Cigna (CI)

Cigna is interesting. Its scale gives it meaningful leverage when negotiating reimbursement rates.― StockStory Analyst Team

1. News

2. Summary

Why Cigna Is Interesting

With roots dating back to 1792 and serving millions of customers across the globe, The Cigna Group (NYSE:CI) provides healthcare services through its Evernorth Health Services and Cigna Healthcare segments, offering pharmacy benefits, specialty care, and medical plans.

- Enormous revenue base of $274.7 billion gives it leverage over plan holders and advantageous reimbursement terms with healthcare providers

- Earnings per share grew by 10.1% annually over the last five years, comfortably beating the peer group average

- On the other hand, its weak customer trends over the past two years suggest it may need to improve its products, pricing, or go-to-market strategy

Cigna is solid, but not perfect. If you like the stock, the valuation looks reasonable.

Why Is Now The Time To Buy Cigna?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Cigna?

At $272.18 per share, Cigna trades at 9.3x forward P/E. Price is what you pay, and value is what you get. Considering this, we think the current valuation is quite a good deal.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Cigna (CI) Research Report: Q4 CY2025 Update

Health insurance company Cigna (NYSE:CI) announced better-than-expected revenue in Q4 CY2025, with sales up 10.3% year on year to $72.47 billion. On the other hand, the company’s full-year revenue guidance of $280 billion at the midpoint came in 0.9% below analysts’ estimates. Its non-GAAP profit of $8.08 per share was 2.5% above analysts’ consensus estimates.

Cigna (CI) Q4 CY2025 Highlights:

- Revenue: $72.47 billion vs analyst estimates of $69.86 billion (10.3% year-on-year growth, 3.7% beat)

- Adjusted EPS: $8.08 vs analyst estimates of $7.88 (2.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $30.25 at the midpoint, in line with analyst estimates

- Operating Margin: 3%, in line with the same quarter last year

- Customers: 16.42 million, up from 16.35 million in the previous quarter

- Market Capitalization: $72.58 billion

Company Overview

With roots dating back to 1792 and serving millions of customers across the globe, The Cigna Group (NYSE:CI) provides healthcare services through its Evernorth Health Services and Cigna Healthcare segments, offering pharmacy benefits, specialty care, and medical plans.

The Cigna Group operates through two main segments. Evernorth Health Services partners with health plans, employers, government organizations, and healthcare providers to deliver pharmacy benefits management, specialty pharmacy services, and care solutions. This segment includes Express Scripts, one of the largest pharmacy benefits managers in the U.S., and Accredo, a specialty pharmacy focused on complex and rare diseases.

The Cigna Healthcare segment provides medical insurance and administrative services to employers, individuals, and government programs. It offers a range of funding arrangements from fully-insured to administrative services only (ASO) plans where employers self-fund healthcare costs. The segment also includes specialty benefits like dental, behavioral health, and pharmacy management solutions.

A typical employer client might use Cigna's ASO services to administer their self-funded health plan while also accessing Evernorth's pharmacy benefits management to control prescription costs. Meanwhile, an individual with a complex condition might receive specialty medications through Accredo while being supported by care management programs.

The company generates revenue through various streams: administrative fees from self-funded clients, insurance premiums from fully-insured customers, and pharmacy-related revenues. For Medicare Advantage plans, Cigna receives payments from the Centers for Medicare and Medicaid Services (CMS) based on customer demographics and health risk factors.

Cigna emphasizes value-based care arrangements with healthcare providers, moving away from traditional fee-for-service models toward payment structures that reward quality outcomes and cost efficiency. The company has over 200 collaborative care arrangements with primary care groups and contracts with more than 200 hospital systems involving quality-based reimbursements.

4. Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

The Cigna Group competes with other major health insurers and pharmacy benefit managers including UnitedHealth Group (NYSE:UNH), CVS Health/Aetna (NYSE:CVS), Humana (NYSE:HUM), Anthem/Elevance Health (NYSE:ELV), and Centene Corporation (NYSE:CNC). In the pharmacy benefits management space, specific competitors include CVS Caremark and OptumRx (part of UnitedHealth Group).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $274.6 billion in revenue over the past 12 months, Cigna is one of the most scaled enterprises in healthcare. This is particularly important because health insurance providers companies are volume-driven businesses due to their low margins.

6. Revenue Growth

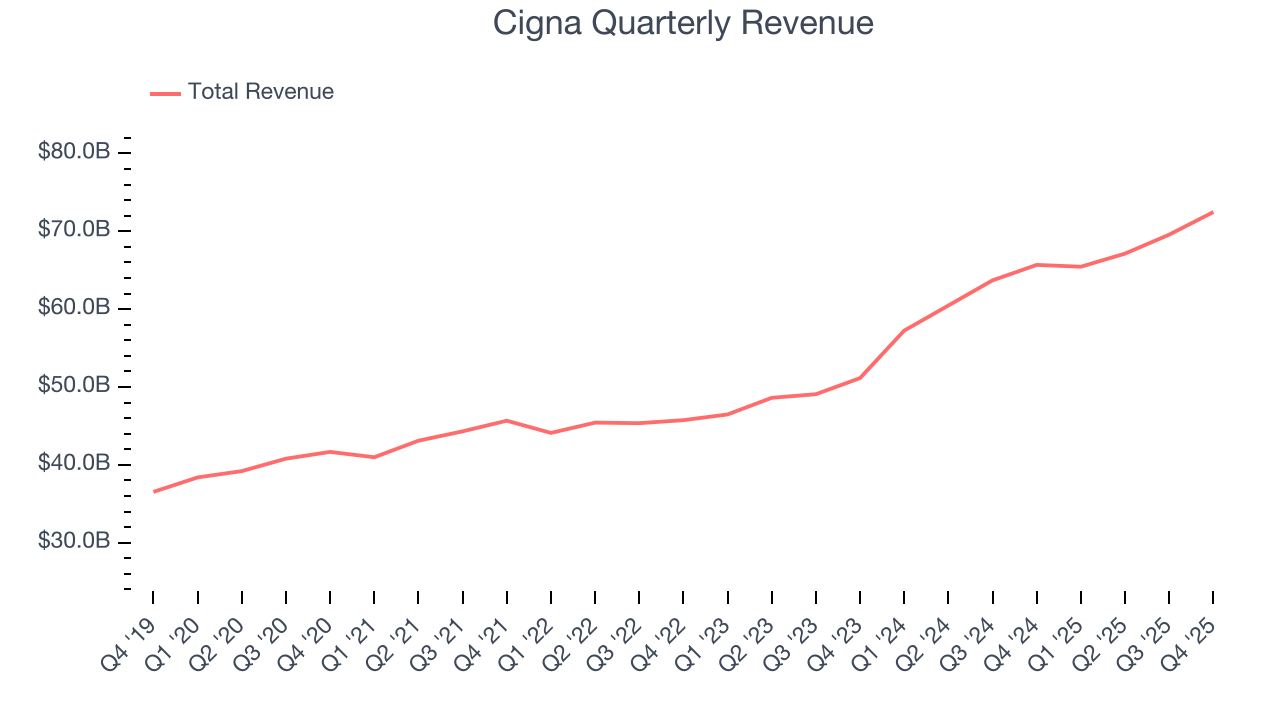

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Cigna grew its sales at a decent 11.4% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Cigna’s annualized revenue growth of 18.6% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 16.42 million in the latest quarter. Over the last two years, Cigna’s customer base averaged 4.5% year-on-year declines. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Cigna reported year-on-year revenue growth of 10.3%, and its $72.47 billion of revenue exceeded Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

7. Operating Margin

Cigna was profitable over the last five years but held back by its large cost base. Its average operating margin of 4% was weak for a healthcare business.

Looking at the trend in its profitability, Cigna’s operating margin decreased by 1.3 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 1.1 percentage points. We still like Cigna but would like to see some improvement in the future.

This quarter, Cigna generated an operating margin profit margin of 3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

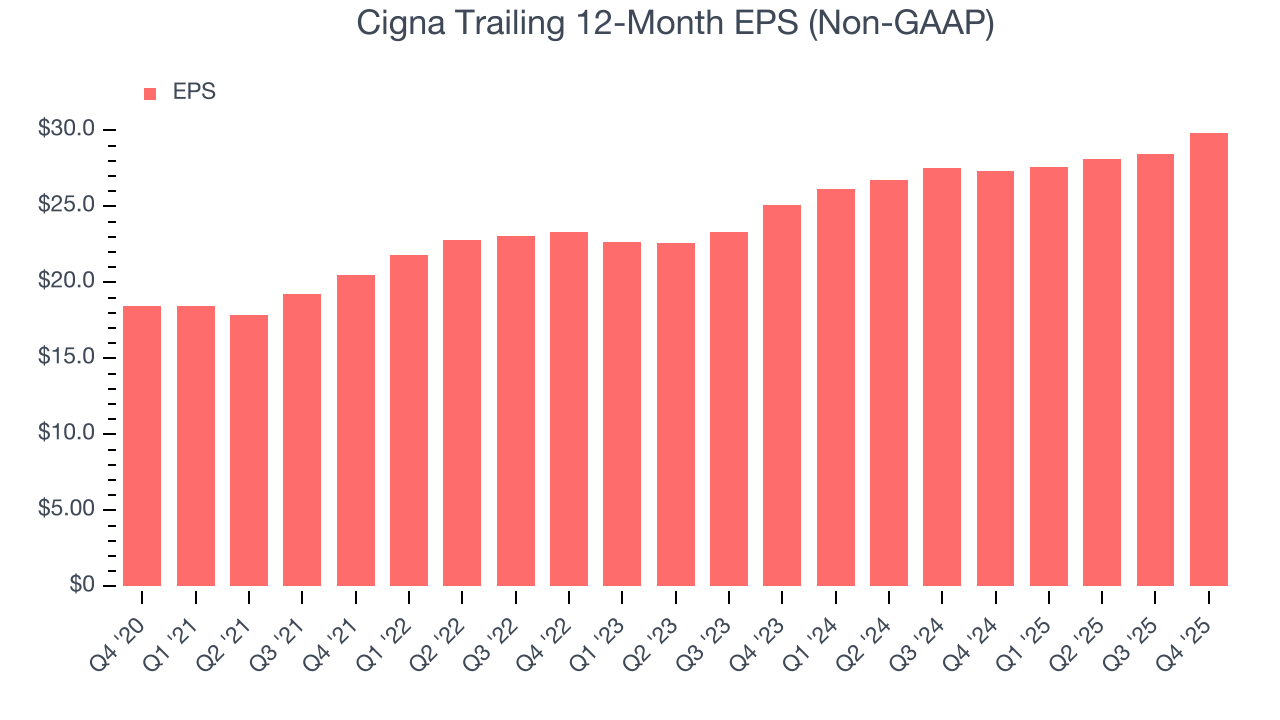

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Cigna’s remarkable 10.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Cigna reported adjusted EPS of $8.08, up from $6.64 in the same quarter last year. This print beat analysts’ estimates by 2.5%. Over the next 12 months, Wall Street expects Cigna’s full-year EPS of $29.85 to grow 1.6%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Cigna has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.5%, subpar for a healthcare business.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Cigna’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 9.8%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Cigna’s ROIC averaged 2.4 percentage point increases each year over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

Cigna reported $7.68 billion of cash and $31.46 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $11.87 billion of EBITDA over the last 12 months, we view Cigna’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $1.06 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Cigna’s Q4 Results

We enjoyed seeing Cigna beat analysts’ revenue expectations this quarter. We were also happy its customer base was in line with Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed and its full-year EPS guidance was in line with Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $270.78 immediately following the results.

13. Is Now The Time To Buy Cigna?

Updated: March 9, 2026 at 12:14 AM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Cigna.

In our opinion, Cigna is a solid company. First off, its revenue growth was good over the last five years. And while its customer momentum declined, its scale gives it meaningful leverage when negotiating reimbursement rates. On top of that, its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders.

Cigna’s P/E ratio based on the next 12 months is 9.3x. Looking at the healthcare landscape right now, Cigna trades at a pretty interesting price. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $336.67 on the company (compared to the current share price of $272.18), implying they see 23.7% upside in buying Cigna in the short term.