Evercore (EVR)

Evercore is a compelling stock. Its superb 32.9% ROE illustrates its skill in making high-return investments.― StockStory Analyst Team

1. News

2. Summary

Why We Like Evercore

Founded in 1995 as a boutique advisory firm focused on independence and client trust, Evercore (NYSE:EVR) is an independent investment banking firm that provides strategic advisory, capital markets, and wealth management services to corporations, financial sponsors, and high-net-worth individuals.

- Annual revenue growth of 25.9% over the past two years was outstanding, reflecting market share gains this cycle

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 50.2% over the last two years outstripped its revenue performance

- Industry-leading 32.9% return on equity demonstrates management’s skill in finding high-return investments

We’re fond of companies like Evercore. The valuation seems fair based on its quality, so this might be a good time to invest in some shares.

Why Is Now The Time To Buy Evercore?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Evercore?

At $356.25 per share, Evercore trades at 18.2x forward P/E. While this multiple is higher than most financials companies, we think the valuation is fair given its quality characteristics.

Entry price certainly impacts returns, but over a long-term, multi-year period, business quality matters much more than where you buy a stock.

3. Evercore (EVR) Research Report: Q4 CY2025 Update

Investment banking firm Evercore (NYSE:EVR) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 31.4% year on year to $1.29 billion. Its non-GAAP profit of $5.13 per share was 26.7% above analysts’ consensus estimates.

Evercore (EVR) Q4 CY2025 Highlights:

- Revenue: $1.29 billion vs analyst estimates of $1.12 billion (31.4% year-on-year growth, 15.1% beat)

- Pre-tax Profit: $313.3 million (24.3% margin)

- Adjusted EPS: $5.13 vs analyst estimates of $4.05 (26.7% beat)

- Market Capitalization: $13.1 billion

Company Overview

Founded in 1995 as a boutique advisory firm focused on independence and client trust, Evercore (NYSE:EVR) is an independent investment banking firm that provides strategic advisory, capital markets, and wealth management services to corporations, financial sponsors, and high-net-worth individuals.

Evercore operates through two main segments: Investment Banking & Equities and Investment Management. The Investment Banking business serves as a trusted advisor on mergers and acquisitions, divestitures, and other complex financial transactions. Unlike full-service investment banks, Evercore doesn't maintain large trading operations or provide commercial banking services, allowing it to offer conflict-free advice without the pressure to cross-sell other products.

When a company like Microsoft considers acquiring a smaller tech firm, Evercore might analyze the target's value, negotiate terms, and structure the deal. Similarly, when a corporation faces financial distress, Evercore's restructuring team helps renegotiate debt terms with creditors and develop turnaround strategies.

The firm's Equities business, Evercore ISI, provides institutional investors with research, sales, and trading services across various sectors and macroeconomic trends. Meanwhile, the Investment Management segment caters to high-net-worth individuals and institutions through Evercore Wealth Management and Evercore Trust Company.

Evercore generates revenue primarily through advisory fees based on the size and complexity of transactions, as well as through commissions on securities trades and management fees on assets under management. The firm has expanded its global footprint with offices across North America, Europe, Asia, and Australia, allowing it to serve multinational clients on cross-border transactions while maintaining deep regional expertise.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

Evercore competes with other independent advisory firms like Lazard (NYSE:LAZ), PJT Partners (NYSE:PJT), and Moelis & Company (NYSE:MC), as well as the investment banking divisions of major financial institutions such as Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), and JPMorgan Chase (NYSE:JPM).

5. Revenue Growth

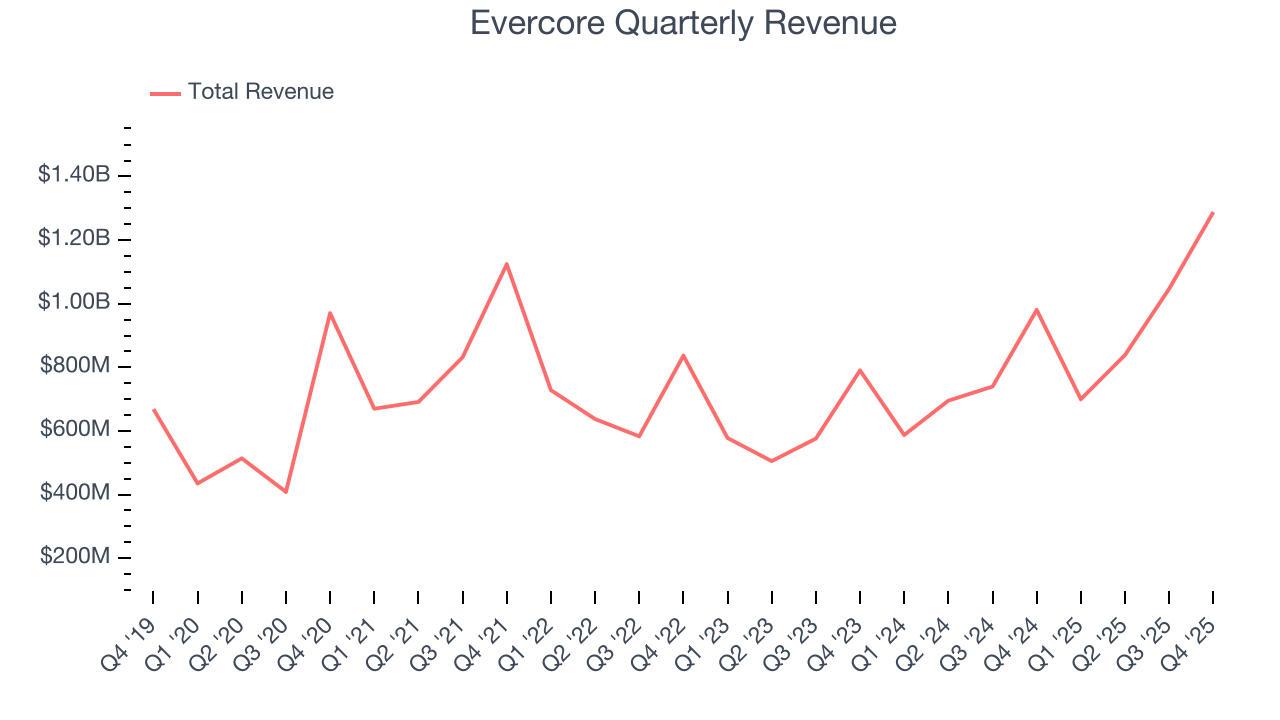

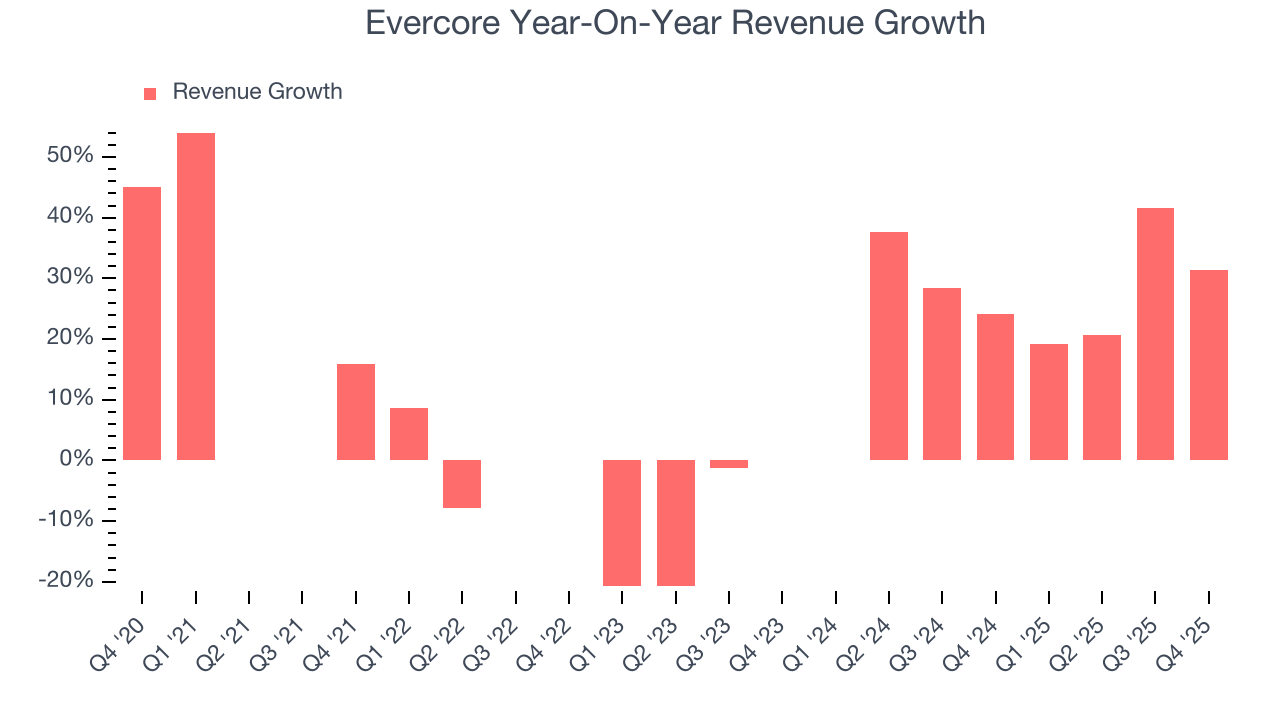

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Evercore’s 10.7% annualized revenue growth over the last five years was decent. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Evercore’s annualized revenue growth of 25.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Evercore reported wonderful year-on-year revenue growth of 31.4%, and its $1.29 billion of revenue exceeded Wall Street’s estimates by 15.1%.

6. Pre-Tax Profit Margin

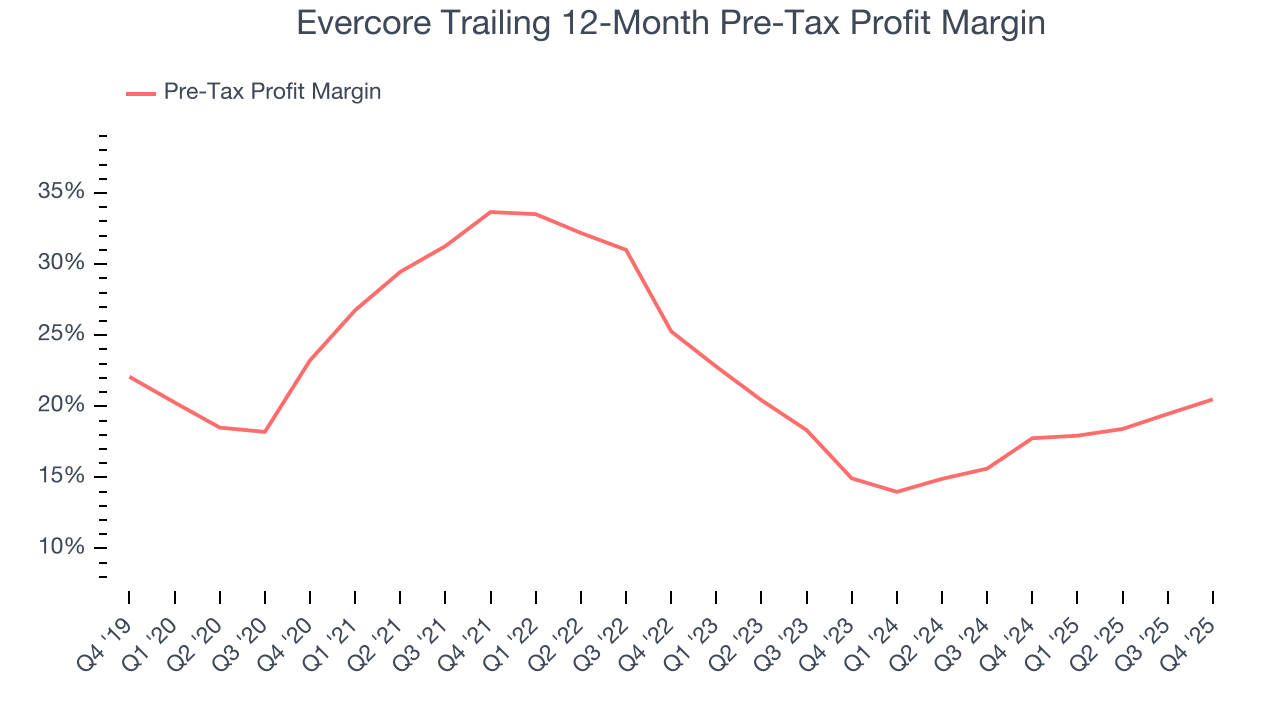

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Evercore’s pre-tax profit margin has risen by 2.7 percentage points, going from 33.7% to 20.5%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 5.6 percentage points on a two-year basis.

Evercore’s pre-tax profit margin came in at 24.3% this quarter. This result was 2.5 percentage points better than the same quarter last year.

7. Earnings Per Share

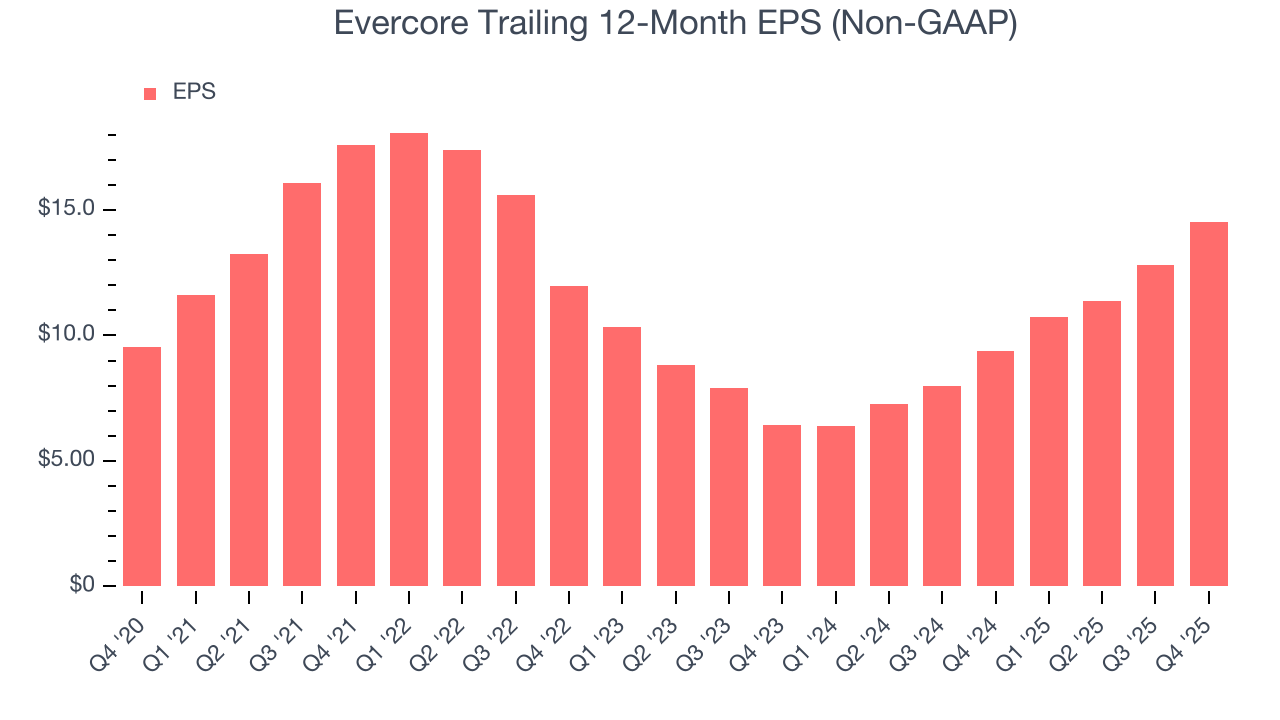

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Evercore’s unimpressive 8.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Evercore’s two-year annual EPS growth of 50.2% was fantastic and topped its 25.8% two-year revenue growth.

We can take a deeper look into Evercore’s earnings quality to better understand the drivers of its performance. Evercore’s pre-tax profit margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Evercore reported adjusted EPS of $5.13, up from $3.41 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Evercore’s full-year EPS of $14.52 to grow 25%.

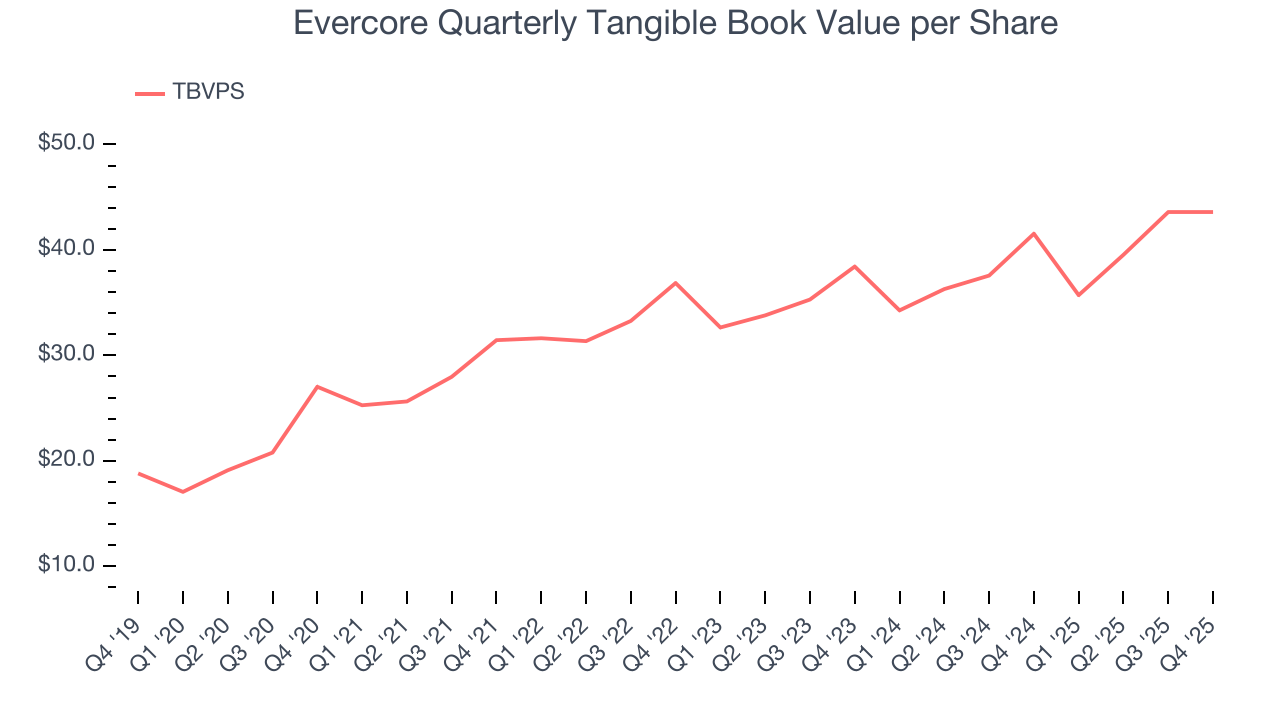

8. Tangible Book Value Per Share (TBVPS)

Diversified financial companies operate across multiple business segments, from investment banking and trading to wealth management and specialized lending. Their valuations hinge on balance sheet quality and the ability to compound shareholder equity across these diverse operations.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to the complexity of multiple business lines, M&A activity, or accounting rules that vary across different financial services segments.

Evercore’s TBVPS grew at a solid 10% annual clip over the last five years. However, TBVPS growth has recently decelerated to 6.5% annual growth over the last two years (from $38.42 to $43.59 per share).

9. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Evercore has averaged an ROE of 32.4%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Evercore has a strong competitive moat.

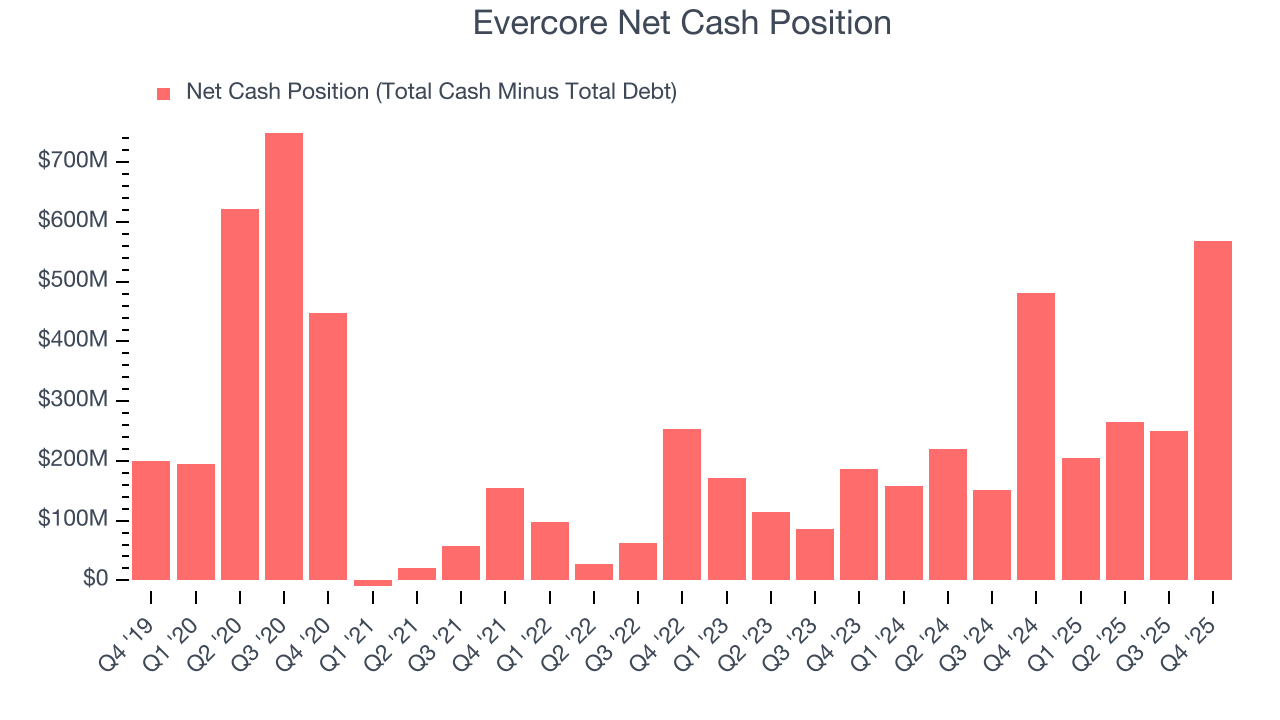

10. Balance Sheet Assessment

Evercore reported $1.11 billion of cash and $540.4 million of debt on its balance sheet in the most recent quarter.

Given the company has more cash than debt, leverage is not an issue here.

11. Key Takeaways from Evercore’s Q4 Results

It was good to see Evercore beat analysts’ revenue and EPS expectations by convincing amounts this quarter. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $338.70 immediately after reporting.

12. Is Now The Time To Buy Evercore?

Updated: February 4, 2026 at 11:26 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Evercore.

Evercore is an amazing business ranking highly on our list. To begin with, its revenue growth was good over the last five years, and its growth over the next 12 months is expected to accelerate. And while its declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically. On top of that, Evercore’s TBVPS growth was solid over the last five years.

Evercore’s P/E ratio based on the next 12 months is 18.2x. Analyzing the financials landscape today, Evercore’s positive attributes shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $391.40 on the company (compared to the current share price of $356.25), implying they see 9.9% upside in buying Evercore in the short term.