Dolby Laboratories (DLB)

Dolby Laboratories faces an uphill battle. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think Dolby Laboratories Will Underperform

Known for its iconic "D" logo that appears before countless movies and TV shows, Dolby Laboratories (NYSE:DLB) designs and licenses audio and video technologies that enhance entertainment experiences in movies, TV shows, music, and other media.

- Muted 1.2% annual revenue growth over the last five years shows its demand lagged behind its software peers

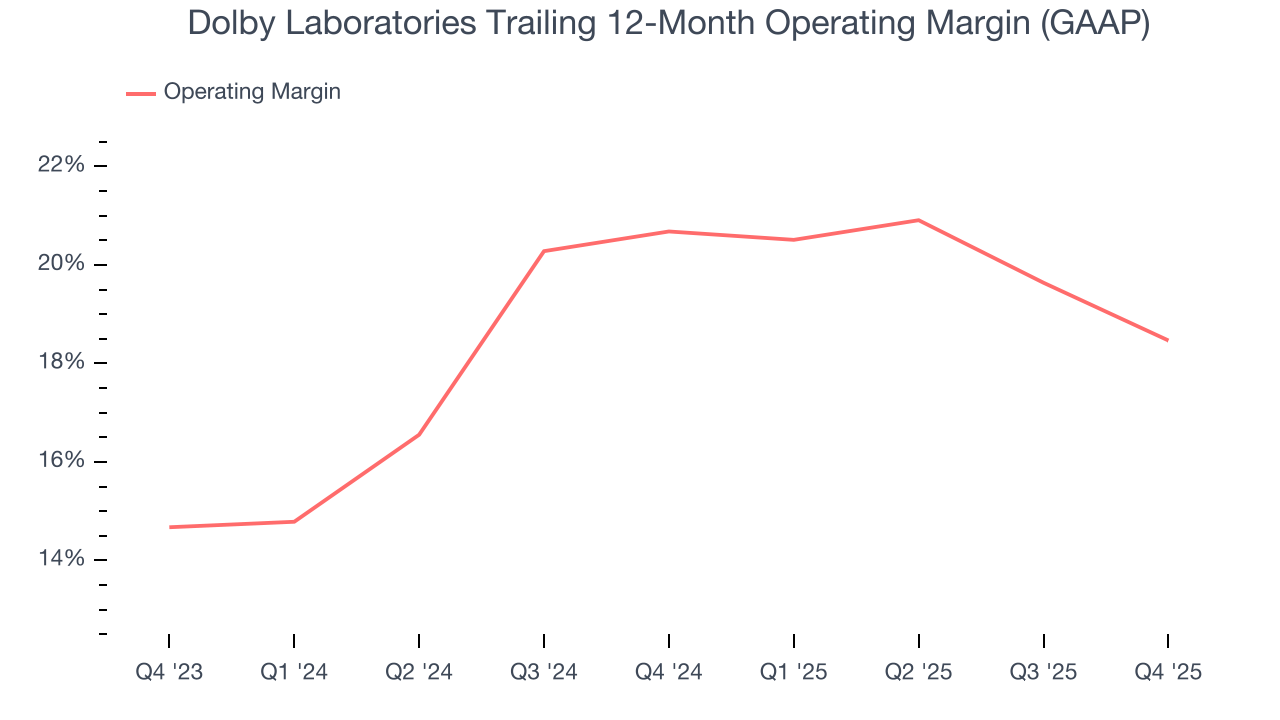

- Expenses have increased as a percentage of revenue over the last year as its operating margin fell by 2.2 percentage points

- Competitive market means the company must spend more on sales and marketing to stand out even if the return on investment is low

Dolby Laboratories’s quality doesn’t meet our hurdle. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Dolby Laboratories

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Dolby Laboratories

At $61.74 per share, Dolby Laboratories trades at 4.1x forward price-to-sales. This is a cheap valuation multiple, but for good reason. You get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Dolby Laboratories (DLB) Research Report: Q4 CY2025 Update

Audio and video technology company Dolby Laboratories (NYSE:DLB) reported Q4 CY2025 results topping the market’s revenue expectations, but sales fell by 2.9% year on year to $346.7 million. Guidance for next quarter’s revenue was optimistic at $390 million at the midpoint, 2.4% above analysts’ estimates. Its non-GAAP profit of $1.06 per share was 6.7% above analysts’ consensus estimates.

Dolby Laboratories (DLB) Q4 CY2025 Highlights:

- Revenue: $346.7 million vs analyst estimates of $331.9 million (2.9% year-on-year decline, 4.5% beat)

- Adjusted EPS: $1.06 vs analyst estimates of $0.99 (6.7% beat)

- Adjusted Operating Income: $119.3 million vs analyst estimates of $50.11 million (34.4% margin, significant beat)

- The company slightly lifted its revenue guidance for the full year to $1.43 billion at the midpoint from $1.42 billion

- Management raised its full-year Adjusted EPS guidance to $4.38 at the midpoint, a 2.6% increase

- Operating Margin: 17.9%, down from 22.4% in the same quarter last year

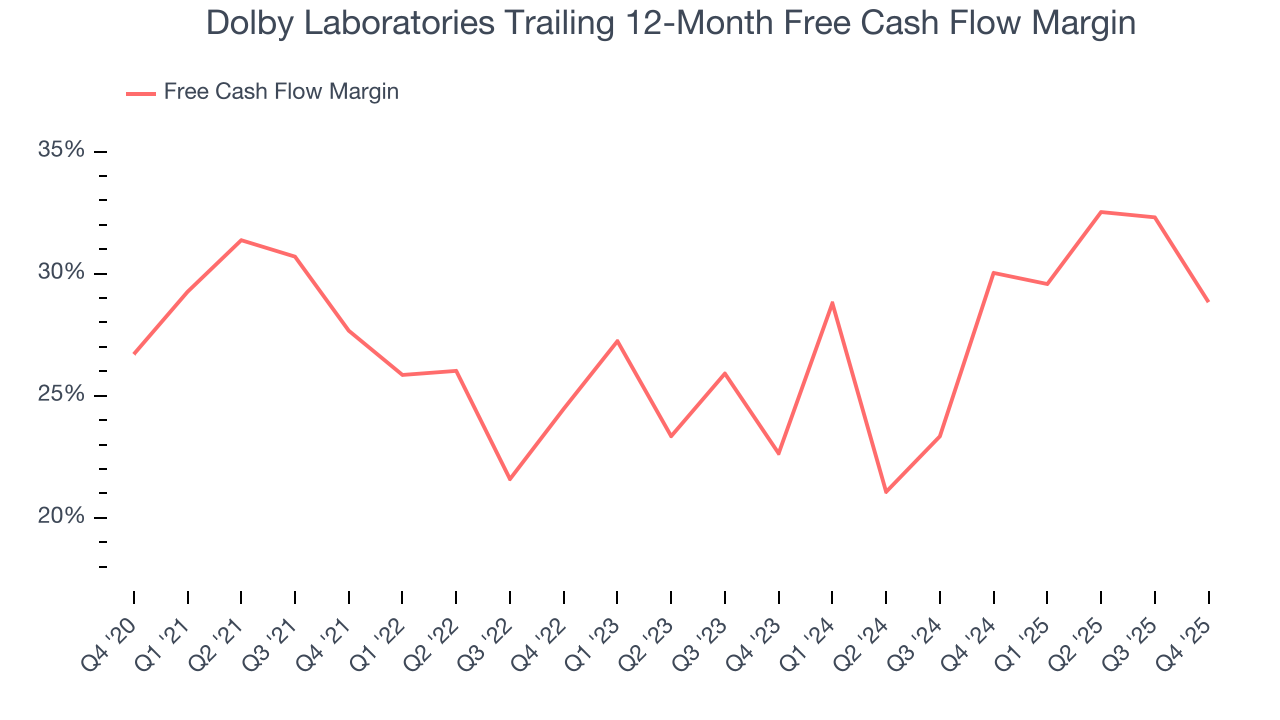

- Free Cash Flow Margin: 14.5%, down from 34.7% in the previous quarter

- Market Capitalization: $6.00 billion

Company Overview

Known for its iconic "D" logo that appears before countless movies and TV shows, Dolby Laboratories (NYSE:DLB) designs and licenses audio and video technologies that enhance entertainment experiences in movies, TV shows, music, and other media.

At the core of Dolby's business is a portfolio of branded technologies that have become industry standards for high-quality entertainment. The company's offerings include audio codecs that compress and decompress sound, Dolby Atmos which creates immersive three-dimensional audio experiences, and Dolby Vision which enhances video with high dynamic range technology. These technologies are licensed to approximately 1,000 consumer electronics manufacturers worldwide.

Dolby operates through a multi-tiered licensing model, first working with semiconductor manufacturers who incorporate its technologies into chips, and then licensing to device makers who use these chips. This approach has created a vast ecosystem where content creators utilize Dolby technologies, distributors deliver this content, and device manufacturers include Dolby capabilities in their products to satisfy consumer demand.

Beyond licensing, Dolby offers premium cinema solutions through Dolby Cinema, which combines Dolby Vision projection and Dolby Atmos sound in specially designed theaters. The company also sells digital cinema servers, processors, amplifiers, and loudspeakers to movie theaters. More recently, Dolby has expanded into software-as-a-service with Dolby.io, which provides real-time video engagement tools for live events, particularly sports.

4. Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Dolby's competitors include DTS (a subsidiary of Xperi Holding Corporation), THX (owned by Razer Inc.), IMAX Corporation (NYSE:IMAX) in the premium cinema space, and various codec technologies from companies like Fraunhofer (developers of MP3) and organizations developing open-source alternatives.

5. Revenue Growth

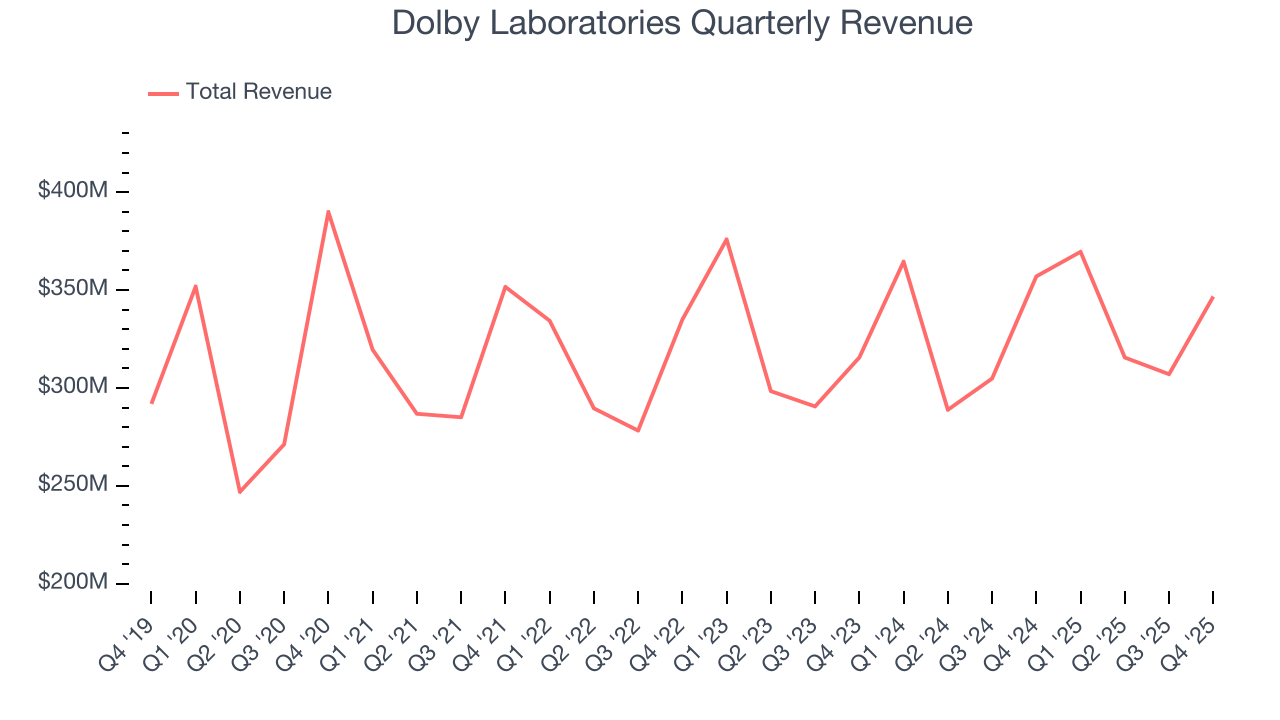

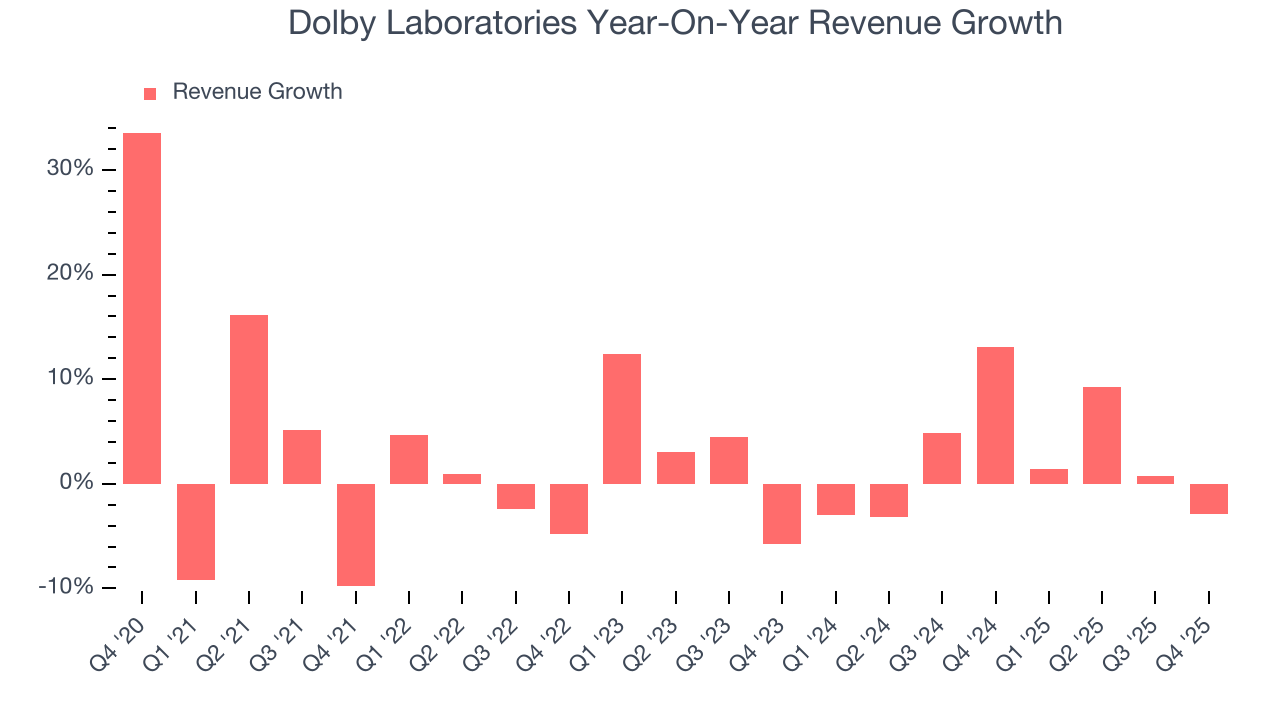

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Dolby Laboratories’s sales grew at a weak 1.2% compounded annual growth rate over the last five years. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Dolby Laboratories’s annualized revenue growth of 2.3% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Dolby Laboratories’s revenue fell by 2.9% year on year to $346.7 million but beat Wall Street’s estimates by 4.5%. Company management is currently guiding for a 5.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Dolby Laboratories’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Dolby Laboratories’s products and its peers.

7. Gross Margin & Pricing Power

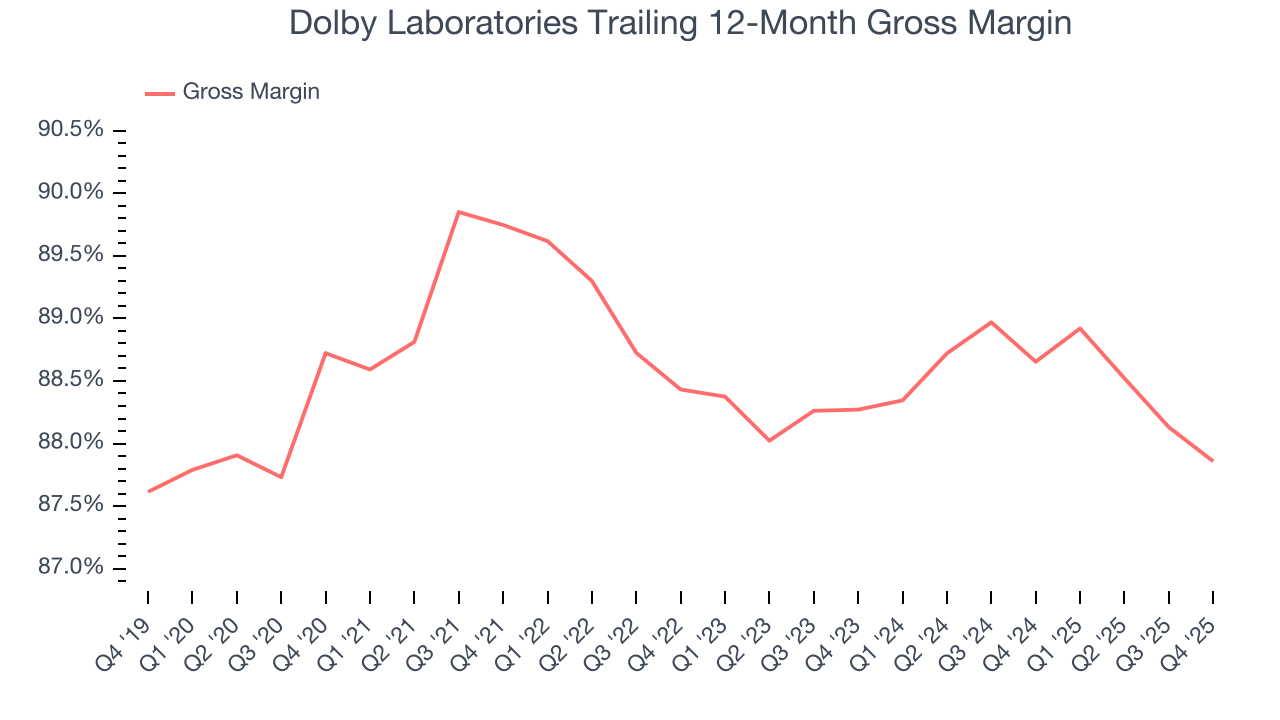

For software companies like Dolby Laboratories, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Dolby Laboratories’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 87.9% gross margin over the last year. Said differently, roughly $87.86 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Dolby Laboratories has seen gross margins decline by 0.4 percentage points over the last 2 year, which is slightly worse than average for software.

In Q4, Dolby Laboratories produced a 87.5% gross profit margin, down 1 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Dolby Laboratories has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 18.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Dolby Laboratories’s operating margin decreased by 2.2 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Dolby Laboratories generated an operating margin profit margin of 17.9%, down 4.4 percentage points year on year. Since Dolby Laboratories’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Dolby Laboratories has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 28.8% over the last year, quite impressive for a software business.

Dolby Laboratories’s free cash flow clocked in at $50.17 million in Q4, equivalent to a 14.5% margin. The company’s cash profitability regressed as it was 13.5 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

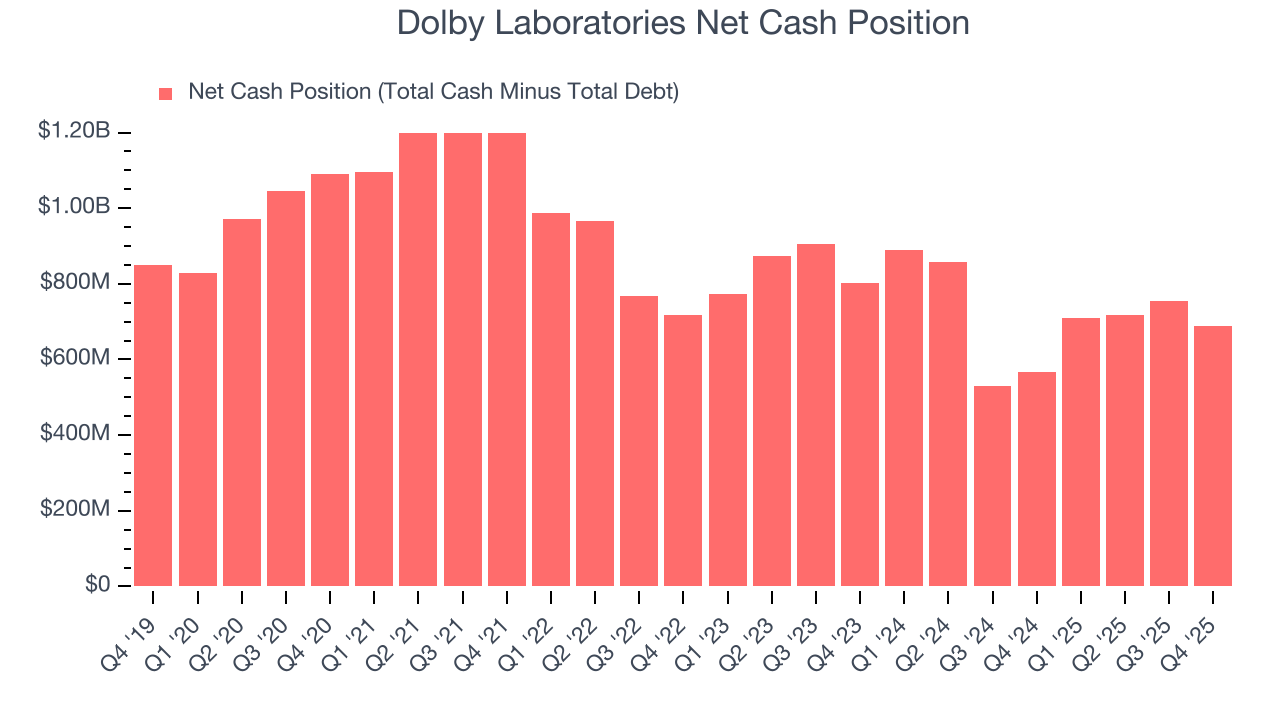

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Dolby Laboratories is a profitable, well-capitalized company with $728.3 million of cash and $40.64 million of debt on its balance sheet. This $687.7 million net cash position is 11.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Dolby Laboratories’s Q4 Results

We were impressed by how significantly Dolby Laboratories blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. Investors were likely hoping for more, and shares traded down 2% to $61.74 immediately after reporting.

12. Is Now The Time To Buy Dolby Laboratories?

Updated: January 29, 2026 at 11:53 PM EST

Are you wondering whether to buy Dolby Laboratories or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Dolby Laboratories doesn’t pass our quality test. First off, its revenue growth was weak over the last five years. And while its admirable gross margin indicates excellent unit economics, the downside is its declining operating margin shows it’s becoming less efficient at building and selling its software. On top of that, its customer acquisition is less efficient than many comparable companies.

Dolby Laboratories’s price-to-sales ratio based on the next 12 months is 4.1x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $89.25 on the company (compared to the current share price of $61.74).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.