Cadre (CDRE)

Cadre catches our eye. Its estimated revenue growth for the next 12 months is great.― StockStory Analyst Team

1. News

2. Summary

Why Cadre Is Interesting

Originally known as Safariland, Cadre (NYSE:CDRE) specializes in manufacturing and distributing safety and survivability equipment for first responders.

- Market share is on track to rise over the next 12 months as its 16.1% projected revenue growth implies demand will accelerate from its two-year trend

- Earnings growth has trumped its peers over the last three years as its EPS has compounded at 114% annually

- The stock is trading at a reasonable price if you like its story and growth prospects

Cadre almost passes our quality test. If you’re a believer, the valuation seems reasonable.

Why Is Now The Time To Buy Cadre?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Cadre?

At $43.39 per share, Cadre trades at 28.8x forward P/E. Cadre’s valuation multiple is higher than that of many industrials peers, but we think this is appropriate when considering fundamentals.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Cadre (CDRE) Research Report: Q3 CY2025 Update

Aerospace and defense company Cadre (NYSE:CDRE) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 42.5% year on year to $155.9 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $627 million at the midpoint. Its GAAP profit of $0.27 per share was in line with analysts’ consensus estimates.

Cadre (CDRE) Q3 CY2025 Highlights:

- Revenue: $155.9 million vs analyst estimates of $160.2 million (42.5% year-on-year growth, 2.7% miss)

- EPS (GAAP): $0.27 vs analyst estimates of $0.26 (in line)

- Adjusted EBITDA: $29.82 million vs analyst estimates of $27.66 million (19.1% margin, 7.8% beat)

- The company reconfirmed its revenue guidance for the full year of $627 million at the midpoint

- EBITDA guidance for the full year is $114 million at the midpoint, in line with analyst expectations

- Operating Margin: 12%, up from 5% in the same quarter last year

- Free Cash Flow was $21.63 million, up from -$6.23 million in the same quarter last year

- Market Capitalization: $1.73 billion

Company Overview

Originally known as Safariland, Cadre (NYSE:CDRE) specializes in manufacturing and distributing safety and survivability equipment for first responders.

Cadre was founded in 1964 by Neale Perkins who began by crafting custom holsters in his garage. Named after the African safari excursions he cherished with his father, Safariland quickly grew from a small operation to a prominent manufacturer producing thousands of holsters monthly. Over the years, through strategic acquisitions and expansions, Safariland transformed into Cadre, broadening its scope to include advanced protective gear and tactical solutions for law enforcement, military, and nuclear safety sectors.

Today, Cadre’s product lineup ranges from highly protective body armor for law enforcement and first responders, to advanced Explosive Ordnance Disposal (EOD) equipment like the ICOR robots, which are integral to bomb disposal and tactical law enforcement operations. Furthermore, Cadre extends its product line to the nuclear safety sector with products and services tailored for environments with critical safety requirements. The company’s offerings include products for radiation protection and nuclear facility safety, supporting government and commercial clients such as the Department of Energy.

Cadre generates a significant portion of its revenue from government contracts, primarily through supplying safety and tactical equipment to various U.S. and international government agencies. These contracts are typically secured via competitive bidding processes and often result in long-term agreements, creating a stable flow of income from year to year.

The company's end markets include law enforcement, military, and nuclear safety sectors, which are areas with high demand for continuous advancements in safety and operational efficiency. These sectors often have stringent replacement and upgrade cycles due to the critical nature of the equipment provided. This leads to recurring revenue streams for Cadre, as products typically require regular updates or replacements to adhere to evolving safety standards and technological improvements.

4. Law Enforcement Suppliers

Many law enforcement suppliers companies require licensing and clearance to manufacture products such as firearms. These companies can enjoy long-term contracts with law enforcement and corrections bodies, leading to more predictable revenue. It is still unclear how the recent focus on excessive force and police accountability will impact longer-term demand. On the one hand, lethal force products could become less popular. On the other hand, products such as body cams that aid in the transparency of policing could become standard. Generally, the sector’s fate will also ebb and flow with state or local budgets, and there is high reputational risk, as one mishap or bad headline can change a company’s fortunes.

Cadre's competitors include Apogee Enterprises (NASDAQ:APOG), Helios Technologies (NYSE:HLIO)

5. Revenue Growth

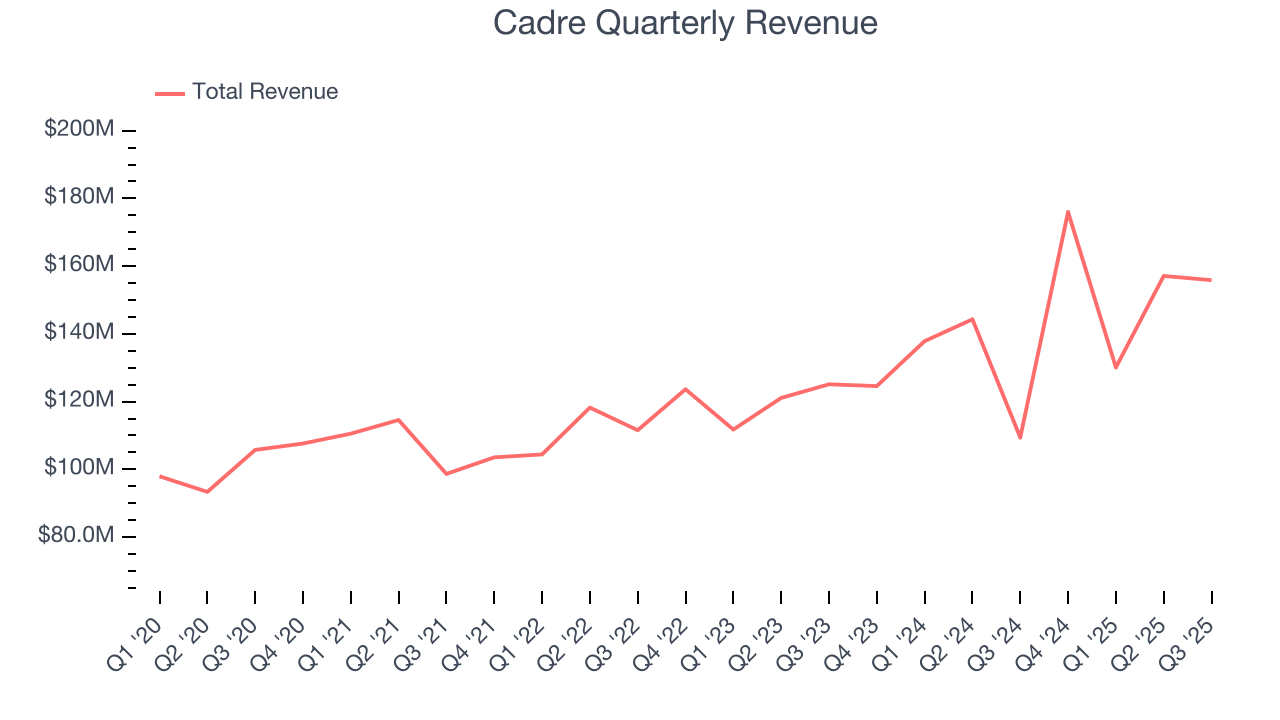

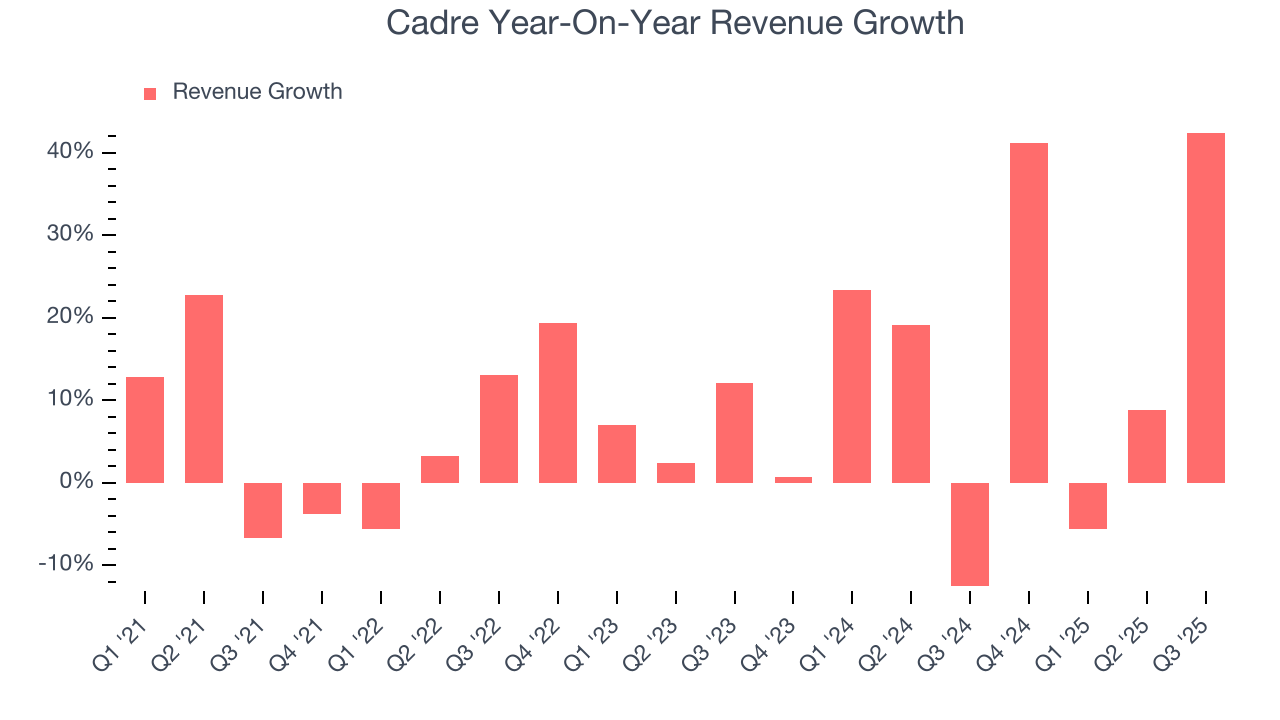

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Cadre’s sales grew at a decent 8.3% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Cadre’s annualized revenue growth of 13.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

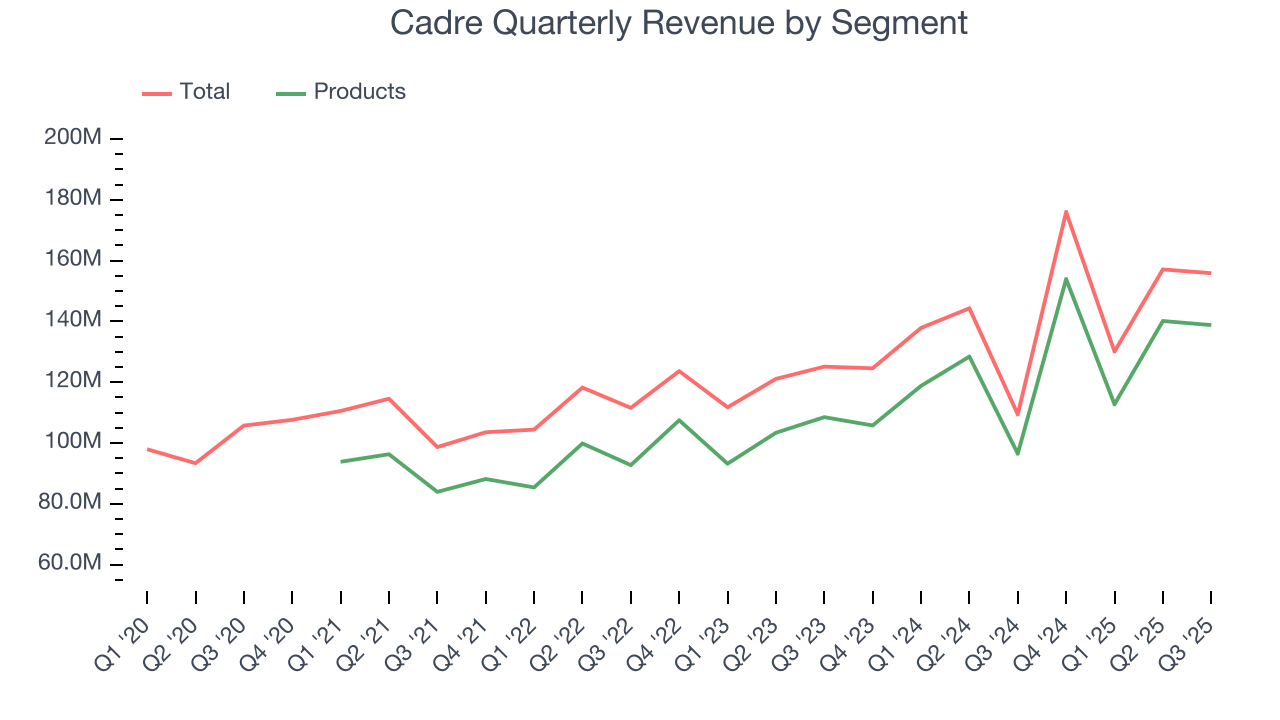

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Products. Over the last two years, Cadre’s Products revenue (body armor, corrections tools, sensors) averaged 16.6% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Cadre achieved a magnificent 42.5% year-on-year revenue growth rate, but its $155.9 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and implies the market is baking in some success for its newer products and services.

6. Operating Margin

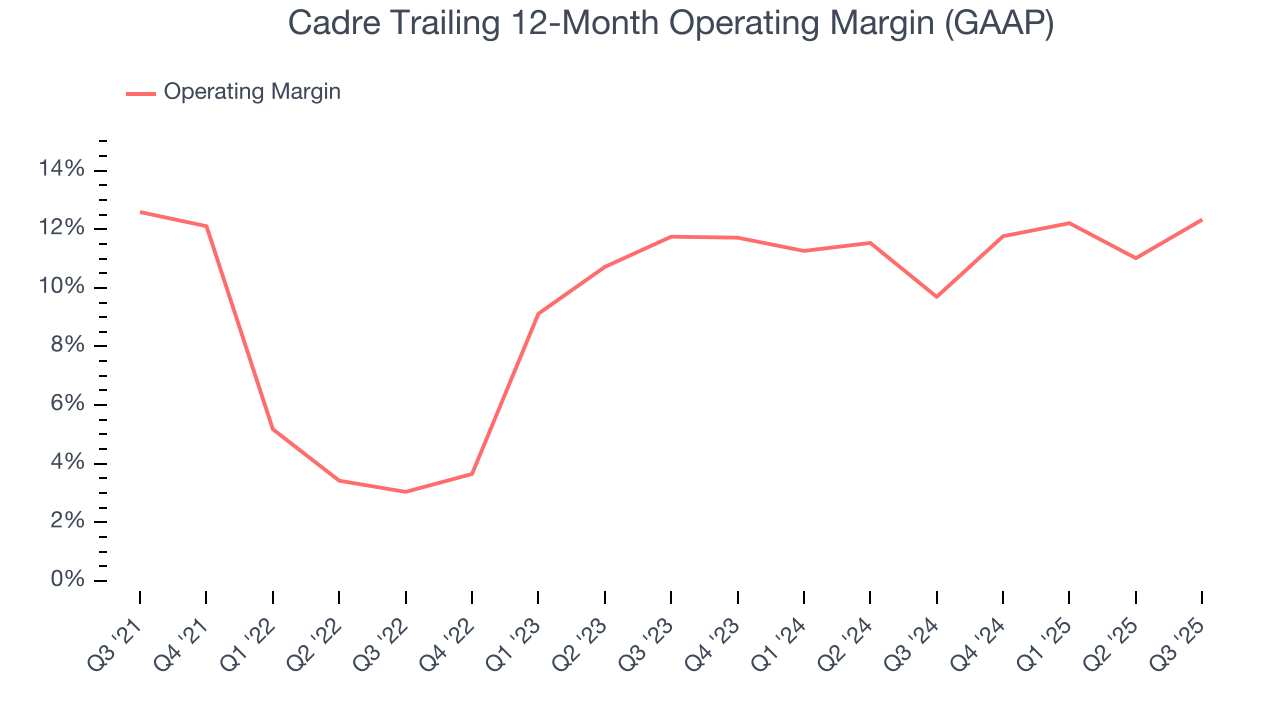

Cadre’s operating margin has been trending up over the last 12 months and averaged 10.1% over the last five years. Its solid profitability for an industrials business shows it’s an efficient company that manages its expenses effectively.

Looking at the trend in its profitability, Cadre’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Cadre generated an operating margin profit margin of 12%, up 7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

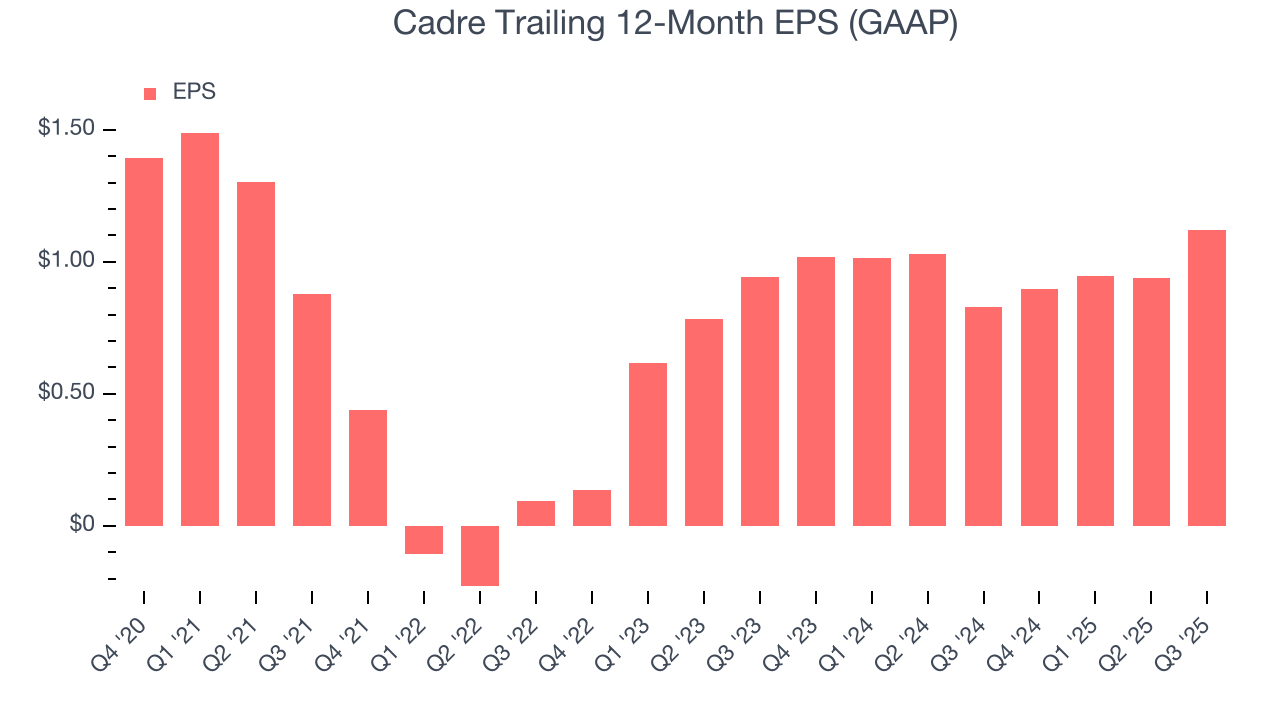

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

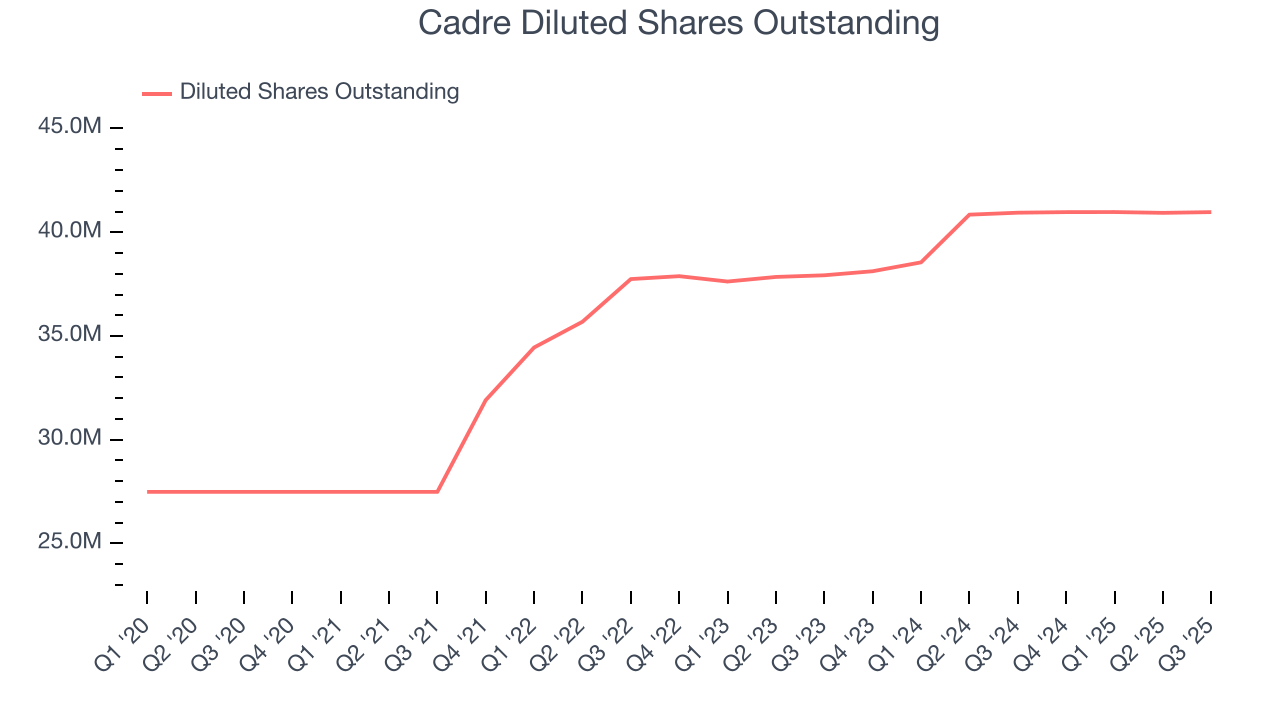

Cadre’s flat EPS over the last five years was below its 8.3% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Diving into the nuances of Cadre’s earnings can give us a better understanding of its performance. Cadre recently raised equity capital, and in the process, grew its share count by 49.1% over the last five years. This has resulted in muted earnings per share growth but doesn’t tell us as much about its future. We prefer to look at operating and free cash flow margins in these situations.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Cadre, its two-year annual EPS growth of 9% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q3, Cadre reported EPS of $0.27, up from $0.09 in the same quarter last year. This print beat analysts’ estimates by 3.3%. Over the next 12 months, Wall Street expects Cadre’s full-year EPS of $1.12 to grow 27.1%.

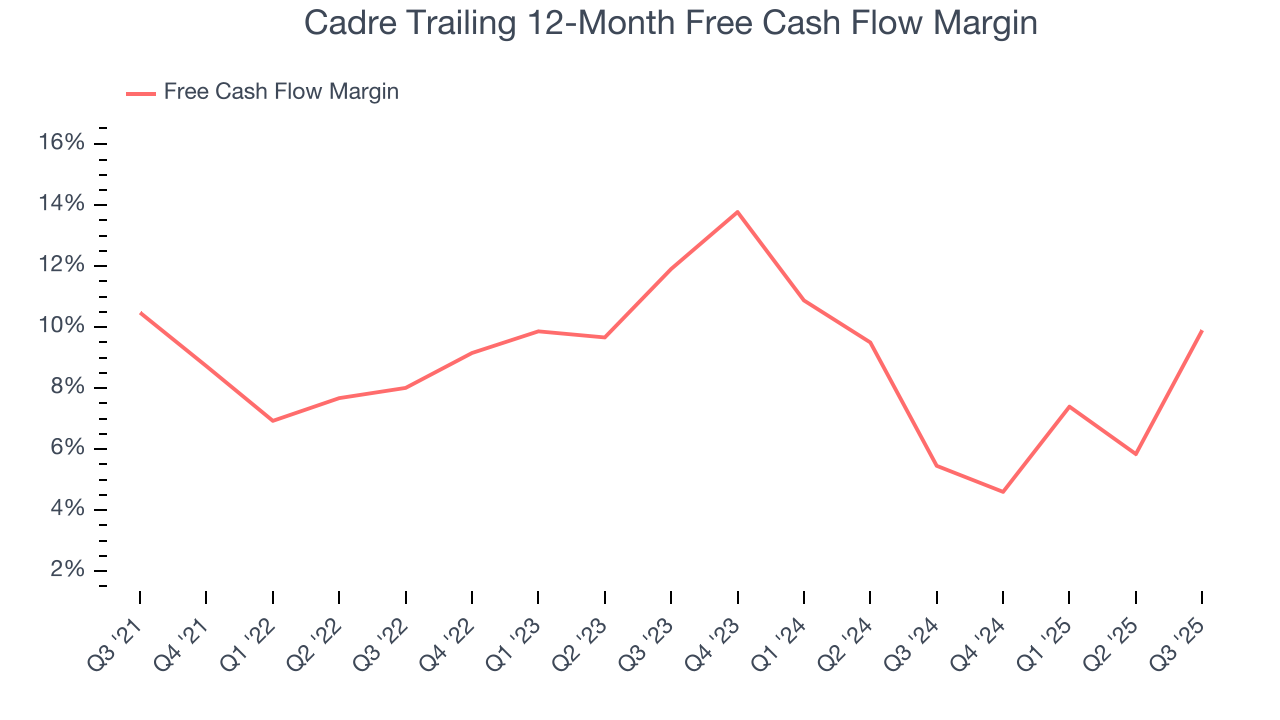

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Cadre has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 9.1% over the last five years, better than the broader industrials sector.

Cadre’s free cash flow clocked in at $21.63 million in Q3, equivalent to a 13.9% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

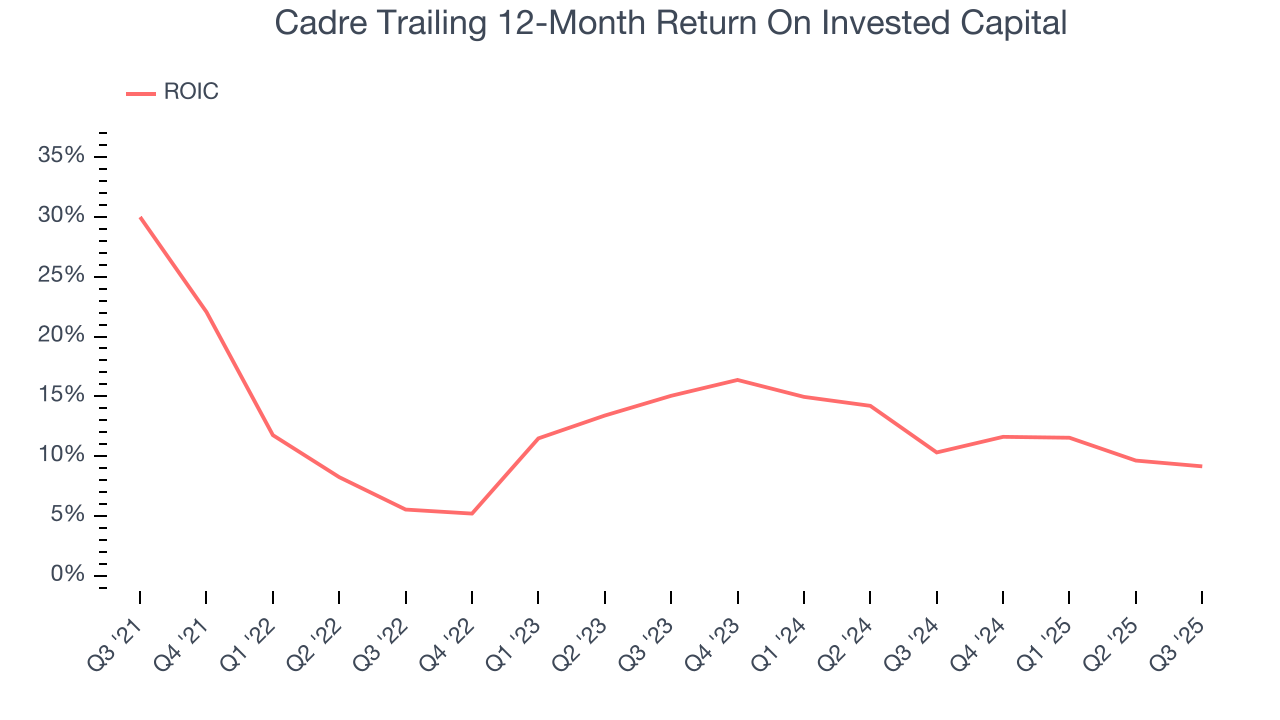

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Cadre hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 14%, impressive for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Cadre’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Assessment

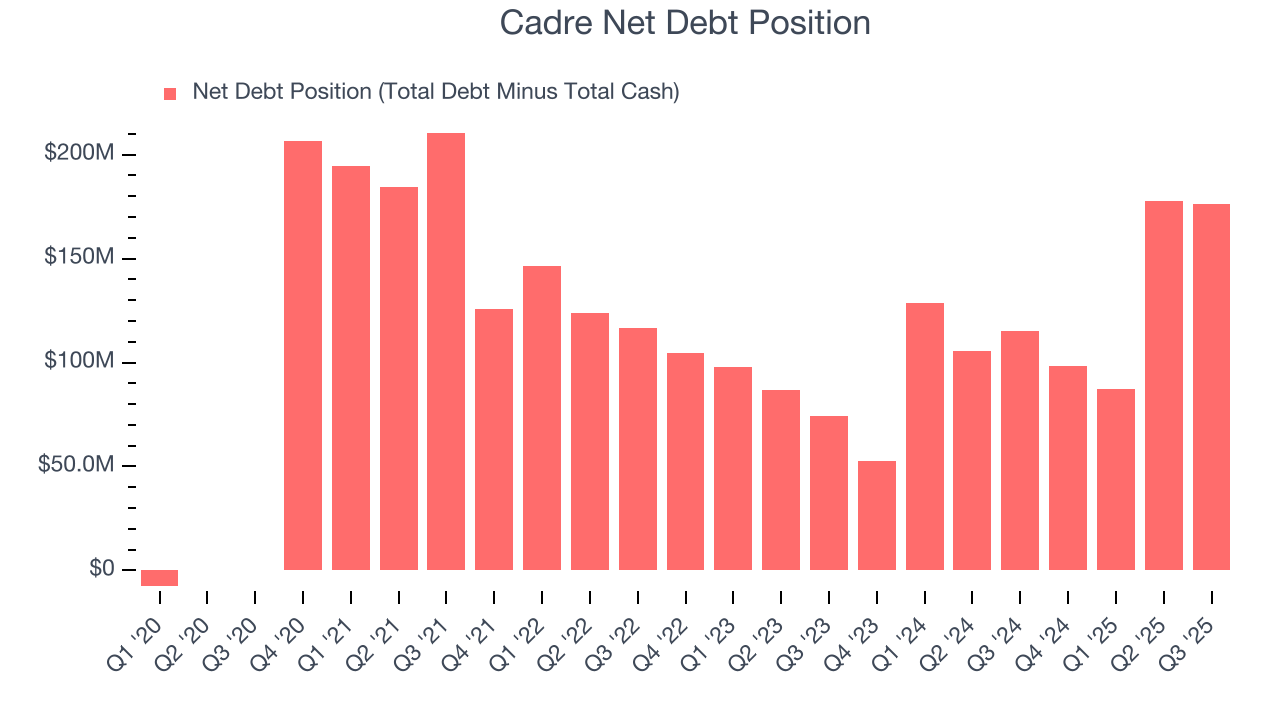

Cadre reported $150.9 million of cash and $327.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $115.8 million of EBITDA over the last 12 months, we view Cadre’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $4.98 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Cadre’s Q3 Results

We were impressed by how significantly Cadre blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS was in line with Wall Street’s estimates. On the other hand, its Products revenue missed and its revenue fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $42.29 immediately after reporting.

12. Is Now The Time To Buy Cadre?

Updated: February 19, 2026 at 10:20 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Cadre.

In our opinion, Cadre is a solid company. First off, its revenue growth was good over the last five years and is expected to accelerate over the next 12 months. And while its diminishing returns show management's recent bets still have yet to bear fruit, its astounding EPS growth over the last three years shows its profits are trickling down to shareholders. On top of that, its solid ROIC suggests it has grown profitably in the past.

Cadre’s P/E ratio based on the next 12 months is 28.8x. Looking at the industrials landscape right now, Cadre trades at a pretty interesting price. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $54 on the company (compared to the current share price of $43.39), implying they see 24.5% upside in buying Cadre in the short term.