CoreCivic (CXW)

CoreCivic keeps us up at night. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think CoreCivic Will Underperform

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE:CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

- Earnings growth underperformed the sector average over the last four years as its EPS grew by just 1.9% annually

- Annual revenue growth of 1.6% over the last five years was below our standards for the business services sector

- Low returns on capital reflect management’s struggle to allocate funds effectively

CoreCivic’s quality is lacking. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than CoreCivic

High Quality

Investable

Underperform

Why There Are Better Opportunities Than CoreCivic

CoreCivic’s stock price of $19 implies a valuation ratio of 15.2x forward P/E. Yes, this valuation multiple is lower than that of other business services peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. CoreCivic (CXW) Research Report: Q4 CY2025 Update

Private prison operator CoreCivic (NYSE:CXW) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 26% year on year to $604 million. Its GAAP profit of $0.26 per share was 33.3% above analysts’ consensus estimates.

CoreCivic (CXW) Q4 CY2025 Highlights:

- Revenue: $604 million vs analyst estimates of $570 million (26% year-on-year growth, 6% beat)

- EPS (GAAP): $0.26 vs analyst estimates of $0.20 (33.3% beat)

- Adjusted EBITDA: $92.45 million vs analyst estimates of $83.77 million (15.3% margin, 10.4% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $1.54 at the midpoint, beating analyst estimates by 5.2%

- EBITDA guidance for the upcoming financial year 2026 is $441 million at the midpoint, above analyst estimates of $427.9 million

- Operating Margin: 22.2%, up from 8% in the same quarter last year

- Market Capitalization: $1.95 billion

Company Overview

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE:CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

CoreCivic's business is divided into three segments: CoreCivic Safety, which manages correctional and detention facilities; CoreCivic Community, which runs residential reentry centers; and CoreCivic Properties, which owns correctional real estate leased to third parties.

As of December 2023, the company operated 43 correctional and detention facilities with approximately 65,000 beds, and 23 residential reentry centers with about 5,000 beds. The company also owned 6 properties with roughly 10,000 beds that it leases to other operators.

Government contracts form the backbone of CoreCivic's revenue model. The company typically secures three-to-five-year contracts with federal, state, and local government agencies, with multiple renewal options. These contracts generally compensate CoreCivic on a per-diem basis according to actual or minimum guaranteed occupancy levels. Federal authorities, particularly Immigration and Customs Enforcement (ICE), the U.S. Marshals Service, and the Bureau of Prisons, accounted for 52% of the company's revenue in 2023.

Beyond basic housing, CoreCivic provides various rehabilitation and educational programs aimed at reducing recidivism. These include basic education, vocational training, substance abuse treatment, and life skills development. The company has implemented technology-based initiatives like ResNet, which provides secure computer access for educational programs, and partnerships with organizations like Persevere and Pivot Tech to teach coding and technology skills.

CoreCivic also offers health care services, food services, and work programs to those in its facilities. Its community corrections facilities focus on employment readiness and life skills for individuals transitioning back into society, while its non-residential services include electronic monitoring and case management.

The company's facilities operate under standards established by various organizations, including the American Correctional Association and the National Commission on Correctional Healthcare. CoreCivic maintains an internal Quality Assurance Division that conducts annual audits of its facilities to ensure compliance with these standards and contractual requirements.

4. Safety & Security Services

Rising concerns over physical security, cybersecurity threats, and workplace safety regulations will present opportunities for companies in this sector. AI and digitization will enhance surveillance, access control, and threat detection, which could benefit key players in Safety & Security Services. These trends could also introduce ethical and regulatory concerns over data privacy and automated decision-making in security operations, giving rise to headline risks. Finally, increasing scrutiny on private security practices and evolving criminal justice policies again mean that companies in the space need to operate with the utmost care or risk being the poster child of abuse of power.

CoreCivic's main competitors include The GEO Group, Inc. (NYSE:GEO), which is the other major publicly traded private prison operator in the United States, as well as Management and Training Corporation, a privately held company. CoreCivic also competes with government agencies that operate their own correctional and detention facilities.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.21 billion in revenue over the past 12 months, CoreCivic is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

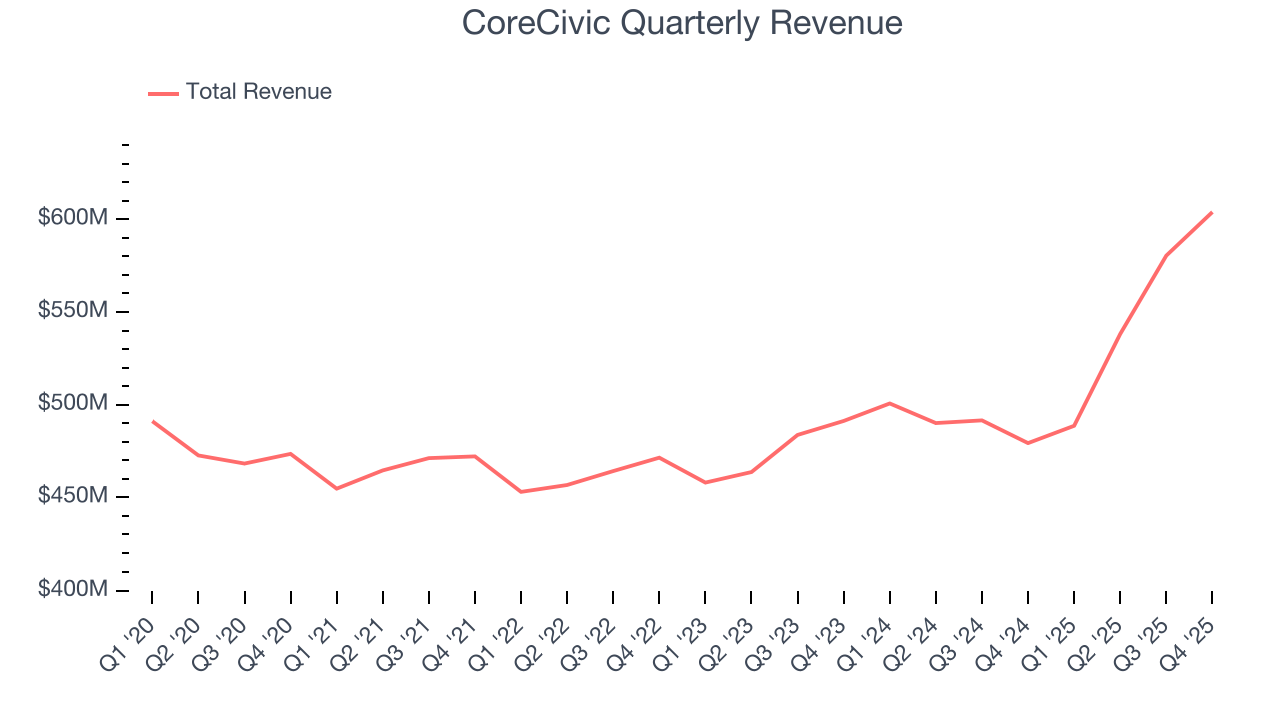

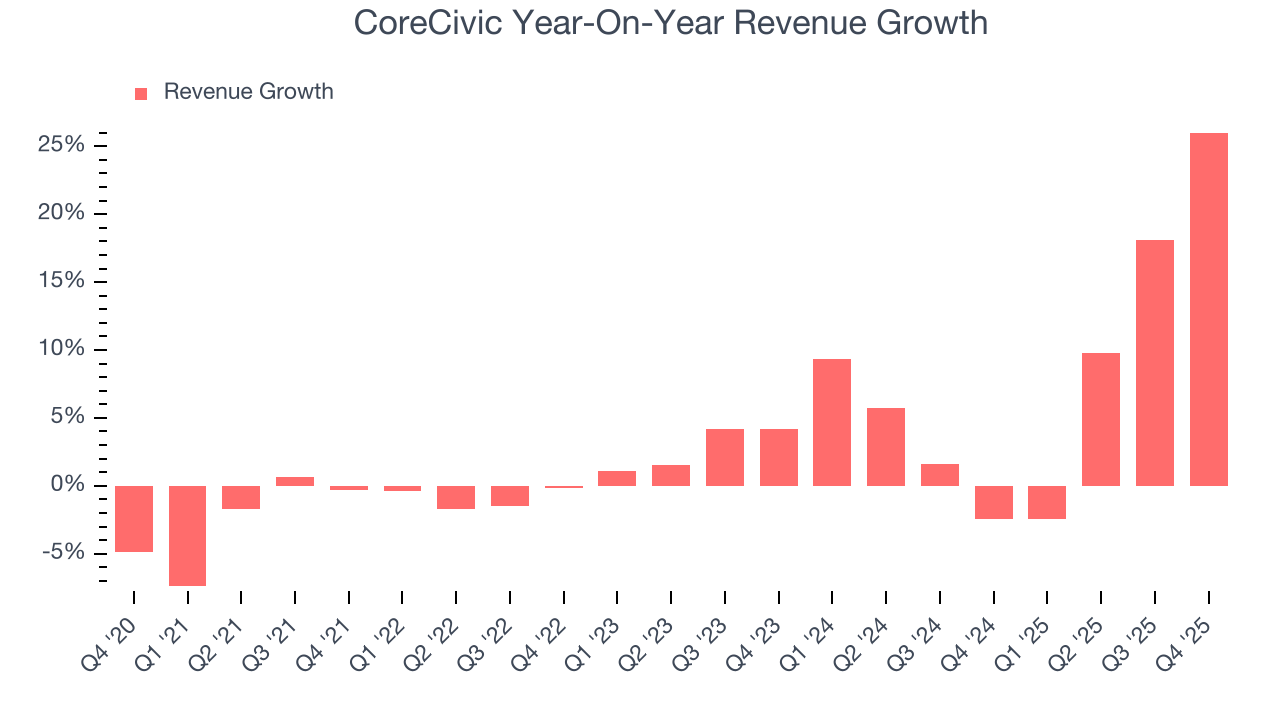

As you can see below, CoreCivic’s sales grew at a tepid 3% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. CoreCivic’s annualized revenue growth of 8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, CoreCivic reported robust year-on-year revenue growth of 26%, and its $604 million of revenue topped Wall Street estimates by 6%.

Looking ahead, sell-side analysts expect revenue to grow 13.8% over the next 12 months, an improvement versus the last two years. This projection is commendable and implies its newer products and services will fuel better top-line performance.

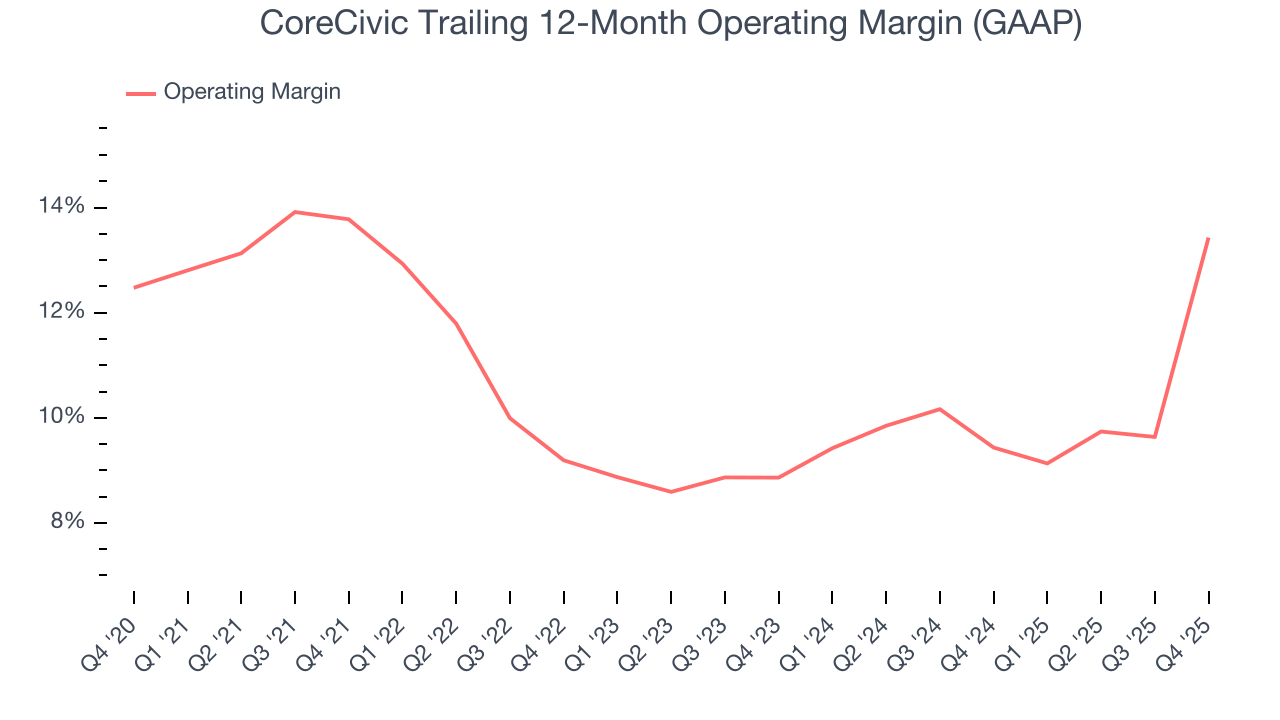

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

CoreCivic’s operating margin has risen over the last 12 months and averaged 11% over the last five years. Its profitability was higher than the broader business services sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, CoreCivic’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, CoreCivic generated an operating margin profit margin of 22.2%, up 14.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

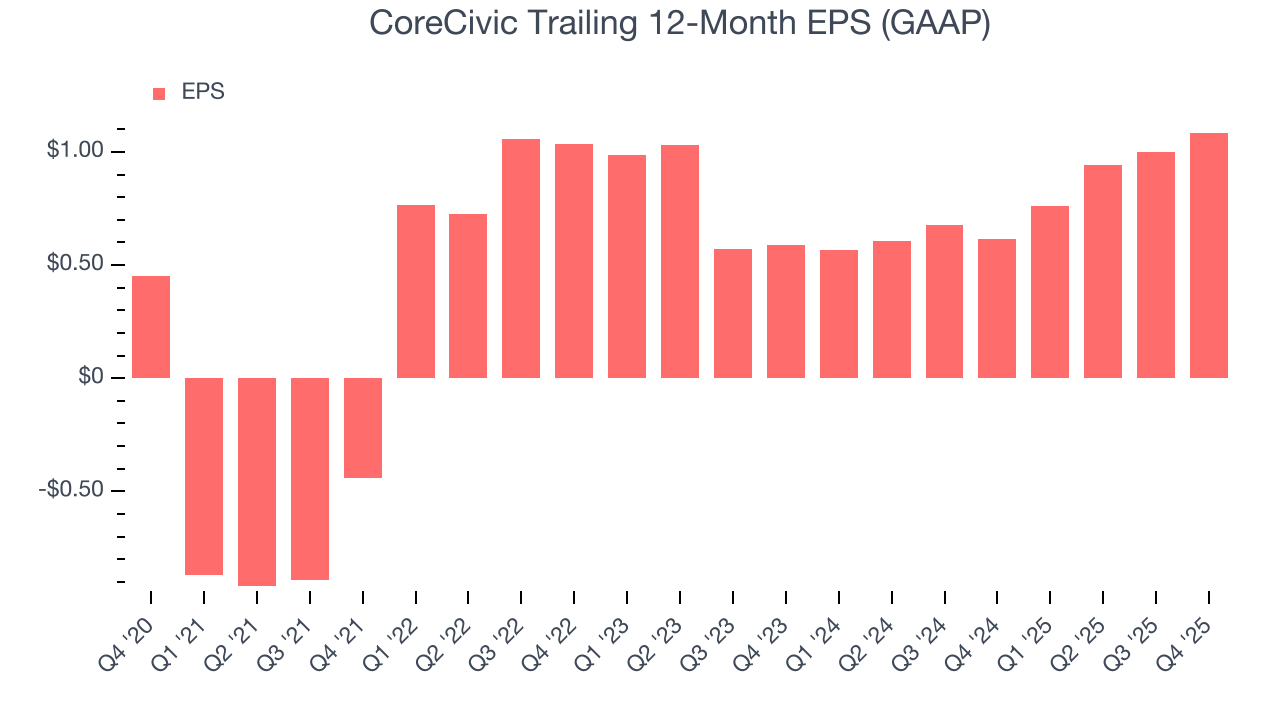

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

CoreCivic’s EPS grew at an astounding 19.2% compounded annual growth rate over the last five years, higher than its 3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For CoreCivic, its two-year annual EPS growth of 35.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, CoreCivic reported EPS of $0.26, up from $0.17 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects CoreCivic’s full-year EPS of $1.09 to grow 34.2%.

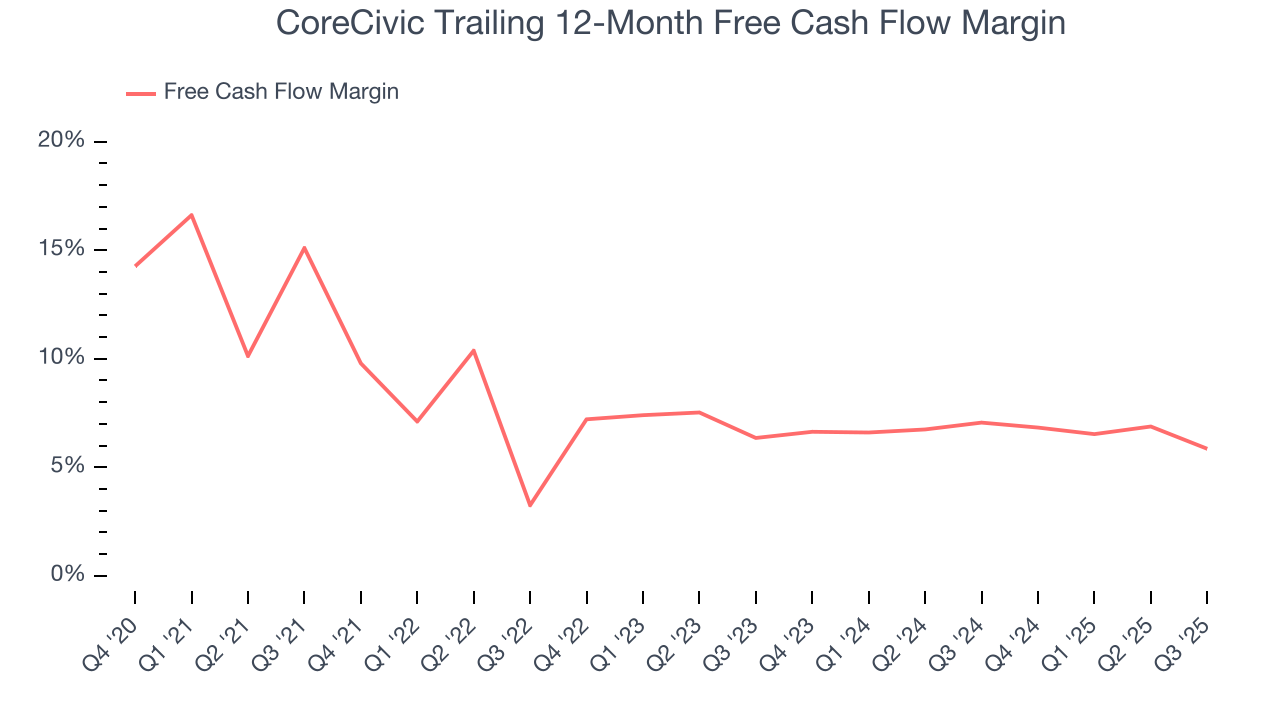

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

CoreCivic has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.3% over the last five years, better than the broader business services sector.

Taking a step back, we can see that CoreCivic’s margin dropped by 10.6 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

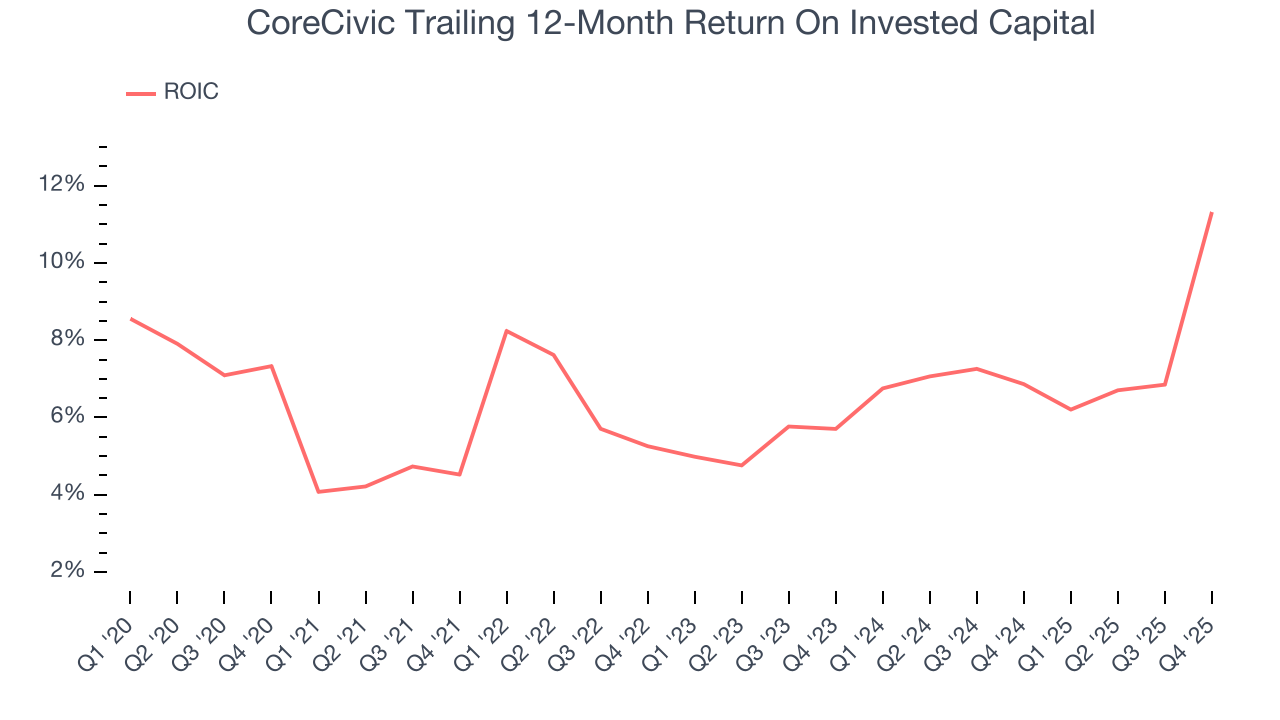

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

CoreCivic historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.7%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, CoreCivic’s ROIC averaged 4.2 percentage point increases each year over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Assessment

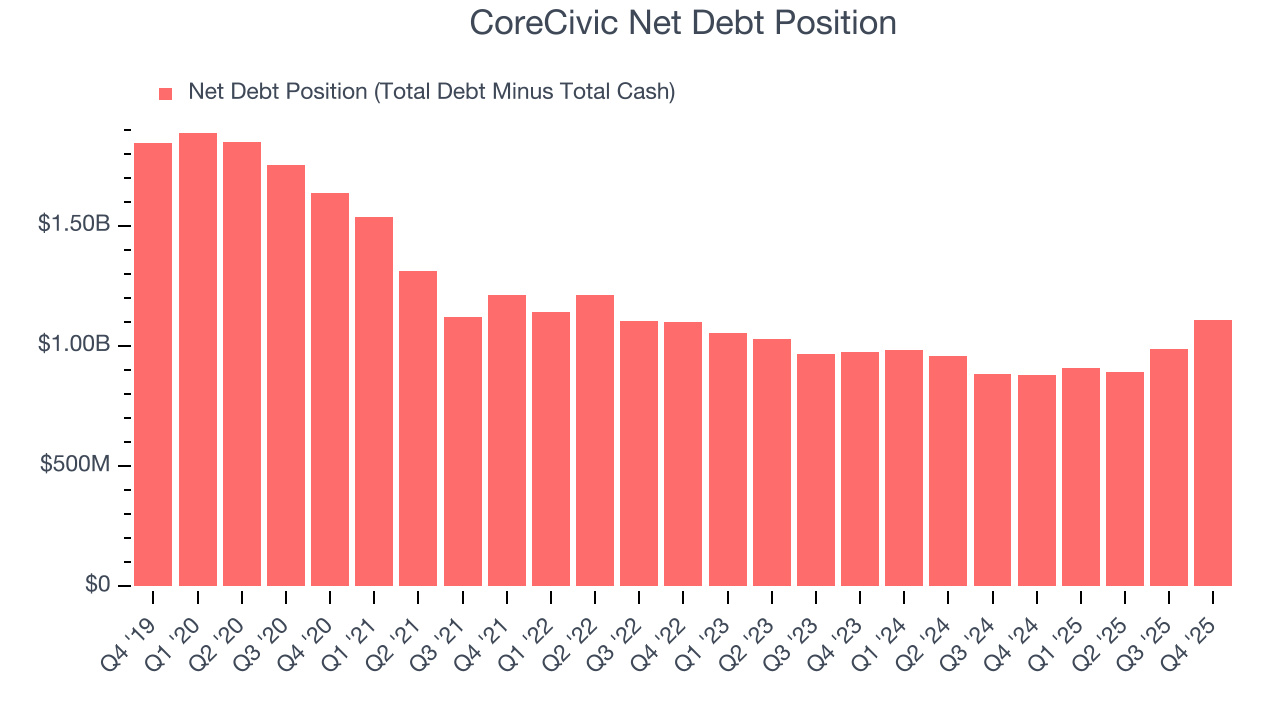

CoreCivic reported $112.4 million of cash and $1.22 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $365.6 million of EBITDA over the last 12 months, we view CoreCivic’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $62.23 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from CoreCivic’s Q4 Results

It was good to see CoreCivic beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 3.6% to $19.17 immediately after reporting.

12. Is Now The Time To Buy CoreCivic?

Updated: February 11, 2026 at 4:50 PM EST

Before deciding whether to buy CoreCivic or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

CoreCivic doesn’t top our investment wishlist, but we understand that it’s not a bad business. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while CoreCivic’s cash profitability fell over the last five years, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

CoreCivic’s P/E ratio based on the next 12 months is 12.5x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $29.88 on the company (compared to the current share price of $19.17).