Crane NXT (CXT)

We wouldn’t buy Crane NXT. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think Crane NXT Will Underperform

Born from a corporate transformation completed in 2023, Crane NXT (NYSE:CXT) provides specialized technology solutions for payment processing, banknote security, and authentication systems for financial institutions and businesses.

- Incremental sales over the last two years were much less profitable as its earnings per share fell by 1.3% annually while its revenue grew

- Organic revenue growth fell short of our benchmarks over the past two years and implies it may need to improve its products, pricing, or go-to-market strategy

- Muted 3.3% annual revenue growth over the last three years shows its demand lagged behind its business services peers

Crane NXT’s quality is insufficient. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Crane NXT

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Crane NXT

Crane NXT is trading at $51.76 per share, or 13.1x forward P/E. Crane NXT’s multiple may seem like a great deal among business services peers, but we think there are valid reasons why it’s this cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Crane NXT (CXT) Research Report: Q4 CY2025 Update

Payment technology company Crane NXT (NYSE:CXT) announced better-than-expected revenue in Q4 CY2025, with sales up 19.5% year on year to $476.9 million. Its non-GAAP profit of $1.27 per share was 1% above analysts’ consensus estimates.

Crane NXT (CXT) Q4 CY2025 Highlights:

- Revenue: $476.9 million vs analyst estimates of $452.3 million (19.5% year-on-year growth, 5.5% beat)

- Adjusted EPS: $1.27 vs analyst estimates of $1.26 (1% beat)

- Adjusted EBITDA: $121.3 million vs analyst estimates of $119.8 million (25.4% margin, 1.3% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.25 at the midpoint, missing analyst estimates by 5.5%

- Operating Margin: 16.7%, down from 17.7% in the same quarter last year

- Free Cash Flow Margin: 20.1%, up from 18.8% in the same quarter last year

- Backlog: $492.8 million at quarter end, up 25% year on year

- Market Capitalization: $3.13 billion

Company Overview

Born from a corporate transformation completed in 2023, Crane NXT (NYSE:CXT) provides specialized technology solutions for payment processing, banknote security, and authentication systems for financial institutions and businesses.

Crane NXT operates through two main business segments: Crane Payment Innovations (CPI) and Crane Currency. The CPI division develops and manufactures electronic payment systems that validate, accept, and dispense cash and other payment methods. These systems are found in vending machines, gaming devices, retail point-of-sale terminals, and self-checkout kiosks. For example, when you insert bills into a vending machine or casino gaming device, there's a good chance you're interacting with CPI technology that authenticates your currency.

The Crane Currency segment focuses on micro-optic security technology for physical products, particularly banknotes. This division works with central banks and government agencies worldwide to design and produce secure currency with advanced anti-counterfeiting features. When a central bank needs to update its currency with new security elements, Crane Currency might provide the specialized security threads or holograms that make counterfeiting more difficult.

The company generates revenue through equipment sales, service contracts, and ongoing maintenance of its systems. Its customer base spans across retail, gaming, financial services, and government sectors. For payment solutions, customers include vending machine operators, retailers, and gaming establishments. For currency security, customers are primarily central banks and government mints.

Crane NXT maintains research and development facilities in the United States, United Kingdom, Mexico, Japan, Germany, Sweden, and Malta. This global footprint allows the company to serve customers across different regions while adapting to local payment preferences and security requirements. The company's technologies incorporate sophisticated optical, mechanical, and electronic systems that require specialized manufacturing capabilities and intellectual property.

4. Specialized Technology

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

Crane NXT competes with payment technology providers like NCR Voyix (NYSE:VYX), Diebold Nixdorf, and Glory Global Solutions in the payment automation space, while its currency security business faces competition from De La Rue plc (LSE:DLAR) and security printing companies like Giesecke+Devrient.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.66 billion in revenue over the past 12 months, Crane NXT is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

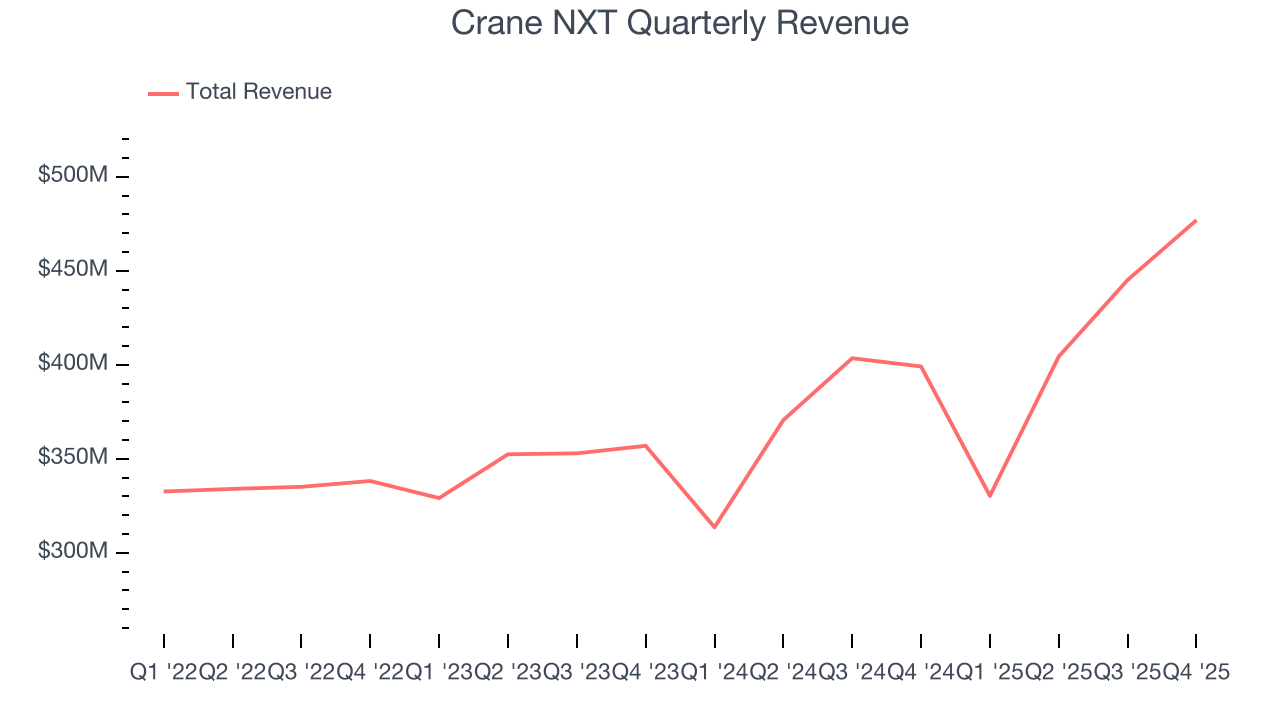

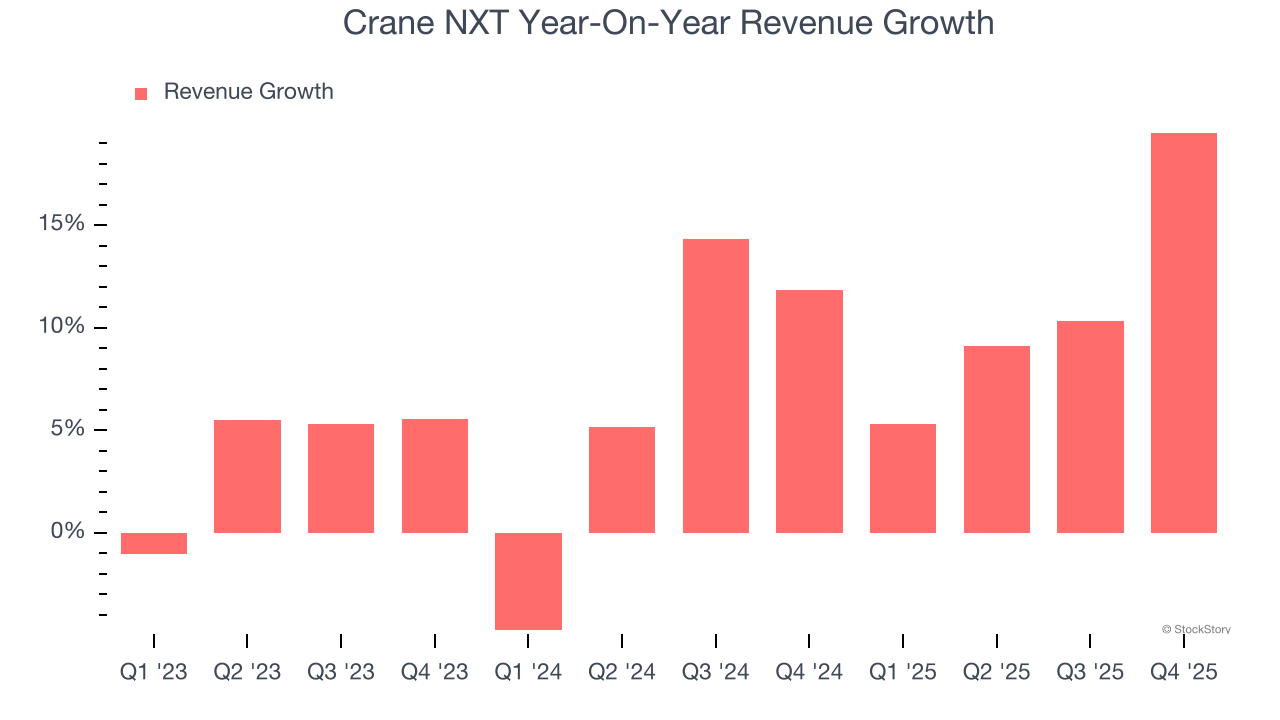

As you can see below, Crane NXT’s sales grew at a tepid 3.3% compounded annual growth rate over the last three years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Crane NXT’s annualized revenue growth of 9.1% over the last two years is above its three-year trend, suggesting its demand recently accelerated.

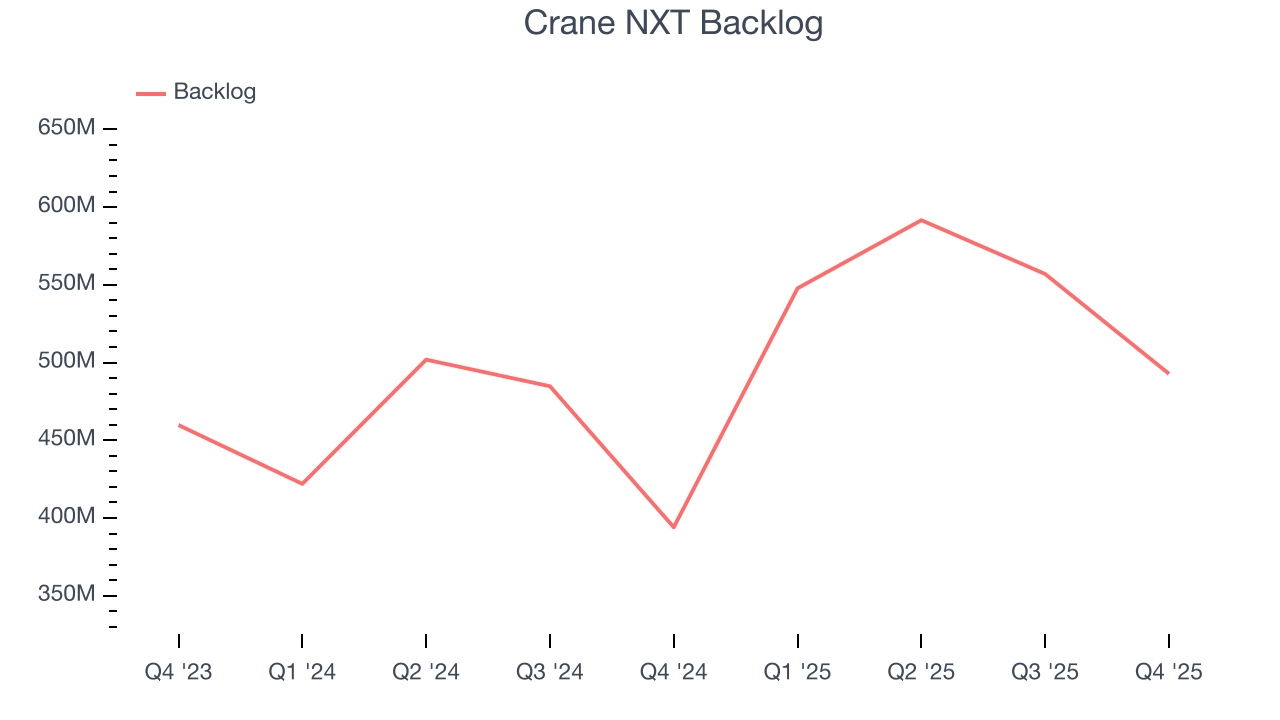

Crane NXT also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Crane NXT’s backlog reached $492.8 million in the latest quarter and averaged 14.7% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Crane NXT’s products and services but raises concerns about capacity constraints.

This quarter, Crane NXT reported year-on-year revenue growth of 19.5%, and its $476.9 million of revenue exceeded Wall Street’s estimates by 5.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and implies the market is forecasting some success for its newer products and services.

6. Operating Margin

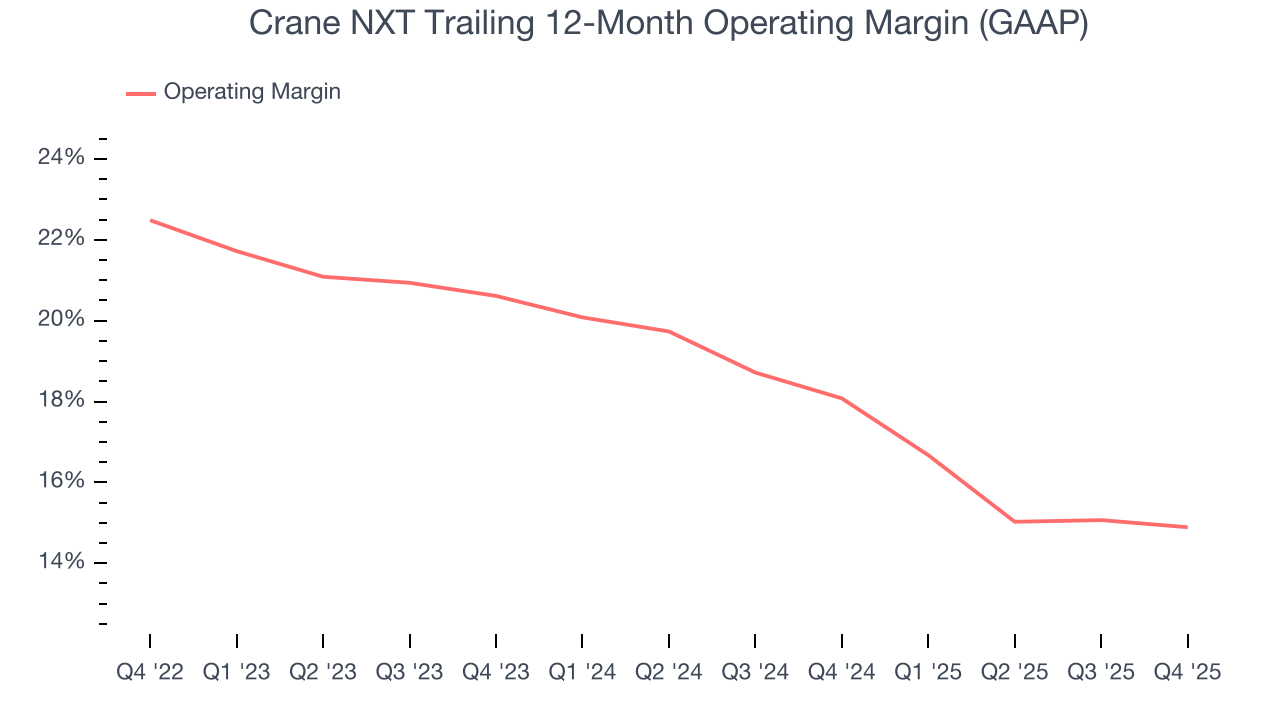

Crane NXT has been a well-oiled machine over the last four years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 18.8%.

Looking at the trend in its profitability, Crane NXT’s operating margin decreased by 7.6 percentage points over the last four years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Crane NXT generated an operating margin profit margin of 16.7%, down 1 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

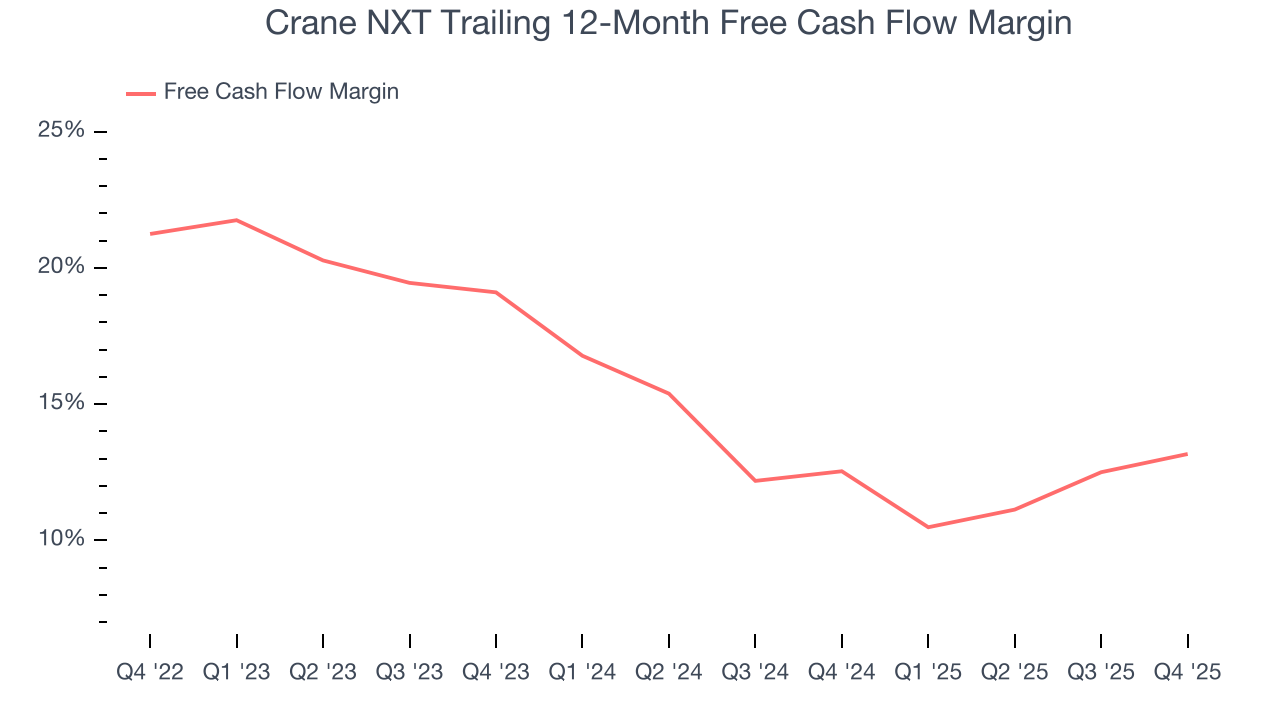

Crane NXT has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 16.3% over the last four years.

Taking a step back, we can see that Crane NXT’s margin dropped by 8.1 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Crane NXT’s free cash flow clocked in at $96 million in Q4, equivalent to a 20.1% margin. This result was good as its margin was 1.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

8. Balance Sheet Assessment

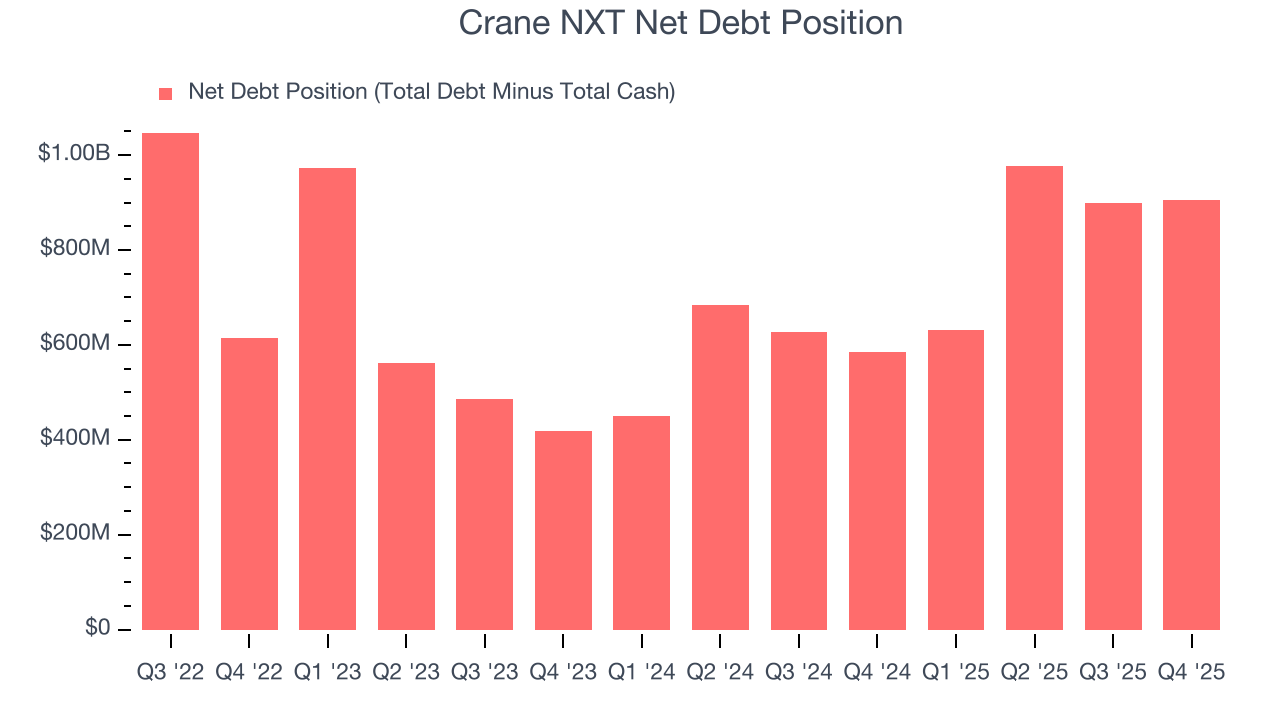

Crane NXT reported $233.8 million of cash and $1.14 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $402.7 million of EBITDA over the last 12 months, we view Crane NXT’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $27.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

9. Key Takeaways from Crane NXT’s Q4 Results

We were impressed by how significantly Crane NXT blew past analysts’ revenue expectations this quarter although EPS beat by a smaller amount. On the other hand, its full-year EPS guidance missed. Overall, this quarter was mixed. The stock remained flat at $51.25 immediately following the results.

10. Is Now The Time To Buy Crane NXT?

Updated: February 11, 2026 at 11:26 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We see the value of companies helping their customers, but in the case of Crane NXT, we’re out. For starters, its revenue growth was uninspiring over the last three years. While its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining EPS over the last two years makes it a less attractive asset to the public markets. On top of that, its declining operating margin shows the business has become less efficient.

Crane NXT’s P/E ratio based on the next 12 months is 13.1x. This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $76.33 on the company (compared to the current share price of $51.76).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.