ESCO (ESE)

ESCO is a world-class company. Its fusion of growth, outstanding profitability, and encouraging prospects makes it a beloved asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like ESCO

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE:ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 19% over the last five years outstripped its revenue performance

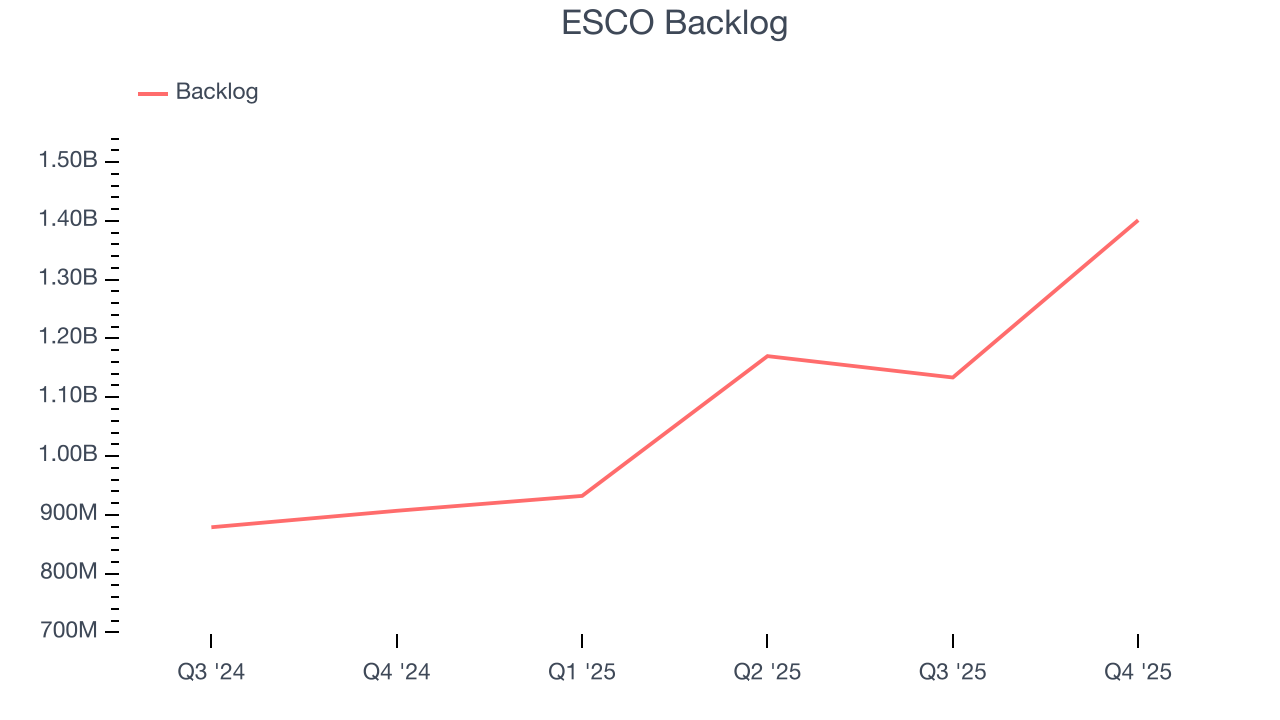

- Demand is greater than supply as the company’s 41.7% average backlog growth over the past two years shows it’s securing new contracts and accumulating more orders than it can fulfill

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders, and its growing cash flow gives it even more resources to deploy

ESCO is a no-brainer. The valuation seems reasonable relative to its quality, and we think now is the time to invest.

Why Is Now The Time To Buy ESCO?

High Quality

Investable

Underperform

Why Is Now The Time To Buy ESCO?

At $238.37 per share, ESCO trades at 29.7x forward P/E. Valuation is above that of many industrials companies, but we think the price is justified given its business fundamentals.

Our work shows, time and again, that buying high-quality companies and holding them routinely leads to market outperformance. Over a multi-year investment horizon, entry price doesn’t matter nearly as much as business quality.

3. ESCO (ESE) Research Report: Q4 CY2025 Update

Engineered products manufacturer ESCO (NYSE:ESE) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 17.3% year on year to $289.7 million. The company’s full-year revenue guidance of $1.31 billion at the midpoint came in 1.5% above analysts’ estimates. Its non-GAAP profit of $1.64 per share was 24.2% above analysts’ consensus estimates.

ESCO (ESE) Q4 CY2025 Highlights:

- Revenue: $289.7 million vs analyst estimates of $289.3 million (17.3% year-on-year growth, in line)

- Adjusted EPS: $1.64 vs analyst estimates of $1.32 (24.2% beat)

- Adjusted EBITDA: $65.05 million vs analyst estimates of $59.59 million (22.5% margin, 9.2% beat)

- The company lifted its revenue guidance for the full year to $1.31 billion at the midpoint from $1.29 billion, a 1.6% increase

- Management raised its full-year Adjusted EPS guidance to $8.03 at the midpoint, a 4.9% increase

- Operating Margin: 13.2%, in line with the same quarter last year

- Free Cash Flow Margin: 21.7%, up from 11.7% in the same quarter last year

- Backlog: $1.40 billion at quarter end, up 54.5% year on year

- Market Capitalization: $6.06 billion

Company Overview

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE:ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

In the aerospace & defense sector, ESCO specializes in designing and manufacturing components and systems for aircraft and defense applications. Its components such as its hydraulic filter elements that regulate the flow of fluids and armored vehicle protection systems are primarily used by aircraft manufacturers, defense contractors, government agencies, and organizations involved in aerospace research and development.

In addition to aerospace & defense, the company develops diagnostic testing and data analytics for electric power grid operators. Its 2007 acquisition of Doble was critical for providing these offerings, which include test instruments, monitoring systems, and consulting services for the energy industry to help make data-backed decisions to properly monitor grids.

ESCO sells its products through direct sales, third-party distribution channels, online platforms, and partnerships. The company engages in different types of contracts (supply agreements, servicing agreements) and offers lower per-unit prices for larger quantities.

4. Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Teledyne (NYSE:TDY), Parker-Hannifin (NYSE:PH), and Ametek (NYSE:AME).

5. Revenue Growth

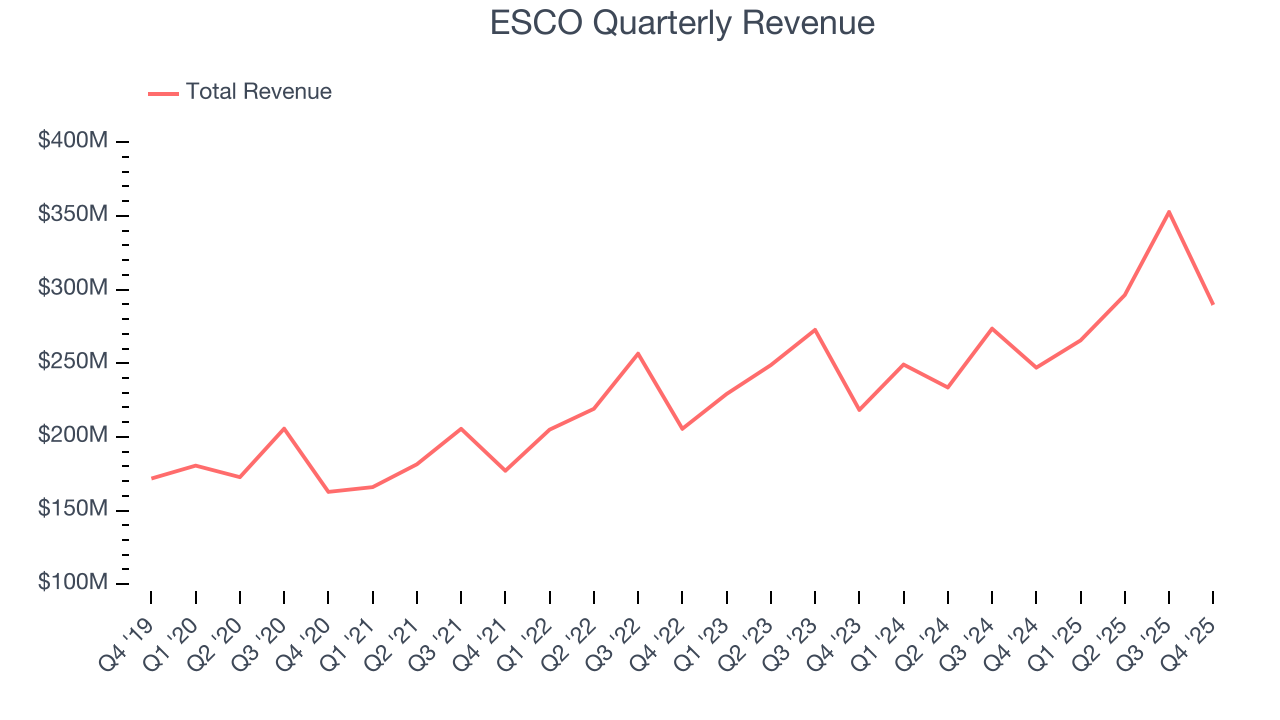

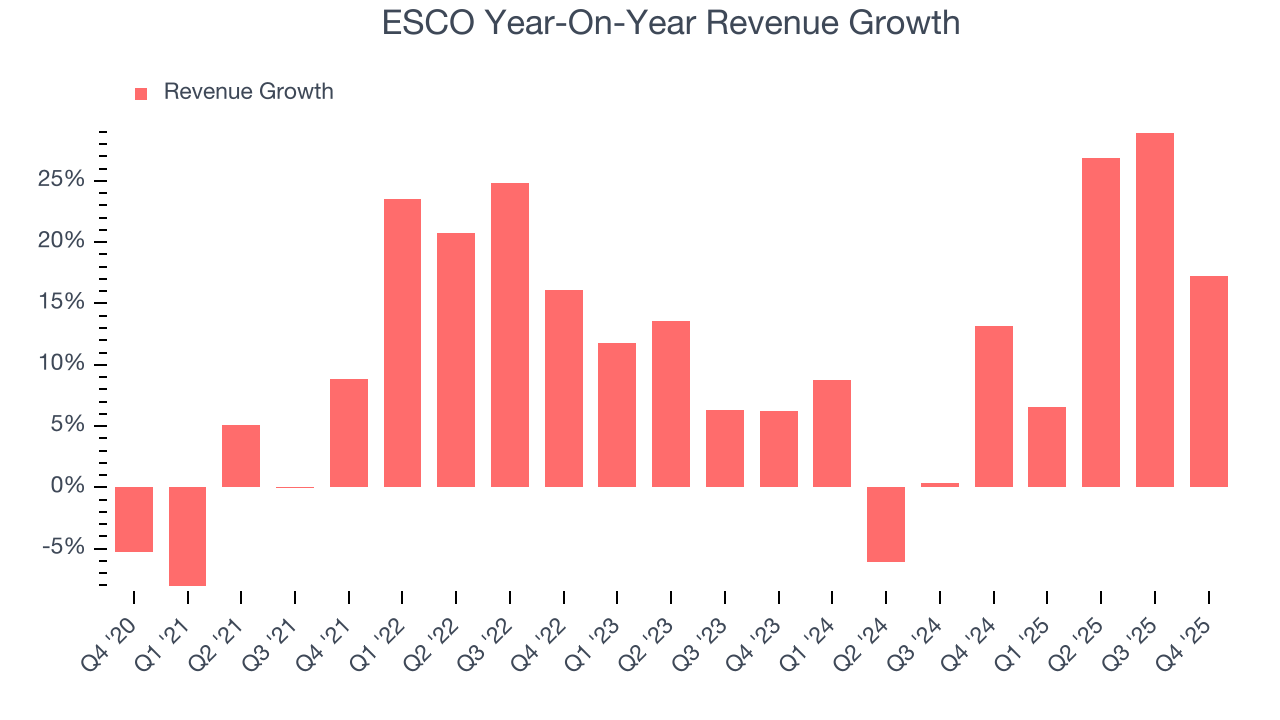

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, ESCO’s sales grew at an impressive 10.8% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. ESCO’s annualized revenue growth of 11.5% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. ESCO’s backlog reached $1.40 billion in the latest quarter and averaged 41.7% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for ESCO’s products and services but raises concerns about capacity constraints.

This quarter, ESCO’s year-on-year revenue growth was 17.3%, and its $289.7 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.5% over the next 12 months, similar to its two-year rate. This projection is noteworthy and implies the market sees success for its products and services.

6. Gross Margin & Pricing Power

ESCO’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 40% gross margin over the last five years. That means ESCO only paid its suppliers $60.05 for every $100 in revenue.

ESCO produced a 41.4% gross profit margin in Q4, up 1.6 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

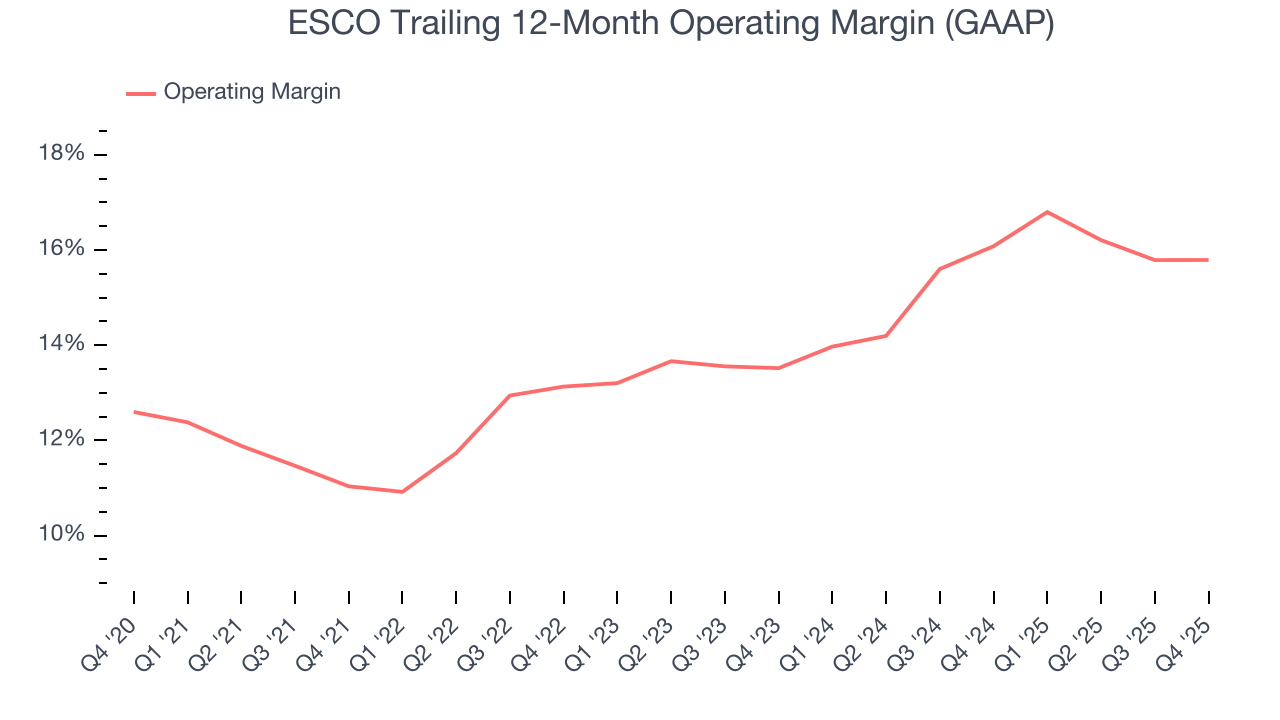

ESCO has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, ESCO’s operating margin rose by 4.8 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, ESCO generated an operating margin profit margin of 13.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

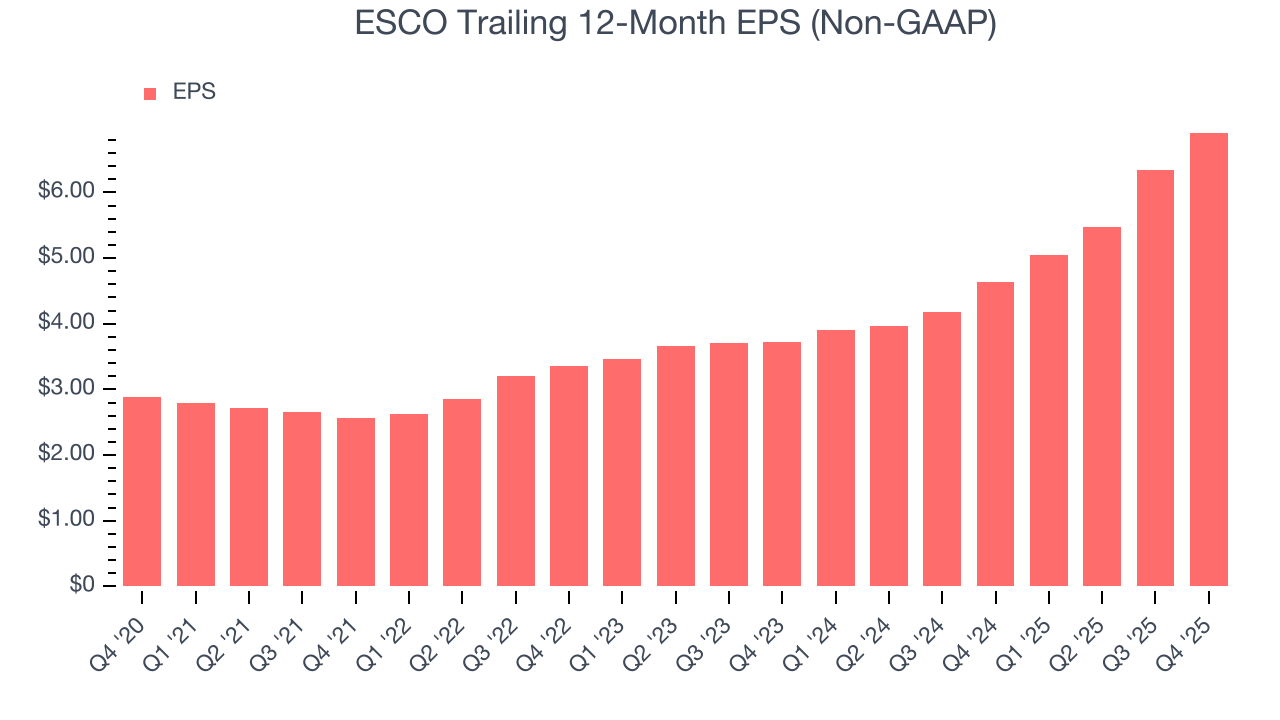

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

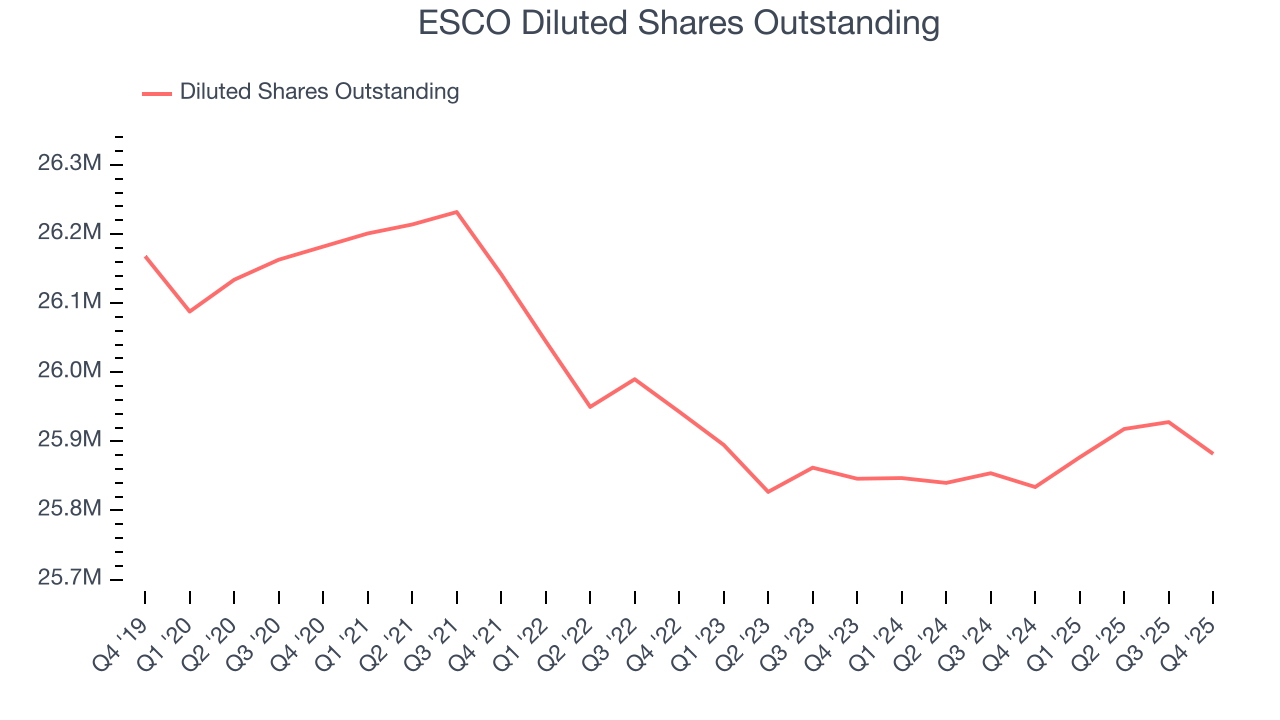

ESCO’s EPS grew at an astounding 19% compounded annual growth rate over the last five years, higher than its 10.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into ESCO’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, ESCO’s operating margin was flat this quarter but expanded by 4.8 percentage points over the last five years. On top of that, its share count shrank by 1.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For ESCO, its two-year annual EPS growth of 36.3% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, ESCO reported adjusted EPS of $1.64, up from $1.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ESCO’s full-year EPS of $6.91 to grow 14.1%.

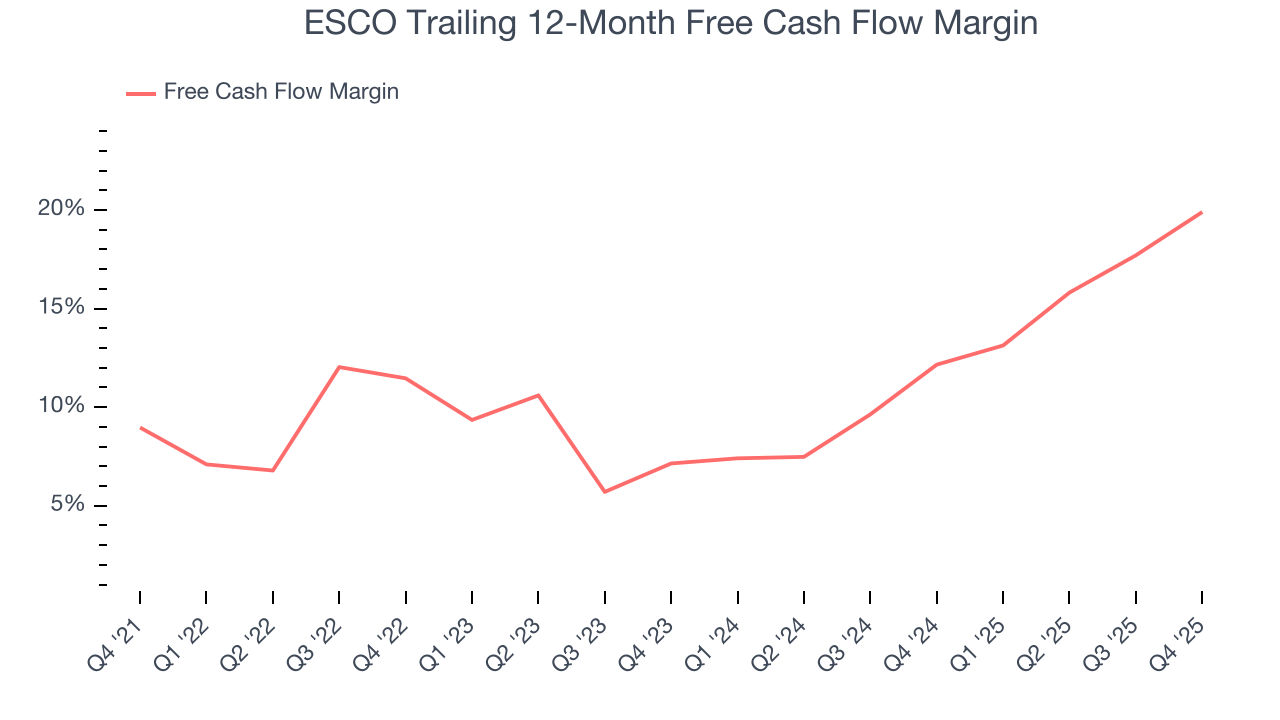

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

ESCO has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 12.5% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that ESCO’s margin expanded by 10.9 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

ESCO’s free cash flow clocked in at $62.96 million in Q4, equivalent to a 21.7% margin. This result was good as its margin was 10 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although ESCO has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, ESCO’s ROIC averaged 2.4 percentage point increases each year. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

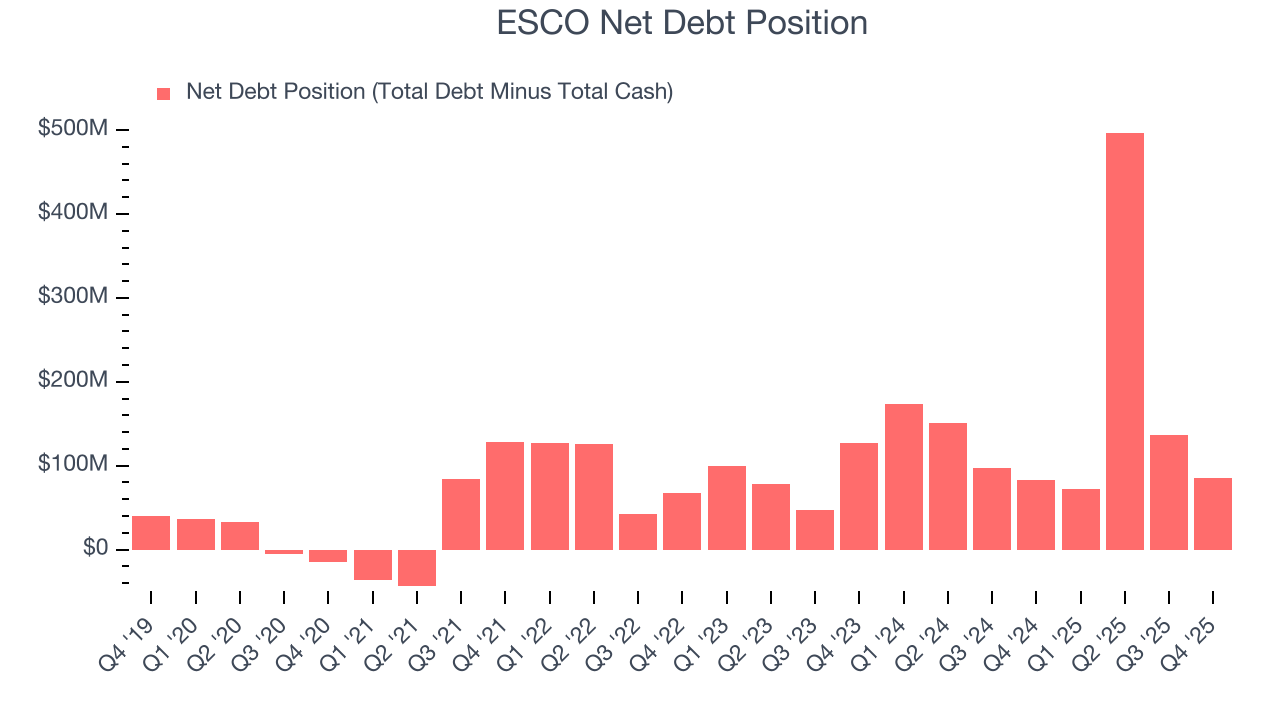

11. Balance Sheet Assessment

ESCO reported $103.8 million of cash and $189 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $278.4 million of EBITDA over the last 12 months, we view ESCO’s 0.3× net-debt-to-EBITDA ratio as safe. We also see its $12.37 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from ESCO’s Q4 Results

We were impressed by how significantly ESCO blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $238.37 immediately after reporting.

13. Is Now The Time To Buy ESCO?

Updated: February 5, 2026 at 10:29 PM EST

Before investing in or passing on ESCO, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

There are multiple reasons why we think ESCO is an elite industrials company. First, the company’s revenue growth was impressive over the last five years, and analysts believe it can continue growing at these levels. And while its mediocre ROIC lags the market and is a headwind for its stock price, its backlog growth has been marvelous. On top of that, ESCO’s rising cash profitability gives it more optionality.

ESCO’s P/E ratio based on the next 12 months is 29.7x. Looking across the spectrum of industrials businesses, ESCO’s fundamentals clearly illustrate it’s a special business. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $255 on the company (compared to the current share price of $238.37), implying they see 7% upside in buying ESCO in the short term.