Chegg (CHGG)

We wouldn’t buy Chegg. Its shrinking sales suggest demand is waning and its lousy free cash flow generation doesn’t do it any favors.― StockStory Analyst Team

1. News

2. Summary

Why We Think Chegg Will Underperform

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

- Sales tumbled by 21.1% annually over the last three years, showing consumer trends are working against its favor

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

- Engagement has been a thorn in its side as its services subscribers averaged 20.7% declines

Chegg is skating on thin ice. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Chegg

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Chegg

Chegg is trading at $0.65 per share, or 2.3x forward EV/EBITDA. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Chegg (CHGG) Research Report: Q4 CY2025 Update

Online study and academic help platform Chegg (NYSE:CHGG) announced better-than-expected revenue in Q4 CY2025, but sales fell by 49.4% year on year to $72.66 million. On the other hand, next quarter’s revenue guidance of $61 million was less impressive, coming in 5.5% below analysts’ estimates. Its non-GAAP loss of $0.01 per share was 90.3% above analysts’ consensus estimates.

Chegg (CHGG) Q4 CY2025 Highlights:

- Revenue: $72.66 million vs analyst estimates of $71 million (49.4% year-on-year decline, 2.3% beat)

- Adjusted EPS: -$0.01 vs analyst estimates of -$0.10 (90.3% beat)

- Adjusted EBITDA: $12.89 million vs analyst estimates of $10.76 million (17.7% margin, 19.8% beat)

- Revenue Guidance for Q1 CY2026 is $61 million at the midpoint, below analyst estimates of $64.58 million

- EBITDA guidance for Q1 CY2026 is $11.5 million at the midpoint, above analyst estimates of $7.23 million

- Operating Margin: -47.2%, down from -2.3% in the same quarter last year

- Free Cash Flow was -$15.48 million compared to -$943,000 in the previous quarter

- Market Capitalization: $86.37 million

Company Overview

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Today, the textbook rental part of the business has been deemphasized, and Chegg Services is the key product. Chegg Services, which is a subscription offering, includes Chegg Study, Chegg Writing, and Chegg Math. Chegg Study allows students to ask questions digitally and receive explanations from subject matter experts. Chegg Writing offers plagiarism detection scans, expert writing feedback, and citation generation. Chegg Math provides step-by-step problem solving so students can get the right answers but also can understand the problem solving process. Tutoring and language learning are emerging areas of focus.

Chegg addresses the high cost of educational resources. Originally, the company offered textbook rentals because the cost of buying, especially for budget-conscious college students, could put a dent in the wallet. From there, the company added subscription services to digitize the business and generate recurring touch points with customers rather than just when textbooks are acquired. The more subjects Chegg adds, the more it becomes a one-stop academic shop.

One growing priority for Chegg is to follow students beyond their educations. The company has begun offering career services such as internship resources and interviewing guides. It has also expanded into financial literacy and other life skills.

4. Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Competitors offering streaming entertainment platforms include Coursera (NYSE:COUR), Udemy (NASDAQ:UDMY), and private company Khan Academy.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Chegg’s demand was weak and its revenue declined by 21.1% per year. This wasn’t a great result and suggests it’s a low quality business.

This quarter, Chegg’s revenue fell by 49.4% year on year to $72.66 million but beat Wall Street’s estimates by 2.3%. Company management is currently guiding for a 49.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 42.3% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

6. Gross Margin & Pricing Power

For internet subscription businesses like Chegg, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center and infrastructure expenses, royalties, and other content-related costs if the company’s offerings include features such as video or music.

Chegg has robust unit economics, an output of its asset-lite business model and pricing power. Its margin is better than the broader consumer internet industry and enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 68.8% gross margin over the last two years. That means Chegg only paid its providers $31.21 for every $100 in revenue.

In Q4, Chegg produced a 57.3% gross profit margin, down 14.8 percentage points year on year. Chegg’s full-year margin has also been trending down over the past 12 months, decreasing by 7.5 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs.

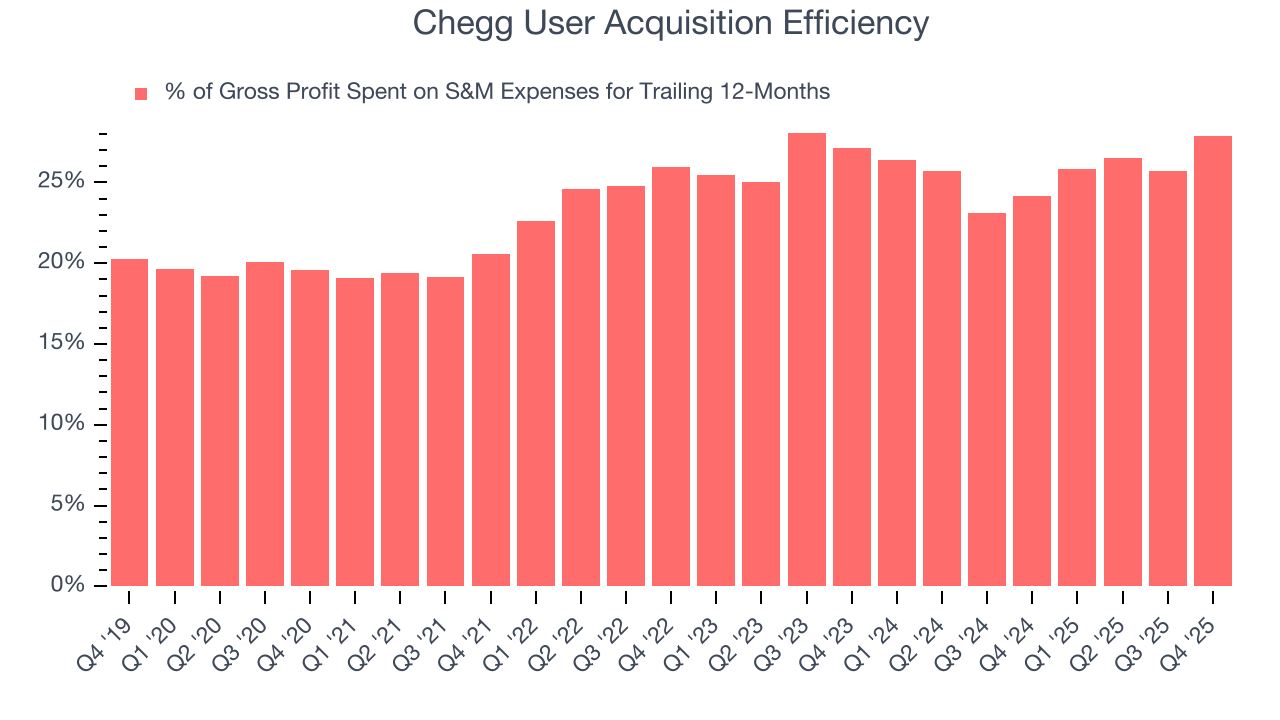

7. User Acquisition Efficiency

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Chegg grow from a combination of product virality, paid advertisement, and incentives.

Chegg is quite efficient at acquiring new users, spending only 27.9% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that Chegg has a highly differentiated product offering, giving it the freedom to invest its resources into new growth initiatives.

8. EBITDA

Chegg has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 21.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Chegg’s EBITDA margin decreased by 15 percentage points over the last few years. Even though its historical margin was healthy, shareholders will want to see Chegg become more profitable in the future.

In Q4, Chegg generated an EBITDA margin profit margin of 17.7%, down 7.7 percentage points year on year. Since Chegg’s gross margin decreased more than its EBITDA margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

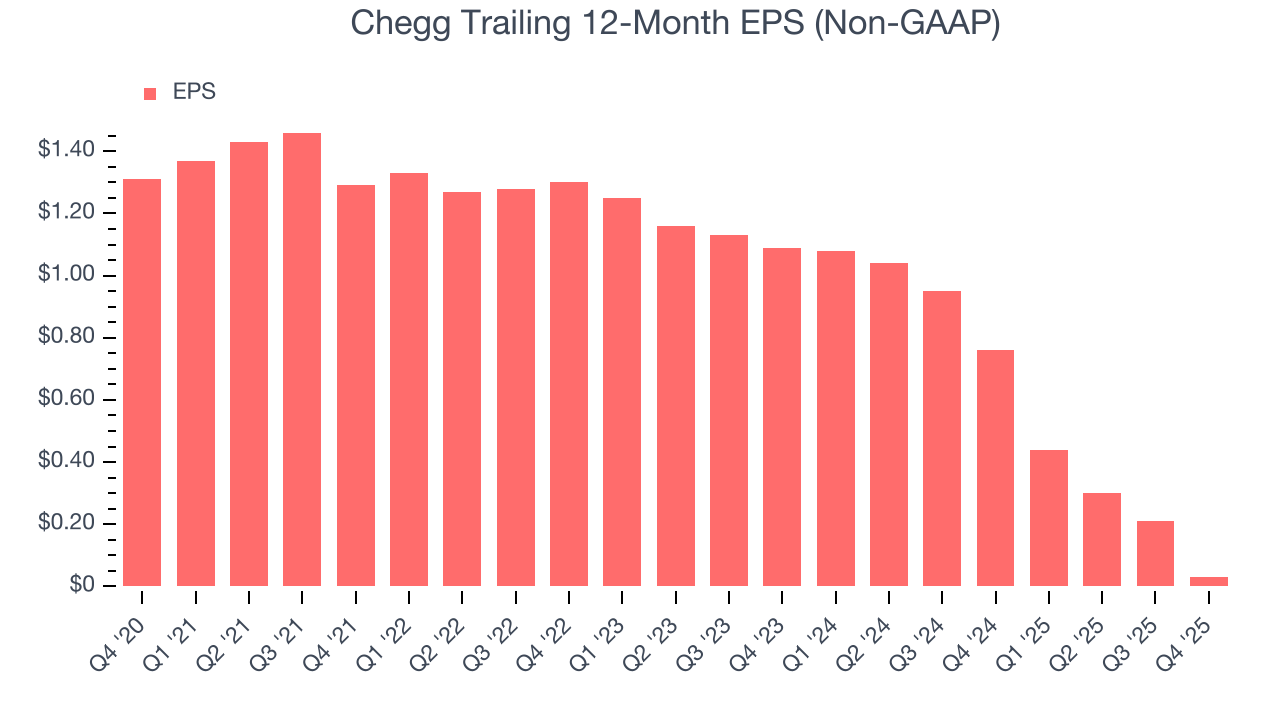

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Chegg, its EPS declined by 71.5% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into Chegg’s earnings to better understand the drivers of its performance. As we mentioned earlier, Chegg’s EBITDA margin declined by 15 percentage points over the last three years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Chegg reported adjusted EPS of negative $0.01, down from $0.17 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Chegg’s full-year EPS of $0.03 to shrink by 33.3%.

10. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Chegg has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.8%, subpar for a consumer internet business. The divergence from its good EBITDA margin stems from its capital-intensive business model, which requires Chegg to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Taking a step back, we can see that Chegg’s margin dropped by 23.5 percentage points over the last few years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Chegg burned through $15.48 million of cash in Q4, equivalent to a negative 21.3% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Chegg is a well-capitalized company with $72.82 million of cash and $68.97 million of debt on its balance sheet. This $3.85 million net cash position is 4.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Chegg’s Q4 Results

We were impressed by Chegg’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue guidance for next quarter missed. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 3.1% to $0.73 immediately after reporting.

13. Is Now The Time To Buy Chegg?

Updated: March 1, 2026 at 9:39 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies serving everyday consumers, but in the case of Chegg, we’ll be cheering from the sidelines. For starters, its revenue has declined over the last three years, and analysts expect its demand to deteriorate over the next 12 months. While its impressive EBITDA margins show it has a highly efficient business model, the downside is its users have declined. On top of that, its projected EPS for the next year is lacking.

Chegg’s EV/EBITDA ratio based on the next 12 months is 2.3x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.