Broadridge (BR)

Broadridge is intriguing. Despite its slow anticipated growth, its extremely profitable operations give it a high margin of safety.― StockStory Analyst Team

1. News

2. Summary

Why Broadridge Is Interesting

Processing over $10 trillion in equity and fixed income trades daily and managing proxy voting for over 800 million equity positions, Broadridge Financial Solutions (NYSE:BR) provides technology-driven solutions that power investing, governance, and communications for banks, broker-dealers, asset managers, and public companies.

- Disciplined cost controls and effective management have materialized in a strong adjusted operating margin

- Strong free cash flow margin of 12.6% gives it the option to reinvest, repurchase shares, or pay dividends, and its growing cash flow gives it even more resources to deploy

- One risk is its estimated sales growth of 3.9% for the next 12 months implies demand will slow from its two-year trend

Broadridge is solid, but not perfect. If you like the story, the valuation seems fair.

Why Is Now The Time To Buy Broadridge?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Broadridge?

Broadridge is trading at $196.64 per share, or 19.7x forward P/E. While this multiple is higher than most business services companies, we think the valuation is deserved for the revenue growth you get.

It could be a good time to invest if you see something the market doesn’t.

3. Broadridge (BR) Research Report: Q4 CY2025 Update

Financial technology provider Broadridge (NYSE:BR) announced better-than-expected revenue in Q4 CY2025, with sales up 7.8% year on year to $1.71 billion. Its non-GAAP profit of $1.59 per share was 16.8% above analysts’ consensus estimates.

Broadridge (BR) Q4 CY2025 Highlights:

- Revenue: $1.71 billion vs analyst estimates of $1.61 billion (7.8% year-on-year growth, 6.5% beat)

- Adjusted EPS: $1.59 vs analyst estimates of $1.36 (16.8% beat)

- Adjusted EBITDA: $130.3 million vs analyst estimates of $279.9 million (7.6% margin, 53.4% miss)

- Operating Margin: 12%, down from 13.3% in the same quarter last year

- Free Cash Flow Margin: 17.8%, up from 13.5% in the same quarter last year

- Market Capitalization: $23.15 billion

Company Overview

Processing over $10 trillion in equity and fixed income trades daily and managing proxy voting for over 800 million equity positions, Broadridge Financial Solutions (NYSE:BR) provides technology-driven solutions that power investing, governance, and communications for banks, broker-dealers, asset managers, and public companies.

Broadridge operates through two main segments: Investor Communication Solutions and Global Technology and Operations. The Investor Communication Solutions segment handles the entire proxy materials distribution and voting process, enabling companies to communicate with their shareholders efficiently. This includes electronic and traditional delivery of proxy materials, vote collection, and tabulation services. The company also provides regulatory communications solutions for mutual funds and other financial institutions.

The Global Technology and Operations segment delivers mission-critical infrastructure to global financial markets. As a software-as-a-service (SaaS) provider, Broadridge offers capital markets and wealth management firms technology that automates the entire trade lifecycle—from order capture and execution through trade confirmation, clearing, settlement, and reporting. The company processes transactions in over 100 countries, handling equities, fixed income, foreign exchange, and exchange-traded derivatives.

For wealth management firms, Broadridge provides technology solutions that help advisors better engage with customers and grow their business. These include data aggregation, performance reporting, and digital marketing tools. The company's investment management solutions offer portfolio management, compliance, and operational support for hedge funds, family offices, and traditional asset managers.

Broadridge's business model is built on multi-client technology platforms that allow financial institutions to mutualize costs for non-differentiating but essential functions. For example, a brokerage firm might use Broadridge's proxy voting infrastructure rather than building its own system, saving significant costs while meeting regulatory requirements. Similarly, asset managers can leverage Broadridge's fund communications platform to distribute regulatory reports and prospectuses to investors across multiple channels.

The company's services have evolved beyond traditional processing to include data analytics and digital capabilities. For corporate issuers, Broadridge offers ESG services, SEC filing assistance, and virtual shareholder meeting technology. For financial institutions, it provides data-driven insights to help them grow revenue, improve operational efficiency, and maintain compliance.

4. Data & Business Process Services

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

Broadridge's competitors include FIS Global (NYSE: FIS), Fiserv (NASDAQ: FISV), and SS&C Technologies (NASDAQ: SSNC) in financial technology services. In the investor communications space, it competes with Mediant Communications and AST Financial, while in wealth management technology, it faces competition from Envestnet (NYSE: ENV) and Orion Advisor Solutions.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $7.18 billion in revenue over the past 12 months, Broadridge is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Broadridge’s 8.9% annualized revenue growth over the last five years was solid. This is an encouraging starting point for our analysis because it shows Broadridge’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Broadridge’s annualized revenue growth of 6.6% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Broadridge reported year-on-year revenue growth of 7.8%, and its $1.71 billion of revenue exceeded Wall Street’s estimates by 6.5%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

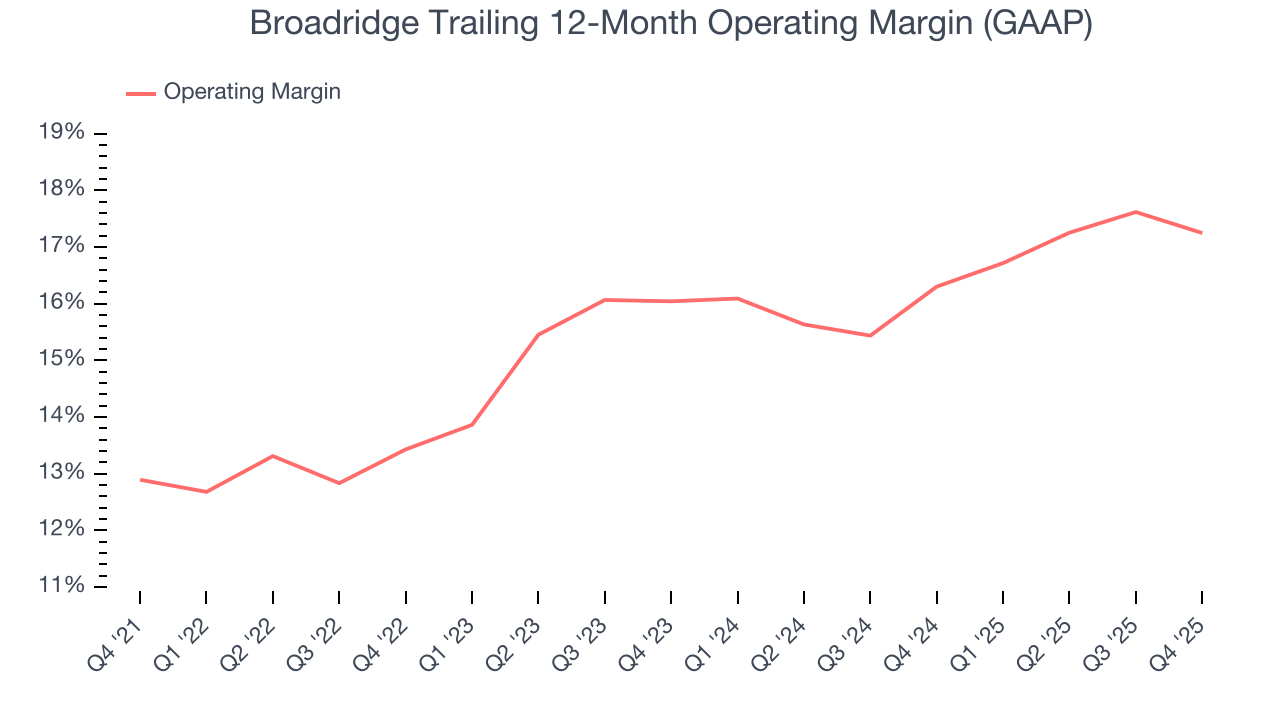

6. Operating Margin

Broadridge has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 15.3%.

Analyzing the trend in its profitability, Broadridge’s operating margin rose by 4.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Broadridge generated an operating margin profit margin of 12%, down 1.2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

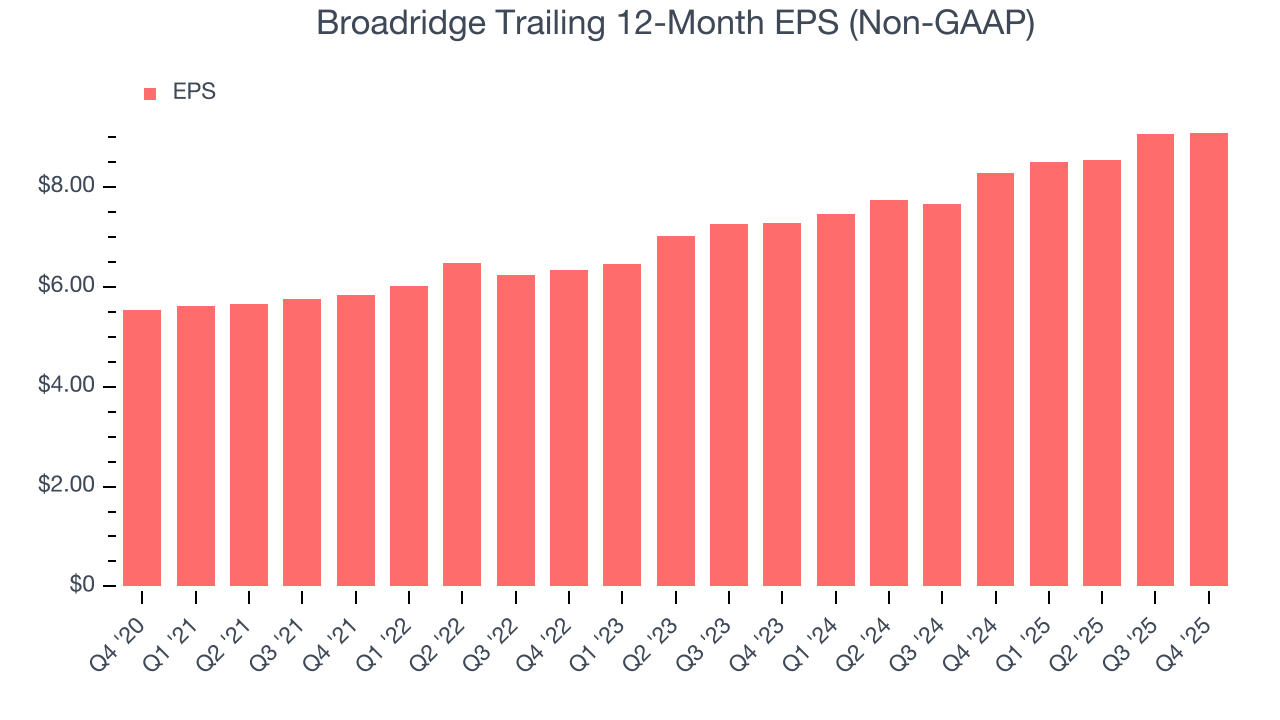

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Broadridge’s solid 10.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Broadridge’s two-year annual EPS growth of 11.8% was decent and topped its 6.6% two-year revenue growth.

Diving into Broadridge’s quality of earnings can give us a better understanding of its performance. While we mentioned earlier that Broadridge’s operating margin declined this quarter, a two-year view shows its margin has expandedwhile its share count has shrunk 1.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Broadridge reported adjusted EPS of $1.59, up from $1.56 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Broadridge’s full-year EPS of $9.09 to grow 5.8%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Broadridge has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.6% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that Broadridge’s margin expanded by 11.2 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Broadridge’s free cash flow clocked in at $305.9 million in Q4, equivalent to a 17.8% margin. This result was good as its margin was 4.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Broadridge’s five-year average ROIC was 14%, higher than most business services businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Broadridge’s has increased over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

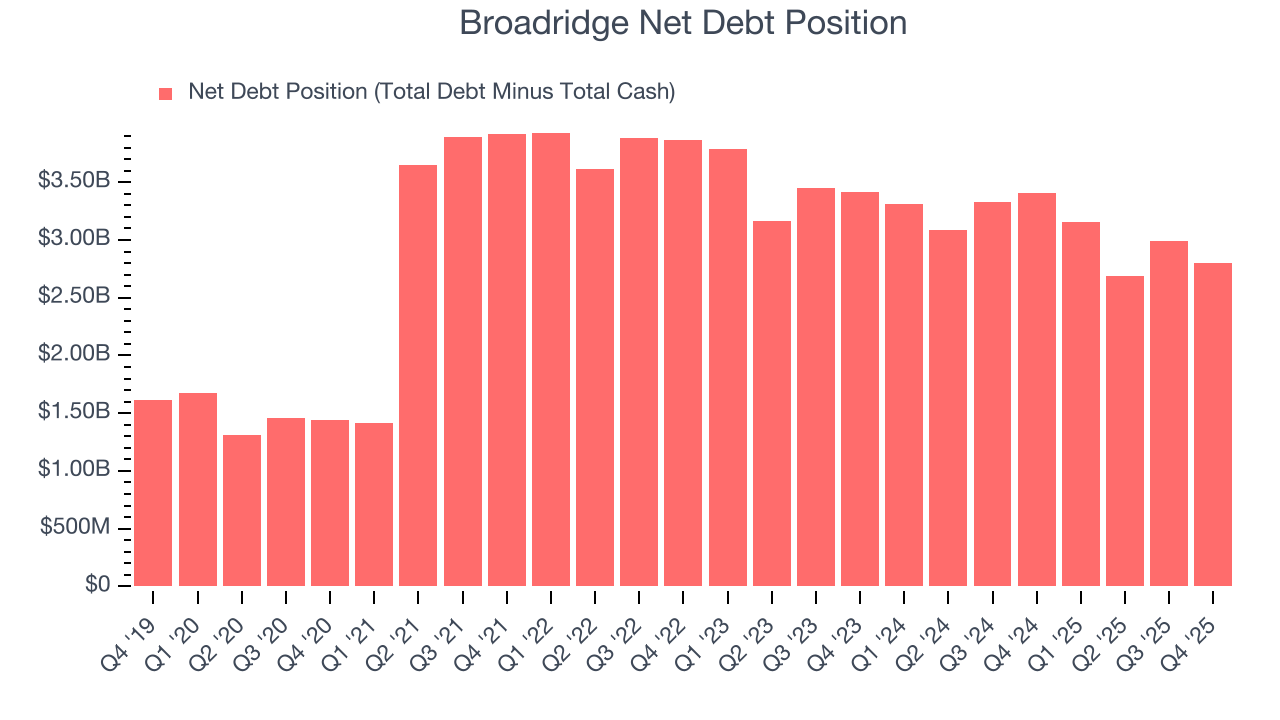

10. Balance Sheet Assessment

Broadridge reported $370.7 million of cash and $3.17 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.55 billion of EBITDA over the last 12 months, we view Broadridge’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $58.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Broadridge’s Q4 Results

It was good to see Broadridge beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 1.7% to $201.67 immediately after reporting.

12. Is Now The Time To Buy Broadridge?

Updated: March 9, 2026 at 12:43 AM EDT

Before investing in or passing on Broadridge, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Broadridge is a fine business. First off, its revenue growth was solid over the last five years. On top of that, Broadridge’s rising cash profitability gives it more optionality, and its rising returns show management's prior bets are paying off.

Broadridge’s P/E ratio based on the next 12 months is 19.7x. Looking at the business services space right now, Broadridge trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $245.88 on the company (compared to the current share price of $196.64), implying they see 25% upside in buying Broadridge in the short term.