Dollar General (DG)

We aren’t fans of Dollar General. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Dollar General Will Underperform

Appealing to the budget-conscious consumer, Dollar General (NYSE:DG) is a discount retailer that sells a wide range of household essentials, groceries, apparel/beauty products, and seasonal merchandise.

- Widely-available products (and therefore stiff competition) result in an inferior gross margin of 30% that must be offset through higher volumes

- ROIC of 9.5% reflects management’s challenges in identifying attractive investment opportunities, and its shrinking returns suggest its past profit sources are losing steam

- A positive is that its scale advantages help overcome its low gross margin as its $42.12 billion revenue base provides operating leverage when demand is strong

Dollar General’s quality is insufficient. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Dollar General

Why There Are Better Opportunities Than Dollar General

Dollar General’s stock price of $146.28 implies a valuation ratio of 20.8x forward P/E. This multiple expensive for its subpar fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Dollar General (DG) Research Report: Q3 CY2025 Update

Discount retailer Dollar General (NYSE:DG) met Wall Streets revenue expectations in Q3 CY2025, with sales up 4.6% year on year to $10.65 billion. Its GAAP profit of $1.28 per share was 37.6% above analysts’ consensus estimates.

Dollar General (DG) Q3 CY2025 Highlights:

- Revenue: $10.65 billion vs analyst estimates of $10.62 billion (4.6% year-on-year growth, in line)

- EPS (GAAP): $1.28 vs analyst estimates of $0.93 (37.6% beat)

- Adjusted EBITDA: $765.5 million vs analyst estimates of $598 million (7.2% margin, 28% beat)

- EPS (GAAP) guidance for the full year is $6.40 at the midpoint, beating analyst estimates by 4.5%

- Operating Margin: 4%, in line with the same quarter last year

- Free Cash Flow Margin: 6.5%, up from 2% in the same quarter last year

- Locations: 20,901 at quarter end, up from 20,523 in the same quarter last year

- Same-Store Sales rose 2.5% year on year (1.3% in the same quarter last year)

- Market Capitalization: $24.19 billion

Company Overview

Appealing to the budget-conscious consumer, Dollar General (NYSE:DG) is a discount retailer that sells a wide range of household essentials, groceries, apparel/beauty products, and seasonal merchandise.

Founded in 1939 and originally called J.L. Turner & Son, the company changed its name to Dollar General in 1968. The core Dollar general customer is typically a lower-income household in underserved rural or suburban areas. Perhaps that area is not served well by large regional grocery stores or general merchandise retailers such as Walmart, which is where Dollar General sees opportunity.

Dollar General tends to sell smaller unit quantities for those who cannot afford to buy in bulk and want to instead buy for immediate need. For example, you might not be able to buy a pack of one or two paper towel rolls at Kroger or Costco, but Dollar General has you covered here.

The Dollar General store is generally less than 10,000 square feet, much smaller than traditional grocery stores or general merchandise giants such as Walmart and Costco. These Dollar General stores feature easy-to-navigate layouts. Because of smaller store sizes, there is usually less selection within categories (only two ketchup brands, for example) and fewer store employees. Dollar General sells a combination of national brands as well as private label products, but again, the selection of brands is limited.

4. Discount Grocery Store

Traditional grocery stores are go-tos for many families, but discount grocers serve those who may not have a traditional grocery store nearby or who may have different spending thresholds. Certain rural or lower-income areas simply don’t have a grocery store. Additionally, some lower-income families would prefer to buy in smaller quantities than available at most stores (think one or two paper towel rolls at a time). While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of buying food. Furthermore, those buying small quantities for immediate need are even less likely to leverage e-commerce for these purposes.

Competitors that sell general merchandise and/or groceries to US consumers include Walmart (NYSE:WMT), Costco (NYSE:COST), and Kroger (NYSE:KR).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $42.12 billion in revenue over the past 12 months, Dollar General is larger than most consumer retail companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. This also gives it the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, Dollar General likely needs to tweak its prices or enter new markets.

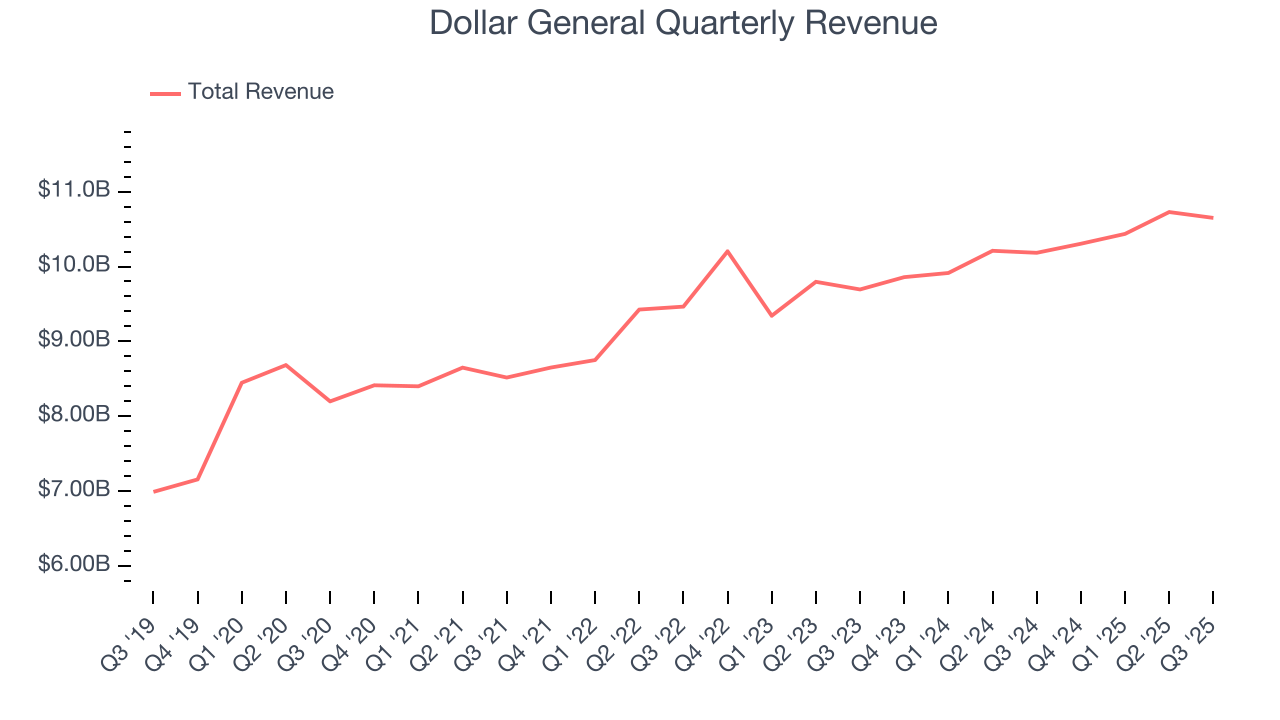

As you can see below, Dollar General’s 5.1% annualized revenue growth over the last three years (we compare to 2019 to normalize for COVID-19 impacts) was tepid as it barely increased sales at existing, established locations.

This quarter, Dollar General grew its revenue by 4.6% year on year, and its $10.65 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months, similar to its three-year rate. We still think its growth trajectory is satisfactory given its scale and implies the market is baking in success for its products.

6. Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

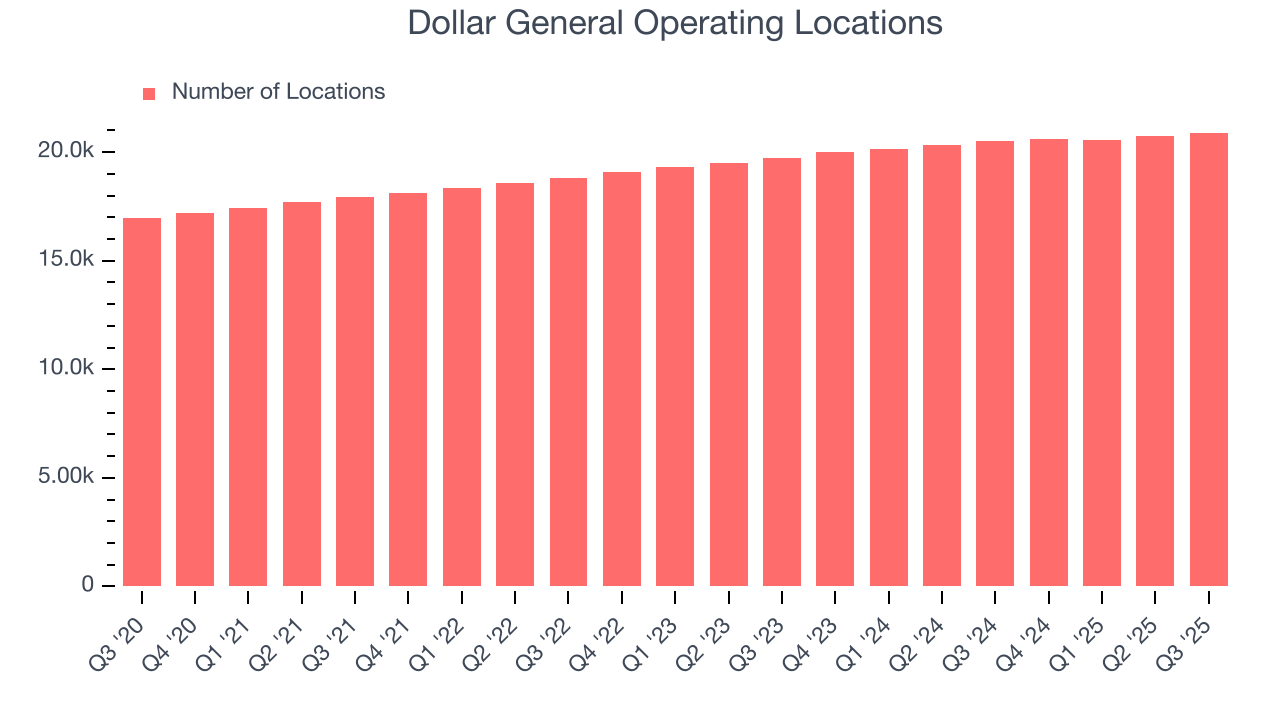

Dollar General operated 20,901 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 3.3% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

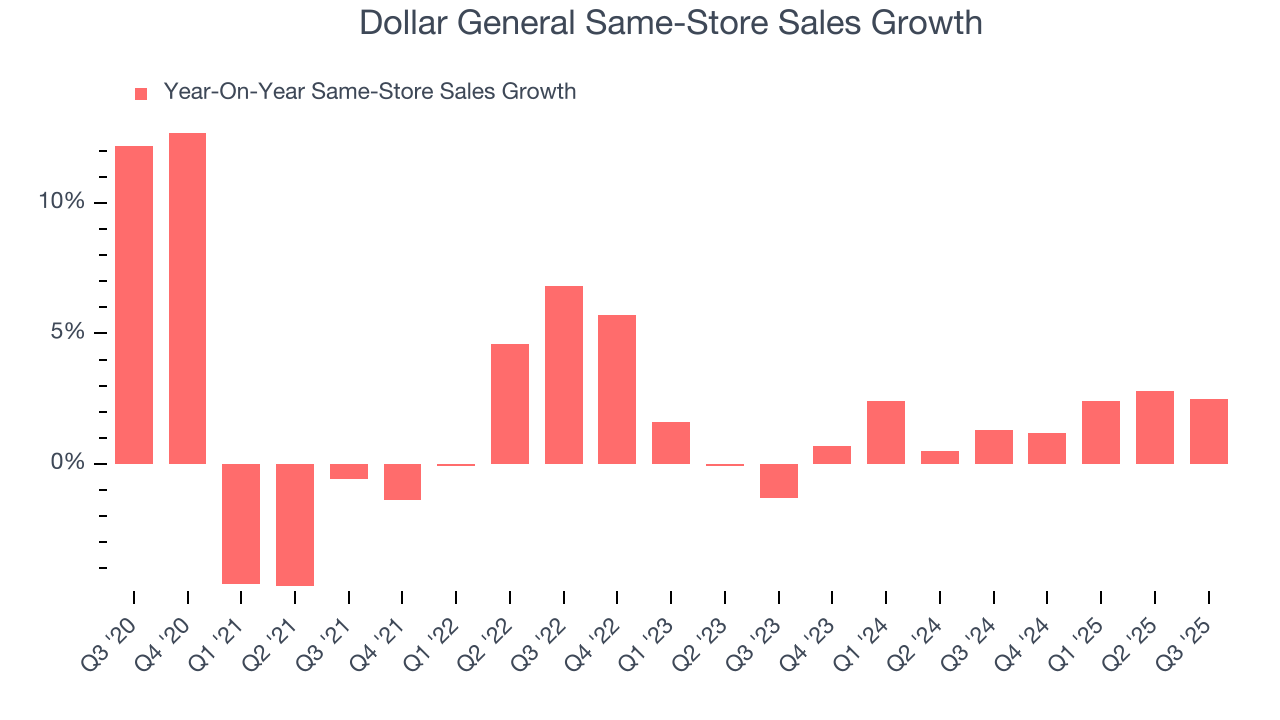

Dollar General’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.7% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Dollar General’s same-store sales rose 2.5% year on year. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

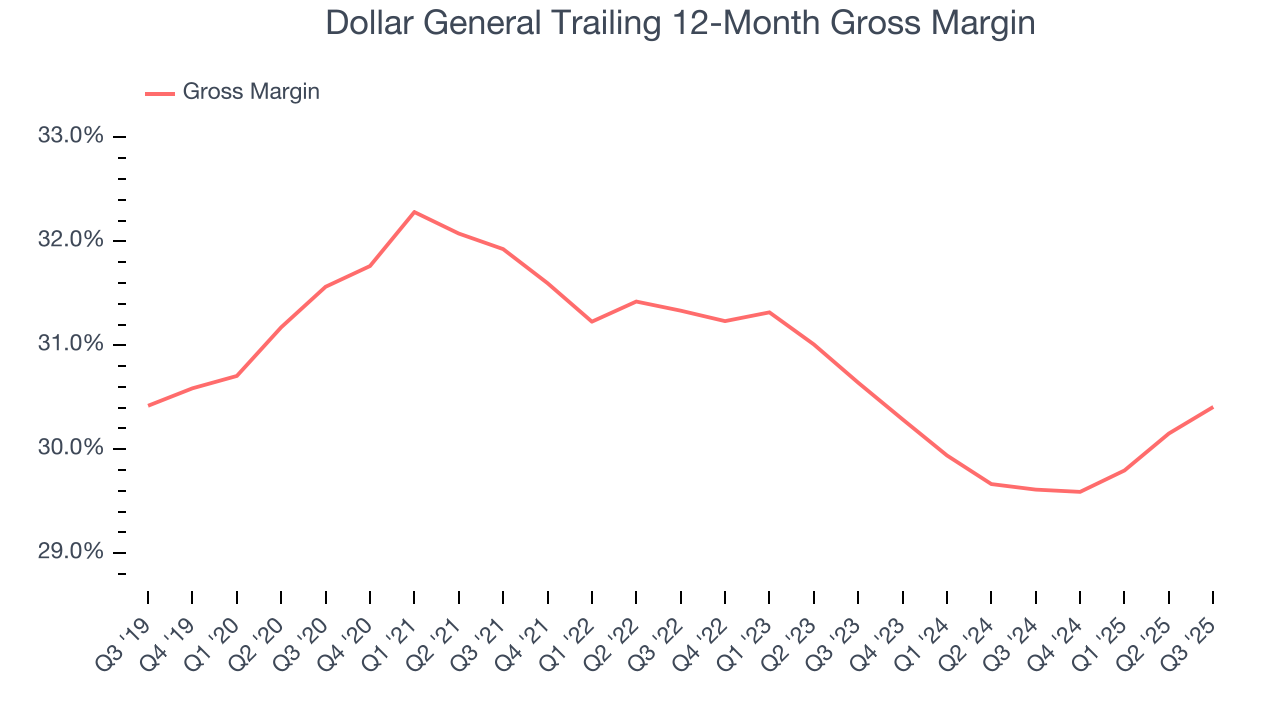

Dollar General has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 30% gross margin over the last two years.

When compared to other non-discretionary retailers, however, it’s actually pretty solid. That’s because non-discretionary retailers have structurally lower gross margins; they compete on the lowest price, sell products easily found elsewhere, and have high transportation costs to move goods. We believe the best metrics to assess these companies are free cash flow margin, operating leverage, and profit volatility, which account for their scale advantages and non-cyclical demand.

This quarter, Dollar General’s gross profit margin was 29.9%, marking a 1.1 percentage point increase from 28.8% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

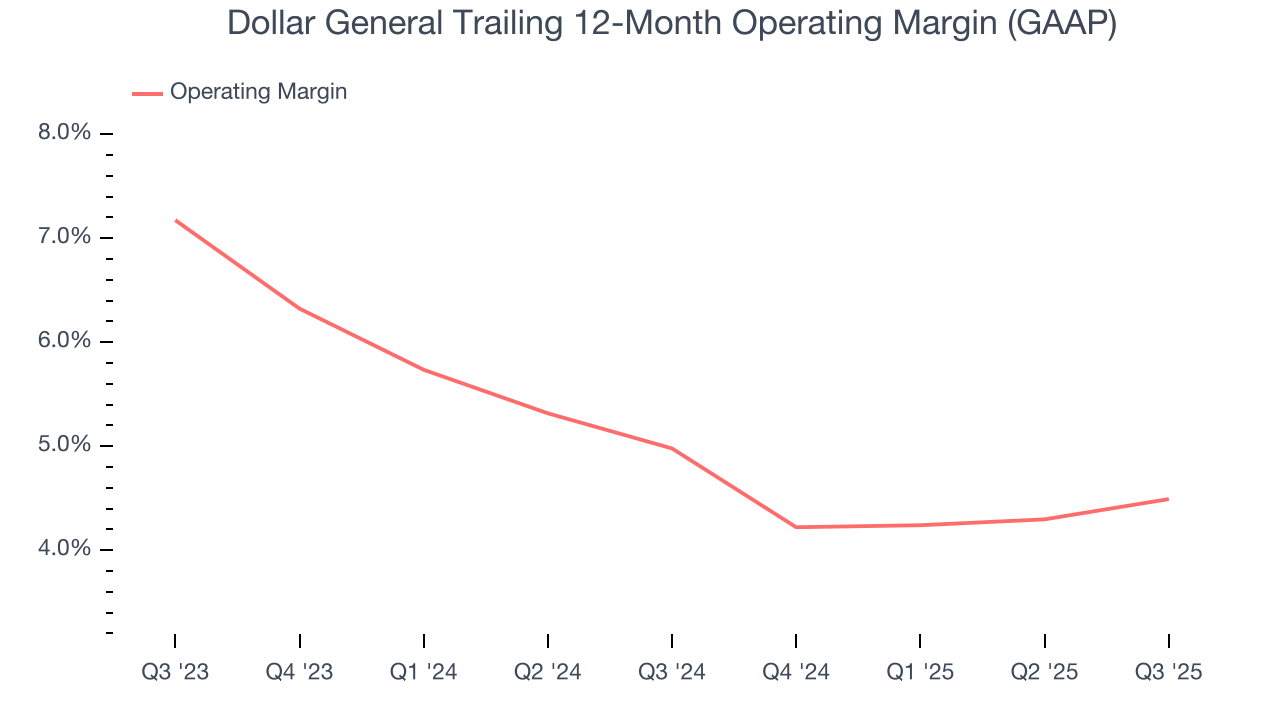

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Dollar General’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.7% over the last two years. This profitability was lousy for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Dollar General’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Dollar General generated an operating margin profit margin of 4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

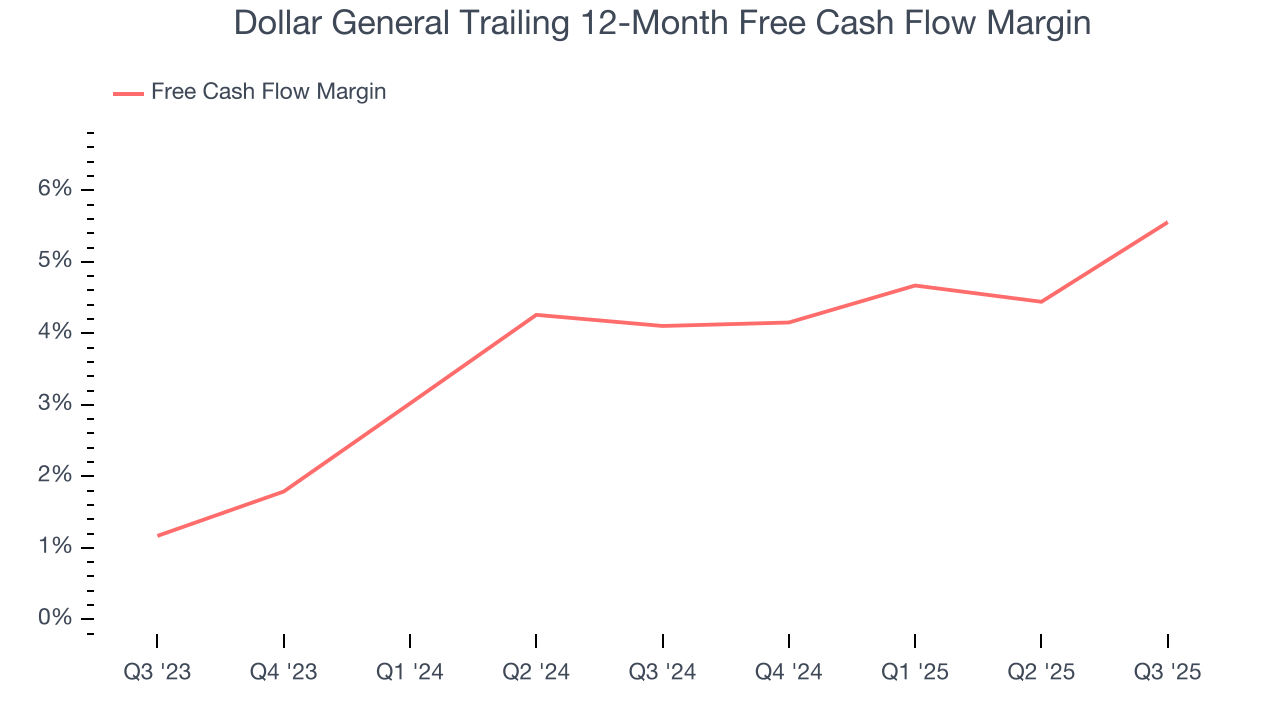

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Dollar General has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 4.8% over the last two years, better than the broader consumer retail sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Dollar General’s margin expanded by 1.5 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Dollar General’s free cash flow clocked in at $690.4 million in Q3, equivalent to a 6.5% margin. This result was good as its margin was 4.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Dollar General historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.5%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

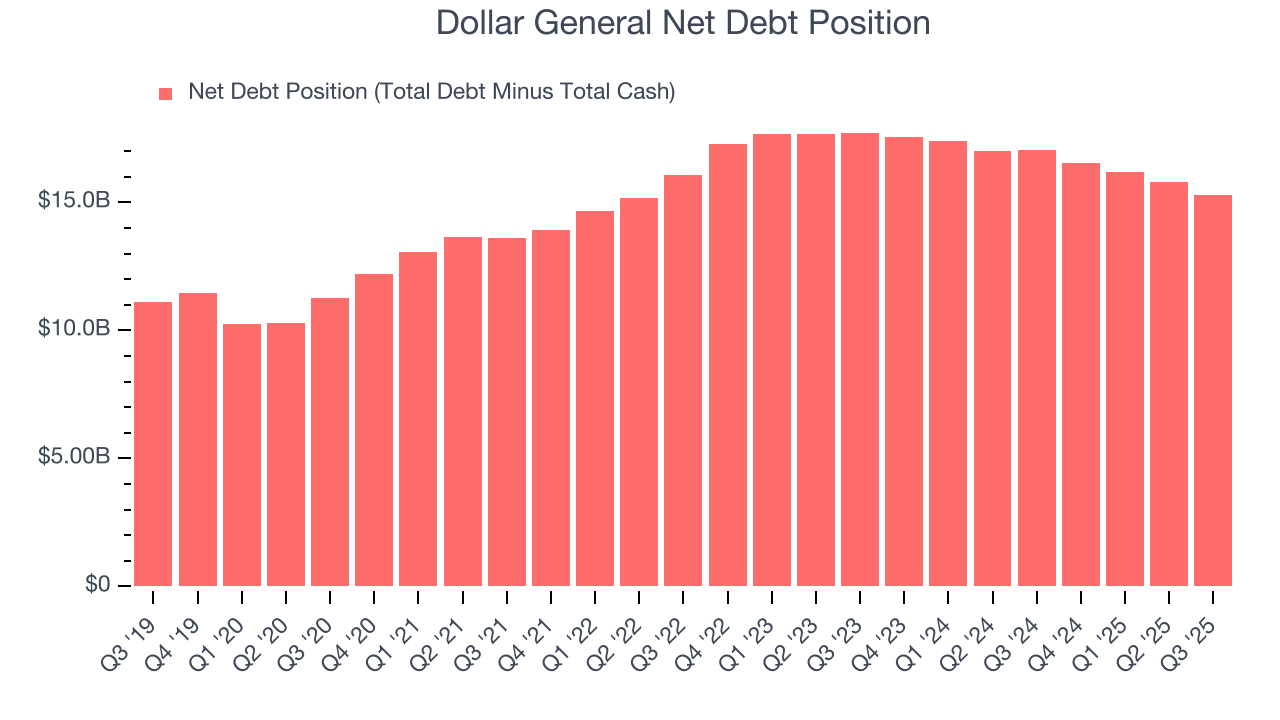

11. Balance Sheet Assessment

Dollar General reported $1.24 billion of cash and $16.51 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.23 billion of EBITDA over the last 12 months, we view Dollar General’s 4.7× net-debt-to-EBITDA ratio as safe. We also see its $132.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Dollar General’s Q3 Results

It was good to see Dollar General beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 3.2% to $113.39 immediately after reporting.

13. Is Now The Time To Buy Dollar General?

Updated: January 23, 2026 at 9:31 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Dollar General.

Dollar General isn’t a terrible business, but it isn’t one of our picks. To begin with, its revenue growth was a little slower over the last three years, and analysts don’t see anything changing over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses. On top of that, its declining EPS over the last three years makes it a less attractive asset to the public markets.

Dollar General’s P/E ratio based on the next 12 months is 20.8x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $138.43 on the company (compared to the current share price of $146.28), implying they don’t see much short-term potential in Dollar General.