Equifax (EFX)

Equifax doesn’t excite us. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Equifax Is Not Exciting

Holding detailed financial records on over 800 million consumers worldwide and dating back to 1899, Equifax (NYSE:EFX) is a global data analytics company that collects, analyzes, and sells consumer and business credit information to lenders, employers, and other businesses.

- Incremental sales over the last five years were less profitable as its 3.7% annual earnings per share growth lagged its revenue gains

- The good news is that its successful business model is illustrated by its impressive adjusted operating margin

Equifax’s quality isn’t great. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Equifax

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Equifax

Equifax’s stock price of $172.46 implies a valuation ratio of 23.9x forward P/E. This multiple is higher than most business services companies, and we think it’s quite expensive for the quality you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Equifax (EFX) Research Report: Q4 CY2025 Update

Credit reporting giant Equifax (NYSE:EFX) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 9.2% year on year to $1.55 billion. Guidance for next quarter’s revenue was optimistic at $1.61 billion at the midpoint, 2.5% above analysts’ estimates. Its non-GAAP profit of $2.09 per share was 1.8% above analysts’ consensus estimates.

Equifax (EFX) Q4 CY2025 Highlights:

- Revenue: $1.55 billion vs analyst estimates of $1.53 billion (9.2% year-on-year growth, 1.4% beat)

- Adjusted EPS: $2.09 vs analyst estimates of $2.05 (1.8% beat)

- Adjusted EBITDA: $508.2 million vs analyst estimates of $508.7 million (32.8% margin, in line)

- Revenue Guidance for Q1 CY2026 is $1.61 billion at the midpoint, above analyst estimates of $1.57 billion

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.50 at the midpoint, missing analyst estimates by 2.2%

- Operating Margin: 18.3%, down from 20.3% in the same quarter last year

- Free Cash Flow Margin: 22%, up from 14.5% in the same quarter last year

- Market Capitalization: $21.43 billion

Company Overview

Holding detailed financial records on over 800 million consumers worldwide and dating back to 1899, Equifax (NYSE:EFX) is a global data analytics company that collects, analyzes, and sells consumer and business credit information to lenders, employers, and other businesses.

Equifax operates through three main segments: Workforce Solutions, U.S. Information Solutions (USIS), and International. The Workforce Solutions segment maintains The Work Number database, which contains employment and income records from over three million organizations, covering approximately 168 million current employment records. This database allows lenders, government agencies, and employers to verify employment and income information when making lending or hiring decisions.

The USIS segment provides credit reports, identity verification, fraud detection, and marketing services to businesses across various industries. When a consumer applies for a mortgage, credit card, or auto loan, the lender likely pulls an Equifax credit report to assess the applicant's creditworthiness. For example, when someone applies for a mortgage, the lender might use Equifax's tri-merge report, which combines information from all three major credit bureaus into a single comprehensive view of the applicant's credit history.

The International segment offers similar services across 24 countries in regions including Asia Pacific, Europe, Latin America, and Canada. In some international markets, Equifax relies more heavily on government data sources than in the U.S.

Beyond simply providing raw data, Equifax applies advanced analytics and artificial intelligence to help clients make more informed decisions. For instance, a bank might use Equifax's scoring models to determine which customers should receive pre-approved credit offers or to detect potentially fraudulent transactions.

Equifax generates revenue primarily through transaction-based fees, charging clients each time they access its databases or use its analytical services. The company's client base is highly diversified across financial services, mortgage lenders, employers, government agencies, telecommunications companies, and healthcare providers, with no single client accounting for more than 2% of total revenue.

4. Data & Business Process Services

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

Equifax's primary competitors include the other two major credit reporting agencies: Experian (OTCMKTS: EXPGY) and TransUnion (NYSE: TRU). In employment verification services, it competes with companies like ADP (NASDAQ: ADP) and smaller providers such as Thomas & Company. In identity protection, competitors include LifeLock (owned by NortonLifeLock, NASDAQ: NLOK) and Credit Karma (owned by Intuit, NASDAQ: INTU).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $6.07 billion in revenue over the past 12 months, Equifax is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

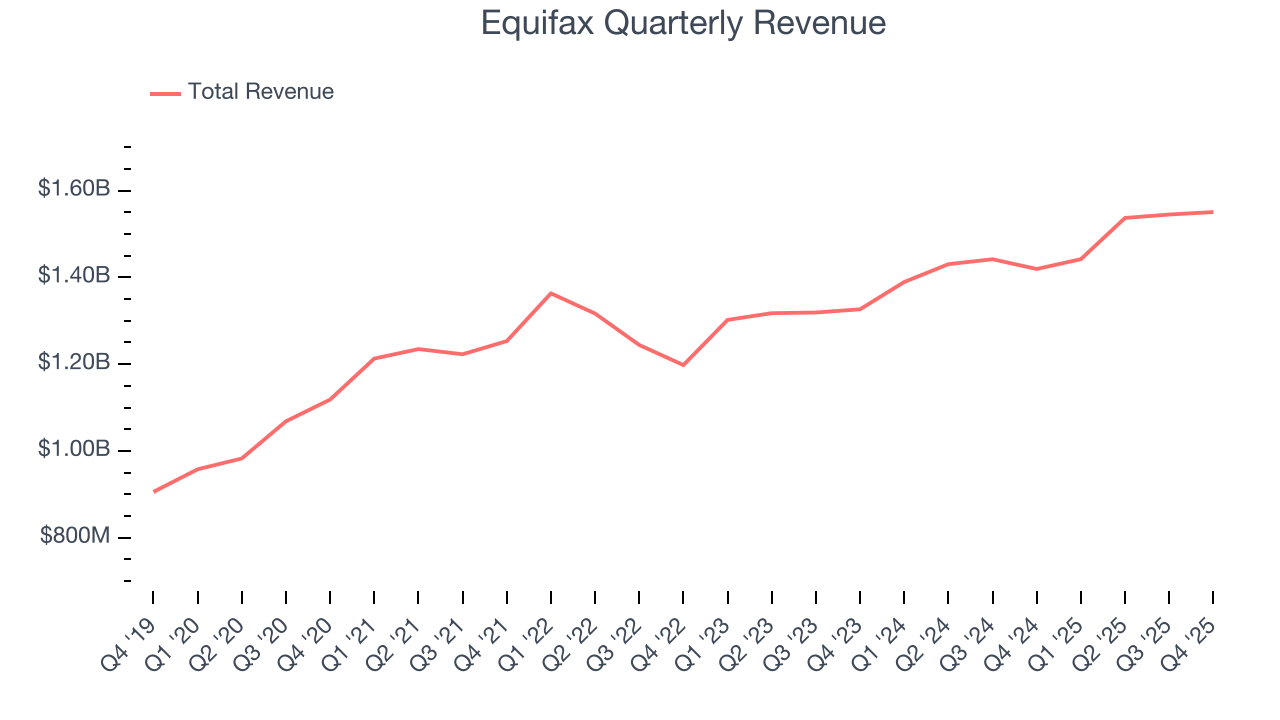

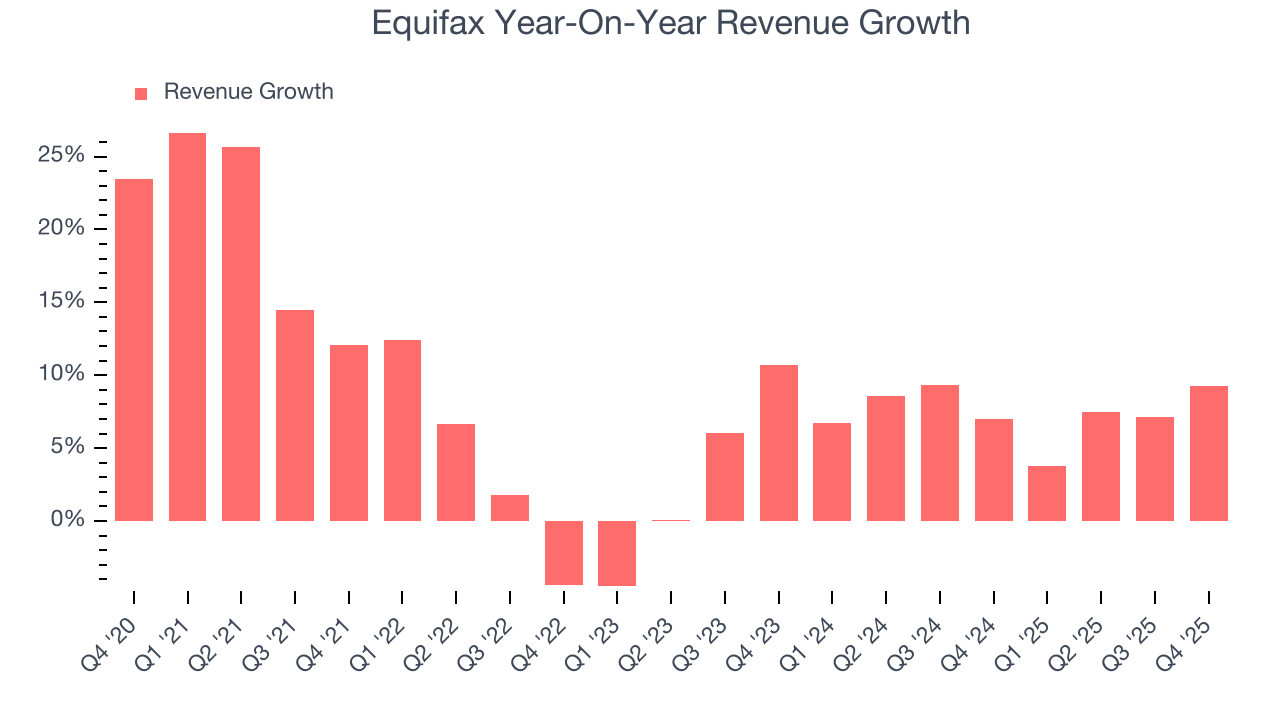

As you can see below, Equifax grew its sales at a solid 8% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Equifax’s annualized revenue growth of 7.4% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

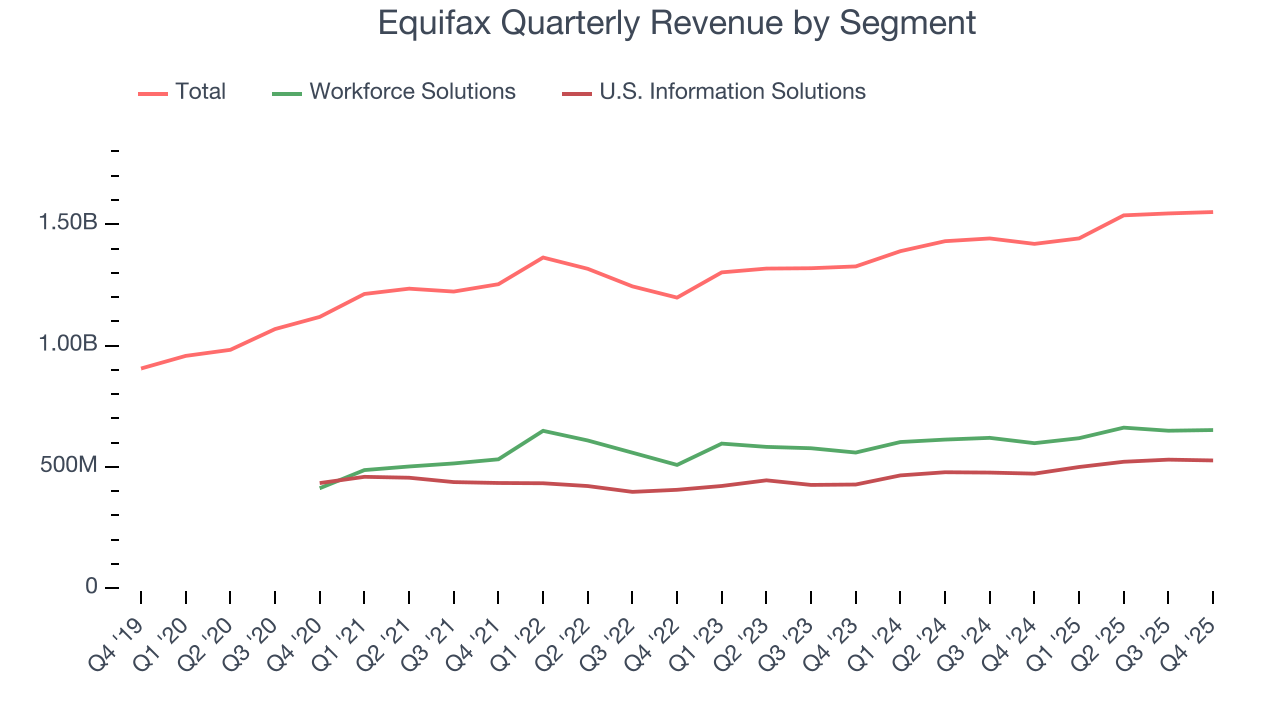

Equifax also breaks out the revenue for its most important segments, Workforce Solutions and U.S. Information Solutions, which are 42.1% and 34% of revenue. Over the last two years, Equifax’s Workforce Solutions revenue (HR services) averaged 5.6% year-on-year growth while its U.S. Information Solutions revenue (credit services) averaged 9.9% growth.

This quarter, Equifax reported year-on-year revenue growth of 9.2%, and its $1.55 billion of revenue exceeded Wall Street’s estimates by 1.4%. Company management is currently guiding for a 11.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, similar to its two-year rate. This projection is noteworthy and suggests its newer products and services will fuel better top-line performance.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

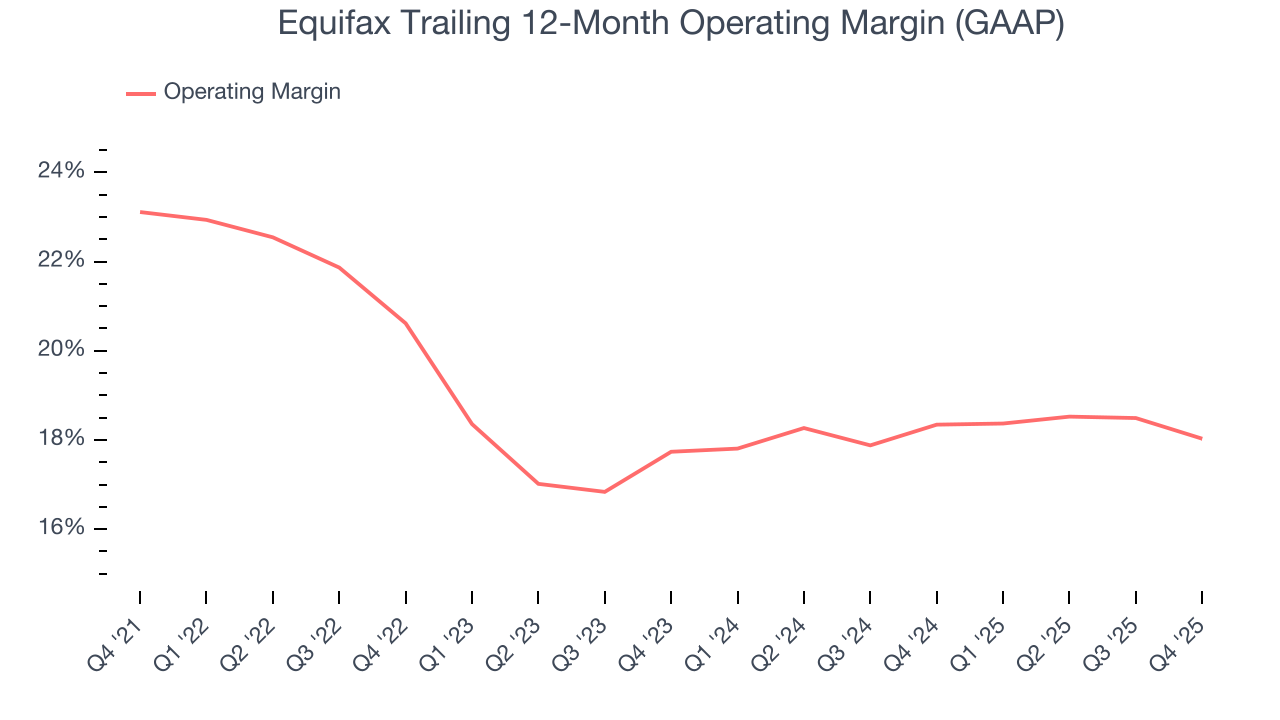

Equifax has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 19.5%.

Analyzing the trend in its profitability, Equifax’s operating margin decreased by 5.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Equifax generated an operating margin profit margin of 18.3%, down 2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

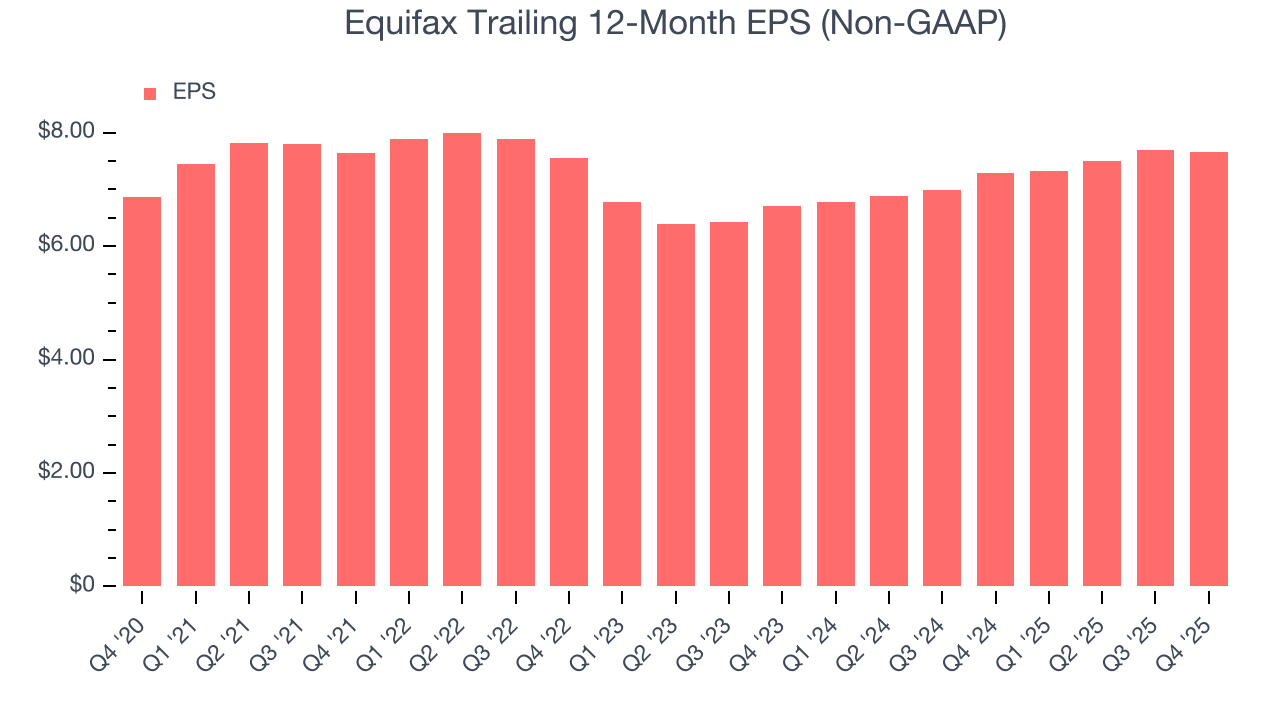

Equifax’s EPS grew at a weak 2.2% compounded annual growth rate over the last five years, lower than its 8% annualized revenue growth. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

Diving into the nuances of Equifax’s earnings can give us a better understanding of its performance. As we mentioned earlier, Equifax’s operating margin declined by 5.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Equifax, its two-year annual EPS growth of 6.8% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, Equifax reported adjusted EPS of $2.09, down from $2.12 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.8%. Over the next 12 months, Wall Street expects Equifax’s full-year EPS of $7.66 to grow 12.5%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

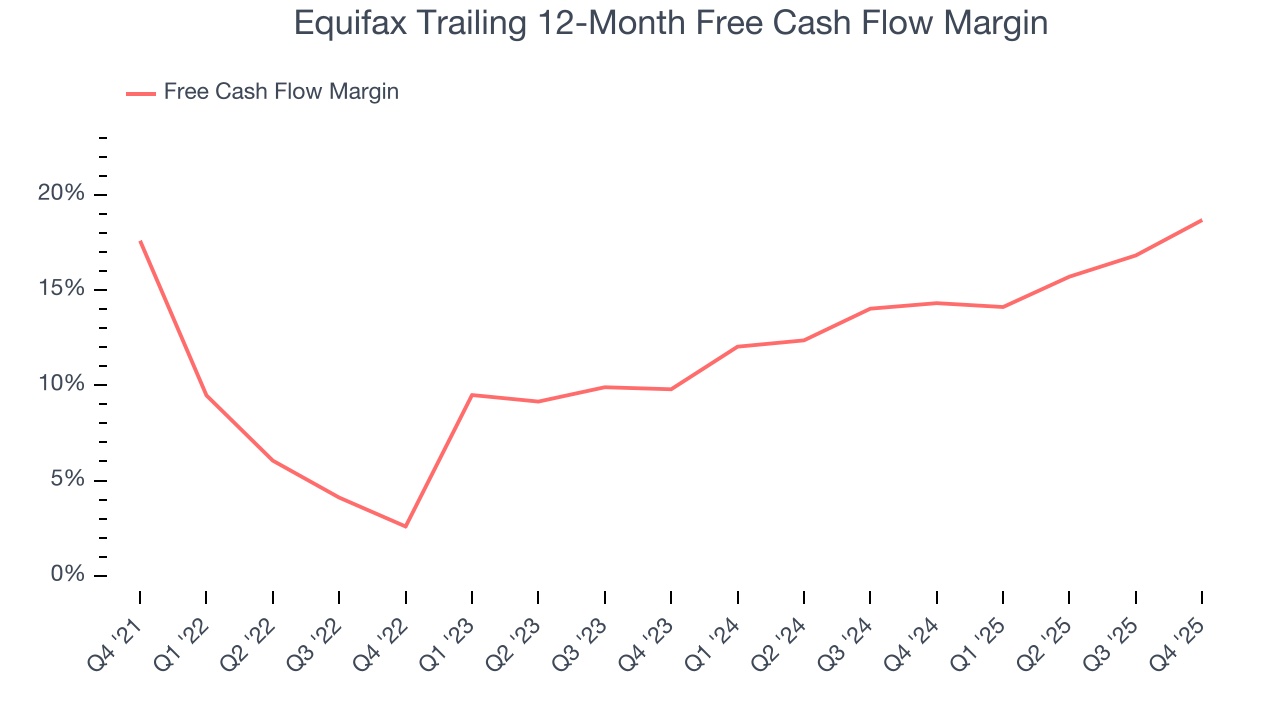

Equifax has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.8% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that Equifax’s margin expanded by 1.1 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Equifax’s free cash flow clocked in at $340.8 million in Q4, equivalent to a 22% margin. This result was good as its margin was 7.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

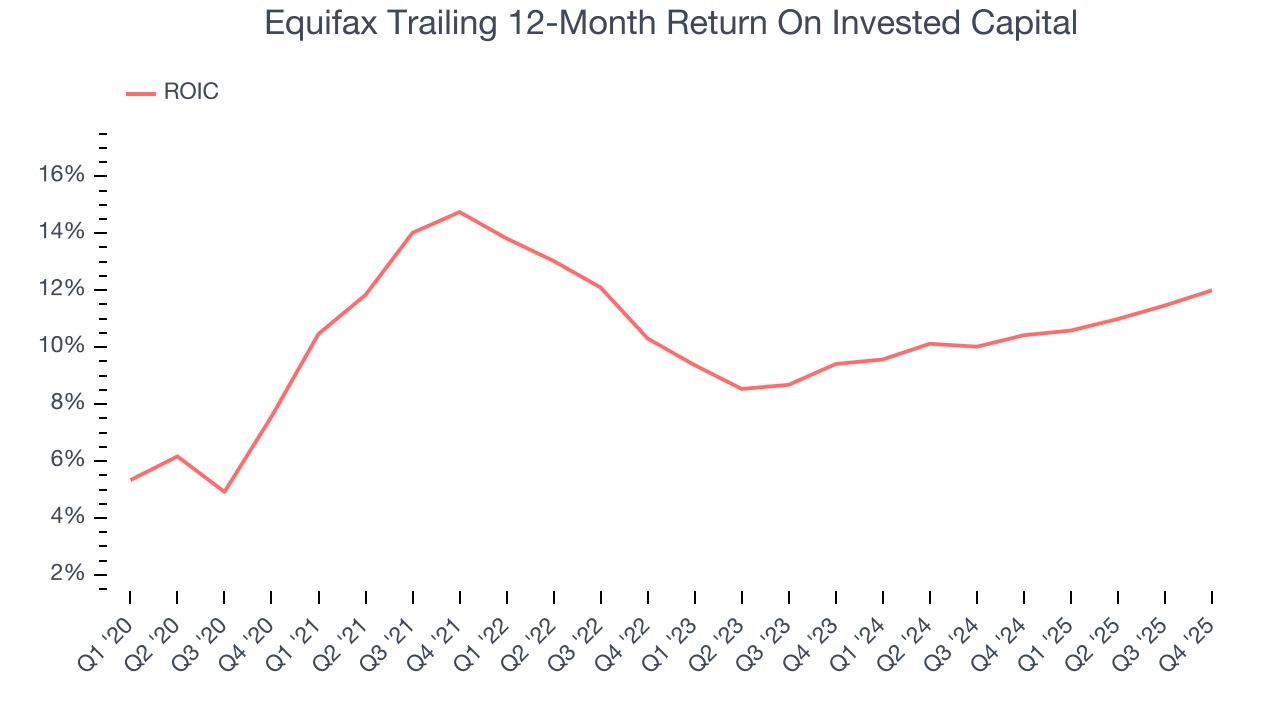

Equifax’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 11.4%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Equifax’s ROIC decreased by 1.3 percentage points annually over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Assessment

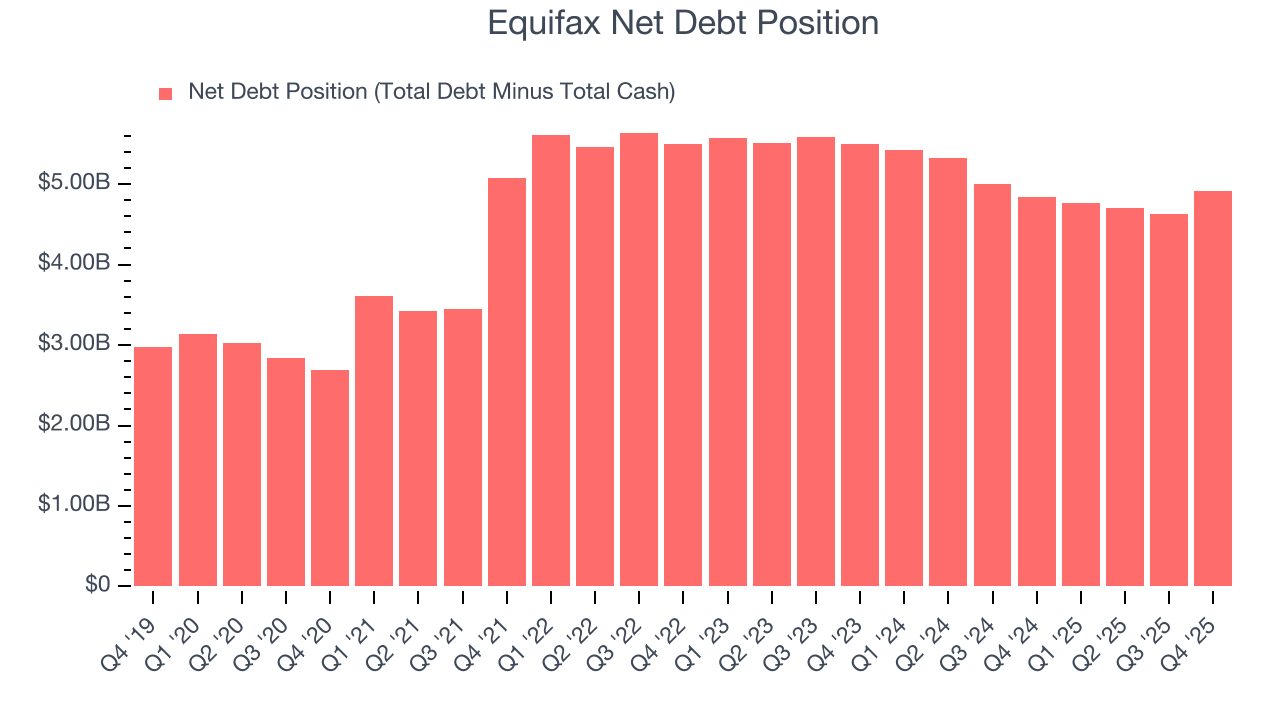

Equifax reported $180.8 million of cash and $5.09 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.94 billion of EBITDA over the last 12 months, we view Equifax’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $104.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Equifax’s Q4 Results

It was great to see Equifax’s revenue guidance for next quarter top analysts’ expectations. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its full-year EPS guidance fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock traded up 1.3% to $177.29 immediately following the results.

12. Is Now The Time To Buy Equifax?

Updated: February 4, 2026 at 6:44 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Equifax isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was solid over the last five years and Wall Street believes it will continue to grow, its declining operating margin shows the business has become less efficient. And while the company’s impressive operating margins show it has a highly efficient business model, the downside is its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Equifax’s P/E ratio based on the next 12 months is 20.3x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $262.30 on the company (compared to the current share price of $177.29).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.