e.l.f. Beauty (ELF)

e.l.f. Beauty is intriguing. Its fast sales growth, strong unit economics, and bright outlook suggest it will win more market share.― StockStory Analyst Team

1. News

2. Summary

Why e.l.f. Beauty Is Interesting

Short for "eyes, lips, face", e.l.f. Beauty (NYSE:ELF) is a developer of high-quality beauty products at accessible price points.

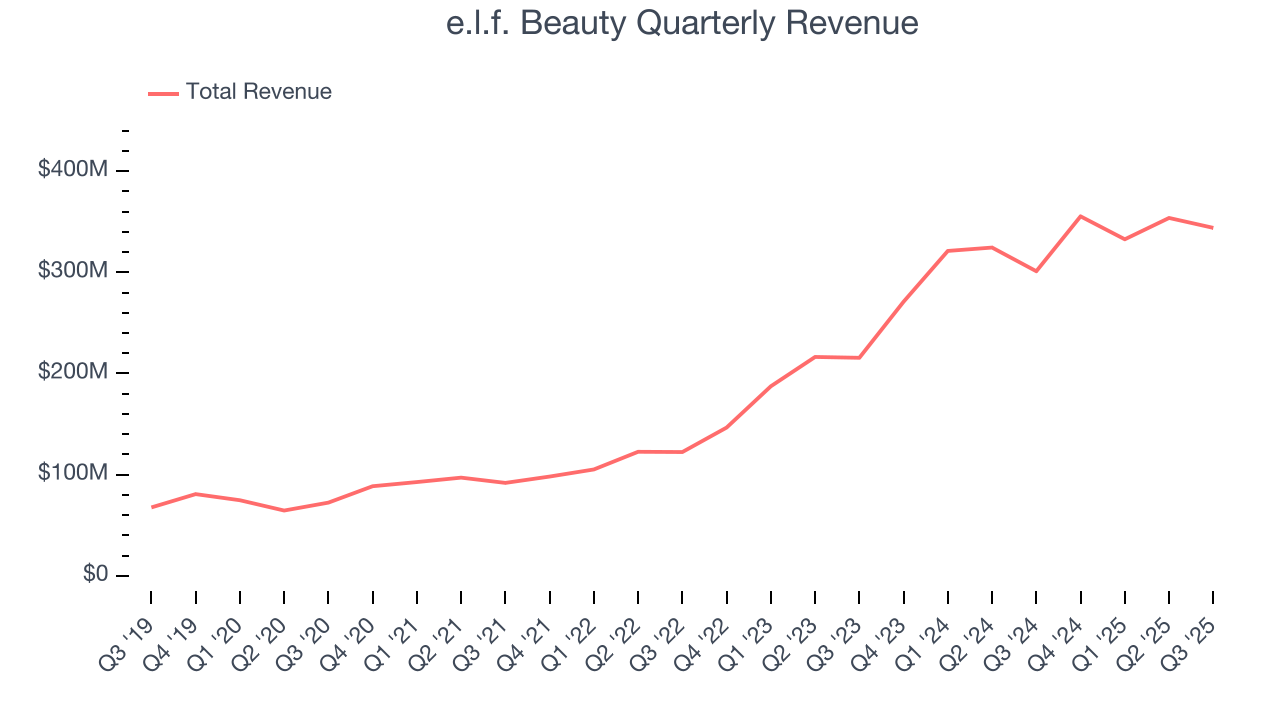

- Remarkable 45.7% revenue growth over the last three years demonstrates its ability to capture significant market share

- Revenue outlook for the upcoming 12 months is outstanding and shows it’s on track to gain market share

- One risk is its modest revenue base of $1.39 billion means it has less operating leverage but can also grow faster if it executes the right sales strategy

e.l.f. Beauty is solid, but not perfect. The stock is up 316% over the last five years.

Why Should You Watch e.l.f. Beauty

High Quality

Investable

Underperform

Why Should You Watch e.l.f. Beauty

e.l.f. Beauty is trading at $94.08 per share, or 30.9x forward P/E. e.l.f. Beauty’s valuation represents a premium to other names in the consumer staples sector.

e.l.f. Beauty could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. e.l.f. Beauty (ELF) Research Report: Q3 CY2025 Update

Cosmetics company e.l.f. Beauty (NYSE:ELF) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 14.2% year on year to $343.9 million. The company’s full-year revenue guidance of $1.56 billion at the midpoint came in 5.5% below analysts’ estimates. Its non-GAAP profit of $0.68 per share was 19.9% above analysts’ consensus estimates.

e.l.f. Beauty (ELF) Q3 CY2025 Highlights:

- Revenue: $343.9 million vs analyst estimates of $367.3 million (14.2% year-on-year growth, 6.4% miss)

- Adjusted EPS: $0.68 vs analyst estimates of $0.57 (19.9% beat)

- Adjusted EBITDA: $66.24 million vs analyst estimates of $60.15 million (19.3% margin, 10.1% beat)

- Adjusted EPS guidance for the full year is $2.83 at the midpoint, missing analyst estimates by 19.9%

- EBITDA guidance for the full year is $304 million at the midpoint, below analyst estimates of $346.1 million

- Operating Margin: 2.2%, down from 9.3% in the same quarter last year

- Free Cash Flow Margin: 4.8%, up from 3.2% in the same quarter last year

- Market Capitalization: $7.02 billion

Company Overview

Short for "eyes, lips, face", e.l.f. Beauty (NYSE:ELF) is a developer of high-quality beauty products at accessible price points.

The company was founded in 2004 on a simple but “crazy” idea: sell premium cosmetics over the internet for $1. Today, e.l.f. has expanded its price points and distribution channels. Specifically, e.l.f. offers a wide range of makeup, skincare, and beauty tools such as mascara, face washes, and makeup brushes under its namesake brand.

e.l.f. targets the budget-conscious beauty enthusiast who is likely young and trend-conscious. Since these individuals are more likely to experiment with different looks and buy cosmetics with more frequency and breadth, the company’s affordable prices and trendy products are attractive. e.l.f. prides itself on selling its products at everyday low prices rather than running occasional promotions and sales.

e.l.f. products can be found in various types of retailers and businesses, making them easily accessible. Mass retailers such as Walmart (NYSE:WMT), national drug store chains such as CVS (NYSE:CVS), and beauty specialty stores such as Ulta (NASDAQ:ULTA) all carry e.l.f. Products. Additionally, e.l.f. allows consumers to buy directly from the company and access exclusive deals, beauty tutorials, and product recommendations.

4. Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors that offer beauty or cosmetics products include Coty (NYSE:COTY), Estee Lauder (NYSE:EL), and L’Oreal (ENXTPA:OR).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.39 billion in revenue over the past 12 months, e.l.f. Beauty is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

As you can see below, e.l.f. Beauty’s 45.7% annualized revenue growth over the last three years was incredible. This is a great starting point for our analysis because it shows e.l.f. Beauty’s demand was higher than many consumer staples companies.

This quarter, e.l.f. Beauty’s revenue grew by 14.2% year on year to $343.9 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 33.5% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is healthy and indicates the market is baking in success for its products.

6. Gross Margin & Pricing Power

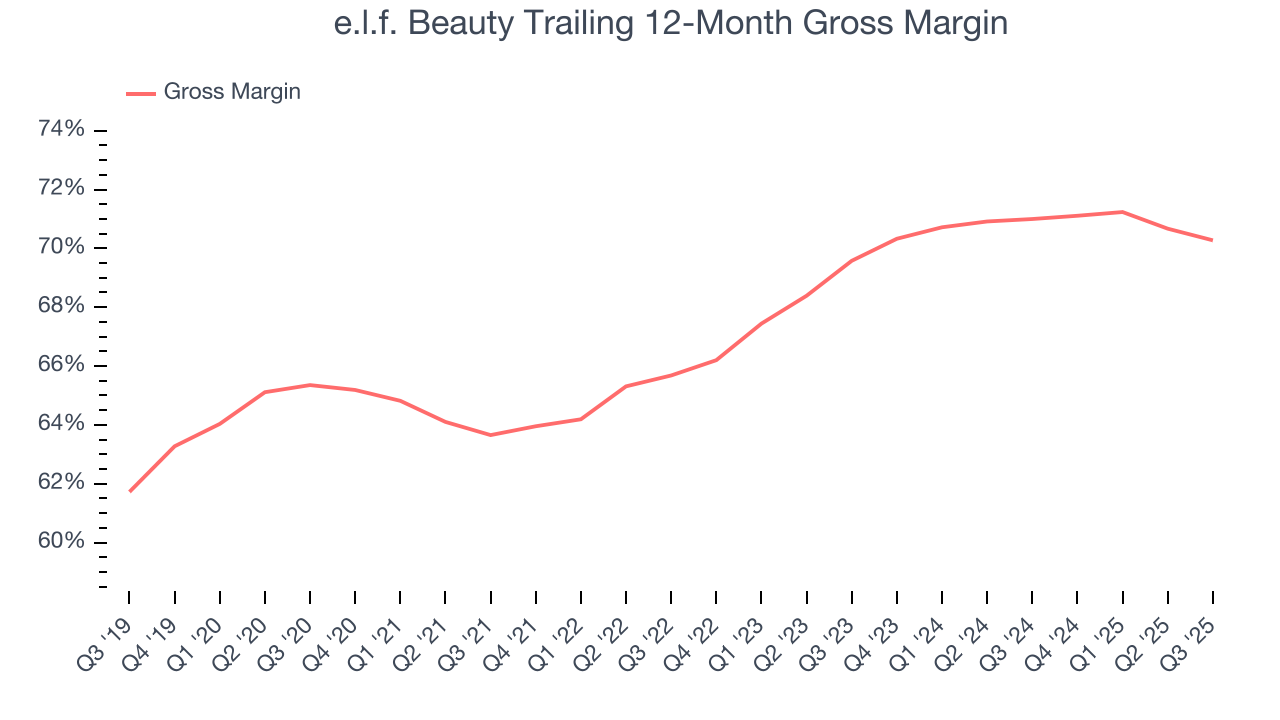

e.l.f. Beauty has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 70.6% gross margin over the last two years. That means for every $100 in revenue, only $29.39 went towards paying for raw materials, production of goods, transportation, and distribution.

This quarter, e.l.f. Beauty’s gross profit margin was 69.4%, marking a 1.6 percentage point decrease from 71.1% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

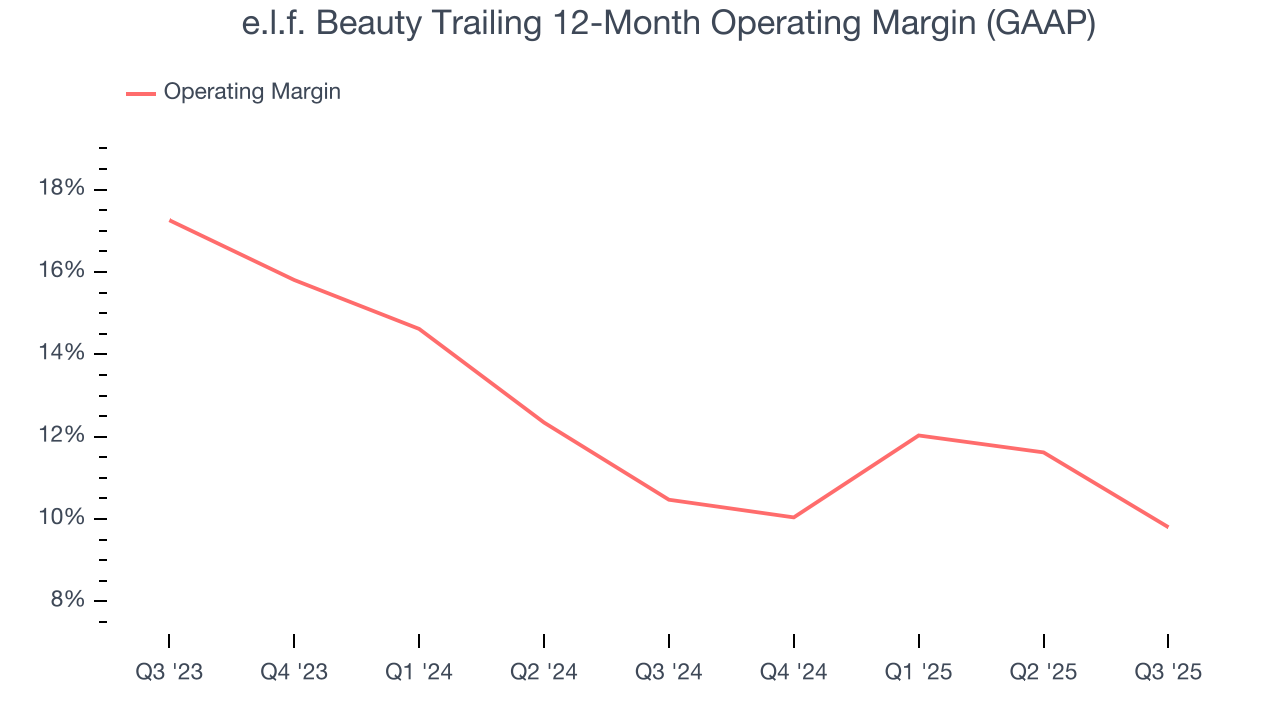

e.l.f. Beauty’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 10.1% over the last two years. This profitability was higher than the broader consumer staples sector, showing it did a decent job managing its expenses. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

Analyzing the trend in its profitability, e.l.f. Beauty’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, e.l.f. Beauty generated an operating margin profit margin of 2.2%, down 7 percentage points year on year. Since e.l.f. Beauty’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

8. Earnings Per Share

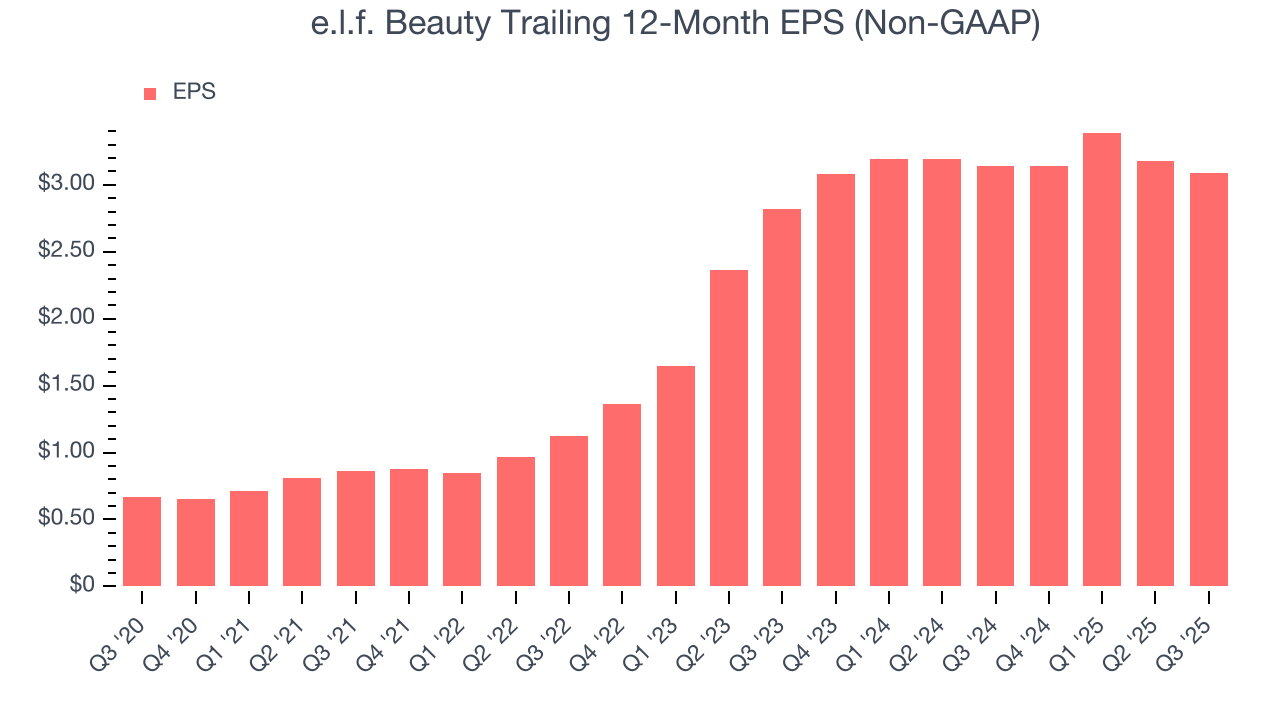

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, e.l.f. Beauty reported adjusted EPS of $0.68, down from $0.77 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects e.l.f. Beauty’s full-year EPS of $3.09 to grow 34%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

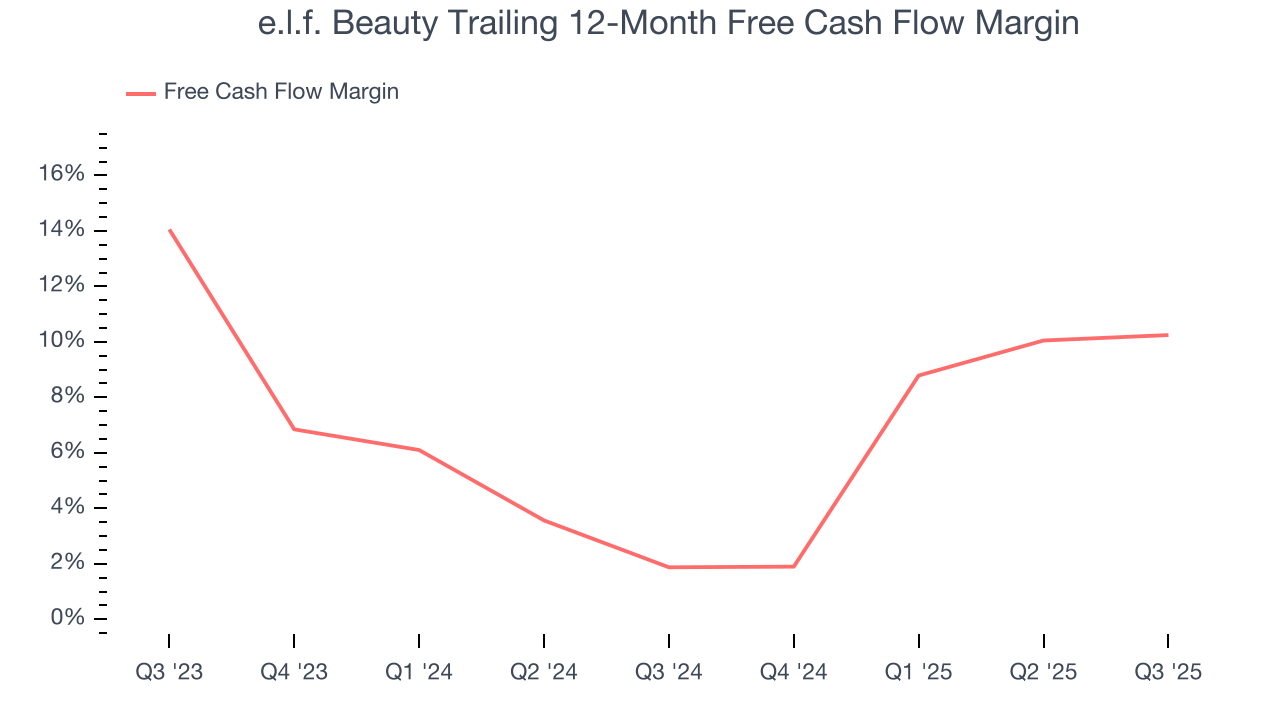

e.l.f. Beauty has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.3% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that e.l.f. Beauty’s margin expanded by 8.4 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

e.l.f. Beauty’s free cash flow clocked in at $16.57 million in Q3, equivalent to a 4.8% margin. This result was good as its margin was 1.6 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

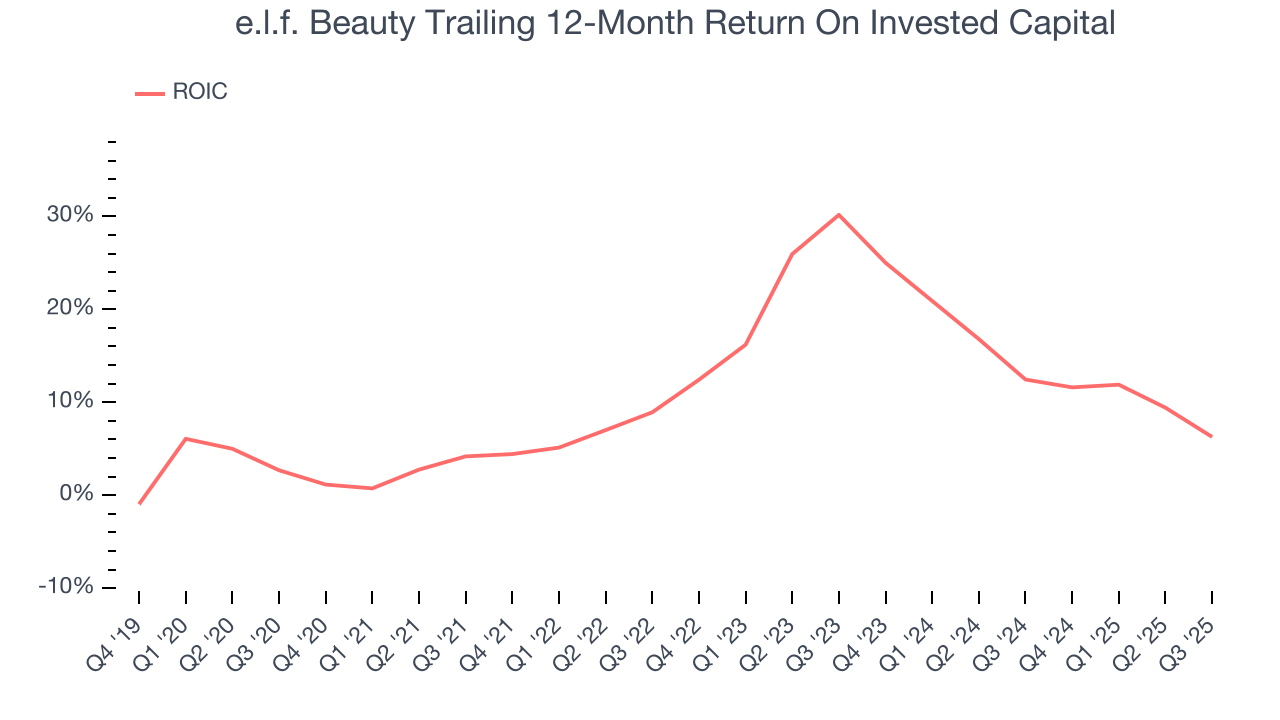

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

e.l.f. Beauty’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 12.4%, slightly better than typical consumer staples business.

11. Balance Sheet Assessment

e.l.f. Beauty reported $194.4 million of cash and $854.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $303.4 million of EBITDA over the last 12 months, we view e.l.f. Beauty’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $18.17 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from e.l.f. Beauty’s Q3 Results

We were impressed by how significantly e.l.f. Beauty blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 21.5% to $92.50 immediately following the results.

13. Is Now The Time To Buy e.l.f. Beauty?

Updated: January 24, 2026 at 9:51 PM EST

When considering an investment in e.l.f. Beauty, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We think e.l.f. Beauty is a good business. First off, its revenue growth was exceptional over the last three years. And while its brand caters to a niche market, its admirable gross margins are a wonderful starting point for the overall profitability of the business. On top of that, its EPS growth over the last three years has been fantastic.

e.l.f. Beauty’s P/E ratio based on the next 12 months is 30.9x. This multiple tells us that a lot of good news is priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $112.43 on the company (compared to the current share price of $94.08).