Ducommun (DCO)

Ducommun keeps us up at night. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Ducommun Will Underperform

California’s oldest company, Ducommun (NYSE:DCO) is a provider of engineering and manufacturing services for high-performance products primarily within the aerospace and defense industries.

- Low free cash flow margin declined over the last five years as its investments ramped, giving it little breathing room

- Below-average returns on capital indicate management struggled to find compelling investment opportunities, and its shrinking returns suggest its past profit sources are losing steam

- Backlog has dropped by 16% on average over the past two years, suggesting it’s losing orders as competition picks up

Ducommun doesn’t live up to our standards. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Ducommun

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Ducommun

Ducommun is trading at $130.34 per share, or 32.5x forward P/E. This multiple is higher than most industrials companies, and we think it’s quite expensive for the weaker revenue growth you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Ducommun (DCO) Research Report: Q4 CY2025 Update

Aerospace and defense company Ducommun (NYSE:DCO) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 9.4% year on year to $215.8 million. Its non-GAAP profit of $1.05 per share was 8.9% above analysts’ consensus estimates.

Ducommun (DCO) Q4 CY2025 Highlights:

- Revenue: $215.8 million vs analyst estimates of $217.6 million (9.4% year-on-year growth, 0.8% miss)

- Adjusted EPS: $1.05 vs analyst estimates of $0.96 (8.9% beat)

- Adjusted EBITDA: $37.87 million vs analyst estimates of $34.9 million (17.5% margin, 8.5% beat)

- Operating Margin: 6.5%, up from 5.3% in the same quarter last year

- Free Cash Flow was -$78.75 million, down from $14.58 million in the same quarter last year

- Backlog: $1.2 billion at quarter end, up 13.4% year on year

- Market Capitalization: $1.89 billion

Correction note:

The previous version of this report incorrectly estimated backlog at $576.4 million. This version has been updated to reflect the correct figure of $1.2 billion

Company Overview

California’s oldest company, Ducommun (NYSE:DCO) is a provider of engineering and manufacturing services for high-performance products primarily within the aerospace and defense industries.

Ducommun's diverse product portfolio includes advanced electronic and electromechanical solutions, structural components, and engineering services. Ducommun's expertise extends to manufacturing complex assemblies for commercial and military aircraft, missile systems, and space exploration programs.

Ducommun serves a global clientele, mainly collaborating with major aerospace and defense contractors, such as Boeing and Airbus, while also serving government agencies and commercial entities. The company's products play a role in enhancing the performance and reliability of aerospace and defense systems, contributing to mission success and technological advancements.

Ducommun often secures long-term contracts with major aerospace and defense contractors and forms partnerships with government agencies. The company utilizes direct sales teams to establish and maintain relationships with key clients, ensuring a personalized approach to meeting their specific needs. Additionally, Ducommun leverages its online presence to showcase its capabilities and facilitate seamless communication with clients in the procurement process.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Ducommun’s peers and competitors include Virgin Galactic (NSYE:SPCE) and Park Aerospace (NYSE:PKE)

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Ducommun’s sales grew at a tepid 5.6% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Ducommun’s recent performance shows its demand has slowed as its annualized revenue growth of 4.4% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

Ducommun also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Ducommun’s backlog reached $1.2 billion in the latest quarter and averaged 16% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Ducommun’s revenue grew by 9.4% year on year to $215.8 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and indicates its newer products and services will spur better top-line performance.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Ducommun was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.7% was weak for an industrials business.

Looking at the trend in its profitability, Ducommun’s operating margin decreased by 11.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Ducommun’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Ducommun generated an operating margin profit margin of 6.5%, up 1.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

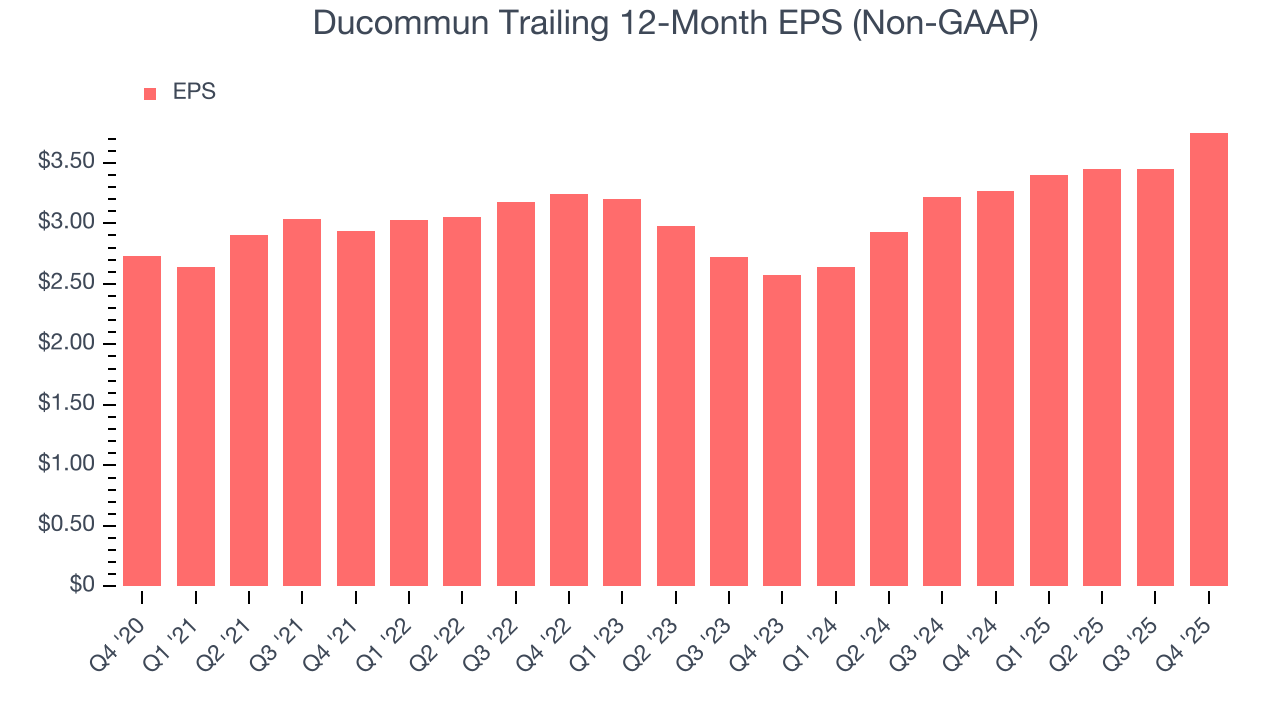

Ducommun’s unimpressive 6.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Ducommun’s two-year annual EPS growth of 20.8% was fantastic and topped its 4.4% two-year revenue growth.

We can take a deeper look into Ducommun’s earnings quality to better understand the drivers of its performance. Ducommun’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Ducommun reported adjusted EPS of $1.05, up from $0.75 in the same quarter last year. This print beat analysts’ estimates by 8.9%. Over the next 12 months, Wall Street expects Ducommun’s full-year EPS of $3.75 to grow 17.8%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Ducommun broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that Ducommun’s margin dropped by 3.2 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s in the middle of an investment cycle.

Ducommun burned through $78.75 million of cash in Q4, equivalent to a negative 36.5% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Ducommun historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.6%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Ducommun’s ROIC decreased by 2.2 percentage points annually each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

Ducommun reported $45.29 million of cash and $311.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $135.6 million of EBITDA over the last 12 months, we view Ducommun’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $6.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Ducommun’s Q4 Results

We were impressed by how significantly Ducommun blew past analysts’ EBITDA expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. The market seemed to be hoping for more, and the stock traded down 4.2% to $121.49 immediately after reporting.

12. Is Now The Time To Buy Ducommun?

Updated: March 5, 2026 at 10:54 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We see the value of companies helping their customers, but in the case of Ducommun, we’re out. First off, its revenue growth was uninspiring over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its declining operating margin shows the business has become less efficient.

Ducommun’s P/E ratio based on the next 12 months is 32.5x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $142 on the company (compared to the current share price of $130.34).