Dover (DOV)

We’re skeptical of Dover. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Dover Will Underperform

A company that manufactured critical equipment for the United States military during World War II, Dover (NYSE:DOV) manufactures engineered components and specialized equipment for numerous industries.

- Organic sales performance over the past two years indicates the company may need to make strategic adjustments or rely on M&A to catalyze faster growth

- 3.9% annual revenue growth over the last five years was slower than its industrials peers

- On the bright side, its excellent operating margin highlights the strength of its business model

Dover’s quality is not up to our standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Dover

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Dover

At $232.46 per share, Dover trades at 21.9x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Dover (DOV) Research Report: Q4 CY2025 Update

Manufacturing company Dover (NYSE:DOV) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 8.8% year on year to $2.10 billion. Its non-GAAP profit of $2.51 per share was 1% above analysts’ consensus estimates.

Dover (DOV) Q4 CY2025 Highlights:

- Revenue: $2.10 billion vs analyst estimates of $2.08 billion (8.8% year-on-year growth, 0.9% beat)

- Adjusted EPS: $2.51 vs analyst estimates of $2.49 (1% beat)

- Adjusted EBITDA: $520.9 million vs analyst estimates of $472.9 million (24.8% margin, 10.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $10.55 at the midpoint, missing analyst estimates by 0.8%

- Operating Margin: 16.5%, up from 15.3% in the same quarter last year

- Free Cash Flow Margin: 23.2%, up from 20% in the same quarter last year

- Organic Revenue rose 5% year on year (beat)

- Market Capitalization: $28.25 billion

Company Overview

A company that manufactured critical equipment for the United States military during World War II, Dover (NYSE:DOV) manufactures engineered components and specialized equipment for numerous industries.

Dover Corporation's story starts when George Ohrstrom Sr., a New York City stockbroker, acquired four manufacturing companies during the 1930s and 1940s. Officially going public in 1955 under the management of Fred D. Durham, the company established its headquarters in Washington, D.C., and embraced a management philosophy of autonomy and decentralization. This approach allowed each division to operate independently, a strategy that still characterizes Dover today.

Dover expanded through acquisitions, particularly in the elevator industry. From 1955 to 1979, Dover acquired 14 companies, significantly enhancing its elevator business. The strategic sale of its elevator division in 1999 to Thyssen AG for $1.1 billion marked a pivotal shift, allowing Dover to concentrate on diversifying and strengthening its other business sectors.

Today, Dover Corporation produces many products essential in industries ranging from automotive and industrial automation to clean energy and healthcare. The company also provides aftermarket services and software offerings to further enhance its products. For instance, through its subsidiary Rotary Lift, Dover provides services including inspection, maintenance, and repair for vehicle lifts. These services are crucial for auto body repair shops that rely on this equipment to remain operational and compliant with safety standards. In the utility management space, Dover’s FlexNet communication network offers a platform for metering services, enabling real-time monitoring, data management and analytics. These offerings create recurring revenue streams for Dover, providing a stable source of income that makes up a substantial portion of the company’s revenue.

Revenue is primarily generated through the sale of its products complemented by aftermarket services and maintenance contracts. Many of Dover's products are configured and monitored remotely, allowing the company to sell aftermarket parts and provide remote diagnostic services efficiently. In terms of the company’s growth strategy, Dover emphasizes bolt-on acquisitions, where the company integrates smaller, complementary businesses that align closely with its existing operations. This strategy helps Dover strengthen its core businesses, ensuring that each acquisition not only expands its portfolio but also enhances its market position and financial health.

4. General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Graco (NYSE:GGG), Illinois Tool Works (NYSE:ITW), and Parker-Hannifin (NYSE:PH).

5. Revenue Growth

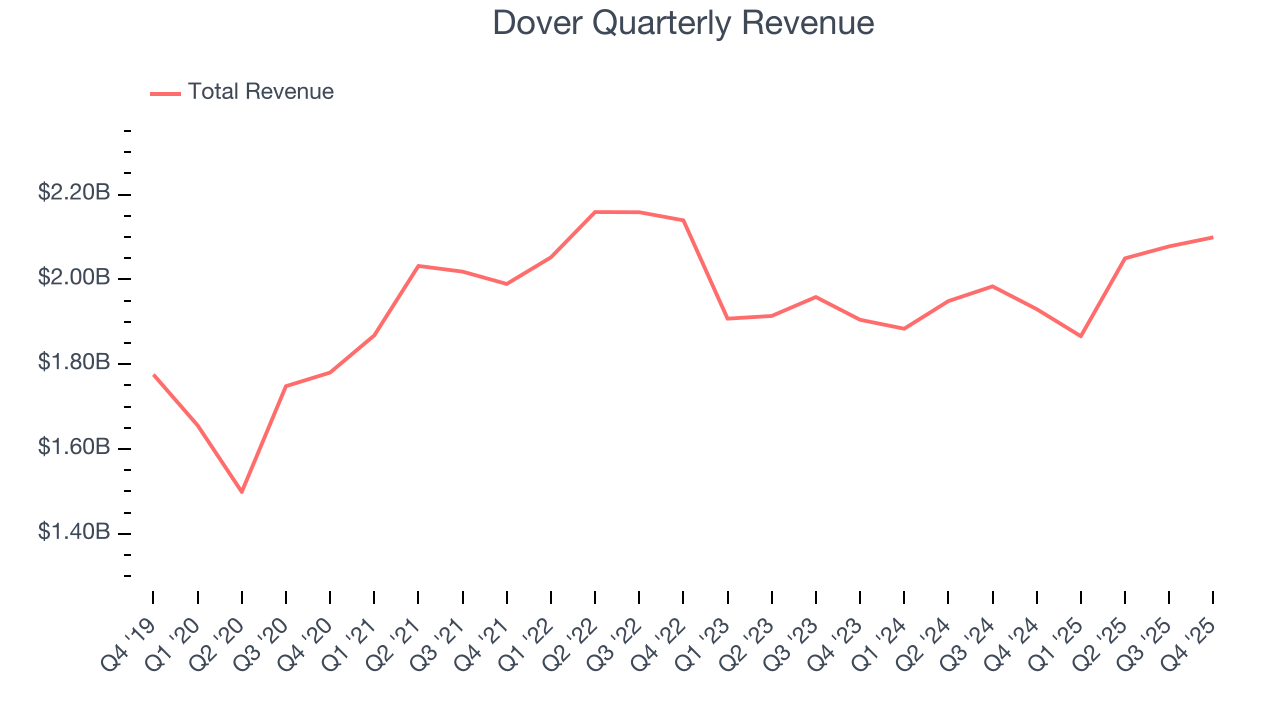

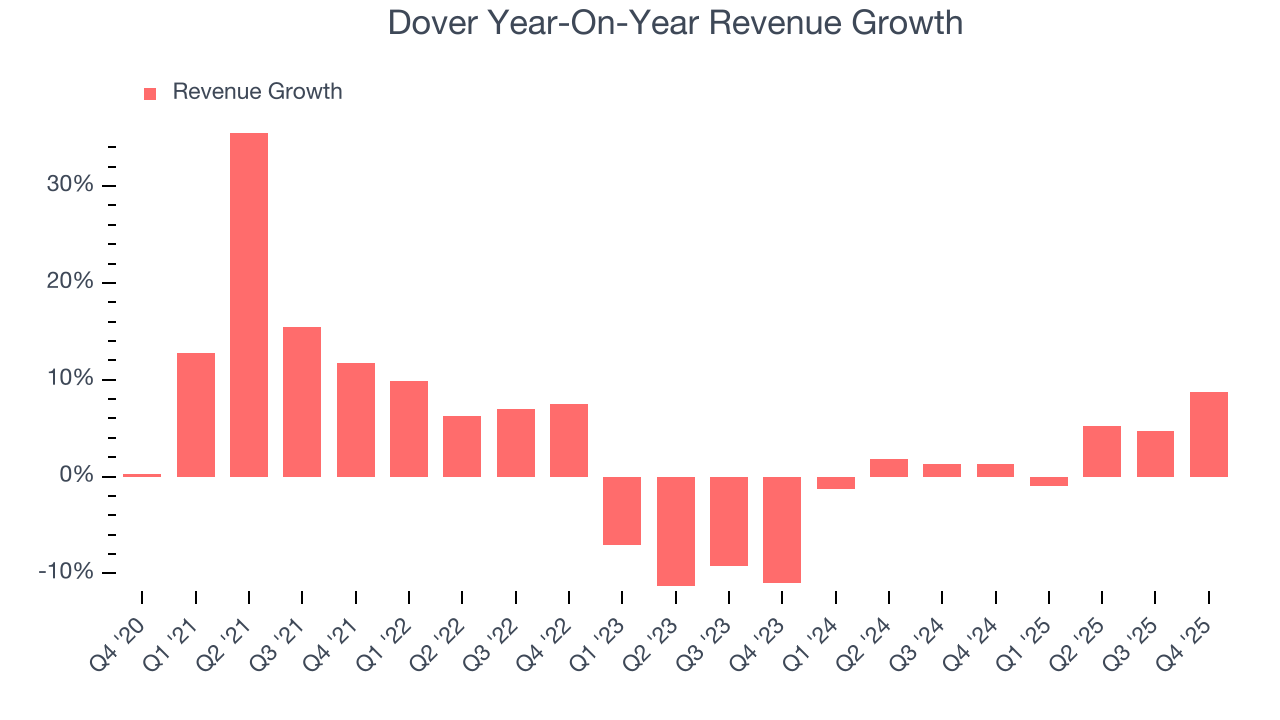

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Dover’s sales grew at a sluggish 3.9% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Dover’s recent performance shows its demand has slowed as its annualized revenue growth of 2.6% over the last two years was below its five-year trend.

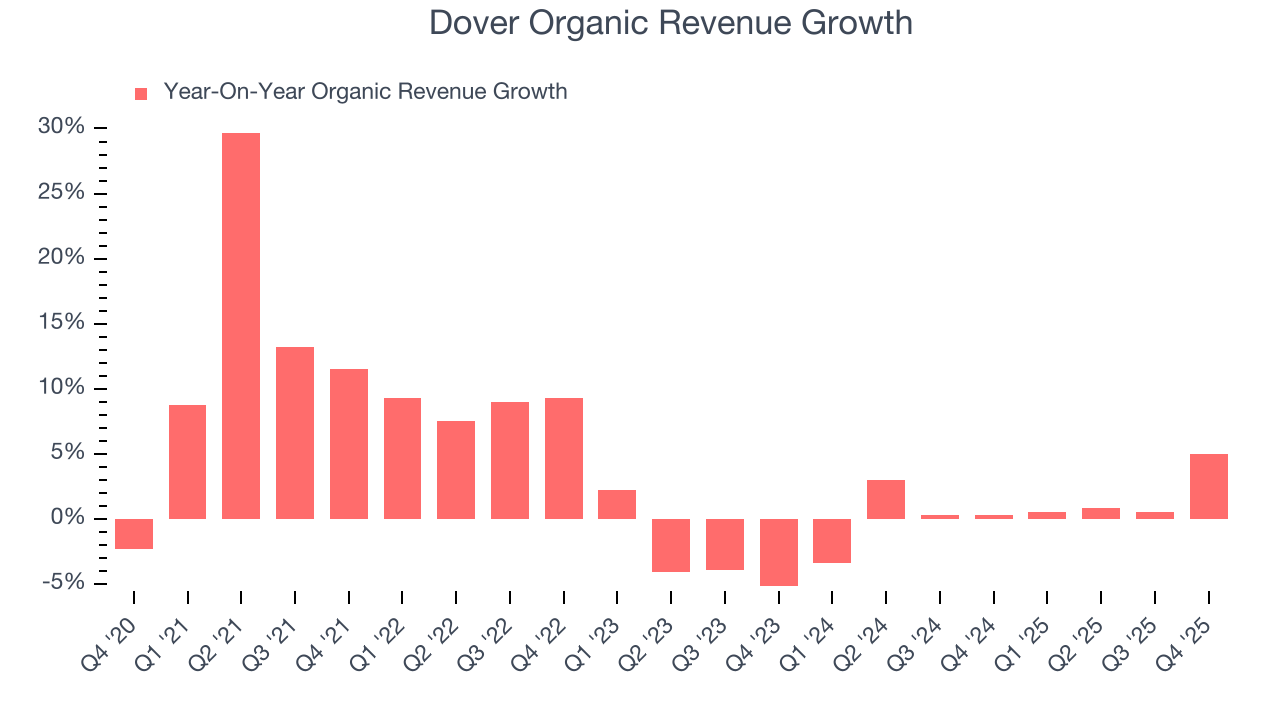

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Dover’s organic revenue was flat. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Dover reported year-on-year revenue growth of 8.8%, and its $2.10 billion of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

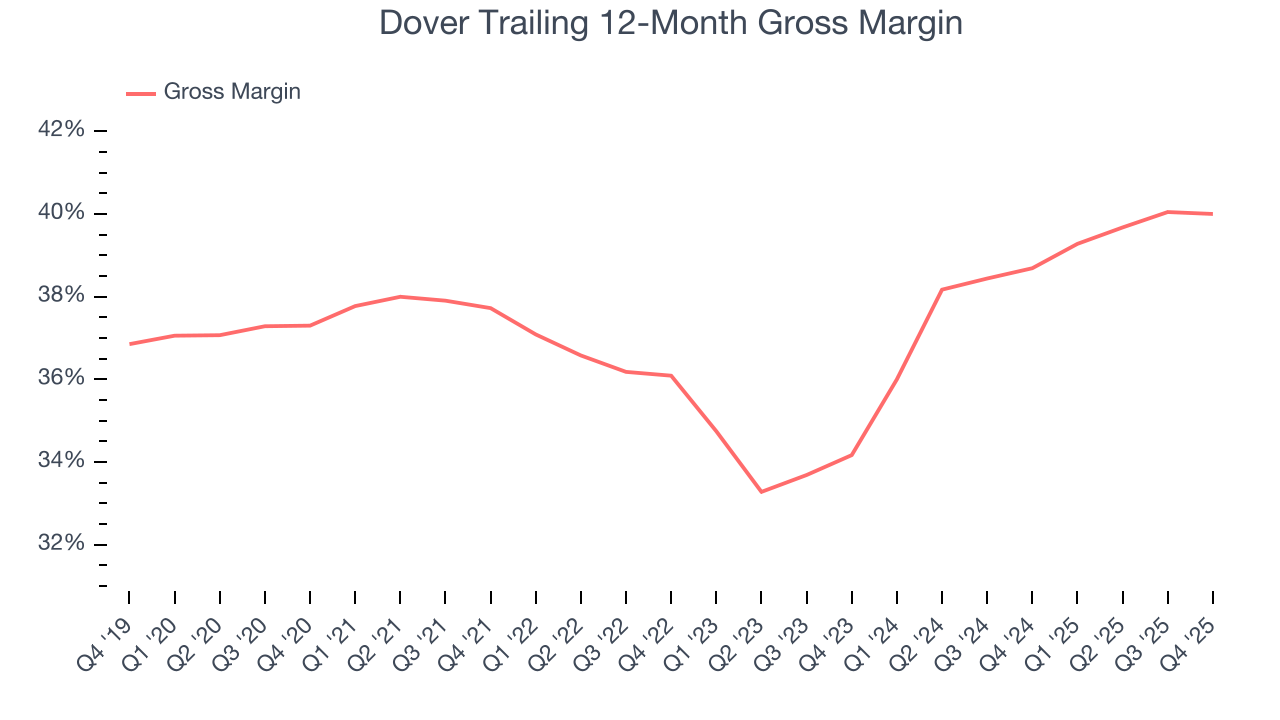

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

Dover’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 37.3% gross margin over the last five years. Said differently, roughly $37.34 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Dover’s gross profit margin came in at 39.1% this quarter, in line with the same quarter last year. Zooming out, Dover’s full-year margin has been trending up over the past 12 months, increasing by 1.3 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

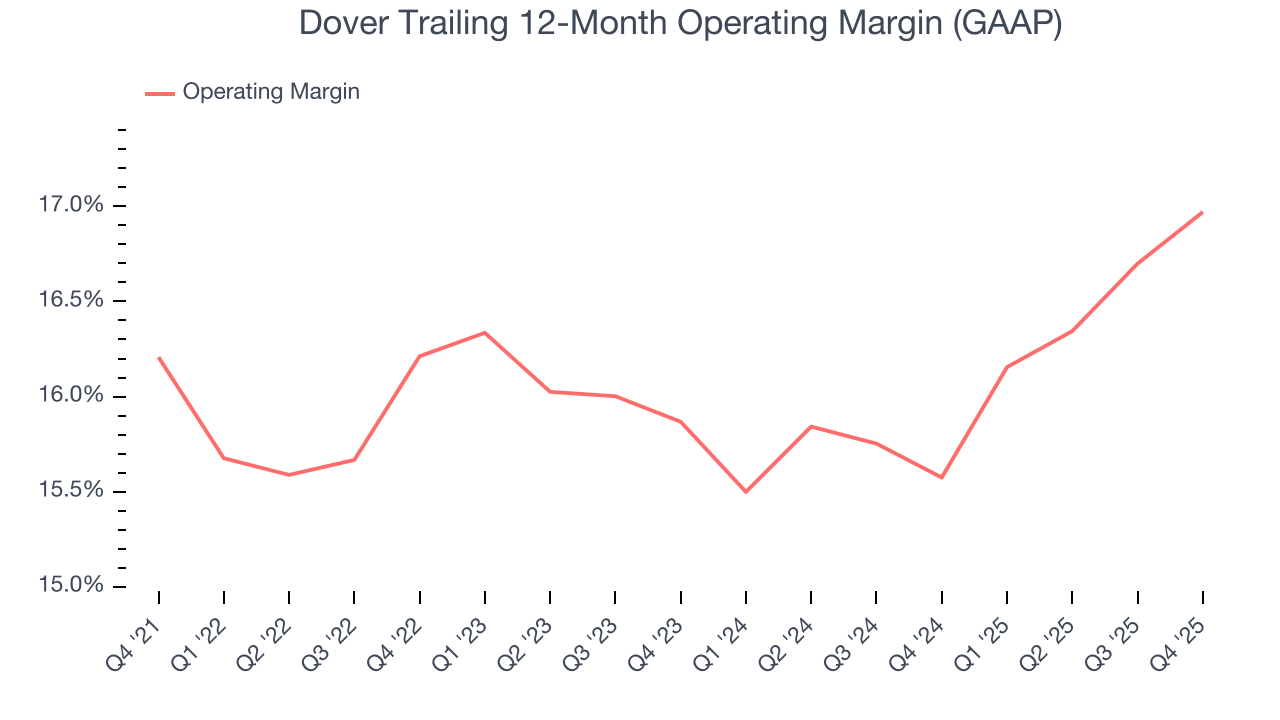

Dover’s operating margin has been trending up over the last 12 months and averaged 16.2% over the last five years. On top of that, its profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Dover’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Dover generated an operating margin profit margin of 16.5%, up 1.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

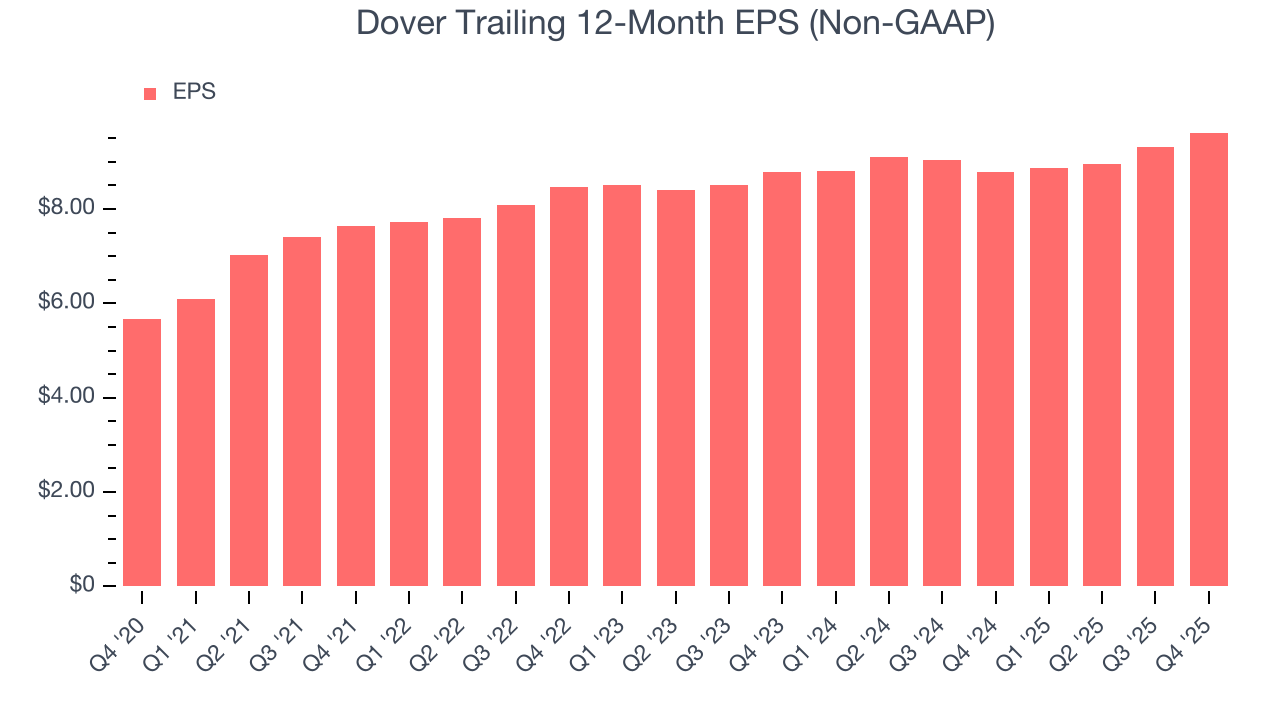

Dover’s EPS grew at a solid 11.1% compounded annual growth rate over the last five years, higher than its 3.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

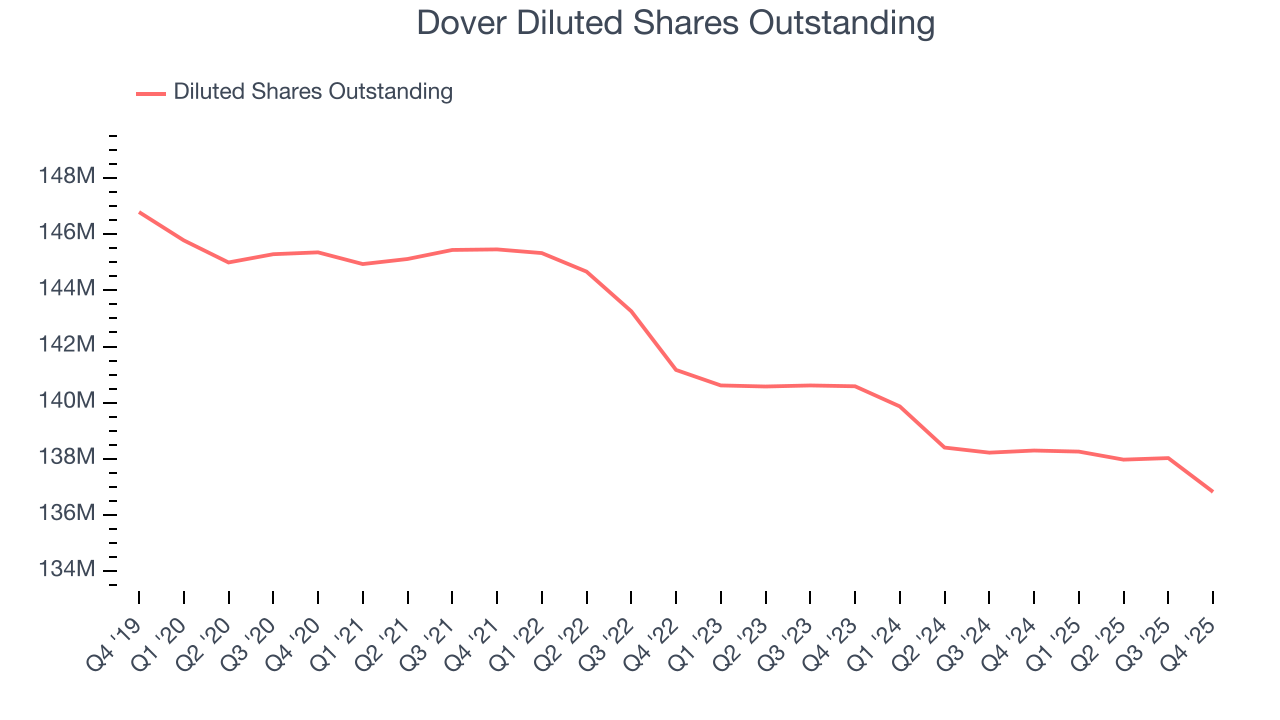

We can take a deeper look into Dover’s earnings quality to better understand the drivers of its performance. A five-year view shows that Dover has repurchased its stock, shrinking its share count by 5.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Dover, its two-year annual EPS growth of 4.6% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Dover reported adjusted EPS of $2.51, up from $2.20 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Dover’s full-year EPS of $9.62 to grow 10.6%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Dover has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.5% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Dover’s margin expanded by 1.9 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Dover’s free cash flow clocked in at $487 million in Q4, equivalent to a 23.2% margin. This result was good as its margin was 3.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

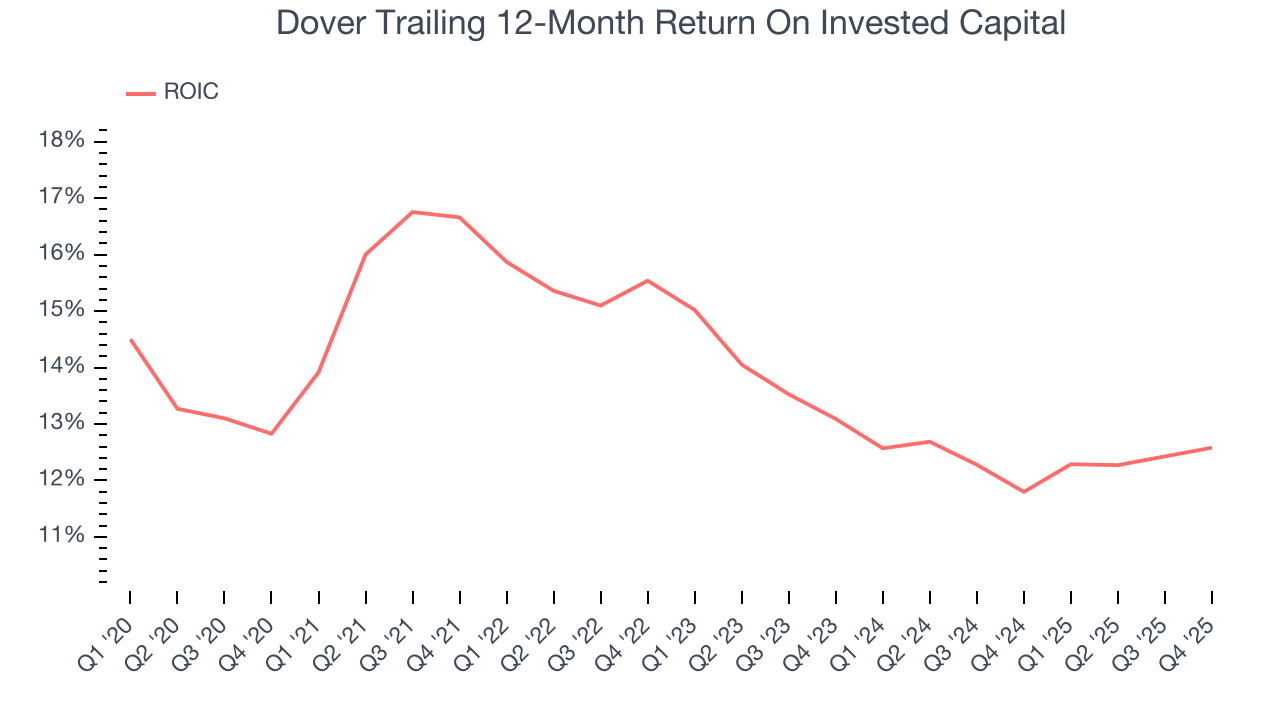

Although Dover hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13.9%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Dover’s ROIC averaged 3.9 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

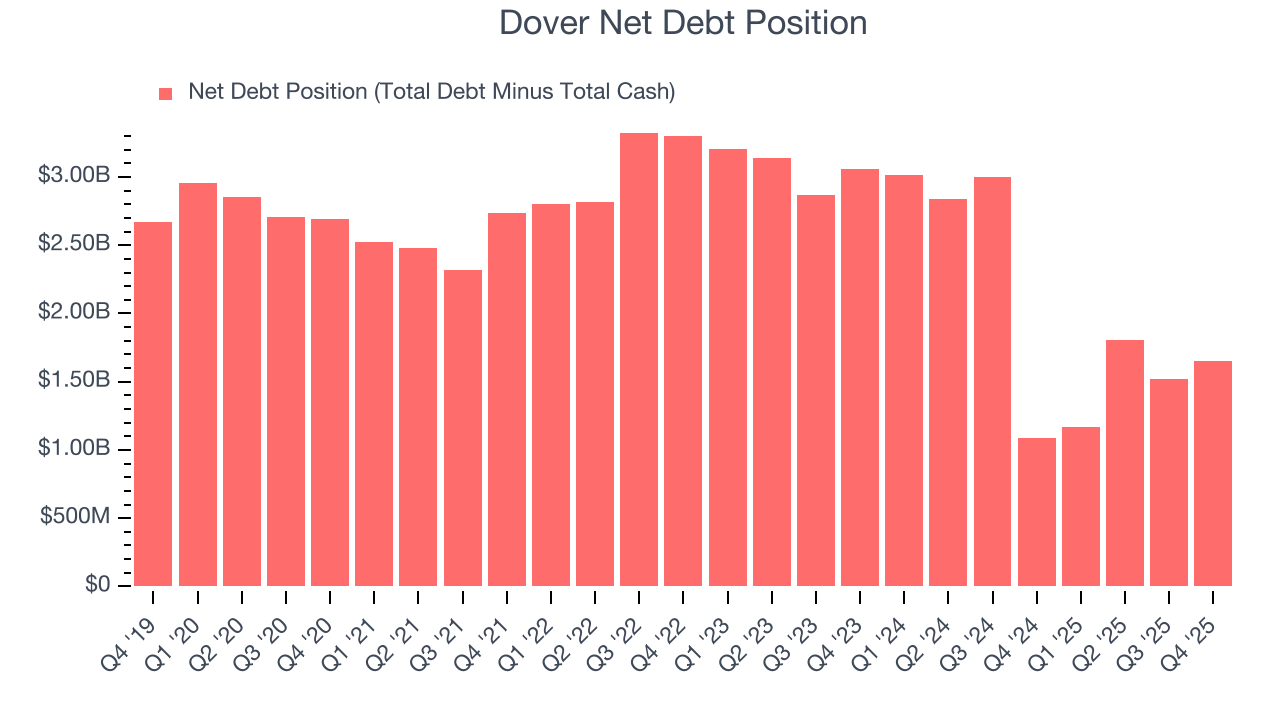

Dover reported $1.68 billion of cash and $3.33 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.9 billion of EBITDA over the last 12 months, we view Dover’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $14.55 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Dover’s Q4 Results

We were impressed by how significantly Dover blew past analysts’ EBITDA expectations this quarter. We were also happy its organic revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed. Overall, this print had some key positives. The stock remained flat at $205.93 immediately after reporting.

13. Is Now The Time To Buy Dover?

Updated: February 19, 2026 at 10:33 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Dover.

Dover isn’t a terrible business, but it isn’t one of our picks. First off, its revenue growth was uninspiring over the last five years. While its impressive operating margins show it has a highly efficient business model, the downside is its organic revenue growth has disappointed. On top of that, its diminishing returns show management's prior bets haven't worked out.

Dover’s P/E ratio based on the next 12 months is 21.9x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $226.00 on the company (compared to the current share price of $232.46).