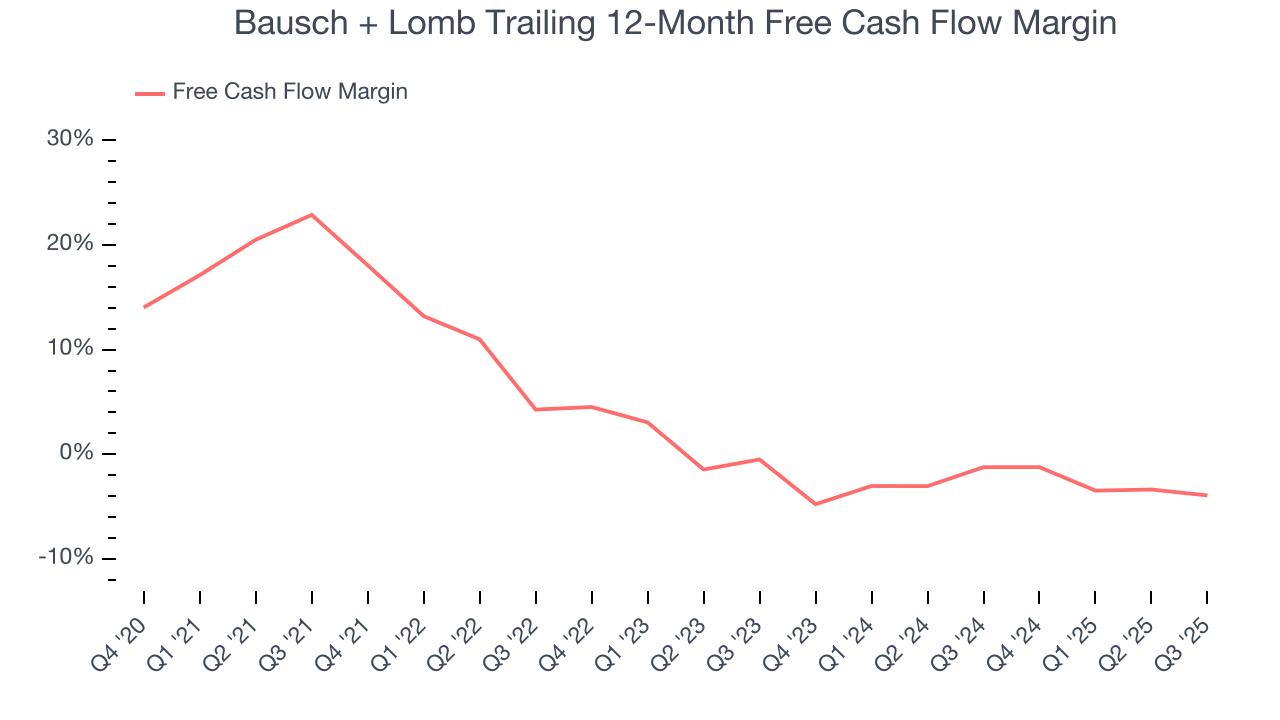

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Bausch + Lomb has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, subpar for a healthcare business.

Taking a step back, we can see that Bausch + Lomb’s margin dropped by 24.4 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Bausch + Lomb historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.5%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Bausch + Lomb’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Key Takeaways from Bausch + Lomb’s Q4 Results

It was good to see Bausch + Lomb narrowly top analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $17.75 immediately following the results.

12. Is Now The Time To Buy Bausch + Lomb?

Updated: February 18, 2026 at 7:37 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Bausch + Lomb.

Bausch + Lomb isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last three years makes it a less attractive asset to the public markets. And while the company’s constant currency growth has been splendid, the downside is its cash profitability fell over the last five years.

Bausch + Lomb’s P/E ratio based on the next 12 months is 22.4x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $17.61 on the company (compared to the current share price of $17.75).