Elanco (ELAN)

We’re skeptical of Elanco. Its poor investment decisions are evident in its negative returns on capital, a troubling sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why We Think Elanco Will Underperform

Originally established as a division of pharmaceutical giant Eli Lilly before becoming independent in 2018, Elanco Animal Health (NYSE:ELAN) develops and sells medications, vaccines, and other health products for pets and farm animals across more than 90 countries.

- Push for growth has led to negative returns on capital, signaling value destruction

- On the plus side, its additional sales over the last five years increased its profitability as the 10.6% annual growth in its earnings per share outpaced its revenue

Elanco lacks the business quality we seek. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Elanco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Elanco

At $24.51 per share, Elanco trades at 26x forward P/E. Not only does Elanco trade at a premium to companies in the healthcare space, but this multiple is also high for its fundamentals.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Elanco (ELAN) Research Report: Q3 CY2025 Update

Animal health company Elanco (NYSE:ELAN) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 10.4% year on year to $1.14 billion. Guidance for next quarter’s revenue was better than expected at $1.10 billion at the midpoint, 1.9% above analysts’ estimates. Its non-GAAP profit of $0.19 per share was 43.9% above analysts’ consensus estimates.

Elanco (ELAN) Q3 CY2025 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.09 billion (10.4% year-on-year growth, 4.1% beat)

- Adjusted EPS: $0.19 vs analyst estimates of $0.13 (43.9% beat)

- Adjusted EBITDA: $198 million vs analyst estimates of $173.3 million (17.4% margin, 14.3% beat)

- Revenue Guidance for Q4 CY2025 is $1.10 billion at the midpoint, above analyst estimates of $1.08 billion

- Management raised its full-year Adjusted EPS guidance to $0.93 at the midpoint, a 5.1% increase

- EBITDA guidance for the full year is $890 million at the midpoint, above analyst estimates of $874.1 million

- Operating Margin: 22.5%, up from -2.1% in the same quarter last year

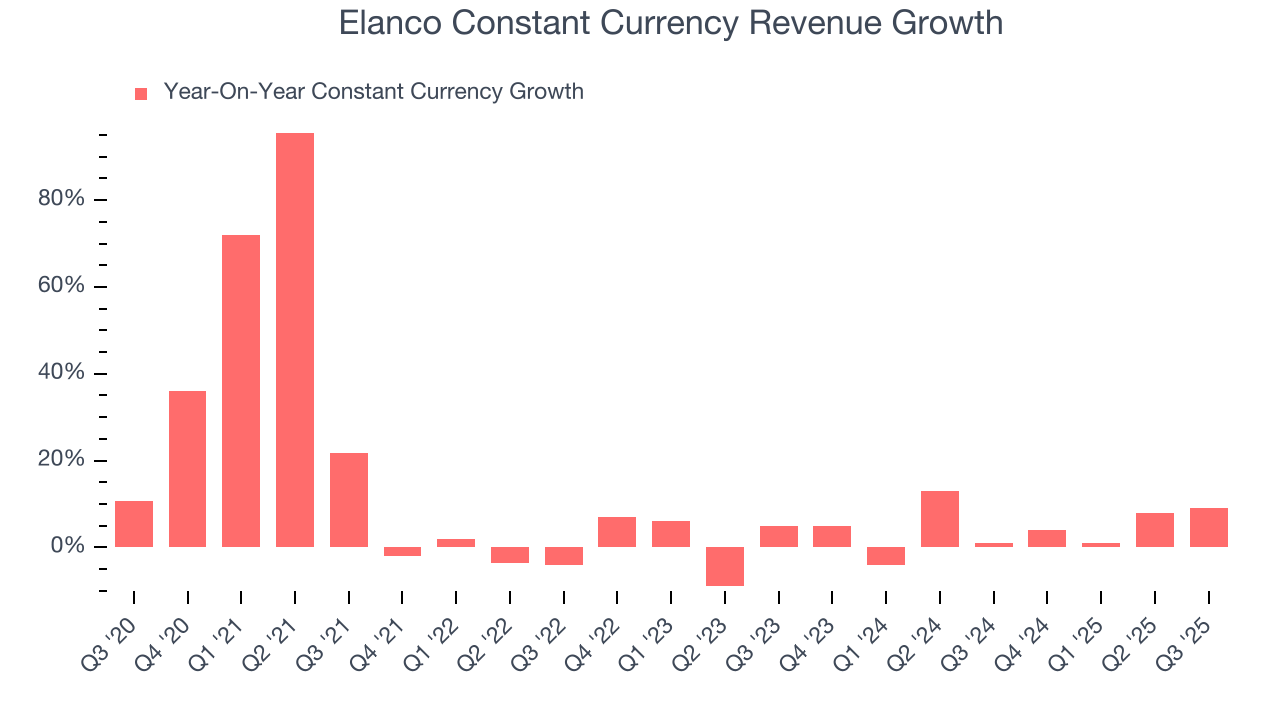

- Constant Currency Revenue rose 9% year on year (1% in the same quarter last year)

- Market Capitalization: $11.18 billion

Company Overview

Originally established as a division of pharmaceutical giant Eli Lilly before becoming independent in 2018, Elanco Animal Health (NYSE:ELAN) develops and sells medications, vaccines, and other health products for pets and farm animals across more than 90 countries.

Elanco's business is divided into two main categories: pet health and farm animal products. The pet health portfolio focuses on parasiticides (products that kill fleas, ticks, and internal parasites), vaccines, and therapeutics for dogs and cats. Popular products include the Seresto flea and tick collar, the Advantage Family of topical parasiticides, and Galliprant for osteoarthritis pain in dogs.

For farm animals, Elanco provides products that improve efficiency, prevent and treat disease, ensure food safety, and enhance sustainability across cattle, poultry, swine, and aquaculture operations. Key farm animal products include Rumensin, which improves feed efficiency in cattle, and Maxiban, which prevents coccidiosis in chickens.

The company's distribution model varies by market segment. Pet health products are sold through veterinary clinics, third-party distributors, retailers, and increasingly through e-commerce channels. Farm animal products are sold directly to producers like dairy farmers and poultry operations, as well as through distributors.

A typical customer experience might involve a veterinarian prescribing Elanco's Credelio to a dog owner for monthly flea and tick prevention, or a cattle producer using Elanco's Rumensin to improve feed efficiency and milk production in dairy cows. The company also provides technical support through veterinary consultants who help customers implement disease management protocols.

Elanco maintains a global research and development operation focused on creating new animal health solutions and extending the usefulness of existing products. The company protects its innovations through a portfolio of patents and trademarks, though some of its older products now face generic competition as patents expire.

4. Specialty Pharmaceuticals

The specialty pharmaceutical industry relies on a high-cost, high-reward business model, driven by substantial investments in research and development to create innovative, patent-protected drugs for niche diseases. Successful products can generate significant revenue streams over their patent life, and the larger a roster of niche drugs, the stronger a moat a company enjoys. However, the business model is inherently risky, with high failure rates during clinical trials, lengthy regulatory approval processes, and competition from generic and biosimilar manufacturers once patents expire. These challenges, combined with scrutiny over drug pricing, create a complex operating environment. Looking ahead, the industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Elanco's main competitors include Zoetis (NYSE:ZTS), Boehringer Ingelheim Vetmedica (private), and Merck Animal Health, a division of Merck & Co. (NYSE:MRK). The company also competes with generic drug manufacturers and animal nutritional product companies like DSM Nutritional Products and Danisco Animal Nutrition & Health.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $4.59 billion in revenue over the past 12 months, Elanco has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

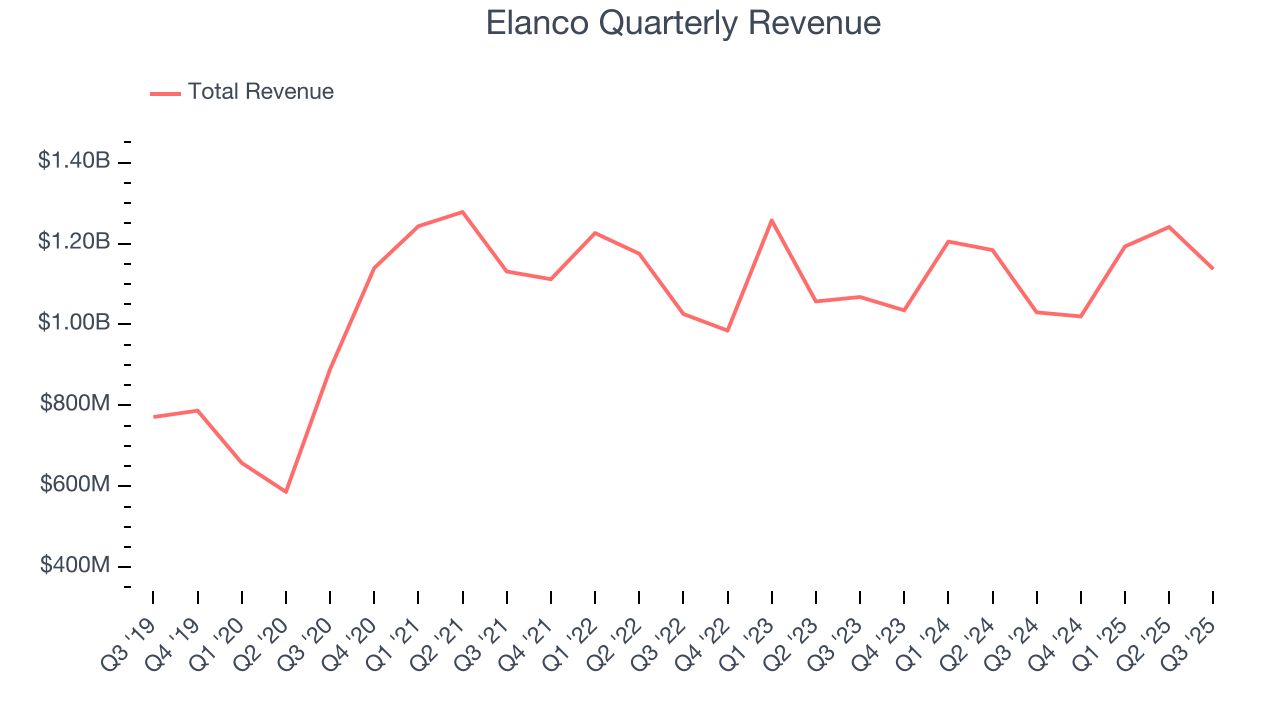

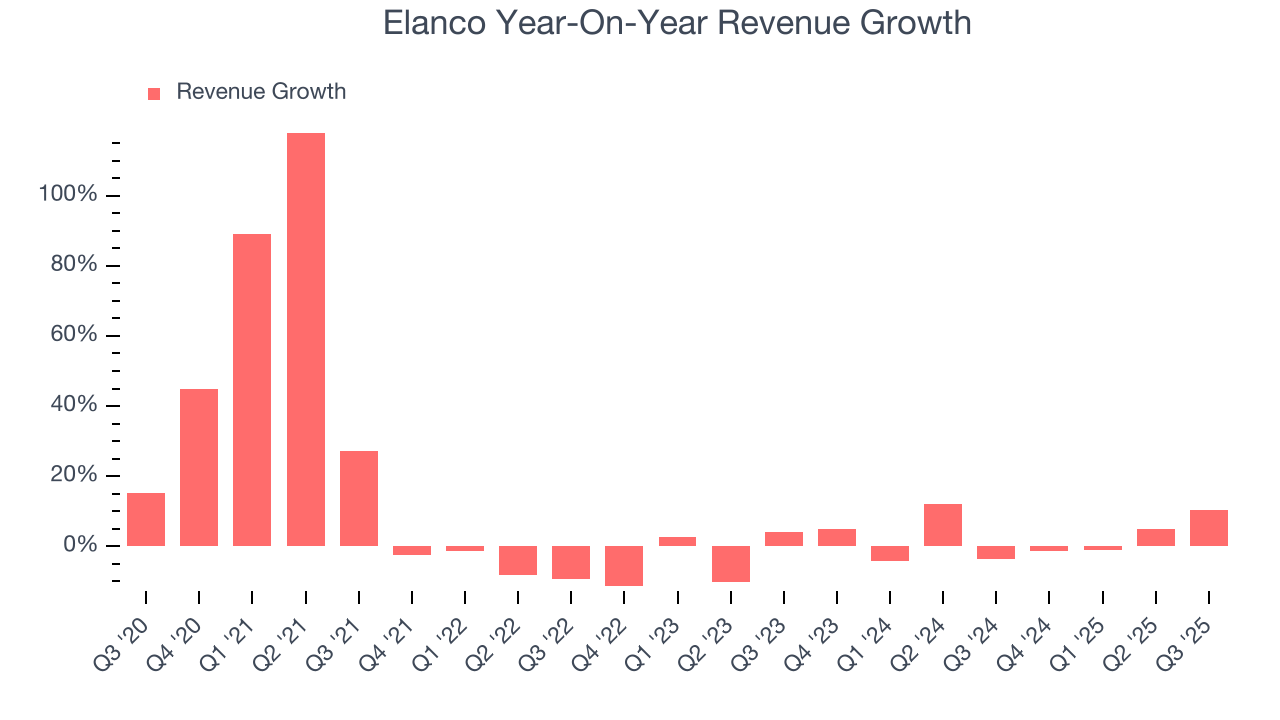

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Elanco grew its sales at a decent 9.5% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Elanco’s recent performance shows its demand has slowed as its annualized revenue growth of 2.5% over the last two years was below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 4.6% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Elanco.

This quarter, Elanco reported year-on-year revenue growth of 10.4%, and its $1.14 billion of revenue exceeded Wall Street’s estimates by 4.1%. Company management is currently guiding for a 7.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

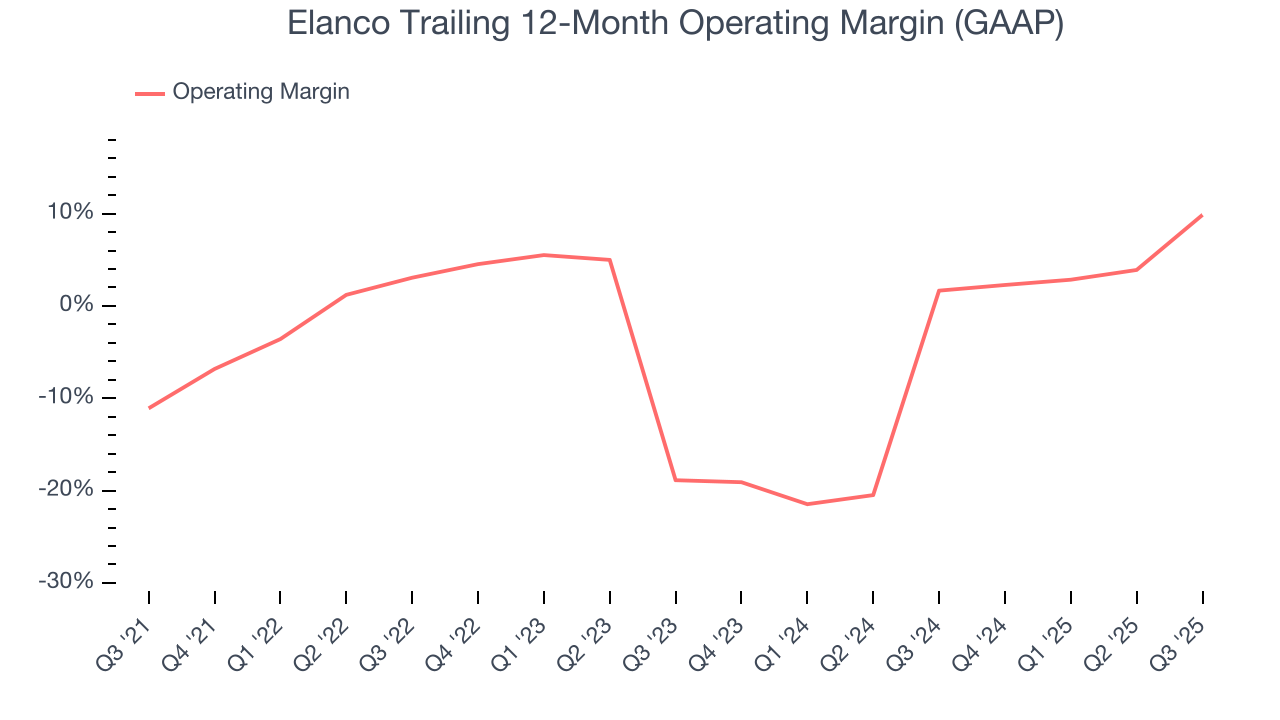

7. Operating Margin

Although Elanco was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 3% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Elanco’s operating margin rose by 20.9 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 28.7 percentage points on a two-year basis.

In Q3, Elanco generated an operating margin profit margin of 22.5%, up 24.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

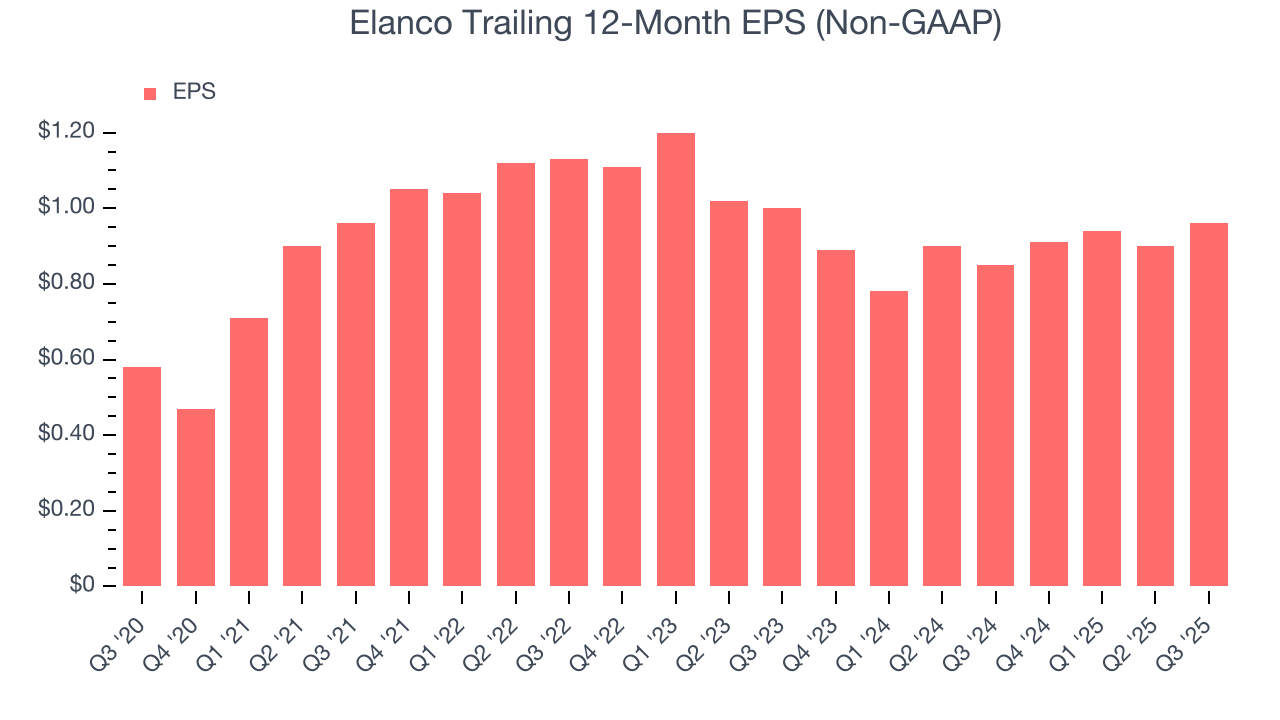

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Elanco’s remarkable 10.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q3, Elanco reported adjusted EPS of $0.19, up from $0.13 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Elanco’s full-year EPS of $0.96 to grow 1.1%.

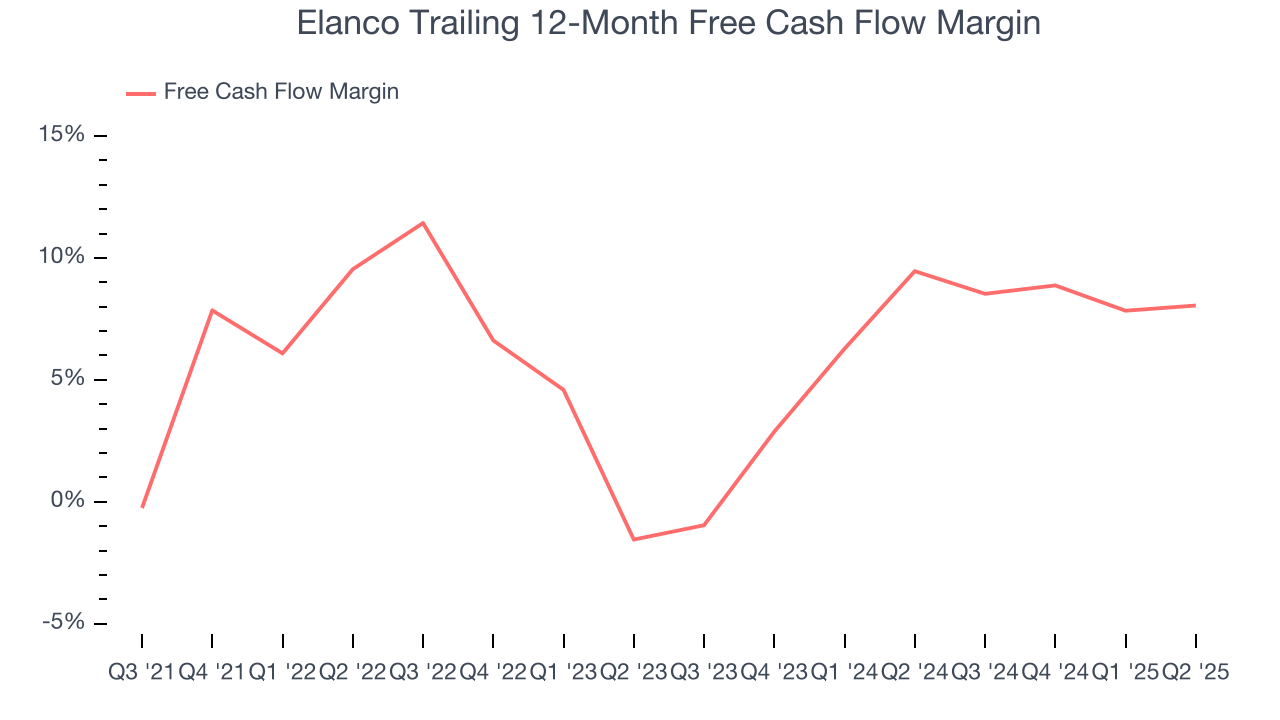

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Elanco has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Elanco’s margin expanded by 9.1 percentage points during that time. This is encouraging because it gives the company more optionality.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Elanco’s five-year average ROIC was negative 3.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Elanco’s ROIC averaged 1.1 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

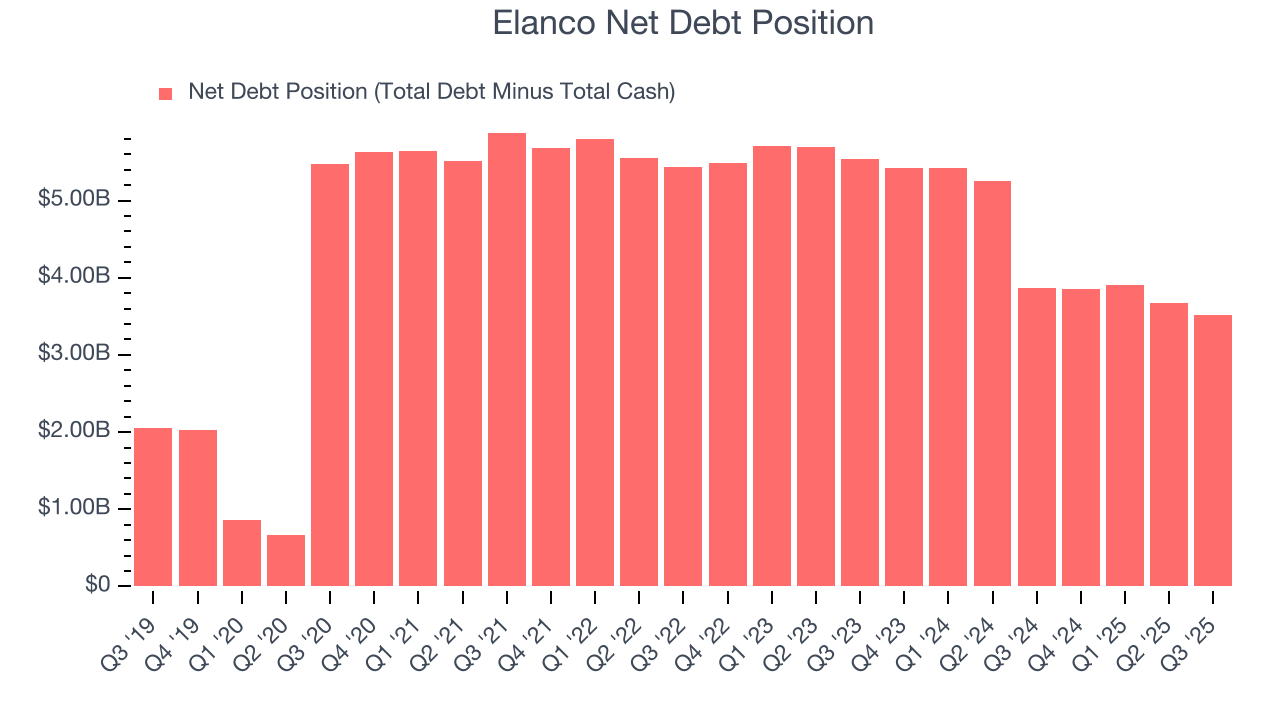

11. Balance Sheet Assessment

Elanco reported $505 million of cash and $4.02 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $889 million of EBITDA over the last 12 months, we view Elanco’s 4.0× net-debt-to-EBITDA ratio as safe. We also see its $82 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Elanco’s Q3 Results

We were impressed by how significantly Elanco blew past analysts’ constant currency revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this print was mixed, and guidance is weighing on the stock. Shares traded down 2.2% to $22.01 immediately after reporting.

13. Is Now The Time To Buy Elanco?

Updated: January 25, 2026 at 11:08 PM EST

Before making an investment decision, investors should account for Elanco’s business fundamentals and valuation in addition to what happened in the latest quarter.

Elanco isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Elanco’s P/E ratio based on the next 12 months is 26x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $25.46 on the company (compared to the current share price of $24.51).