EMCOR (EME)

EMCOR is one of our favorite stocks. Its impressive sales growth and high returns on capital tee it up for fast and profitable expansion.― StockStory Analyst Team

1. News

2. Summary

Why We Like EMCOR

Through its network of over 70 subsidiaries, EMCOR (NYSE:EME) provides electrical, mechanical, and building construction and services

- Impressive 15.9% annual revenue growth over the last two years indicates it’s winning market share this cycle

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 35.7% over the last five years outstripped its revenue performance

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures, and its returns are climbing as it finds even more attractive growth opportunities

EMCOR sets the bar. The price looks reasonable relative to its quality, and we think now is the time to invest in the stock.

Why Is Now The Time To Buy EMCOR?

Why Is Now The Time To Buy EMCOR?

EMCOR is trading at $693.46 per share, or 26.1x forward P/E. Scanning the industrials landscape, we think this multiple is reasonable - arguably even attractive - for the quality you get.

By definition, where you buy a stock impacts returns. Compared to entry price, business quality matters much more for long-term market outperformance. Buying in at a great price helps, nevertheless.

3. EMCOR (EME) Research Report: Q3 CY2025 Update

Specialty construction contractor company EMCOR (NYSE:EME) met Wall Streets revenue expectations in Q3 CY2025, with sales up 16.4% year on year to $4.30 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $16.75 billion at the midpoint. Its GAAP profit of $6.57 per share was 0.7% above analysts’ consensus estimates.

EMCOR (EME) Q3 CY2025 Highlights:

- Revenue: $4.30 billion vs analyst estimates of $4.29 billion (16.4% year-on-year growth, in line)

- EPS (GAAP): $6.57 vs analyst estimates of $6.53 (0.7% beat)

- The company slightly lifted its revenue guidance for the full year to $16.75 billion at the midpoint from $16.65 billion

- The company slightly lifted its EPS guidance for the full year to $25.38 at the midpoint from $25.13 billion

- Operating Margin: 9.4%, in line with the same quarter last year

- Free Cash Flow Margin: 10.4%, down from 13.8% in the same quarter last year

- Market Capitalization: $34.78 billion

Company Overview

Through its network of over 70 subsidiaries, EMCOR (NYSE:EME) provides electrical, mechanical, and building construction and services

The company provides the design, installation, operation, and maintenance of complex mechanical and electrical systems, like electrical power transmission systems. Its services ensure the safe and sustainable operation of these mechanical and electrical systems in buildings and industrial sites.

Specifically, it services power cables, power supply systems, electric vehicle charging stations, roadway transit lighting, ventilation systems in buildings, and fire protection and suppression systems. It also offers more hands-on services like crane and rigging services and steel fabrication and welding services on-site.

EMCOR's main sources of revenue come from the contracts it receives for its mechanical and electrical construction projects. Its business is modeled around project-based work, and its wide clientele means it has a diversified revenue stream, ranging from commercial buildings and healthcare facilities to government entities and industrial sites. Due to the service and maintenance nature of this company, a significant portion of its revenue comes in a recurring form.

4. Engineering and Design Services

Companies providing engineering and design services boast ever-evolving technical expertise. Compared to their counterparts who manufacture and sell physical products, these companies can also pivot faster to more trending areas due to their smaller physical asset bases. Green energy and water conservation, for example, are current themes driving incremental demand in this space. On the other hand, those providing engineering and design services are at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

EMCOR’s competitors include Quanta Services (NYSE:PWR), Comfort Systems (NYSE:FIX), and Dycom Industries (NYSE:DY).

5. Revenue Growth

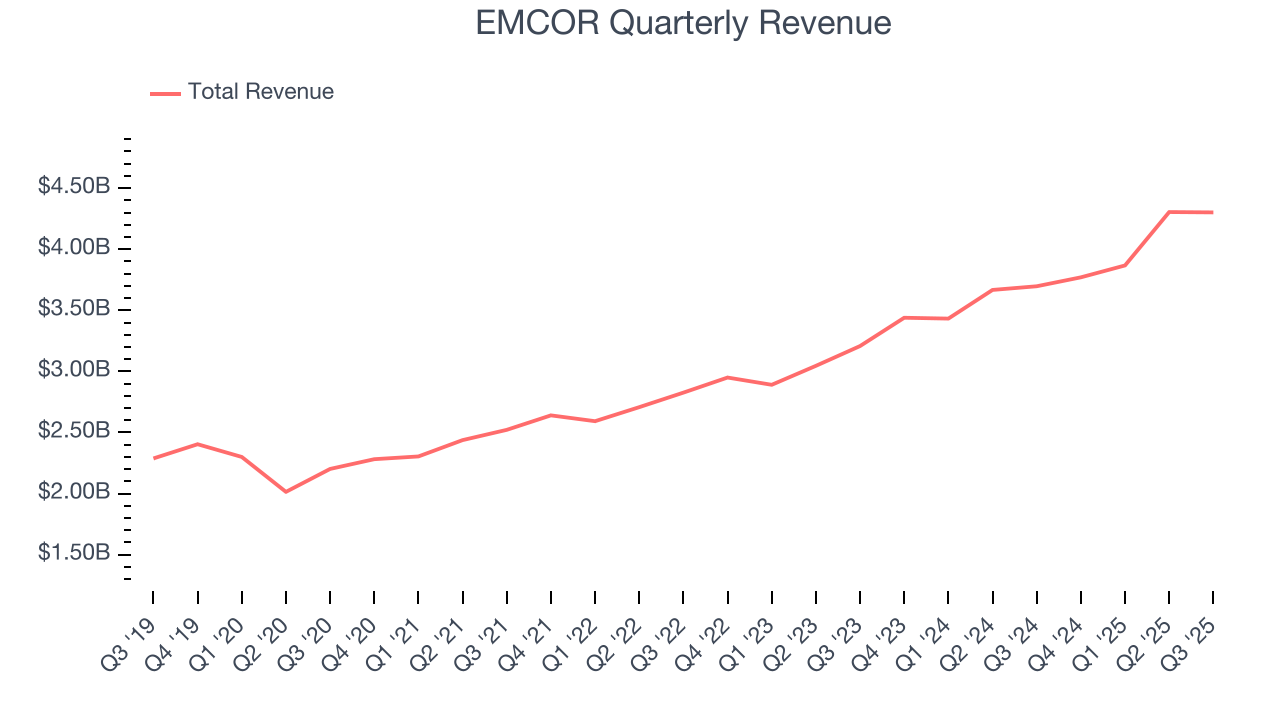

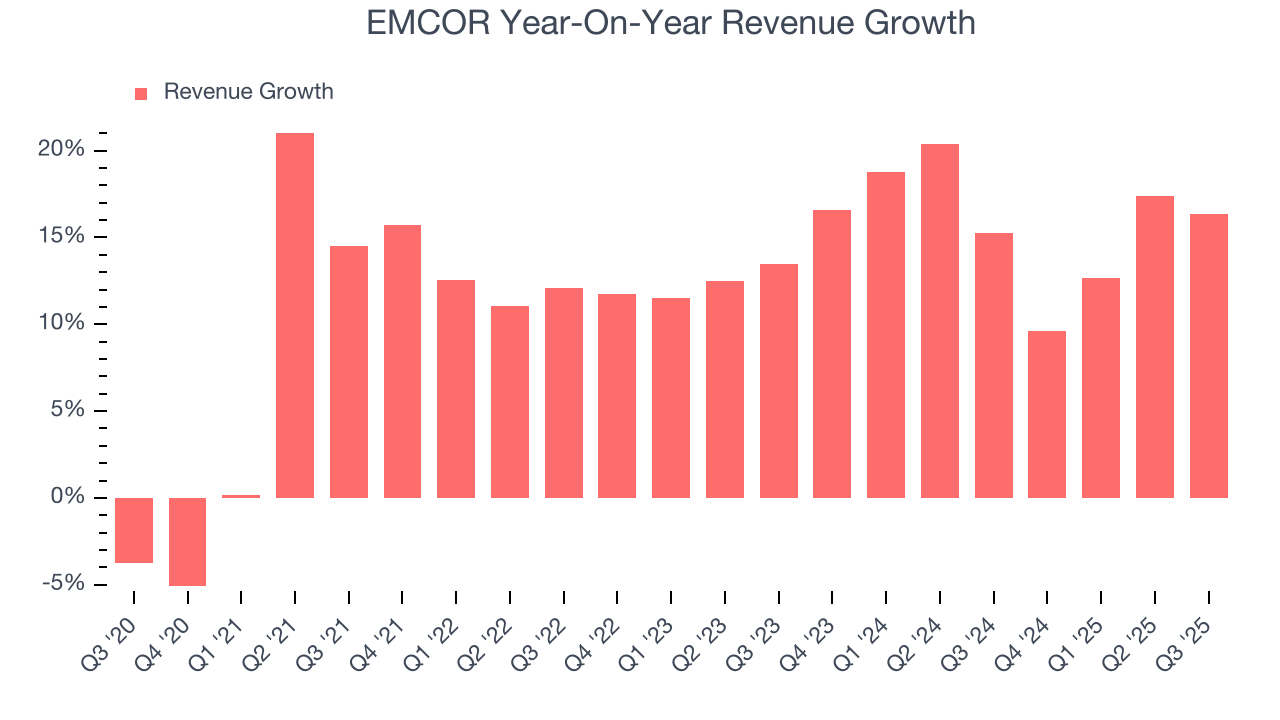

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, EMCOR’s 12.7% annualized revenue growth over the last five years was excellent. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. EMCOR’s annualized revenue growth of 15.9% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

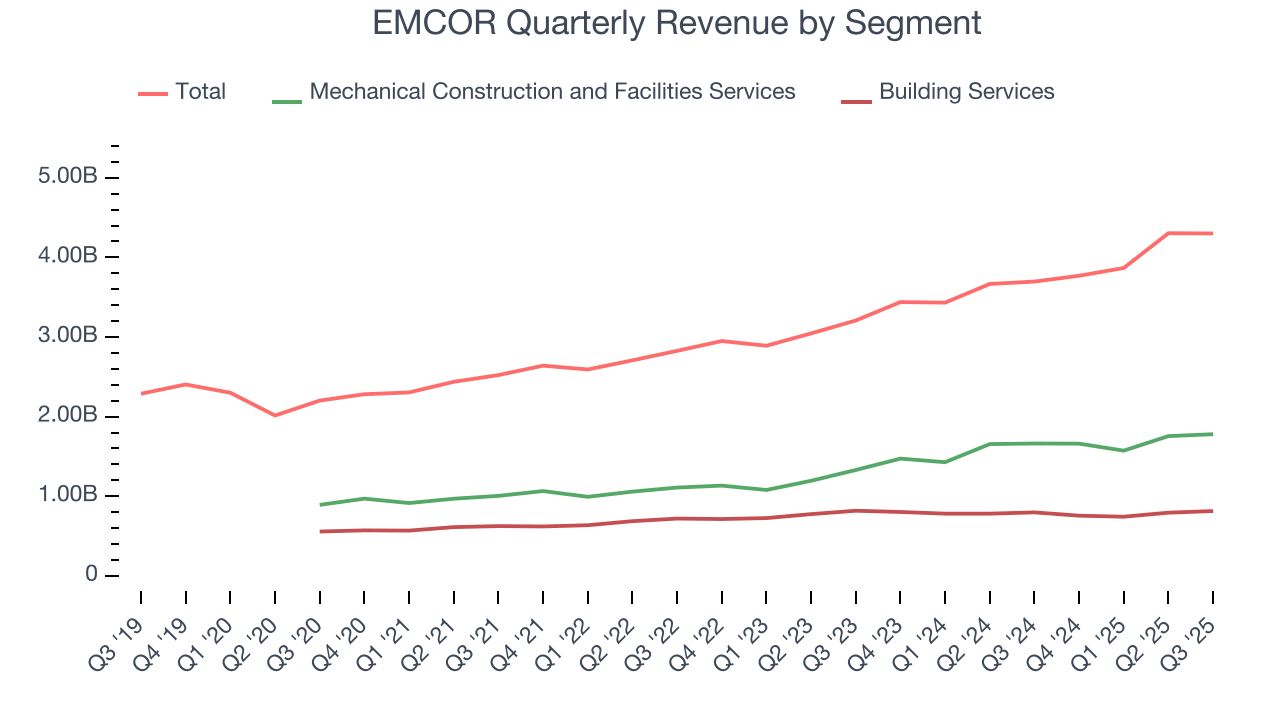

We can better understand the company’s revenue dynamics by analyzing its most important segments, Mechanical Construction and Facilities Services and Building Services , which are 41.4% and 18.9% of revenue. Over the last two years, EMCOR’s Mechanical Construction and Facilities Services revenue (design, integration, installation) averaged 20.2% year-on-year growth while its Building Services revenue (maintenance, electrical, plumbing) averaged 1.4% growth.

This quarter, EMCOR’s year-on-year revenue growth was 16.4%, and its $4.30 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and implies the market sees success for its products and services.

6. Gross Margin & Pricing Power

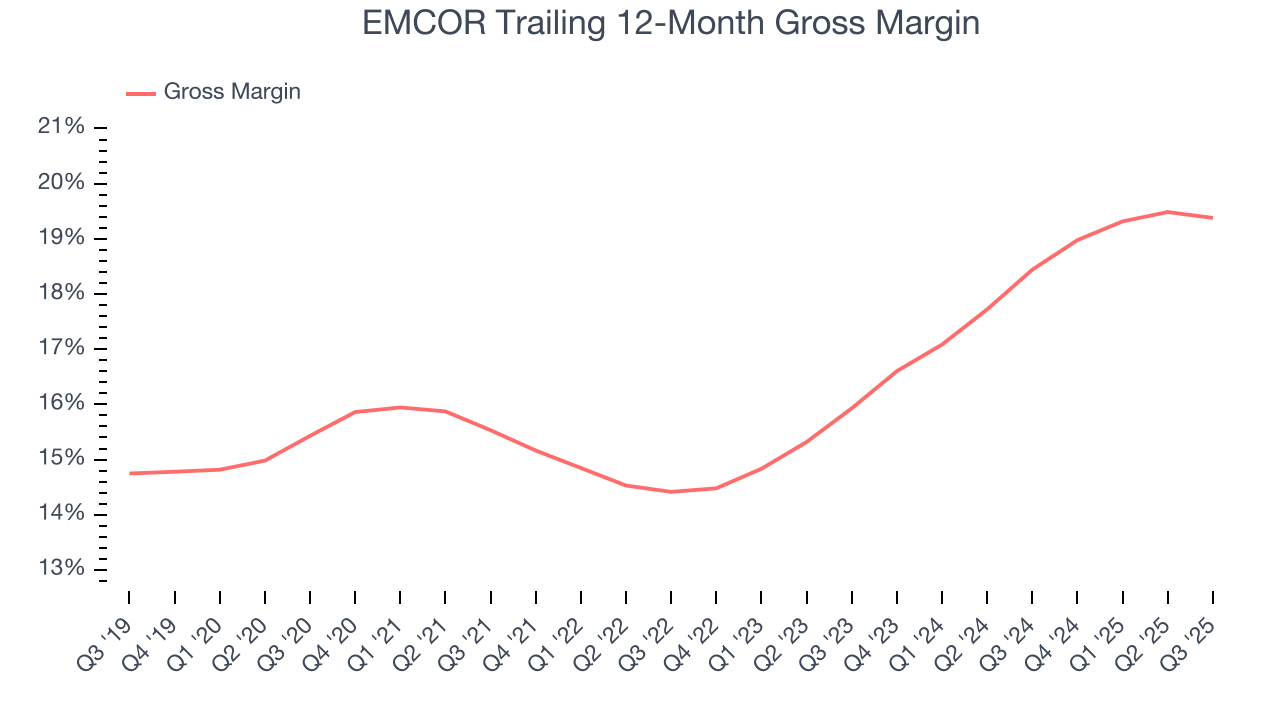

EMCOR has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 17.1% gross margin over the last five years. That means EMCOR paid its suppliers a lot of money ($82.93 for every $100 in revenue) to run its business.

EMCOR’s gross profit margin came in at 19.4% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

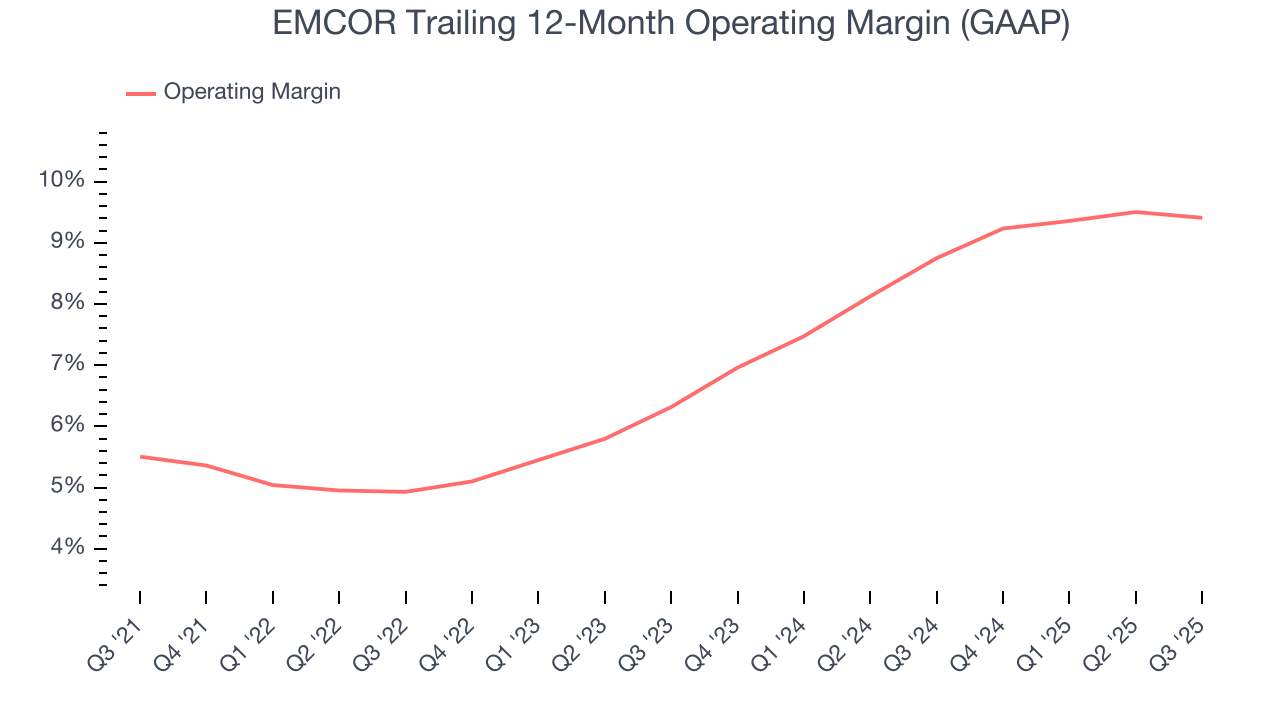

EMCOR was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, EMCOR’s operating margin rose by 3.9 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, EMCOR generated an operating margin profit margin of 9.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

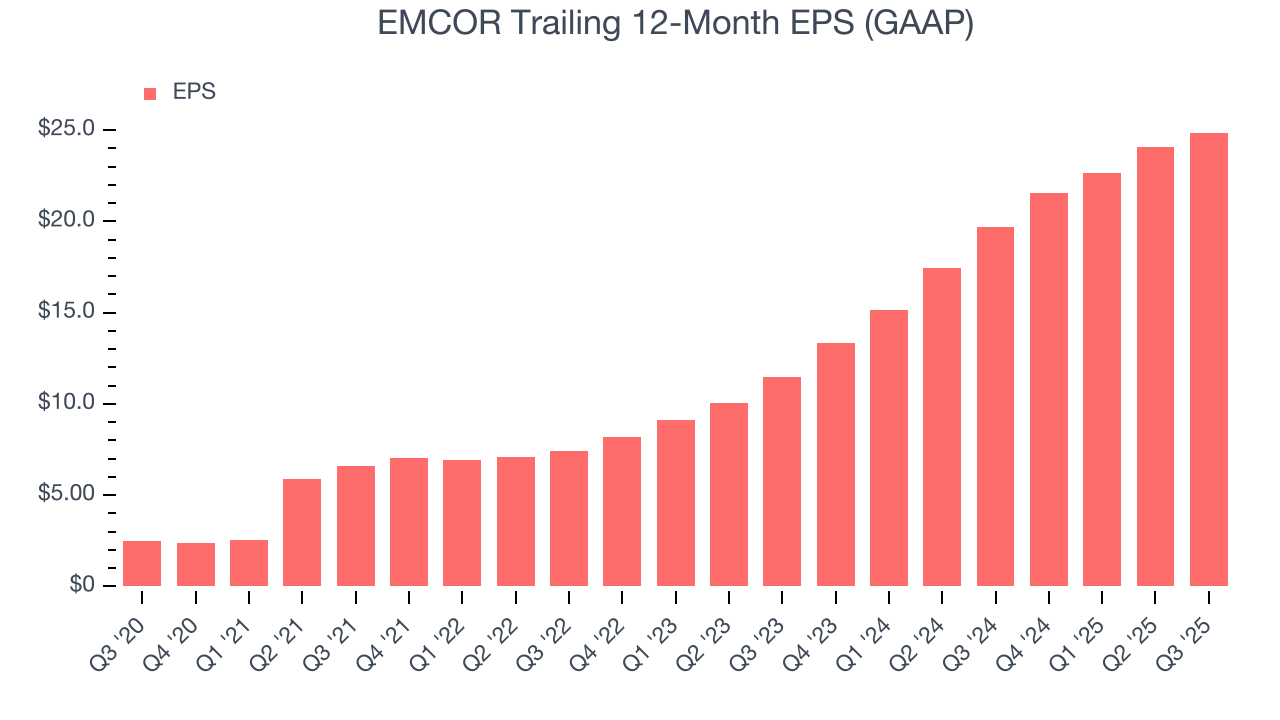

EMCOR’s EPS grew at an astounding 58.7% compounded annual growth rate over the last five years, higher than its 12.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

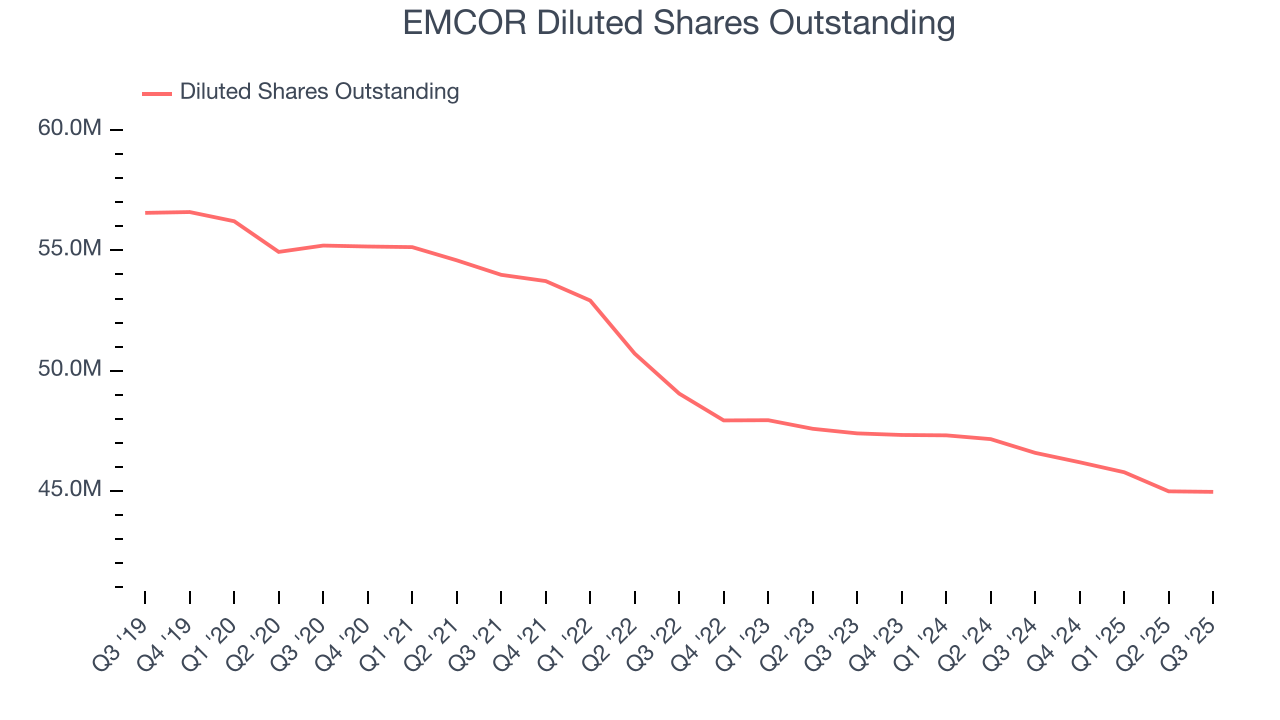

Diving into EMCOR’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, EMCOR’s operating margin was flat this quarter but expanded by 3.9 percentage points over the last five years. On top of that, its share count shrank by 18.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For EMCOR, its two-year annual EPS growth of 47.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, EMCOR reported EPS of $6.57, up from $5.80 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects EMCOR’s full-year EPS of $24.87 to grow 7.3%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

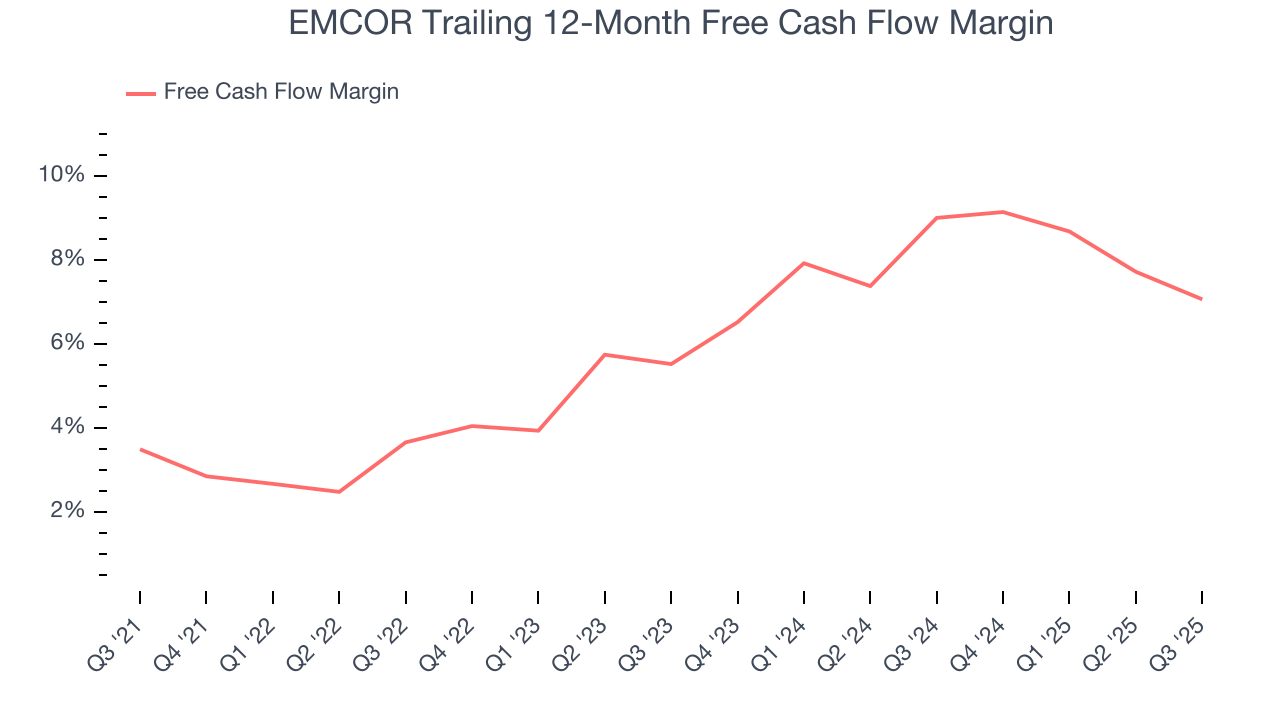

EMCOR has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.1% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that EMCOR’s margin expanded by 3.6 percentage points during that time. This is encouraging because it gives the company more optionality.

EMCOR’s free cash flow clocked in at $448.8 million in Q3, equivalent to a 10.4% margin. The company’s cash profitability regressed as it was 3.3 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to short-term swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

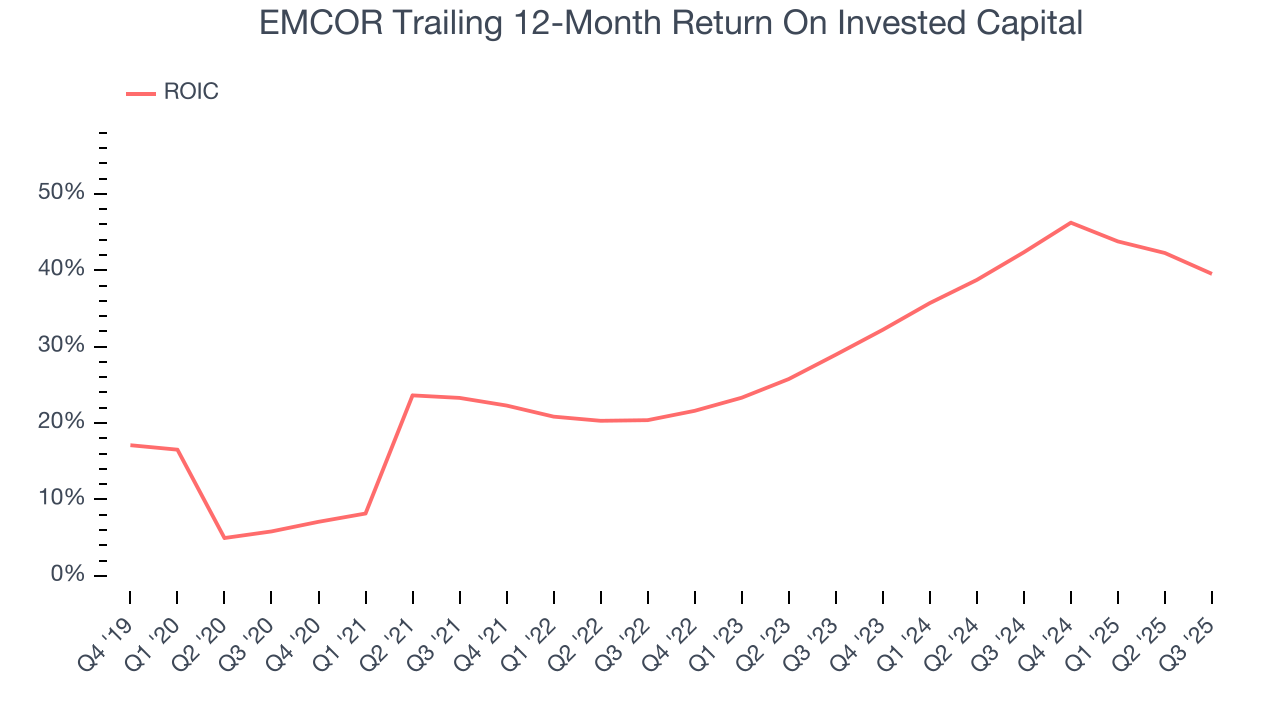

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

EMCOR’s five-year average ROIC was 30.9%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, EMCOR’s ROIC has increased significantly. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

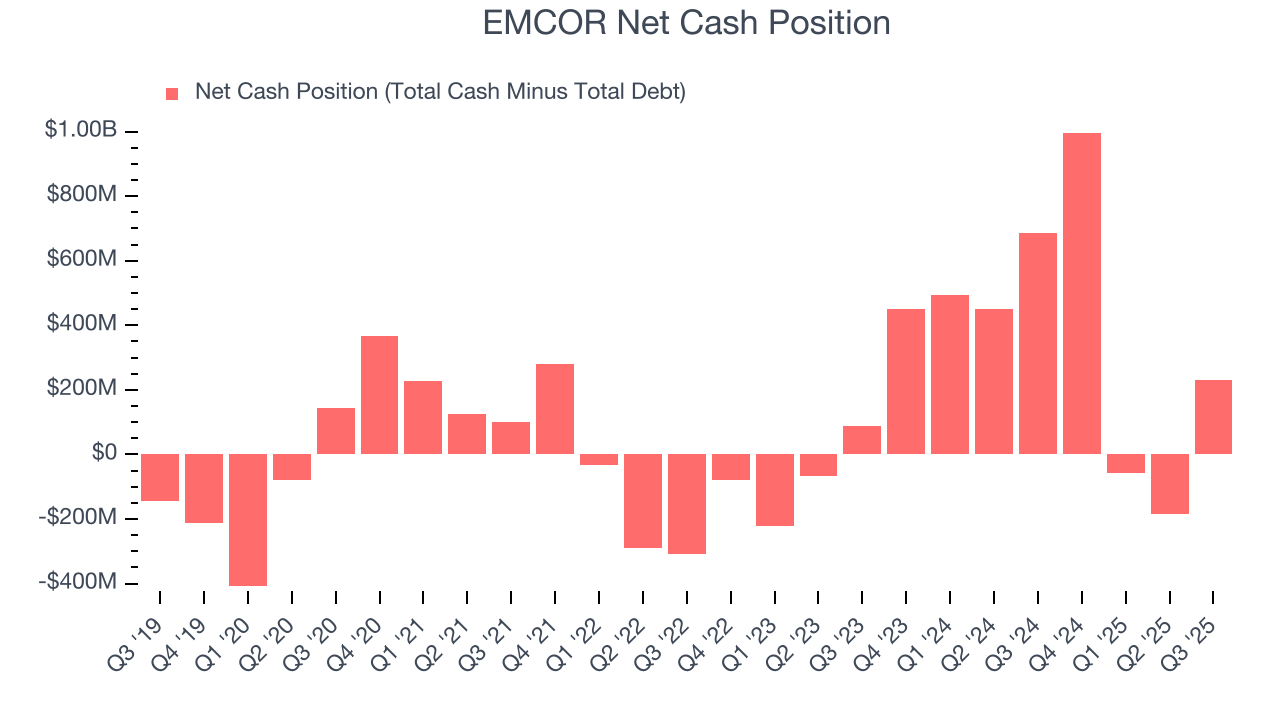

Companies with more cash than debt have lower bankruptcy risk.

EMCOR is a profitable, well-capitalized company with $655.1 million of cash and $424.6 million of debt on its balance sheet. This $230.5 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from EMCOR’s Q3 Results

Revenue was just in line, and while the company raised full-year guidance for both revenue and EPS, it was a small lift. The market was hoping for more, especially after strong results from peer Comfort Systems (FIX). The stock traded down 13.5% to $672 immediately following the results.

13. Is Now The Time To Buy EMCOR?

Updated: January 24, 2026 at 10:13 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

There are numerous reasons why we think EMCOR is one of the best industrials companies out there. First of all, the company’s revenue growth was impressive over the last five years. And while its low gross margins indicate some combination of competitive pressures and high production costs, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, EMCOR’s stellar ROIC suggests it has been a well-run company historically.

EMCOR’s P/E ratio based on the next 12 months is 26.1x. Looking at the industrials space today, EMCOR’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $758.50 on the company (compared to the current share price of $693.46), implying they see 9.4% upside in buying EMCOR in the short term.