Coty (COTY)

We wouldn’t buy Coty. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Coty Will Underperform

With a portfolio boasting many household brands, Coty (NYSE:COTY) is a beauty products powerhouse spanning cosmetics, fragrances, and skincare.

- Organic sales performance over the past two years indicates the company may need to make strategic adjustments or rely on M&A to catalyze faster growth

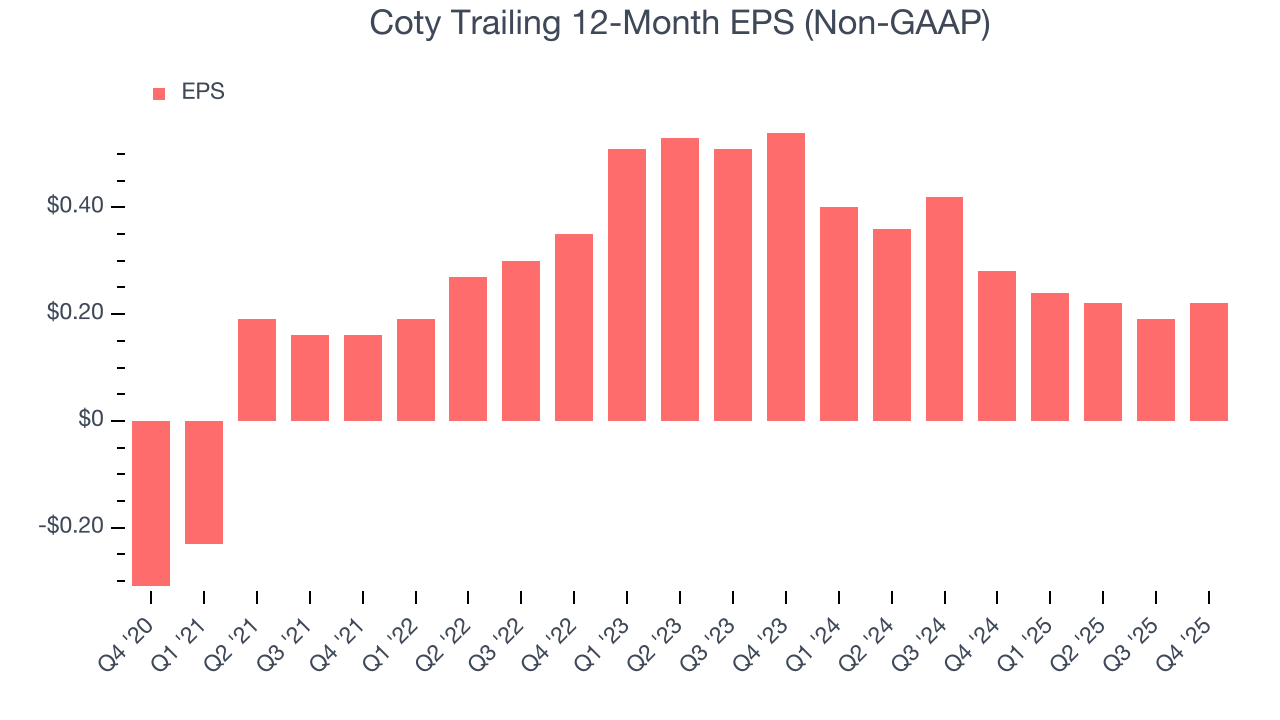

- Earnings per share have dipped by 14.3% annually over the past three years, which is concerning because stock prices follow EPS over the long term

- ROIC of 3.4% reflects management’s challenges in identifying attractive investment opportunities

Coty lacks the business quality we seek. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Coty

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Coty

Coty is trading at $2.67 per share, or 7.3x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Coty (COTY) Research Report: Q4 CY2025 Update

Beauty products company Coty (NYSE:COTY) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales were flat year on year at $1.68 billion. Its non-GAAP profit of $0.14 per share was 24.2% below analysts’ consensus estimates.

Coty (COTY) Q4 CY2025 Highlights:

- Revenue: $1.68 billion vs analyst estimates of $1.66 billion (flat year on year, 1.1% beat)

- Adjusted EPS: $0.14 vs analyst expectations of $0.18 (24.2% miss)

- Adjusted EBITDA: $330.2 million vs analyst estimates of $338.1 million (19.7% margin, 2.3% miss)

- Operating Margin: 8.8%, down from 16.1% in the same quarter last year

- Free Cash Flow Margin: 30.6%, up from 25.1% in the same quarter last year

- Organic Revenue fell 3% year on year (beat)

- Market Capitalization: $3 billion

Company Overview

With a portfolio boasting many household brands, Coty (NYSE:COTY) is a beauty products powerhouse spanning cosmetics, fragrances, and skincare.

The company’s most iconic brands include CoverGirl, Clairol, OPI, and Rimmel London. In addition, Coty has licensing agreements in place to offer fragrances and select other products bearing the Gucci, Calvin Klein, Balenciaga, and Marc Jacobs brands. While there are differences between the brands, the unifying theme is quality at an attainable price.

Given the breadth of its offerings and brand portfolio as well as its mid-tier price points, Coty caters to a broad spectrum of beauty enthusiasts. Their core customer is a middle-income adult woman. She cares about her appearance and has strong brand preferences, but she also doesn’t want to break the bank by buying beauty and personal care products. To meet her needs, the company’s messaging mixes aspiration (celebrity endorsements), inclusivity (products for all ages and races), and trendiness.

Coty products enjoy wide distribution and are most commonly found in beauty retailers such as Ulta Beauty (NASDAQ:ULTA), department stores such as Macy’s (NYSE:M) and Kohl’s (NYSE:KSS), and drugstores such as CVS (NYSE:CVS). This mass distribution ensures that the customer base is never far from a Coty product and also reinforces the brand’s attainability and reasonable price points.

4. Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors that offer a wide range of beauty and cosmetics products include L’Oreal (ENXTPA:OR), Estée Lauder (NYSE:EL), Proctor & Gamble (NYSE:PG), and private company Revlon.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $5.81 billion in revenue over the past 12 months, Coty carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

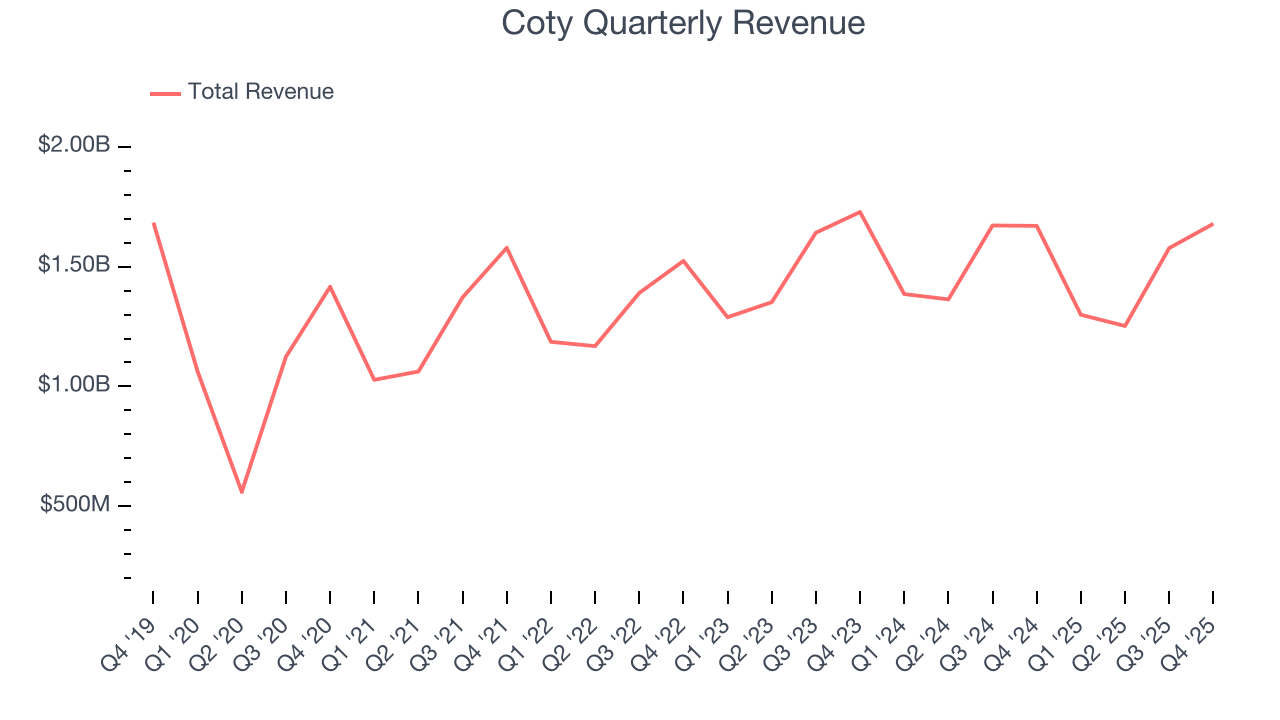

As you can see below, Coty’s 3.3% annualized revenue growth over the last three years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Coty’s $1.68 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, similar to its three-year rate. This projection is underwhelming and indicates its newer products will not accelerate its top-line performance yet.

6. Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

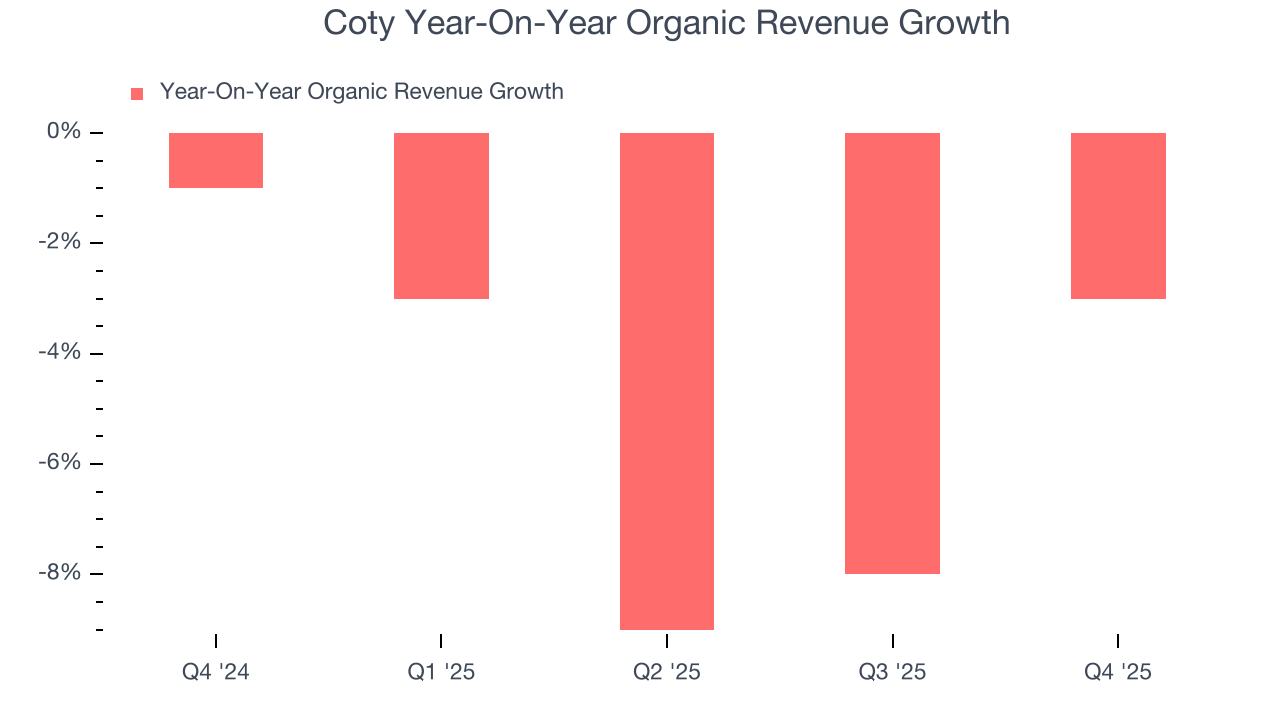

Coty’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 4.8% year on year.

In the latest quarter, Coty’s organic sales fell by 3% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

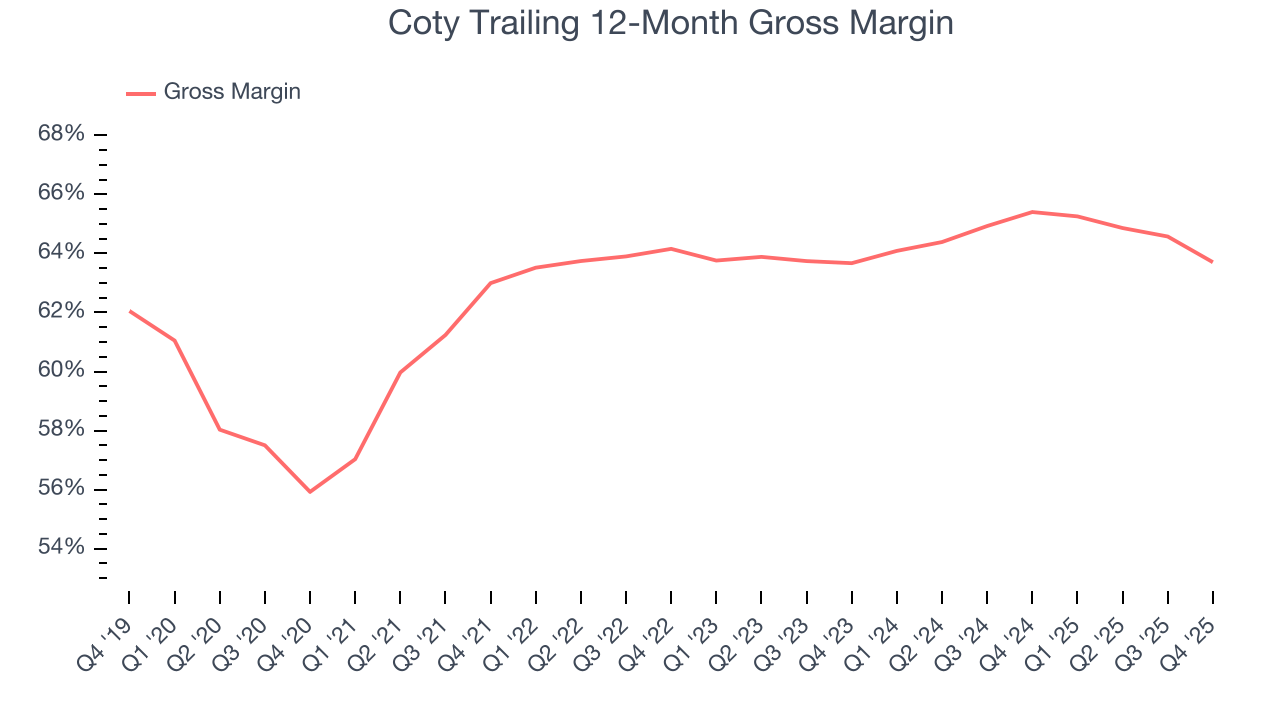

Coty has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 64.6% gross margin over the last two years. That means for every $100 in revenue, only $35.43 went towards paying for raw materials, production of goods, transportation, and distribution.

In Q4, Coty produced a 63.8% gross profit margin, marking a 3 percentage point decrease from 66.8% in the same quarter last year. Coty’s full-year margin has also been trending down over the past 12 months, decreasing by 1.7 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

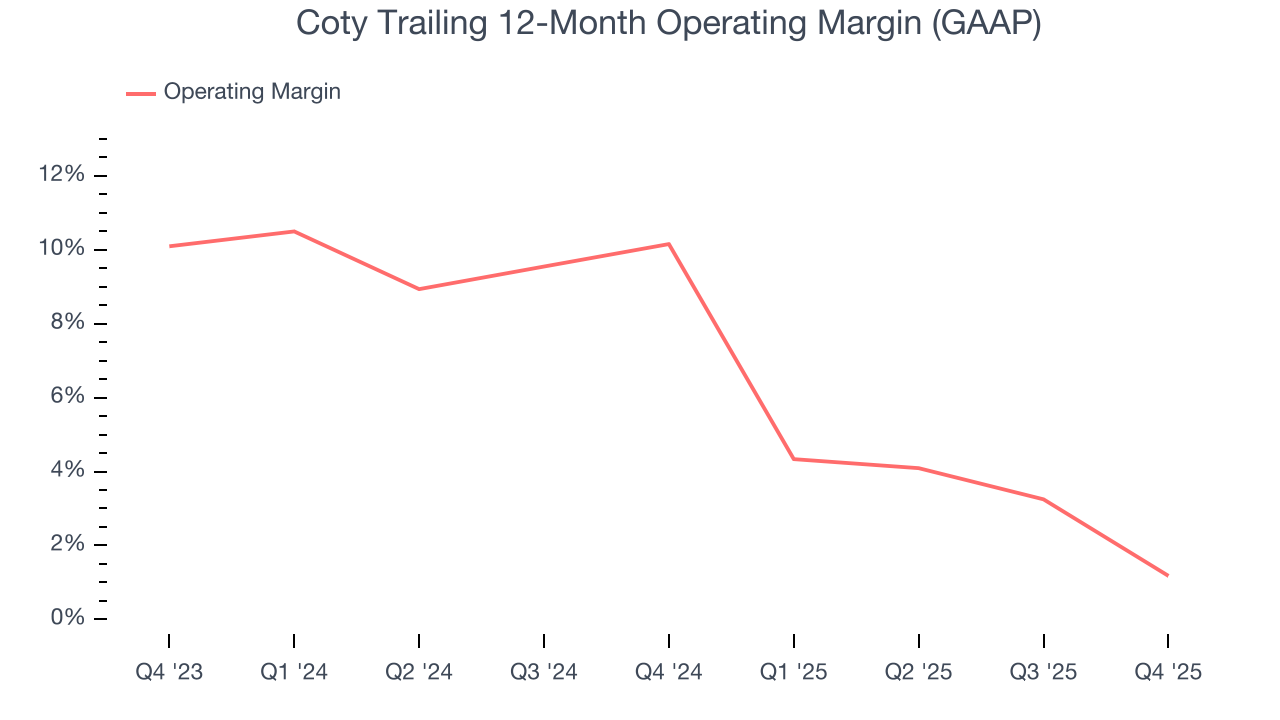

Coty was profitable over the last two years but held back by its large cost base. Its average operating margin of 5.8% was weak for a consumer staples business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, Coty’s operating margin decreased by 9 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Coty’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Coty generated an operating margin profit margin of 8.8%, down 7.2 percentage points year on year. Since Coty’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Coty, its EPS declined by 14.3% annually over the last three years while its revenue grew by 3.3%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, Coty reported adjusted EPS of $0.14, up from $0.11 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Coty’s full-year EPS of $0.22 to grow 113%.

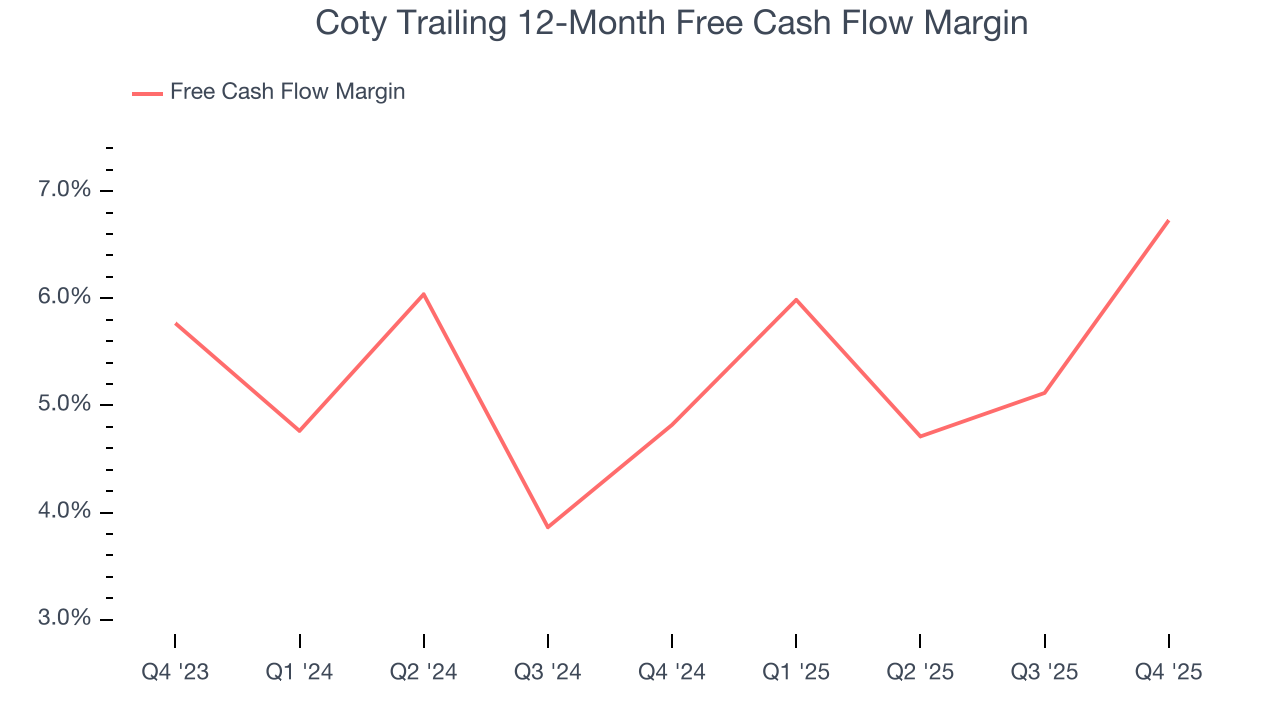

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Coty has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.8% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that Coty’s margin expanded by 1.9 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Coty’s free cash flow clocked in at $513.1 million in Q4, equivalent to a 30.6% margin. This result was good as its margin was 5.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

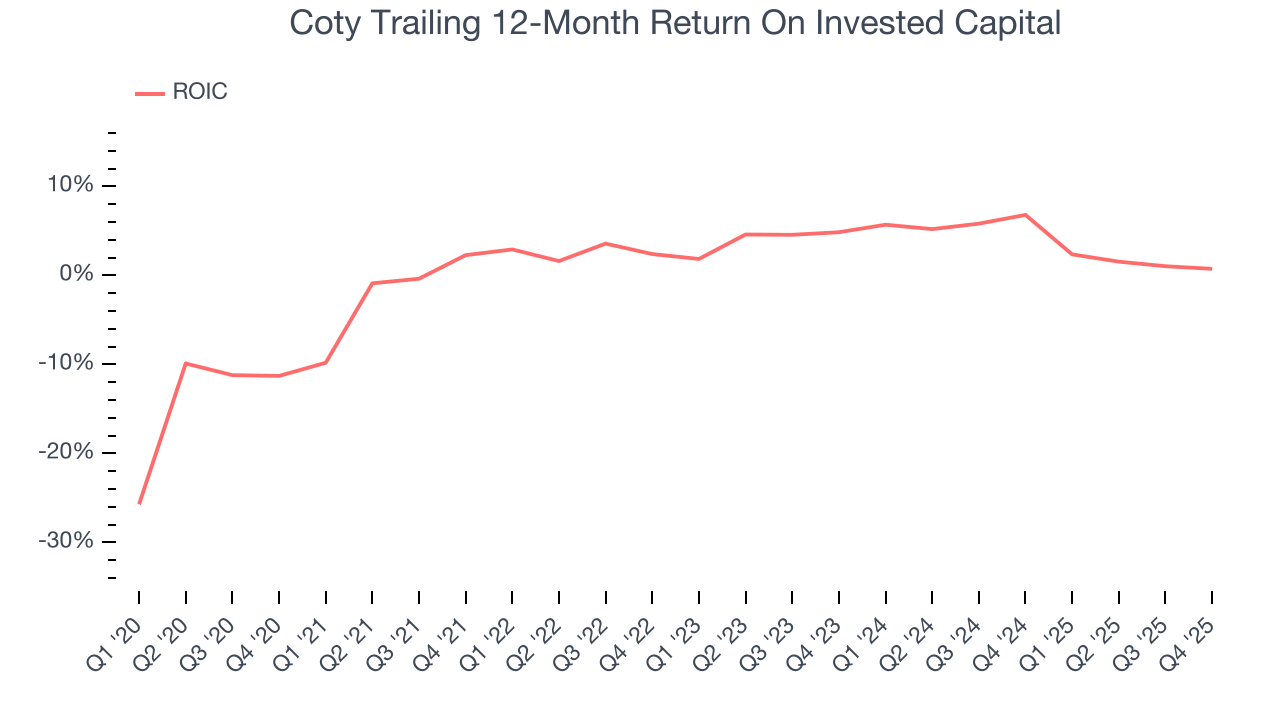

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Coty historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.4%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

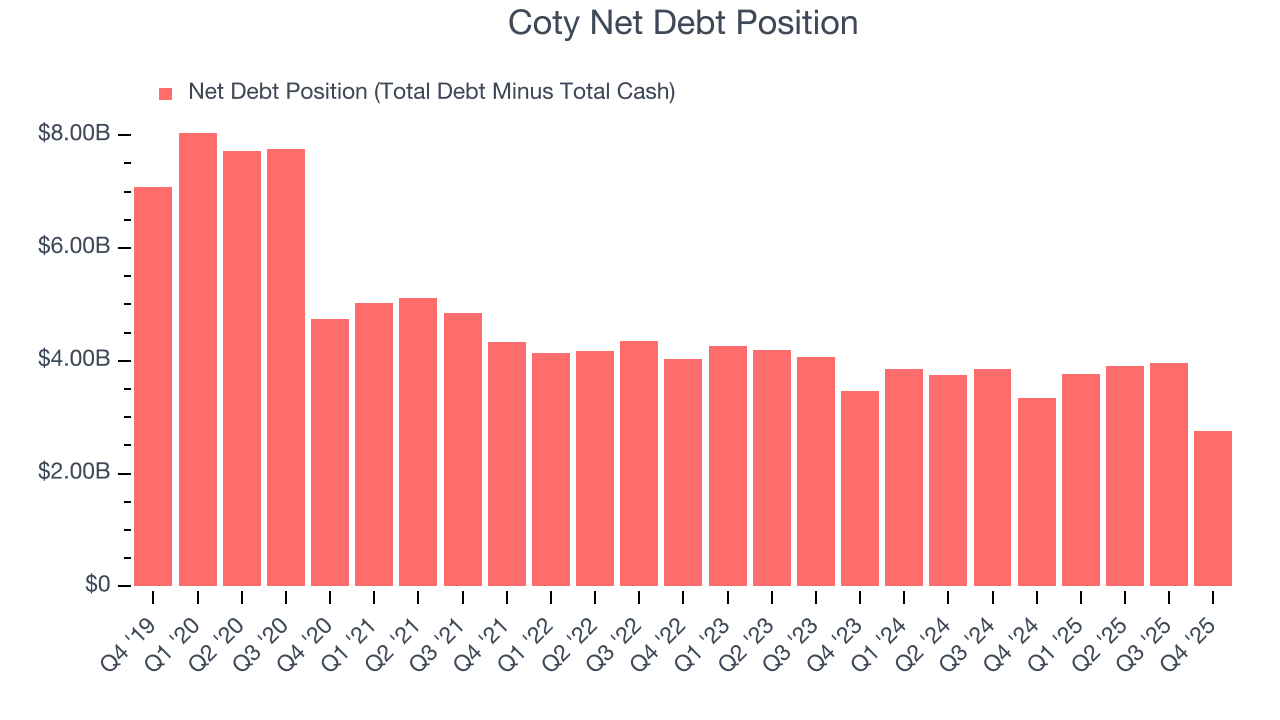

12. Balance Sheet Assessment

Coty reported $448 million of cash and $3.20 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $957.2 million of EBITDA over the last 12 months, we view Coty’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $106.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Coty’s Q4 Results

It was good to see Coty narrowly top analysts’ revenue expectations this quarter. We were also happy its organic revenue was in line with Wall Street’s estimates. On the other hand, its EPS missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 14% to $2.71 immediately after reporting.

14. Is Now The Time To Buy Coty?

Updated: February 5, 2026 at 9:54 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Coty.

We see the value of companies helping consumers, but in the case of Coty, we’re out. To begin with, its revenue growth was uninspiring over the last three years, and analysts don’t see anything changing over the next 12 months. And while its admirable gross margins are a wonderful starting point for the overall profitability of the business, the downside is its declining operating margin shows the business has become less efficient. On top of that, its declining EPS over the last three years makes it a less attractive asset to the public markets.

Coty’s P/E ratio based on the next 12 months is 7.3x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $4.43 on the company (compared to the current share price of $2.67).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.