Builders FirstSource (BLDR)

Builders FirstSource keeps us up at night. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Builders FirstSource Will Underperform

Headquartered in Irving, TX, Builders FirstSource (NYSE:BLDR) is a construction materials manufacturer that offers a variety of lumber and lumber-related building products.

- Annual sales declines of 5.7% for the past two years show its products and services struggled to connect with the market during this cycle

- Earnings per share decreased by more than its revenue over the last two years, showing each sale was less profitable

- Sales are projected to be flat over the next 12 months and imply weak demand

Builders FirstSource doesn’t measure up to our expectations. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Builders FirstSource

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Builders FirstSource

At $111.95 per share, Builders FirstSource trades at 19.4x forward P/E. Builders FirstSource’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Builders FirstSource (BLDR) Research Report: Q4 CY2025 Update

Building materials company Builders FirstSource (NYSE:BLDR) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 12.1% year on year to $3.36 billion. On the other hand, the company’s full-year revenue guidance of $15.3 billion at the midpoint came in 1.1% above analysts’ estimates. Its non-GAAP profit of $1.12 per share was 12.3% below analysts’ consensus estimates.

Builders FirstSource (BLDR) Q4 CY2025 Highlights:

- Revenue: $3.36 billion vs analyst estimates of $3.45 billion (12.1% year-on-year decline, 2.8% miss)

- Adjusted EPS: $1.12 vs analyst expectations of $1.28 (12.3% miss)

- Adjusted EBITDA: $274.9 million vs analyst estimates of $336.4 million (8.2% margin, 18.3% miss)

- EBITDA guidance for the upcoming financial year 2026 is $1.5 billion at the midpoint, in line with analyst expectations

- Operating Margin: 1.8%, down from 8% in the same quarter last year

- Free Cash Flow Margin: 3.2%, down from 7.2% in the same quarter last year

- Market Capitalization: $12.69 billion

Company Overview

Headquartered in Irving, TX, Builders FirstSource (NYSE:BLDR) is a construction materials manufacturer that offers a variety of lumber and lumber-related building products.

The company manufactures and supplies building materials to the residential construction market. It provides goods to customers as big as large-scale residential contractors and small DIY home renovators. Homebuilders are its primary customers, which are reached through direct sales representatives. Contractors and home renovators are its secondary customers, who place their orders through digital or physical visits to the company’s stores.

The company offers a wide range of products needed to build a home, including lumber, lumber-related building materials like roof trusses, and interior home products such as windows, doors, and millwork. The company also provides services for homebuilders, including architectural and engineering design for roof trusses and visual renderings for renovators.

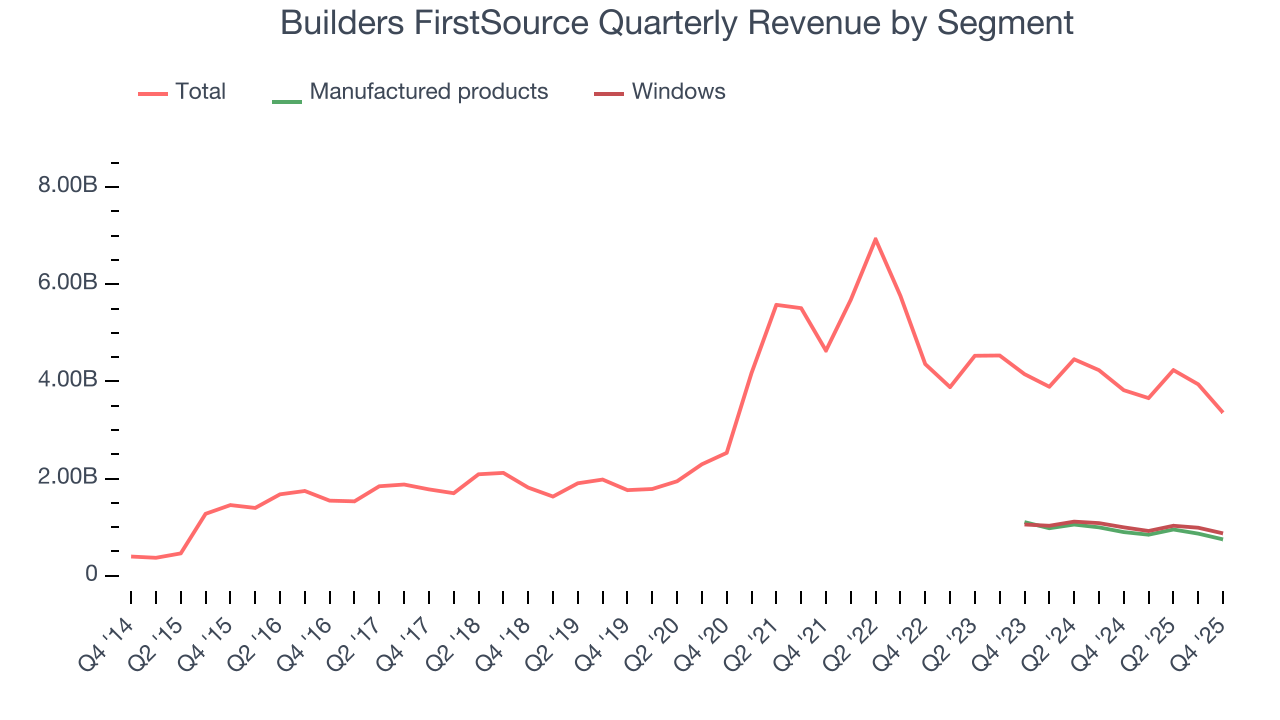

Most of the company’s revenue stream is lumber and lumber-related goods sales, followed by manufactured products (i.e., roof trusses), windows, doors & millwork, and specialty building products and services. Recurring revenue is a small part of the company’s business model, as its specialty building products and services segment offers software and design services to help builders plan their projects. However, the company is still largely at the whim of the housing cycle, which is impacted by macro factors such as interest rates.

4. Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Competitors in the building materials industry include Beacon Roofing Supply (NASDAQ:BECN), Home Depot (NYSE: HD), and Lowe’s (NYSE: LOW).

5. Revenue Growth

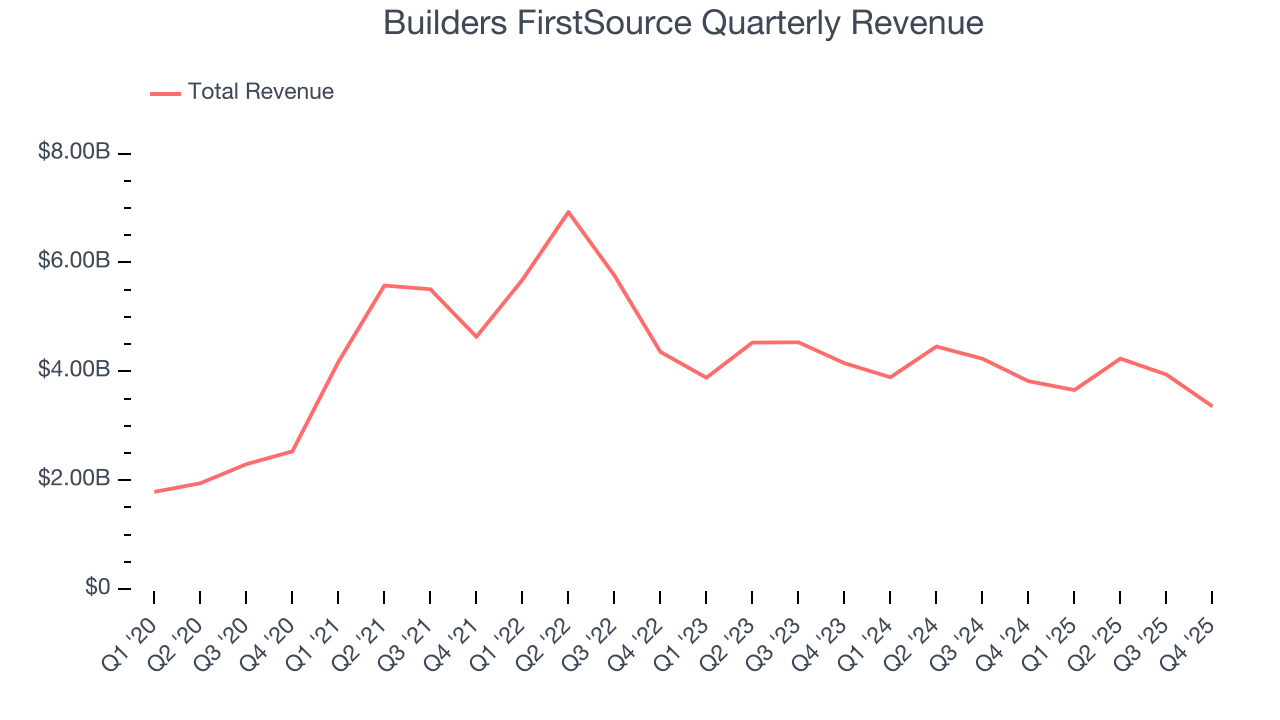

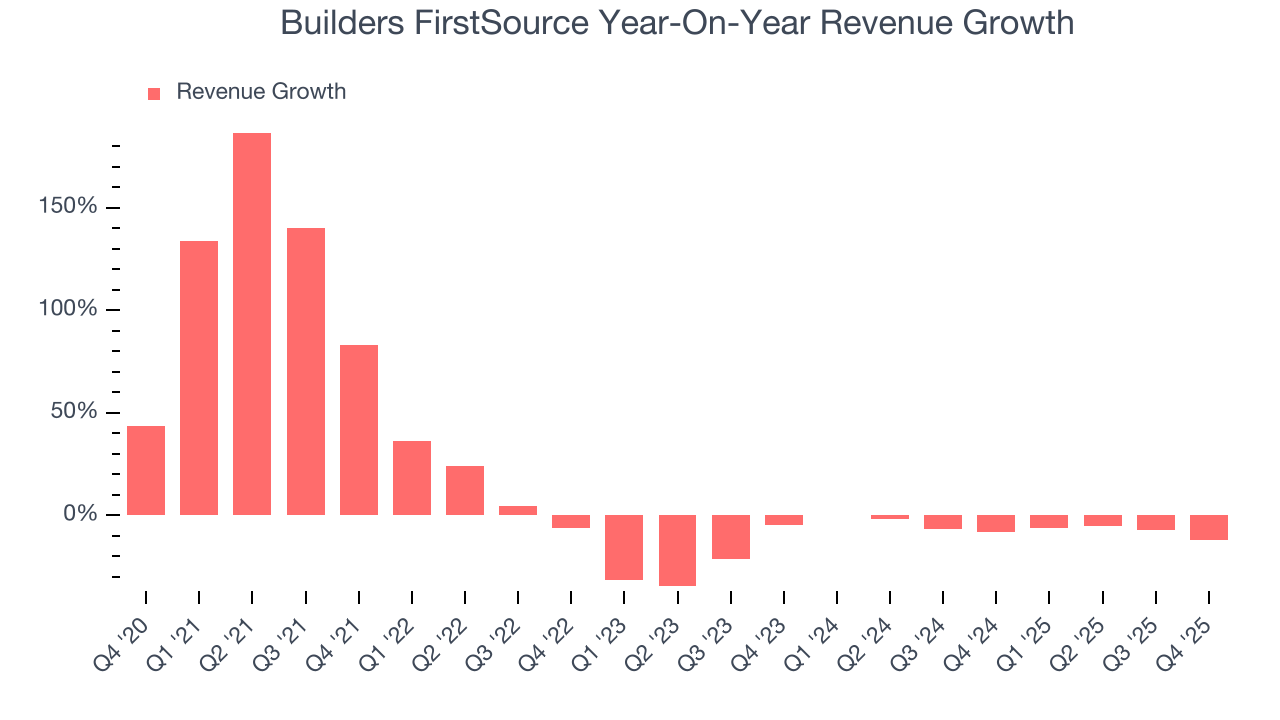

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Builders FirstSource’s 12.2% annualized revenue growth over the last five years was excellent. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Builders FirstSource’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5.7% over the last two years.

Builders FirstSource also breaks out the revenue for its most important segments, Manufactured products and Windows, doors & millwork , which are 22.3% and 26% of revenue. Over the last two years, Builders FirstSource’s Manufactured products revenue (floors, wall panels, and engineered wood) averaged 14.3% year-on-year declines while its Windows, doors & millwork revenue (self explanatory) averaged 9% declines.

This quarter, Builders FirstSource missed Wall Street’s estimates and reported a rather uninspiring 12.1% year-on-year revenue decline, generating $3.36 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

Builders FirstSource’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand.As you can see below, it averaged a decent 32.4% gross margin over the last five years. That means for every $100 in revenue, roughly $32.42 was left to spend on selling, marketing, R&D, and general administrative overhead.

Builders FirstSource’s gross profit margin came in at 29.8% this quarter, down 2.5 percentage points year on year. Builders FirstSource’s full-year margin has also been trending down over the past 12 months, decreasing by 2.4 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

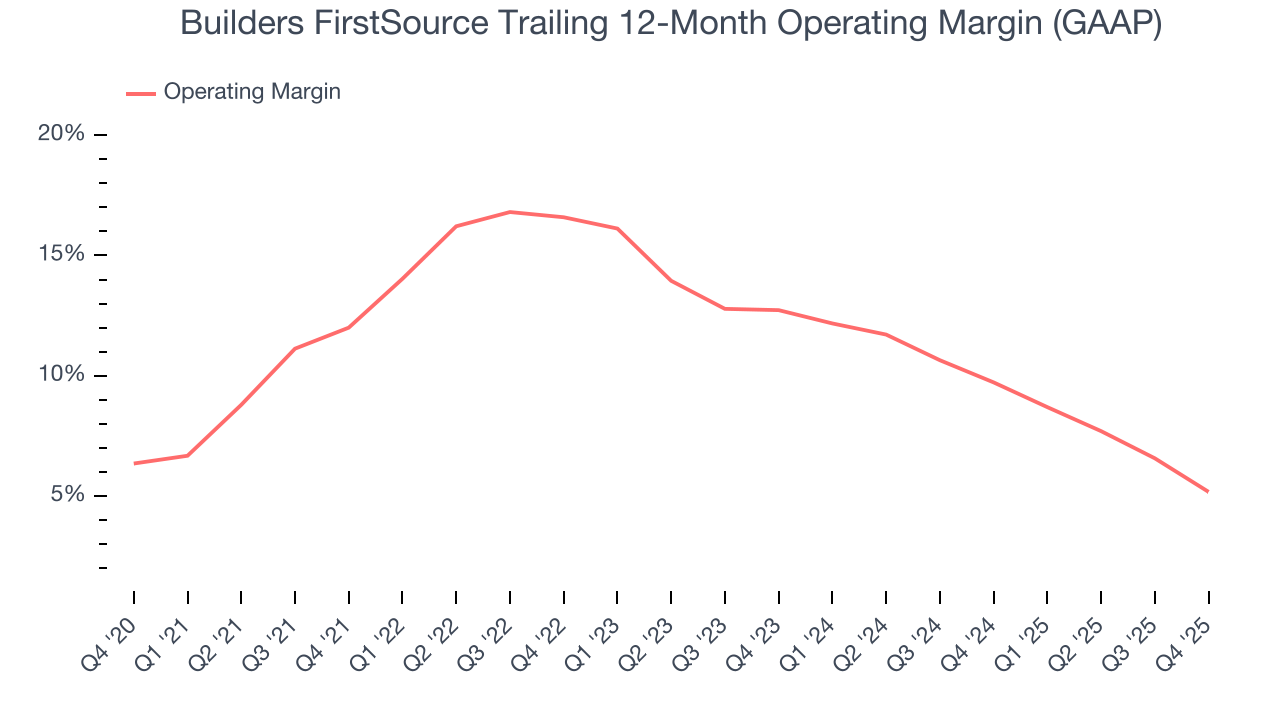

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Builders FirstSource has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.7%.

Analyzing the trend in its profitability, Builders FirstSource’s operating margin decreased by 6.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Builders FirstSource generated an operating margin profit margin of 1.8%, down 6.1 percentage points year on year. Since Builders FirstSource’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

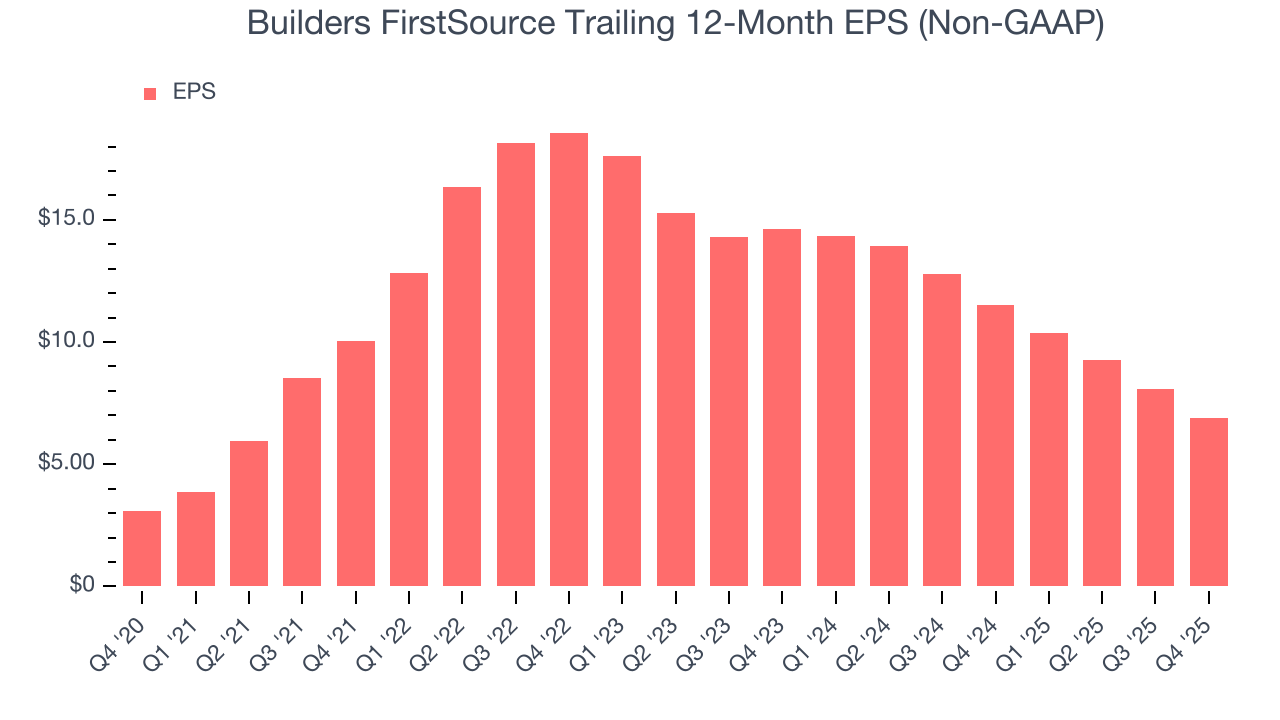

Builders FirstSource’s EPS grew at a spectacular 17.4% compounded annual growth rate over the last five years, higher than its 12.2% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

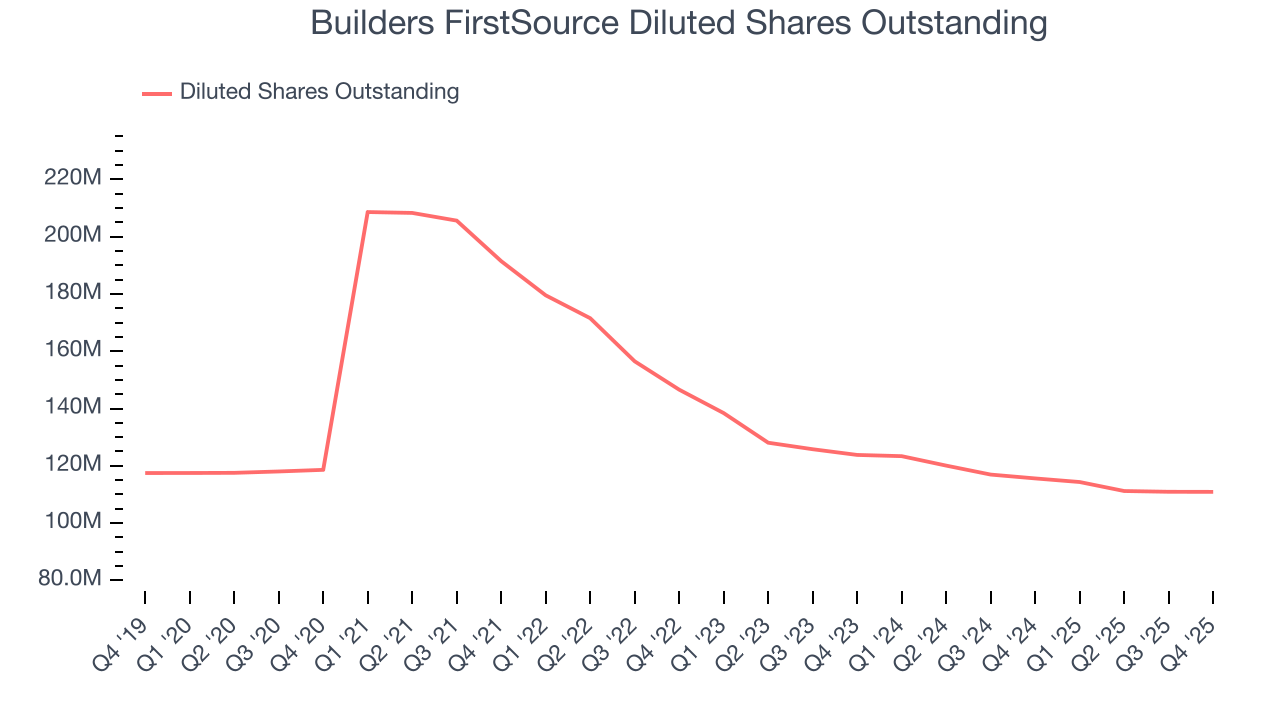

Diving into Builders FirstSource’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Builders FirstSource has repurchased its stock, shrinking its share count by 6.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Builders FirstSource, its two-year annual EPS declines of 31.4% mark a reversal from its (seemingly) healthy five-year trend. We hope Builders FirstSource can return to earnings growth in the future.

In Q4, Builders FirstSource reported adjusted EPS of $1.12, down from $2.31 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Builders FirstSource’s full-year EPS of $6.89 to shrink by 9.9%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

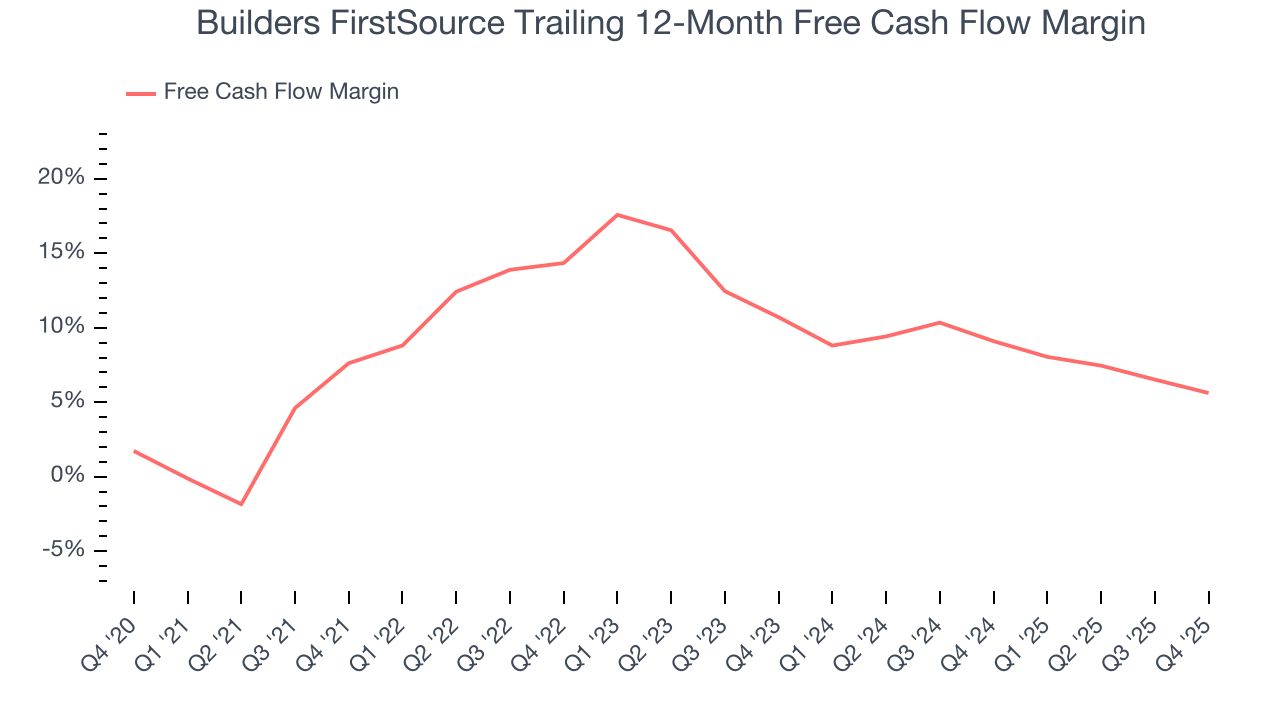

Builders FirstSource has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 9.8% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Builders FirstSource’s margin dropped by 2 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Builders FirstSource’s free cash flow clocked in at $106.7 million in Q4, equivalent to a 3.2% margin. The company’s cash profitability regressed as it was 4 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

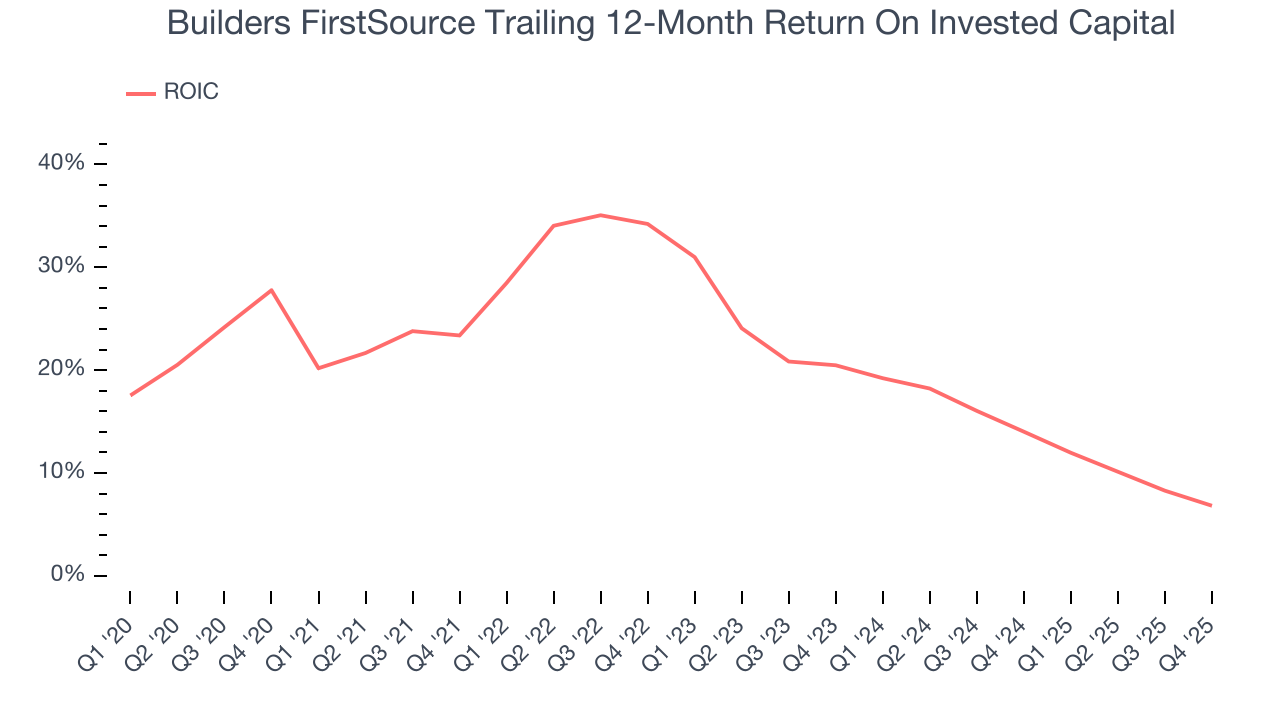

Although Builders FirstSource hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 19.8%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Builders FirstSource’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

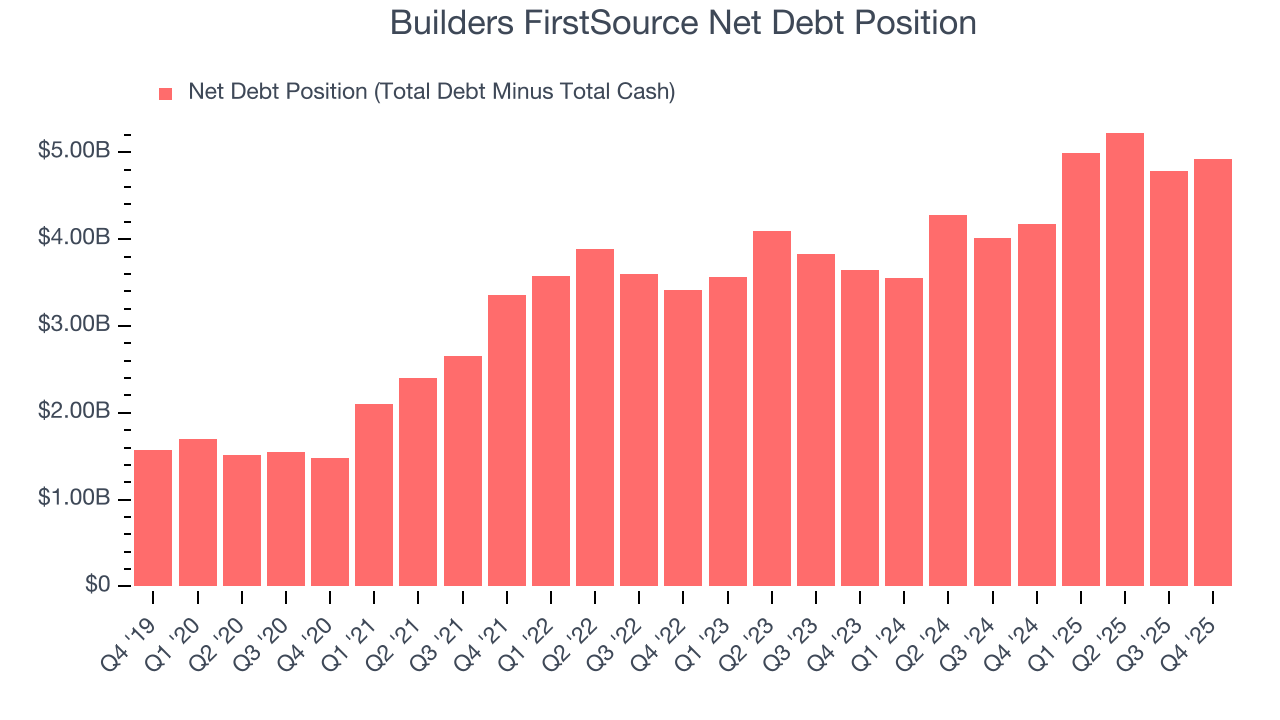

Builders FirstSource reported $181.8 million of cash and $5.1 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.58 billion of EBITDA over the last 12 months, we view Builders FirstSource’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $138.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Builders FirstSource’s Q4 Results

It was good to see Builders FirstSource provide full-year revenue guidance that slightly beat analysts’ expectations. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $115.71 immediately after reporting.

13. Is Now The Time To Buy Builders FirstSource?

Updated: February 19, 2026 at 10:26 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Builders FirstSource doesn’t pass our quality test. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s spectacular EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking.

Builders FirstSource’s P/E ratio based on the next 12 months is 19.4x. This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $128.43 on the company (compared to the current share price of $111.95).