Estée Lauder (EL)

We’re skeptical of Estée Lauder. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Estée Lauder Will Underperform

Named after its founder, who was an entrepreneurial woman from New York with a passion for skincare, Estée Lauder (NYSE:EL) is a one-stop beauty shop with products in skincare, fragrance, makeup, sun protection, and men’s grooming.

- Products aren't resonating with the market as its revenue declined by 5.8% annually over the last three years

- Earnings per share decreased by more than its revenue over the last three years, showing each sale was less profitable

- One positive is that its products command premium prices and result in a best-in-class gross margin of 73.2%

Estée Lauder’s quality isn’t up to par. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Estée Lauder

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Estée Lauder

Estée Lauder’s stock price of $116.92 implies a valuation ratio of 51.1x forward P/E. This valuation is extremely expensive, especially for the weaker revenue growth you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Estée Lauder (EL) Research Report: Q3 CY2025 Update

Beauty products company Estée Lauder (NYSE:EL) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 3.6% year on year to $3.48 billion. Its non-GAAP profit of $0.32 per share was 81.9% above analysts’ consensus estimates.

Estée Lauder (EL) Q3 CY2025 Highlights:

- Revenue: $3.48 billion vs analyst estimates of $3.38 billion (3.6% year-on-year growth, 2.9% beat)

- Adjusted EPS: $0.32 vs analyst estimates of $0.18 (beat)

- Adjusted EBITDA: $369 million vs analyst estimates of $369 million (10.6% margin, in line)

- Management reiterated its full-year Adjusted EPS guidance of $2 at the midpoint

- Operating Margin: 4.9%, up from -3.6% in the same quarter last year

- Free Cash Flow was -$436 million compared to -$811 million in the same quarter last year

- Organic Revenue rose 3% year on year vs analyst estimates of flat growth (360.8 basis point beat)

- Market Capitalization: $35.08 billion

Company Overview

Named after its founder, who was an entrepreneurial woman from New York with a passion for skincare, Estée Lauder (NYSE:EL) is a one-stop beauty shop with products in skincare, fragrance, makeup, sun protection, and men’s grooming.

In addition to its namesake brand, the company also goes to market with the Clinique, MAC, Bobbi Brown, and La Mer brands. While there are differences between the brands, the unifying theme is quality and elegance.

Estée Lauder caters to a broad spectrum of beauty enthusiasts, but their core customer is a more affluent adult woman. This woman isn’t afraid to pay a premium for trusted brands and wants beauty products that are effective. To meet her needs, the company maintains an air of exclusivity through a combination of aspirational marketing, thoughtful distribution, and product innovation.

Estée Lauder's products are most commonly found in upscale department stores like Nordstrom (NYSE:JWN) and Bloomingdale's as well as specialty beauty retailers such as Ulta Beauty (NASDAQ:ULTA) and Sephora. The company also strategically places its products in luxury boutiques and upscale spas to maintain its premium image. On the other hand, Estée Lauder will generally not be found in drugstores, lower-tier department stores, or discount chains.

4. Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors that offer a wide range of beauty and cosmetics products include L’Oreal (ENXTPA:OR), Coty (NYSE:COTY), Proctor & Gamble (NYSE:PG), and private company Revlon.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $14.45 billion in revenue over the past 12 months, Estée Lauder is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To accelerate sales, Estée Lauder likely needs to optimize its pricing or lean into new products and international expansion.

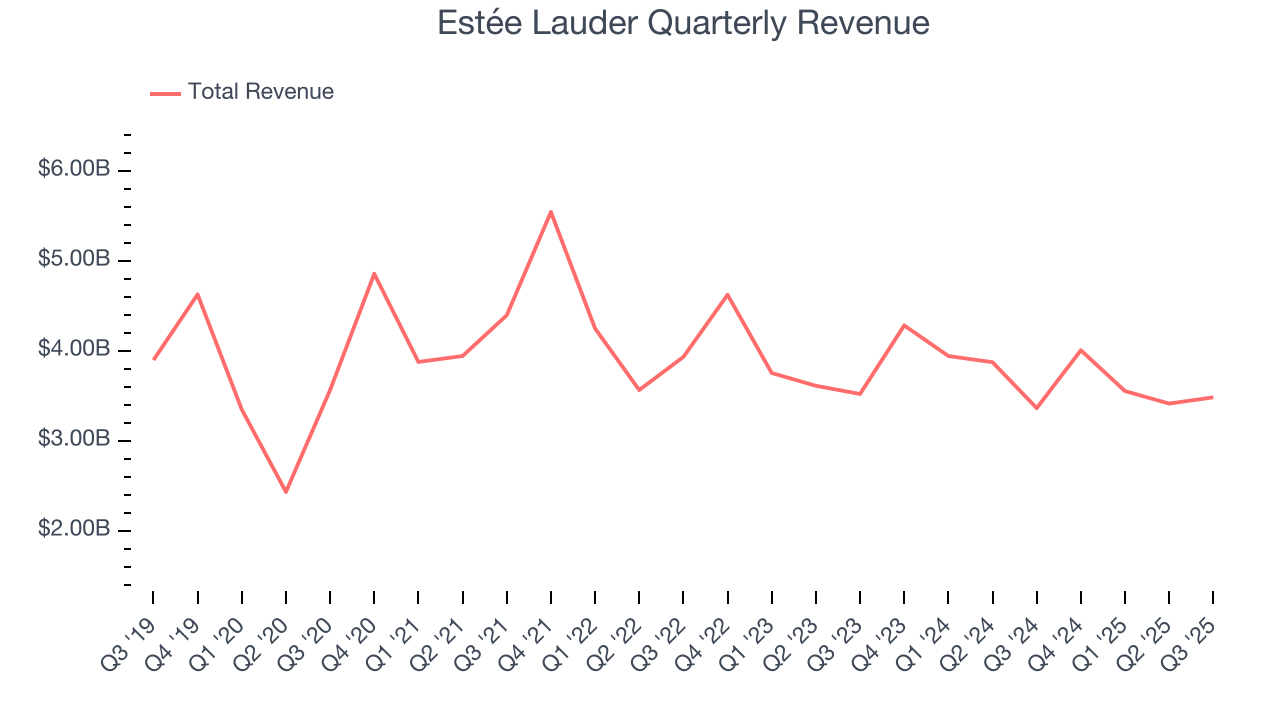

As you can see below, Estée Lauder struggled to generate demand over the last three years. Its sales dropped by 5.8% annually, a tough starting point for our analysis.

This quarter, Estée Lauder reported modest year-on-year revenue growth of 3.6% but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months. Although this projection implies its newer products will fuel better top-line performance, it is still below average for the sector.

6. Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

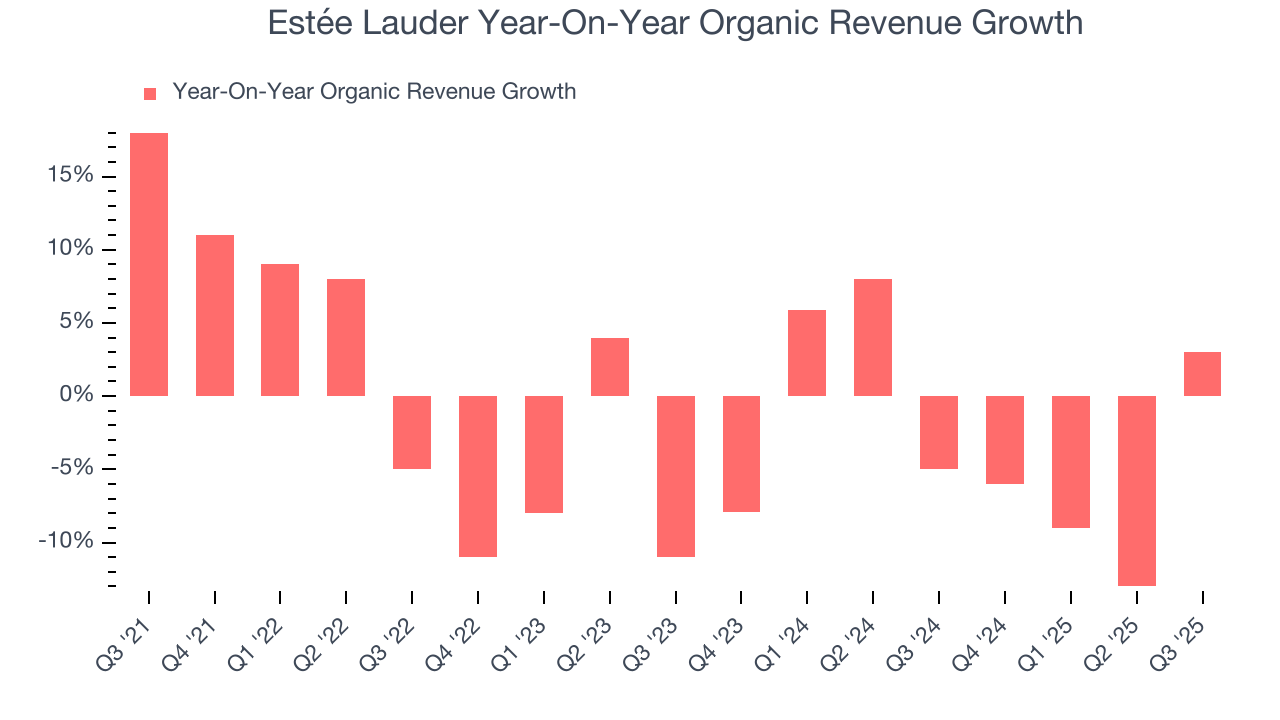

Estée Lauder’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 3% year on year.

In the latest quarter, Estée Lauder’s organic sales rose by 3% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

7. Gross Margin & Pricing Power

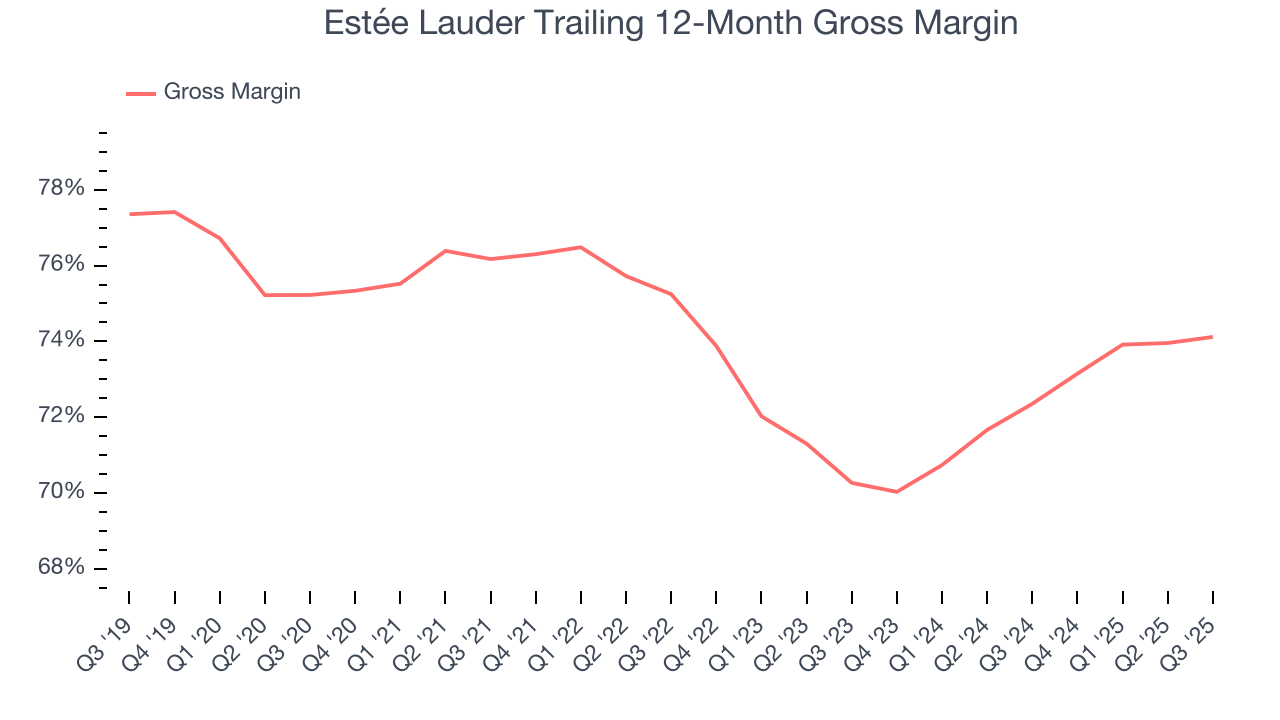

Estée Lauder has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 73.2% gross margin over the last two years. That means for every $100 in revenue, only $26.79 went towards paying for raw materials, production of goods, transportation, and distribution.

Estée Lauder’s gross profit margin came in at 73.4% this quarter, in line with the same quarter last year. Zooming out, Estée Lauder’s full-year margin has been trending up over the past 12 months, increasing by 1.8 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

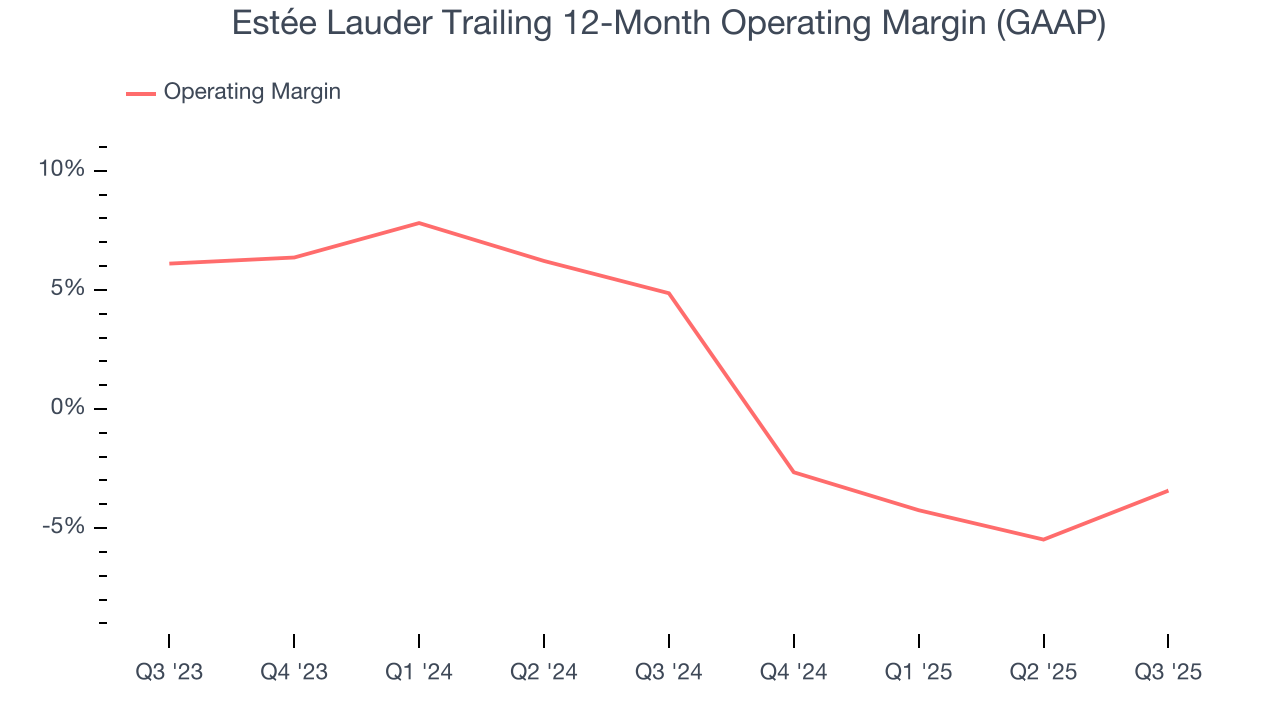

Estée Lauder was roughly breakeven when averaging the last two years of quarterly operating profits, lousy for a consumer staples business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, Estée Lauder’s operating margin decreased by 8.3 percentage points over the last year. Estée Lauder’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Estée Lauder generated an operating margin profit margin of 4.9%, up 8.5 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

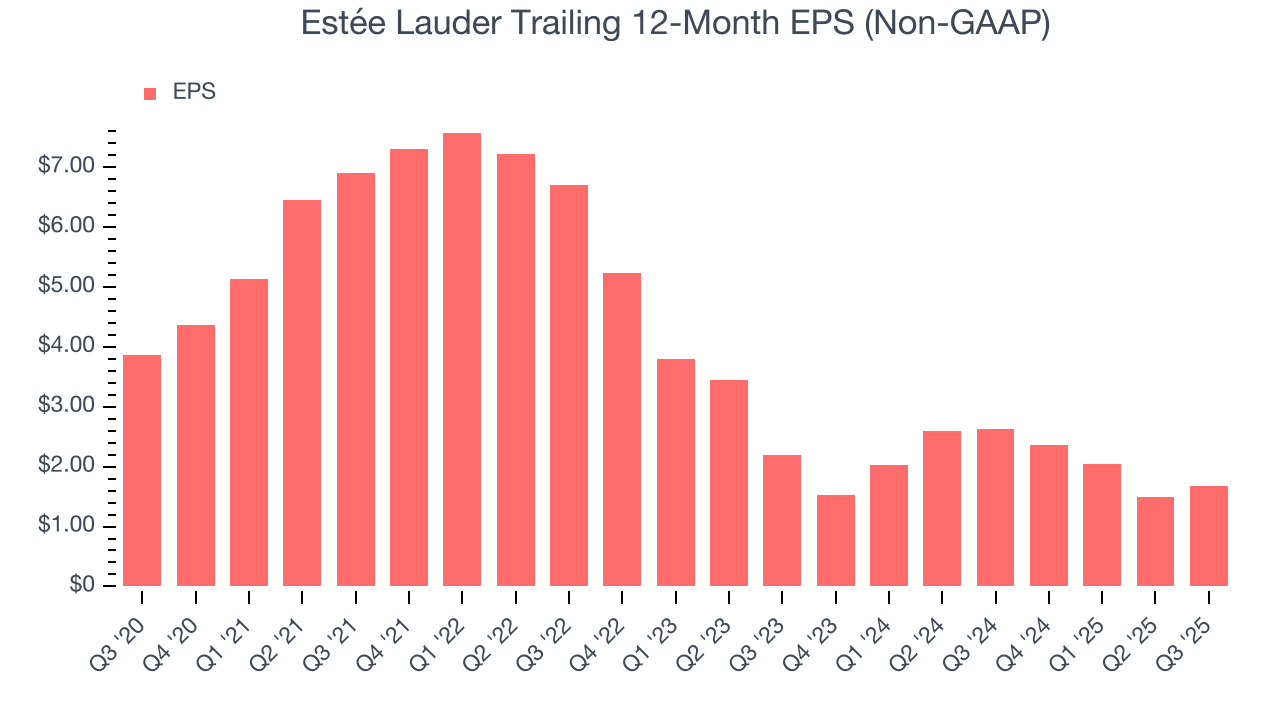

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, Estée Lauder reported adjusted EPS of $0.32, up from $0.14 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Estée Lauder’s full-year EPS of $1.68 to grow 37.3%.

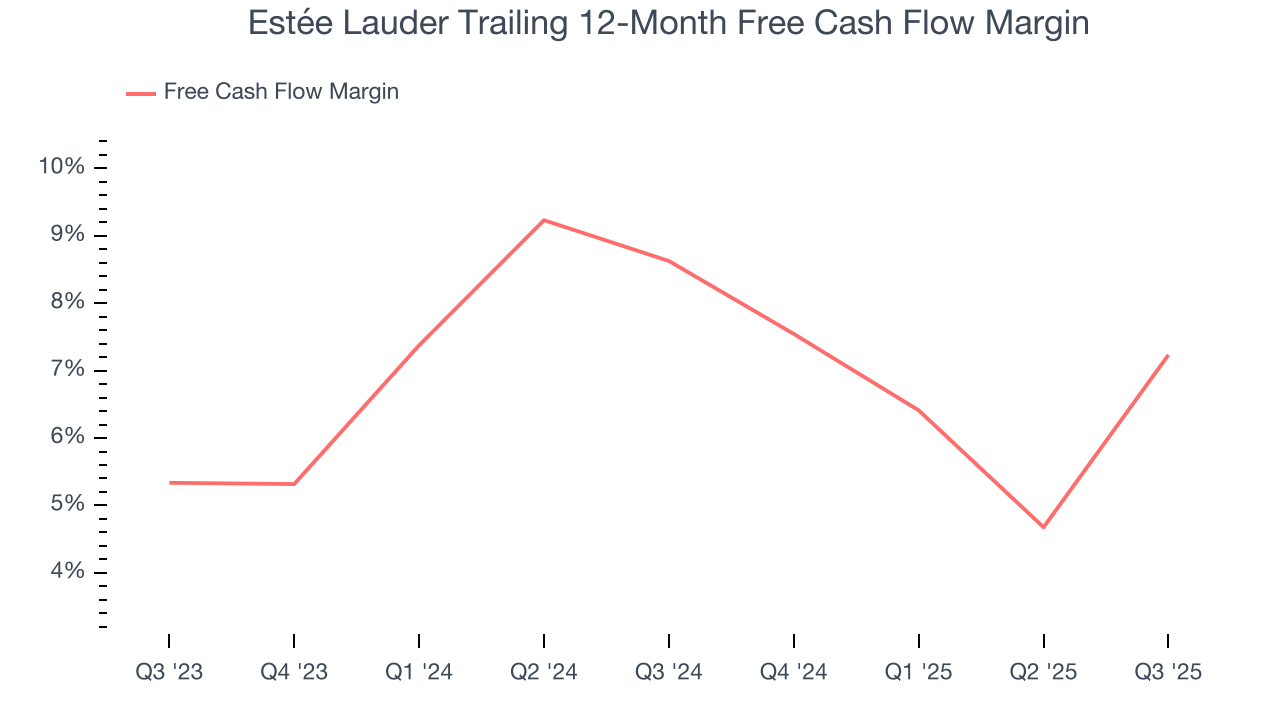

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Estée Lauder has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8% over the last two years, better than the broader consumer staples sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Estée Lauder’s margin dropped by 1.4 percentage points over the last year. This decrease warrants extra caution because Estée Lauder failed to grow its revenue organically. Its cash profitability could decay further if it tries to reignite growth through investments.

Estée Lauder burned through $436 million of cash in Q3, equivalent to a negative 12.5% margin. The company’s cash burn slowed from $811 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

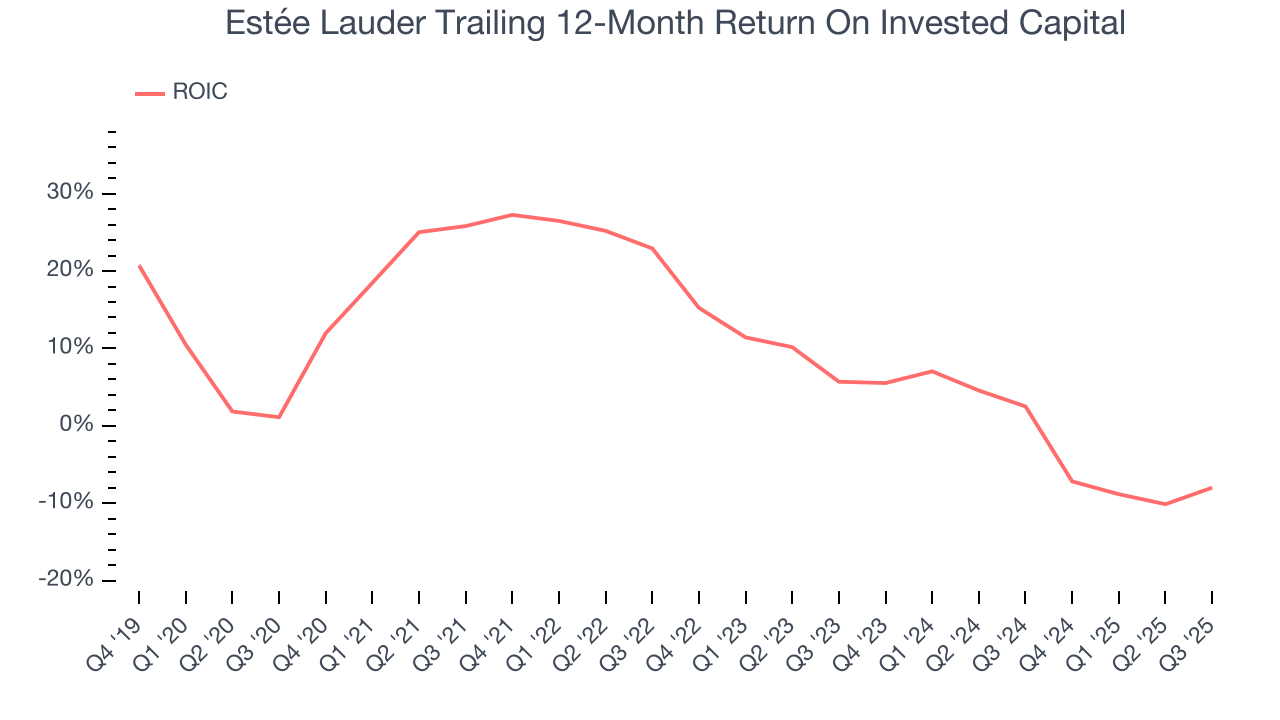

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Estée Lauder historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.8%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

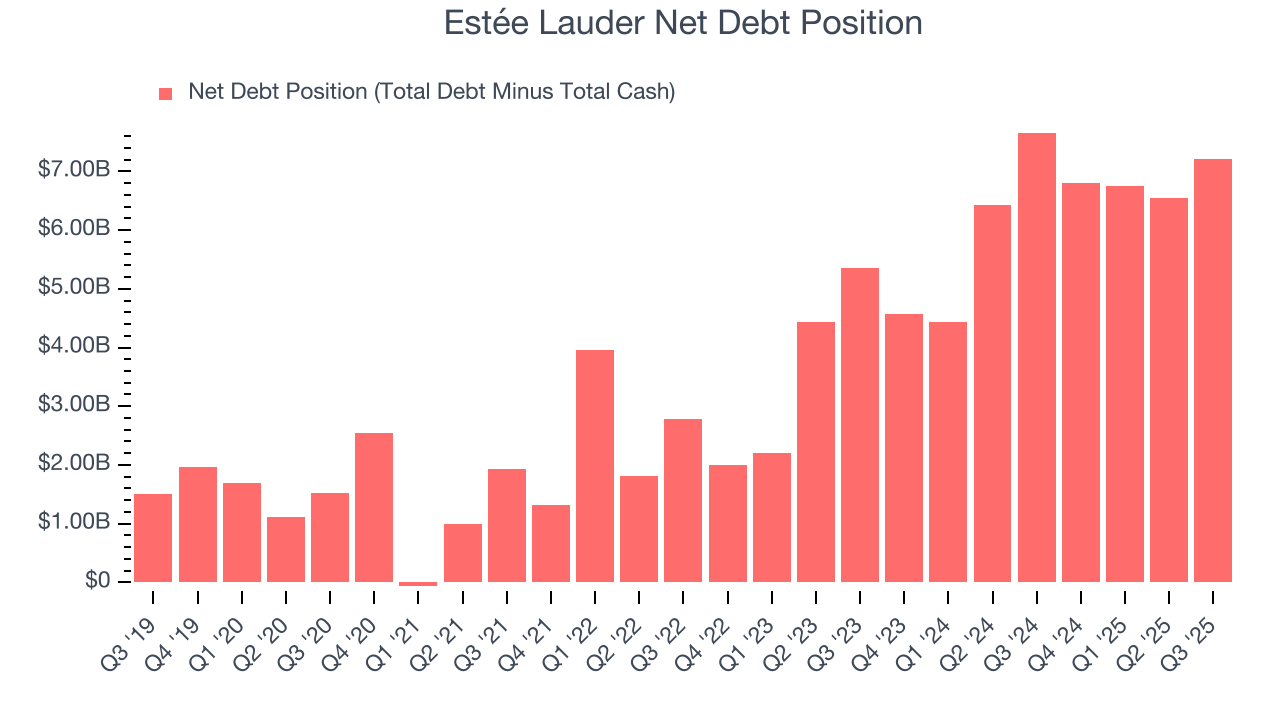

12. Balance Sheet Assessment

Estée Lauder reported $2.22 billion of cash and $9.42 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.99 billion of EBITDA over the last 12 months, we view Estée Lauder’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $130 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Estée Lauder’s Q3 Results

It was good to see Estée Lauder beat analysts’ organic revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed. Overall, we still think this was a decent quarter with some key metrics above expectations. The stock traded up 5.2% to $102.50 immediately after reporting.

14. Is Now The Time To Buy Estée Lauder?

Updated: January 23, 2026 at 9:44 PM EST

When considering an investment in Estée Lauder, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Estée Lauder’s business quality ultimately falls short of our standards. First off, its revenue has declined over the last three years. And while its admirable gross margins are a wonderful starting point for the overall profitability of the business, the downside is its declining operating margin shows the business has become less efficient. On top of that, its declining EPS over the last three years makes it a less attractive asset to the public markets.

Estée Lauder’s P/E ratio based on the next 12 months is 51.1x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $109.58 on the company (compared to the current share price of $116.92), implying they don’t see much short-term potential in Estée Lauder.