ESCO (ESE)

Not many stocks excite us like ESCO. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why We Like ESCO

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE:ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

- Additional sales over the last five years increased its profitability as the 18% annual growth in its earnings per share outpaced its revenue

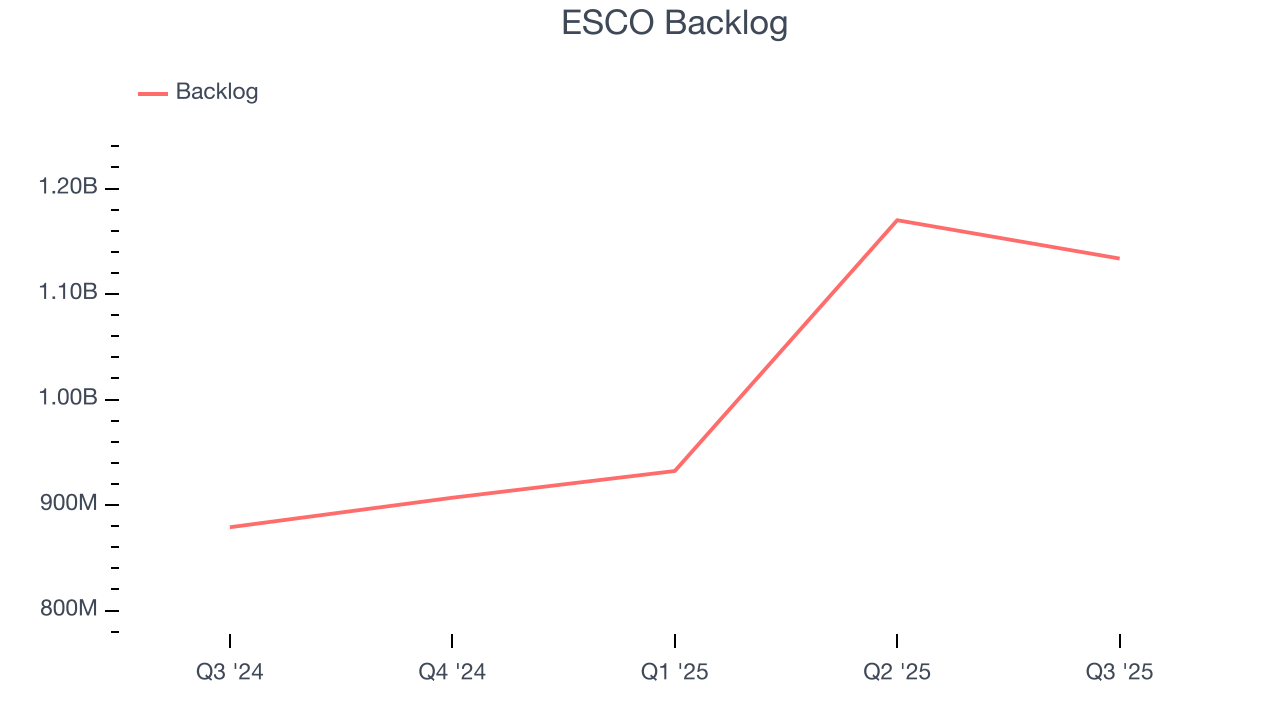

- Sales pipeline is in good shape as its backlog averaged 29% growth over the past two years

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently, and its growing cash flow gives it even more resources to deploy

We expect great things from ESCO. The valuation seems reasonable when considering its quality, and we think now is a good time to invest in the stock.

Why Is Now The Time To Buy ESCO?

High Quality

Investable

Underperform

Why Is Now The Time To Buy ESCO?

At $220.16 per share, ESCO trades at 28.9x forward P/E. Most companies in the industrials sector may feature a cheaper multiple, but we think ESCO is priced fairly given its fundamentals.

Our work shows, time and again, that buying high-quality companies and holding them routinely leads to market outperformance. Over a multi-year investment horizon, entry price doesn’t matter nearly as much as business quality.

3. ESCO (ESE) Research Report: Q3 CY2025 Update

Engineered products manufacturer ESCO (NYSE:ESE) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 18.1% year on year to $352.7 million. The company’s full-year revenue guidance of $1.29 billion at the midpoint came in 0.8% above analysts’ estimates. Its non-GAAP profit of $2.32 per share was 8.7% above analysts’ consensus estimates.

ESCO (ESE) Q3 CY2025 Highlights:

- Revenue: $352.7 million vs analyst estimates of $306.4 million (18.1% year-on-year growth, 15.1% beat)

- Adjusted EPS: $2.32 vs analyst estimates of $2.14 (8.7% beat)

- Adjusted EBITDA: $93.33 million vs analyst estimates of $89.11 million (26.5% margin, 4.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.65 at the midpoint, beating analyst estimates by 5.4%

- Operating Margin: 18.3%, up from 17.3% in the same quarter last year

- Free Cash Flow Margin: 27.7%, up from 20.4% in the same quarter last year

- Backlog: $1.13 billion at quarter end, up 29% year on year

- Market Capitalization: $5.60 billion

Company Overview

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE:ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

In the aerospace & defense sector, ESCO specializes in designing and manufacturing components and systems for aircraft and defense applications. Its components such as its hydraulic filter elements that regulate the flow of fluids and armored vehicle protection systems are primarily used by aircraft manufacturers, defense contractors, government agencies, and organizations involved in aerospace research and development.

In addition to aerospace & defense, the company develops diagnostic testing and data analytics for electric power grid operators. Its 2007 acquisition of Doble was critical for providing these offerings, which include test instruments, monitoring systems, and consulting services for the energy industry to help make data-backed decisions to properly monitor grids.

ESCO sells its products through direct sales, third-party distribution channels, online platforms, and partnerships. The company engages in different types of contracts (supply agreements, servicing agreements) and offers lower per-unit prices for larger quantities.

4. Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Teledyne (NYSE:TDY), Parker-Hannifin (NYSE:PH), and Ametek (NYSE:AME).

5. Revenue Growth

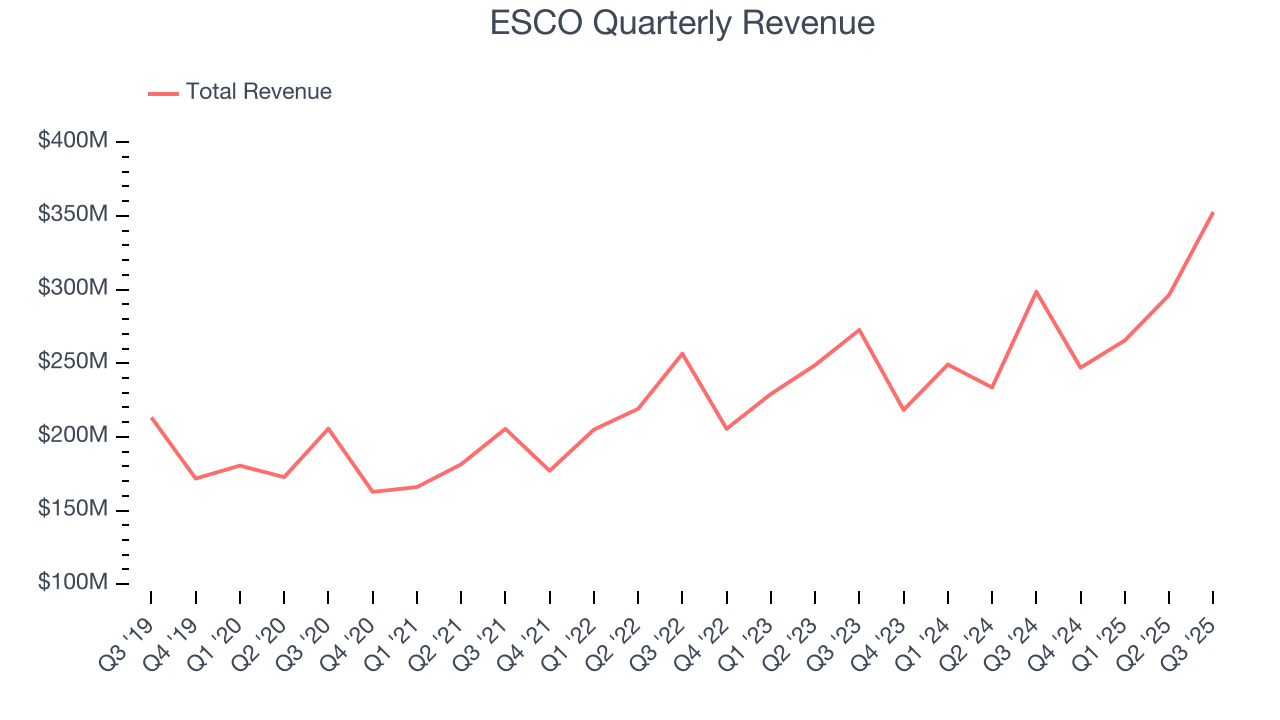

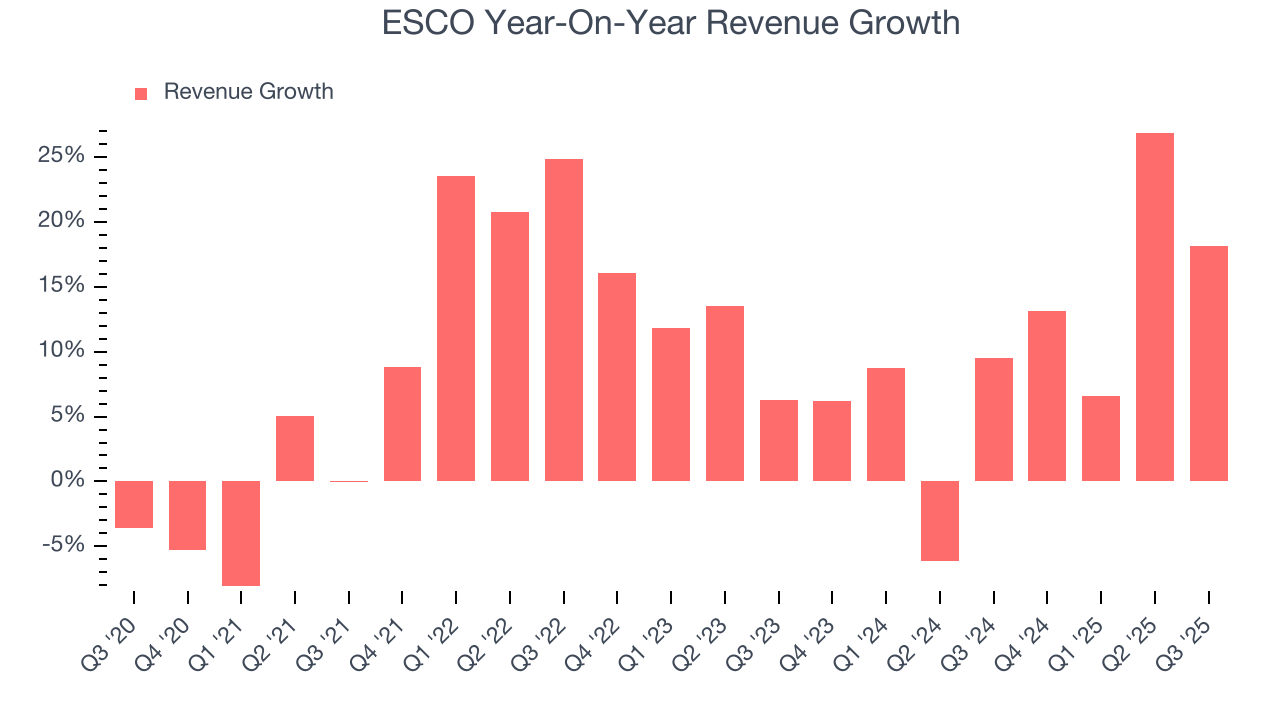

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, ESCO grew its sales at a solid 9.7% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. ESCO’s annualized revenue growth of 10.2% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. ESCO’s backlog reached $1.13 billion in the latest quarter and averaged 29% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for ESCO’s products and services but raises concerns about capacity constraints.

This quarter, ESCO reported year-on-year revenue growth of 18.1%, and its $352.7 million of revenue exceeded Wall Street’s estimates by 15.1%.

Looking ahead, sell-side analysts expect revenue to grow 10.6% over the next 12 months, similar to its two-year rate. This projection is admirable and suggests the market is baking in success for its products and services.

6. Gross Margin & Pricing Power

ESCO’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 39.6% gross margin over the last five years. That means ESCO only paid its suppliers $60.43 for every $100 in revenue.

ESCO produced a 42.4% gross profit margin in Q3, up 2.3 percentage points year on year. ESCO’s full-year margin has also been trending up over the past 12 months, increasing by 1.3 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

ESCO has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, ESCO’s operating margin rose by 4.3 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, ESCO generated an operating margin profit margin of 18.3%, up 1.1 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

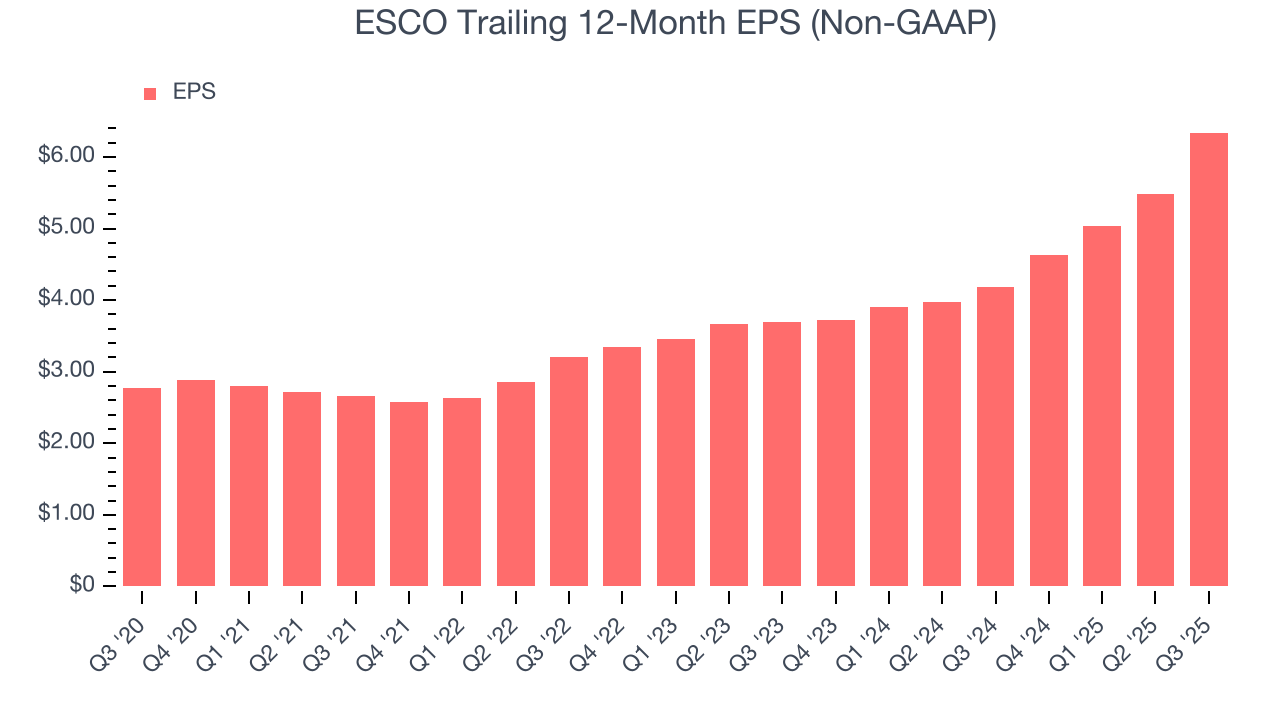

ESCO’s EPS grew at an astounding 18% compounded annual growth rate over the last five years, higher than its 9.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into ESCO’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, ESCO’s operating margin expanded by 4.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For ESCO, its two-year annual EPS growth of 30.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, ESCO reported adjusted EPS of $2.32, up from $1.46 in the same quarter last year. This print beat analysts’ estimates by 8.7%. Over the next 12 months, Wall Street expects ESCO’s full-year EPS of $6.34 to grow 14.4%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

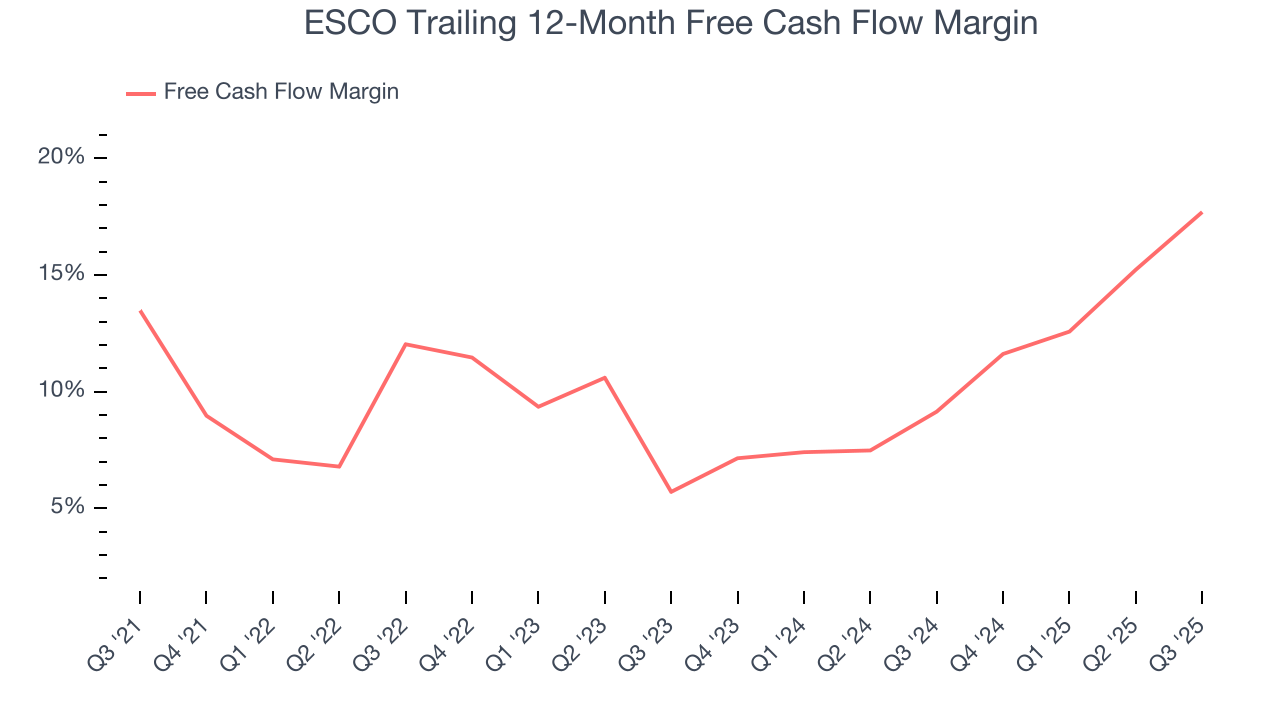

ESCO has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.8% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that ESCO’s margin expanded by 4.2 percentage points during that time. This is encouraging because it gives the company more optionality.

ESCO’s free cash flow clocked in at $97.83 million in Q3, equivalent to a 27.7% margin. This result was good as its margin was 7.3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although ESCO has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.2%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, ESCO’s ROIC averaged 2 percentage point increases each year. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

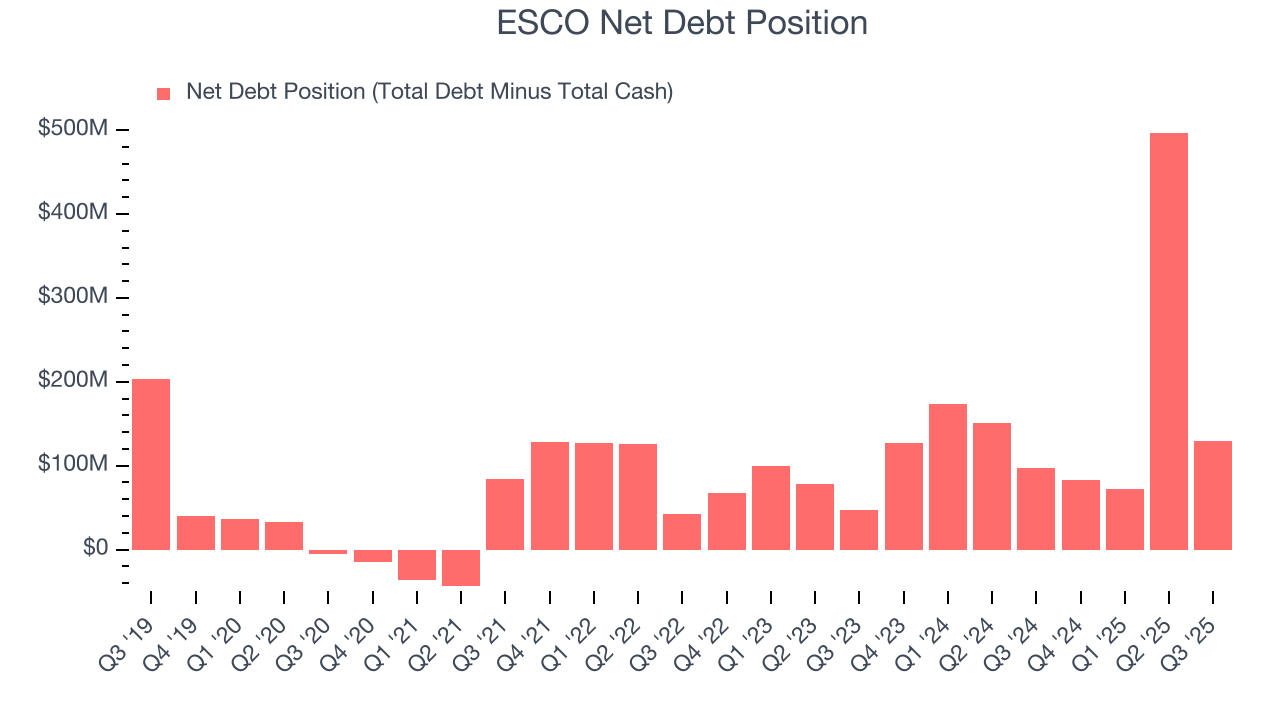

ESCO reported $101.4 million of cash and $230.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $259.4 million of EBITDA over the last 12 months, we view ESCO’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $7.24 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from ESCO’s Q3 Results

We were impressed by how significantly ESCO blew past analysts’ revenue expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Zooming out, we think this was a solid print. The stock traded up 4.6% to $220 immediately following the results.

13. Is Now The Time To Buy ESCO?

Updated: January 23, 2026 at 10:14 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in ESCO.

ESCO is a cream-of-the-crop industrials company. For starters, its revenue growth was solid over the last five years and is expected to accelerate over the next 12 months. And while its mediocre ROIC lags the market and is a headwind for its stock price, its backlog growth has been marvelous. Additionally, ESCO’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

ESCO’s P/E ratio based on the next 12 months is 28.9x. Looking at the industrials space today, ESCO’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $255 on the company (compared to the current share price of $220.16), implying they see 15.8% upside in buying ESCO in the short term.