DaVita (DVA)

We’re skeptical of DaVita. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why DaVita Is Not Exciting

With over 2,600 dialysis centers across the United States and a presence in 13 countries, DaVita (NYSE:DVA) operates a network of dialysis centers providing treatment and care for patients with chronic kidney disease and end-stage kidney disease.

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 2.9% for the last five years

- Estimated sales growth of 3.7% for the next 12 months implies demand will slow from its two-year trend

- A bright spot is that its industry-leading 15.3% return on capital demonstrates management’s skill in finding high-return investments, and its rising returns show it’s making even more lucrative bets

DaVita is in the doghouse. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than DaVita

High Quality

Investable

Underperform

Why There Are Better Opportunities Than DaVita

DaVita’s stock price of $109.31 implies a valuation ratio of 8.7x forward P/E. This sure is a cheap multiple, but you get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. DaVita (DVA) Research Report: Q4 CY2025 Update

Dialysis provider DaVita Inc. (NYSE:DVA) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 9.9% year on year to $3.62 billion. Its non-GAAP profit of $3.40 per share was 6.5% above analysts’ consensus estimates.

DaVita (DVA) Q4 CY2025 Highlights:

- Revenue: $3.62 billion vs analyst estimates of $3.51 billion (9.9% year-on-year growth, 3.2% beat)

- Adjusted EPS: $3.40 vs analyst estimates of $3.19 (6.5% beat)

- Adjusted EBITDA: $786.2 million vs analyst estimates of $742 million (21.7% margin, 6% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $14.30 at the midpoint, beating analyst estimates by 12.3%

- Operating Margin: 15.5%, down from 17.2% in the same quarter last year

- Free Cash Flow Margin: 8.5%, down from 11.4% in the same quarter last year

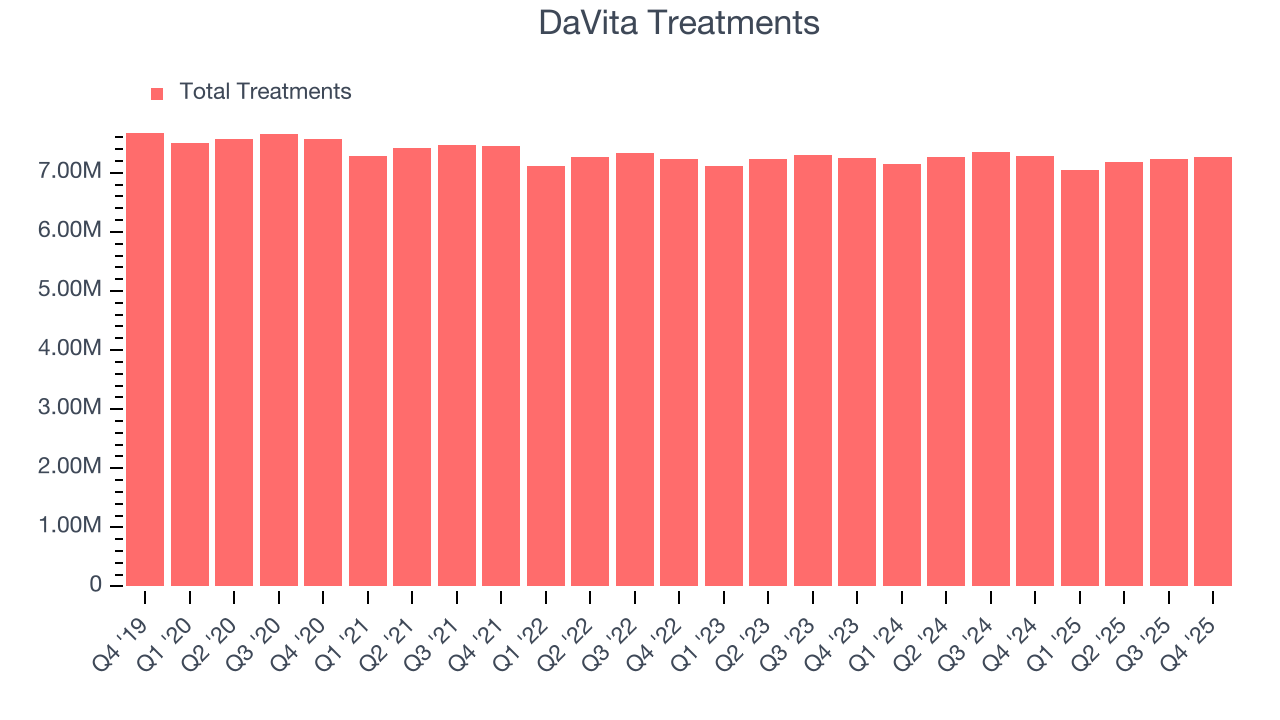

- Sales Volumes were flat year on year, in line with the same quarter last year

- Market Capitalization: $7.72 billion

Company Overview

With over 2,600 dialysis centers across the United States and a presence in 13 countries, DaVita (NYSE:DVA) operates a network of dialysis centers providing treatment and care for patients with chronic kidney disease and end-stage kidney disease.

DaVita's core business revolves around providing life-sustaining dialysis treatments that filter waste and excess fluid from the blood when a patient's kidneys can no longer perform this essential function. The company offers several treatment options, including in-center hemodialysis (where patients typically visit three times weekly), home hemodialysis, and peritoneal dialysis (which patients can perform at home).

Each DaVita dialysis center is staffed with a team of healthcare professionals including registered nurses, patient care technicians, social workers, and dietitians. The centers operate under the supervision of a medical director, typically a board-certified nephrologist who contracts with DaVita to oversee clinical care.

The company serves approximately 200,800 patients in the U.S. and 80,300 internationally. For most patients, dialysis is not a short-term treatment but rather a long-term necessity until they either receive a kidney transplant or reach the end of life. A typical dialysis patient might visit a DaVita center 156 times annually, creating an ongoing relationship between the patient and their care team.

DaVita's revenue comes primarily from government programs, with approximately 74% of U.S. patients covered under Medicare or Medicare Advantage plans. The remaining revenue comes from Medicaid, commercial insurance, and other government programs. Notably, while commercial insurance patients represent only about 11% of DaVita's U.S. patient population, they generate a disproportionately higher percentage of revenue due to higher reimbursement rates.

Beyond traditional dialysis, DaVita has expanded into integrated kidney care through its DaVita Integrated Kidney Care (IKC) division, which provides comprehensive care management for patients with chronic kidney disease. This includes coordinating care across the entire kidney disease journey, from early diagnosis through transplantation when possible. The company also operates clinical research programs, a transplant software business, and maintains a venture group that invests in kidney care innovations.

4. Outpatient & Specialty Care

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amid competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

DaVita's primary competitor in the U.S. dialysis market is Fresenius Medical Care (NYSE: FMS), which operates a similar network of dialysis centers. Other competitors include U.S. Renal Care, American Renal Associates, and various regional and hospital-based dialysis providers.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $13.64 billion in revenue over the past 12 months, DaVita has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

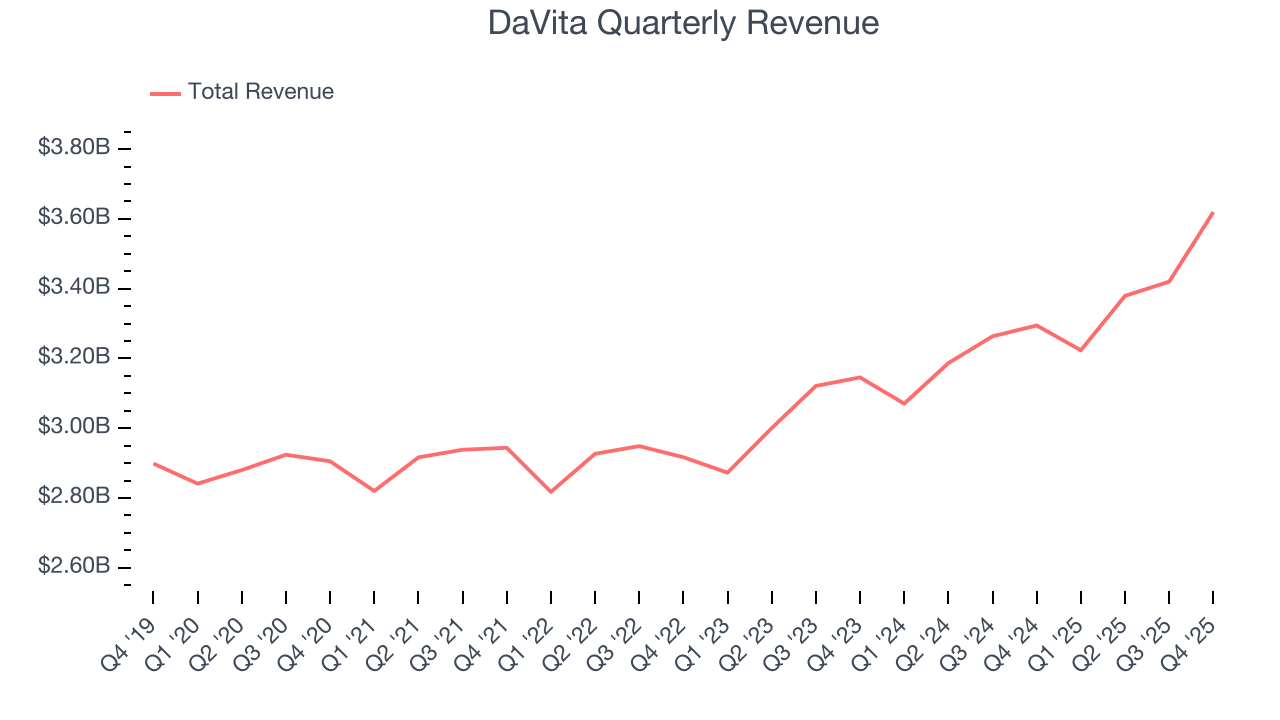

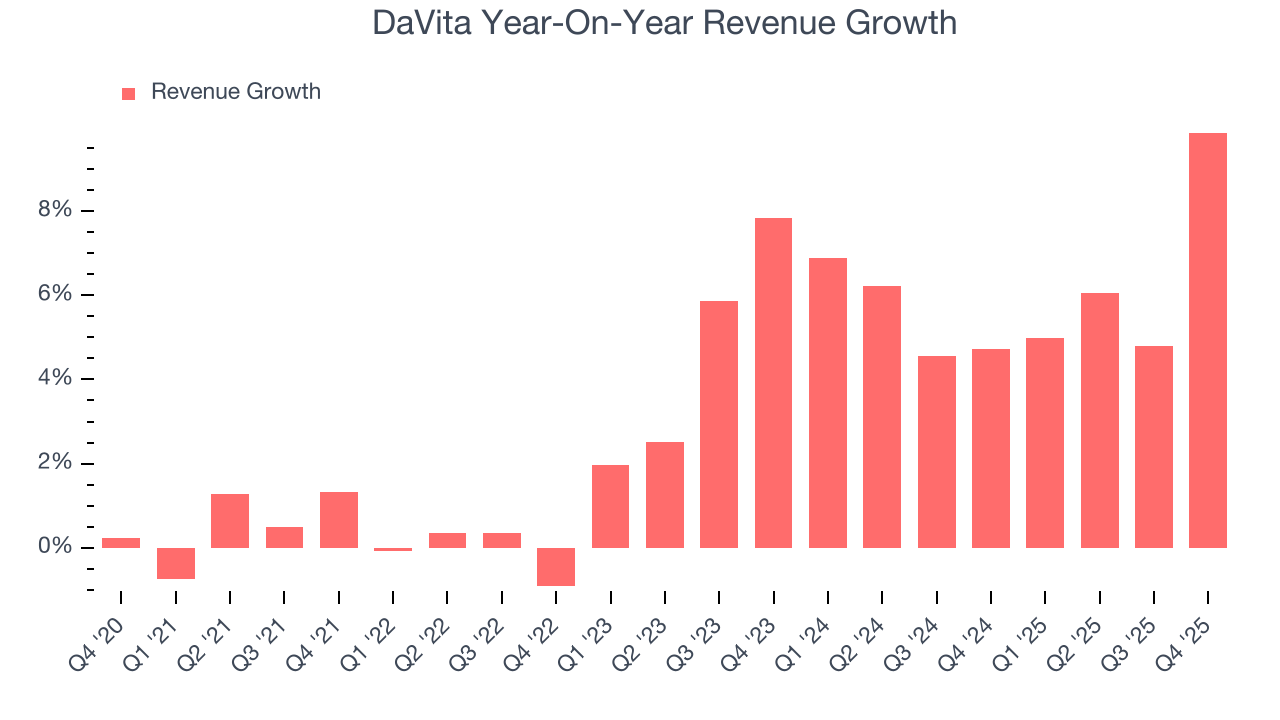

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, DaVita’s sales grew at a tepid 3.4% compounded annual growth rate over the last five years. This fell short of our benchmark for the healthcare sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. DaVita’s annualized revenue growth of 6% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can better understand the company’s revenue dynamics by analyzing its number of treatments, which reached 7.26 million in the latest quarter. Over the last two years, DaVita’s treatments were flat. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, DaVita reported year-on-year revenue growth of 9.9%, and its $3.62 billion of revenue exceeded Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

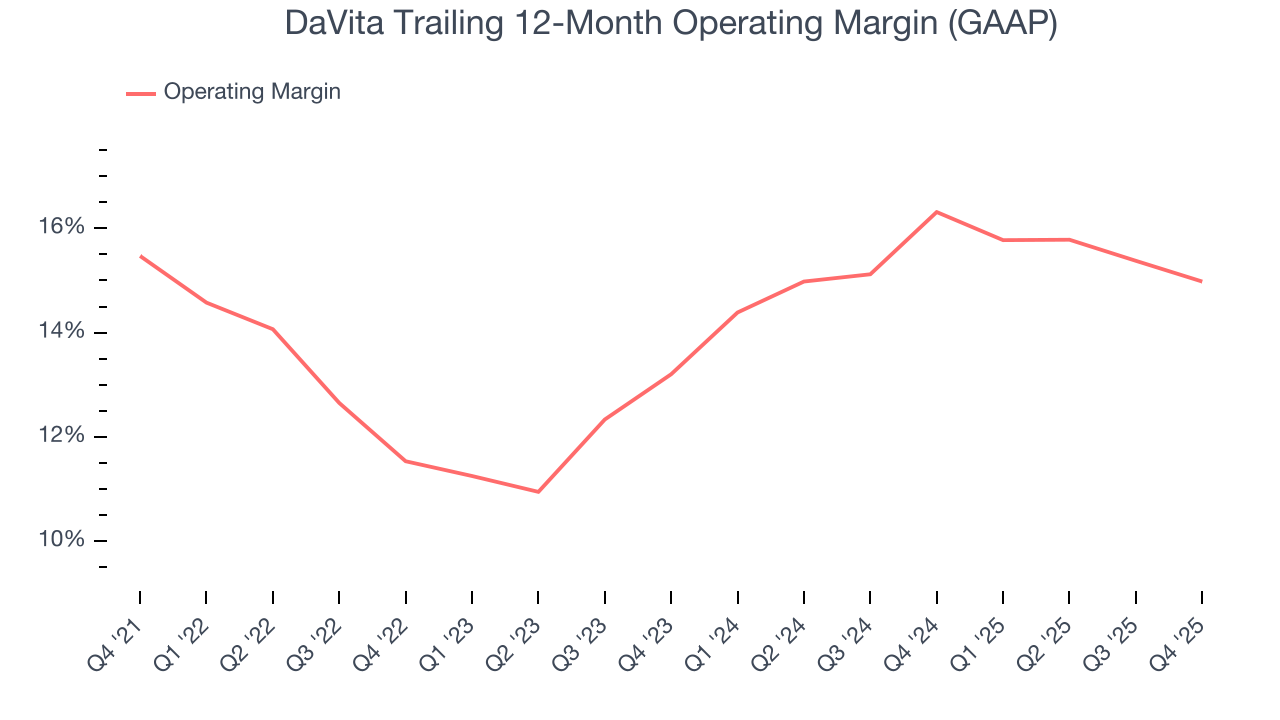

7. Operating Margin

DaVita’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 14.4% over the last five years. This profitability was higher than the broader healthcare sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, DaVita’s operating margin of 15% for the trailing 12 months may be around the same as five years ago, but it has increased by 1.8 percentage points over the last two years.

This quarter, DaVita generated an operating margin profit margin of 15.5%, down 1.7 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

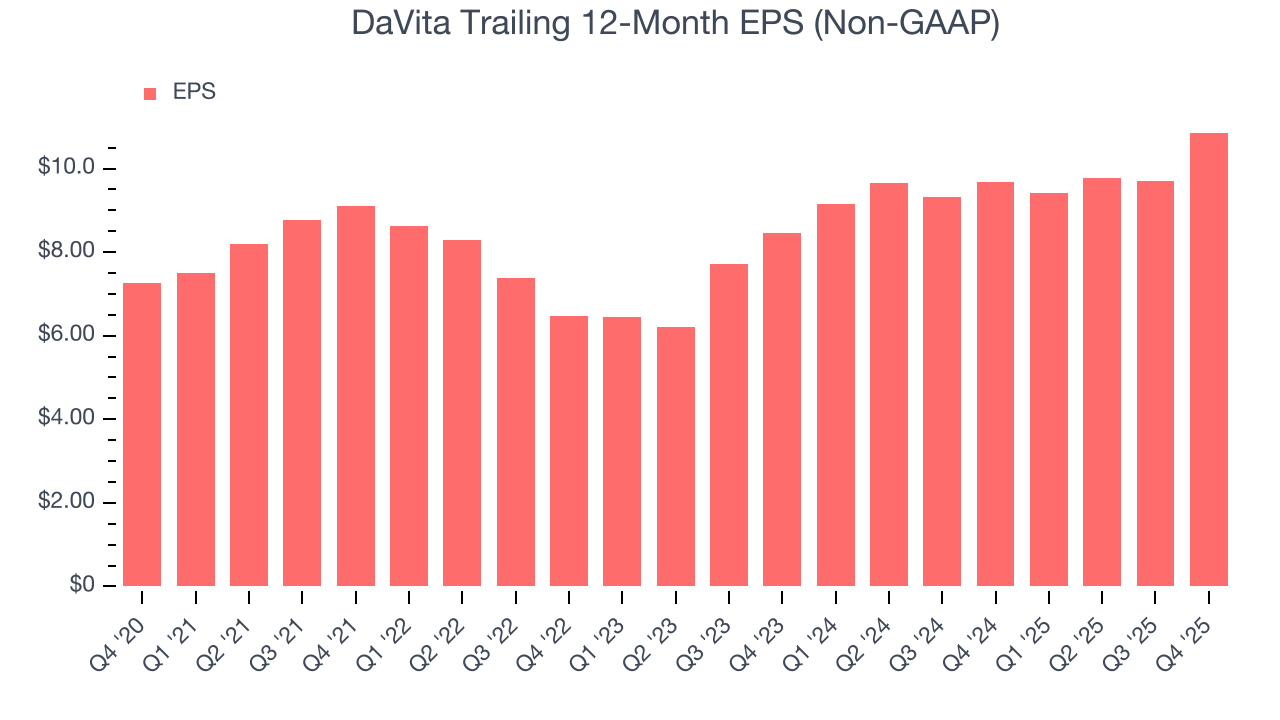

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

DaVita’s EPS grew at a solid 8.4% compounded annual growth rate over the last five years, higher than its 3.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into DaVita’s earnings to better understand the drivers of its performance. A five-year view shows that DaVita has repurchased its stock, shrinking its share count by 38.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, DaVita reported adjusted EPS of $3.40, up from $2.24 in the same quarter last year. This print beat analysts’ estimates by 6.5%. Over the next 12 months, Wall Street expects DaVita’s full-year EPS of $10.86 to grow 19.4%.

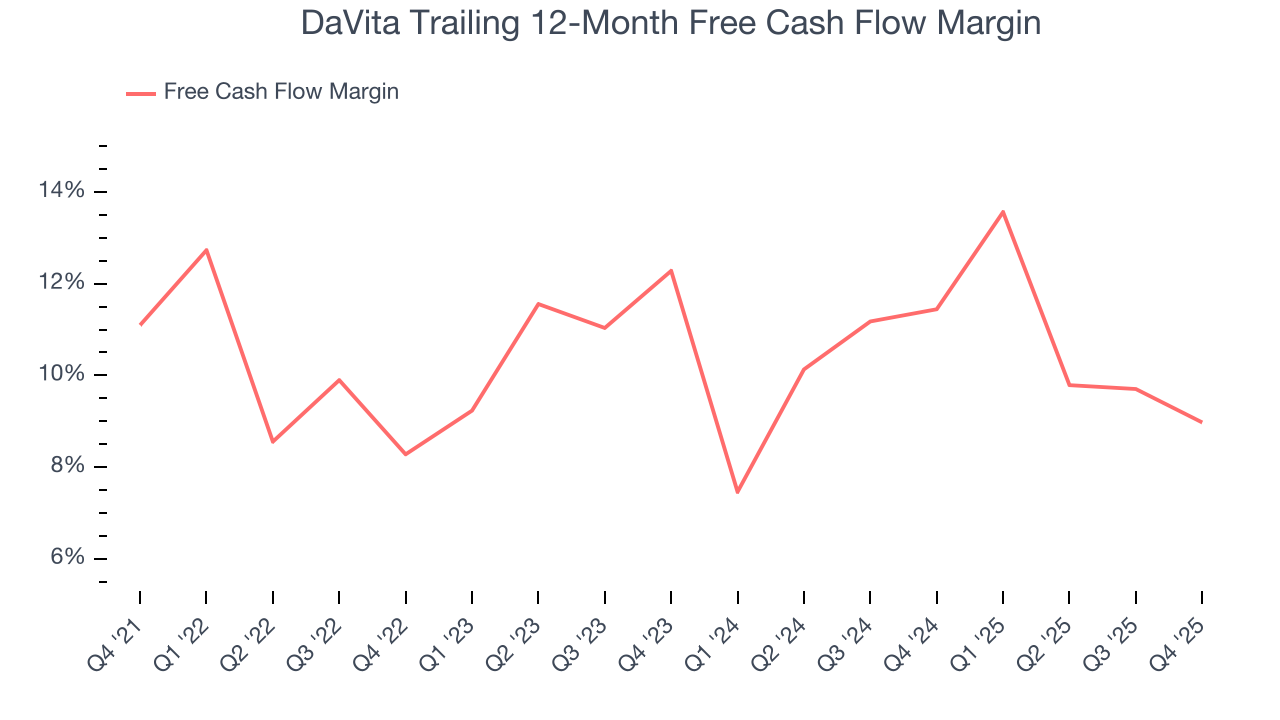

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

DaVita has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.4% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that DaVita’s margin dropped by 2.1 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

DaVita’s free cash flow clocked in at $309 million in Q4, equivalent to a 8.5% margin. The company’s cash profitability regressed as it was 2.9 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

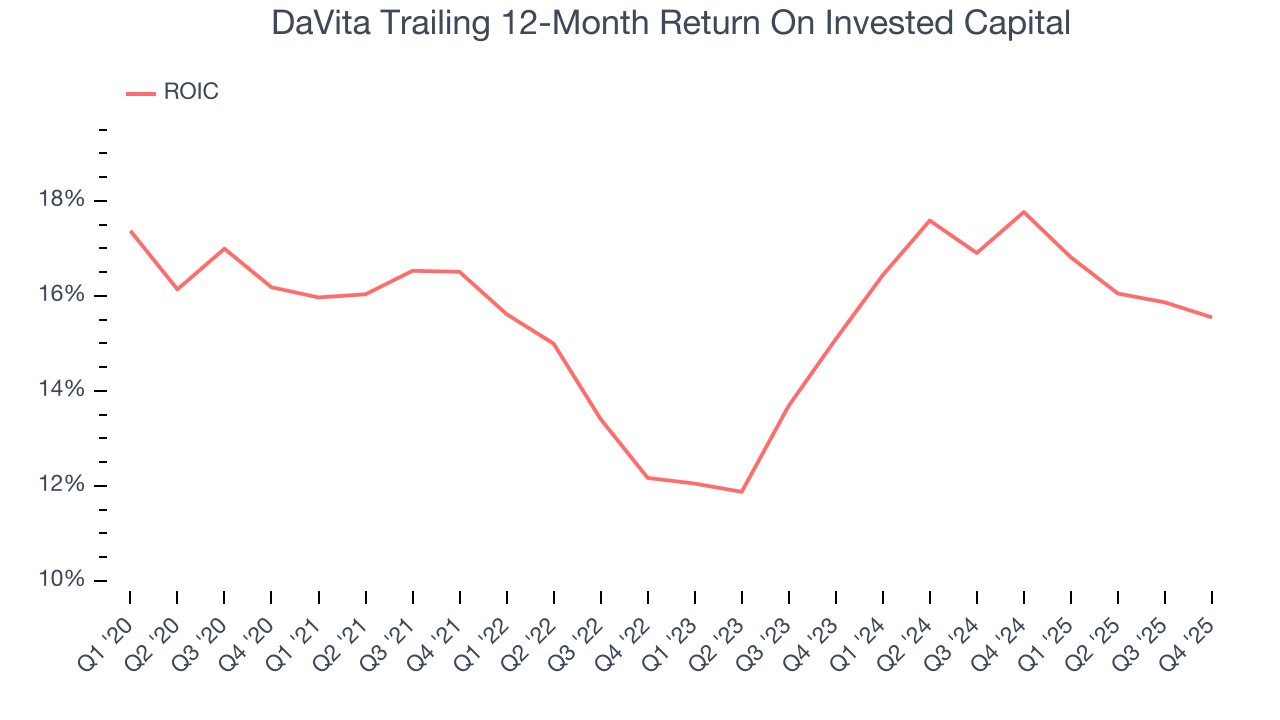

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although DaVita hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 15.4%, impressive for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, DaVita’s ROIC averaged 2.3 percentage point increases each year. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

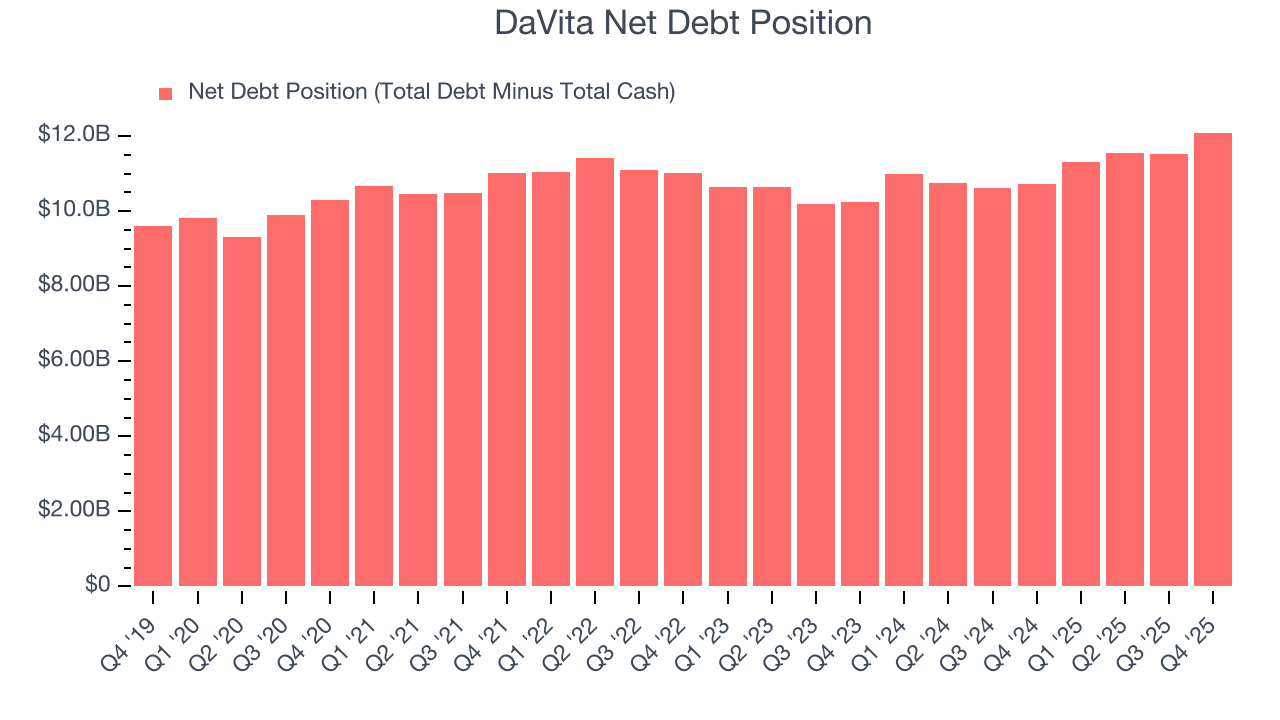

11. Balance Sheet Assessment

DaVita reported $782.1 million of cash and $12.87 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.82 billion of EBITDA over the last 12 months, we view DaVita’s 4.3× net-debt-to-EBITDA ratio as safe. We also see its $277.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from DaVita’s Q4 Results

We were impressed by how significantly DaVita blew past analysts’ full-year EPS guidance expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 8.7% to $118.50 immediately after reporting.

13. Is Now The Time To Buy DaVita?

Updated: February 2, 2026 at 11:07 PM EST

When considering an investment in DaVita, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

DaVita isn’t a terrible business, but it doesn’t pass our quality test. First off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while DaVita’s solid ROIC suggests it has grown profitably in the past, its flat treatments disappointed.

DaVita’s P/E ratio based on the next 12 months is 8.4x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $143 on the company (compared to the current share price of $127.25).