TopBuild (BLD)

We’re not sold on TopBuild. Its decelerating growth shows demand is falling and its weak gross margin indicates it has bad unit economics.― StockStory Analyst Team

1. News

2. Summary

Why TopBuild Is Not Exciting

Established in 2015 following a spinoff from Masco Corporation, TopBuild (NYSE:BLD) is a distributor and installer of insulation and other building products.

- Competitive supply chain dynamics and steep production costs are reflected in its low gross margin of 29.8%

- The good news is that its earnings per share grew by 22.1% annually over the last five years, outpacing its peers

TopBuild falls short of our quality standards. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than TopBuild

High Quality

Investable

Underperform

Why There Are Better Opportunities Than TopBuild

At $438.91 per share, TopBuild trades at 24.2x forward P/E. The current valuation may be fair, but we’re still passing on this stock due to better alternatives out there.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. TopBuild (BLD) Research Report: Q4 CY2025 Update

Building services and installation company TopBuild (NYSE:BLD) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 13.2% year on year to $1.49 billion. On the other hand, the company’s full-year revenue guidance of $6.08 billion at the midpoint came in 1.4% below analysts’ estimates. Its non-GAAP profit of $4.50 per share was 0.9% below analysts’ consensus estimates.

TopBuild (BLD) Q4 CY2025 Highlights:

- Revenue: $1.49 billion vs analyst estimates of $1.49 billion (13.2% year-on-year growth, in line)

- Adjusted EPS: $4.50 vs analyst expectations of $4.54 (0.9% miss)

- Adjusted EBITDA: $265.2 million vs analyst estimates of $266.5 million (17.9% margin, in line)

- EBITDA guidance for the upcoming financial year 2026 is $1.08 billion at the midpoint, below analyst estimates of $1.15 billion

- Operating Margin: 12.1%, down from 16.6% in the same quarter last year

- Free Cash Flow Margin: 10.7%, down from 19.3% in the same quarter last year

- Market Capitalization: $13.55 billion

Company Overview

Established in 2015 following a spinoff from Masco Corporation, TopBuild (NYSE:BLD) is a distributor and installer of insulation and other building products.

The company operates through two segments: Installation and Specialty Distribution. The Installation segment, operating under the TruTeam brand, serves a range of customers including builders, homeowners, and commercial contractors. TruTeam distinguishes itself through its nationwide network of contractor services and primarily installs fiberglass, spray foam, and cellulose insulation products.

The Specialty Distribution segment, operating under the Service Partners brand, distributes insulation, accessories, and other building materials through 160+ centers. It serves contractors, dealers, and builders, and demand is mainly driven by residential and commercial construction, remodeling, and the need for energy-efficient buildings.

The marriage of TruTeam and Service Partners makes TopBuild a one-stop-shop solution that effectively serves the broad needs of the construction industry. It also gives the company scale and a broader customer reach through local presences, providing it with competitive advantages in a fragmented market.

When expanding its business, TopBuild has been quite acquisitive. One big deal it executed was the 2021 purchase of Distribution International for $1 billion. Distribution International was a key strategic move for the company as it extended its reach into the maintenance, repair, and overhaul (MRO) market, which sports recurring revenue characteristics. This large transaction was an anomaly, however, as TopBuild generally prefers to acquire many smaller companies in the sub $50 million enterprise value range as it can negotiate better terms and pricing, giving its deals a better chance of being accretive to its earnings.

4. Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

TopBuild’s primary competitors include Installed Building Products (NYSE:IBP), Masco (NYSE:MAS), Owens Corning (NYSE:OC), and Builders FirstSource (NYSE:BLDR).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, TopBuild’s sales grew at an exceptional 14.8% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. TopBuild’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2% over the last two years was well below its five-year trend.

This quarter, TopBuild’s year-on-year revenue growth was 13.2%, and its $1.49 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months, an improvement versus the last two years. This projection is admirable and suggests its newer products and services will spur better top-line performance.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

TopBuild’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 29.8% gross margin over the last five years. Said differently, TopBuild had to pay a chunky $70.23 to its suppliers for every $100 in revenue.

TopBuild’s gross profit margin came in at 27.2% this quarter, down 2.6 percentage points year on year. TopBuild’s full-year margin has also been trending down over the past 12 months, decreasing by 1.3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

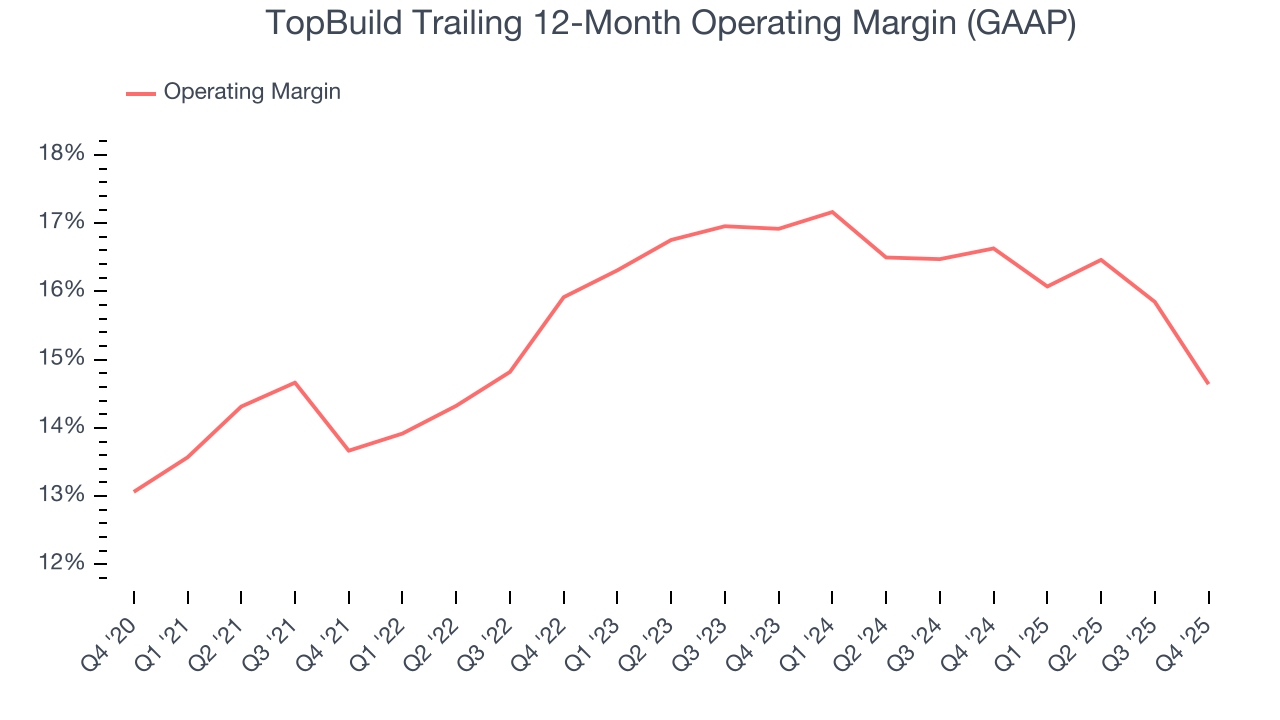

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

TopBuild’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 15.7% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, TopBuild’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. We like to see margin expansion, but we’re still happy with TopBuild’s performance considering most Home Builders companies saw their margins plummet.

This quarter, TopBuild generated an operating margin profit margin of 12.1%, down 4.5 percentage points year on year. Since TopBuild’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

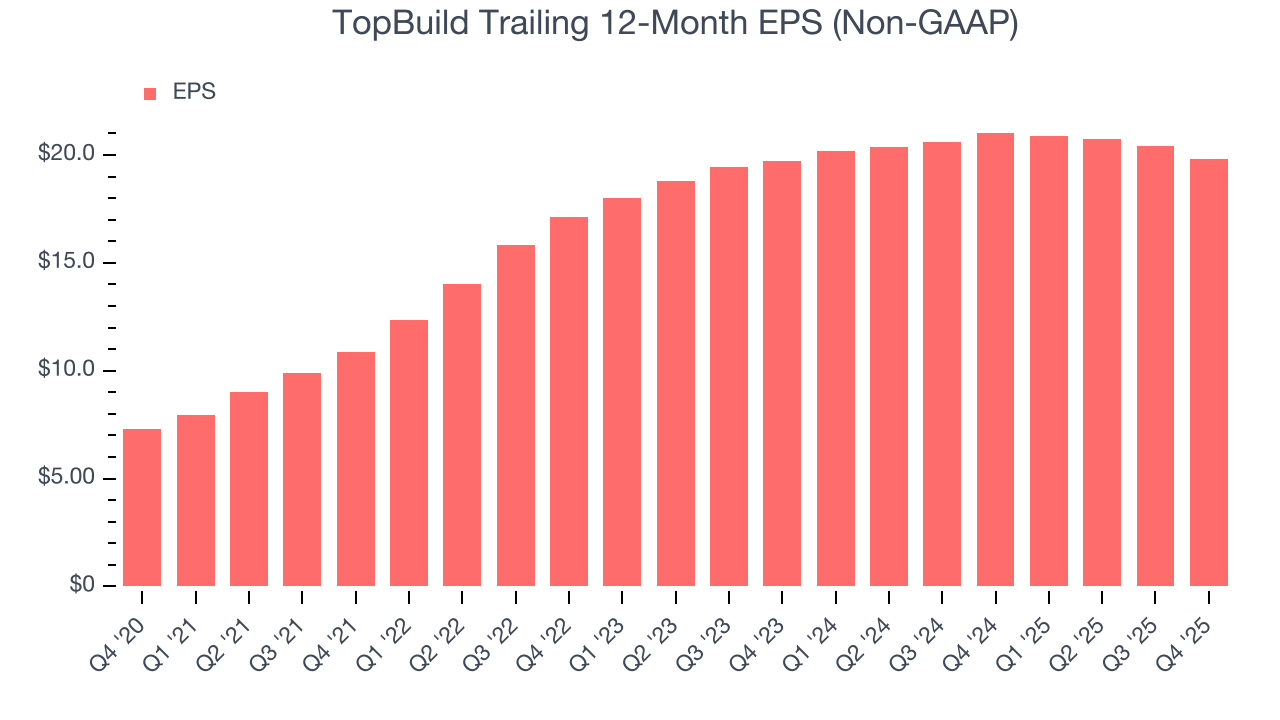

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

TopBuild’s EPS grew at an astounding 22.1% compounded annual growth rate over the last five years, higher than its 14.8% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Diving into TopBuild’s quality of earnings can give us a better understanding of its performance. A five-year view shows that TopBuild has repurchased its stock, shrinking its share count by 15.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For TopBuild, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q4, TopBuild reported adjusted EPS of $4.50, down from $5.13 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects TopBuild’s full-year EPS of $19.80 to grow 5.5%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

TopBuild has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 12.1% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that TopBuild’s margin expanded by 2.9 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

TopBuild’s free cash flow clocked in at $159.4 million in Q4, equivalent to a 10.7% margin. The company’s cash profitability regressed as it was 8.6 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although TopBuild hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 18.7%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, TopBuild’s ROIC averaged 1.1 percentage point increases each year over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

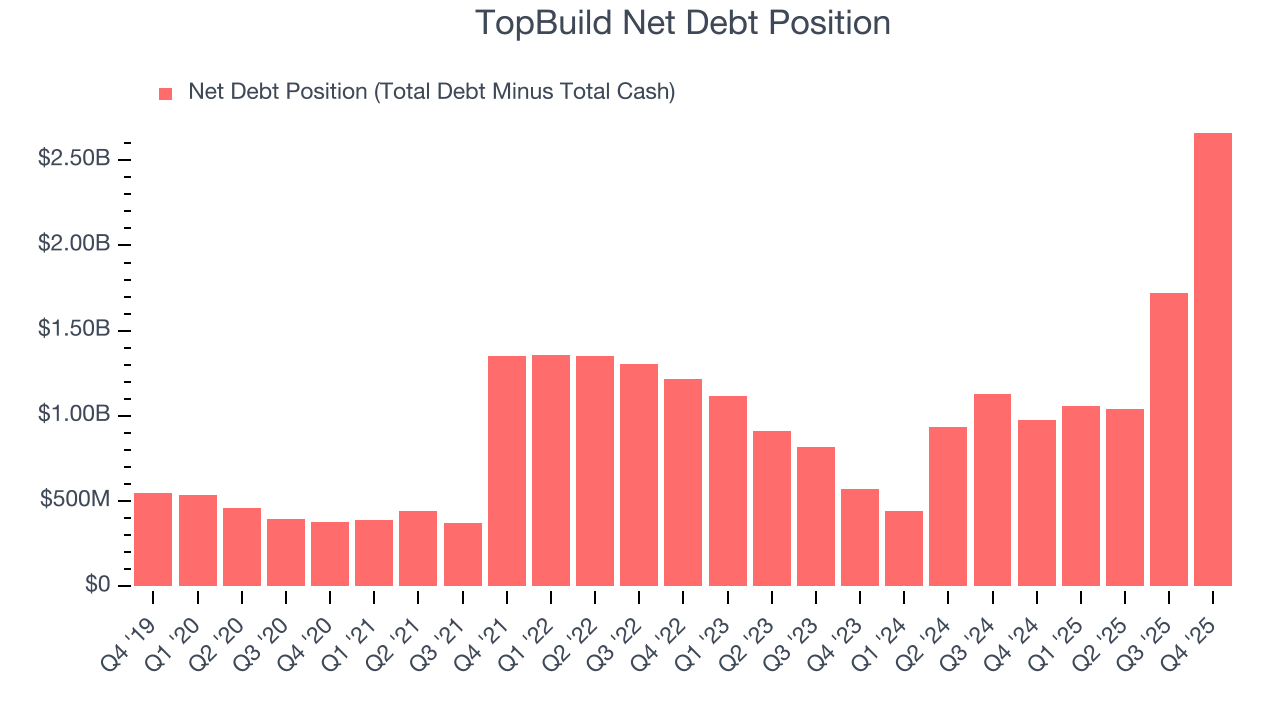

11. Balance Sheet Assessment

TopBuild reported $184.7 million of cash and $2.85 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.04 billion of EBITDA over the last 12 months, we view TopBuild’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $103.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from TopBuild’s Q4 Results

We struggled to find many positives in these results. Its full-year EBITDA guidance missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $483 immediately following the results.

13. Is Now The Time To Buy TopBuild?

Updated: March 2, 2026 at 11:11 PM EST

Before deciding whether to buy TopBuild or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There are some bright spots in TopBuild’s fundamentals, but its business quality ultimately falls short. To kick things off, its revenue growth was exceptional over the last five years. And while TopBuild’s projected EPS for the next year is lacking, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

TopBuild’s P/E ratio based on the next 12 months is 24.2x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $499.40 on the company (compared to the current share price of $438.91).