DigitalBridge (DBRG)

We’re cautious of DigitalBridge. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think DigitalBridge Will Underperform

Transforming from a traditional real estate investor to a digital-focused powerhouse in 2021, DigitalBridge Group (NYSE:DBRG) is a global digital infrastructure investment firm that manages capital and operates assets across data centers, cell towers, fiber networks, and edge infrastructure.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 35.2% annually over the last five years

- ROE of 1.4% reflects management’s challenges in identifying attractive investment opportunities

- Negative earnings profile makes it challenging to secure favorable financing terms from lenders

DigitalBridge is skating on thin ice. Better businesses are for sale in the market.

Why There Are Better Opportunities Than DigitalBridge

High Quality

Investable

Underperform

Why There Are Better Opportunities Than DigitalBridge

DigitalBridge’s stock price of $15.40 implies a valuation ratio of 2.3x forward P/E. This multiple is quite expensive for the quality you get.

We’d rather invest in companies with elite fundamentals than questionable ones with open questions and big downside risks. The durable earnings power of high-quality businesses helps us sleep well at night.

3. DigitalBridge (DBRG) Research Report: Q4 CY2025 Update

Digital infrastructure investor DigitalBridge Group (NYSE:DBRG) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 27.6% year on year to $47.9 million. Its GAAP profit of $0.27 per share was significantly above analysts’ consensus estimates.

DigitalBridge (DBRG) Q4 CY2025 Highlights:

- Assets Under Management: $41 billion

- Revenue: $47.9 million vs analyst estimates of $106.9 million (27.6% year-on-year decline, 55.2% miss)

- Pre-tax Profit: $32.85 million (68.6% margin)

- EPS (GAAP): $0.27 vs analyst estimates of $0.06 (significant beat)

- Market Capitalization: $2.81 billion

Company Overview

Transforming from a traditional real estate investor to a digital-focused powerhouse in 2021, DigitalBridge Group (NYSE:DBRG) is a global digital infrastructure investment firm that manages capital and operates assets across data centers, cell towers, fiber networks, and edge infrastructure.

DigitalBridge operates through two primary business segments: Digital Investment Management and Digital Operating. The investment management arm raises capital from institutional investors like sovereign wealth funds, pension plans, and insurance companies, then deploys these funds into digital infrastructure opportunities. The company earns management fees based on assets under management and can receive additional incentive fees when investments perform well.

The Digital Operating segment maintains direct ownership stakes in digital infrastructure companies, including DataBank, an edge colocation data center business, and Vantage SDC, which operates hyperscale data centers. These investments generate recurring revenue through leasing digital asset space and capacity to businesses that need reliable digital infrastructure.

For example, a cloud service provider might lease space in a DigitalBridge-owned data center to house servers that power their applications, while a telecommunications company might utilize their cell towers to expand network coverage. This infrastructure forms the backbone of modern digital services, from streaming video to cloud computing.

DigitalBridge's strategic focus on digital assets represents a significant pivot from its past. The company has systematically divested non-core assets, including its hotel and healthcare real estate portfolios, to concentrate exclusively on digital infrastructure. This transformation reflects the company's belief in the growing importance of digital connectivity and data processing capabilities in the global economy.

4. Specialty Finance

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

DigitalBridge's competitors include other digital infrastructure investors such as American Tower (NYSE:AMT), Crown Castle (NYSE:CCI), Equinix (NASDAQ:EQIX), and Digital Realty Trust (NYSE:DLR), as well as private equity firms with digital infrastructure portfolios like Blackstone and KKR.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. DigitalBridge struggled to consistently generate demand over the last five years as its revenue dropped at a 68.3% annual rate. This wasn’t a great result and suggests it’s a low quality business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. DigitalBridge’s recent performance shows its demand remained suppressed as its revenue has declined by 77.6% annually over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, DigitalBridge missed Wall Street’s estimates and reported a rather uninspiring 27.6% year-on-year revenue decline, generating $47.9 million of revenue.

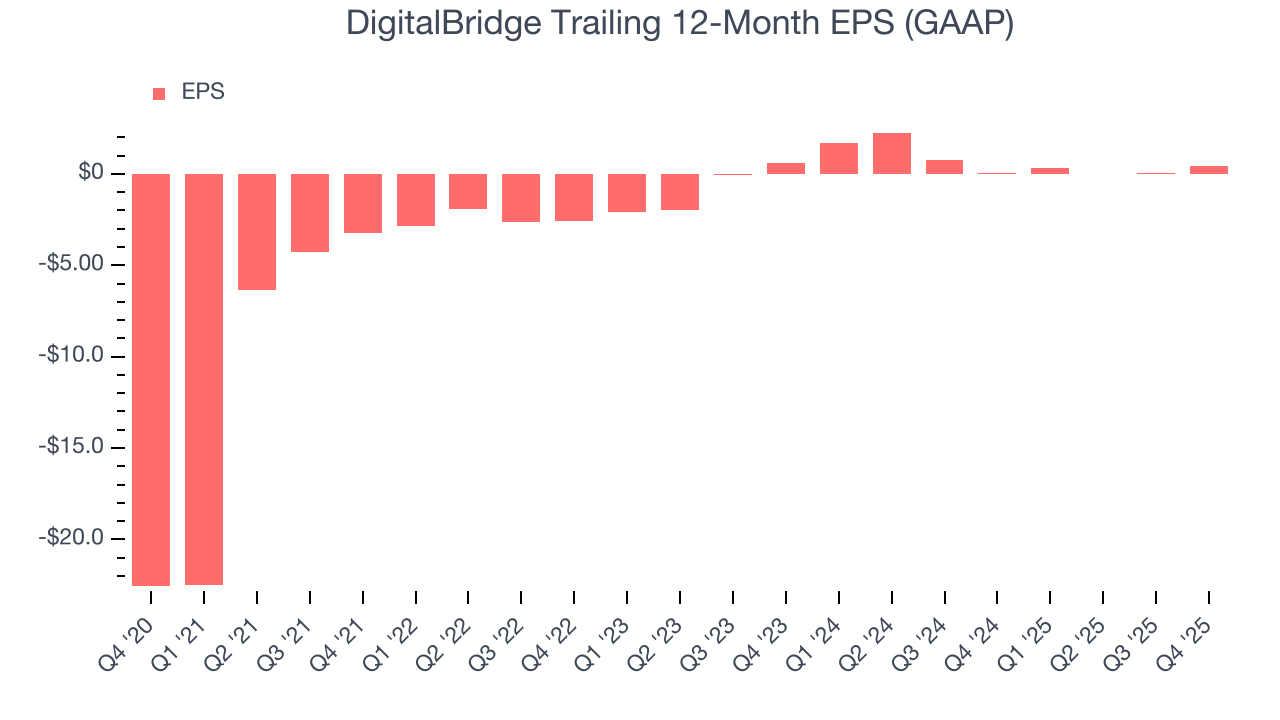

6. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

DigitalBridge’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for DigitalBridge, its EPS and revenue declined by 14.1% and 77.6% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, DigitalBridge’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, DigitalBridge reported EPS of $0.27, up from negative $0.12 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects DigitalBridge’s full-year EPS of $0.45 to stay about the same.

7. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, DigitalBridge has averaged an ROE of 1.7%, uninspiring for a company operating in a sector where the average shakes out around 10%.

8. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

DigitalBridge currently has $298.8 million of debt and $2.11 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.2×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

9. Key Takeaways from DigitalBridge’s Q4 Results

It was good to see DigitalBridge beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Overall, this was a softer quarter. The stock remained flat at $15.25 immediately after reporting.

10. Is Now The Time To Buy DigitalBridge?

Updated: February 26, 2026 at 12:35 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own DigitalBridge, you should also grasp the company’s longer-term business quality and valuation.

DigitalBridge falls short of our quality standards. To kick things off, its revenue has declined over the last five years. And while DigitalBridge’s expanding pre-tax profit margin shows the business has become more efficient, its relatively low ROE suggests management has struggled to find compelling investment opportunities.

DigitalBridge’s P/E ratio based on the next 12 months is 2.2x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $16 on the company (compared to the current share price of $15.38).