Cummins (CMI)

We aren’t fans of Cummins. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Cummins Is Not Exciting

With more than half of the heavy-duty truck market using its engines at one point, Cummins (NYSE:CMI) offers engines and power systems.

- Gross margin of 24.6% is below its competitors, leaving less money to invest in areas like marketing and R&D

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 6.2%

- A silver lining is that its ROIC punches in at 17.5%, illustrating management’s expertise in identifying profitable investments

Cummins’s quality doesn’t meet our bar. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Cummins

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Cummins

Cummins is trading at $560.28 per share, or 22x forward P/E. This multiple is lower than most industrials companies, but for good reason.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Cummins (CMI) Research Report: Q4 CY2025 Update

Engine manufacturer Cummins (NYSE:CMI) announced better-than-expected revenue in Q4 CY2025, with sales up 1.1% year on year to $8.54 billion. Its GAAP profit of $4.27 per share was 14.9% below analysts’ consensus estimates.

Cummins (CMI) Q4 CY2025 Highlights:

- Revenue: $8.54 billion vs analyst estimates of $8.11 billion (1.1% year-on-year growth, 5.3% beat)

- EPS (GAAP): $4.27 vs analyst expectations of $5.02 (14.9% miss)

- Adjusted EBITDA: $1.37 billion vs analyst estimates of $1.34 billion (16% margin, 2.4% beat)

- Operating Margin: 9.5%, in line with the same quarter last year

- Free Cash Flow Margin: 11.6%, up from 10.4% in the same quarter last year

- Market Capitalization: $83.6 billion

Company Overview

With more than half of the heavy-duty truck market using its engines at one point, Cummins (NYSE:CMI) offers engines and power systems.

Cummins was founded in 1919 by a mechanic and banker focused on developing the diesel engine. It was not until 1933 that the company saw success and its engine eventually became an integral part of the post-World War II road-building boom. The company continued to grow organically and made acquisitions which enabled it to begin offering natural gas engines, power generation systems, and filtration and emission technologies. Specifically, its 2022 acquisition of Meritor for $3.7 billion was pivotal for expanding its range of engine offerings and adding new axle and brake technology to its existing product line.

Cummins offers diesel and natural gas engines used in trucks, buses, and heavy equipment like bulldozers and excavators. These engines are used for a wide variety of purposes ranging from trucks making deliveries of freight to construction machinery and agricultural operations. In addition, the company also offers power generation (producing electricity using engines or generators) systems. These systems ensure electricity supply and are crucial for powering buildings, especially in areas where grid electricity may be unreliable or unavailable.

Supplementing its core offerings, Cummins also develops technologies that clean up engine exhaust. It makes filters and systems that reduce harmful pollutants like smoke and gasses from diesel engines. These are sold as components integrated into its engines or as aftermarket products.

The company primarily engages in long-term contracts typically spanning three to five years, though it can vary depending on the customer. These contracts include agreements on the sale of its products and can include service agreements.

4. Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Competitors offering similar products include Caterpillar (NYSE:CAT), Deere (NYSE:DE), PACCAR (NASDAQ:PCAR), and Navistar (NYSE:NAV).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Cummins’s sales grew at an impressive 11.2% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Cummins’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years. We also note many other Heavy Transportation Equipment businesses have faced declining sales because of cyclical headwinds. While Cummins’s growth wasn’t the best, it did do better than its peers.

Cummins also breaks out the revenue for its most important segments, Components and Engine , which are 28.6% and 30.5% of revenue. Over the last two years, Cummins’s Components revenue (axles, brakes, drivelines) averaged 12.9% year-on-year declines while its Engine revenue (diesel and gas-powered engines) averaged 3.4% declines.

This quarter, Cummins reported modest year-on-year revenue growth of 1.1% but beat Wall Street’s estimates by 5.3%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

Cummins has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 24.5% gross margin over the last five years. Said differently, Cummins had to pay a chunky $75.46 to its suppliers for every $100 in revenue.

Cummins produced a 22.9% gross profit margin in Q4, marking a 2.5 percentage point decrease from 25.4% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Cummins’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 9.9% over the last five years. This profitability was higher than the broader industrials sector, showing it did a decent job managing its expenses.

Analyzing the trend in its profitability, Cummins’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Cummins generated an operating margin profit margin of 9.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

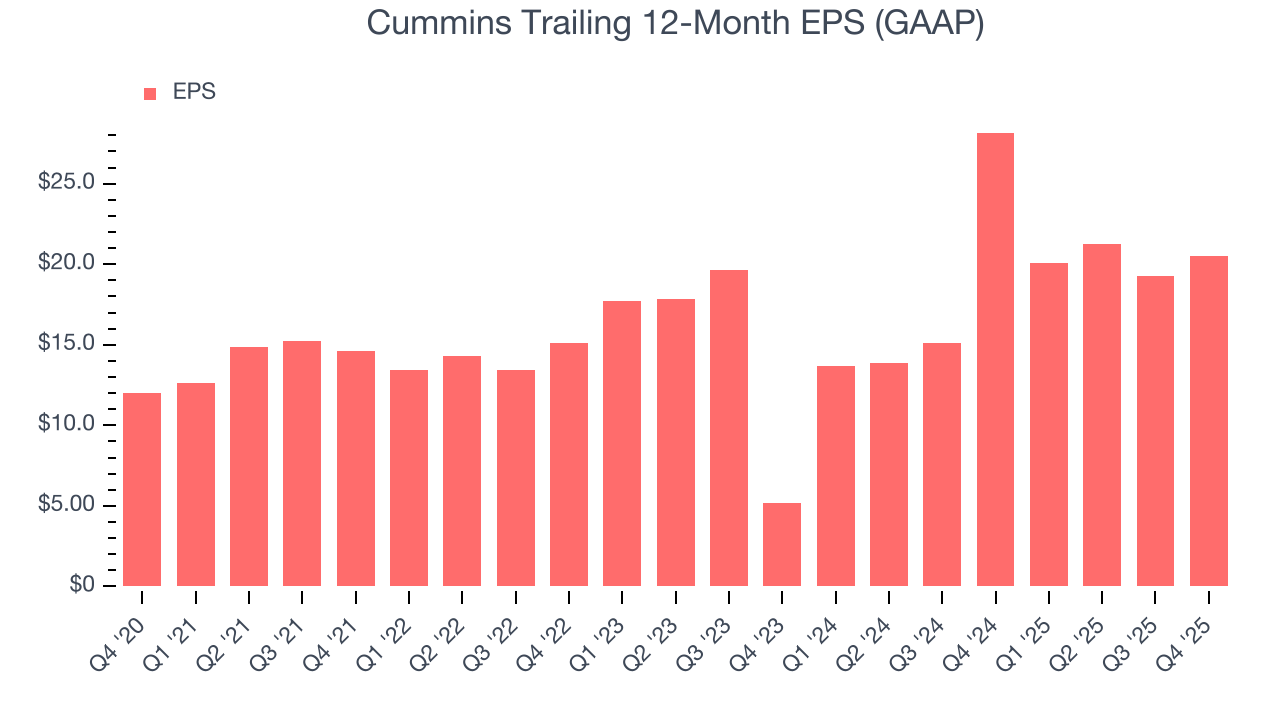

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Cummins’s solid 11.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Cummins’s two-year annual EPS growth of 99% was fantastic and topped its flat revenue.

Diving into the nuances of Cummins’s earnings can give us a better understanding of its performance. While we mentioned earlier that Cummins’s operating margin was flat this quarter, a two-year view shows its margin has expandedwhile its share count has shrunk 2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Cummins reported EPS of $4.27, up from $3.02 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Cummins’s full-year EPS of $20.52 to grow 21.4%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Cummins has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.3%, subpar for an industrials business.

Cummins’s free cash flow clocked in at $990 million in Q4, equivalent to a 11.6% margin. This result was good as its margin was 1.2 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Cummins hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 17.5%, impressive for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Cummins’s ROIC averaged 2 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

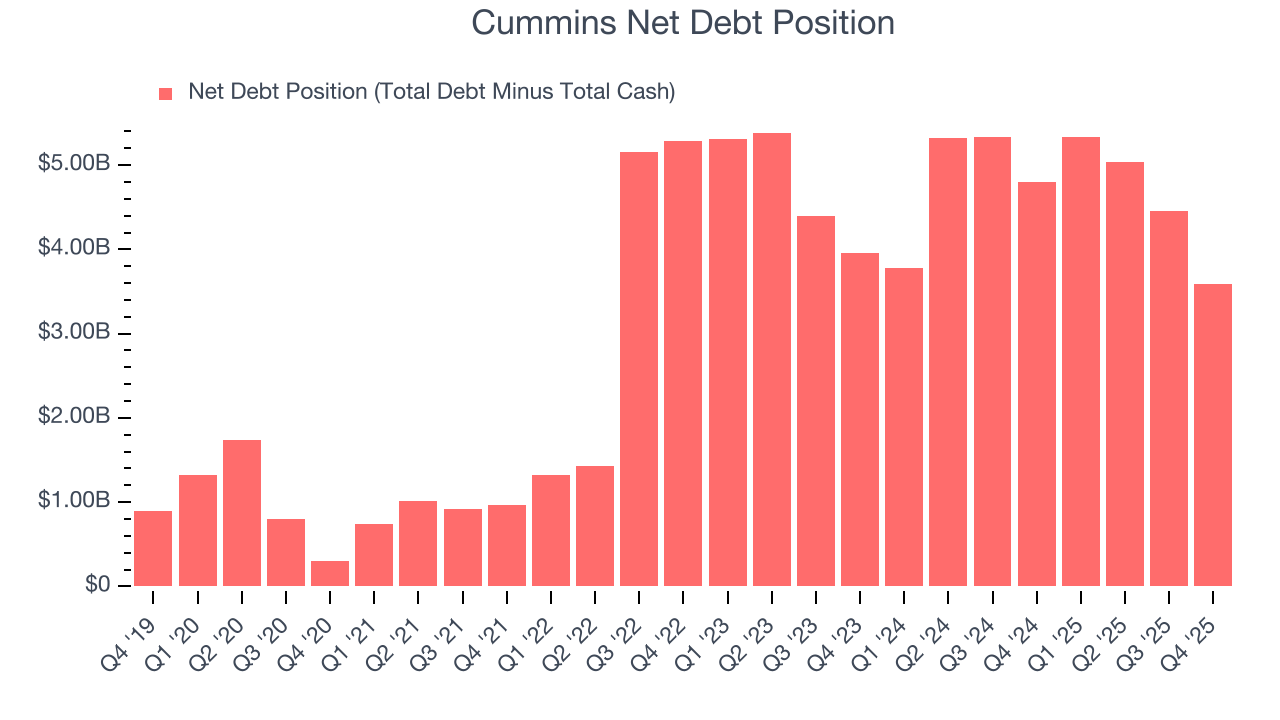

11. Balance Sheet Assessment

Cummins reported $3.61 billion of cash and $7.20 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $5.84 billion of EBITDA over the last 12 months, we view Cummins’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $80 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Cummins’s Q4 Results

We were impressed by how significantly Cummins blew past analysts’ revenue expectations this quarter. We were also glad its Components revenue topped Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 1.4% to $597.43 immediately following the results.

13. Is Now The Time To Buy Cummins?

Updated: March 3, 2026 at 10:45 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Cummins.

Cummins isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its gross margins are lower than its industrials peers. And while the company’s stellar ROIC suggests it has been a well-run company historically, the downside is its diminishing returns show management's prior bets haven't worked out.

Cummins’s P/E ratio based on the next 12 months is 22x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $613.23 on the company (compared to the current share price of $560.28).