Autodesk (ADSK)

We aren’t fans of Autodesk. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Autodesk Is Not Exciting

Starting with AutoCAD in the 1980s and evolving into a comprehensive design ecosystem, Autodesk (NASDAQ:ADSK) provides software solutions for architecture, engineering, construction, manufacturing, and entertainment industries to design, simulate, and visualize projects.

- Static operating margin over the last year shows it couldn’t become more efficient

- Extended payback periods on sales investments suggest the company’s platform isn’t resonating enough to drive efficient sales conversions

- A bright spot is that its software is difficult to replicate at scale and leads to a best-in-class gross margin of 92.3%

Autodesk doesn’t meet our quality standards. Better stocks can be found in the market.

Why There Are Better Opportunities Than Autodesk

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Autodesk

At $260.73 per share, Autodesk trades at 6.9x forward price-to-sales. This multiple is quite expensive for the quality you get.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Autodesk (ADSK) Research Report: Q4 CY2025 Update

3D design software company Autodesk (NASDAQ:ADSK) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 19.4% year on year to $1.96 billion. Guidance for next quarter’s revenue was optimistic at $1.89 billion at the midpoint, 2.9% above analysts’ estimates. Its non-GAAP profit of $2.85 per share was 7.8% above analysts’ consensus estimates.

Autodesk (ADSK) Q4 CY2025 Highlights:

- Revenue: $1.96 billion vs analyst estimates of $1.92 billion (19.4% year-on-year growth, 2.1% beat)

- Adjusted EPS: $2.85 vs analyst estimates of $2.64 (7.8% beat)

- Adjusted Operating Income: $750 million vs analyst estimates of $699.1 million (38.3% margin, 7.3% beat)

- Revenue Guidance for Q1 CY2026 is $1.89 billion at the midpoint, above analyst estimates of $1.84 billion

- Adjusted EPS guidance for the upcoming financial year 2027 is $12.43 at the midpoint, beating analyst estimates by 6.6%

- Operating Margin: 22%, in line with the same quarter last year

- Free Cash Flow Margin: 49.7%, up from 23.2% in the previous quarter

- Billings: $2.80 billion at quarter end, up 33% year on year

- Market Capitalization: $47.57 billion

Company Overview

Starting with AutoCAD in the 1980s and evolving into a comprehensive design ecosystem, Autodesk (NASDAQ:ADSK) provides software solutions for architecture, engineering, construction, manufacturing, and entertainment industries to design, simulate, and visualize projects.

Autodesk's software portfolio enables professionals to create digital models and designs before physical construction or manufacturing begins. The company organizes its offerings into three main segments: Architecture, Engineering and Construction (AEC); Manufacturing (MFG); and Media and Entertainment (M&E). Each segment offers specialized tools tailored to industry-specific workflows.

In the AEC segment, products like Revit and AutoCAD Civil 3D allow architects and engineers to create detailed building information models (BIM). For example, an architectural firm might use Revit to design a hospital, simulate its energy performance, and coordinate with structural engineers and contractors—all within the same digital environment.

The Manufacturing segment includes Fusion and Inventor, which help product designers and engineers create everything from consumer electronics to industrial machinery. A manufacturing company might use these tools to design a new product, simulate its performance, and create the tooling needed for production.

For media and entertainment professionals, Autodesk offers Maya and 3ds Max, which are used to create visual effects, animations, and digital worlds for films, games, and visualizations. Many blockbuster movies and popular video games rely on these tools for their visual elements.

Autodesk operates globally through both direct sales and a network of approximately 1,450 resellers and distributors. The company has shifted its business model from perpetual licenses to subscription-based offerings, providing customers with regular updates and cloud-based capabilities.

4. Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Autodesk's primary competitors include Dassault Systèmes (OTCMKTS:DASTY) with its SOLIDWORKS products, Bentley Systems (NASDAQ:BSY) in infrastructure software, Nemetschek Group (ETR:NEM) with its AEC solutions, PTC Inc. (NASDAQ:PTC) in CAD and PLM software, and Trimble (NASDAQ:TRMB) in construction technology.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Autodesk grew its sales at a 13.7% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the software sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Autodesk’s annualized revenue growth of 14.5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Autodesk reported year-on-year revenue growth of 19.4%, and its $1.96 billion of revenue exceeded Wall Street’s estimates by 2.1%. Company management is currently guiding for a 15.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Autodesk’s billings punched in at $2.80 billion in Q4, and over the last four quarters, its growth was fantastic as it averaged 29.6% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Autodesk’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

8. Gross Margin & Pricing Power

For software companies like Autodesk, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Autodesk’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 92% gross margin over the last year. Said differently, roughly $91.99 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Autodesk has seen gross margins improve by 0.4 percentage points over the last 2 year, which is slightly better than average for software.

Autodesk produced a 91.5% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

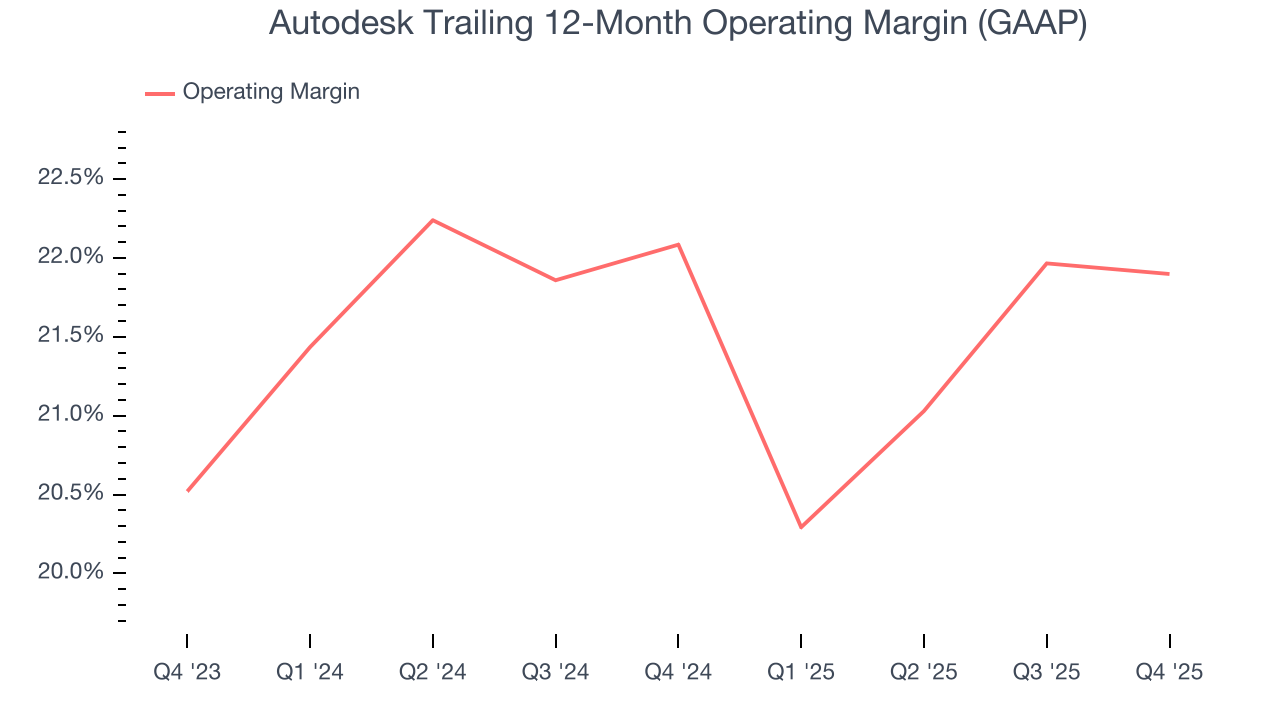

9. Operating Margin

Autodesk has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 21.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Autodesk’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Autodesk generated an operating margin profit margin of 22%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Autodesk has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 33.4% over the last year.

Autodesk’s free cash flow clocked in at $972 million in Q4, equivalent to a 49.7% margin. This result was good as its margin was 8.3 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Autodesk’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 33.4% for the last 12 months will decrease to 31.9%.

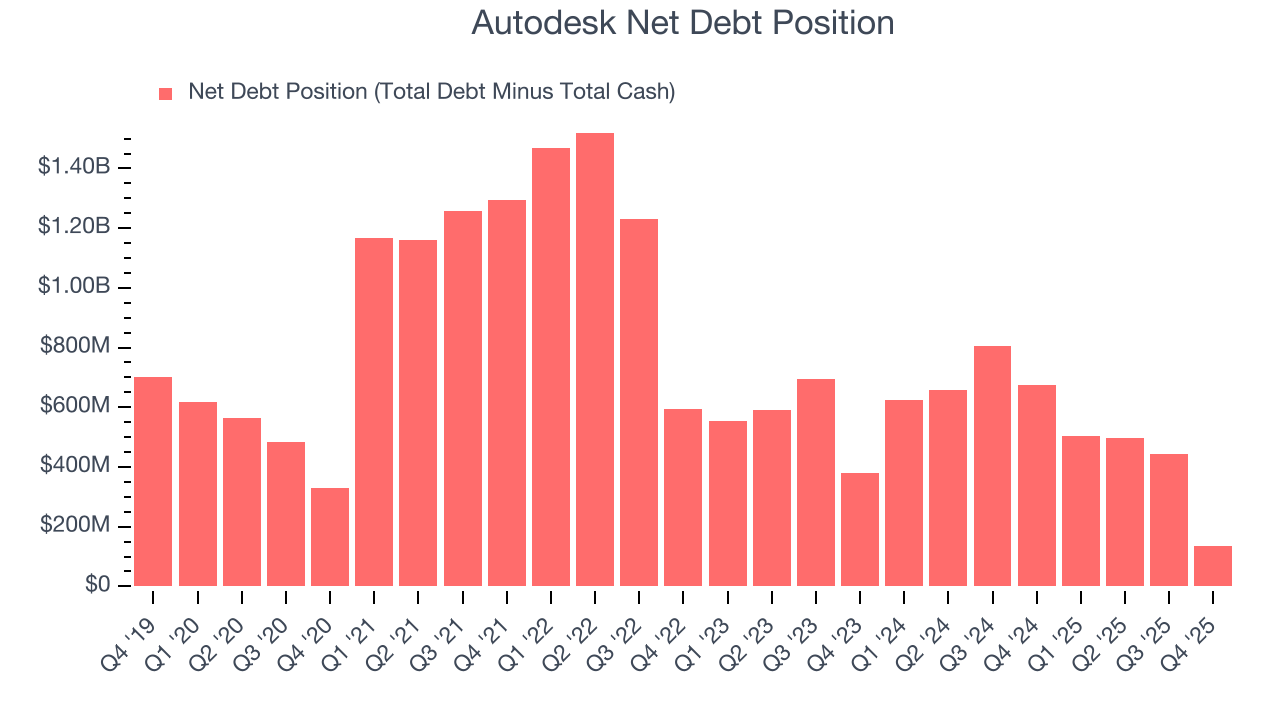

11. Balance Sheet Assessment

Autodesk reported $2.60 billion of cash and $2.73 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.77 billion of EBITDA over the last 12 months, we view Autodesk’s 0.0× net-debt-to-EBITDA ratio as safe. We also see its $19 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Autodesk’s Q4 Results

We were impressed by how significantly Autodesk blew past analysts’ billings expectations this quarter, leading to beats on the revenue and adjusted operating profit lines. We were also glad its EPS guidance for next quarter trumped Wall Street’s estimates. Overall, we think this was a solid quarter with some key metrics above expectations. The stock traded up 6.9% to $249.65 immediately following the results.

13. Is Now The Time To Buy Autodesk?

Updated: March 8, 2026 at 10:08 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Autodesk.

Autodesk isn’t a terrible business, but it doesn’t pass our bar. First off, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. While its admirable gross margin indicates excellent unit economics, the downside is its operating margin hasn't moved over the last year. On top of that, its customer acquisition is less efficient than many comparable companies.

Autodesk’s price-to-sales ratio based on the next 12 months is 6.9x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $331.75 on the company (compared to the current share price of $260.73).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.