ChargePoint (CHPT)

ChargePoint piques our interest, but its negative EBITDA and debt balance put it in a tough position.― StockStory Analyst Team

1. News

2. Summary

Why ChargePoint Is Not Exciting

The most prominent EV charging company during the COVID bull market, ChargePoint (NYSE:CHPT) is a provider of electric vehicle charging technology solutions in North America and Europe.

- Historical operating margin losses point to an inefficient cost structure

- Cash-burning history makes us doubt the long-term viability of its business model

- Negative EBITDA restricts its access to capital and increases the probability of shareholder dilution if things turn unexpectedly

ChargePoint has some noteworthy aspects, but we wouldn’t invest until its EBITDA can comfortably support its debt.

Why There Are Better Opportunities Than ChargePoint

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ChargePoint

ChargePoint’s stock price of $6.69 implies a valuation ratio of 0.4x forward price-to-sales. The market typically values companies like ChargePoint based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. ChargePoint (CHPT) Research Report: Q3 CY2025 Update

EV charging solutions provider ChargePoint Holdings (NYSE:CHPT) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 6.1% year on year to $105.7 million. Guidance for next quarter’s revenue was optimistic at $105 million at the midpoint, 2.5% above analysts’ estimates. Its GAAP loss of $2.23 per share was 3% below analysts’ consensus estimates.

ChargePoint (CHPT) Q3 CY2025 Highlights:

- Revenue: $105.7 million vs analyst estimates of $95.89 million (6.1% year-on-year growth, 10.2% beat)

- EPS (GAAP): -$2.23 vs analyst expectations of -$2.16 (3% miss)

- Adjusted EBITDA: -$19.45 million (-18.4% margin, 32% year-on-year growth)

- Revenue Guidance for Q4 CY2025 is $105 million at the midpoint, above analyst estimates of $102.4 million

- Adjusted EBITDA Margin: -18.4%, up from -28.7% in the same quarter last year

- Free Cash Flow was -$23.55 million compared to -$33.39 million in the same quarter last year

- Market Capitalization: $195 million

Company Overview

The most prominent EV charging company during the COVID bull market, ChargePoint (NYSE:CHPT) is a provider of electric vehicle charging technology solutions in North America and Europe.

ChargePoint's business model focuses on selling networked charging hardware combined with cloud-based software services. The company typically does not own or operate EV charging assets, nor does it monetize drivers or rely on profits from electricity sales.

The company's product portfolio includes Level 2 AC and DC fast charging equipment, cloud services for station management and driver interfaces, and extended warranty solutions. ChargePoint's latest charging station family, the CP6000 series, is designed for commercial and fleet applications, offering up to 19.2kW per port and compatibility with various connector standards. The company also provides DC fast charging solutions capable of delivering up to 500kW per port, depending on configuration.

ChargePoint's cloud services enable customers to manage charging operations, set pricing, control access, and optimize energy use. The company has recently launched a Network Operations Center to address network reliability through 24/7 proactive station monitoring and predictive analytics.

The company serves three different verticals: commercial, fleet, and residential. Commercial customers include various businesses and organizations looking to provide EV charging as an amenity or service. Fleet customers range from delivery and logistics companies to shared transit operators. In the residential sector, ChargePoint offers solutions for both single-family homes and multi-family dwellings.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors in the electric vehicle charging industry include Blink Charging (NASDAQ:BLNK), EVgo (NASDAQ:EVGO), and Wallbox (NYSE:WBX).

5. Revenue Growth

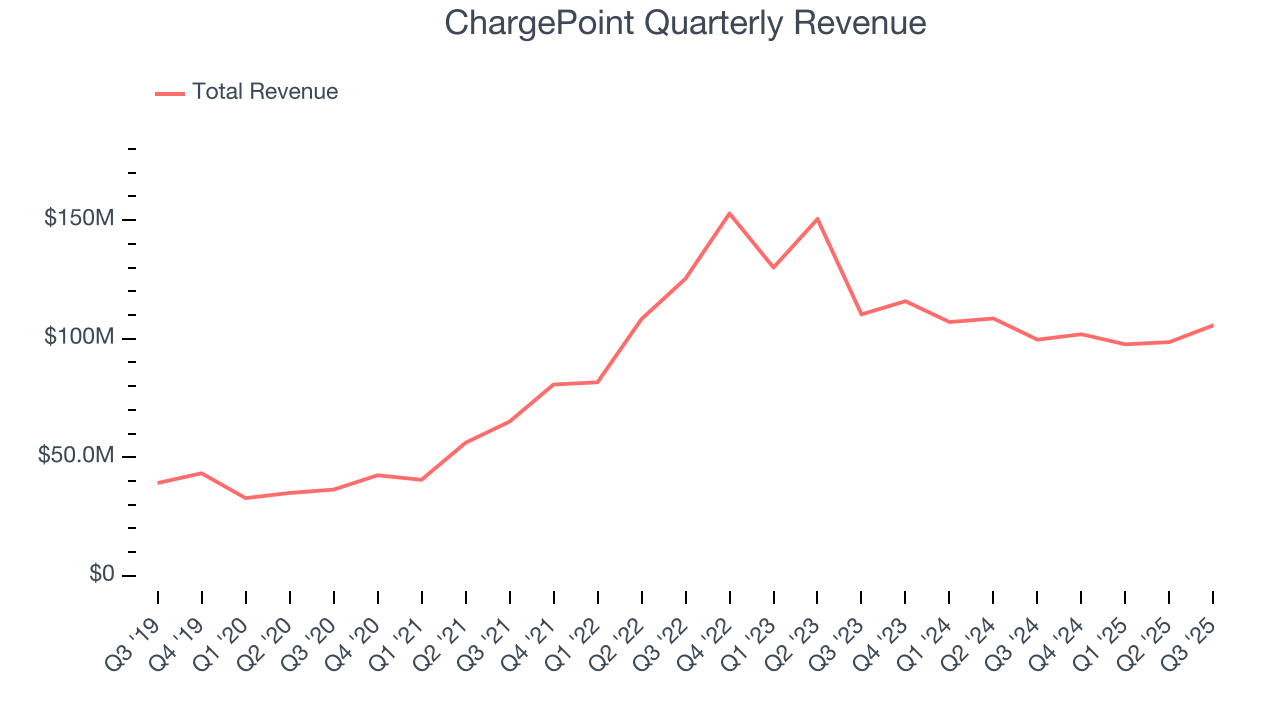

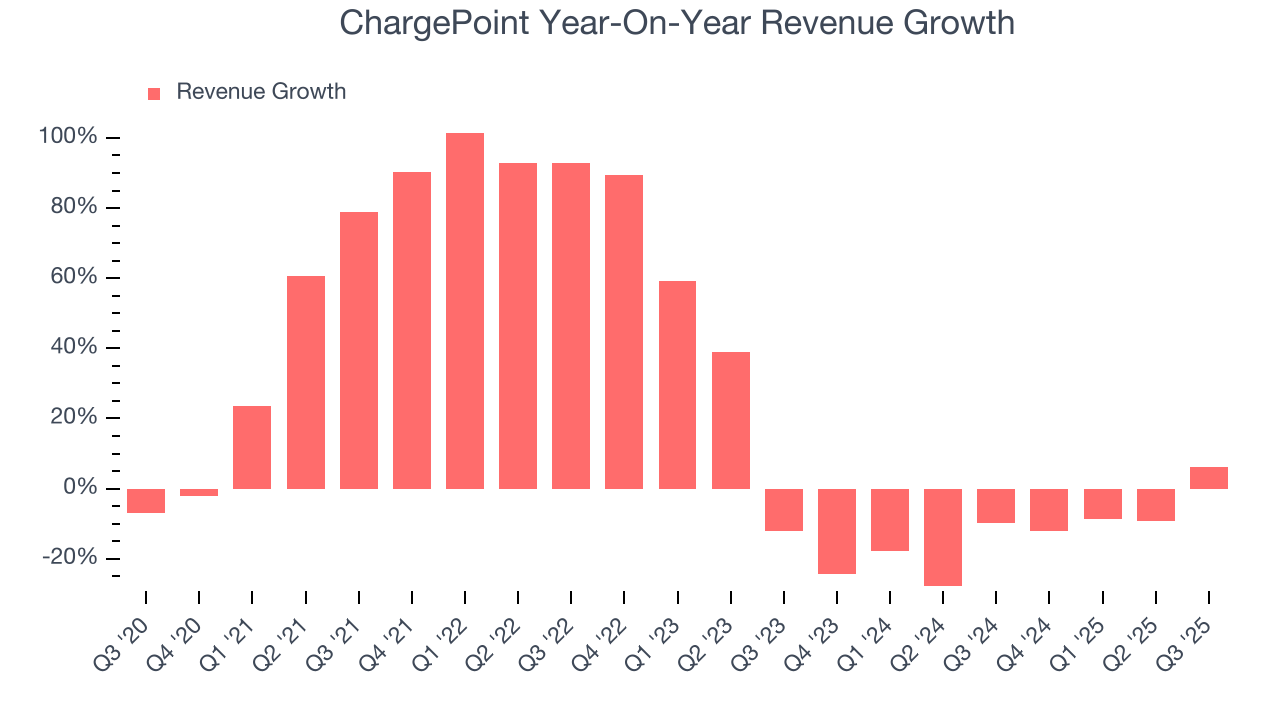

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, ChargePoint’s 22.3% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. ChargePoint’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 13.8% over the last two years.

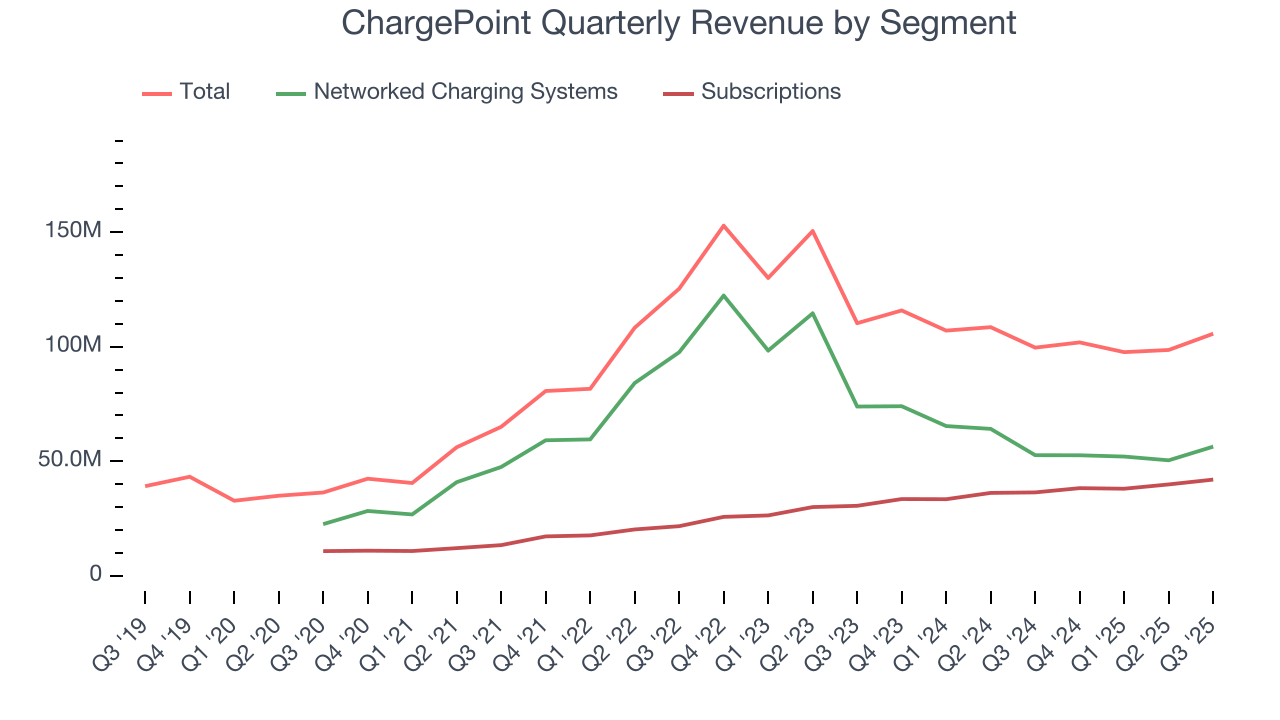

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Networked Charging Systems and Subscriptions, which are 53.4% and 39.7% of revenue. Over the last two years, ChargePoint’s Networked Charging Systems revenue (hardware) averaged 26.2% year-on-year declines. On the other hand, its Subscriptions revenue (software) averaged 18.8% growth.

This quarter, ChargePoint reported year-on-year revenue growth of 6.1%, and its $105.7 million of revenue exceeded Wall Street’s estimates by 10.2%. Company management is currently guiding for a 3.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

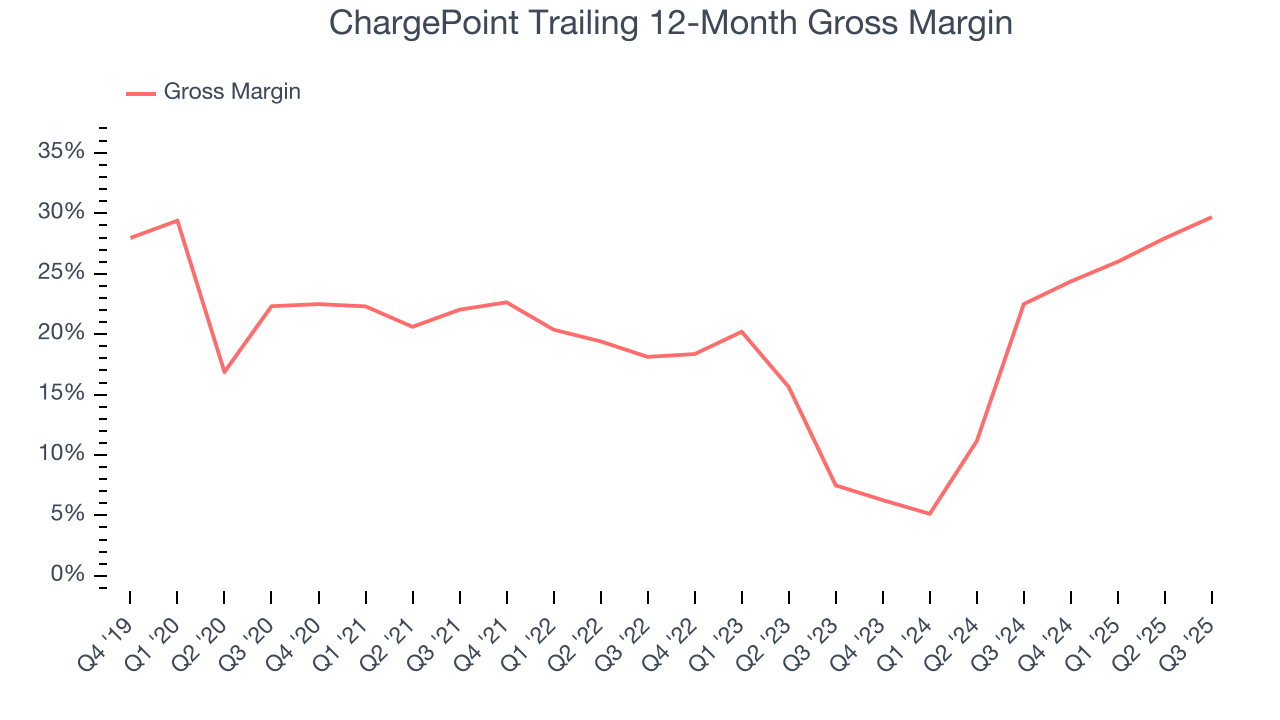

ChargePoint has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 18.9% gross margin over the last five years. That means ChargePoint paid its suppliers a lot of money ($81.08 for every $100 in revenue) to run its business.

ChargePoint’s gross profit margin came in at 30.7% this quarter, marking a 6.9 percentage point increase from 23.8% in the same quarter last year. ChargePoint’s full-year margin has also been trending up over the past 12 months, increasing by 7.2 percentage points. If this move continues, it could suggest a less competitive environment where the company has better pricing power and leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

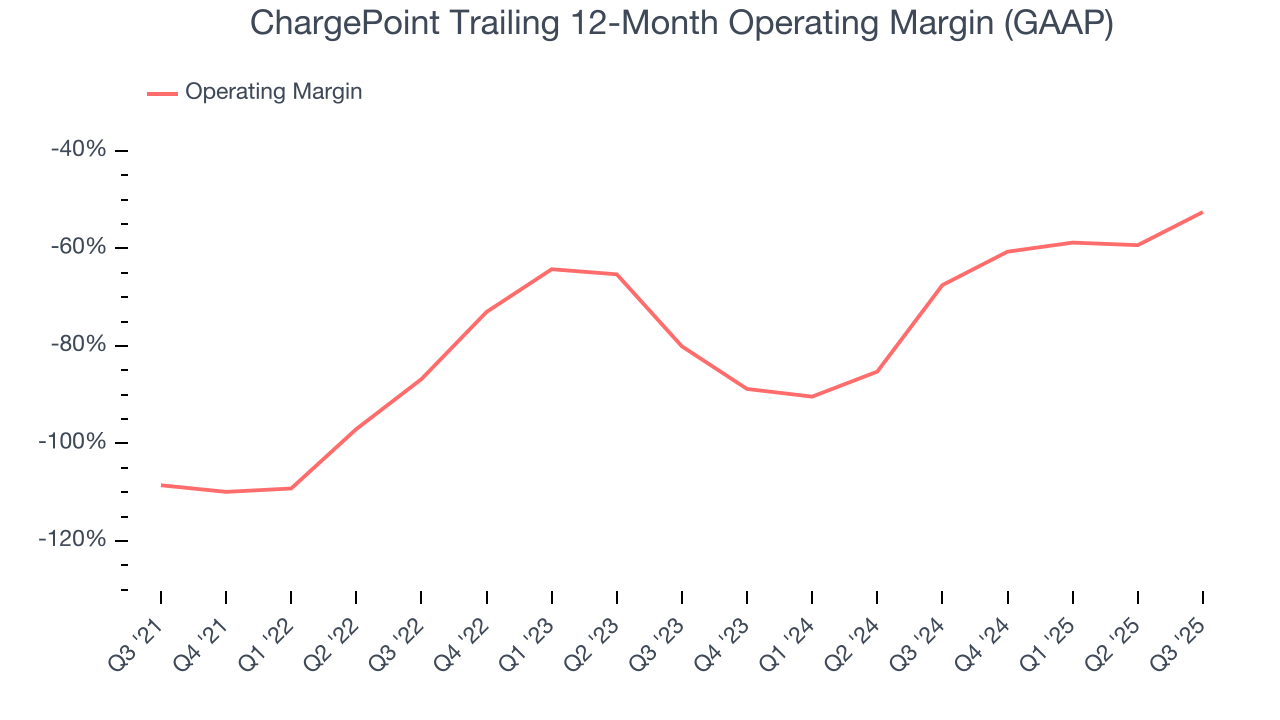

ChargePoint’s high expenses have contributed to an average operating margin of negative 76% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, ChargePoint’s operating margin rose by 56 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q3, ChargePoint generated a negative 42% operating margin.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

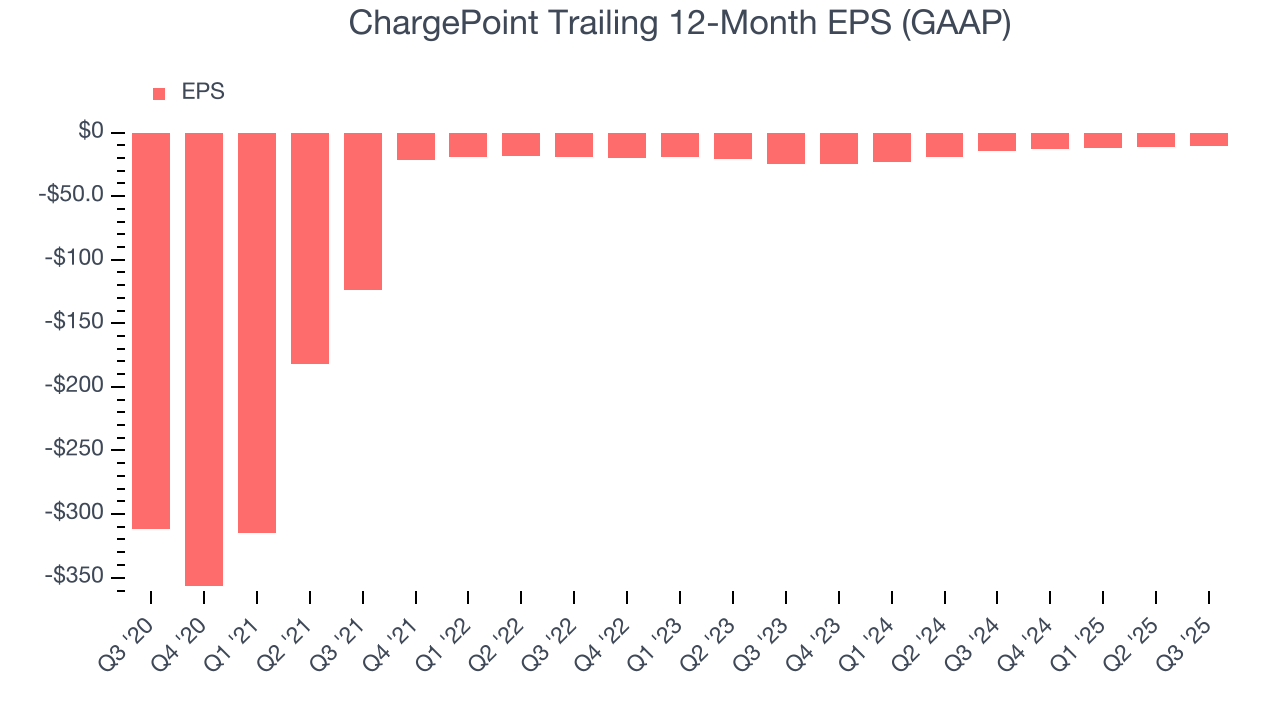

Although ChargePoint’s full-year earnings are still negative, it reduced its losses and improved its EPS by 49.4% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For ChargePoint, its two-year annual EPS growth of 35.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, ChargePoint reported EPS of negative $2.23, up from negative $3.56 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects ChargePoint to improve its earnings losses. Analysts forecast its full-year EPS of negative $10.33 will advance to negative $7.93.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

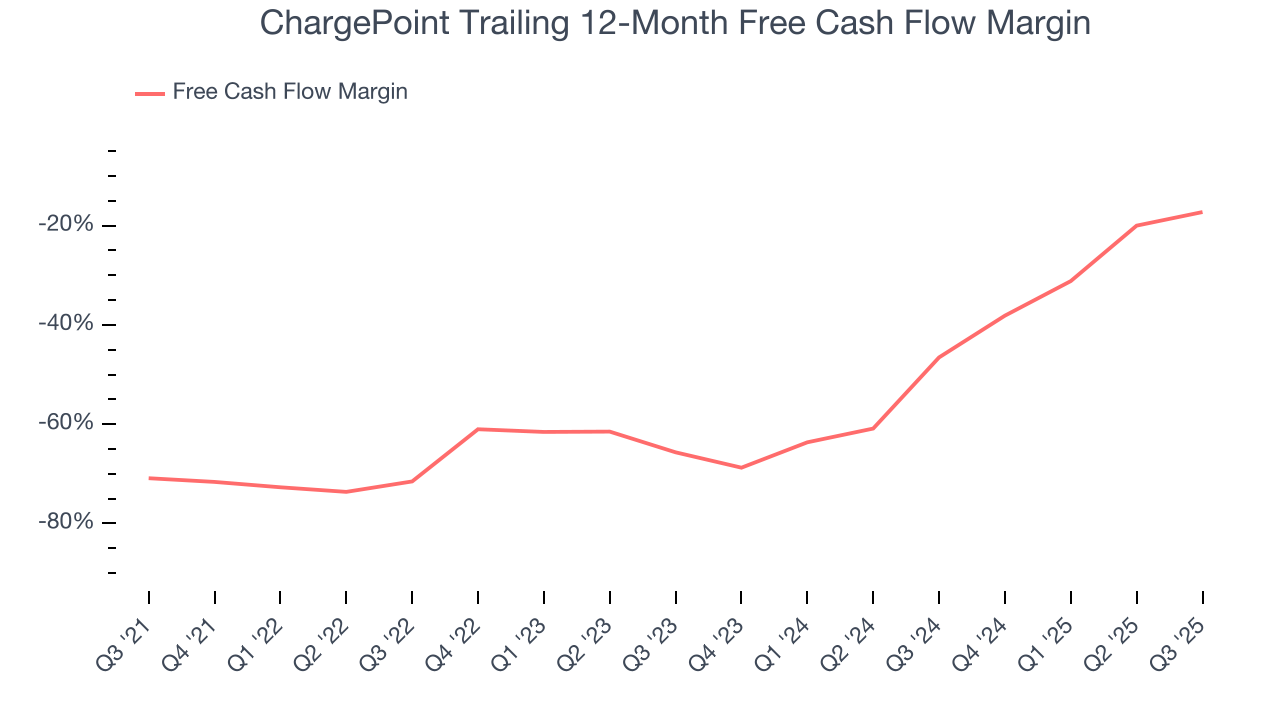

ChargePoint’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 53.3%, meaning it lit $53.33 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that ChargePoint’s margin expanded by 53.6 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

ChargePoint burned through $23.55 million of cash in Q3, equivalent to a negative 22.3% margin. The company’s cash burn was similar to its $33.39 million of lost cash in the same quarter last year.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

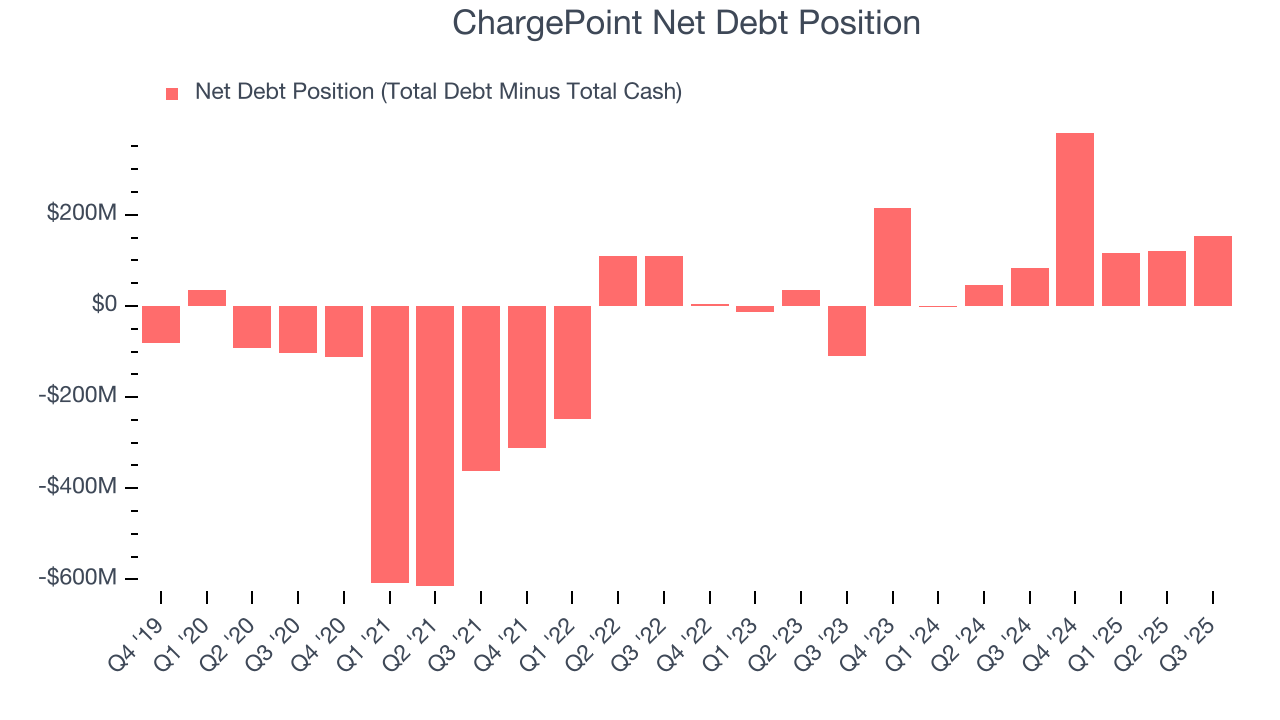

ChargePoint posted negative $81.62 million of EBITDA over the last 12 months, and its $333.7 million of debt exceeds the $180.9 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade ChargePoint if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope ChargePoint can improve its profitability and remain cautious until then.

11. Key Takeaways from ChargePoint’s Q3 Results

We were impressed by how significantly ChargePoint blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.9% to $9.15 immediately following the results.

12. Is Now The Time To Buy ChargePoint?

Updated: January 21, 2026 at 10:26 PM EST

Are you wondering whether to buy ChargePoint or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Aside from its balance sheet, ChargePoint is a pretty decent company. To kick things off, its revenue growth was exceptional over the last five years. And while its operating margins reveal poor profitability compared to other industrials companies, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

ChargePoint’s forward price-to-sales ratio is 0.4x. Despite its notable business characteristics, we’d hold off for now because its balance sheet concerns us. We think a potential buyer of the stock should wait until the company generates sufficient cash flows or raises money.

Wall Street analysts have a consensus one-year price target of $10.19 on the company (compared to the current share price of $6.61).