Torrid (CURV)

Torrid faces an uphill battle. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Torrid Will Underperform

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE:CURV) is a plus-size women’s apparel and accessories retailer.

- Recent store closures and weak same-store sales point to soft demand and an operational restructuring

- Sales are projected to tank by 10.2% over the next 12 months as its demand continues evaporating

- High net-debt-to-EBITDA ratio of 5× increases the risk of forced asset sales or dilutive financing if operational performance weakens

Torrid falls short of our expectations. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Torrid

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Torrid

At $1.24 per share, Torrid trades at 8x forward EV-to-EBITDA. This multiple is high given its weaker fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Torrid (CURV) Research Report: Q3 CY2025 Update

Women’s plus-size apparel retailer Torrid Holdings (NYSE:CURV) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 10.8% year on year to $235.2 million. The company’s full-year revenue guidance of $998.5 million at the midpoint came in 2.2% below analysts’ estimates. Its GAAP loss of $0.06 per share was significantly below analysts’ consensus estimates.

Torrid (CURV) Q3 CY2025 Highlights:

- Revenue: $235.2 million vs analyst estimates of $239.9 million (10.8% year-on-year decline, 2% miss)

- EPS (GAAP): -$0.06 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: $9.78 million vs analyst estimates of $18.33 million (4.2% margin, 46.7% miss)

- The company dropped its revenue guidance for the full year to $998.5 million at the midpoint from $1.02 billion, a 2.3% decrease

- EBITDA guidance for the full year is $60.5 million at the midpoint, below analyst estimates of $82.84 million

- Operating Margin: 0.1%, down from 2.7% in the same quarter last year

- Free Cash Flow was -$6.61 million compared to -$5.52 million in the same quarter last year

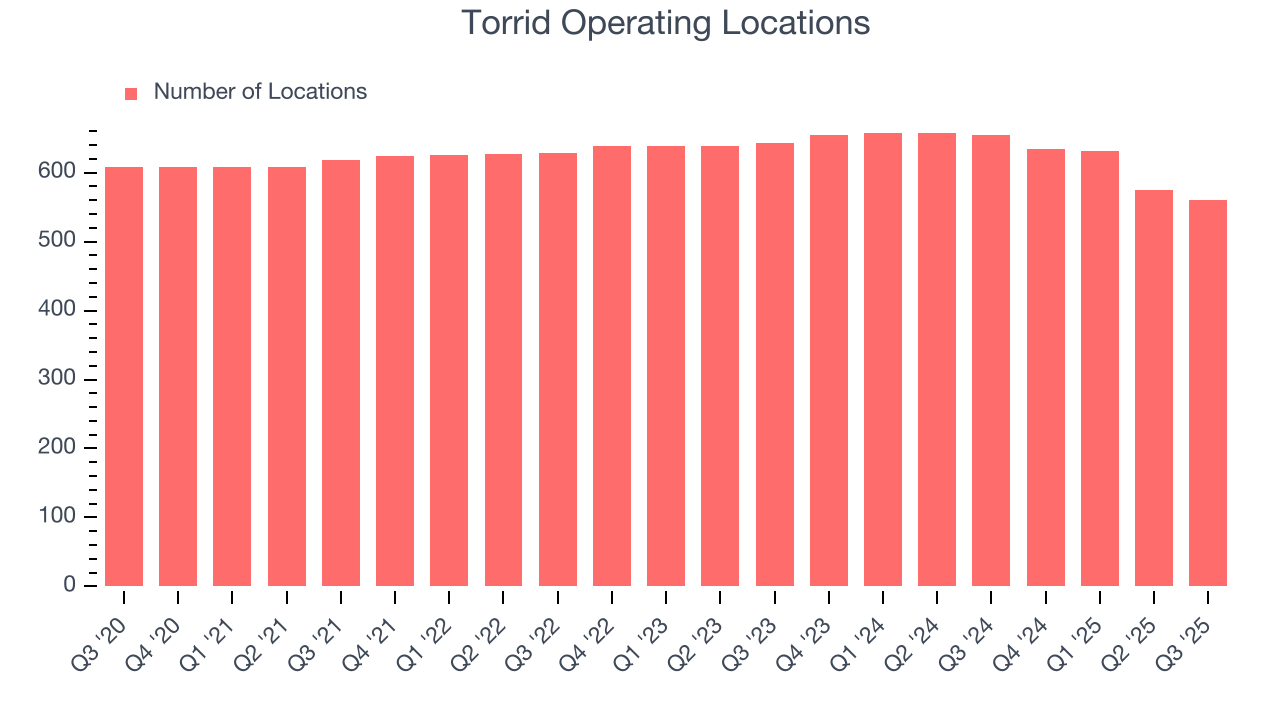

- Locations: 560 at quarter end, down from 655 in the same quarter last year

- Same-Store Sales fell 8% year on year (-6.5% in the same quarter last year)

- Market Capitalization: $130.9 million

Company Overview

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE:CURV) is a plus-size women’s apparel and accessories retailer.

Specifically, the company sells tops, bottoms, dresses, lingerie, shoes, and accessories, in sizes ranging from 10 to 30 under its namesake brand. The Torrid aesthetic is trendy, fashionable, and body-positive. The brand offers clothing and accessories that are designed to flatter a larger frame, while also keeping up with the latest fashion trends. Bold prints, bright colors, and unique designs are common.

Torrid clothing is mid-priced. It’s more expensive than fast fashion, which reflects higher-quality fabrics and construction. However, Torrid items are much more affordable than comparable luxury brand merchandise. The core customer is therefore a plus-size, middle income woman who may be underserved by traditional apparel retailers and brands.

The average Torrid store is approximately 3,000 square feet and is located in a mall or shopping center. The entrance usually features new arrivals and promotions while the center features sections such as dresses, tops, and bottoms. The back is usually devoted to accessories, shoes, and sale items. Torrid has an ecommerce presence that was launched in 2005. The company's website also features a blog and social media accounts that provide customers with fashion inspiration and body-positive messaging.

4. Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Retail competitors offering some selection of plus-size women’s apparel and accessories include department stores such as Macy’s (NYSE:M) and Kohl’s (NYSE:KSS) as well as off-price concepts such as TJX (NYSE:TJX) and Ross Stores (NASDAQ:ROST).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.04 billion in revenue over the past 12 months, Torrid is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

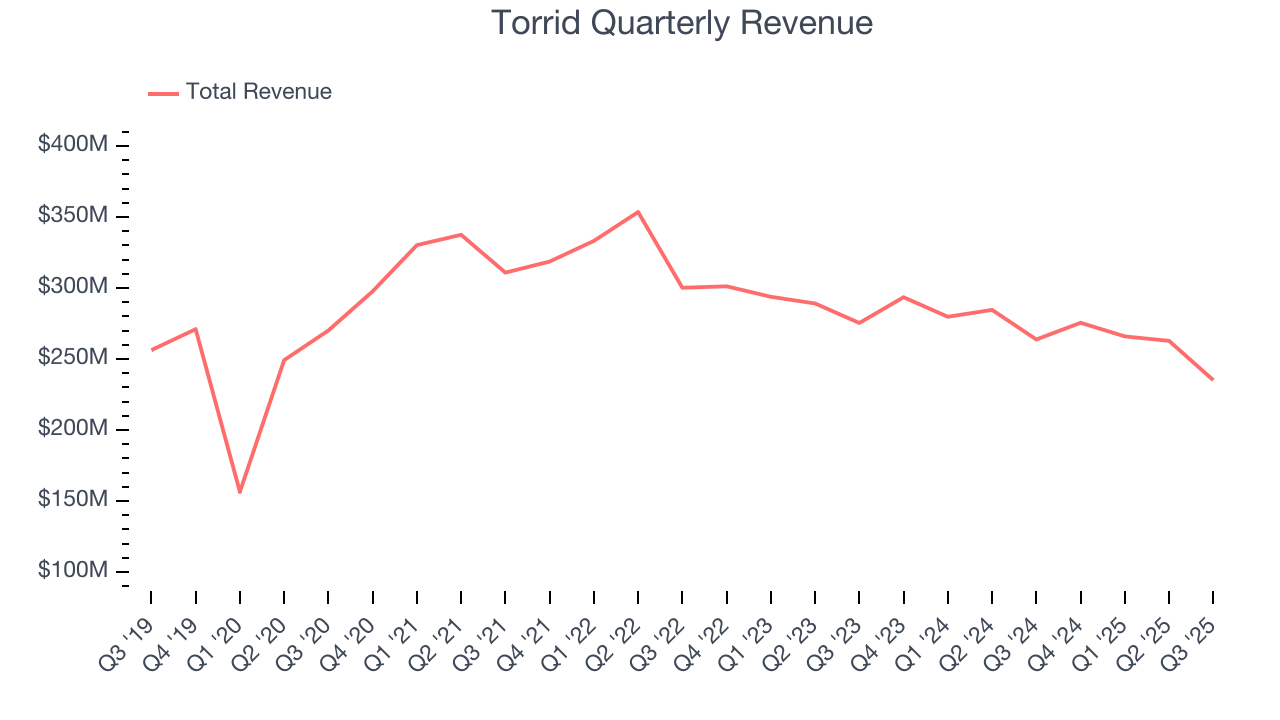

As you can see below, Torrid’s revenue declined by 7.3% per year over the last three years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores and observed lower sales at existing, established locations.

This quarter, Torrid missed Wall Street’s estimates and reported a rather uninspiring 10.8% year-on-year revenue decline, generating $235.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 5.4% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

6. Store Performance

Number of Stores

Torrid listed 560 locations in the latest quarter and has generally closed its stores over the last two years, averaging 3% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

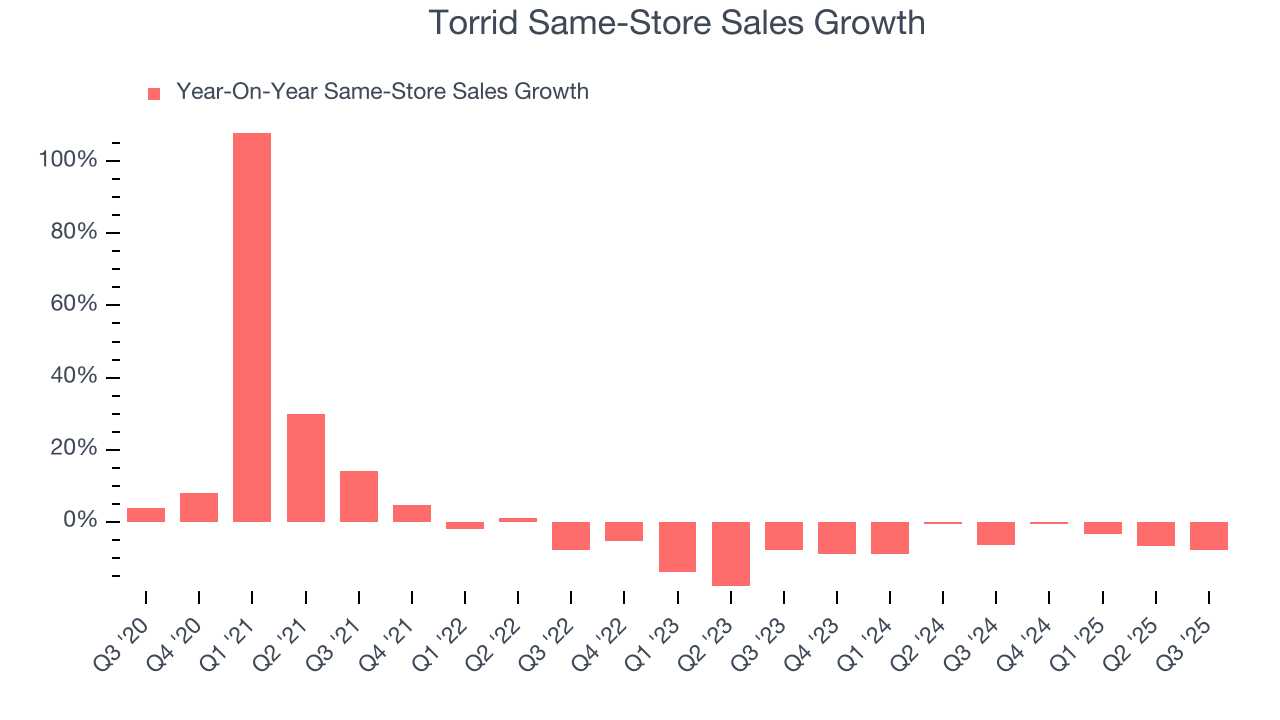

Torrid’s demand has been shrinking over the last two years as its same-store sales have averaged 5.6% annual declines. This performance isn’t ideal, and Torrid is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Torrid’s same-store sales fell by 8% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

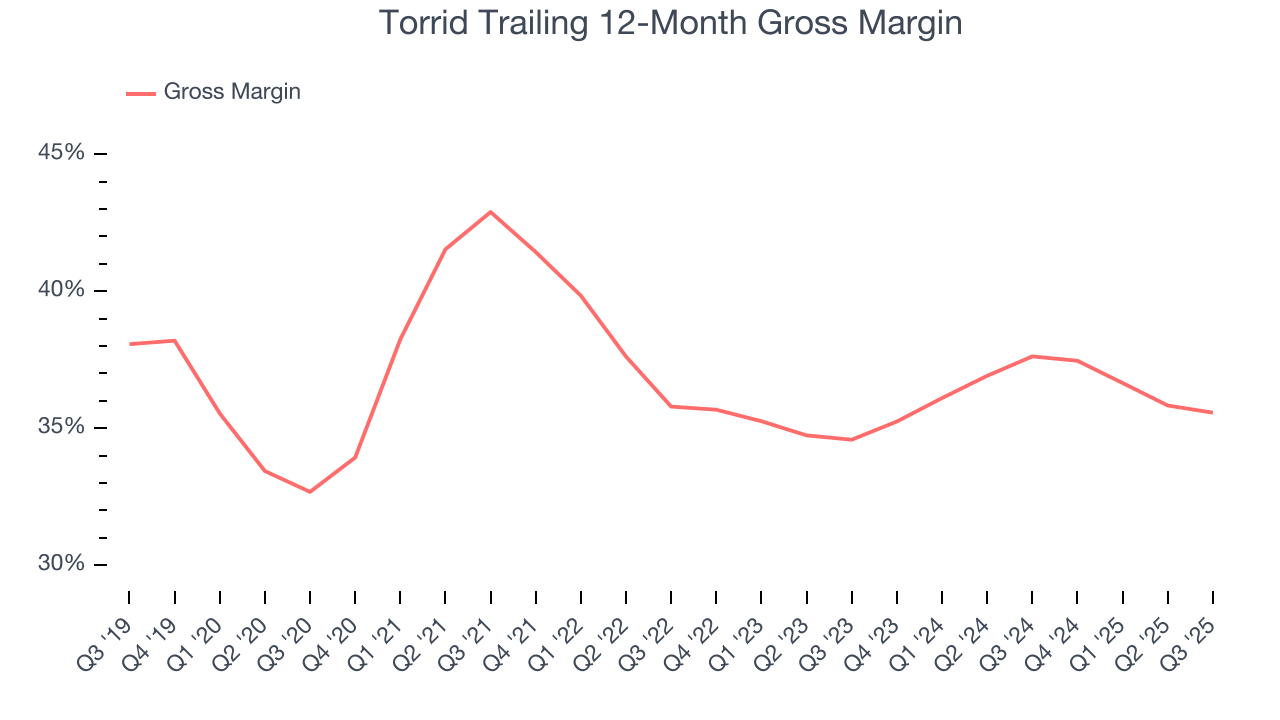

Torrid has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 36.6% gross margin over the last two years. That means Torrid paid its suppliers a lot of money ($63.37 for every $100 in revenue) to run its business.

In Q3, Torrid produced a 34.9% gross profit margin, marking a 1.1 percentage point decrease from 36.1% in the same quarter last year. Torrid’s full-year margin has also been trending down over the past 12 months, decreasing by 2.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to discount products and higher input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

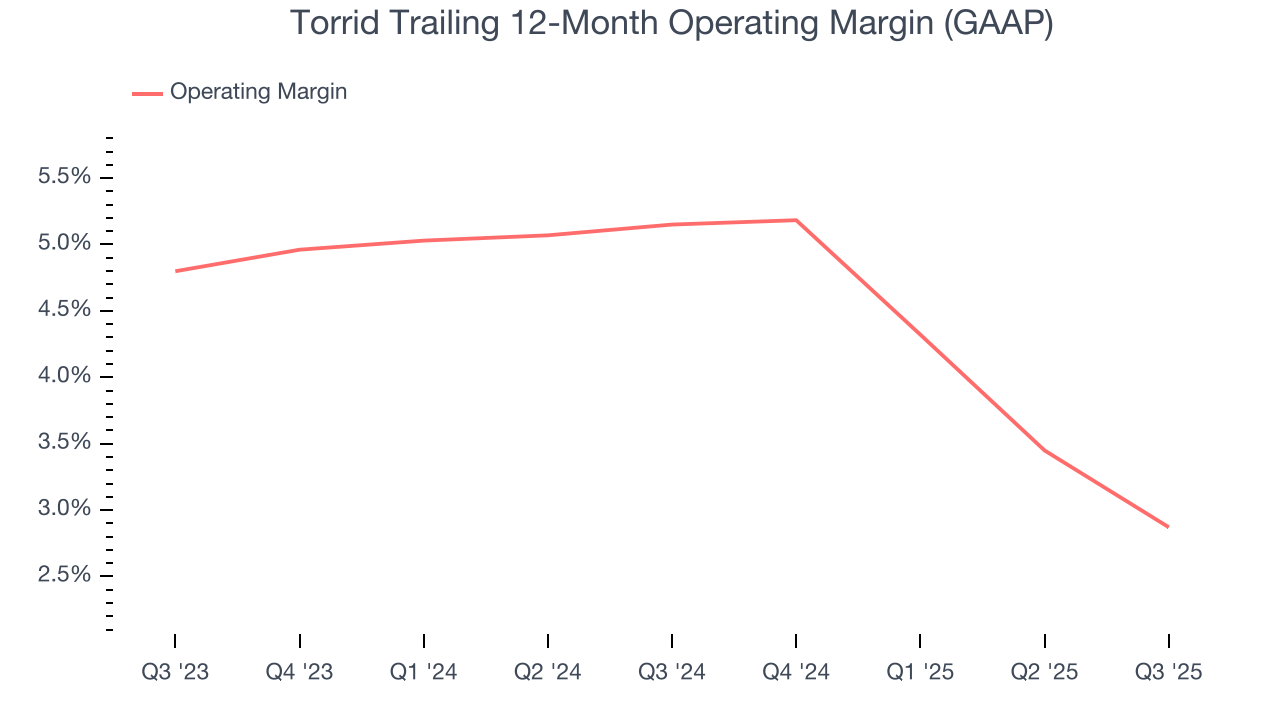

Torrid was profitable over the last two years but held back by its large cost base. Its average operating margin of 4.1% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Torrid’s operating margin decreased by 2.3 percentage points over the last year. Torrid’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Torrid’s breakeven margin was down 2.6 percentage points year on year. Since Torrid’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

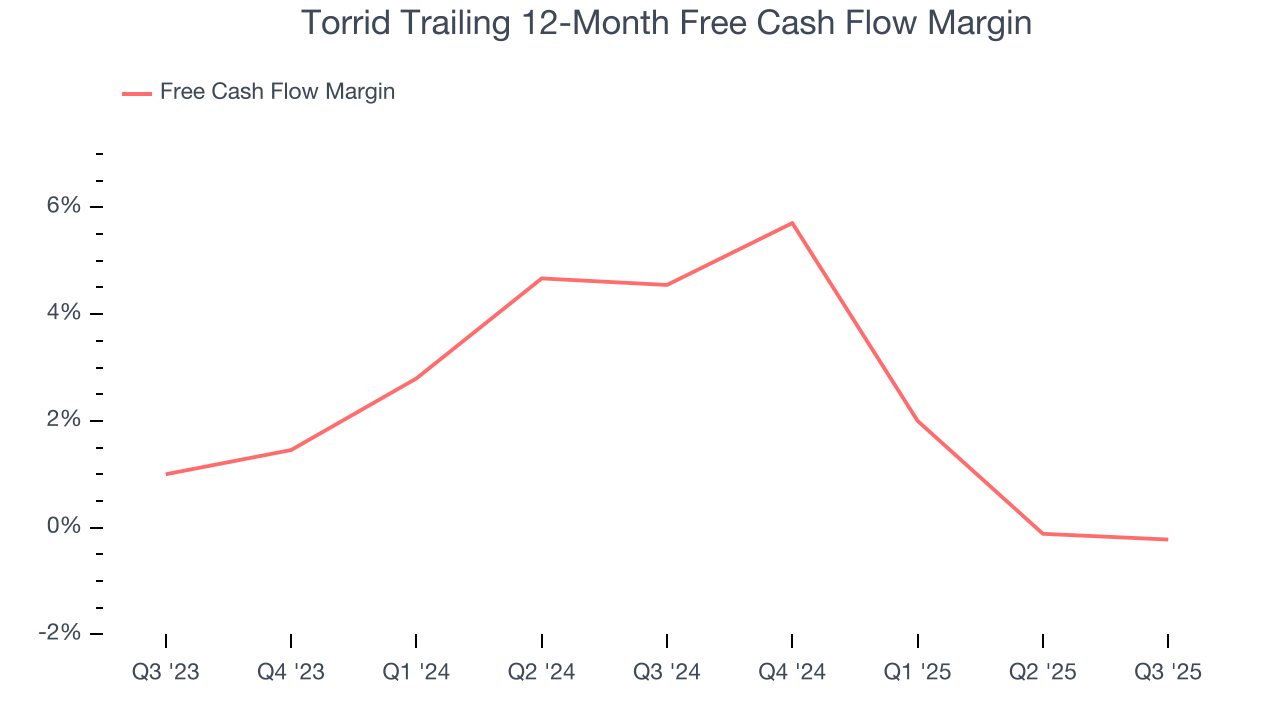

Torrid has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, subpar for a consumer retail business.

Taking a step back, we can see that Torrid’s margin dropped by 4.8 percentage points over the last year. This decrease warrants extra caution because Torrid failed to grow its same-store sales. Its cash profitability could decay further if it tries to reignite growth by opening new stores.

Torrid burned through $6.61 million of cash in Q3, equivalent to a negative 2.8% margin. The company’s cash burn was similar to its $5.52 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Torrid historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.9%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

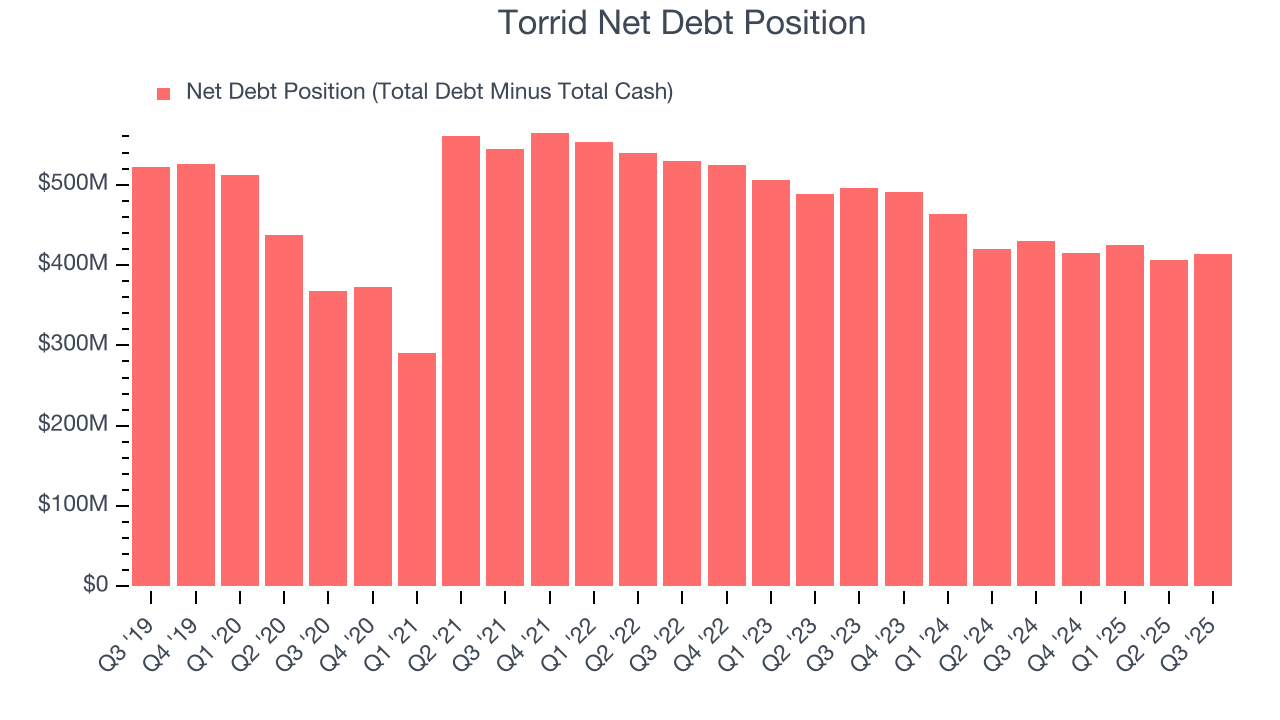

Torrid’s $431.2 million of debt exceeds the $17.61 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $75.15 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Torrid could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Torrid can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Torrid’s Q3 Results

We struggled to find many positives in these results. Its full-year EBITDA guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 9.4% to $1.15 immediately after reporting.

13. Is Now The Time To Buy Torrid?

Updated: January 24, 2026 at 9:39 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Torrid.

Torrid doesn’t pass our quality test. To kick things off, its revenue has declined over the last three years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Torrid’s declining EPS over the last three years makes it a less attractive asset to the public markets, and its projected EPS for the next year is lacking.

Torrid’s EV-to-EBITDA ratio based on the next 12 months is 8x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $1.48 on the company (compared to the current share price of $1.24).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.