Crown Holdings (CCK)

We aren’t fans of Crown Holdings. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Crown Holdings Will Underperform

Formerly Crown Cork & Seal, Crown Holdings (NYSE:CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 1.3% over the last five years was below our standards for the industrials sector

- Gross margin of 20.5% is below its competitors, leaving less money to invest in areas like marketing and R&D

- On the plus side, its stellar returns on capital showcase management’s ability to surface highly profitable business ventures

Crown Holdings falls below our quality standards. There are more promising alternatives.

Why There Are Better Opportunities Than Crown Holdings

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Crown Holdings

At $101.74 per share, Crown Holdings trades at 13x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Crown Holdings (CCK) Research Report: Q3 CY2025 Update

Metal packaging products manufacturer Crown Holdings (NYSE:CCK) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 4.2% year on year to $3.20 billion. Its non-GAAP profit of $2.24 per share was 12.7% above analysts’ consensus estimates.

Crown Holdings (CCK) Q3 CY2025 Highlights:

- Revenue: $3.20 billion vs analyst estimates of $3.15 billion (4.2% year-on-year growth, 1.5% beat)

- Adjusted EPS: $2.24 vs analyst estimates of $1.99 (12.7% beat)

- Adjusted EBITDA: $539 million vs analyst estimates of $538 million (16.8% margin, in line)

- Management raised its full-year Adjusted EPS guidance to $7.75 at the midpoint, a 6.2% increase

- Operating Margin: 13.2%, down from 14.4% in the same quarter last year

- Free Cash Flow Margin: 15.2%, similar to the same quarter last year

- Market Capitalization: $10.8 billion

Company Overview

Formerly Crown Cork & Seal, Crown Holdings (NYSE:CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Founded in 1892 and headquartered in Yardley, Pennsylvania, Crown operates through four primary reportable segments: Americas Beverage, European Beverage, Asia Pacific, and Transit Packaging.

The Americas Beverage segment produces aluminum beverage cans and ends, glass bottles, steel crowns, and aluminum caps in manufacturing facilities across the United States, Brazil, Canada, Colombia, and Mexico. The European Beverage segment focuses on manufacturing aluminum beverage cans and ends in Europe, the Middle East, and North Africa.

The Asia Pacific segment primarily operates beverage can facilities in Cambodia, China, Indonesia, Malaysia, Myanmar, Thailand, and Vietnam. The Transit Packaging segment offers products including automation and equipment technologies, protective packaging solutions, and steel and plastic consumables.

4. Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

Competitors in the packaging industry include Ball Corporation (NYSE:BLL), Ardagh Group (NYSE:ARD), and Silgan Holdings (NASDAQ:SLGN)

5. Revenue Growth

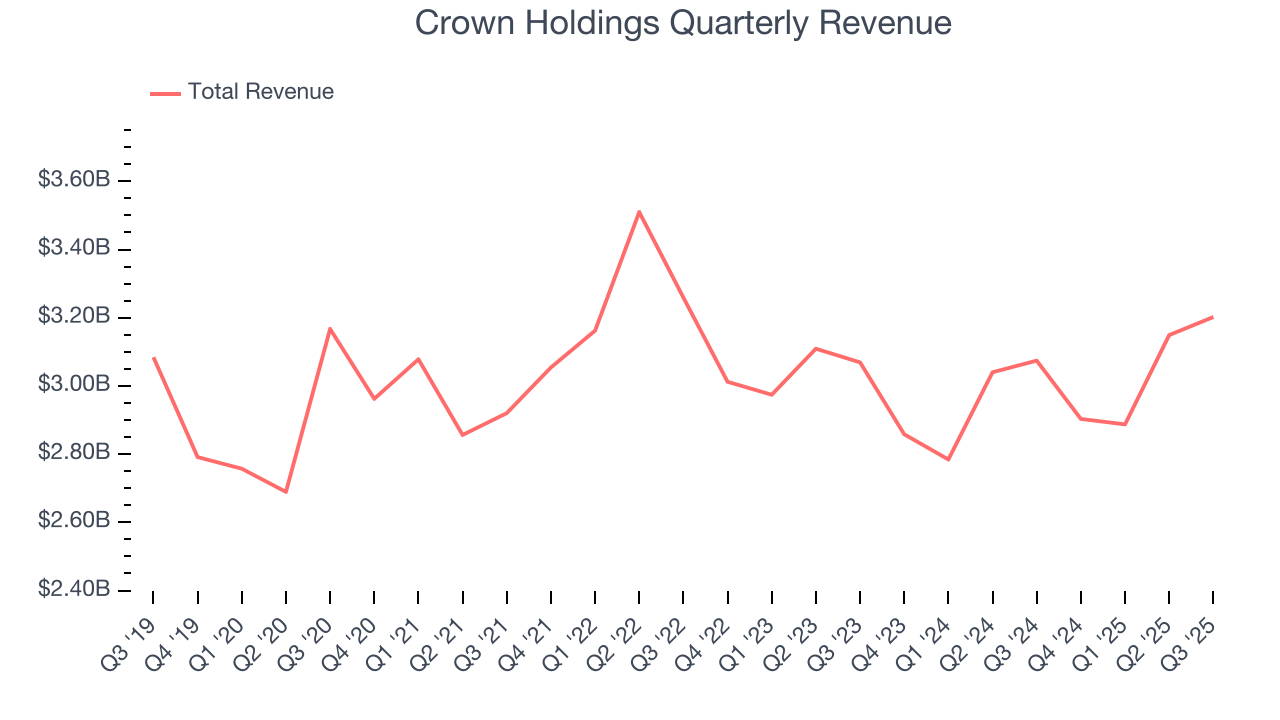

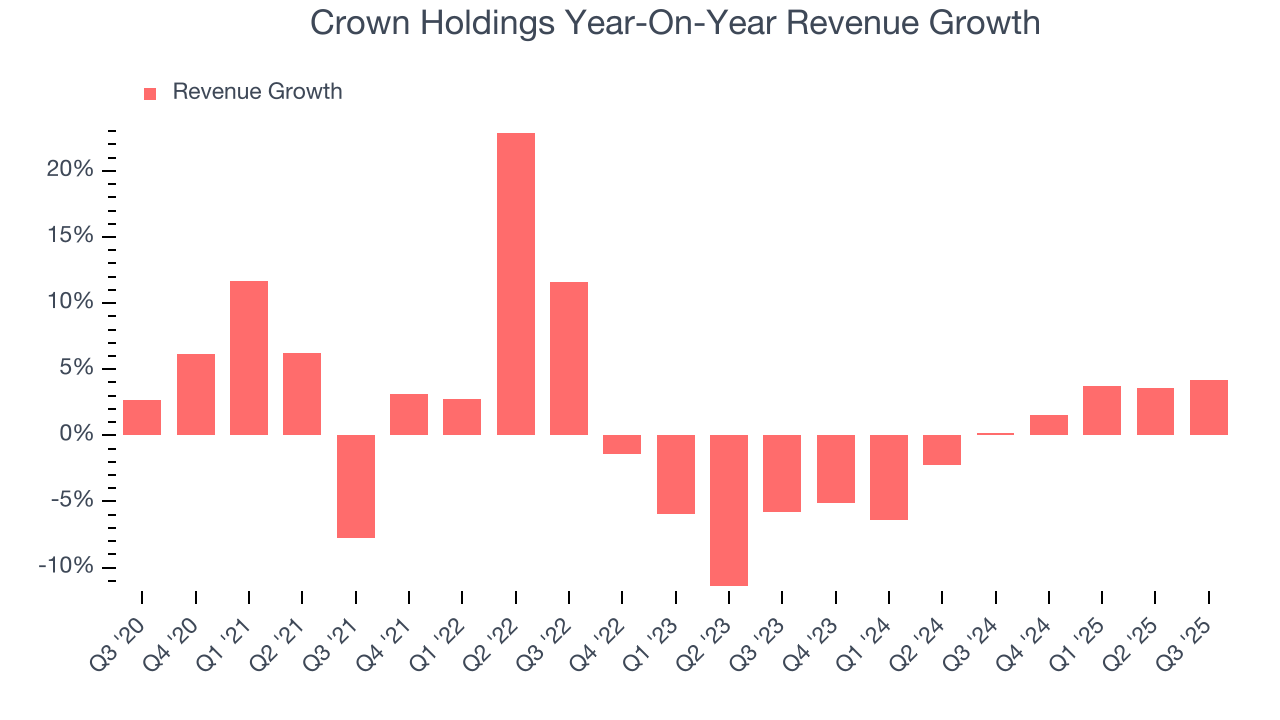

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Crown Holdings grew its sales at a weak 1.3% compounded annual growth rate. This was below our standards and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Crown Holdings’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Crown Holdings reported modest year-on-year revenue growth of 4.2% but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Crown Holdings has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 20.5% gross margin over the last five years. That means Crown Holdings paid its suppliers a lot of money ($79.53 for every $100 in revenue) to run its business.

In Q3, Crown Holdings produced a 22.6% gross profit margin, in line with the same quarter last year. Zooming out, Crown Holdings’s full-year margin has been trending up over the past 12 months, increasing by 1.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

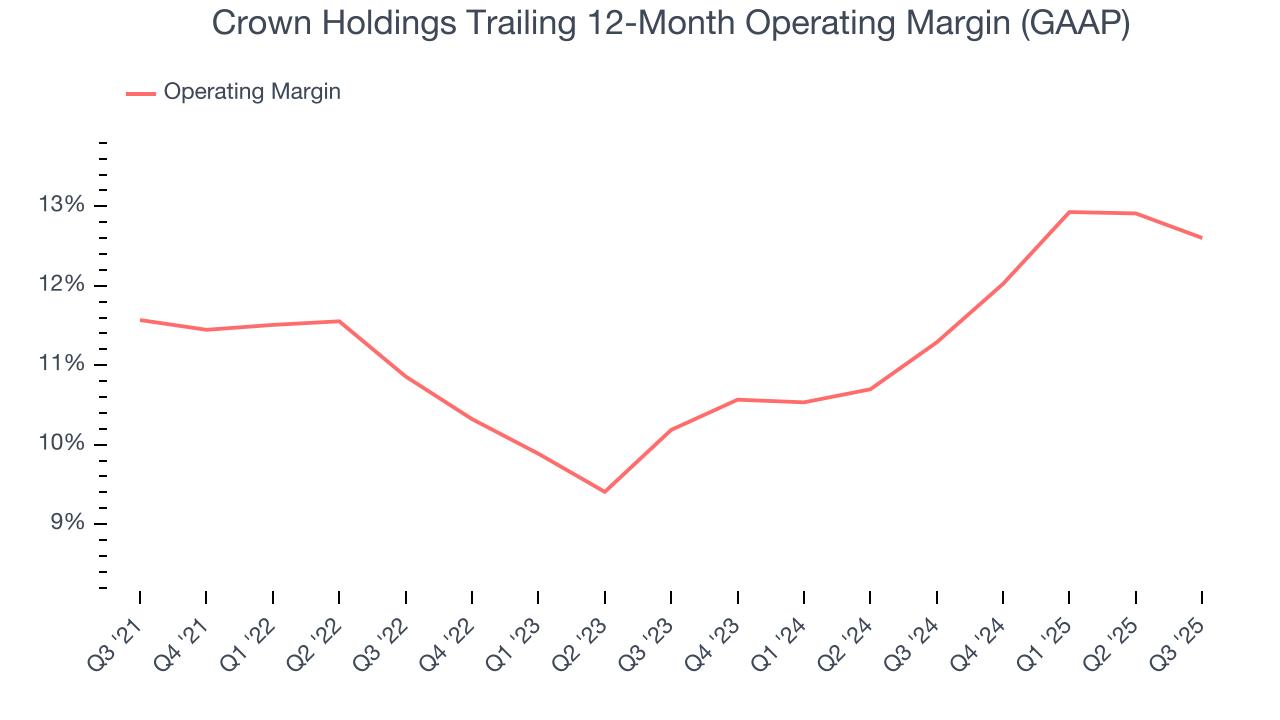

Crown Holdings has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Crown Holdings’s operating margin rose by 1 percentage points over the last five years, as its sales growth gave it operating leverage. Its expansion was impressive, especially when considering most Industrial Packaging peers saw their margins plummet.

This quarter, Crown Holdings generated an operating margin profit margin of 13.2%, down 1.2 percentage points year on year. Since Crown Holdings’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

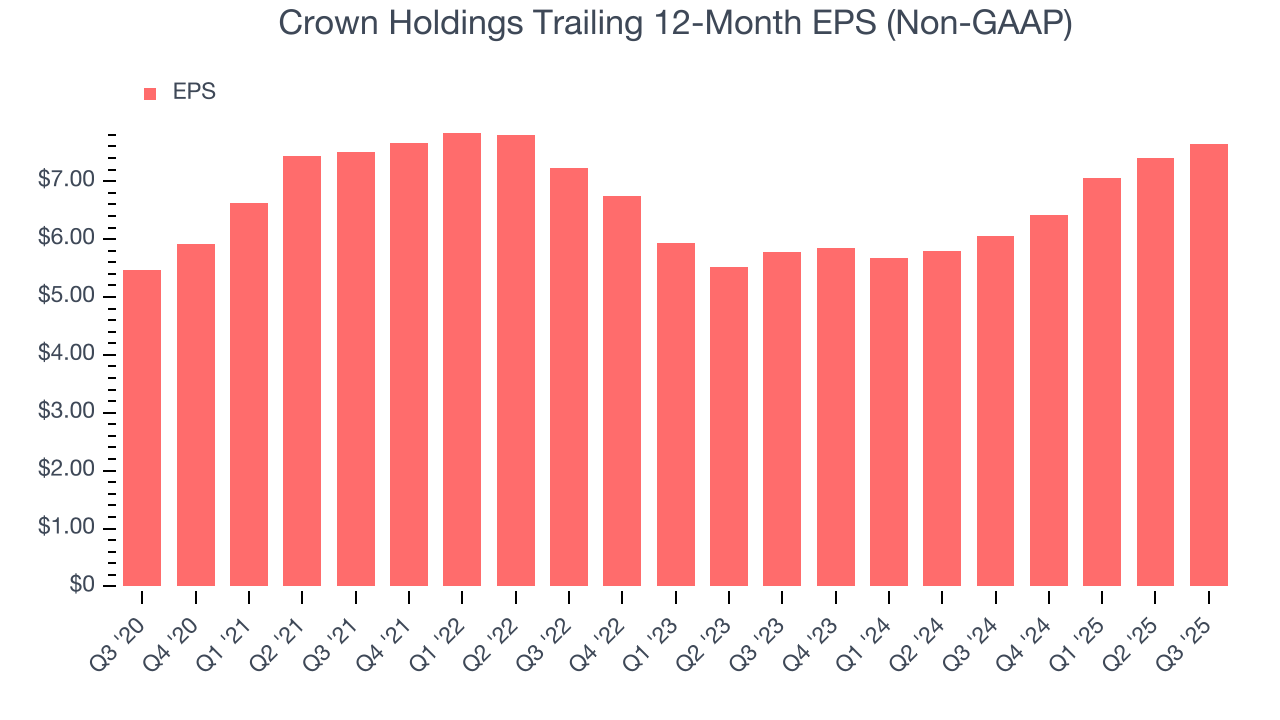

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Crown Holdings’s EPS grew at an unimpressive 7% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Crown Holdings’s earnings can give us a better understanding of its performance. As we mentioned earlier, Crown Holdings’s operating margin declined this quarter but expanded by 1 percentage points over the last five years. Its share count also shrank by 13.9%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Crown Holdings, its two-year annual EPS growth of 15% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, Crown Holdings reported adjusted EPS of $2.24, up from $1.99 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Crown Holdings’s full-year EPS of $7.65 to stay about the same.

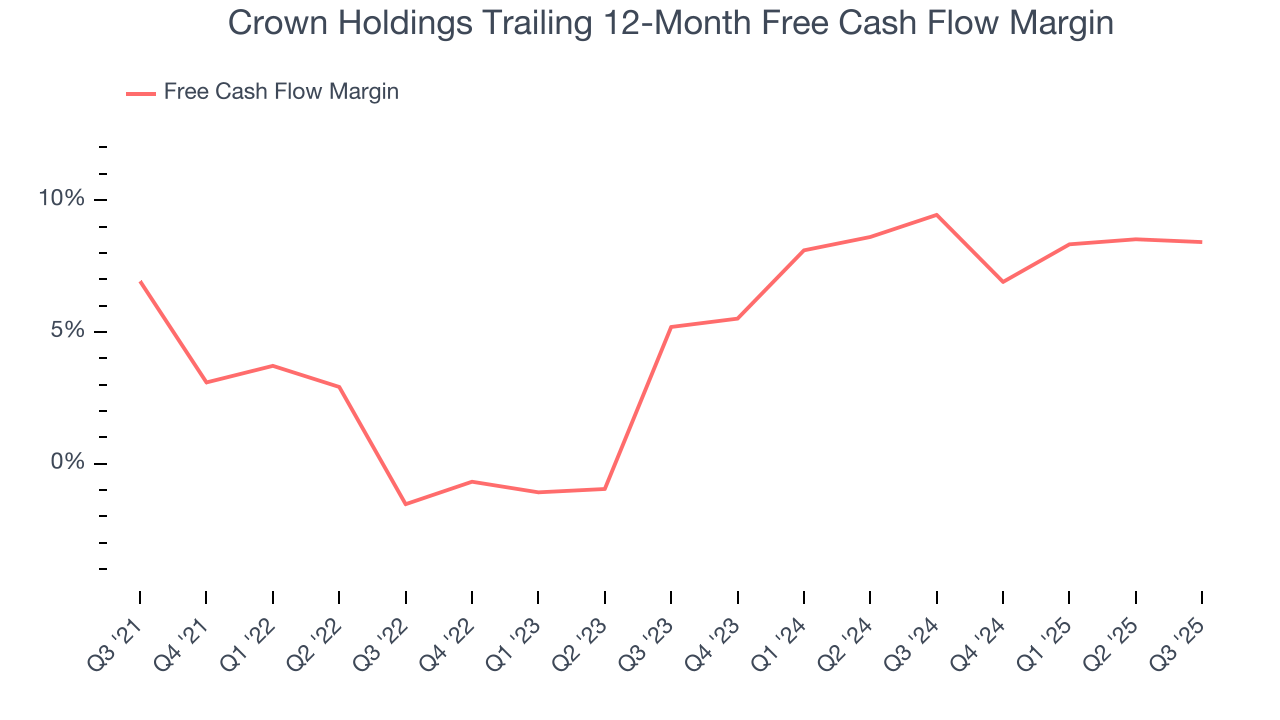

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Crown Holdings has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.6%, subpar for an industrials business.

Taking a step back, an encouraging sign is that Crown Holdings’s margin expanded by 1.5 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Crown Holdings’s free cash flow clocked in at $488 million in Q3, equivalent to a 15.2% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

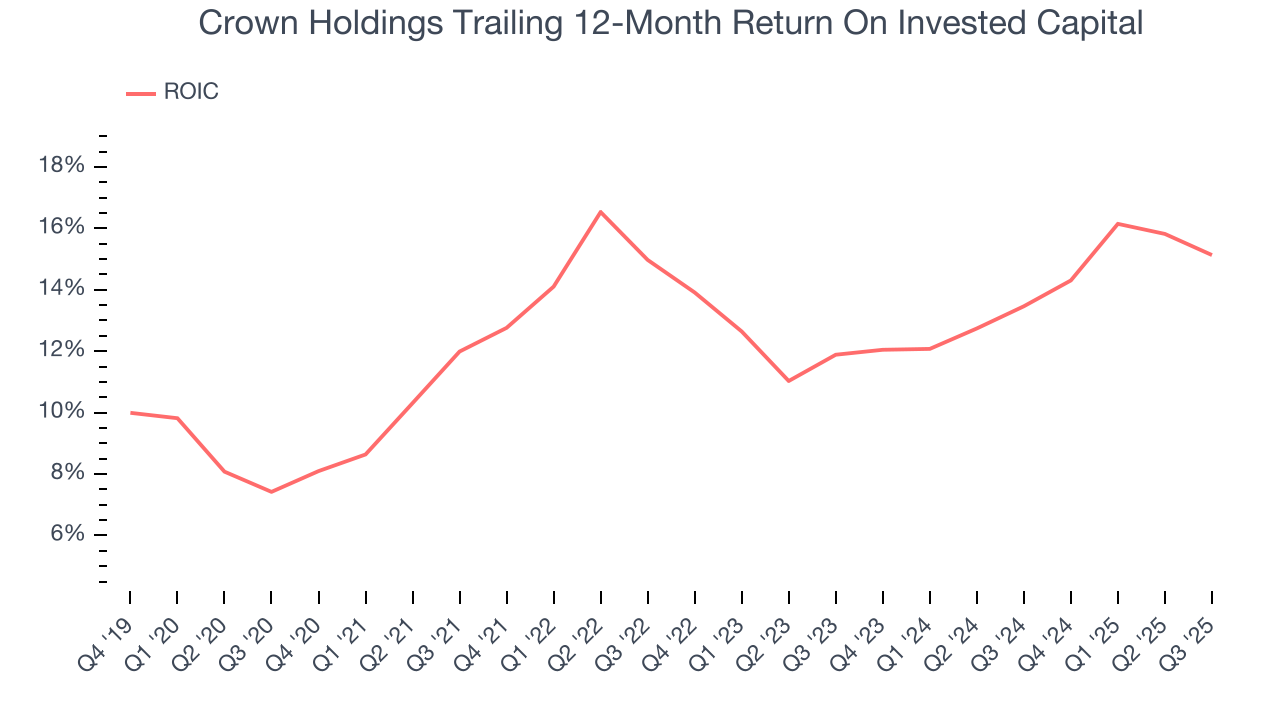

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Crown Holdings hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13.5%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Crown Holdings’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

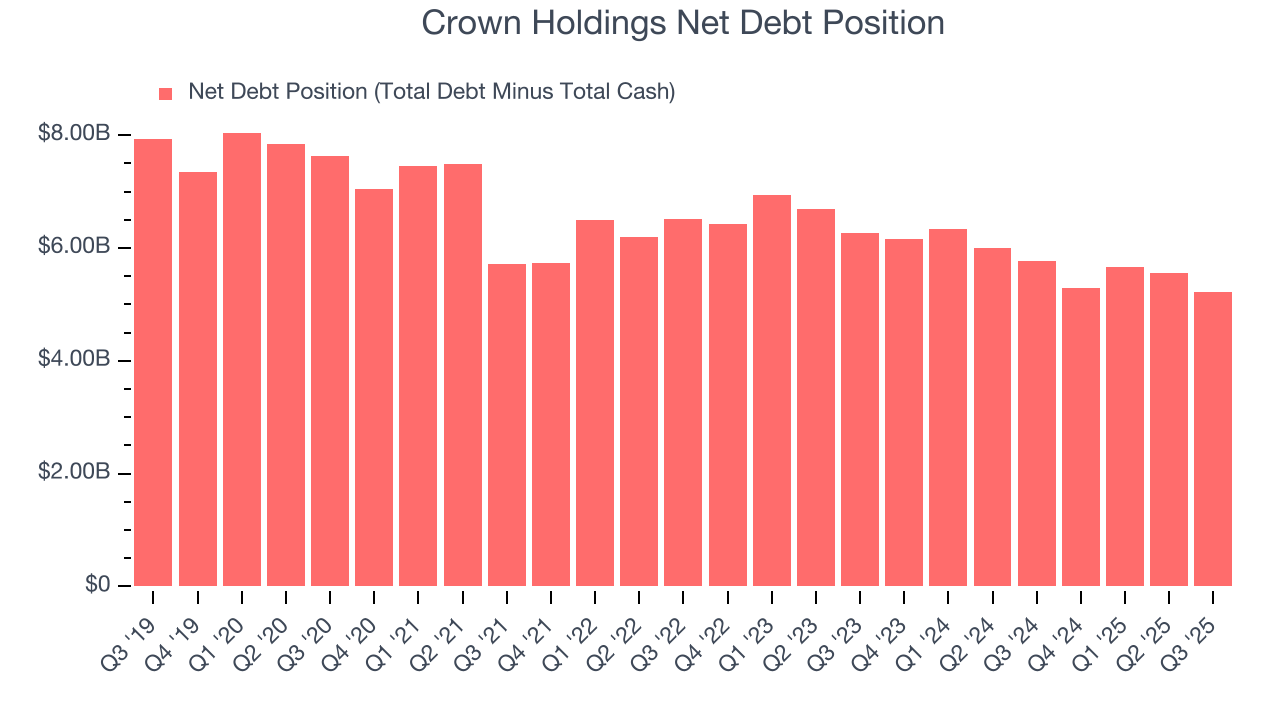

11. Balance Sheet Assessment

Crown Holdings reported $1.17 billion of cash and $6.39 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.07 billion of EBITDA over the last 12 months, we view Crown Holdings’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $173 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Crown Holdings’s Q3 Results

Revenue and EPS both beat, making for a solid quarter. We were also impressed by Crown Holdings’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance was raised and trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 11.2% to $104.97 immediately after reporting.

13. Is Now The Time To Buy Crown Holdings?

Updated: January 20, 2026 at 10:43 PM EST

Before making an investment decision, investors should account for Crown Holdings’s business fundamentals and valuation in addition to what happened in the latest quarter.

Crown Holdings’s business quality ultimately falls short of our standards. First off, its revenue growth was weak over the last five years. And while its solid ROIC suggests it has grown profitably in the past, the downside is its flat constant currency disappointed. On top of that, its low gross margins indicate some combination of competitive pressures and high production costs.

Crown Holdings’s P/E ratio based on the next 12 months is 13x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $122.43 on the company (compared to the current share price of $101.74).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.