Cardinal Health (CAH)

Cardinal Health is intriguing. Its scale makes it a trusted partner with negotiating leverage.― StockStory Analyst Team

1. News

2. Summary

Why Cardinal Health Is Interesting

Operating as a critical link in the healthcare supply chain since 1979, Cardinal Health (NYSE:CAH) distributes pharmaceuticals and manufactures medical products for hospitals, pharmacies, and healthcare providers across the global healthcare supply chain.

- Unparalleled scale of $244.7 billion in revenue gives it negotiating leverage and staying power in an industry with high barriers to entry

- Earnings per share have comfortably outperformed the peer group average over the last five years, increasing by 10.2% annually

- On the other hand, its poor expense management has led to an adjusted operating margin that is below the industry average

Cardinal Health shows some promise. If you like the stock, the price seems fair.

Why Is Now The Time To Buy Cardinal Health?

Why Is Now The Time To Buy Cardinal Health?

At $231.85 per share, Cardinal Health trades at 20.9x forward P/E. When stacked up against other healthcare companies, we think Cardinal Health’s multiple is fair for the fundamentals you get.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Cardinal Health (CAH) Research Report: Q4 CY2025 Update

Healthcare distributor and services company Cardinal Health (NYSE:CAH) announced better-than-expected revenue in Q4 CY2025, with sales up 18.8% year on year to $65.63 billion. Its non-GAAP profit of $2.63 per share was 11.2% above analysts’ consensus estimates.

Cardinal Health (CAH) Q4 CY2025 Highlights:

- Revenue: $65.63 billion vs analyst estimates of $64.85 billion (18.8% year-on-year growth, 1.2% beat)

- Adjusted EPS: $2.63 vs analyst estimates of $2.37 (11.2% beat)

- Adjusted EBITDA: $1.03 billion vs analyst estimates of $928.3 million (1.6% margin, 10.7% beat)

- Management raised its full-year Adjusted EPS guidance to $10.25 at the midpoint, a 5.1% increase

- Operating Margin: 1.1%, in line with the same quarter last year

- Free Cash Flow was $555 million, up from -$499 million in the same quarter last year

- Market Capitalization: $49.15 billion

Company Overview

Operating as a critical link in the healthcare supply chain since 1979, Cardinal Health (NYSE:CAH) distributes pharmaceuticals and manufactures medical products for hospitals, pharmacies, and healthcare providers across the global healthcare supply chain.

Cardinal Health operates through two main segments: Pharmaceutical and Specialty Solutions (Pharma) and Global Medical Products and Distribution (GMPD). The Pharma segment serves as a vital intermediary between pharmaceutical manufacturers and healthcare providers, distributing branded and generic drugs, specialty pharmaceuticals, and over-the-counter products to retail pharmacies, hospitals, and specialty care providers.

Through its pharmaceutical distribution network, Cardinal Health offers prime vendor relationships that streamline purchasing processes, creating efficiencies and cost savings for its customers. The company provides inventory management, data reporting, and new product launch support to manufacturers, while also offering specialized services for high-value specialty pharmaceuticals used in treating complex conditions like cancer and rheumatological disorders.

The GMPD segment manufactures and distributes Cardinal Health branded medical supplies and devices, including surgical gloves, wound care products, surgical drapes, and urology supplies. These branded products typically generate higher margins than the distribution business. This segment also provides supply chain services to hospitals, ambulatory surgery centers, and clinical laboratories.

A hospital might use Cardinal Health as its primary vendor for both pharmaceutical needs and medical supplies, receiving daily deliveries of medications for its pharmacy while also sourcing Cardinal-branded surgical kits for its operating rooms. The company's Wavemark technology platform helps these facilities manage inventory efficiently.

Cardinal Health generates revenue through distribution fees from manufacturers, margins on generic pharmaceuticals, and sales of its branded medical products. The company maintains strategic partnerships to enhance its sourcing capabilities, including Red Oak Sourcing, a joint venture with CVS Health that negotiates generic pharmaceutical contracts.

4. Healthcare Distribution & Related Services

Healthcare distributors operate scale-driven business models that thrive on high volumes. Their recurring revenue streams from contracts with hospitals, pharmacies, and healthcare providers provide stability, but profitability can be squeezed by powerful stakeholders on both sides (suppliers and customers), pricing pressures, and regulatory changes. Looking ahead, the sector is positioned for growth due to increasing demand for healthcare services driven by an aging population and advancements in medical technology. However, rising operational costs, potential drug pricing reforms, and supply chain vulnerabilities present potential headwinds. Additionally, the push for digitalization and value-based care creates opportunities for innovation but requires significant investment to remain competitive.

Cardinal Health's primary competitors in pharmaceutical distribution include McKesson Corporation and Cencora, Inc. (formerly AmerisourceBergen). In the medical products segment, it competes with Medline Industries, Inc., Owens & Minor, Inc., and Becton, Dickinson and Company.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $244.7 billion in revenue over the past 12 months, Cardinal Health is one of the most scaled enterprises in healthcare. This is particularly important because healthcare distribution & related services companies are volume-driven businesses due to their low margins.

6. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Cardinal Health grew its sales at a decent 9.4% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Cardinal Health’s recent performance shows its demand has slowed as its annualized revenue growth of 6.4% over the last two years was below its five-year trend.

This quarter, Cardinal Health reported year-on-year revenue growth of 18.8%, and its $65.63 billion of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 10.6% over the next 12 months, an improvement versus the last two years. This projection is particularly healthy for a company of its scale and indicates its newer products and services will fuel better top-line performance.

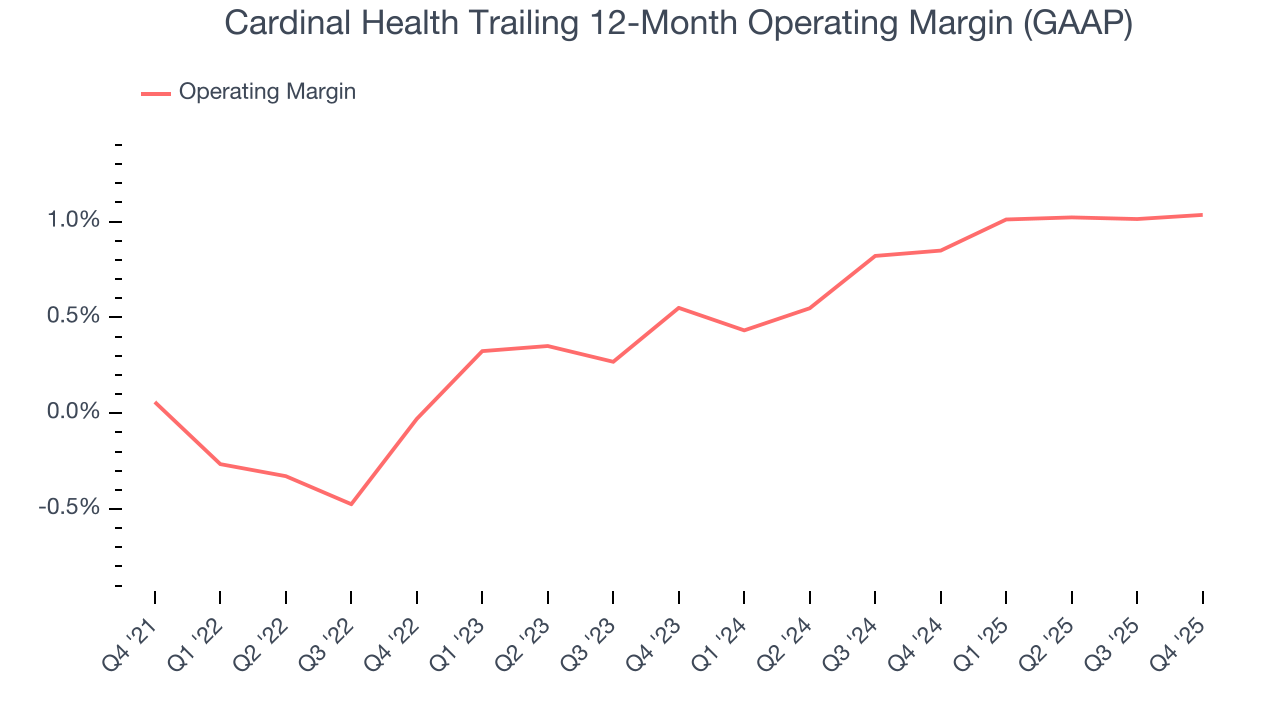

7. Operating Margin

Cardinal Health’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same. The company broke even over the last five years, lousy for a healthcare business. Its large expense base and inefficient cost structure were the main culprits behind this performance.

Looking at the trend in its profitability, Cardinal Health’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Cardinal Health generated an operating margin profit margin of 1.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

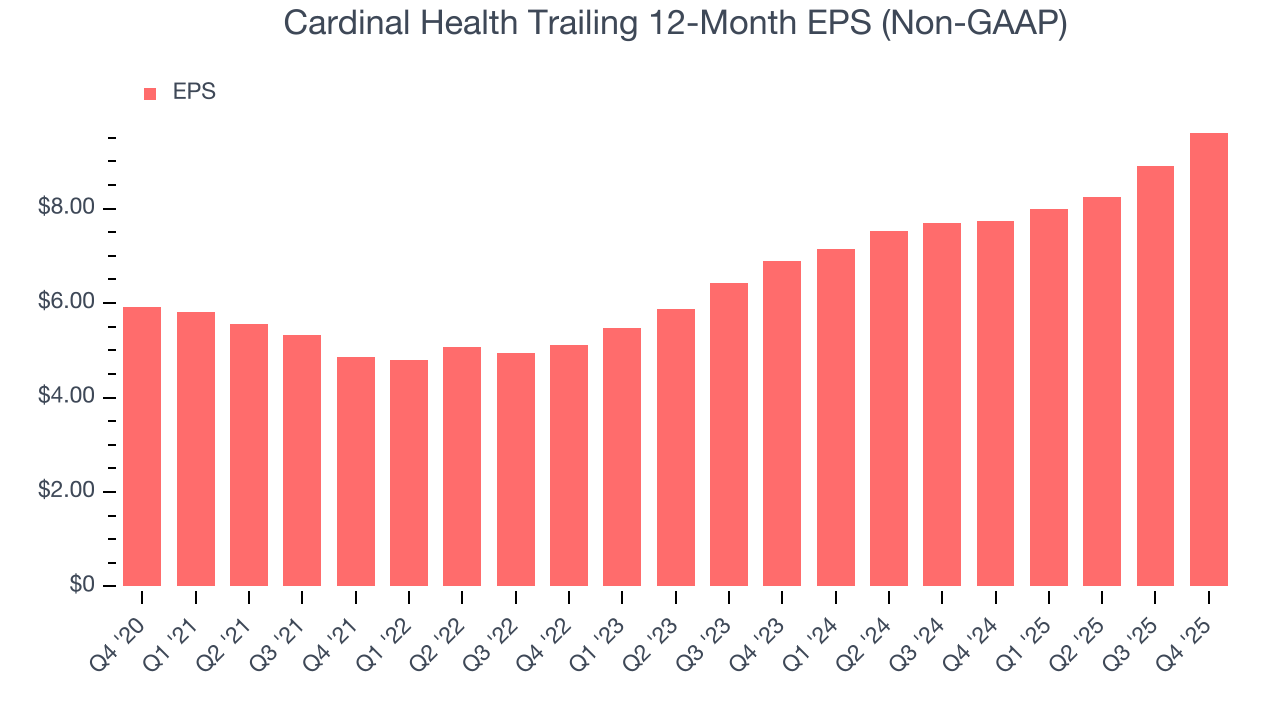

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Cardinal Health’s remarkable 10.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Cardinal Health reported adjusted EPS of $2.63, up from $1.93 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Cardinal Health’s full-year EPS of $9.61 to grow 10.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Cardinal Health has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.2%, subpar for a healthcare business.

Taking a step back, an encouraging sign is that Cardinal Health’s margin expanded by 1.6 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Cardinal Health broke even from a free cash flow perspective in Q4. This result was good as its margin was 1.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

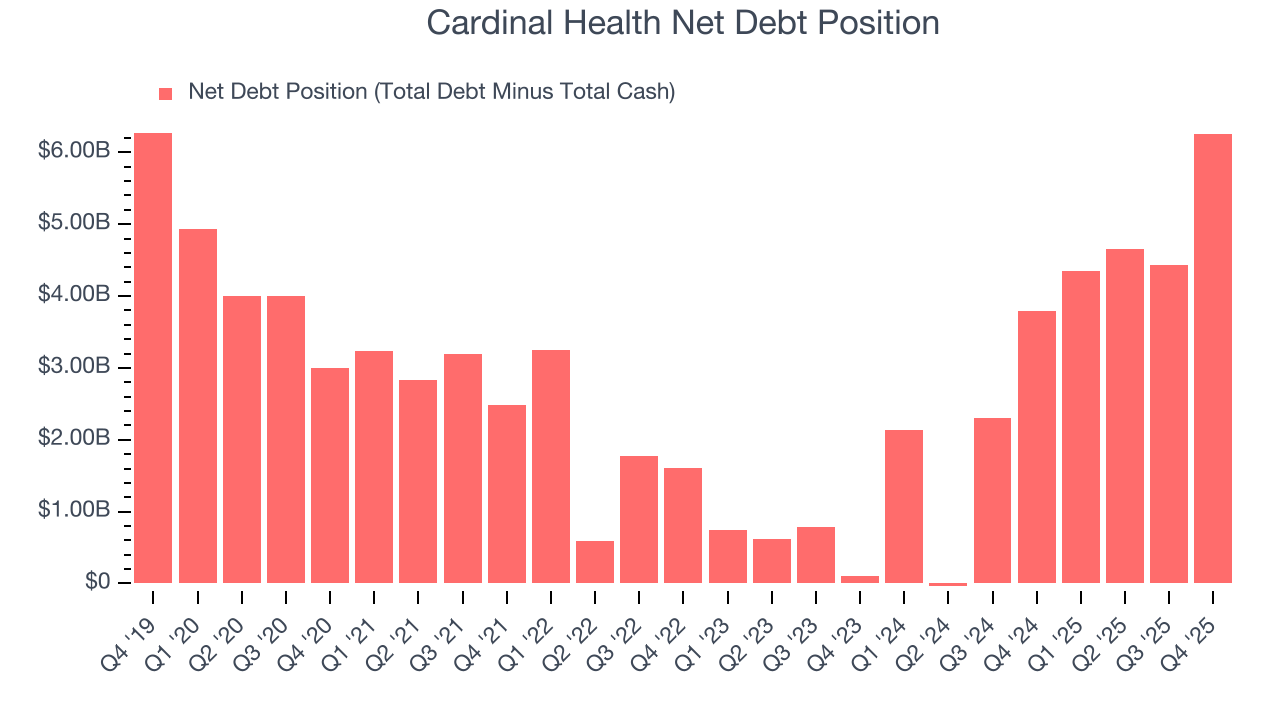

10. Balance Sheet Assessment

Cardinal Health reported $2.78 billion of cash and $9.03 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.66 billion of EBITDA over the last 12 months, we view Cardinal Health’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $195 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Cardinal Health’s Q4 Results

It was encouraging to see Cardinal Health beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its revenue and EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.3% to $209.44 immediately after reporting.

12. Is Now The Time To Buy Cardinal Health?

Updated: February 28, 2026 at 11:38 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

There are definitely a lot of things to like about Cardinal Health. First off, its revenue growth was decent over the last five years and is expected to accelerate over the next 12 months. And while its operating margins are low compared to other healthcare companies, its scale makes it a trusted partner with negotiating leverage. On top of that, its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders.

Cardinal Health’s P/E ratio based on the next 12 months is 20.9x. Looking at the healthcare space right now, Cardinal Health trades at a compelling valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $248.80 on the company (compared to the current share price of $231.85), implying they see 7.3% upside in buying Cardinal Health in the short term.