Fresh Del Monte Produce (FDP)

We wouldn’t recommend Fresh Del Monte Produce. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Fresh Del Monte Produce Will Underperform

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE:FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

- Flat sales over the last three years suggest it must innovate and find new ways to grow

- Sales are projected to tank by 2.9% over the next 12 months as demand evaporates further

- Commoditized products, bad unit economics, and high competition are reflected in its low gross margin of 8.2%

Fresh Del Monte Produce doesn’t meet our quality criteria. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Fresh Del Monte Produce

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Fresh Del Monte Produce

Fresh Del Monte Produce’s stock price of $40.32 implies a valuation ratio of 14.3x forward P/E. Fresh Del Monte Produce’s valuation may seem like a bargain, especially when stacked up against other consumer staples companies. We remind you that you often get what you pay for, though.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Fresh Del Monte Produce (FDP) Research Report: Q4 CY2025 Update

Fresh produce company Fresh Del Monte (NYSE:FDP) announced better-than-expected revenue in Q4 CY2025, but sales were flat year on year at $1.02 billion. Its non-GAAP profit of $0.70 per share was significantly above analysts’ consensus estimates.

Fresh Del Monte Produce (FDP) Q4 CY2025 Highlights:

- Revenue: $1.02 billion vs analyst estimates of $1.01 billion (flat year on year, 0.7% beat)

- Adjusted EPS: $0.70 vs analyst estimates of $0.28 (significant beat)

- Adjusted EBITDA: $67.1 million vs analyst estimates of $40.4 million (6.6% margin, 66.1% beat)

- Operating Margin: 4.5%, up from 2% in the same quarter last year

- Free Cash Flow was -$17.2 million compared to -$22.3 million in the same quarter last year

- Market Capitalization: $1.93 billion

Company Overview

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE:FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

The company has a rich and storied history dating back to 1886 when it was founded as the California Fruit Canners Association in San Francisco, California. Its early focus was on canning and preserving fruits to meet the growing demand for convenient, shelf-stable produce. As the company expanded and technology allowed for longer storage times, it not only processed fruits but also began cultivating them.

Over the last century, Fresh Del Monte has diversified its offerings, which now include bananas, pineapples, melons, tomatoes, avocados, and citrus fruits, among others. It’s also expanded its global reach, establishing owned and operated farms and production facilities in various countries.

These assets are strategically located in regions known for their ideal growing conditions to ensure a year-round supply of produce. Fresh Del Monte’s global footprint also enables its products to adorn the shelves of supermarkets, restaurants, and households in over 100 countries.

Supplementing the company’s distribution capabilities is its active engagement with consumers. Fresh Del Monte promotes healthy eating habits by sharing recipes and nutritional information, encouraging consumers to incorporate more fruits and vegetables into their diets. This commitment to consumer well-being aligns with the growing demand for nutritious, convenient, and sustainably sourced foods.

4. Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Competitors in the fresh produce category include Calavo Growers (NASDAQ:CVGW), Dole (NYSE:DOLE), and Mission Produce (NASDAQ:AVO) along with private companies Chiquita Brands International and Sunkist Growers.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.32 billion in revenue over the past 12 months, Fresh Del Monte Produce carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

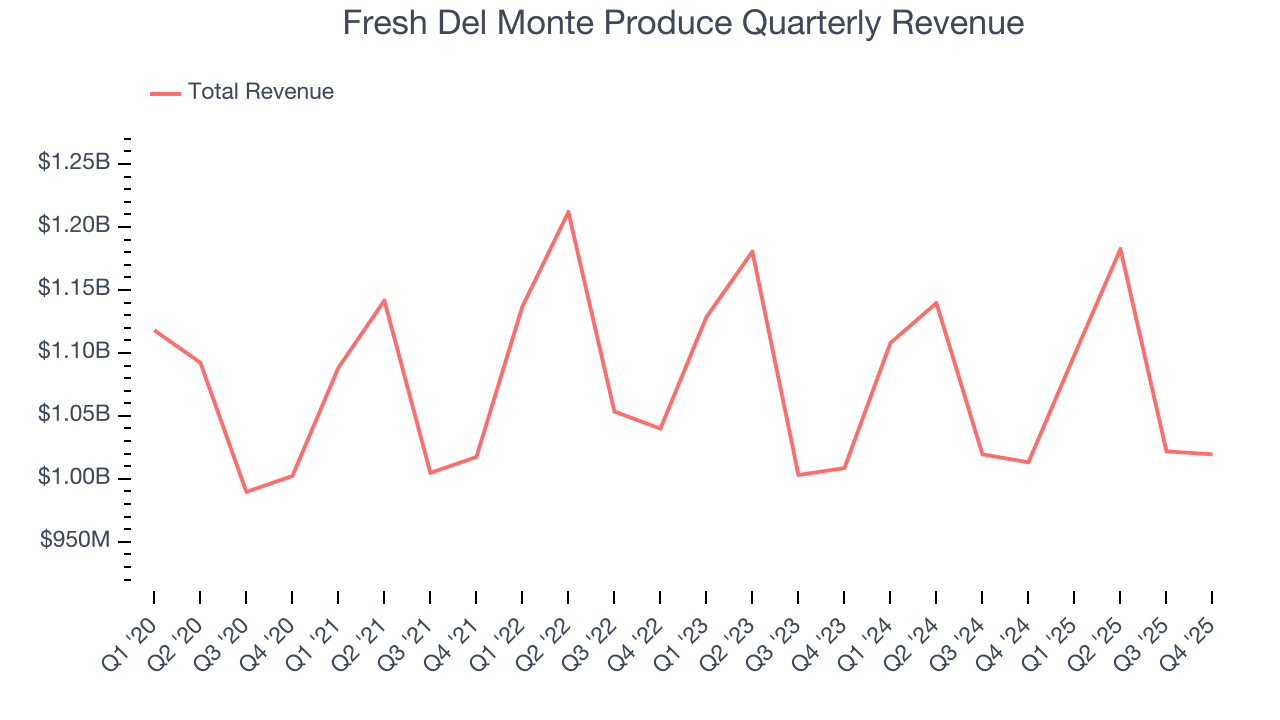

As you can see below, Fresh Del Monte Produce struggled to increase demand as its $4.32 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a tough starting point for our analysis.

This quarter, Fresh Del Monte Produce’s $1.02 billion of revenue was flat year on year but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to decline by 3.5% over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and implies its products will face some demand challenges.

6. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

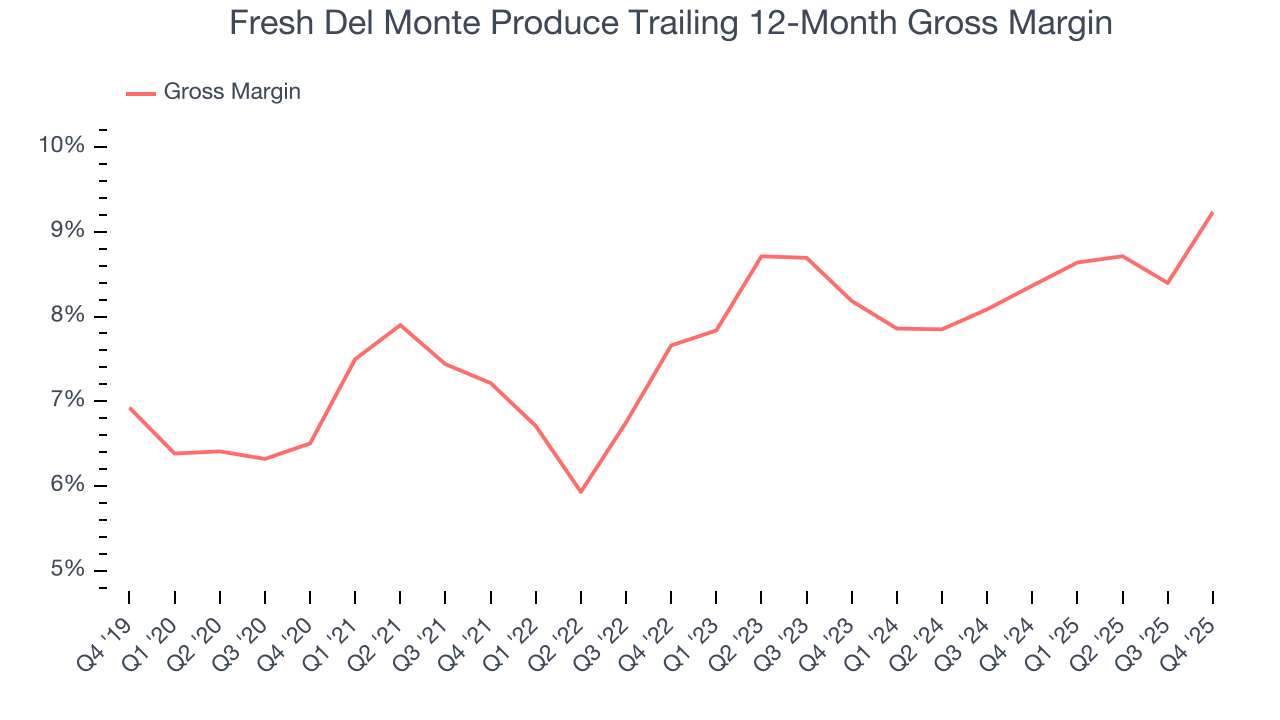

Fresh Del Monte Produce has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 8.8% gross margin over the last two years. That means Fresh Del Monte Produce paid its suppliers a lot of money ($91.20 for every $100 in revenue) to run its business.

Fresh Del Monte Produce produced a 10.4% gross profit margin in Q4 , marking a 3.6 percentage point increase from 6.8% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

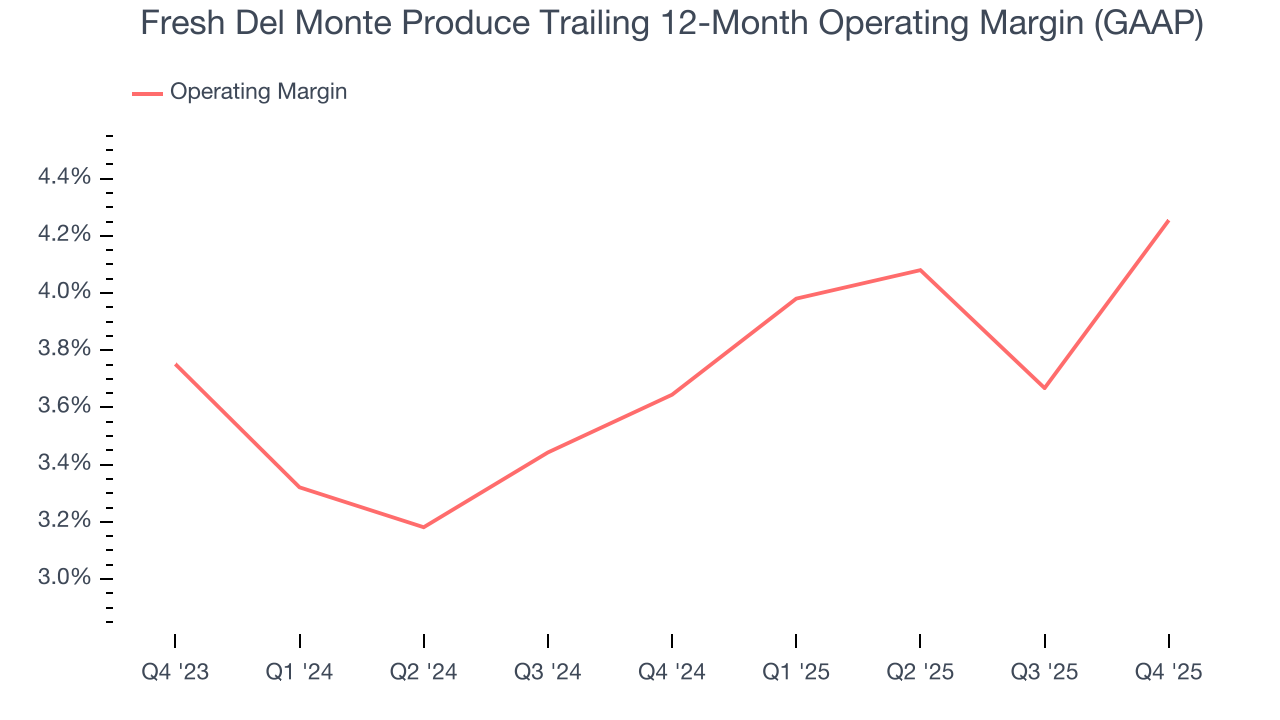

Fresh Del Monte Produce’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4% over the last two years. This profitability was paltry for a consumer staples business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Fresh Del Monte Produce’s operating margin might fluctuated slightly but has generally stayed the same over the last year, meaning it will take a fundamental shift in the business model to change.

This quarter, Fresh Del Monte Produce generated an operating margin profit margin of 4.5%, up 2.5 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

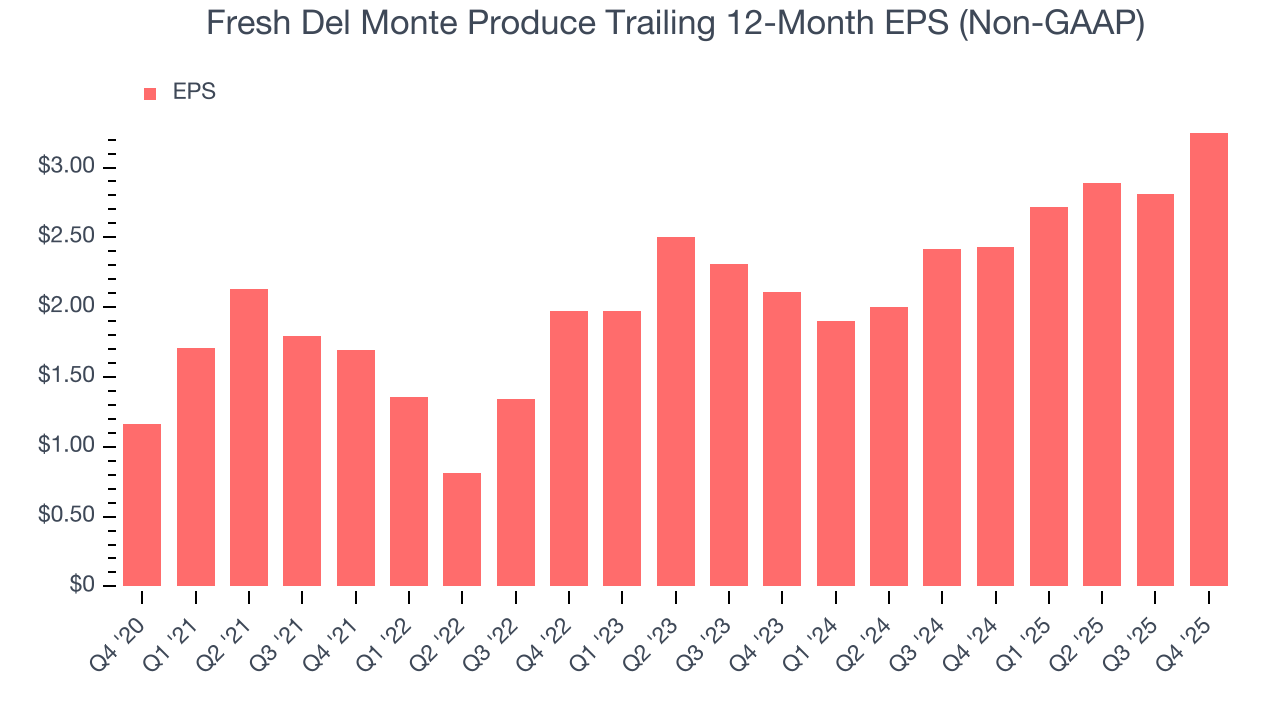

Fresh Del Monte Produce’s EPS grew at a remarkable 18.2% compounded annual growth rate over the last three years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

In Q4, Fresh Del Monte Produce reported adjusted EPS of $0.70, up from $0.26 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Fresh Del Monte Produce’s full-year EPS of $3.25 to shrink by 5.5%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

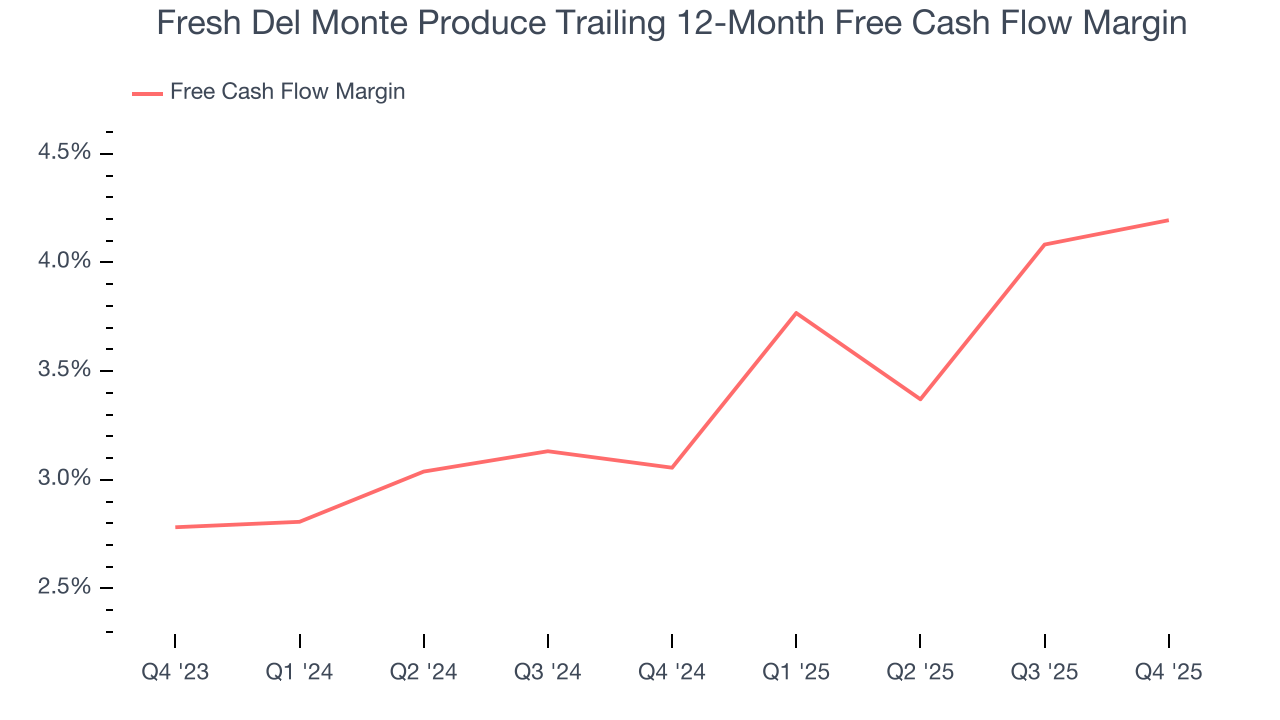

Fresh Del Monte Produce has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.6%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that Fresh Del Monte Produce’s margin expanded by 1.1 percentage points over the last year. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Fresh Del Monte Produce burned through $17.2 million of cash in Q4, equivalent to a negative 1.7% margin. The company’s cash burn was similar to its $22.3 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

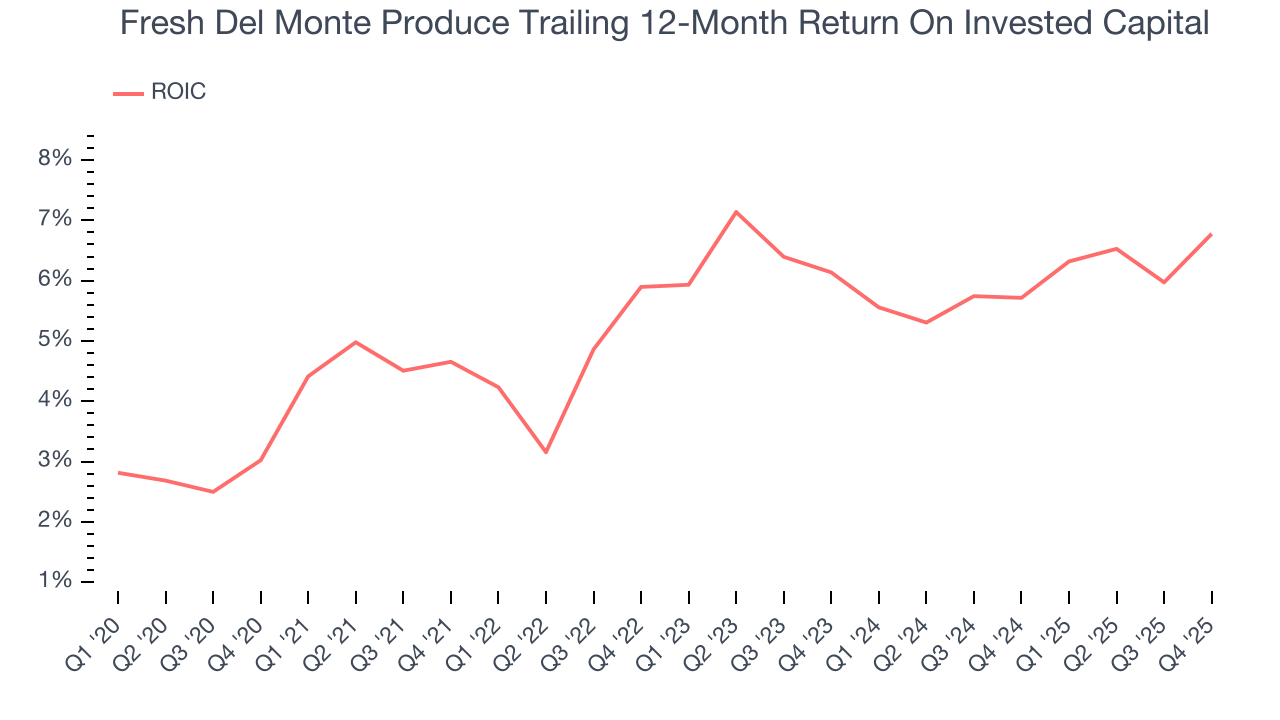

Fresh Del Monte Produce historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.8%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

11. Balance Sheet Assessment

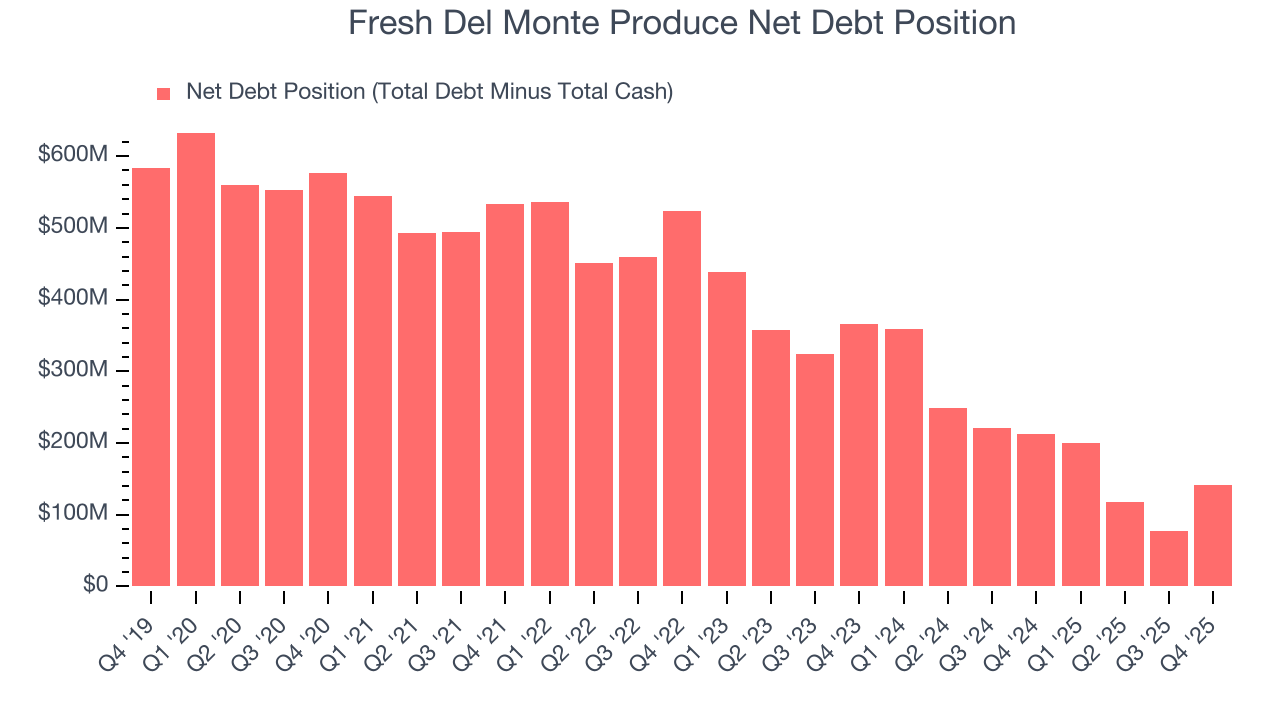

Fresh Del Monte Produce reported $35.7 million of cash and $177.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $281.8 million of EBITDA over the last 12 months, we view Fresh Del Monte Produce’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $6.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Fresh Del Monte Produce’s Q4 Results

It was good to see Fresh Del Monte Produce beat analysts’ EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 5.8% to $42.66 immediately after reporting.

13. Is Now The Time To Buy Fresh Del Monte Produce?

Updated: February 18, 2026 at 6:17 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Fresh Del Monte Produce.

Fresh Del Monte Produce falls short of our quality standards. To kick things off, its revenue has declined over the last three years, and analysts expect its demand to deteriorate over the next 12 months. While its EPS growth over the last three years has significantly beat its peer group average, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses. On top of that, its projected EPS for the next year is lacking.

Fresh Del Monte Produce’s P/E ratio based on the next 12 months is 13.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $46 on the company (compared to the current share price of $42.66).