BellRing Brands (BRBR)

BellRing Brands doesn’t excite us. Its sales and earnings are expected to be muted over the next 12 months, implying a dearth of catalysts.― StockStory Analyst Team

1. News

2. Summary

Why BellRing Brands Is Not Exciting

Spun out of Post Holdings in 2019, Bellring Brands (NYSE:BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

- Smaller revenue base of $2.32 billion means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- Estimated sales growth of 4.3% for the next 12 months implies demand will slow from its three-year trend

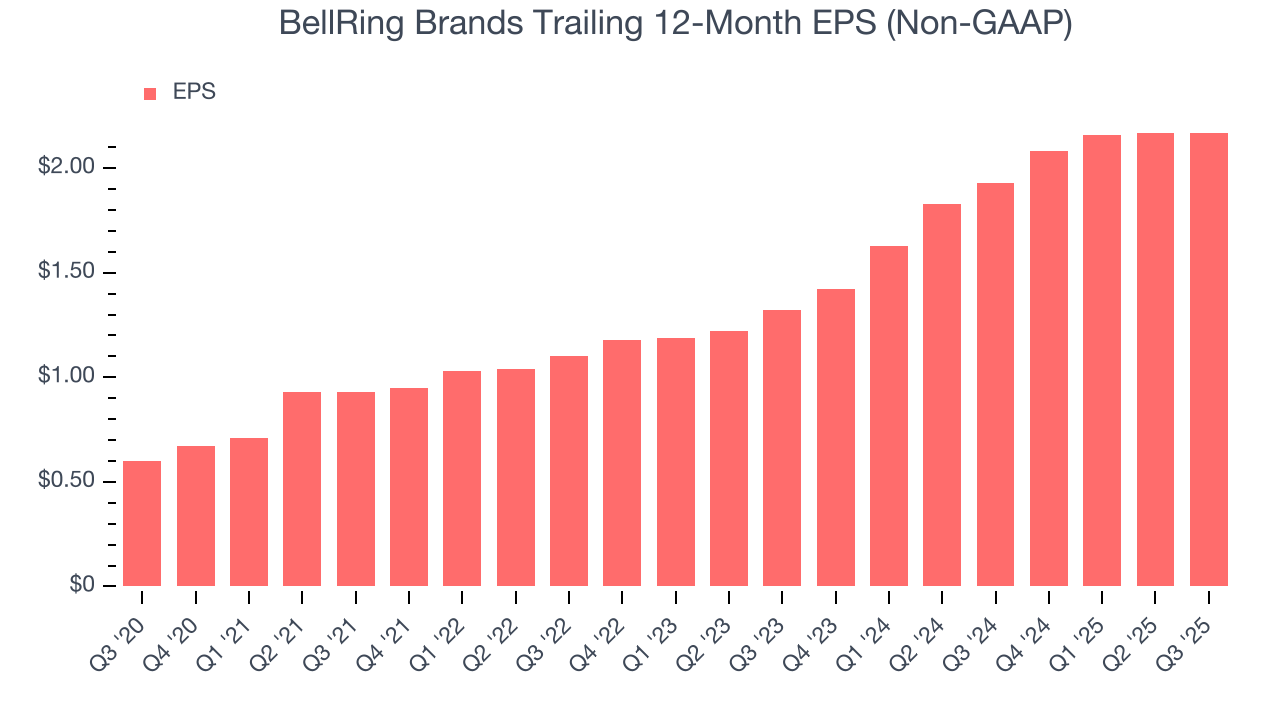

- A positive is that its earnings per share grew by 25.4% annually over the last three years, outpacing its peers

BellRing Brands’s quality doesn’t meet our hurdle. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than BellRing Brands

High Quality

Investable

Underperform

Why There Are Better Opportunities Than BellRing Brands

At $27.62 per share, BellRing Brands trades at 14.7x forward P/E. Yes, this valuation multiple is lower than that of other consumer staples peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. BellRing Brands (BRBR) Research Report: Q3 CY2025 Update

Nutrition products company Bellring Brands (NYSE:BRBR) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 16.6% year on year to $648.2 million. On the other hand, the company’s full-year revenue guidance of $2.45 billion at the midpoint came in 2.1% below analysts’ estimates. Its non-GAAP profit of $0.51 per share was 6.8% below analysts’ consensus estimates.

BellRing Brands (BRBR) Q3 CY2025 Highlights:

- Revenue: $648.2 million vs analyst estimates of $633.6 million (16.6% year-on-year growth, 2.3% beat)

- Adjusted EPS: $0.51 vs analyst expectations of $0.55 (6.8% miss)

- Adjusted EBITDA: $117.4 million vs analyst estimates of $120.9 million (18.1% margin, 2.9% miss)

- EBITDA guidance for the upcoming financial year 2026 is $440 million at the midpoint, below analyst estimates of $489.1 million

- Operating Margin: 15.8%, down from 20.2% in the same quarter last year

- Organic Revenue rose 16.6% year on year vs analyst estimates of 14.4% growth (215.5 basis point beat)

- Sales Volumes rose 19.2% year on year, in line with the same quarter last year

- Market Capitalization: $3.23 billion

Company Overview

Spun out of Post Holdings in 2019, Bellring Brands (NYSE:BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

These products emphasize protein and low-carb or low-sugar content for weight loss and weight management. The Bellring Brands core customer is therefore a health-conscious individual who prioritizes nutritious eating or someone who wants to become that health-conscious person. Some customer archetypes include fitness enthusiasts or people on low-carb or keto diets looking to lose weight.

Bellring Brands’s products are available in general retailers such as grocery stores and club warehouse stores as well as in specialty retailers that cater to fitness and nutrition enthusiasts. Additionally, gyms and fitness centers sometimes carry the company’s products. Lastly, each of the company’s brands has a dedicated website where consumers can browse products, access exclusive deals, and access information on health and fitness.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors offering health and wellness supplements and products include The Simply Good Foods Company (NASDAQ:SMPL), Herbalife (NYSE:HLF), and Usana Health Sciences (NYSE:USNA) .

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

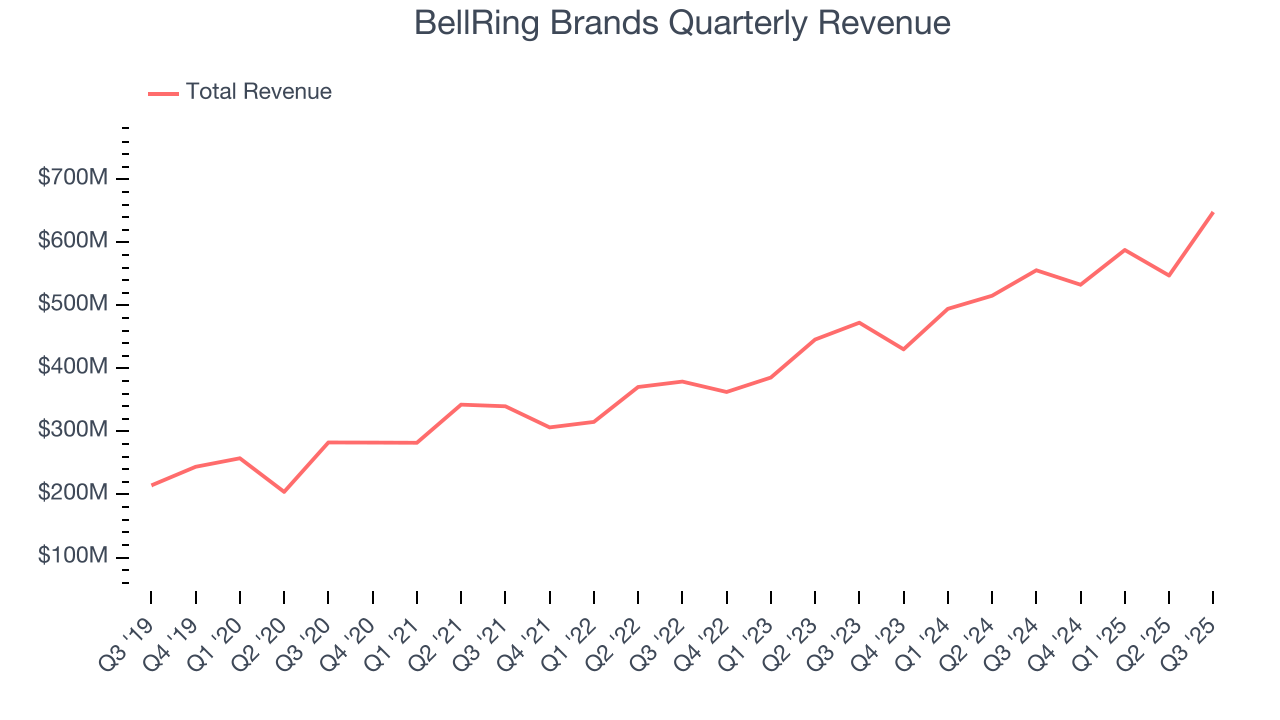

With $2.32 billion in revenue over the past 12 months, BellRing Brands is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

As you can see below, BellRing Brands’s 19.1% annualized revenue growth over the last three years was impressive as consumers bought more of its products.

This quarter, BellRing Brands reported year-on-year revenue growth of 16.6%, and its $648.2 million of revenue exceeded Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and suggests the market is forecasting some success for its newer products.

6. Volume Growth

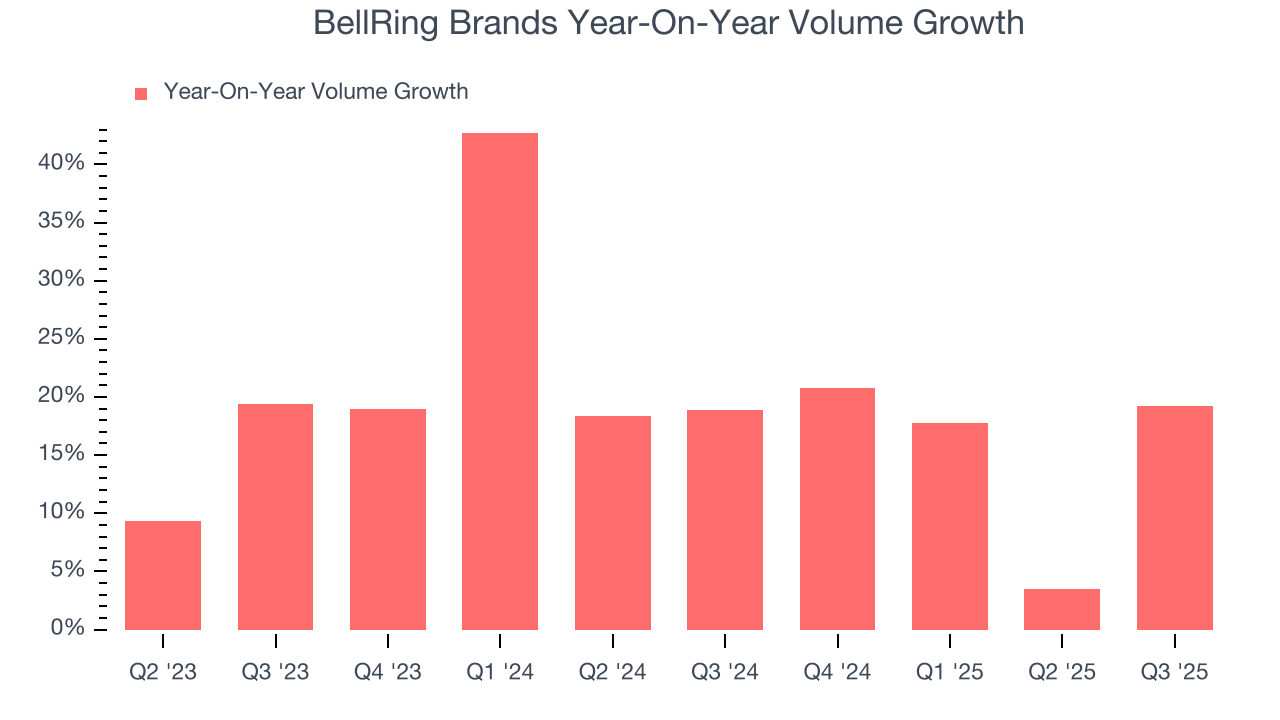

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether BellRing Brands generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, BellRing Brands’s average quarterly volume growth of 20% has outpaced the competition by a long shot. In the context of its 18.5% average organic revenue growth, we can see that most of the company’s gains have come from more customers purchasing its products.

In BellRing Brands’s Q3 2025, sales volumes jumped 19.2% year on year. This result was in line with its historical levels.

7. Gross Margin & Pricing Power

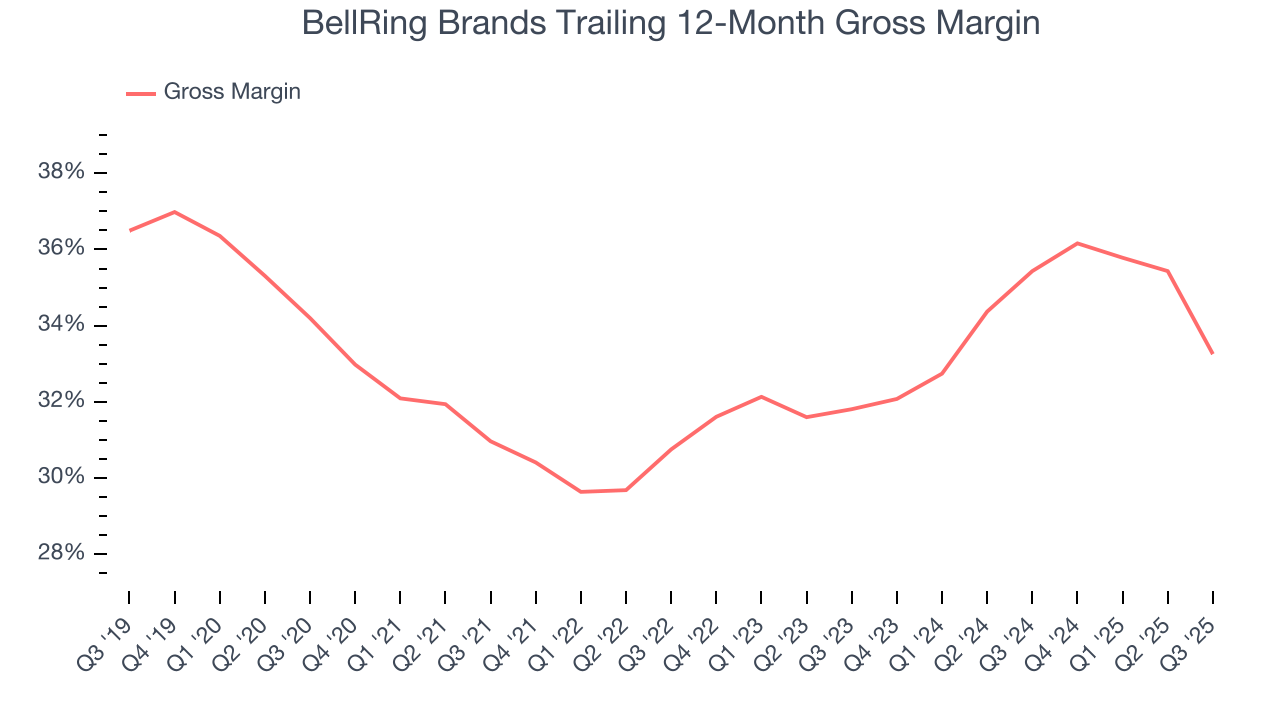

BellRing Brands’s unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 34.3% gross margin over the last two years. That means for every $100 in revenue, $65.74 went towards paying for raw materials, production of goods, transportation, and distribution.

In Q3, BellRing Brands produced a 28.9% gross profit margin, down 8 percentage points year on year. BellRing Brands’s full-year margin has also been trending down over the past 12 months, decreasing by 2.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

BellRing Brands has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 17.3%.

Looking at the trend in its profitability, BellRing Brands’s operating margin decreased by 4 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, BellRing Brands generated an operating margin profit margin of 15.8%, down 4.4 percentage points year on year. Since BellRing Brands’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, and administrative overhead expenses.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, BellRing Brands reported adjusted EPS of $0.51, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects BellRing Brands’s full-year EPS of $2.17 to grow 4.4%.

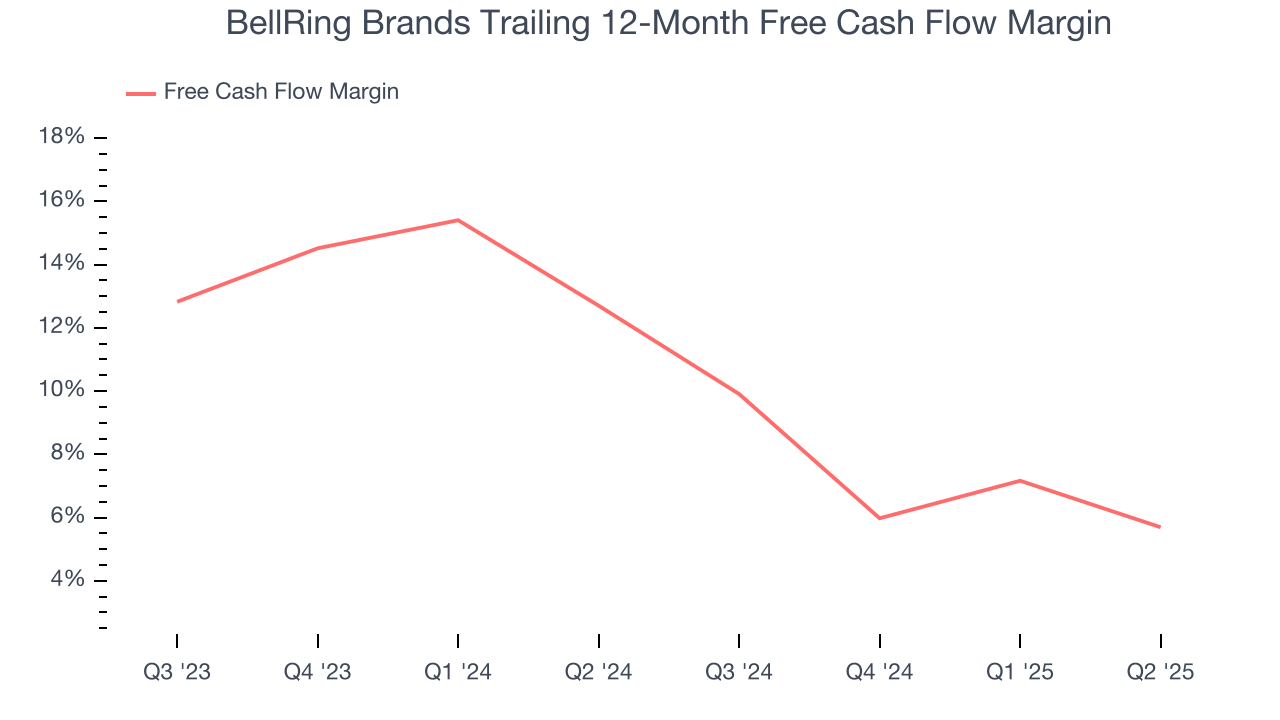

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

BellRing Brands has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.8% over the last two years, better than the broader consumer staples sector.

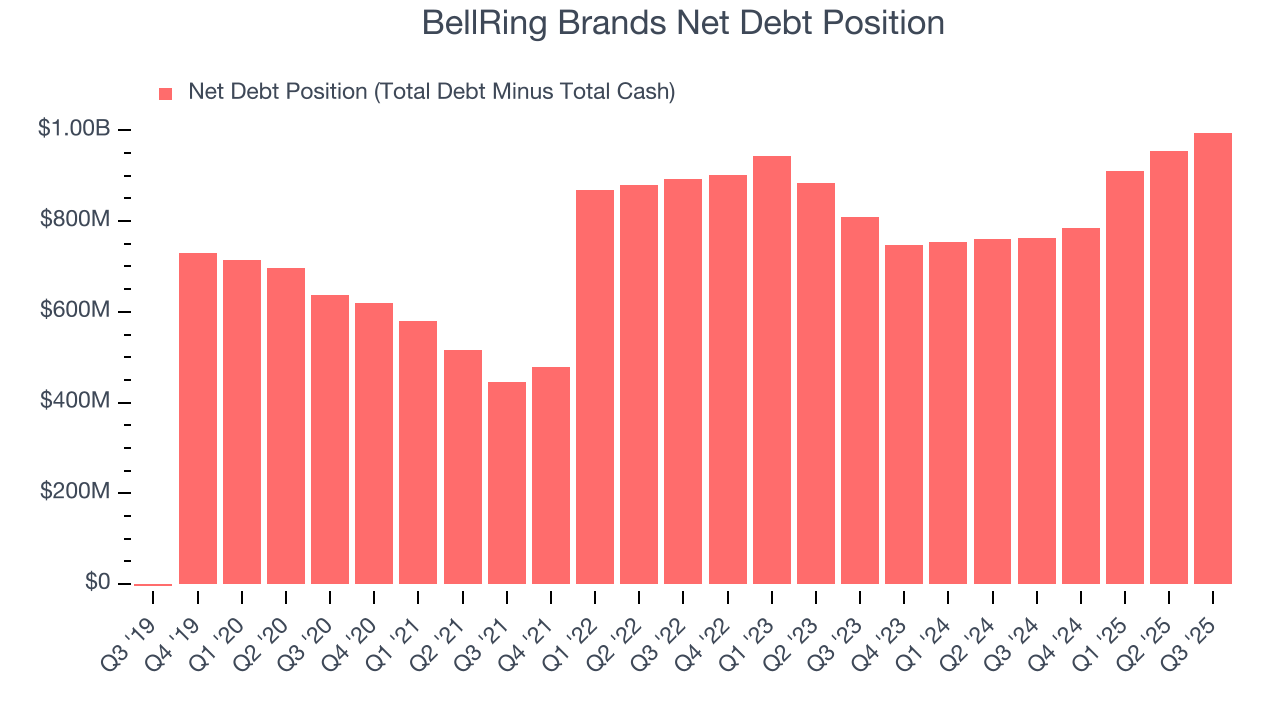

11. Balance Sheet Assessment

BellRing Brands reported $89.1 million of cash and $1.08 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $481.6 million of EBITDA over the last 12 months, we view BellRing Brands’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $30.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from BellRing Brands’s Q3 Results

We enjoyed seeing BellRing Brands beat analysts’ organic revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its gross margin fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 16.2% to $21.47 immediately after reporting.

13. Is Now The Time To Buy BellRing Brands?

Updated: January 21, 2026 at 9:53 PM EST

Before making an investment decision, investors should account for BellRing Brands’s business fundamentals and valuation in addition to what happened in the latest quarter.

When it comes to BellRing Brands’s business quality, there are some positives, but it ultimately falls short. To kick things off, its revenue growth was impressive over the last three years. And while BellRing Brands’s projected EPS for the next year is lacking, its volume growth has been in a league of its own.

BellRing Brands’s P/E ratio based on the next 12 months is 14.1x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $36.50 on the company (compared to the current share price of $28.03).