Comfort Systems (FIX)

We’re bullish on Comfort Systems. Its elite revenue growth and returns on capital demonstrate it can grow rapidly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why We Like Comfort Systems

Formed through the merger of 12 companies, Comfort Systems (NYSE:FIX) provides mechanical and electrical contracting services.

- Impressive 26.1% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 49.8% over the last five years outstripped its revenue performance

- Revenue outlook for the upcoming 12 months is outstanding and shows it’s on track to gain market share

We expect great things from Comfort Systems. The price seems fair in light of its quality, and we believe now is a good time to invest.

Why Is Now The Time To Buy Comfort Systems?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Comfort Systems?

Comfort Systems is trading at $1,273 per share, or 36.7x forward P/E. Valuation is above that of many industrials companies, but we think the price is justified given its business fundamentals.

Entry price may seem important in the moment, but our work shows that time and again, long-term market outperformance is determined by business quality rather than getting an absolute bargain on a stock.

3. Comfort Systems (FIX) Research Report: Q4 CY2025 Update

HVAC and electrical contractor Comfort Systems (NYSE:FIX) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 41.7% year on year to $2.65 billion. Its GAAP profit of $9.37 per share was 38.7% above analysts’ consensus estimates.

Comfort Systems (FIX) Q4 CY2025 Highlights:

- Revenue: $2.65 billion vs analyst estimates of $2.34 billion (41.7% year-on-year growth, 13% beat)

- EPS (GAAP): $9.37 vs analyst estimates of $6.75 (38.7% beat)

- Adjusted EBITDA: $464 million vs analyst estimates of $346.5 million (17.5% margin, 33.9% beat)

- Operating Margin: 16.1%, up from 12.1% in the same quarter last year

- Free Cash Flow Margin: 15.2%, up from 9.2% in the same quarter last year

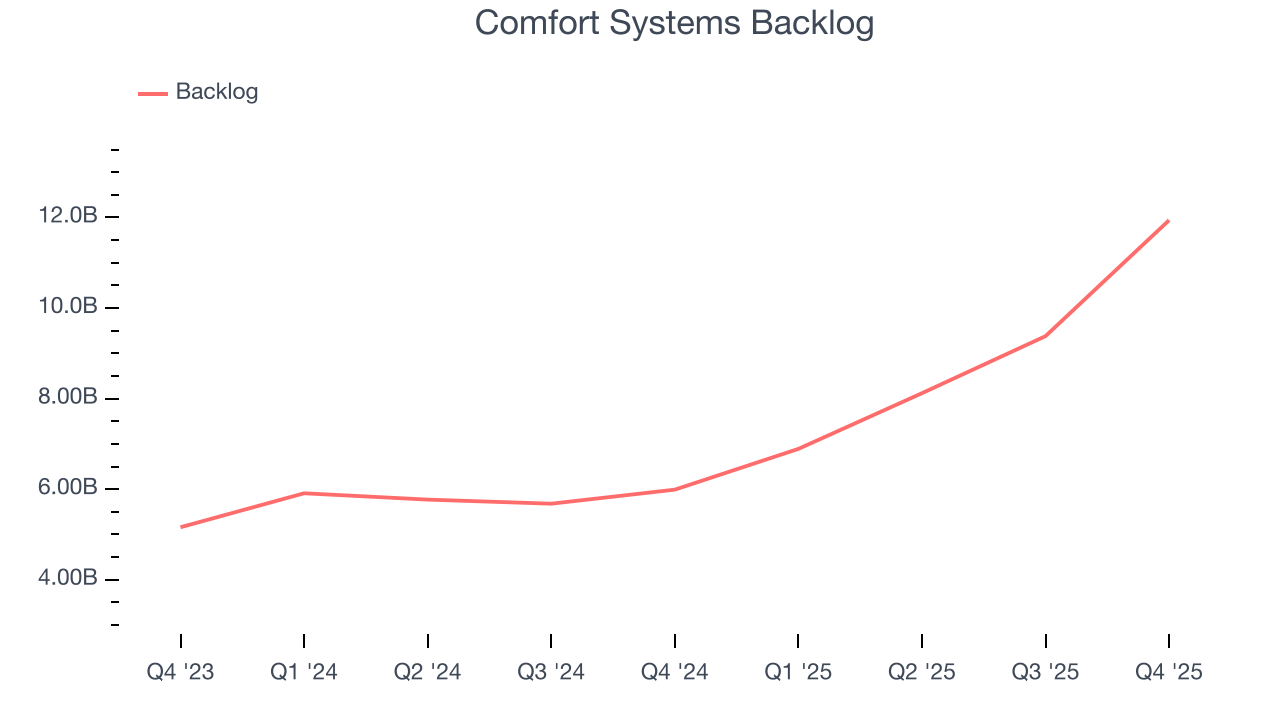

- Backlog: $11.94 billion at quarter end, up 99.3% year on year

- Market Capitalization: $46.44 billion

Company Overview

Formed through the merger of 12 companies, Comfort Systems (NYSE:FIX) provides mechanical and electrical contracting services.

The company specializes in the design, installation, maintenance, and repair of heating, ventilation, air conditioning (HVAC), and electrical systems for commercial, industrial, and institutional buildings across the United States. How else would the typical American office building keep its workers chilly and in need of a sweater during the sweltering summer months?

Additional product offerings include building automation and controls, energy retrofitting, plumbing and piping solutions, indoor air quality improvement equipment, and electrical and lighting services. Many of these are top-of-mind for customers who want to digitize their operations or improve energy efficiency efforts.

Historically, a major percentage of the company’s total revenue is attributed to installation services within newly-constructed facilities. Another meaningful portion of revenue is from the renovation, expansion, maintenance, repair, and replacement of its equipment in existing buildings. In addition to organic growth, acquisitions have also contributed to Comfort Systems' growth. For example, the company acquired electrical contracting service company Amteck in 2021 as well as a number of acquisitions in 2024.

4. Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Comfort Systems USA's top competitors include EMCOR (NYSE:EME), Johnson Controls (NYSE:JCI), and Trane Technologies (NYSE:TT).

5. Revenue Growth

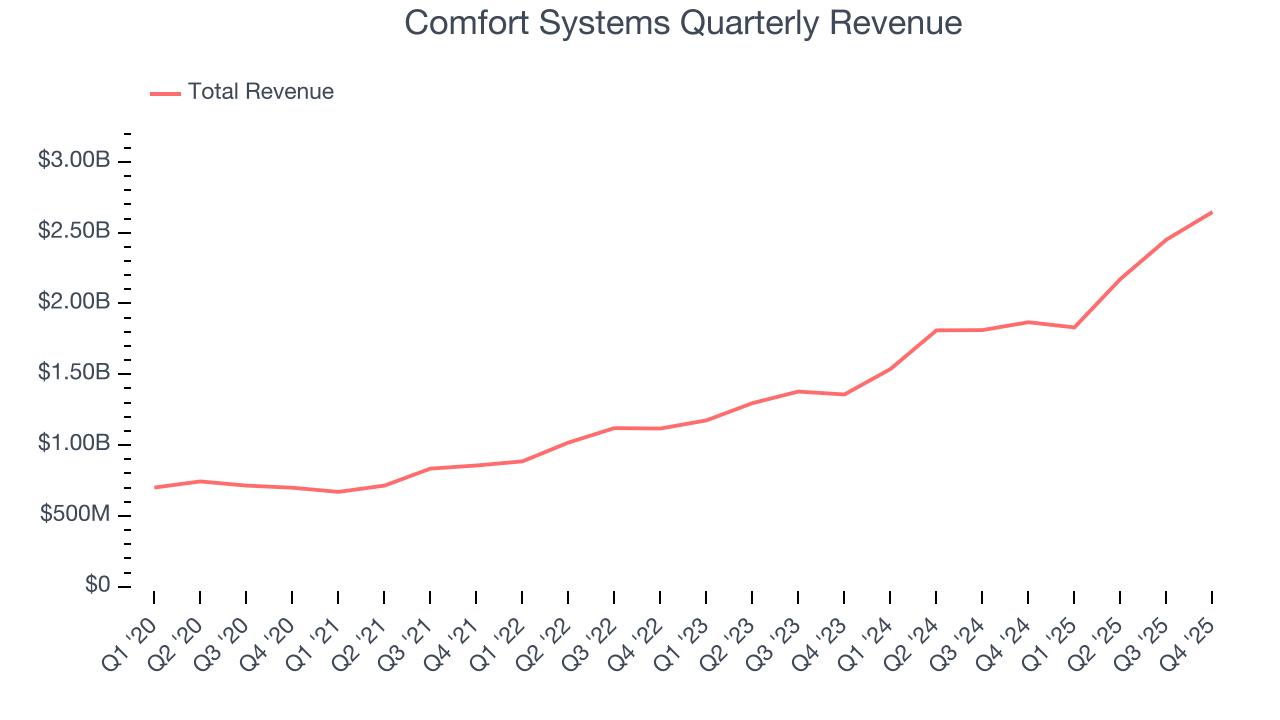

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Comfort Systems’s 26.1% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Comfort Systems’s annualized revenue growth of 32.2% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Comfort Systems’s backlog reached $11.94 billion in the latest quarter and averaged 47.6% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Comfort Systems’s products and services but raises concerns about capacity constraints.

This quarter, Comfort Systems reported magnificent year-on-year revenue growth of 41.7%, and its $2.65 billion of revenue beat Wall Street’s estimates by 13%.

Looking ahead, sell-side analysts expect revenue to grow 12% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and indicates the market is forecasting success for its products and services.

6. Gross Margin & Pricing Power

Comfort Systems has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 20.9% gross margin over the last five years. That means Comfort Systems paid its suppliers a lot of money ($79.12 for every $100 in revenue) to run its business.

Comfort Systems produced a 25.5% gross profit margin in Q4, up 2.3 percentage points year on year. Comfort Systems’s full-year margin has also been trending up over the past 12 months, increasing by 3.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

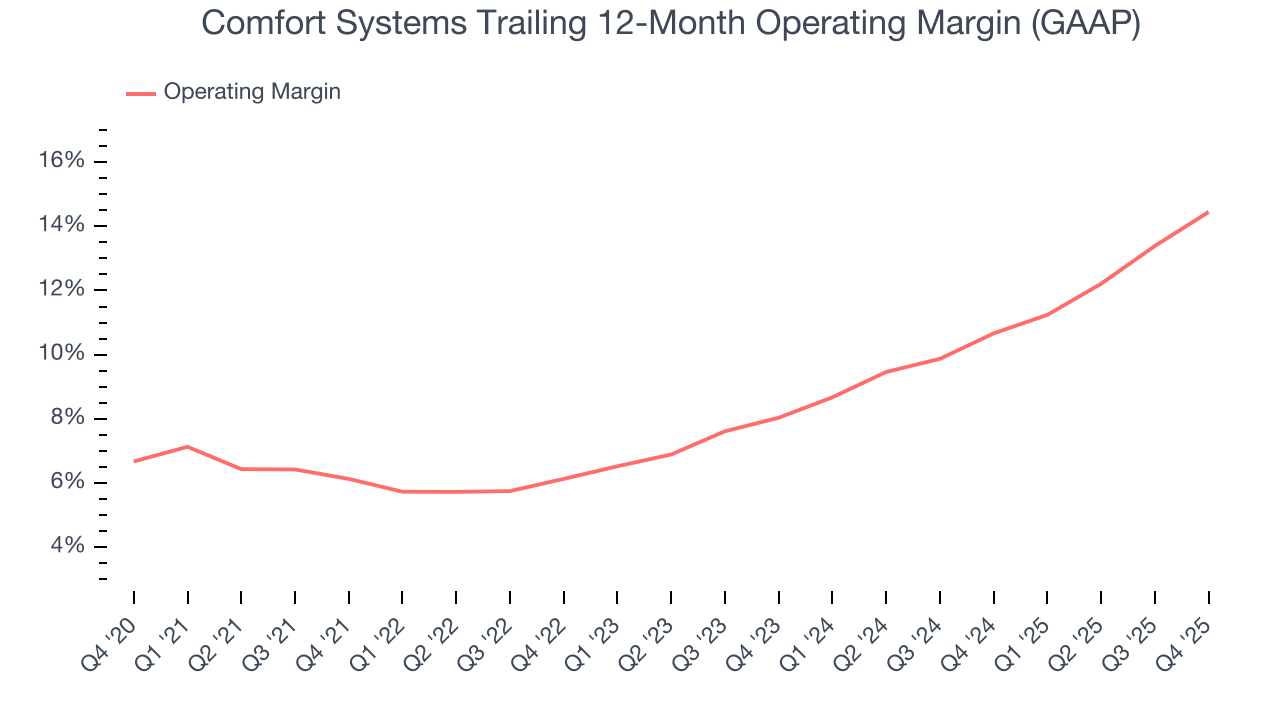

Comfort Systems has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Comfort Systems’s operating margin rose by 8.3 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Comfort Systems generated an operating margin profit margin of 16.1%, up 4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Comfort Systems’s EPS grew at an astounding 47.8% compounded annual growth rate over the last five years, higher than its 26.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Comfort Systems’s earnings to better understand the drivers of its performance. As we mentioned earlier, Comfort Systems’s operating margin expanded by 8.3 percentage points over the last five years. On top of that, its share count shrank by 3.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Comfort Systems, its two-year annual EPS growth of 79.1% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Comfort Systems reported EPS of $9.37, up from $4.09 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Comfort Systems’s full-year EPS of $28.90 to grow 6.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Comfort Systems has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 9.6% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Comfort Systems’s margin expanded by 6.1 percentage points during that time. This is encouraging because it gives the company more optionality.

Comfort Systems’s free cash flow clocked in at $403 million in Q4, equivalent to a 15.2% margin. This result was good as its margin was 6 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Comfort Systems’s five-year average ROIC was 34%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Comfort Systems’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

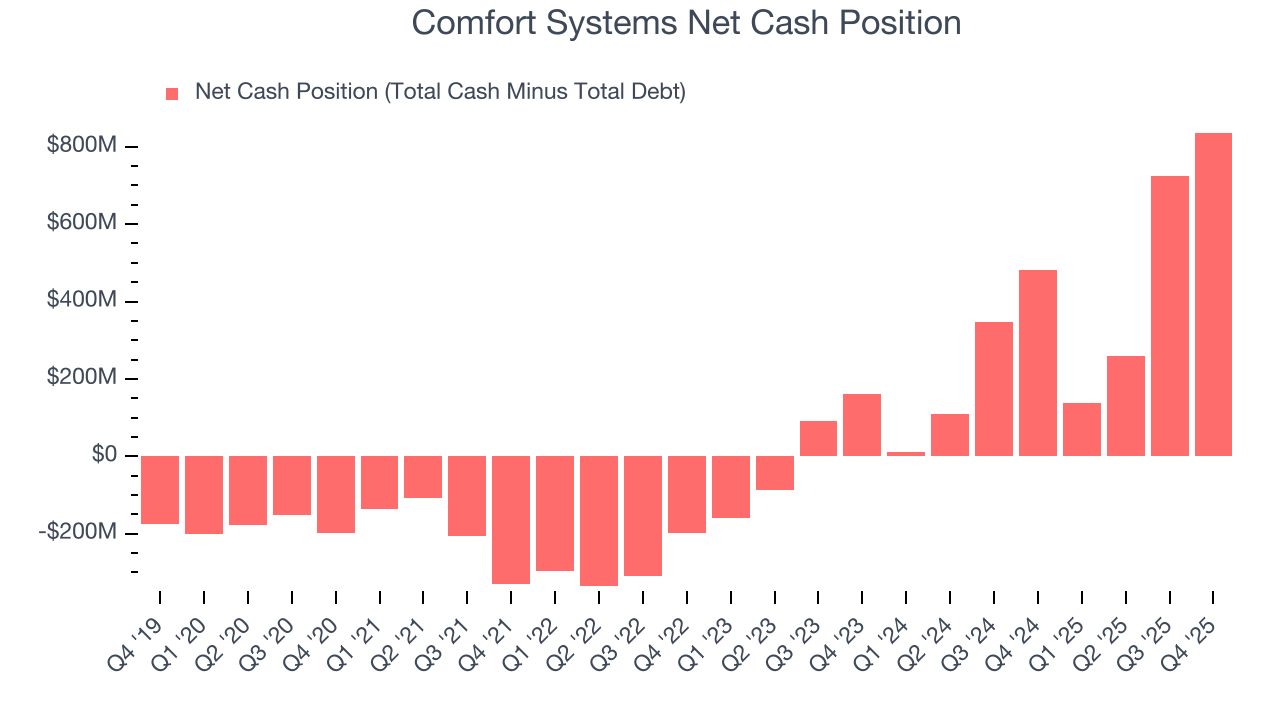

Companies with more cash than debt have lower bankruptcy risk.

Comfort Systems is a profitable, well-capitalized company with $981.9 million of cash and $145.2 million of debt on its balance sheet. This $836.7 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Comfort Systems’s Q4 Results

It was good to see Comfort Systems beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 3.5% to $1,423 immediately after reporting.

13. Is Now The Time To Buy Comfort Systems?

Updated: March 7, 2026 at 10:16 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Comfort Systems.

There is a lot to like about Comfort Systems. First of all, the company’s revenue growth was exceptional over the last five years. And while its low gross margins indicate some combination of competitive pressures and high production costs, its backlog growth has been marvelous. Additionally, Comfort Systems’s rising cash profitability gives it more optionality.

Comfort Systems’s P/E ratio based on the next 12 months is 36.7x. Scanning the industrials landscape today, Comfort Systems’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $1,696 on the company (compared to the current share price of $1,273), implying they see 33.2% upside in buying Comfort Systems in the short term.