Elanco (ELAN)

We aren’t fans of Elanco. Its poor investment decisions are evident in its negative returns on capital, a troubling sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why We Think Elanco Will Underperform

Originally established as a division of pharmaceutical giant Eli Lilly before becoming independent in 2018, Elanco Animal Health (NYSE:ELAN) develops and sells medications, vaccines, and other health products for pets and farm animals across more than 90 countries.

- Negative returns on capital show that some of its growth strategies have backfired

- The good news is that its additional sales over the last five years increased its profitability as the 10.6% annual growth in its earnings per share outpaced its revenue

Elanco’s quality is lacking. Better stocks can be found in the market.

Why There Are Better Opportunities Than Elanco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Elanco

Elanco is trading at $25.32 per share, or 26.1x forward P/E. Not only does Elanco trade at a premium to companies in the healthcare space, but this multiple is also high for its fundamentals.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Elanco (ELAN) Research Report: Q4 CY2025 Update

Animal health company Elanco (NYSE:ELAN) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 12.2% year on year to $1.14 billion. Guidance for next quarter’s revenue was better than expected at $1.29 billion at the midpoint, 1% above analysts’ estimates. Its non-GAAP profit of $0.13 per share was 15.6% above analysts’ consensus estimates.

Elanco (ELAN) Q4 CY2025 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.09 billion (12.2% year-on-year growth, 4.8% beat)

- Adjusted EPS: $0.13 vs analyst estimates of $0.11 (15.6% beat)

- Adjusted EBITDA: $189 million vs analyst estimates of $178.1 million (16.5% margin, 6.1% beat)

- Revenue Guidance for Q1 CY2026 is $1.29 billion at the midpoint, above analyst estimates of $1.28 billion

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.03 at the midpoint, in line with analyst estimates

- EBITDA guidance for the upcoming financial year 2026 is $970 million at the midpoint, below analyst estimates of $980.8 million

- Operating Margin: 13.8%, up from 0.1% in the same quarter last year

- Constant Currency Revenue rose 9% year on year (4% in the same quarter last year)

- Market Capitalization: $12.3 billion

Company Overview

Originally established as a division of pharmaceutical giant Eli Lilly before becoming independent in 2018, Elanco Animal Health (NYSE:ELAN) develops and sells medications, vaccines, and other health products for pets and farm animals across more than 90 countries.

Elanco's business is divided into two main categories: pet health and farm animal products. The pet health portfolio focuses on parasiticides (products that kill fleas, ticks, and internal parasites), vaccines, and therapeutics for dogs and cats. Popular products include the Seresto flea and tick collar, the Advantage Family of topical parasiticides, and Galliprant for osteoarthritis pain in dogs.

For farm animals, Elanco provides products that improve efficiency, prevent and treat disease, ensure food safety, and enhance sustainability across cattle, poultry, swine, and aquaculture operations. Key farm animal products include Rumensin, which improves feed efficiency in cattle, and Maxiban, which prevents coccidiosis in chickens.

The company's distribution model varies by market segment. Pet health products are sold through veterinary clinics, third-party distributors, retailers, and increasingly through e-commerce channels. Farm animal products are sold directly to producers like dairy farmers and poultry operations, as well as through distributors.

A typical customer experience might involve a veterinarian prescribing Elanco's Credelio to a dog owner for monthly flea and tick prevention, or a cattle producer using Elanco's Rumensin to improve feed efficiency and milk production in dairy cows. The company also provides technical support through veterinary consultants who help customers implement disease management protocols.

Elanco maintains a global research and development operation focused on creating new animal health solutions and extending the usefulness of existing products. The company protects its innovations through a portfolio of patents and trademarks, though some of its older products now face generic competition as patents expire.

4. Specialty Pharmaceuticals

The specialty pharmaceutical industry relies on a high-cost, high-reward business model, driven by substantial investments in research and development to create innovative, patent-protected drugs for niche diseases. Successful products can generate significant revenue streams over their patent life, and the larger a roster of niche drugs, the stronger a moat a company enjoys. However, the business model is inherently risky, with high failure rates during clinical trials, lengthy regulatory approval processes, and competition from generic and biosimilar manufacturers once patents expire. These challenges, combined with scrutiny over drug pricing, create a complex operating environment. Looking ahead, the industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Elanco's main competitors include Zoetis (NYSE:ZTS), Boehringer Ingelheim Vetmedica (private), and Merck Animal Health, a division of Merck & Co. (NYSE:MRK). The company also competes with generic drug manufacturers and animal nutritional product companies like DSM Nutritional Products and Danisco Animal Nutrition & Health.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $4.72 billion in revenue over the past 12 months, Elanco has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Elanco’s 7.6% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Elanco’s recent performance shows its demand has slowed as its annualized revenue growth of 3.3% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 5.5% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Elanco.

This quarter, Elanco reported year-on-year revenue growth of 12.2%, and its $1.14 billion of revenue exceeded Wall Street’s estimates by 4.8%. Company management is currently guiding for a 8.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, similar to its two-year rate. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

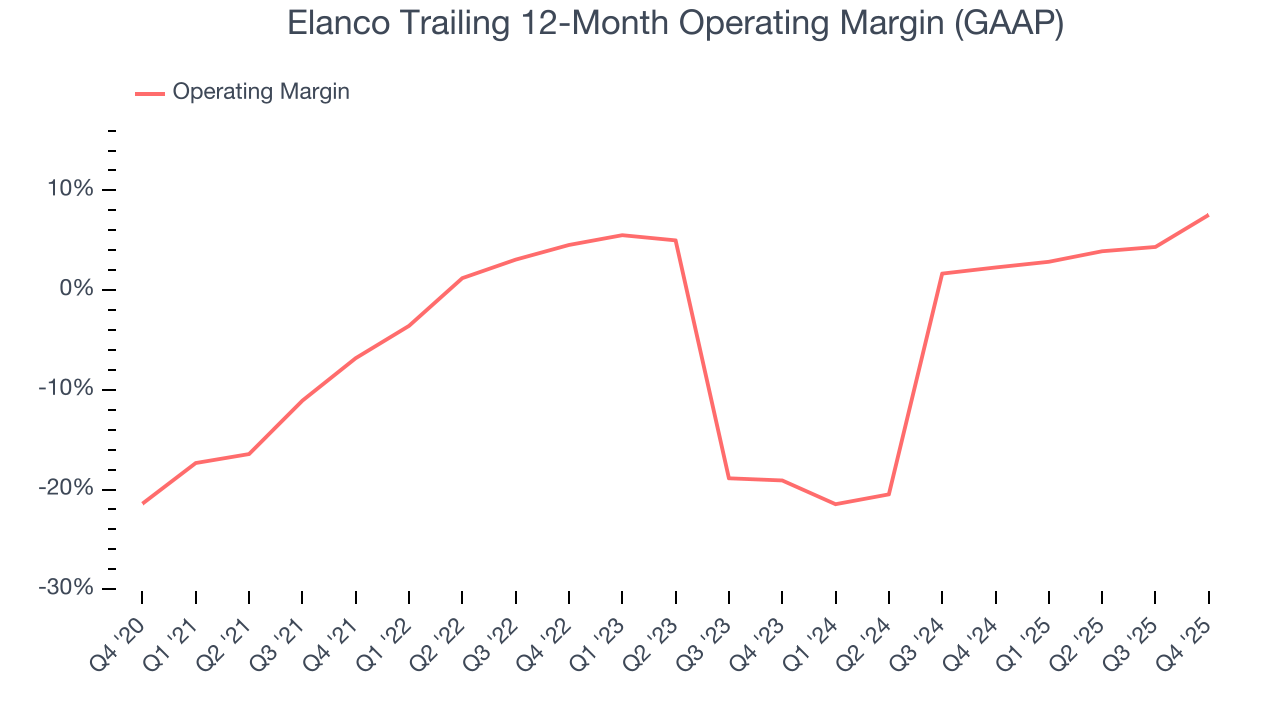

7. Operating Margin

Although Elanco was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.2% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Elanco’s operating margin rose by 14.4 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 26.6 percentage points on a two-year basis.

This quarter, Elanco generated an operating margin profit margin of 13.8%, up 13.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Elanco’s EPS grew at an astounding 15.1% compounded annual growth rate over the last five years, higher than its 7.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Elanco’s earnings can give us a better understanding of its performance. As we mentioned earlier, Elanco’s operating margin expanded by 14.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Elanco reported adjusted EPS of $0.13, down from $0.14 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Elanco’s full-year EPS of $0.95 to grow 7.6%.

9. Cash Is King

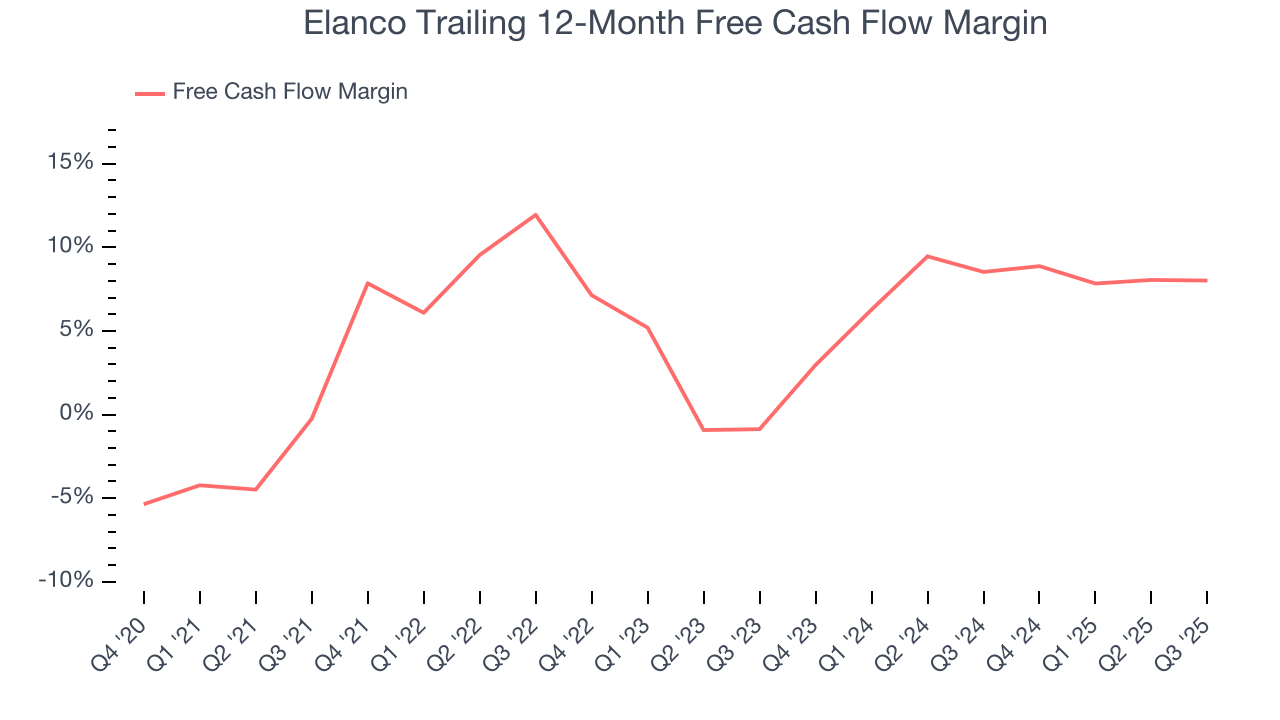

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Elanco has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.7% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Elanco’s margin expanded by 1.2 percentage points during that time. This is encouraging because it gives the company more optionality.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Elanco’s five-year average ROIC was negative 1.7%, meaning management lost money while trying to expand the business. Investors are likely hoping for a change soon.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Elanco’s ROIC averaged 2.7 percentage point increases each year. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Assessment

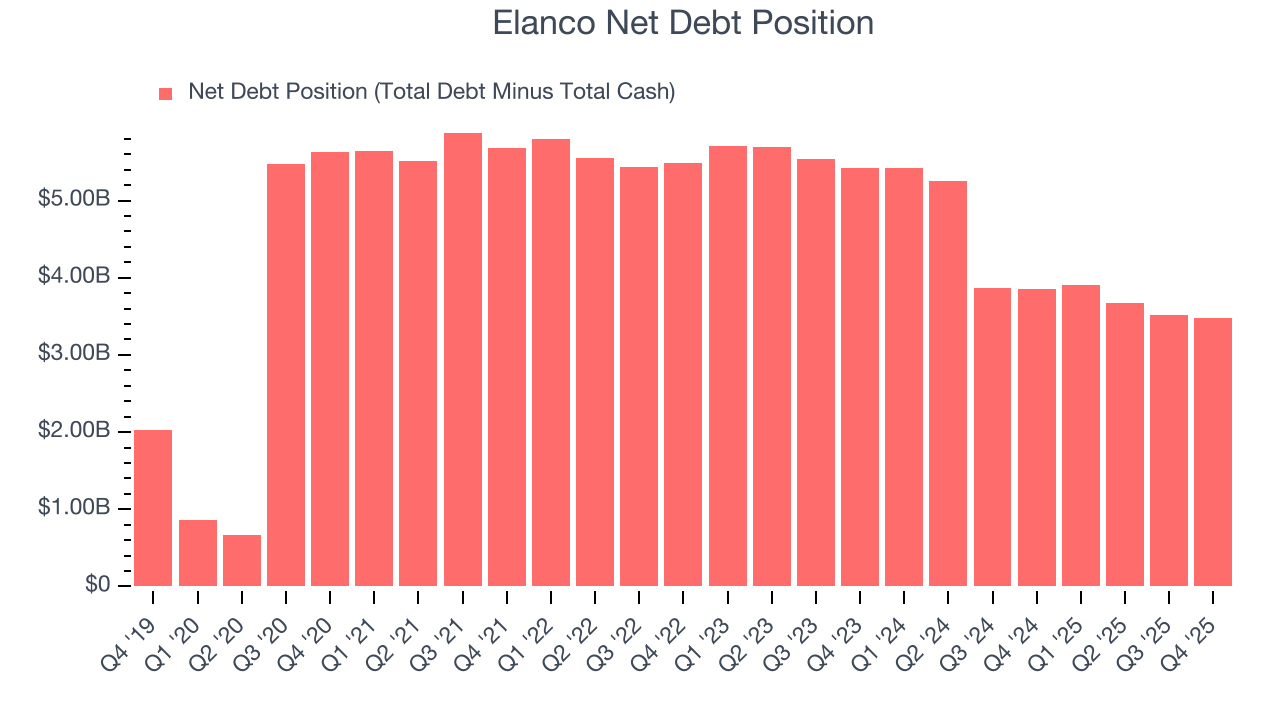

Elanco reported $545 million of cash and $4.02 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $901 million of EBITDA over the last 12 months, we view Elanco’s 3.9× net-debt-to-EBITDA ratio as safe. We also see its $60 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Elanco’s Q4 Results

We enjoyed seeing Elanco beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 1.4% to $24.41 immediately following the results.

13. Is Now The Time To Buy Elanco?

Updated: February 24, 2026 at 6:38 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Elanco.

Elanco isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its operating margins reveal poor profitability compared to other healthcare companies.

Elanco’s P/E ratio based on the next 12 months is 24.2x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $26.23 on the company (compared to the current share price of $24.41).