Sprinklr (CXM)

We wouldn’t recommend Sprinklr. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think Sprinklr Will Underperform

With a proprietary AI engine processing 450 million data points daily across 30+ digital channels, Sprinklr (NYSE:CXM) provides cloud-based software that helps large enterprises manage customer experiences across social, messaging, chat, and voice channels.

- Estimated sales growth of 4.1% for the next 12 months implies demand will slow from its two-year trend

- Operating margin was unchanged over the last year, suggesting it failed to gain leverage on its fixed costs

- Products, pricing, or go-to-market strategy may need some adjustments as its 6.9% average billings growth over the last year was weak

Sprinklr’s quality doesn’t meet our hurdle. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Sprinklr

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Sprinklr

At $5.74 per share, Sprinklr trades at 1.6x forward price-to-sales. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Sprinklr (CXM) Research Report: Q3 CY2025 Update

Customer experience management platform Sprinklr (NYSE:CXM) announced better-than-expected revenue in Q3 CY2025, with sales up 9.2% year on year to $219.1 million. On top of that, next quarter’s revenue guidance ($217 million at the midpoint) was surprisingly good and 3.1% above what analysts were expecting. Its non-GAAP profit of $0.12 per share was 32% above analysts’ consensus estimates.

Sprinklr (CXM) Q3 CY2025 Highlights:

- Revenue: $219.1 million vs analyst estimates of $209.6 million (9.2% year-on-year growth, 4.5% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.09 (32% beat)

- Adjusted Operating Income: $33.52 million vs analyst estimates of $28.71 million (15.3% margin, 16.7% beat)

- Revenue Guidance for Q4 CY2025 is $217 million at the midpoint, above analyst estimates of $210.4 million

- Management raised its full-year Adjusted EPS guidance to $0.44 at the midpoint, a 2.4% increase

- Operating Margin: 5.3%, up from 3.9% in the same quarter last year

- Free Cash Flow Margin: 7.1%, down from 14% in the previous quarter

- Market Capitalization: $1.84 billion

Company Overview

With a proprietary AI engine processing 450 million data points daily across 30+ digital channels, Sprinklr (NYSE:CXM) provides cloud-based software that helps large enterprises manage customer experiences across social, messaging, chat, and voice channels.

Sprinklr's unified platform is organized into four main product suites: Service, Social, Insights, and Marketing. The Service suite enables businesses to provide omnichannel customer support across voice, digital, and social channels. The Social suite helps manage social media publishing and engagement with governance controls. The Insights suite offers AI-powered analytics to track customer sentiment, brand reputation, and competitive benchmarking. The Marketing suite streamlines campaign planning, content creation, and social advertising.

What differentiates Sprinklr is its AI technology, which processes unstructured data like text, images, and video from digital channels. For example, a global hotel chain might use Sprinklr to monitor guest comments across review sites, respond to social media inquiries, analyze sentiment trends, and deliver personalized marketing—all within one platform instead of using multiple point solutions.

Sprinklr primarily targets large enterprises, with more than 60% of Fortune 100 companies among its customer base. The company monetizes through subscription-based pricing, with larger clients typically paying $1 million or more annually. Beyond software, Sprinklr offers professional services including implementation, training, and managed services to help customers maximize their platform investment.

The company has expanded internationally to serve customers in over 80 countries and supports more than 150 languages, making it suitable for global enterprises with complex, multi-market operations.

4. Customer Experience Software

The Internet has given customers more choice on whom to conduct business with and has also given them the power to easily share their experiences with other customers. These twin dynamics effectively have increased pressure on companies to both improve their customer service and also monitor their brand reputation online, driving the need for customer experience software offerings.

Sprinklr's competitors include customer experience platforms like Adobe Experience Cloud (NASDAQ: ADBE), Salesforce Service Cloud (NYSE: CRM), and Zendesk (private). In social media management, it competes with Hootsuite (private) and Khoros (private), while in contact center solutions, it faces competition from NICE (NASDAQ: NICE) and Genesys (private).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Sprinklr grew its sales at a decent 17.7% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Sprinklr’s recent performance shows its demand has slowed as its annualized revenue growth of 9.2% over the last two years was below its five-year trend.

This quarter, Sprinklr reported year-on-year revenue growth of 9.2%, and its $219.1 million of revenue exceeded Wall Street’s estimates by 4.5%. Company management is currently guiding for a 7.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Sprinklr’s billings came in at $158.4 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 6.9% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Sprinklr to acquire new customers as its CAC payback period checked in at 95.4 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

8. Gross Margin & Pricing Power

For software companies like Sprinklr, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Sprinklr’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 68.7% gross margin over the last year. That means Sprinklr paid its providers a lot of money ($31.28 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Sprinklr has seen gross margins decline by 6.9 percentage points over the last 2 year, which is among the worst in the software space.

Sprinklr’s gross profit margin came in at 66.4% this quarter, down 4.8 percentage points year on year. Sprinklr’s full-year margin has also been trending down over the past 12 months, decreasing by 4.6 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

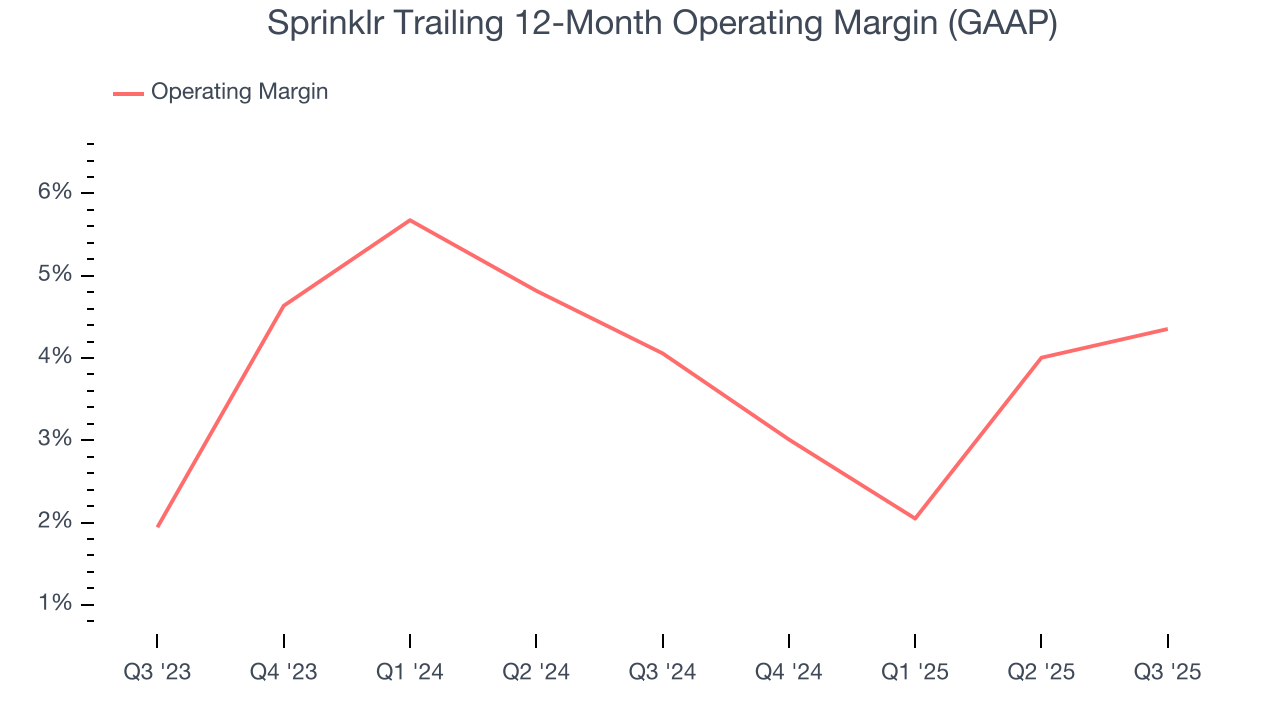

9. Operating Margin

Sprinklr has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 4.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Sprinklr’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Sprinklr generated an operating margin profit margin of 5.3%, up 1.3 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Sprinklr has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 15.2% over the last year, slightly better than the broader software sector.

Sprinklr’s free cash flow clocked in at $15.52 million in Q3, equivalent to a 7.1% margin. This result was good as its margin was 4.6 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Sprinklr’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 15.2% for the last 12 months will decrease to 14.5%.

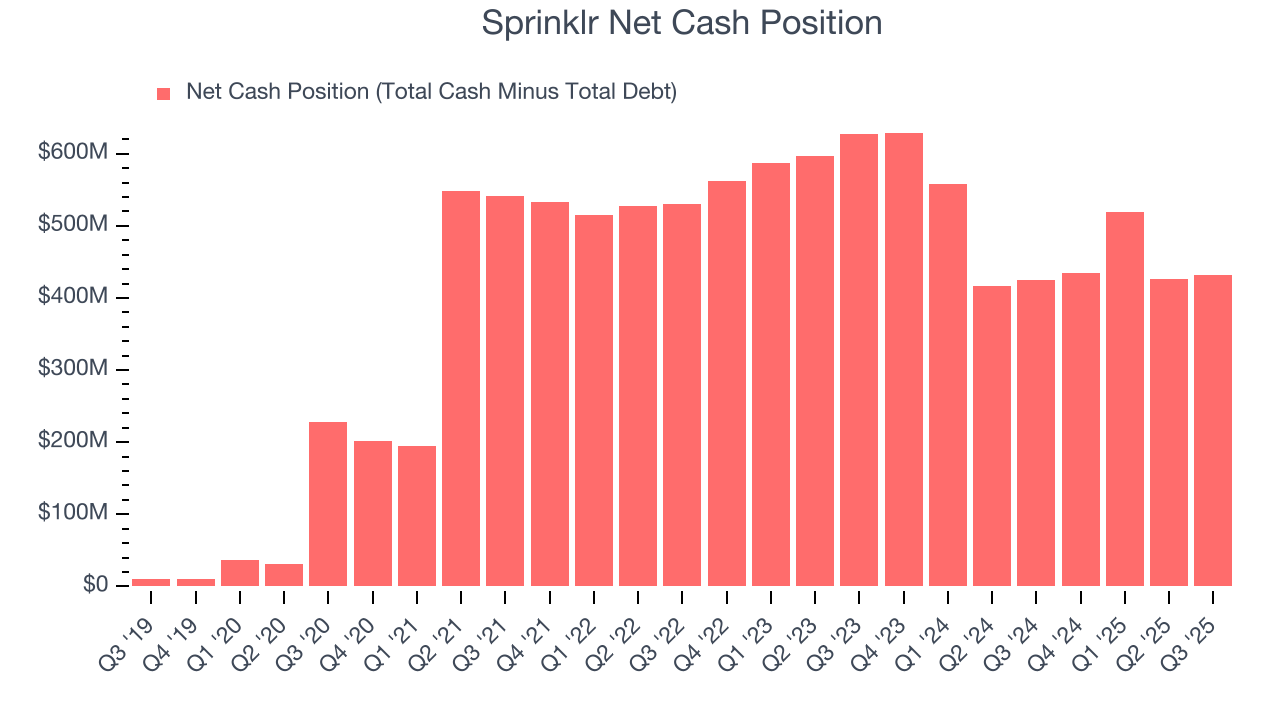

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Sprinklr is a profitable, well-capitalized company with $480.3 million of cash and $48.44 million of debt on its balance sheet. This $431.9 million net cash position is 22.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Sprinklr’s Q3 Results

We were impressed by Sprinklr’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.7% to $7.90 immediately after reporting.

13. Is Now The Time To Buy Sprinklr?

Updated: February 26, 2026 at 9:43 PM EST

Are you wondering whether to buy Sprinklr or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies solving complex business issues, but in the case of Sprinklr, we’ll be cheering from the sidelines. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its operating margin hasn't moved over the last year. And while the company’s operating margins are in line with the overall software sector, the downside is its gross margin is below our standards.

Sprinklr’s price-to-sales ratio based on the next 12 months is 1.6x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $10.38 on the company (compared to the current share price of $5.74).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.